08/07/30 - TSX Venture Exchange Daily Bulletins

TSX VENTURE COMPANIES

ADVANCED EXPLORATIONS INC. ("AXI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced July 23,

2008:

Number of Shares: 5,442,453 flow-through shares

Purchase Price: $1.10 per share

Number of Placees: 31 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

William Washington P 45,000

James D. Dale P 50,000

Finder's Fee: Wellington West Capital Markets Inc.

will receive a finder's fee of

$329,736.00 and 224,820 Compensation

Warrants that are exercisable into

common shares at $1.10 per share for a

two year period.

Limited Market Dealers Inc. will receive

a finder's fee of $10,000.00 and 6,818

Compensation Warrants that are

exercisable into common shares at $1.10

per share for a two year period.

Ensign Capital will receive a finder's

fee of $38,000.00 and 25,909

Compensation Warrants that are

exercisable into common shares at $1.10

per share for a two year period.

PI Financial corp. will receive a

finder's fee of $86,240.00 and 58,800

Compensation Warrants that are

exercisable into common shares at $1.10

per share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

ANDOVER VENTURES INC. ("AOX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. has accepted for filing documentation in

connection with a purchase agreement (the "Purchase Agreement") between

Andover Ventures Inc. ("Andover") and Genco Resources Ltd. (TSX: GGC)

("Genco") under which Andover will purchase from Genco an approximate

64.7% interest (the "Interest") in Chief Consolidated Mining Company

("Chief"), a publicly traded company based in Eureka, Utah. The Interest

is comprised of 13,034,769 common shares of Chief and 6,477,241

convertible shares of Chief ("Convertible Shares") where each Convertible

Share is convertible into one common share of Chief at no additional cost.

Chief's principal assets include the Trixie Mine and the Burgin Mine

located in the Tintic Mining District, Utah.

The following consideration is payable under the Purchase Agreement in

order for Andover to acquire the Interest:

1. Andover will pay to Genco USD$2,500,000 by July 31, 2008;

2. Andover will pay a further USD$2,378,002.50 on or before September 15,

2008 plus reimbursement of legal, accounting and other costs incurred by

Genco related to the purchase of the Interest;

3. Andover will issue 1,500,000 common shares to Genco on the issuance of

this Bulletin;

4. Andover will pay Genco a "net profits" royalty (the "Royalty")

calculated based on the pro rata share of issued and outstanding Chief

securities represented by the Interest multiplied by 6% of an amount equal

to Chief's net profits for the preceding fiscal year. In the event that

Chief should achieve sustained commercial production from the Trixie Mine

and Burgin Mine, Genco may elect to convert the Royalty into an additional

1,500,000 common shares of Andover.

5. In the two years following the closing of the acquisition of the

Interest, if Andover disposes of the Interest or any portion thereof and

realizes a net profit, or in the event that Chief liquidates its assets

and distributes the proceeds to its shareholders, Andover will share a

percentage of such amounts received, with such percentage to decrease over

time.

Insider / Pro Group Participation: Andover and Genco have two common

directors: Robert Gardner and Brian Smith. Andover formed an independent

committee of independent directors to approve the acquisition of the

Interest.

TSX-X

--------------------------------------------------------------------------

CHINA OPPORTUNITY INC. ("COC.P")

BULLETIN TYPE: Halt

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at 11:23 a.m. PST, July 30, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

CHROME CAPITAL INC. ("KRM.P")

BULLETIN TYPE: Halt

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at 11:23 a.m. PST, July 30, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

HALO RESOURCES LTD. ("HLO")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 30, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing a property option agreement

between Halo Resources Ltd. (the "Company"), Rubicon Minerals Corporation

and Ron Gangloff (collectively the "Vendors") whereby the Company has the

right to earn up to a 75% interest in 87 claim units located in the Ball

Township Red Lake Mining Division in Ontario. In consideration, the

Company will pay the Vendors a total of $120,000 and issue 100,000 common

shares.

TSX-X

--------------------------------------------------------------------------

HIGHBANK RESOURCES LTD. ("HBK")

BULLETIN TYPE: Property-Asset Agreement

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option agreement between

Highbank Resources Ltd. (the "Company") and Gary R. Brown ("Brown"),

whereby the Company can acquire a 100% interest in the Murvey and Mace

molybdenum prospecting licenses located in the County of Galway, Republic

of Ireland.

