Richemont Reaches YNAP Divestment Deal With Farfetch -- Update

24 August 2022 - 5:00PM

Dow Jones News

By Joshua Kirby

Swiss luxury-goods group Compagnie Financiere Richemont SA said

Wednesday that it has agreed to sell a majority stake in

Yoox-Net-A-Porter to Farfetch Inc. and Dubai-based investor Mohamed

Alabbar, securing a deal--first flagged at the end of last

year--that could see Farfetch assume full ownership of YNAP in the

future.

British-Portuguese e-commerce platform Farfetch will acquire an

initial 47.5% stake in peer YNAP in return for 53 million-58.5

million of its own shares, or around 12%-13% of its issued share

capital, Richemont said.

Richemont, owner of jewelers Cartier and Van Cleef & Arpels,

said it will receive a further $250 million on the fifth

anniversary of the completion of the initial transaction, also

payable in shares in New York-listed Farfetch. Based on Farfetch's

latest closing price of $7.84, this gives YNAP an implied equity

value of $1.5 billion.

Symphony Global, an investment vehicle controlled by real-estate

mogul Mr. Alabbar, will acquire a 3.2% stake in return for the

shares it owns in a joint venture with YNAP in the Gulf Cooperation

Council region, Richemont said. This will give YNAP full ownership

of its business in the region, the company said.

Richemont will book a 2.7 billion euro ($2.69 billion) noncash

writedown from the divestment, it said, adding that YNAP will be

booked as discontinued operations for the fiscal first half ending

Sept. 30 and until the closing of the initial transaction.

Under the terms of the deal, YNAP will be debt-free at the time

of closing, with a balance sheet holding at least $290 million in

cash. Richemont will also make available a loan facility of $450

million that YNAP can draw upon at its discretion, it said.

Under the deal, which is subject to conditions including

antitrust approvals and is expected to be completed by the end of

next year, Farfetch has an option to acquire all remaining shares

in YNAP between three to five years from that point, at fair market

value, Richemont said.

The call option is subject to YNAP achieving positive adjusted

earnings before interest, taxes, depreciation and amortization in

the previous 12-month period and in three of four quarters within

that period, Richemont said.

Richemont and YNAP will also use Farfetch's technology platform

as a sales channel under the deal, Richemont said, with most of the

group's brands to launch e-concessions on Farfetch's

marketplace.

The deal comes nine months after Richemont first said it was in

talks with Farfetch over divesting control of YNAP, which it has

struggled to make profitable. The group said at the time that it

wanted YNAP to become a neutral platform for the industry, with no

overall controlling shareholder.

Following the transaction, YNAP will be governed by three

directors each from Richemont and Farfetch and one representative

of Mr. Alabbar, the company said.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

August 24, 2022 02:45 ET (06:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

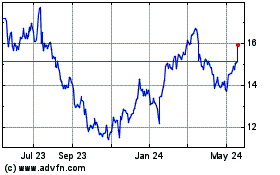

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Dec 2024 to Jan 2025

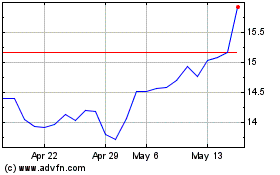

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Jan 2024 to Jan 2025