UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| |

x

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2014

|

|

or

|

|

|

o

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 333-192156

WORLD MEDIA & TECHNOLOGY CORP.

(Exact Name of Registrant as Specified in its Charter)

| | |

Nevada

|

| 46-1204713

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

| (I.R.S. Employer

Identification No.)

|

|

|

|

600 Brickell World Plaza, Suite 1775,

Miami, Florida

|

|

33131

|

(Address of Principal Executive Offices)

|

| (Zip Code)

|

Registrant’s telephone number including area code: (347) 717-4966

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X ] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this From 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ]

Accelerated filer [ ]

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

Smaller reporting company [x]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ]

No [x]

1

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter.

As of June 30, 2014, the aggregate market value of voting stock held by non-affiliates of the registrant, based on the price at which the common equity was sold, was $1,610,000, as 3,220,000 shares were held by non-affiliates. As of June 30, 2014, the registrant had 4,000,000 shares of Common Stock outstanding held by the registrant's directors and officers.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. The registrant had 28,581,000 shares of common stock issued and outstanding as of April 14, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Articles of Incorporation, Bylaws and Subscription Agreement are incorporated by reference to the Company’s Registration Statement on Form S-1 filed with the SEC on November 7, 2013.

Stock Purchase Agreements between World Assurance Group, Inc. and the registrant and registrant’s shareholders

2

Table of Contents

| | |

|

| Page

|

| PART I

|

|

|

|

|

Item 1

| Business

| 4

|

Item 1A

| Risk Factors

| 6

|

Item 2

| Properties

| 15

|

Item 3

| Legal Proceedings

| 15

|

Item 4

| Mine Safety Disclosures

| 15

|

|

|

|

| PART II

|

|

|

|

|

Item 5

| Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

| 15

|

Item 6

| Selected Financial Data

| 16

|

Item 7

| Management's Discussion and Analysis of Financial Condition and Results of Operations

| 17

|

Item 7A

| Quantitative and Qualitative Disclosures about Market Risk

| 19

|

Item 8

| Financial Statements and Supplementary Data

| 20

|

Item 9

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

| 21

|

Item 9A

| Controls and Procedures

| 21

|

|

|

|

| PART III

|

|

|

|

|

Item 10

| Directors and Executive Officers and Corporate Governance

| 21

|

Item 11

| Executive Compensation

| 23

|

Item 12

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

| 25

|

Item 13

| Certain Relationships and Related Transactions

| 25

|

Item 14

| Principal Accountant Fees and Services

| 27

|

|

|

|

| PART IV

|

|

|

|

|

Item 15

| Exhibits, Financial Statement Schedules

| 27

|

| | |

| Signatures

| 29

|

3

WORLD MEDIA & TECHNOLOGY CORP.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

Ÿ

the uncertainty of profitability based upon our history of losses;

Ÿ

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern;

Ÿ

risks related to our international operations and currency exchange fluctuations; and

Ÿ

other risks and uncertainties related to our business plan and business strategy.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward- looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company”, “WRMT” and “World Media & Technology Corp.” mean World Media & Technology Corp. unless otherwise indicated.

Item 1. BUSINESS

Our Business

Organizational History

World Media & Technology Corp. (formerly Halton Universal Brands, Inc.) (“WRMT” or the “Company”) was incorporated under the laws of the State of Nevada on October 22, 2010 (“Inception”). The Company was originally a brokerage and brand consultancy firm specializing in product development, brand consultation, product launches and brokerage services for manufacturers of grocery, specialty food and health supplements.

On October 29, 2014, World Assurance Group, Inc. (WDAS) acquired 7,095,000 of the outstanding common stock that resulted in a change of control of the Company and with it a change in the Company’s business plan from a brokerage and brand consultancy firm specializing in product development, brand consultation, product launches and brokerage services to that of the design, manufacture and marketing of wearable technology products and services.

Acquisition of the Space Technology Business and related assets

Effective October 29, 2014, WDAS sold its SPACE technology business and certain related assets to the Company. In accordance with ASC 805-50, as this transaction is deemed to be between entities under common control, the assets of the SPACE technology business were transferred from WDAS to the Company at the carrying value of such assets within the financial statements of WDAS at the time of transfer. Accordingly, the sole asset recorded by the Company as a result of this acquisition was a supplier deposit for $103,226 as all other assets transferred had a carrying value of $0. As a condition of the acquisition, the Company agreed to reimburse WDAS for the supplier deposit and certain costs, totaling $454,672 incurred by WDAS in the development of the Space technology. As a result of the acquisition, the Company recorded: (1) a current asset for the supplier deposit in the amount of $103,226; (2) an intercompany payable to WDAS in the amount of $557,898; and (3) a reduction of additional paid in capital of $454,672 representing the excess of liabilities incurred ($557,898) over carrying value of the assets assumed ($103,226) as a result of this being a transaction between entities under common control.

In November 2014, the board of directors and majority stockholder, WDAS, authorized a name change of the Company from Halton Universal Brands, Inc. to World Media & Technology Corp. The name change went effective with FINRA on December 22, 2014.

4

Prior Operations

The Company was a brokerage, consulting and marketing firm specializing in brand consulting and new product strategy consulting for emerging brands. The Company focused on natural food products, specialty food products, and mass market grocery items that are manufactured in North America and seek new market penetration in Eastern Europe. It offered services that fall into three major categories: strategic management consulting, sales brokerage, and marketing. Its main areas of focus were serving manufacturers and distributors in the grocery, specialty food, and health supplement channels.

