Aram Resources PLC - Acquisition

05 March 1999 - 4:04AM

UK Regulatory

RNS No 5837w

ARAM RESOURCES PLC

4th March 1999

ARAM RESOURCES PLC ("Aram")

Proposed Acquisition of Tregunnon Quarry Limited ("the Acquisition")

Introduction

Aram announces that it has exchanged conditional contracts for the acquisition

of the entire issued share capital of Tregunnon Quarry Limited ("TQL").

TQL was incorporated in October 1995 and until recently had not traded. Its

last audited accounts were prepared to 31 December 1997. For the year then

ended TQL reported losses of #8,441 and had net liabilities of #15,838. These

accounts attributed no value to TQL's principal asset being its leasehold

interest in Tregunnon Quarry ("the Quarry"). As at the Completion Date, TQL

is expected to have net liabilities of #230,000.

Tregunnon Quarry is a diorite quarry located seven miles west of Launceston,

Cornwall. The Quarry is held by TQL on a 21 year lease which commenced on 17

April 1996. The Quarry is subject to a planning permission dating from 2 July

1987. The planning permission lasts for 30 years subject to a 15 year review.

The planning permission currently restricts output from the Quarry to 50,000

tonnes per annum.

TQL is a company owned and controlled by Mr Binns, Aram's Chief Executive, and

other members of his family - as recorded in the Placing Prospectus for Aram

issued at the time of the Company's admission to trading on the Altenative

Investment Market ("AIM").

The total consideration for the Acquisition is to be satisfied first on

completion by #163,750 in cash and 450,000 new ordinary shares to be issued at

the closing mid-market price on the business day prior to the completion date

and secondly by the Company undertaking to discharge the overdraft of TQL

which amounts to #248,128.70. Based upon the Company's closing mid-market

price on 3 March 1999 of 85p the total consideration would be #794,378.

Application will be made to the London Stock Exchange for the new ordinary

shares to be issued on completion to be admitted to trading on the AIM.

Dealings in the new ordinary shares are expected to commence on 26 March 1999.

In a separate agreement Mrs Binns will grant an option to a settlement

established by Mr G M B Nixon, the Company's Non-Executive Chairman, to

acquire 225,000 of Mrs Binns' shares in the Company for a total consideration

of #1. The purpose of this option is to allow the current equality in the

shareholdings of Messrs. Binns and Nixon to be maintained after the

Acquisition. Messrs. Binns and Nixon, who have been business associates for

many years, are each currently interested in 2,402,500 ordinary shares in the

Company, representing a total of approximately 93.3 per cent. of the Company's

issued ordinary shares.

Due to the size of the Acquisition in relation to the Company and because

Messrs. Binns and Nixon are interested parties, section 320 of the Companies

Act 1985 requires that the Acquisition is subject to shareholders' approval.

In addition, all negotiation of the Purchase Agreement on behalf of the

Company has been undertaken by the Independent Directors.

Further the Independent Directors have commissioned specialist independent

valuers to report on the Quarry. The valuers have reported to the Independent

Directors that they estimate the exploitable mineral reserves to be at least 2

million tonnes and to have a value on a discounted cashflow basis of

#2,800,000. This valuation is based upon sales prices and production cost

estimates supplied by the Independent Directors and assumes output from the

Quarry of 50,000 tonnes per annum each year until the current planning

permission expires in 2017.

In addition the Independent Directors commissioned independent drilling and

mineralogical reports. These have confirmed, inter alia, the quantity of the

Quarry's reserves and the polished stone value ("PSV") of its stone.

Background to and Reasons for the Acquisition

Over the last year, your Board has identified an increasing trend whereby, in

response to a continuing desire to improve road safety, a higher specification

of wearing surfaces with better and longer term skid resistant properties is

being required. Local area surveyors are seeking to achieve this through

increasing the PSV specification of the aggregates used in the wearing course

and surface dressing of roads.