The option may be exercised by the Company by:

a) issuing an aggregate of 2,000,000 common shares, at a deemed value of

$0.20,

b) issuing a non-transferable warrant for the right to purchase an

additional 500,000 common shares; and

c) paying an aggregate of $250,000 to Brown;

based on the following schedule:

- paying $50,000 upon execution of the letter of intent (paid);

- paying an additional $200,000 within five business days of approval;

- issuing 500,000 common shares within five business days of approval;

- issuing an additional 500,000 common shares, subject only to the Company

obtaining a NI #43-101 report recommending exploration expenditures

aggregating not less than $375,000 on an exploration program on License

934, such report which will be completed not later than June 30, 2008;

- issuing an additional 1,000,000 common shares upon completion of the

recommended Phase I exploration program, such program to be completed by

December 31, 2008;

- granting Brown a warrant for the right to purchase up to 500,000 common

shares of the Company, exercisable at the price of $0.30 per share for two

years following approval; and

- incurring Exploration Expenditures aggregating not less $500,000 on an

exploration program, to be completed within three years of approval.

The Licenses are also subject to a 2% NSR with the Company having the

right to purchase up to 1.5% of the 2%, prior to a bankable feasibility

study, for the sum of $1,500,000.

A Finder's Fee in consideration of the agreement of $25,000 cash and

150,000 common shares of the Company at a deemed value of $0.20 is payable

to Gregory J. McGroarty of Main Street, Ballintra, County Donegal,

Republic of Ireland.

For more information, please refer to the Company's news release dated May

9, 2008.

TSX-X

--------------------------------------------------------------------------

ISLAND ARC EXPLORATION CORP. ("IAX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 8, 2008:

Number of Shares: 2,691,934 shares

Purchase Price: $0.15 per share

Warrants: 1,345,967 share purchase warrants to

purchase 1,345,967 shares

Warrant Exercise Price: $0.25 for an eighteen month period

Number of Placees: 30 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Tom Vinterlik P 100,000

Paul Trudeau P 100,000

Osvaldo Iadarola Y 30,000

James T. Gillis Management Y 100,000

Finder's Fee: 37,067 shares and 18,534 share purchase

warrants with the same terms as above,

payable to Chadwin Stratulat, $15,223

payable to Orange Capital Corp. and

$4,800 payable to Al Ritchie

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

--------------------------------------------------------------------------

JAMES BAY RESOURCES LIMITED ("JBR")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

The Company's Initial Public Offering ("IPO") Prospectus dated July 14,

2008, has been filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the Ontario Securities Commission on July 14, 2008,

pursuant to the provisions of the Securities Act (Ontario).

The gross proceeds received by the Company for the Offering were

$9,309,812.50, consisting of 7,447,850 Units at $1.25 per Unit. Each Unit

includes one Common Share and a one half Common Share purchase Warrant.

Each whole Warrant entitles the holder to purchase a further Common Share

at $2.00 until July 24, 2008. The Company is classified as a 'Mining'

company.

Commence Date: At the opening Thursday, July 31, 2008,

the common shares will commence trading

on TSX Venture Exchange.

Corporate Jurisdiction: Ontario

Capitalization: Unlimited common shares with no par

value of which 27,872,850 common shares

are issued and outstanding

Escrowed Shares: 10,925,000 common shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: JBR

CUSIP Number: 470273 10 3

Agent: IBK Capital Corp.

Agent's Warrants: 744,785 non-transferable purchase

warrants. Each Warrant entitles the

holder to purchase one Unit at $1.25 per

Unit for a period of 24 months.

For further information, please refer to the Company's Prospectus dated

July 14, 2008.

Company Contact: Stephen Shefsky, President & CEO

Company Address: 20 Victoria Street, Suite 800

Toronto, ON M5C 2N8

Company Phone Number: (416) 366-4200

Company Fax Number: (416) 366-4201

TSX-X

--------------------------------------------------------------------------

LA QUINTA RESOURCES CORPORATION ("LAQ")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 2,981,250

Original Expiry Date of Warrants: August 13, 2008

New Expiry Date of Warrants: February 13, 2009

Exercise Price of Warrants: $0.35

These warrants were issued pursuant to a private placement of 5,962,500

shares with 2,981,250 share purchase warrants attached, which was accepted

for filing by the Exchange effective February 12, 2008.

TSX-X

--------------------------------------------------------------------------

ORIENTAL MINERALS INC. ("OTL")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue up to 2,127,659 bonus shares to Longview Capital Partners Inc., an

Insider of the company, in consideration of a $3,000,000 credit facility.

Shares

Longview Capital Partners Inc. 2,127,659

TSX-X

--------------------------------------------------------------------------

SHEFFIELD RESOURCES LTD. ("SLD")

BULLETIN TYPE: Delist

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at the close of business July 31, 2008, the common shares will

be delisted from TSX Venture Exchange at the request of the Company.