New Business Plan

Effective upon the consummation of the stock purchase and the change in control on October 29, 2014 described above, the Company discontinued its previous business plan and changed its business operations to focus on the design, manufacture and marketing of wearable technology products and services.

Effective October 29, 2014, the Company acquired the SPACE technology business and certain related assets, from WDAS’ subsidiary company, World Global Assets Pte Ltd (WGA), an affiliate company (See Item 13: Related Party Transactions) to continue the development and commercialization of wearable computers, binocular media display glasses, wireless devices and the necessary platforms and wireless connectivity to provide its customers with an all encompassing, out-of-the-box, unique, fully-connected, rich, infotainment experience.

The Opportunity

The Company has the goal of earning stable and recurring revenues through the sale of wearable computers, binocular media display glasses, wire free devices and related wireless services to end customers around the World. The Company is planning to create a unique and rich customer infotainment experience by designing and manufacturing binocular media display glasses, marketed as ‘Lumina Glasses’ and is also planning to offer some unique communication service offerings globally.

The Company intends to initially market its wearable technology products and wireless services in the United States, where it is anticipated that the products and services will be available for sale during 2015.

What The Company Plans to Offer

The Company plans to offer wearable technology products and related wireless services, and is currently completing the development and testing of its two breakthrough products. the first product is ‘SPACE’ Computer, a wearable, fully connected, high-powered computer and the second product is ‘Lumina Glasses’, which are binocular glasses that connect to the ‘SPACE’ Computer (and other computers) and deliver clear, infinity view images.

The Company also plans to offer customers the opportunity to become a subscriber to the Company’s proposed unified cloud based communications platform, ‘SPACE Works’, and its ‘SPACE Wireless’ service, which will be available initially in the United States. The Company also plans to distribute its devices with its SPACE Wireless service embedded and pre-enabled as part of its turnkey offering. Consequently, other wireless service providers will not be given the opportunity to supply the initial service and SPACE Wireless will ensure a complete service offering and therefore increase subscriber adoption and retention.

Growth Strategy

The Company’s goal is to develop and commercialize its wearable technology products and related wireless services so that it can establish and build an industry-leading position as a unique, market leading, wearable device solution provider and provider of data and wireless services. The Company intends to pursue the following strategies in an attempt to achieve this goal.

Sales and Marketing

The Company is currently negotiating distribution agreements with leading international direct sales companies to engage in marketing and selling the Company’s proprietary devices and services to technology savvy users, who subscribe to the offering. It is expected that SPACE Works and SPACE Wireless services will be available as a monthly subscription service. SPACE Works is expected to have different price plans depending on the levels of functionality require and SPACE Wireless will offer different pricing plans depending on the levels of data required.

The Company plans to successfully leverage the uniqueness of SPACE Computer and Lumina Glasses that will be exclusively available through these distribution channels .

Customers

The Company, through distribution channel partners will target technologically inclined subscribers and early adopters who seek a rich infotainment experience delivered via unique products. These customers will also become subscribers to the services. It is expected that initial customers will come from Florida, Texas and California, and thereafter sales will spread throughout the rest of North America and internationally.

5

Patent, Trademark, License and Franchise Restrictions and Contractual Obligations and Concessions

The Company has acquired the ‘SPACE’ brand and Lumina Glasses manufacturing relationships previously developed by World Global Assets Pte Ltd (WGA), an affiliate company (See Item 13: Related Party Transactions) to develop and commercialize the SPACE products and services.

The Company currently does not have any Patents or Trademarks for the planned products and services. The Company plans to initiate trademark registration for its products and services when they are completed and offered for sale in 2015. We rely on non-disclosure and non-compete agreements and other contractual restrictions, to establish and protect our proprietary rights to our products and related services. Employees and consultants are required to execute confidentiality and non-use agreements to automatically transfer any rights they may have in copyrightable works or patentable technologies to us.

In addition, prior to entering into discussions with potential business partners or customers regarding our business and technologies, we generally require that such parties enter into non-disclosure, non-compete and non-circumvention agreements with us as appropriate. If these discussions result in a license or other business relationship, we also generally require that the agreement setting forth the parties’ respective rights and obligations include provisions for the protection of our intellectual property rights.

Any steps taken by us may not, however, be adequate to prevent the misappropriation of our proprietary rights or technology.

Research and Development Activities

We are currently completing the manufacturing and testing of our two wearable technology products: SPACE Computer and Lumina Glasses. During the period from inception of the SPACE wearable technology and Lumina glasses business in May 2014 through to December 31, 2014, a total of $522,388 has been incurred in research and development costs. Of this balance, $454,672 was incurred while the SPACE business was owned by WDAS prior to its transfer to the Company on October 29, 2014 and $69,216 was incurred by the Company after it had acquired the business on October 29, 2014. We currently plan to spend an additional $500,000 approximately on research and development activities in the future related to continued development and testing of current and new wearable technology products and related services.

Compliance with Environmental Laws

We are not aware of any environmental laws that have been enacted, nor are we aware of any such laws being contemplated for the future, that impact issues specific to our business.

