UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2014

Commission File Number: 001-31799

ROUGE RESOURCES

INC.

(Translation of Registrant’s Name into English)

#203-409 Granville St, Vancouver, British Columbia,

Canada, V6C 1T2

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F]

Form 20-F [X] Form 40-F

[ ]

[Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)]

Yes [

] No [X]

[Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)]

Yes [

] No [X]

[Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12-g-3-3(b) under the Securities

Exchange Act of 1934]

Yes [ ] No

[X]

If “Yes” is marked, indicate below the file number assigned to

the registrant in connection with Rule 12g3-2(b): 82-_______________

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on behalf of the

Company by the undersigned, thereunto duly authorized.

Rouge Resources Ltd.

| Dated: September 10, 2014 |

By: |

/s/ Linda Smith |

| |

|

|

| |

|

|

| |

|

Linda Smith |

| |

Title: |

Chief Executive Officer

|

ROUGE RESOURCES LTD.

(An Exploration Stage Company)

UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

SIX MONTHS ENDED JULY 31, 2014

(Expressed in Canadian Dollars)

| |

• |

Statements of Financial Position

|

| |

|

|

| |

• |

Statements of Comprehensive Loss

|

| |

|

|

| |

• |

Statements of Changes in Equity

|

| |

|

|

| |

• |

Statements of Cash Flows |

| |

|

|

| |

• |

Notes to Financial Statements

|

NOTICE OF NO AUDITOR REVIEW OF INTERIM FINANCIAL STATEMENTS

Under National Instrument 51-102, Part 4, subsection 4.3(3)

(a), if an auditor has not performed a review of the condensed interim financial

statements, they must be accompanied by a notice indicating that the financial

statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim financial

statements of the Company have been prepared by management and approved by the

Audit Committee and Board of Directors of the Company. They include appropriate

accounting principles, judgement and estimates in accordance with IFRS for

interim financial statements.

The Company’s independent auditors have not performed a review

of these condensed interim financial statements in accordance with the standards

established by the Canadian Institute of Chartered Accountants for a review of

condensed interim financial statements by an entity’s auditors.

Rouge Resources Ltd.

Condensed Interim Statements of

Financial Position

(Expressed in Canadian dollars – unaudited)

| |

|

Notes |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

July 31, |

|

|

January

31, |

|

| |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

(audited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash |

|

|

|

$ |

25,483 |

|

$ |

178,317 |

|

$ |

96,466 |

|

| GST receivable |

|

|

|

|

1,002 |

|

|

|

|

|

1,425 |

|

| |

|

|

|

|

|

|

|

1,730 |

|

|

|

|

| |

|

|

|

|

26,485 |

|

|

180,047 |

|

|

97,891 |

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Credit card security deposit |

|

|

|

|

6,900 |

|

|

|

|

|

6,900 |

|

| |

|

|

|

|

|

|

|

6,900 |

|

|

|

|

| Equipment |

|

4 |

|

|

1,085 |

|

|

|

|

|

1,268 |

|

| |

|

|

|

|

|

|

|

1,423 |

|

|

|

|

| Exploration and evaluation assets |

|

5 |

|

|

303,507 |

|

|

291,008 |

|

|

291,007 |

|

| |

|

|

|

|

311,492 |

|

|

299,331 |

|

|

299,175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

|

|

$ |

337,977 |

|

$ |

479,378 |

|

$ |

397,066 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Trade payables and accrued liabilities |

|

6 |

|

$ |

18,340 |

|

$ |

10,905 |

|

$ |

25,607 |

|

| Loan payable |

|

7 |

|

|

39,676 |

|

|

39,676 |

|

|

39,676 |

|

| Related party payables |

|

8 |

|

|

69,853 |

|

|

38,960 |

|

|

46,555 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILIITES |

|

|

|

|

127,869 |

|

|

89,541 |

|

|

111,838 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

9 |

|

|

3,953,590 |

|

|

3,953,590 |

|

|

3,953,590 |

|

| Convertible debt reserve |

|

10 |

|

|

53,357 |

|

|

|

|

|

53,357 |

|

| |

|

|

|

|

|

|

|

53,357 |

|

|

|

|

| Deficit |

|

|

|

|

(3,796,839 |

) |

|

(3,617,110 |

) |

|

(3,721,719 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

EQUITY |

|

|

|

|

210,108 |

|

|

389,837 |

|

|

285,228 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES AND EQUITY |

|

|

|

$ |

337,977 |

|

$ |

479,378 |

|

$ |

397,066 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Going concern |

|

1 |

|

|

|

|

|

|

|

|

|

|

Approved on behalf of the Board of Directors:

| “Linda

Smith” |

|

“Ronald McGregor” |

| Director |

|

Director |

| The accompanying notes are an integral part of these

financial statements |

2 |

Rouge Resources Ltd.

Condensed Interim Statements of

Comprehensive Loss

(Expressed in Canadian dollars – unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

ended |

|

| |

|

Notes |

|

|

Three months ended July 31, |

|

|

Six months ended July 31, |

|

|

January 31, |

|

| |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(audited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

|

$ |

88 |

|

$ |

194 |

|

$ |

183 |

|

$ |

388 |

|

$ |

543 |

|

| Consulting fees |

|

8 |

|

|

600 |

|

|

- |

|

|

600 |

|

|

3,000 |

|

|

5,800 |

|

| Listing application expenses |

|

|

|

|

- |

|

|

- |

|

|

- |

|

|

403 |

|

|

402 |

|

| Management services |

|

8 |

|

|

15,000 |

|

|

15,000 |

|

|

30,000 |

|

|

30,000 |

|

|

60,000 |

|

| Office administration and travel |

|

8 |

|

|

13,218 |

|

|

21,005 |

|

|

27,553 |

|

|

41,445 |

|

|

74,694 |

|

| Professional fees |

|

8 |

|

|

369 |

|

|

8,563 |

|

|

4,869 |

|

|

12,526 |

|

|

44,368 |

|

|

Transfer agent and filing fees |

|

|

|

|

5,261 |

|

|

2,667 |

|

|

11,915 |

|

|

17,253 |

|

|

23,817 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net and comprehensive loss |