TSX-X

--------------------------------------------------------------------------

STRATEGIC OIL & GAS LTD. ("SOG")

BULLETIN TYPE: Halt

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at 6:00 a.m. PST, July 30, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

STRATEGIC OIL & GAS LTD. ("SOG")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at 11:45 a.m. PST, July 30, 2008, shares of the Company resumed

trading, an announcement having been made over Marketwire.

TSX-X

--------------------------------------------------------------------------

REVA RESOURCES CORP. ("RVA")

BULLETIN TYPE: Change of Business

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Change of

Business as described in its Filing Statement dated July 21, 2008, which

involves the acceptance of an arm's length option to acquire from Carl von

Einsiedel, a 100% interest (subject to a 2% net smelter royalty) in the

Adams Plateau silver-lead-zinc property (the Property) consisting of 8

mineral tenures comprising 6,927 hectares located approximately 75

kilometers northeast of Kamloops, British Columbia. In order to earn the

interest in the Property the Company is required to pay $100,000 in cash,

issue a total of 250,000 common shares of the Company at a deemed price of

$0.25 per share, and incur total exploration expenditures on the Property

of $1,000,000, all over the period ending December 31, 2011. A total of

25,000 common shares, out of the 250,000 common shares, were issued and a

cash payment of $10,000 was made, upon Exchange acceptance.

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Carl von Einsiedel Y 250,000 (1)

Note:

(1) This assumes the issuance of the total number of common shares

issuable to Mr. Von Einsiedel over a four year period, as contemplated by

the transaction.

The Exchange has been advised that the above transaction has been

completed.

For a complete description of the Change of Business and the business of

the Company please refer to the Filing Statement of the Company dated July

21 2008, as filed on SEDAR (www.sedar.com).

The Company is classified as a mining company.

Capitalization: 500,000,000 common shares authorized

with no par value of which 45,177,774

shares are issued and outstanding,

following initial issuance of 25,000

common shares pursuant to the

transaction.

TSX-X

--------------------------------------------------------------------------

THREEGOLD RESOURCES INC. ("THG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

a Purchase Agreement dated November 8, 2007, among Nievex Geoconseil Inc.

(the "Vendor") and the Company, in connection with the purchase by the

Company of a 100% interest in the Mercier Property, consisting of 30

mining claims located approximately 100 km of Senneterre in the province

of Quebec. The transaction is a non arm's length party transaction. Mr.

Antoine Fournier is an insider of Nievex Geoconseil Inc. (Antoine Fournier

is also President of the Company).

The Company is required to issue a total of 100,000 shares upon signature

of the agreement and make a cash payment of $25,000.

The Vendor shall retain a 2 % Net Smelter Royalty of which 1% can be

bought back at $1,500,000.

For further information, please refer to the Company's press release dated

November 21, 2007.

RESSOURCES THREEGOLD INC. ("THG")

TYPE DE BULLETIN: Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN: Le 30 juillet 2008

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention d'achat datee du 8 novembre 2007, entre Nievex Geoconseil Inc.

(le "vendeur") et la societe, relativement a l'acquisition d'un interet de

100 % dans la propriete Mercier, laquelle consiste en 30 claims miniers

situes a une centaine de kilometres de Senneterre dans la province de

Quebec. L'operation constitue une operation aupres d'une personne ayant un

lien de dependance avec la societe. M. Antoine Fournier est un initie de

Nievex Geoconseil Inc. (Antoine Fournier est aussi president de la

societe).

La societe doit emettre un total de 100 000 actions et effectuer un

paiement au comptant de 25 000 $.

Le vendeur conservera une royaute de 2 % du produit net de la vente des

metaux dont 1 % pourra etre rachete au prix de 1 500 000 $.

Pour plus d'information, veuillez-vous referer au communique de presse

emis par la societe le 21 novembre 2007.

TSX-X

--------------------------------------------------------------------------

TRANSGLOBE INTERNET AND TELECOM CO., LTD. ("TTI")

BULLETIN TYPE: Sustaining Fees-Resume Trading

BULLETIN DATE: July 30, 2008

TSX Venture Tier 2 Company

Effective at the open, Thursday, July 31, 2008, trading in the shares of

the Company will resume, the Company having paid its Sustaining Fees.

TSX-X

--------------------------------------------------------------------------

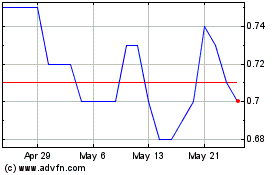

Thiogenesis Therapeutics (TSXV:TTI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Thiogenesis Therapeutics (TSXV:TTI)

Historical Stock Chart

From Jan 2024 to Jan 2025