Current Report Filing (8-k)

14 April 2023 - 6:31AM

Edgar (US Regulatory)

0001752474truefalseNONE00017524742023-04-062023-04-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 13, 2023 (April 6, 2023) |

KLDiscovery Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38789 |

61-1898603 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9023 Columbine Road |

|

Eden Prairie, Minnesota |

|

55347 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 703 288-3380 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Compensatory Arrangements of Certain Officers.

During 2022, KLDiscovery Inc. (the “Company”) granted performance based restricted stock units (“RSUs”) to the Company’s named executive officers (the “NEOs”), 50% of which vest based on the achievement of annual consolidated revenue targets and 50% of which vest based on the achievement of annual revenue targets for Nebula, the Company’s flagship, end-to-end AI / ML powered solution (“Performance Awards”). The RSUs vest in three annual installments based on the achievement of the annual consolidated revenue and Nebula revenue performance conditions, subject to the NEO’s continued employment with the Company through the applicable vesting date. If the performance conditions are not met in the first or second year, all RSUs granted can still vest in the third year if the cumulative performance conditions are met at that time. One share of the Company’s common stock will be issued upon the vesting of each RSU. On February 2, 2023, notwithstanding that neither of the revenue targets for 2022 were met, the Compensation Committee of the Company’s Board of Directors approved the vesting of fifty percent of the total shares eligible to vest in the first annual installment of the Performance Awards due to achievement of the Company’s adjusted EBITDA target in 2022 and the goals of the Company to incentivize employees.

On April 6, 2023, the Compensation Committee of the Company’s Board of Directors concluded that, based on the Company’s results in 2022, the consolidated and Nebula revenue targets for 2023 and 2024 in the Performance Awards were unattainable, and amended the targets for the remaining years to align more closely with the Company’s current budget. The consolidated revenue target for 2023 was lowered by 7.2% and the Nebula revenue target for 2023 was lowered by 47.4% whilst the applicable targets for 2024 were changed to be based on a percentage increase over actual 2023 consolidated and Nebula revenue and the amount of the percentage increase for the 2024 consolidated revenue target decreased by 4%.

The grant of awards with realistic performance conditions supports the Company’s goal of aligning executive incentives with long-term stockholder value and ensuring that the NEOs have a continuing stake in the long-term success of the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KLDiscovery Inc. |

|

|

|

|

Date: |

April 13, 2023 |

By: |

/s/ Christopher J. Weiler |

|

|

Name: Title: |

Christopher J. Weiler

Chief Executive Officer |

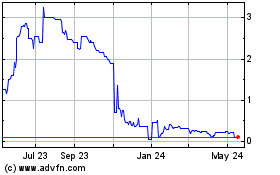

KLDiscovery Com (PK) (USOTC:KLDI)

Historical Stock Chart

From May 2024 to Jun 2024

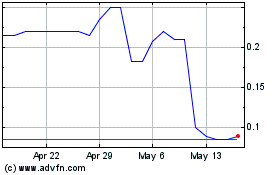

KLDiscovery Com (PK) (USOTC:KLDI)

Historical Stock Chart

From Jun 2023 to Jun 2024