|

|

|

$ |

|

|

$ |

(47,429 |

) |

$ |

(75,120 |

) |

$ |

(105,015 |

) |

$ |

|

|

| |

|

|

|

|

(34,536 |

) |

|

|

|

|

|

|

|

|

|

|

(209,624 |

) |

| Loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – basic and diluted |

|

9 |

|

$ |

(0.00 |

) |

$ |

(0.00 |

) |

$ |

(0.00 |

) |

$ |

(0.00 |

) |

$ |

(0.00 |

) |

| Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – basic and diluted |

|

|

|

|

44,633,171 |

|

|

44,633,171 |

|

|

44,633,171 |

|

|

44,633,171 |

|

|

44,633,171 |

|

| The accompanying notes are an integral part of these

financial statements |

3 |

Rouge Resources Ltd.

Condensed Interim Statement of Changes

in Equity

(Expressed in Canadian dollars – unaudited)

| |

|

|

|

|

|

|

|

|

|

|

Convertible |

|

|

|

|

|

|

|

| |

|

|

|

|

Common Shares |

|

|

Debt |

|

|

|

|

|

|

|

|

|

Notes |

|

|

Number |

|

|

Amount |

|

|

Reserve |

|

|

Deficit |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2013

(audited) |

|

|

|

|

44,633,171 |

|

$ |

3,953,590 |

|

$ |

53,357 |

|

$ |

(3,512,095 |

) |

|

494,852 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss for six

months

ended July 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(105,015 |

) |

|

(105,015 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at July 31, 2013 |

|

|

|

|

44,633,171 |

|

|

3,953,590 |

|

|

53,357 |

|

|

(3,617,110 |

) |

|

389,837 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss for six

months

ended January 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(104,609 |

) |

|

(104,609 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2014

(audited) |

|

|

|

|

44,633,171 |

|

|

3,953,590 |

|

|

53,357 |

|

|

(3,721,719 |

) |

|

285,228 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss for six

months

ended July 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(75,120 |

) |

|

(75,120 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at July 31, 2014 |

|

|

|

|

44,633,171 |

|

$ |

3,953,590 |

|

$ |

53,357 |

|

$ |

(3,796,839 |

) |

|

210,108 |

|

| The accompanying notes are an integral part of these

financial statements |

24 |

Rouge Resources Ltd.

Condensed Interim Statements of Cash

Flows

(Expressed in Canadian dollars – unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

ended |

|

| |

|

Three months ended July 31, |

|

|

Six months ended July 31, |

|

|

January 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(audited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net and comprehensive loss |

$ |

(34,536 |

) |

$ |

(47,429 |

) |

$ |

(75,120 |

) |

$ |

(105,015 |

) |

$ |

(209,624 |

) |

| Adjustments for non-cash item: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

|

|

194 |

|

|

183 |

|

|

388 |

|

|

543 |

|

| |

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in non-cash working capital items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GST receivable |

|

|

|

|

5,304 |

|

|

423 |

|

|

2,392 |

|

|

2,697 |

|

| |

|

422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses |

|

|

|

|

- |

|

|

- |

|

|

- |

|

|

1,625 |

|

| |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trade payables and accrued

liabilities |

|

|

|

|

(19,293 |

) |

|

(7,267 |

) |

|

(27,978 |

) |

|

(13,276 |

) |

| |

|

(1,743 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash flows

used in operating activities |

|

(35,769 |

) |

|

(60,411 |

) |

|

(81,781 |

) |

|

(128,588 |

) |

|

(218,035 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration and evaluation expenditures |

|

- |

|

|

(9,934 |

) |

|

(12,500 |

) |

|

(22,434 |

) |

|

(22,433 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash flows used in investing activities |

|

- |

|

|

(9,934 |

) |

|

(12,500 |

) |

|

(22,434 |

) |

|

(22,433 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase

(decrease) in related party payables |

|

(4,613 |

) |

|

7,303 |

|

|

23,298 |

|

|

27,494 |

|

|

35,089 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash flows

from financing activities |

|

(4,613 |

) |

|

7,303 |

|

|

23,298 |

|

|

27,494 |

|

|

35,089 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash |

|

(40,382 |

) |

|

(63,042 |

) |

|

(70,983 |

) |

|

(123,528 |

) |

|

(205,379 |

) |

| Cash, beginning |

|

65,865 |

|

|

241,359 |

|

|

96,466 |

|

|

301,845 |

|

|

301,845 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, ending |

$ |

25,483 |

|

$ |

178,317 |

|

$ |

25,483 |

|

$ |

178,317 |

|

$ |

96,466 |

|

| The accompanying notes are an integral part of these

financial statements |

5 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

1.

Nature and continuance of operations

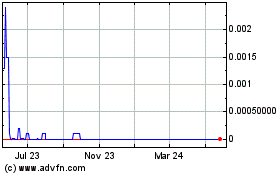

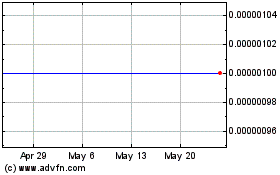

Rouge Resources Ltd (the “Company”) was incorporated on March

31, 1988 under the laws of the province of British Columbia, Canada, and its

principal activity is the acquisition and exploration of mineral properties in

Canada. The Company’s shares are traded on the TSX Venture Exchange (“TSX-V”)

under the symbol ROU and quoted on the OTC:BB in the United States.