Employees

As of the date of this Annual Report we have three employees, the Company’s officers, Fabio Galdi, our President, Chief Executive Officer and Corporate Secretary, Alfonso Galdi, our Chief Financial Officer and Treasurer, and Alessandro Senatore, our Chief Operating Officer. Our officers and directors are responsible for planning, developing and operational duties, and will continue to do so throughout the early stages of our growth. The Company, in the near term, plans to hire key personnel who will ensure that product development and commercialization plans continue to be implemented.

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, ("SEC"), at the SEC's Public Reference Room at 100 F Street NE, Washington, DC 20549.

The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. RISK FACTORS

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

6

Risks Related our Company

Currency translation and transaction risk may adversely affect our business, financial condition and results of operations.

Although our reporting currency is the US dollar, we expect to conduct some business and incur costs in the local currency of most countries in which we operate. As a result, we will be subject to currency translation risk. We expect a large percentage of our revenues and costs to be generated outside the United States and denominated in foreign currencies in the future. Changes in exchange rates between foreign currencies and the US dollar could affect our revenues and cost of revenues, and could result in exchange losses. We cannot accurately predict the impact of future exchange rate fluctuations on our results of operations.

Control by Principal Stockholder.

Mr. Fabio Galdi, the Company's Chairman and Chief Executive Officer and his affiliate companies beneficially own approximately 99% of our outstanding Common Stock. As a result, Mr. Galdi and his affiliate companies are, collectively, able to exercise control over all matters requiring stockholder approval, including the election of all directors and the approval of significant corporate transactions. This ownership may have the effect of delaying or preventing a change in control of the Company which could materially adversely affect the price of the Common Stock, and which may be to the benefit of the Directors and executive officers but not in the interest of the shareholders. The interests of Mr. Galdi may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders. Additionally, potential investors should take into account the fact that any vote of shares purchased will have limited effect on the outcome of corporate decisions.

World Media & Technology Corp. is an “emerging growth company” under the Jumpstart Our Business Startups Act. We cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our shares of common stock less attractive to investors.

WRMT is and will remain an "emerging growth company" until the earliest to occur of (a) the last day of the fiscal year during which its total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (b) the last day of the fiscal year following the fifth anniversary of its initial public offering, (c) the date on which WRMT has, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or (d) the date on which WRMT is deemed a "large accelerated filer" (with at least $700 million in public float) under the Securities and Exchange Act of 1934 (the "EXCHANGE ACT").

For so long as WRMT remains an "emerging growth company" as defined in the JOBS Act, it may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" as described in further detail in the risk factors below. WRMT cannot predict if investors will find its shares of common stock less attractive because WRMT will rely on some or all of these exemptions. If some investors find WRMT’ shares of common stock less attractive as a result, there may be a less active trading market for its shares of common stock and its stock price may be more volatile.

If WRMT avails itself of certain exemptions from various reporting requirements, its reduced disclosure may make it more difficult for investors and securities analysts to evaluate WRMT and may result in less investor confidence.

The recently enacted JOBS Act is intended to reduce the regulatory burden on "emerging growth companies". WRMT meets the definition of an "emerging growth company" and so long as it qualifies as an "emerging growth company," it will not be required to:

·

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

·

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

·

submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

·

disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, WRMT is choosing to "opt out" of such extended transition period, and as a result, WRMT will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that its decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal.

7

However, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We lack an operating history. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, our business will fail.

We were incorporated on October 22, 2010, have generated $49,582, in revenues and incurred $81,074 in operating losses in discontinued operations from inception to October 29, 2014 and operating losses of $131,440 from our continuing operations from October 29, 2014 to December 31, 2014. As of December 31, 2014, we had deficit accumulated of $212,514. We have a limited operating history upon which an evaluation of our future success or failure can be made. Given that we have undertaken new business activities following the acquisition of ‘SPACE’ these activities have not yet generated revenues and also carry significant risks generally associated with the development and manufacturing and marketing of any new product or service. As these products are unproven in the market, there can be no certainty that customers will ultimately adopt the products and services we manufacture. If we do generate revenues from these new products in the future, these revenues may not be sufficient to cover our operating costs. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to achieve a sustainable sales level will cause us to go out of business.

We will not be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act until the end of the second fiscal year reported upon in our second annual report on form 10-K.

The Sarbanes-Oxley Act of 2002 and the new rules subsequently implemented by the Securities and Exchange Commissions, the Financial Industry Regulatory Authority (“FINRA”) and the Public Company Accounting Oversight Board have imposed various new requirements on public companies, including requiring changes in corporate governance practices.

We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. These costs could affect profitability and our results of operations.

We are in the process of determining whether our existing internal controls over financial reporting systems are compliant with Section 404. We will not be required to conduct the evaluation of effectiveness of our internal controls until the end of the fiscal year reported upon in our second annual report on Form 10-K. In addition, because we are a smaller reporting company, we are not required to obtain the auditor attestation of management’s evaluation of internal controls over financial reporting. If we obtain and disclose such reports we could continue doing so at our discretion so long as we remain a smaller reporting company.

This process of internal control evaluation and attestation may divert internal resources and will take a significant amount of time, effort and expense to complete. If it is determined that we are not in compliance with Section 404, we may be required to implement new internal control procedures and re-evaluate our financial reporting. If we are unable to implement these changes effectively or efficiently, it could harm our operations, financial reporting or financial results, which could adversely affect our ability to comply with our periodic reporting obligations under the Exchange Act.

