1st Colonial Bancorp, Inc. (OTCBB:FCOB), holding company of 1st

Colonial National Bank, today reported that its net income for the

three months ended March 31, 2012 was $383,000 ($0.12 per share),

compared to $170,000 ($0.05 per share) for the three months ended

March 31, 2011.

Gerry Banmiller, President and Chief Executive Officer,

commented, “In prior messages I promised we would attack the cost

of deposits by reducing our Certificate of Deposit portfolio.

Kindly note that as of March 31st, the time deposit interest

expense decreased from $248,000 to $109,000. Yet, even with this

reduction, we still have a conservative loan-to-deposit ratio of

70%. Our dramatic increase in net income for the first quarter

resulted from this level of intense focus on expense control.”

He added, “We are continuing our efforts to produce more fee

income through our participation in the SBA loan program. Due to

the Small Business Administration’s guaranty of these loans, this

lending function has minimal risk to the Bank, and is therefore

made for these challenging economic times.”

At March 31, 2012, 1st Colonial also reported $282.3 million in

total assets and $247.3 million in deposits. These amounts reflect

increases of $6.2 million in assets and $6.6 million in deposits

from March 31, 2011. As noted above, the deposit mix changed as a

result of a decrease of $25.8 million in certificates of deposits

and an increase of $22.9 million in transaction accounts and $9.5

million in savings accounts. Loans were relatively unchanged at

$178.2 million.

Net interest income of $2,377,000 for the three months ended

March 31, 2012 was $224,000, or 10.4%, higher than the net interest

income of $2,153,000 for the three months ended March 31, 2011.

This was due primarily to an increase of 0.28% in net interest

spread to 3.45% for the three months ended March 31, 2012 compared

to 3.17% for the three months ended March 31, 2011.

1st Colonial’s provision for loan losses was $450,000 for the

three months ended March 31, 2012 and March 31, 2011.

Non-interest income of $399,000 for the three months ended March

31, 2012 was $12,000 higher than the first quarter of 2011.

Non-interest expense for the three months ended March 31, 2012

decreased $117,000 or 6.1% from the comparable period in 2011. FDIC

Assessments decreased $41,000, expenses related to loans in

foreclosure decreased by $38,000 and occupancy and equipment

expenses decreased by $21,000.

For the three months ended March 31, 2012, 1st Colonial had

income tax expenses of $128,000 compared to tax benefit of $12,000

for the three months ended March 31, 2011 representing an increase

of $140,000.

Highlights as of March 31, 2012 and March 31, 2011, and

comparing the three months ended March 31, 2012 and the three

months ended March 31, 2011, respectively, include the following

(dollars in thousands, except per share data):

At At $

increase/ % increase/

March 31,

2012

March 31,

2011

(decrease)

(decrease)

Total assets $ 282,317 $ 276,090 $ 6,227 2.3 % Total

loans 178,239 177,820 419 0.2 % Investments 89,223 83,329

5,894 7.1 % Total deposits 247,257 240,635 6,622 2.8 %

Shareholders' equity

24,670 23,374 1,296 5.5 %

Book value per share

$ 7.75 $ 7.34 $ 0.41 5.5 %

For the three months ended $ increase/ % increase/

March 31,

2012

March 31,

2011

(decrease)

(decrease)

Net interest income $ 2,377 $ 2,153 $ 224 10.4 %

Provision for loan losses 450 450 0 0.0 % Other income 399

387 12 3.1 % Non-interest expense 1,815 1,932 (117 ) -6.1 %

Tax expense (benefit) 128 (12 ) 140 -1,166.7 % Net

income 383 170 213 125.3 % Earnings per share, diluted $

0.12 $ 0.05 $ 0.08 140.0 %

1st Colonial National Bank, the subsidiary of 1st Colonial

Bancorp, provides a range of business and consumer financial

services, placing emphasis on customer service and access to

decision makers. Headquartered in Collingswood, New Jersey, the

Bank also has branches in the New Jersey communities of Westville

and Cinnaminson. To learn more, call (856) 858-8402 or visit

www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; varying and unanticipated costs of collection with

respect to nonperforming loans; changes in interest rates, changes

in FDIC assessments, deposit flows, loan demand, and real estate

values; changes in relationships with major customers; operational

risks, including the risk of fraud by employees or outsiders;

competition; changes in accounting principles, policies or

guidelines; changes in laws or regulations and in the manner in

which the regulators enforce same; new technology and other factors

affecting our operations, pricing, products and services.

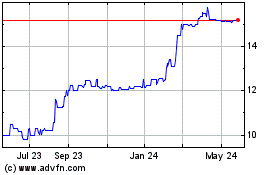

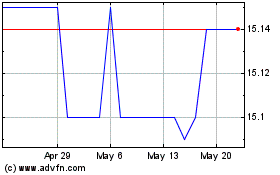

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jun 2024 to Jul 2024

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jul 2023 to Jul 2024