The Company’s registered and records office is located at Suite

203 - 409 Granville St., Vancouver, British Columbia, V6C 1T2.

These condensed interim financial statements have been prepared

on the assumption that the Company will continue in operation for the

foreseeable future and will be able to realize assets and discharge liabilities

in the ordinary course of business. As at July 31, 2014, the Company had not

advanced any of its properties to commercial production and is not able to

finance day-to-day activities through operations. The Company’s continuation as

a going concern is dependent upon the successful results from its mineral

property exploration activities; its ability to attain profitable operations and

generate funds therefrom; and its ability to raise equity capital or borrowings

sufficient to meet current and future obligations. These factors indicate the

existence of a material uncertainty that may cast significant doubt about the

Company’s ability to continue as a going concern. Management intends to finance

operating costs over the next twelve months with existing cash on hand, loans

from directors and companies controlled by directors, and/or private placement

of common shares. Should the Company be unable to continue as a going concern,

the net realizable value of its assets may be materially less than the amounts

on its Statements of Financial Position.

2.

Significant accounting policies and basis of preparation

These condensed interim financial statements were authorized

for issue on September 10, 2014 by the directors of the Company.

Statement of compliance and conversion to International

Financial Reporting Standards

These condensed interim financial

statements comply with International Financial Reporting Standards (“IFRS”)

issued by the International Accounting Standards Board (“IASB”) and with

interpretations of the International Financial Reporting Interpretations

Committee (“IFRIC”). Therefore, these financial statements also comply with

International Accounting Standard (“IAS”) 34, Interim Financial

Reporting.

This interim financial report does not include all of the

information required of a full annual financial report and is intended to

provide users with an update in relation to events and transactions that are

significant to an understanding of the changes in financial position and

performance of the Company since the end of the last annual reporting period. It

is therefore recommended that this financial report be read in conjunction with

the audited annual financial statements of the Company for the year ended

January 31, 2014 filed on SEDAR and EDGAR. However, this interim financial

report provides selected significant disclosures that are required in the annual

financial statements under IFRS.

Basis of preparation

These condensed interim

financial statements have been prepared on an accrual basis; are based on

historical costs, modified where applicable; and are presented in Canadian

dollars unless otherwise noted.

Significant estimates and assumptions

The preparation of financial statements in accordance with IFRS requires

the Company to make estimates and assumptions concerning the future. The

Company’s management reviews these estimates and underlying assumptions on an

ongoing basis, based on experience and other factors, including expectations of

future events that are believed to be reasonable under the circumstances.

Revisions to estimates are adjusted prospectively in the period in which the

estimates are revised.

Estimates and assumptions where there is significant risk of

material adjustments to assets and liabilities in future accounting periods

include: the useful lives of equipment, the recoverability of the carrying value

of exploration and evaluation assets, fair value measurements for financial

instruments, recoverability and measurement of deferred tax assets, and

provisions for restoration and environmental obligations and contingent

liabilities.

| The accompanying notes are an integral part of these

financial statements |

6 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

Significant judgments

The preparation of

financial statements in accordance with IFRS requires the Company to make

judgments, apart from those involving estimates and assumptions, in applying

accounting policies. The most significant judgments in preparing the Company’s

financial statements include:

| - |

assessment of the Company’s ability to continue as a

going concern and whether there are events or conditions that may give

rise to significant uncertainty; and |

| - |

classification / allocation of expenditures as

exploration and evaluation assets or operating expenses.

|

Foreign currency translation, transactions and balances

The functional currency of a Company is measured using the currency

of the primary economic environment in which it operates. These financial

statements are presented in Canadian dollars which is the Company’s functional

and presentation currency.

Foreign currency transactions, where applicable, are translated

into the functional currency using the exchange rates prevailing at the date of

the transaction. Foreign currency monetary items are translated at the

period-end exchange rate. Non-monetary items measured at historical cost

continue to be carried at the exchange rate at the date of the transaction.

Non-monetary items measured at fair value are reported at the exchange rate at

the date when fair values were determined.

Exchange differences arising on the translation of monetary

items or on settlement of monetary items are recognized in the Statement of

Comprehensive Loss in the period in which they arise, except where deferred in

equity as a qualifying cash flow or net investment hedge.

Exchange differences arising on the translation of non-monetary

items are recognized in other comprehensive income to the extent that gains and

losses arising on those non-monetary items are also recognized in other

comprehensive income. Where the non-monetary gain or loss is recognized in

profit or loss, the exchange component is also recognized in profit or loss.

Exploration and evaluation assets

Costs

incurred before the Company has obtained the legal rights to explore an area are

expensed as incurred. Exploration and evaluation expenditures include the costs

of acquiring licenses and costs associated with exploration and evaluation

activity. Option payments are considered acquisition costs provided that the

Company has the intention of exercising the underlying option.

Property option agreements are exercisable entirely at the

option of the optionee. Therefore, option payments (or recoveries) are recorded

when payment is made (or received) and are not accrued.

Exploration and evaluation expenditures are capitalized. The

Company capitalizes costs to specific blocks of claims or areas of geological

interest. Government tax credits received are recorded as a reduction to the

cumulative costs incurred and capitalized on the related property.

Exploration and evaluation assets are tested for impairment if

facts or circumstances indicate that impairment exists. Examples of such facts

and circumstances are as follows:

| - |

the period for which the Company has the right to explore

in the specific area has expired during the period or will expire in the

near future, and is not expected to be renewed; |

| |

|

| - |

substantive expenditure on further exploration for and

evaluation of mineral resources in the specific area is neither budgeted

nor planned; |

| |

|

| - |

exploration for and evaluation of mineral resources in

the specific area have not led to the discovery of commercially viable

quantities of mineral resources and the entity has decided to discontinue

such activities in the specific area; and |

| |

|

| - |

sufficient data exist to indicate that, although a

development in the specific area is likely to proceed, the carrying amount

of the exploration and evaluation asset is unlikely to be recovered in

full from successful development or by sale. |

| The accompanying notes are an integral part of these

financial statements |

7 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

After technical feasibility and commercial viability of

extracting a mineral resource are demonstrable, the Company stops capitalizing

expenditures for the applicable block of claims or geological area of interest

and tests the asset for impairment. The capitalized balance, net of any

impairment recognized, is then reclassified to either tangible or intangible

mine development assets according to the nature of the asset.

