By Ellen Emmerentze Jervell

T-shirts and bluejeans have company among casual clothes gone

Establishment: sneakers.

Athletic shoes have become core lifestyle footwear, not only in

street culture but also for fashionistas and corporate types.

Sneakers are more commonly being paired with men's suits. And it's

the retro styles that are raising the game for shoe makers.

Skaters, celebrities and brides are posting pictures of themselves

on social media in sneakers such as the signature styles Kareem

Abdul-Jabbar and Billie Jean King wore.

"They've finally been around long enough to become classic,"

says Russ Bengtson, senior editor at urban-culture site

Complex.com.

Reissued or "heritage" shoes were the fastest-growing footwear

category in the U.S. last year, according to analysts NPD Group,

which estimates sector sales rose more than 50% and accounted for

about 20% of the $17.2 billion U.S. athletic footwear market.

It is good news for Germany's venerable Adidas AG and Puma SE,

which are working to reprise their classics. Both companies have

struggled to regain their disco-era cool in today's highly

competitive market, and each has seven decades of products to

mine.

At Adidas, the world's second-largest sportswear maker after

Nike Inc., the cash cow is a range of leather tennis and basketball

shoes dating back to the 1960s. Now part of the company's

'Originals' business, the line is "the backbone of our success,"

says Arthur Hoeld, Originals general manager.

Originals' surge was a top reason Adidas last year achieved

sales growth of almost 20% from 2014, the company says. Overall

revenue for 2015 was EUR16.9 billion ($19.12 billion); Originals

grew at a "double digit" percentage rate. The rise included a

strong rebound in the U.S., where Adidas has struggled.

Adidas says it sold 8 million pairs of its Stan Smiths last year

-- compared with about 50 million pairs sold in the past

half-century. The company also sold 15 million pairs of Superstars

in 2015, with Adidas's signature triple stripe. Both models average

about $70.

"They're the crown jewels," says Mr. Hoeld of the heritage

shoes.

Puma CEO Bjørn Gulden is more circumspect.

"Heritage sneakers are an important part of our business," but

perhaps not for long, he says. "Trends come and go." He noted that

retro basketball shoes are hot now, while retro running shoes were

recently trendier.

Puma's 2015 revenue was EUR3.4 billion, up from EUR2.9 billion a

year earlier.

The retro-style trend has been decades in the making. In 1982,

rap duo Run-DMC's hit "My Adidas" breathed life into the company's

decade-old Superstar line. "I wanted to bring a positive

representation to the sneakers that break dancers, DJs, MC's and

the graffiti writers were wearing," says Darryl McDaniels, who goes

by DMC and still wears Adidas.

When Madonna a decade later performed in old Adidas Gazelle

sneakers, the company upped production of past best-sellers.

Nike jumped on Michael Jordan's retirement in 1994 to reissue

its Air Jordan basketball shoes from the 1980s. It did so again in

1998 when he retired a second time.

Today, sport shoes are generally split between "performance"

models aimed at serious athletes and "lifestyle" footwear for

people who don't necessarily aim to break a sweat. Many of today's

lifestyle shoes are yesteryear's performance models.

Nike, whose most popular back-catalog items stem from the 1980s

and '90s, has long been more aggressive at marketing and

capitalizing on its retro products than Adidas or Puma, says John

Guy, an analyst at MainFirst bank. Nike still sells more heritage

sneakers than any rival, says NPD analyst Matt Powell.

Nike also owns Converse's Chuck Taylor All-Stars, introduced

nearly 100 years ago, which have long been in demand.

Nike says it saw "strong value in celebrating our heritage,"

according to a spokesman, though reissued models use new materials

and construction. Today's Nike's Air Max and Air Jordan retail for

about $150 and $100, respectively.

What distinguishes today's renaissance is who's sporting sport

shoes. Older sneakers from Adidas and Puma are kicking aside

traditional dress shoes and opening new sartorial frontiers.

When Adidas relaunched Stan Smiths in 2014, it wooed the fashion

world. High-end designers Phoebe Philo, Raf Simons and Marc Jacobs

all wore the white-and-green leather sneaker. U.S. designer

Alexander Wang presented catwalk outfits inspired by the shoe.

Nike's retro sales, such as past resurgences of Adidas and other

heritage brands, largely have focused on young and athletic buyers.

"Adidas is targeting a broader range of consumers," says Matt

Halfhill, founder of sneaker site Nicekicks.com.

Adidas appears to have a leg up on Nike in respectable retro,

observers say, because its sneakers date back to when baby boomers

were babies. Stan Smith played tennis when rackets were made of

wood and sportswear essentially was modified casual attire.

Adidas's retro models are "kind of 'pre-style,'" says Mr.

Bengtson at Complex.com. "People aren't going to stop you on the

street and say 'Ew, that's awful'."

A delicate issue brands face managing the current fad is

avoiding overexposure. Adidas executives admit they mishandled

their Run-DMC lift by flooding the market and killing their own

cachet.

Mr. Hoeld at Adidas says the company is managing retro

popularity in "a very cohesive manner," with a steady flow of

variations to maintain interest.

Most important, says Mr. Gulden at Puma, is to limit marketing

exuberance and "have a good balance between performance, new

lifestyle shoes and heritage."

Write to Ellen Emmerentze Jervell at ellen.jervell@wsj.com

(END) Dow Jones Newswires

June 20, 2016 15:33 ET (19:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

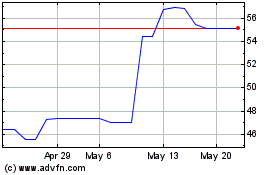

Puma Ag Rudolf Dassl (PK) (USOTC:PMMAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Puma Ag Rudolf Dassl (PK) (USOTC:PMMAF)

Historical Stock Chart

From Jan 2024 to Jan 2025