The loss of the services of our key employees, particularly the services rendered by Fabio Galdi, our Chief Executive Officer and Secretary, and Alfonso Galdi, our Chief Financial Officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Fabio Galdi, Our Chief Executive Officer and Secretary, and Alfonso Galdi, our Chief Financial Officer. The loss of any key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws.

Mr. Fabio Galdi and Mr. Alfonso Galdi lack public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002 or responsibilities such as complying with federal securities laws and making required disclosures on a timely basis. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934, as amended, which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

8

Our officers, directors, consultants and advisors are not obligated to commit their time and attention exclusively to our business and therefore they may encounter conflicts of interest with respect to the allocation of time and business opportunities between our operations and those of other businesses.

Our officers and directors are not obligated to commit their time and attention exclusively to our business and, accordingly, they may encounter conflicts of interest in allocating their own time, or any business opportunities that they may encounter, between our operations and those of other businesses.

Currently, Fabio Galdi, our Chief Executive Officer, Secretary and Director, Alfonso Galdi, our Chief Financial Officer and Director, and Alessandro Senatore, our Chief Operating Officer and Director, each commit approximately 50% of their time to our business in their capacities as officers and directors. Nevertheless, if the execution of our business plan demands more time than is currently committed by any of our officers, directors, consultants or advisors, they will be under no obligation to commit such additional time, and their failure to do so may adversely affect our ability to carry on our business and successfully execute our business plan.

Additionally, all of our officers and directors, in the course of their other business activities, may become aware of investments, business or information which may be appropriate for presentation to us as well as to other entities to which they owe a fiduciary duty.

They may also in the future become affiliated with entities that are engaged in business or other activities similar to those we intend to conduct. As a result, they may have conflicts of interest in determining to which entity particular opportunities or information should be presented. If, as a result of such conflict, we are deprived of investments, business or information, the execution of our business plan and our ability to effectively compete in the marketplace may be adversely affected.

We do not have a majority of independent directors on our Board and the Company has not voluntarily implemented various corporate governance measures, in the absence of which stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these other corporate governance measures and since our securities are not yet listed on a national securities exchange, we are not required to do so. Our Board of Directors is comprised of two individuals, both of whom are also our executive officers. As a result, we do not have independent directors on our Board of Directors.

We have not adopted corporate governance measures such as an audit or other independent committee of our board of directors, as we presently do not have independent directors on our board. If we expand our board membership in future periods to include additional independent directors, we may seek to establish an audit and other committee of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurance that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, at present in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages or employment contracts to our senior officers are made by a majority of directors who have an interest in the outcome of the matters being decided. However, as a general rule, the board of directors, in making its decisions, determines first that the terms of such transaction are no less favorable to us that those that would be available to us with respect to such a transaction from unaffiliated third parties. The company executes the transaction between executive officers and the company once it was approved by the Board of Directors.

Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

None of the members of our Board of Directors are considered audit committee financial experts. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Our Board of Directors are inexperienced with U.S. GAAP and the related internal control procedures required of U.S. public companies. Management has determined that our internal audit function is also significantly deficient due to insufficient qualified resources to perform internal audit functions. Finally, we have not established an Audit Committee of our Board of Directors.

9

We are a development stage company with limited resources. Therefore, we cannot assure investors that we will be able to maintain effective internal controls over financial reporting based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. For these reasons, we are considering the costs and benefits associated with improving and documenting our disclosure controls and procedures and internal controls and procedures, which includes (i) hiring additional personnel with sufficient U.S. GAAP experience and (ii) implementing ongoing training in U.S. GAAP requirements for our CFO and accounting and other finance personnel.

If the result of these efforts are not successful, or if material weaknesses are identified in our internal control over financial reporting, our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting and/or our disclosure controls and procedures, and we could be required to further implement expensive and time-consuming remedial measures and potentially lose investor confidence in the accuracy and completeness of our financial reports which could have an adverse effect on our stock price and potentially subject us to litigation.

Our officers and directors live outside the United States, making it difficult for an investor to enforce liabilities in foreign jurisdictions.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors herein. An investor would have the ability to effect service of process in any action on the company within the United States. However, our principal operations and assets are located outside of the United States, and all of our executive officers and directors are non-residents of the United States. Therefore, it may be difficult to effect service of process on us in the United States, and it may be difficult to enforce any judgment rendered against us. As a result, it may be difficult or impossible for an investor to bring an action against our officers and directors, in the event that an investor believes that such investor’s rights have been infringed under the U.S. securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the international laws may render that investor unable to enforce a judgment against our assets. As a result, our shareholders may have more difficulty in protecting their interests through actions against our management, director or major shareholder, compared to shareholders of a corporation doing business and whose officers and directors reside within the United States.

Additionally, because a significant proportion of our assets are located outside of the United States, they will be outside of the jurisdiction of United States courts to administer, if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declare bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the United States under United States bankruptcy laws. As a result, it may not be possible for investors to:

·

effect service of process within the United States against your non-U.S. resident officers or directors;

·

enforce U.S. court judgments based upon the civil liability provisions of the U.S. federal securities laws against any of the above referenced foreign persons in the United States;

·

enforce in foreign courts U.S. court judgments based on the civil liability provisions of the U.S. federal securities laws against the above foreign persons; and

·

bring an original action in foreign courts to enforce liabilities based upon the U.S. federal securities laws against the above foreign persons.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested Director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than legally required, we have not yet adopted these measures.