Development expenditures

Costs arising from

the construction, installation or completion of infrastructure facilities are

capitalized within mine development assets until the mine achieves commercial

production at which point accumulated costs are transferred to producing mine

assets.

Share-based payments

The Company has a stock

option plan. Share-based payments to employees are measured at the fair value of

the instruments issued and amortized over the vesting periods. Share-based

payments to non-employees are measured at the fair value of goods or services

received or the fair value of the equity instruments issued, if it is determined

the fair value of the goods or services cannot be reliably measured, and are

recorded at the date the goods or services are received. Compensation expense is

recognized and the corresponding amount is recorded in the share option reserve.

The fair value of options is determined using the Black–Scholes pricing model.

The number of shares and options expected to vest is reviewed and adjusted at

the end of each reporting period such that the amount recognized for services

received as consideration for the equity instruments granted shall be based on

the number of equity instruments that eventually vest. When the options are

exercised, share capital is credited for the consideration received and the

related share option reserve is decreased.

Loss per share

Basic loss per share is

calculated by dividing the loss attributable to common shareholders by the

weighted average number of common shares outstanding in the period. For all

periods presented, the loss attributable to common shareholders equals the

reported loss attributable to owners of the Company. Diluted loss per share is

calculated by the treasury stock method. Under this method, the weighted average

number of common shares outstanding for the calculation of diluted loss per

share assumes that the proceeds to be received on the exercise of dilutive share

options and warrants are used to repurchase common shares at the average market

price during the period. Any stock options or share purchase warrants

outstanding cause the calculation of diluted loss per share to be anti-dilutive

and are therefore not included in the calculation.

Financial instruments

The Company

classifies its financial instruments in the following categories: fair value

through profit or loss (“FVTPL”), loans and receivables, held-to-maturity

investments, available-for-sale and financial liabilities. The classification

depends on the purpose for which the financial instruments were acquired.

Management determines the classification of its financial instruments at initial

recognition.

Fair value through profit or loss investments are either

held-for-trading for the purpose of short-term profit taking, derivatives not

held for hedging purposes, or held on fair value basis with a documented risk

management or investment strategy. when designated as such to avoid an

accounting mismatch or to enable performance evaluation where a group of

financial assets is managed by key management personnel. Such assets are

subsequently measured at fair value with unrealized changes in carrying value

being included in profit or loss.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active market and are

subsequently measured at amortized cost. They are included in current assets

except for maturities greater than 12 months after the end of the reporting

period. These are classified as non-current assets. Held-to-maturity investments

are non-derivative financial assets that have fixed maturities and fixed or

determinable payments with Company’s intention to hold these investments to

maturity. They are subsequently measured at amortized cost. Held-to-maturity

investments are included in non-current assets, except for those instruments

that are expected to mature within 12 months after the end of the reporting

period.

Available-for-sale financial assets are non-derivative

financial assets that are designated as available-for-sale or are not suitable

to be classified as financial assets at fair value through profit or loss ,

loans and receivables or held-to-maturity investments and are subsequently

measured at fair value. These are included in current assets to the extent they

are expected to be realized within 12 months after the end of the reporting

period. Unrealized gains and losses are recognized in other comprehensive income, except for

impairment losses and foreign exchange gains and losses on monetary financial

assets which are recognized in profit or loss.

| The accompanying notes are an integral part of these

financial statements |

8 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

Non-derivative financial liabilities (excluding financial

guarantees) are subsequently measured at amortized cost. Regular purchases and

sales of financial assets are recognized on the trade-date, ie. the date on

which the group commits to purchase the asset.

Financial assets are derecognized when the rights to receive

cash flows from the investments have expired or have been transferred and the

Company has transferred substantially all risks and rewards of ownership.

At each reporting date, the Company assesses whether there is

objective evidence that a financial instrument has been impaired. In the case of

available-for-sale financial instruments, a significant and prolonged decline in

the value of the instrument is considered to determine whether an impairment has

arisen.

Transaction costs related to financial instruments include

professional, consulting, regulatory, agency commissions and other costs that

are incremental to the acquisition, issuance or disposition of financial assets,

liabilities or equity instruments. Transaction costs are initially charged to

the related financial instrument or equity instrument, except where the

financial instrument is classified as fair value through profit or loss , in

which case transaction costs are expensed to the Statement of Comprehensive Loss

immediately.

The Company does not have any derivative financial assets and

liabilities.

Impairment of assets

The carrying amount of

the Company’s non-current assets, which include equipment and exploration and

evaluation assets, is reviewed at each reporting date to determine whether there

is an indication of impairment. If such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent of the

impairment loss. An impairment loss is recognized in the Statement of

Comprehensive Loss whenever the carrying amount of the asset, or its

cash-generating unit, exceeds its recoverable amount.

The recoverable amount is the greater of an asset’s fair value

less costs to sell and its value in use. In assessing value in use, the

estimated future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of the time value

of money and the risks specific to the asset. For an asset that does not

generate cash flows largely independent of those from other assets, the

recoverable amount is determined for the cash-generating unit to which the asset

belongs.

A cash-generating unit is the smallest identifiable group of

assets that generates cash inflows largely independent of the cash flows from

other assets or groups of assets. Impairment losses recognized in respect of

cash-generating units are allocated first to reduce the carrying amount of any

goodwill allocated to the cash-generating unit and then to reduce the carrying

amount of the other assets in the unit on a pro-rata basis.

