UPDATE: Chile Endesa 2011 Net Profit -16.2% On Year To CLP446.87 Billion

01 February 2012 - 7:52AM

Dow Jones News

Chile's largest power producer, Empresa Nacional de Electricidad

SA (EOC, ENDESA.SN), posted a 2011 net profit of 446.87 billion

Chilean pesos ($909.94 million), a 16.2% decrease from CLP533.57

billion the previous year.

The drop was due to lower reservoir water levels in Chile, which

reduced the company's production of electricity from cheaper

hydrogeneration, forcing it to turn to more expensive thermal

generation, the company said in a statement.

Endesa added that the adverse hydrological conditions in Chile

were partially offset by "the geographic diversity of the company's

investments in the region, a correct commercial policy and the

adequate generation mix."

The company's per-share earnings fell 16.3% to CLP54.50 from

CLP65.10 in 2010, Endesa said in a statement.

Its earnings before income tax, depreciation and amortization,

or Ebitda, fell 9% on the year to CLP973.89 billion from CLP1.07

trillion in 2010.

The generator has 13,846 megawatts of installed capacity in

Argentina, Chile, Colombia and Peru, and owns an equity stake in

987 MW of installed capacity in Brazil. Some 38% of Endesa's

capacity is in Chile.

Broken down by country, Endesa reported that Ebitda in its Peru

operations rose 30% on the year in 2011 to CLP141.21 billion, while

Ebitda in Colombia fell 2.4% to CLP290.82 billion.

In Argentina, Ebitda retreated 22.8% to CLP46.23 billion, while

that in Chile fell 18% to CLP495.63 billion.

Endesa is controlled by power-holding company Enersis SA (ENI,

ENERSIS.SN), which in turn is controlled by Spain's Endesa SA

(ELEZF, ELE.MC).

-By Carolina Pica, Dow Jones Newswires; 56-2-715-8919;

carolina.pica@dowjones.com

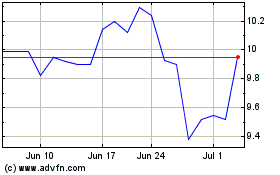

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jun 2024 to Jul 2024

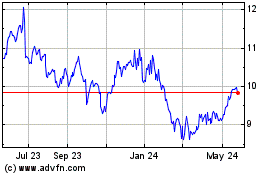

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jul 2023 to Jul 2024