Because our Directors are not independent Directors, we do not currently have independent audit or compensation committees. As a result, our Directors have the ability to, among other things, determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested Director transactions, conflicts of interest, if any, and similar matters and any potential investors may be reluctant to provide us with funds necessary to expand our operations.

We intend to comply with all corporate governance measures relating to Director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, Directors and members of board committees required to provide for our effective management as a result of the Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of Directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

10

We do not intend to pay dividends in the foreseeable future. Any return on investment may be limited to the value of our common stock.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may likely prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in WRMT Inc. will need to come through appreciation of the stock’s price.

Risks Related to Our Common Stock and its Market

We do not currently have an active public market for our securities. If there is a market for our securities in the future, such market may be volatile and illiquid.

While our common stock has been quoted on the Over-The-Counter Bulletin Board (“ OTCBB ”) under the symbol “ HNVB ” from June 3, 2014 to December 21, 2014, and under the symbol “WRMT” since December 22, 2014, only a limited number of shares of common stock have traded to date and there is currently no active public market for our common stock. There may not be an active public market for our common stock in the future. If there is an active market for our common stock in the future, we anticipate that such market would be illiquid and would be subject to wide fluctuations in response to several factors, including, but not limited to:

| | |

| (1)

| actual or anticipated variations in our results of operations;

|

| | |

| (2)

| our ability or inability to generate revenues;

|

| | |

| (3)

| the number of shares in our public float;

|

| | |

| (4)

| increased competition;

|

Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock. Additionally, moving forward we anticipate having a limited number of shares in our public float, and as a result, there could be extreme fluctuations in the price of our common stock. Further, due to the limited volume of our shares which trade and our limited public float, we believe that our stock prices (bid, ask and closing prices) will be entirely arbitrary, will not relate to the actual value of the Company, and will not reflect the actual value of our common stock. Shareholders and potential investors in our common stock should exercise caution before making an investment in the Company, and should not rely on the publicly quoted or traded stock prices in determining our common stock value, but should instead determine the value of our common stock based on the information contained in the Company's public reports, industry information, and those business valuation methods commonly used to value private companies.

The company is subject to the 15(D) reporting requirements under the Securities Exchange Act of 1934, which does not require a company to file all the same reports and information as a fully reporting company.

Until our common stock is registered under the Exchange Act, we will not be a fully reporting company, but only subject to the reporting obligations imposed by Section 15(d) of the Securities Exchange Act of 1934. Pursuant to Section 15(d), we will be required to file periodic reports with the SEC, such as annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, once this registration statement is declared effective, including the annual report on Form 10-K for the fiscal year during which the registration statement is declared effective. That filing obligation will generally apply even if our reporting obligations have been suspended automatically under section 15(d) of the Exchange Act prior to the due date for the Form 10-K.

After that fiscal year and provided the Company has less than 300 shareholders, the Company is not required to file these reports. If the reports are not filed, the investors will have reduced visibility as to the Company and its financial condition. In addition, as a filer subject to Section 15(d) of the Exchange Act, the Company is not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; the company will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our company; that these persons will not be subject to the short-swing profit recovery provisions of the Exchange Act; and that more than five percent (5%) holders of classes of your equity securities will not be required to report information about their ownership positions in the securities.

11

Our common stock is deemed to be “ penny stock ”, which may make it more difficult for investors to sell their shares due to suitability requirements.

Our common stock is deemed to be “ penny stock ” as that term is defined in Rule 3a51-1 promulgated under the Securities Exchange Act of 1934, as amended (the “ Exchange Act ”). These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline. Penny stocks are stock:

| | |

| ·

| With a price of less than $5.00 per share;

|

| | |

| ·

| That are not traded on a “ recognized ” national exchange;

|

| | |

| ·

| Whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ listed stock must still have a price of not less than $5.00 per share); or

|

| | |

| ·

| In issuers with net tangible assets less than $2.0 million (if the issuer has been in continuous operation for at least three years) or $10.0 million (if in continuous operation for less than three years), or with average revenues of less than $6.0 million for the last three years.

|

Broker-dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker-dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. Many brokers have decided not to trade “ penny stocks ” because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “ penny stock rules ” for any significant period, there may develop an adverse impact on the market, if any, for our securities. Because our securities are subject to the “ penny stock rules, ” investors will find it more difficult to dispose of our securities.

Risks Factors Related To Our Business and Industry

We may not be able to integrate new technologies and provide new services in a cost-efficient manner.

Our industry is subject to rapid and significant changes in technology, frequent new service introductions and evolving industry standards. We cannot predict the effect of these changes on our competitive position, our profitability or the industry generally. Technological developments may reduce the attractiveness of our offering. If we fail to adapt successfully to technological advances or fail to obtain access to new technologies, we could lose customers and be limited in our ability to attract new customers and/or sell new services to our existing customers. In addition, delivery of new services in a cost-efficient manner depends upon many factors, and we may not generate anticipated revenue from such services.

Disruptions in our wireless service and infrastructure may result in customer dissatisfaction, customer loss or both, which could materially and adversely affect our reputation and business.