An impairment loss is only reversed if there is an indication

that the impairment loss may no longer exist and there has been a change in the

estimates used to determine the recoverable amount. However, any reversal of

impairment cannot increase the carrying value of the asset to an amount higher

than the carrying amount that would have been determined had no impairment loss

been recognized in previous years. An impairment loss with respect to goodwill

is never reversed.

Assets that have an indefinite useful life are not subject to

amortization and are tested annually for impairment.

Cash

Cash includes cash on hand and deposits

held at call with banks.

Income taxes

Current income

tax

Current income tax assets and liabilities for the current

period are measured at the amount expected to be recovered from or paid to the

taxation authorities. The tax rates and tax laws used to compute the amount are

those that are enacted or substantively enacted, at the reporting date, in the

countries where the Company operates and generates taxable income.

| The accompanying notes are an integral part of these

financial statements |

9 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

Current income tax relating to items recognized directly in

other comprehensive income or equity is recognized in other comprehensive income

or equity and not in profit or loss. Management periodically evaluates positions

taken in the tax returns with respect to situations in which applicable tax

regulations are subject to interpretation and establishes provisions where

appropriate.

Deferred income tax

Deferred income

tax is recognized using the asset and liability method on temporary differences

at the reporting date arising between the tax bases of assets and liabilities

and their carrying amounts for financial reporting purposes. The carrying amount

of deferred income tax assets is reviewed at the end of each reporting period

and recognized only to the extent that it is probable that sufficient taxable

profit will be available to allow all or part of the deferred income tax asset

to be utilized.

Deferred income tax assets and liabilities are measured at the

tax rates that are expected to apply to the year when the asset is realized or

the liability is settled, based on tax rates (and tax laws) that have been

enacted or substantively enacted by the end of the reporting period.

Deferred income tax assets and deferred income tax liabilities

are offset, if a legally enforceable right exists to set off current tax assets

against current income tax liabilities and the deferred income taxes relate to

the same taxable entity and the same taxation authority.

Flow-through shares

On the issuance of

flow-through shares, any premium received in excess of the closing market price

of the Company’s common shares is initially recorded as a liability

(“flow-through tax liability”). Provided that the Company has renounced the

related expenditures, or that there is a reasonable expectation that it will do

so, the flow-through tax liability is reduced on a pro-rata basis as the

expenditures are incurred. If such expenditures are capitalized, a deferred tax

liability is recognized. To the extent that the Company has suitable

unrecognized deductible temporary differences, an offsetting recovery of

deferred income taxes would be recorded.

Restoration and environmental obligations

The

Company recognizes liabilities for statutory, contractual, constructive or legal

obligations associated with the retirement of long-term assets, when those

obligations result from the acquisition, construction, development or normal

operation of the assets. The net present value of future restoration cost

estimates arising from the decommissioning of plant and other site preparation

work is capitalized to the related asset along with a corresponding increase in

the restoration provision in the period incurred. Discount rates using a pre-tax

rate that reflects the time value of money are used to calculate the net present

value.

The Company’s estimates of restoration costs could change as a

result of changes in regulatory requirements, discount rates and assumptions

regarding the amount and timing of the future expenditures. These changes are

recorded directly to exploration and evaluation assets with corresponding

entries to the related asset and the restoration provision. The Company’s

estimates are reviewed annually for changes in regulatory requirements, discount

rates, effects of inflation and changes in estimates.

Changes in the net present value, excluding changes in the

Company’s estimates of restoration costs, are charged to the Statement of

Comprehensive Loss for the period. The net present value of restoration costs

arising from subsequent site damage that is incurred on an ongoing basis during

production are charged to the Statement of Comprehensive Loss in the period

incurred. These changes are recorded directly to the related asset with a

corresponding entry to the provision. The increase in the restoration provision

due to the passage of time is recognized as interest expense.

The net present value of restoration costs arising from

subsequent site damage that is incurred on an ongoing basis during production

are charged to the statement of comprehensive loss in the period incurred.

The costs of restoration projects that were included in the

provision are recorded against the provision as incurred. The costs to prevent

and control environmental impacts at specific properties are capitalized in

accordance with the Company’s accounting policy for exploration and evaluation

assets.

At present, the Company has not identified any significant

restoration and environmental obligations in its operations. Accordingly, no

provision has been made.

| The accompanying notes are an integral part of these

financial statements |

10 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

Equipment

Equipment is stated at historical

cost less accumulated amortization and accumulated impairment losses. Subsequent

costs are included in the asset’s carrying amount or recognized as a separate

asset, as appropriate, only when it is probable that future economic benefits

associated with the item will flow to the Company and the cost of the item can

be measured reliably. The carrying amount of the replaced part, if applicable,

is derecognized. All other repairs and maintenance are charged to the Statement

of Comprehensive Loss during the financial period in which they are

incurred.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognized in the Statement of

Comprehensive Loss.

Amortization is calculated on a declining balance method to

write-off the cost of the equipment to its residual value over its estimated

useful life at the rate of 30% per year.

Comparative figures

Certain

comparative figures have been reclassified to conform with the current period’s

presentation.

3.

Accounting standards issued recently

New standard IFRS 9 “Financial Instruments”

This new standard is a partial replacement of IAS 39 “Financial

Instruments: Recognition and Measurement”. IFRS 9 uses a single approach to

determine whether a financial asset is measured at amortized cost or fair value,

replacing the multiple rules in IAS 39. The approach in IFRS 9 is based on how

an entity manages its financial instruments in the context of its business model

and the contractual cash flow characteristics of the financial assets.

The new standard also requires a single impairment method to be

used, replacing the multiple impairment methods in IAS 39. The proposed

effective date for IFRS 9 is for annual periods beginning on or after January 1,

2018.

Amendments to IAS 32 “Financial Instruments:

Presentation”

These amendments address inconsistencies when applying

the offsetting requirements, and is effective for annual periods beginning on or

after January 1, 2014.

The Company has not early adopted these standards and is

currently assessing the impact that these standards will have on its financial

statements.

Other accounting standards or amendments to existing accounting

standards that have been issued but have future effective dates are either not

applicable or are not expected to have a significant impact on the Company’s

financial statements.

| The accompanying notes are an integral part of these

financial statements |

11 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

4.

Equipment

| |

|

|

|

|

Accumulated |

|

|

Net

book |

|

| |

|

Cost |

|

|

amortization |

|

|

Value |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2013 |

|

8,710 |

|

|

(6,899 |

) |

|

1,811 |

|

|

Amortization expense for six months ended July 31, 2013 |

|

- |

|

|

(388 |

) |

|

(388 |

) |

| |

|

|

|

|

|

|

|

|

|

| Balance at July 31, 2013 |

|

8,710 |

|

|

(7,287 |

) |

|

1,423 |

|

| Amortization expense for six months ended

January 31, 2014 |

|

|

|

|

(155 |

) |

|

(155 |

) |

| |

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2014 |

|

8,710 |

|

|

(7,442 |

) |

|

1,268 |

|

|

Amortization expense for six months ended July 31, 2014 |

|

|

|

|

(183 |

) |

|

(183 |

) |

| |

|

|

|

|

|

|

|

|

|

| Balance at

July 31, 2014 |

|

8,710 |

|

|

(7 625 |

) |

|

1 085 |

|

5.

Exploration and evaluation assets

The following table summarizes the amounts expended on

exploration and evaluation assets for the six months ended July 31, 2014 and

year ended January 31, 2014:

| |

|

|

|

|

|

|

|

Total for six |

|

|

Total

for year |

|

| |

|

North-Central Ontario |

|

|

months ended |

|

|

ended |

|

| |

|

Dotted Lake |

|

|

Lampson |

|

|

July 31, |

|

|

January 31, |

|

| |

|

mining claims |

|

|

Lake mining |

|

|

2014 |

|

|

2014 |

|

| |

|

$ |

|

|

claims |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

$ |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Property acquisition costs |

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, beginning |

|

24,607 |

|

|

49,533 |

|

|

74,140 |

|

$ |

61,640 |

|

| Additions |

|

- |

|

|

|

|

|

12,500 |

|

|

12,500 |

|

| |

|

|

|

|

12,500 |

|

|

|

|

|

|

|

| Balance, ending |

|

24,607 |

|

|

62,033 |

|

|

86,640 |

|

|

74,140 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration and evaluation costs |

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, beginning |

|

216,867 |

|

|

- |

|

|

216,867 |

|

|

206,934 |

|

| Additions |

|

|

|

|

|

|

|

|

|

|

|

|

| Field and camp costs |

|

|

|

|

|

|

|

- |

|

|

- |

|

| Geological consulting and

reporting |

|

|

|

|

|

|

|

- |

|

|

- |

|

| Geo-referencing |

|

|

|

|

|

|

|

|

|

|

9,933 |

|

| Project administration |

|

|

|

|

|

|

|

- |

|

|

- |

|

| Soil

sample analysis |

|

|

|

|

|

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

- |

|

|

9,933 |

|

| Balance,

ending |

|

216,867 |

|

|

- |

|

|

216,867 |

|

|

216,867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total balance,

ending |

|

241,474 |

|

|

62,033 |

|

|

303,507 |

|

$ |

291,007 |

|

| The accompanying notes are an integral part of these

financial statements |

12 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

We now hold a 100% interest in eighteen claims in the Thunder

Bay Mining District of North Central Ontario area, called the Dotted Lake

Property, following our final payment in April 2014 pursuant to the exclusive

Lampson Lake agreement with local prospectors (“Optionors”) regarding the

acquisition of two additional claims adjacent to the Dotted Lake Property. Since

the outset, Lampson Lake option payments totaling $60,000 have been paid as

follows: $7,000 payment when the agreement was signed on April 20, 2010; $12,000

payment on April 20, 2011; $16,000 payment on April 20, 2012; and a final amount

of $25,000 due on April 20, 2013. However on March 1, 2013, the Company agreed

with the optionors to split the final payment into two equal amounts of $12,500.

The first was paid on April 20, 2013 and the second and final payment was made

on April 20, 2014.

The Lampson Lake claims are subject to a 2% net smelter royalty

(“NSR”) in favour of the optionors on one claim and with respect to the other, a

combination of a 2% NSR in favour of the optionors and a 1% NSR on any metals

and/or a 1% NSR payable to Ontario Exploration Company (“OEC”) on any precious

metals recovered from the property. The Company has the right to buy back 1% of

the NSR in favour of the optionors for $1,000,000 and to buy back three-quarters

of 1% of the royalty vested with OEC over 10 years on an increasing scale from

$15,000 to $750,000.

6.

Trade payables and accrued liabilities

Trade payables and accrued liabilities included in the

Statements of Financial Position are as follows:

| |

|

|

July 31, |

|

|

January 31, |

|

| |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

|

(audited) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Trade payables |

$ |

15,340 |

|

$ |

10,905 |

|

$ |

10,367 |

|

| |

Accrued

liabilities |

|

3,040 |

|

|

1,760 |

|

|

15,240 |

|

| |

|

$ |

18,380 |

|

$ |

10,905 |

|

$ |

25,607 |

|

7.

Loan payable

This $39,676 debt to a former professional advisor is unsecured

and non-interest bearing. The balance was due after July 31, 2013; however there

has been no demand for repayment.