Our systems are an integral part of our customers’ business operations. It is critical for our customers, that our systems provide a continued and uninterrupted performance. Customers may be dissatisfied by any system failure that interrupts our ability to provide services to them. Sustained or repeated system failures would reduce the attractiveness of our services significantly and could result in decreased demand for our services. Disruptions may cause interruptions in service or reduced capacity for customers, either of which could cause us to lose customers and/or incur expenses, and thereby adversely affect our business, revenue and cash flow.

Integration of technologies, network capacity or acquisitions ultimately may not provide the benefits originally anticipated by management and may distract the attention of our personnel from the operation of our business.

We strive to broaden our solutions offerings as well as to continuously improve the functionality of our products and services. We may pursue acquisitions in the future to further strengthen our strategic objectives. Acquisitions of businesses, networks, spectrum or technologies involve operational risks, including the possibility that an acquisition may not ultimately provide the benefits originally anticipated by management. Moreover, we may not be successful in identifying attractive acquisition candidates, completing and financing additional acquisitions on favorable terms, or integrating the acquired business or assets into our own. There may be difficulty in integrating technologies and solutions, in migrating customer bases and in integrating the service offerings, distribution channels and networks gained through acquisitions with our own. Successful integration of operations and technologies requires the dedication of management and other personnel, which may distract their attention from the day-to-day business, the development or acquisition of new technologies, and the pursuit of other business acquisition opportunities. Therefore, successful integration may not occur in light of these factors.

12

Product defects or software errors could adversely affect our business.

Design defects or software errors may cause delays in product introductions and project implementations, damage customer satisfaction and may have a material adverse effect on our business, results of operations and financial condition. Our software systems are highly complex and may, from time to time, contain design defects or software errors that may be difficult to detect and correct. Design defects, software errors, misuse of our products, incorrect data from external sources or other potential problems within or outside of our control may arise during implementation or from the use of our products, and may result in financial or other damages to our customers, for which we may be held responsible. Although we will have license agreements with our customers that contain provisions designed to limit our exposure to potential claims and liabilities arising from customer problems, these provisions may not effectively protect us against such claims in all cases and in all jurisdictions. Our insurance coverage is not sufficient to protect against all possible product liability for defects or software errors. In addition, as a result of business and other considerations, we may undertake to compensate our customers for damages caused to them arising from the use of our products, even if our liability is limited by a license or other agreement. Claims and liabilities arising from customer problems could also damage our reputation, adversely affecting our business, results of operations and the financial condition.

Changes in the regulation of the industries we operate in could adversely affect our business, revenue or cash flow.

We operate in a heavily regulated industry. As a provider of wireless and other services, we are directly and indirectly subject to varying degrees of regulation in each of the jurisdictions in which we provide our services. Local laws and regulations, and the interpretation of such laws and regulations, differ significantly among the jurisdictions in which we operate. Enforcement and interpretations of these laws and regulations can be unpredictable and are often subject to the informal views of government officials. Certain foreign, federal, and state regulations and local franchise requirements have been, are currently, and may in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals. Such proceedings may relate to, among other things, the rates we may charge for our local, network access and other services, the manner in which we offer and bundle our services, the terms and conditions of interconnection, unbundled network elements and resale rates, and could change the manner in which telecommunications companies operate. We cannot predict the outcome of these proceedings or the impact they will have on our business, revenue and cash flow.

There can be no assurance that future regulatory changes will not have a material adverse effect on us, or that regulators or third parties will not raise material issues with regard to our compliance or noncompliance with applicable regulations, any of which could have a material adverse effect upon us. Potential future regulatory, judicial, legislative, and government policy changes in jurisdictions where we operate could have a material adverse effect on us. Domestic or international regulators or third parties may raise material issues with regard to our compliance or noncompliance with applicable regulations, and therefore may have a material adverse impact on our competitive position, growth and financial performance.

Deterioration in our relationships with facilities-based carriers could have a material adverse effect upon our telecommunications traffic business.

In our SPACE Works and SPACE Wireless business, we connect our customers’ telephone calls and data/Internet needs through access agreements with facilities-based mobile, VOIP and PSTN carriers. Our ability to maintain and expand our business depends on our ability to maintain favorable relationships with these carriers. If our relationship with one or more of these carriers were to deteriorate or terminate, it could have a material adverse effect upon our cost structure, service quality, network diversity, results of operations and financial condition. If we experience difficulties with our third-party providers, we may not achieve desired quality of service, economies of scale or otherwise which may prevent us from growing our business.

If we are not able to provide a cost-effective wireless network to our subscribers, we may not be able to grow our business successfully.

Our long-term success in the US depends on our ability to design, implement, provide and manage a reliable and cost-effective wireless service, where we, or third parties, provide the networks. Failure to manage the service or third party relationships may have an adverse impact on our business growth and financial condition. .

New technology developments or a change in competitor activity may cause our business to suffer.

The wearable market in which we operate is highly competitive and rapidly changing and we may be unable to compete successfully. There are a number of companies that develop or may develop products that compete in our targeted markets. Some of our competitors are much larger than we are and have significantly greater financial, development and marketing resources than we do. The competition in these markets could adversely affect our operating results by reducing the volume of the products we sell or the prices we can charge. These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. They may also devote greater resources to the development, promotion and sale of their products than we do.