It continues to be a current liability at July 31, 2014 and is

unsecured and non-interest bearing.

8.

Related party payables and transactions

Related party payables included in the Statements of Financial

Position are as follows:

| |

|

|

July 31, |

|

|

January 31, |

|

| |

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

(audited) |

|

| |

Payable to Company directors and companies controlled by

directors |

$ |

69,853 |

|

$ |

38,960 |

|

$ |

46,555 |

|

These amounts are non-interest bearing and unsecured with no

fixed term of repayment.

Related party transactions with directors and companies

controlled by directors included in the Statements of Comprehensive Loss are as

follows:

| The accompanying notes are an integral part of these

financial statements |

13 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

| |

|

|

|

|

|

|

|

|

Year

ended |

|

| |

|

|

Six months ended July 31, |

|

|

January 31, |

|

| |

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

(audited) |

|

| |

Consulting fees |

$ |

600 |

|

$ |

1,000 |

|

$ |

2,800 |

|

| |

Management fees |

|

30,000 |

|

|

30,000 |

|

|

60,000 |

|

| |

Office rent |

|

15,000 |

|

|

15,000 |

|

|

30,000 |

|

| |

Professional fees |

|

4,267 |

|

|

3,575 |

|

|

16,170 |

|

| |

|

$ |

49,867 |

|

$ |

49,575 |

|

$ |

108,970 |

|

These transactions are recorded at the exchange amount, which

is the consideration agreed to between the related parties.

9.

Share capital

Authorized share capital

Unlimited number of

common shares without par value.

Issued share capital

At July 31, 2014, there

were 44,633,171 issued and fully paid common shares outstanding (January 31,

2014 – 44,633,171) of which 2,842,200 shares are held in escrow, subject to

release under regulatory approval.

Basic and diluted loss per share

The

calculation of basic and diluted loss per share for six months ended July 31,

2014 was based on the comprehensive loss attributable to common shareholders of

$75,120 (July 31, 2013 - $105,015 ) and the weighted average number of common

shares outstanding of 44,633,171 (July 31, 2013 - 44,633,171). The diluted loss

per share will not include the effect of any share purchase warrants outstanding

in the future since the effect would be anti-dilutive.

Stock options

The Company has adopted an

incentive stock option plan which provides that the Board of Directors of the

Company may from time to time, in its discretion and in accordance with the

TSX-V requirements, grant to directors, officers, employees and technical

consultants to the Company, non-transferable stock options to purchase common

shares, provided that the number of common shares reserved for issuance in any

twelve month period will not exceed 10% of the Company’s issued and outstanding

common shares. Such options will be exercisable for a period of up to 5 years

from the date of grant at a price not less than the closing price of the

Company’s shares on the last trading day before the grant of such options less

any discount, if applicable, but in any event not less than $0.10 per share In

connection with the foregoing, the number of common shares reserved for issuance

to any one optionee insider in any twelve month period will not exceed ten

percent (10%) of the issued and outstanding common shares and the number of

common shares reserved for issuance to any one employee or consultant will not

exceed two percent (2%) of the issued and outstanding common shares. Options may

be exercised no later than 90 days following cessation of the optionee’s

position with the Company or 30 days following cessation of an optionee

conducting investor relations activities.

At July 31, 2014, the Company had no issued or outstanding

stock options.

Share purchase warrants

The changes in

warrants outstanding during the six months ended July 31, 2014 and year ended

January 31, 2014 are as follows:

| The accompanying notes are an integral part of these

financial statements |

14 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

| |

|

|

Six Months Ended July 31, 2014 |

|

|

Year Ended January 31, 2014 |

|

| |

|

|

Number of |

|

|

Exercise price |

|

|

Number of |

|

|

Exercise price |

|

| |

|

|

warrants |

|

|

$ |

|

|

warrants |

|

|

$ |

|

| |

Balance, beginning |

|

- |

|

|

- |

|

|

4,068,000 |

|

|

0.40 |

|

| |

Warrants issued |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Warrants expired |

|

|

|

|

|

|

|

(4,068,000 |

) |

|

|

|

| |

Balance, ending |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

10. Convertible debt

reserve

The convertible debt reserve records the equity component of

convertible debt with liability and equity components. On conversion, the amount

recorded is transferred to share capital.

11. Income

taxes

At July 31, 2014 and year ended January 31, 2014, the Company

had various tax pools relating to deductible temporary differences available to

reduce future taxable income which expire as follows:

| |

|

Canadian non- |

|

|

|

|

|

|

|

|

|

|

| |

|

capital losses |

|

|

Resources pool |

|

|

Equipment |

|

|

Share

issue costs |

|

| 2015 |

$ |

83,521 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

| 2026 |

|

132,052 |

|

|

- |

|

|

- |

|

|

- |

|

| 2027 |

|

175,837 |

|

|

- |

|

|

- |

|

|

- |

|

| 2028 |

|

152,040 |

|

|

- |

|

|

- |

|

|

- |

|

| 2029 |

|

182,808 |

|

|

- |

|

|

- |

|

|

- |

|

| 2030 |

|

105,295 |

|

|

- |

|

|

- |

|

|

- |

|

| 2031 |

|

243,513 |

|

|

- |

|

|

- |

|

|

- |

|

| 2032 |

|

278,811 |

|

|

- |

|

|

- |

|

|

- |

|

| 2033 |

|

273,858 |

|

|

|

|

|

|

|

|

|

|

| 2034 |

|

244,457 |

|

|

|

|

|

|

|

|

|

|

| No

expiry |

|

- |

|

|

491,007 |

|

|

2,407 |

|

|

105,059 |

|

| |

$ |

1,872,192 |

|

$ |

491,007 |

|

$ |

2,407 |

|

$ |

105,059 |

|

A valuation allowance has been used to offset the net benefit

related to the future tax assets arising from these deductible temporary

differences due to the uncertainty associated with the ultimate realization of

both the non-capital losses and the resource pools before expiry.