Our success will depend substantially upon our ability to enhance our products and technologies and to develop and introduce, on a timely and cost-effective basis, new products and features that meet changing customer requirements and incorporate technological enhancements. If we are unable to develop new products and enhance functionalities or technologies to adapt to these changes, or if we are unable to realize synergies among our acquired products and technologies, our business will suffer.

13

Our products may not be accepted in the market or the market may not grow sufficiently to grow revenues.

Our SPACE Computer or Lumina Glasses may not be widely accepted by the market. Customers may determine that Lumina Glasses are not comfortable, weigh too much or the size and format of the display is inappropriate. Consumers may not be satisfied with the SPACE Computer or SPACE Works platform or they may find that the connectivity may not meet with their expectations or there may be insufficient content or capacity to meet with their requirements.

Other factors that may affect market acceptance of our application include the reliability of these devices; our ability to implement upgrades and other changes to our software without disrupting our service; the level of customization or configuration we offer; and the price, performance and availability of competing products and services.

The market for these devices and services may not develop further, or may develop more slowly than we expect, either of which would negatively affect our ability to grow revenues, achieve profitability and generate positive cash flow.

We rely on third party suppliers for component parts for our devices and any disruption in the supply chain could have negative impact on our ability to manufacture and supply our customers

We have not established long term agreements with our suppliers. Our ability to manufacture and distribute SPACE Computer and Lumina Glasses would be severely limited if suppliers were to terminate supply agreements or become unable to provide the required capacity and quality on a timely basis. This lack of supply may prevent us from manufacturing and shipping sufficient products to meet demand. Furthermore, we cannot provide assurances that we would be able to establish alternative component supply arrangements on acceptable terms.

A breach of data security may subject us subject us to fines, law suits and loss of customers.

We rely on our electronic information systems to perform the routine transactions to run our business. We transact business over the Internet with customers, vendors and our subsidiaries. We have implemented security measures to protect unauthorized access to this information. If our security systems are penetrated and confidential and or proprietary information is taken, we could be subject to fines, lawsuits and loss of customers.

A disruption to our information technology systems could significantly impact our operations and impact our revenue and profitability.

We maintain proprietary data processing systems and use customized software systems. An interruption to these systems for an extended period may impact our ability to operate the business, process transactions or supply services that could result in a decline in sales and affect our ability to achieve or maintain profitability.

Our business could suffer if we lose the services of, or fail to attract, key personnel.

In order to continue to provide quality products in our rapidly changing business, we believe it is important to retain personnel with experience and expertise relevant to our business.

Due to the level of technical and marketing expertise necessary to support our existing and new customers, our success will depend upon our ability to attract and retain highly skilled management, technical, and sales and marketing personnel. Competition for highly skilled personnel is intense and there may be only a limited number of persons with the requisite skills to serve in these positions. Due to the competitive nature of the labor markets in which we operate, we may be unsuccessful in attracting and retaining these personnel. Our inability to attract and retain key personnel could adversely affect our ability to develop and manufacture our products. In addition, our success depends in large part upon a number of key management and technical employees. The loss of the services of one or more key employees, including Mr Fabio Galdi, our President and Chief Executive Officer, could seriously impede our success. We do not maintain any “key-man” insurance policies on Mr Fabio Galdi or any other employees.

We rely on a number of third parties, and such reliance exposes us to a number of risks.

Our operations depend on a number of third parties. We have limited control over these third parties. There can be no assurance that any such agreements will not be terminated or that they will be renewed in the future on terms acceptable to us, or that we will be able to enter into additional such agreements. We also rely on a variety of technology that we license from third parties. Our loss of, or inability to, maintain or obtain upgrades to any of these technology licenses could result in delays. These delays could materially adversely affect our business, results of operations and financial condition, until equivalent technology could be identified and licensed, or developed and integrated. Moreover, we use third parties in connection with our website and other marketing materials. Overall, our inability to maintain satisfactory relationships with the requisite third parties on acceptable commercial terms, or the failure of such third parties to maintain the quality of services they provide at a satisfactory standard, could materially adversely affect our business, results of operations and financial condition.

14

Item 2. PROPERTIES

The Company subleases office space from World Global Group, Inc. (WGG), which is controlled by Fabio Galdi, our Chief Executive Officer, President and Director, at a rate of $5,000 per calendar month, which sublease remains in effect on a month-to-month basis during the 10 year WGG lease term, and which office space is located at 600 Brickell World Plaza, Suite 1775, Miami, Florida 33132. Neither the Company nor WGG has any immediate plans to change office space. The Company recorded a rental charge of $10,000 for the year ended December 31, 2014.

Item 3. LEGAL PROCEEDINGS

We are not currently a party to any legal proceedings, and we are not aware of any pending or potential legal actions.

Item 4. MINE SAFETY DISCLOSURES

Not applicable to our Company.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

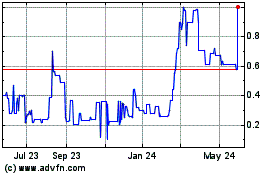

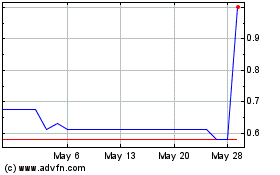

While our common stock has been quoted on the Over-The-Counter Bulletin Board (“OTCBB ”) under the symbol “ HNVB ” from June 3, 2014 to December 21, 2014, and under the symbol “WRMT” since December 22, 2014, only a very limited number of shares of common stock have traded to date and there is currently no active public market for our common stock. During the past 12 months the 52-week high price of our stock was $0.50 and 52-week low was $0.50.

The Company's common stock is considered a "penny stock " as defined in the Commission's rules promulgated under the Exchange Act (the “ Rules ”). The Commission's rules regarding penny stocks impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally persons with net worth in excess of $1,000,000, exclusive of residence, or an annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by the rules, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. Thus the Rules affect the ability of broker-dealers to sell the Company's shares should they wish to do so because of the adverse effect that the Rules have upon liquidity of penny stocks. Unless the transaction is exempt under the Rules, under the Securities Enforcement Remedies and Penny Stock Reform Act of 1990, broker-dealers effecting customer transactions in penny stocks are required to provide their customers with (i) a risk disclosure document; (ii) disclosure of current bid and ask quotations if any; (iii) disclosure of the compensation of the broker-dealer and its sales personnel in the transaction; and (iv) monthly account statements showing the market value of each penny stock held in the customer's account. As a result of the penny stock rules, the market liquidity for the Company's securities may be severely adversely affected by limiting the ability of broker-dealers to sell the Company's securities and the ability of purchasers of the securities to resell them.

Holders of Common Stock

As of December 31, 2014, we had an aggregate of approximately 34 stockholders of record as reported by our transfer agent.

Dividends and Dividend Policy

There are no restrictions imposed on the Company that limit its ability to declare or pay dividends on its common stock, except as limited by state corporation law. During the last two fiscal years, no cash or stock dividends were declared or paid and none are expected to be paid in the foreseeable future.

We expect to retain all earnings generated by our future operations for the development and growth of our business. The Board of Directors will determine whether or not to pay dividends in the future in light of our earnings, financial condition, capital requirements and other factors.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

15

Recent sales of unregistered securities.

We issued 8,000,000 shares of restricted common stock at a total price of $2,000,000 to WDAS on October 29, 2014. The issuance of these shares of common stock are exempt from the registration requirements of the Securities Act pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated under the Securities Act ("Regulation D"). The Registrant made this determination based on the representations of WDAS that WDAS is an "accredited investor" within the meaning of Rule 501 of Regulation D and has access to information about the Registrant.

We completed an offering of 4,000,000 shares of our common stock at a price of $0.001 per share to our Directors Alexander Averchenko (2,000,000) and Elena Shmarihina (2,000,000) in December of 2012 and September of 2013 respectively. The total amount received from this Offering was $4,000. We completed this offering pursuant to Regulation S of the Securities Act.

The offer and sale of all shares of our common stock listed above were affected in reliance on the exemptions for sales of securities not involving a public offering, as set forth in Regulation S promulgated under the Securities Act. The investor acknowledged the following: subscriber is not a United States Person, nor is the subscriber acquiring the shares directly or indirectly for the account or benefit of a United States Person. None of the funds used by the subscriber to purchase the units have been obtained from United States Persons.

For purposes of the Subscription Agreement, “United States Person” within the meaning of U.S. tax laws, means a citizen or resident of the United States, any former U.S. citizen subject to Section 877 of the Internal Revenue Code, any corporation, or partnership organized or existing under the laws of the United States of America or any state, jurisdiction, territory or possession thereof and any estate or trust the income of which is subject to U.S. federal income tax irrespective of its source, and within the meaning of U.S. securities laws, as defined in Rule 902(o) of Regulation S, means: (i) any natural person resident in the United States; (ii) any partnership or corporation organized or incorporated under the laws of the United States; (iii) any estate of which any executor or administrator is a U.S. person; (iv) any trust of which any trustee is a U.S. person; (v) any agency or branch of a foreign entity located in the United States; (vi) any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. person; (vii) any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if an individual) resident in the United States; and (viii) any partnership or corporation if organized under the laws of any foreign jurisdiction, and formed by a U.S. person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a)) who are not natural persons, estates or trusts.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the years ended December 31, 2014 and 2013.

Item 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

16

Item 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or our behalf. We disclaim any obligation to update forward-looking statements.

This discussion presents management’s analysis of our results of operations and financial condition as of and for each of the years in the two-year period ended December 31, 2014. The discussion should be read in conjunction with our financial statements and the notes related thereto which appear elsewhere in this report.

Year End Summary:

| | | | | |

| Year Ended December 31

| | Percentage

|

| 2014

| | 2013

| | Increase/

|

| | | | | (Decrease)

|

Operating expenses

| 131,440

| | -

| | 100%

|

Loss from continuing operations

| (131,440)

| | -

| | 100%

|

Other Expenses:

| | | | | |

Loss from discontinued operations

| 42,160

| | 29,825

| | 41%

|

Total Other expenses

| 42,160

| | 29,825

| | 41%

|

Net Loss

| (173,600)

| | (29,825)

| | 482%

|

During the year ended December 31, 2014, we recorded a loss from discontinued operations of $42,160 as compared to a loss from discontinued operations of $29,825 for the year ended December 31, 2013. Loss from discontinued operations consists of the operating activities of Halton Universal Brands prior to the acquisition by WDAS and our subsequent departure from the brokerage, consulting and marketing in brand consulting and new product strategy consulting for emerging brands into the SPACE Computer business.

Results of Operations

For the year ended December 31, 2014 compared to the year ended December 31, 2013

Operating Costs and Expenses