These tax pools will be updated during year ended January 31,

2015.

12. Financial

instruments and financial risk management

The Company is exposed in varying degrees to financial

instrument related risks. The Board of Directors approves and monitors the risk

management processes, inclusive of documented investment policies, counterparty

limits, and controlling and reporting structures. The type of risk exposure and

the way in which such exposure is managed is as follows:

Credit risk

Credit risk is the risk that one

party to a financial instrument will fail to discharge an obligation and cause

the other party to incur a financial loss. The Company’s primary exposure to

credit risk is on its cash held in bank accounts and its credit and security

deposit. The Company’s cash and credit card deposit are deposited in bank

accounts held with one major bank in Canada so there is a concentration of

credit risk. This risk is managed by using a major bank that is a high credit quality financial institution as

determined by rating agencies. The Company’s secondary exposure to risk is on

its GST receivable is minimal since it is refundable from the Canadian

Government.

| The accompanying notes are an integral part of these

financial statements |

15 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

Liquidity risk

Liquidity risk is the risk

that the Company will not be able to meet its financial obligations as they fall

due. The Company has a planning and budgeting process in place to help determine

the funds required to support the Company’s normal operating requirements on an

on-going basis. The Company ensures there are sufficient funds to meet

short-term business requirements, taking into account its current cash position

and potential funding sources. Historically, the Company's source of funding has

been either the issuance of equity securities for cash through private

placements or loans from Company directors and officers. The Company’s access to

financing is always uncertain and there can be no assurance of continued access

to significant funding from these sources.

Foreign exchange risk

Foreign currency risk is

the risk that the fair values of future cash flows of a financial instrument

will fluctuate because they are denominated in currencies that differ from the

Company’s functional currency. The Company only operates in Canada and is

therefore not exposed to foreign exchange risk arising from transactions

denominated in a foreign currency.

Interest rate risk

Interest rate risk is the

risk that the fair value of future cash flows of a financial instrument will

fluctuate because of changes in market interest rates. The Company’s exposure to

interest rate risk relates to its ability to earn interest income on cash

balances at variable rates. Changes in short term interest rates will not have a

significant effect on the fair value of the Company’s cash account.

Classification of financial

instruments

Financial assets included in the Statements of Financial

Position are as follows:

| |

|

|

July 31, |

|

|

January 31, |

|

| |

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

(audited) |

|

| |

Fair value through profit and loss: |

|

|

|

|

|

|

|

|

|

| |

Cash |

$ |

25,483 |

|

$ |

178,317 |

|

$ |

96,466 |

|

| |

Credit

card security deposit |

|

6,900 |

|

|

6,900 |

|

|

6,900 |

|

| |

|

$ |

32,383 |

|

$ |

185,217 |

|

$ |

103,366 |

|

Other financial liabilities included in the Statements of

Financial Position are as follows:

| |

|

July 31, |

|

|

January 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

(audited) |

|

| Non-derivative financial liabilities: |

|

|

|

|

|

|

|

|

|

| Trade payables |

$ |

15,340 |

|

$ |

9,145 |

|

|

10,367 |

|

| Loan payable |

|

39,676 |

|

|

39,676 |

|

|

39,676 |

|

|

Related party payables |

|

69,853 |

|

|

38,960 |

|

|

46,555 |

|

| |

$ |

124,869 |

|

$ |

87,781 |

|

|

96,598 |

|

Fair value

The fair value of the Company’s

financial assets and liabilities approximate the carrying amounts. Financial

instruments measured at fair value are classified into one of three levels in

the fair value hierarchy according to the relative reliability of the inputs

used to estimate the fair values. The three levels of the fair value hierarchy

are:

| |

• |

Level 1 – Unadjusted quoted prices in active markets for

identical assets or liabilities; |

| |

• |

Level 2 – Inputs other than quoted prices that are

observable for the asset or liability either directly or indirectly; and

|

| The accompanying notes are an integral part of these

financial statements |

16 |

| Rouge Resources Ltd. |

| Notes to the Condensed Interim Financial Statements |

| (Expressed in Canadian dollars - unaudited) |

| For the six

months ended July 31, 2014 and 2013 |

| |

• |

Level 3 – Inputs that are not

based on observable market data. |

13. Capital

management

The Company's policy is to maintain a sufficient capital base

so as to maintain investor and creditor confidence, safeguard the Company’s

ability to support the exploration and development of its exploration and

evaluation assets and to sustain future development of the business. The capital

structure of the Company consists of share and working capital. There were no

changes in the Company's approach to capital management during the year and the

Company is not subject to any restrictions on its capital.

14. Segmented

information

The Company operates in a single reportable operating segment

being the acquisition, exploration and development of mineral properties,

currently all located in Canada.

| The accompanying notes are an integral part of these

financial statements |

17 |

Rouge Resources Ltd.

Management Discussion and

Analysis

Six Months Ended July 31, 2014

ROUGE

RESOURCES LTD.

(An Exploration Stage Company)

MANAGEMENT DISCUSSION AND ANALYSIS

FOR SIX MONTHS ENDED JULY 31, 2014

(Stated in

Canadian Dollars)

1

Rouge Resources Ltd.

Management Discussion and

Analysis

Six Months Ended July 31, 2014

ITEM

1.1 DATE AND

INTRODUCTION

This Management Discussion and Analysis (“MD&A”) was

prepared as of September 10, 2014 and authorized for issuance by the directors

of the Company effective on this date. This report should be read in conjunction

with both the condensed interim financial statements and notes for the six

months ended July 31, 2014 and the audited financial statements and notes for

the year ended January 31, 2014. It focuses on events and activities that

affected the Company during the six months ended July 31, 2014 and to the date

of this report.