Carnsew, the quarry which the Company owns and uses to satisfy its local

markets, produces aggregates with a PSV of 55. While this is sufficient for

many contracts, it is not sufficient to satisfy the higher PSV specification

contracts which typically require a PSV in excess of 57. The availability in

Cornwall of aggregates with PSV in this range is severely restricted and, in

order to meet contract demands, Carnsew has had to import approximately 16,000

tonnes of stone with a PSV of greater than 60 from Northern Ireland and South

Wales during the last trading year. Clearly the costs of obtaining supplies

from these distant sources restricts the number of contracts for which Aram

can economically compete.

The PSV of the Quarry's stone has been independently confirmed to be in the

range of 57 to 59 and the Acquisition would therefore have the following

benefits for Aram:

* it would provide a guaranteed local supply of a scarce resource;

* it would provide an immediate cost saving at Carnsew in respect of the high

PSV aggregates the Company is currently importing from Northern Ireland and

South Wales, due to lower raw material costs per tonne and to reduced haulage

costs;

* it would allow Aram to quote more competitively for contracts in its local

markets, particularly in the surface dressing market; and

* it would open up new markets for Aram, for example, in west Devon.

The Independent Directors have taken market soundings and are confident that

there is sufficient market demand to ensure that the current consented output

from the Quarry can be fully utilised. The Independent Directors also believe

that the Company may be able to secure a higher consented output from the

Quarry in due course, particularly as the Quarry is a source of a material in

short supply.

The Quarry will then be operated on a seasonal basis commencing in April 1999.

It is anticipated that in its first 12 months the Quarry will produce less

than 50,000 tonnes, its maximum consent output, and will breakeven. After

that maximum consented output should be achieved and the Quarry should be

profitable.

Terms of the Acquisition

Under the terms of the Purchase Agreement, the Company has agreed to purchase

the entire issued share capital of TQL for a consideration of #80,000 in cash

and 450,000 new Ordinary Shares and an obligation to discharge the overdraft

of TQL. The cash consideration is subject to adjustment by an amount equal to

the amount (if any) by which the net liabilities of TQL on the Completion

Date, exceed #315,000.

The new ordinary shares will be issued on the completion date at the closing

mid-market price on the business day prior to the completion date, which is

expected to be 23 March 1999.

The Acquisition is conditional upon receiving shareholders' approval at the

forthcoming EGM.

Current trading and prospects

The Company's interim statement announced on 29 October 1998 contained full

details of the substantial progress made. Since then further progress has

been made in the establishment of the Company's satellite coating plants. In

addition to the planning permissions already granted in respect of the

Company's freehold wharf in Plymouth, planning consent for an aggregate

terminal and roadstone coating and bagging plant at Southampton has also been

granted. Furthermore, the Company is in the process of establishing an

aggregate terminal at its leasehold wharf in Portland. These sites should

become fully operational during the course of this year and should

significantly enhance the financial performance of the Company. The Company

is actively pursuing opportunities to establish further satellite sites.

The Directors are also pleased to announce that the Department of the

Environment Transport and the Regions has now confirmed their approval of a

grant in the sum of #1,057,000 for certain of the engineering works concerned.

This is in addition to the Regional Selective Assistance Grant in the sum of

#280,000 referred to in the interim statement of the Company. Approved grants

to date therefore total #1,337,000 which the Directors believe justifies your

Board's decision to defer the developments concerned until the decision on the

grants was secured.

Recommendation

The Independent Directors, having undertaken their own due diligence and

consulted with the Company's nominated adviser, Rowan Dartington & Co.

Limited, consider that the Acquisition pursuant to the terms of the Purchase

Agreement is fair and reasonable so far as the shareholders of the Company are

concerned and that the Acquisition is in the best interests of the

shareholders as a whole.

A circular, containing further details of the Acquisition and convening an

Extraordinary General Meeting at which shareholders' approval to the

Acquisition will be sought, will be despatched to shareholders shortly.

For further information please contact:

Ken Rees, Winningtons - 0117 930 8816

END

ACQNFKDLESLNEFN

Aura Renewable Acquisiti... (LSE:ARA)

Historical Stock Chart

From Jun 2024 to Jul 2024

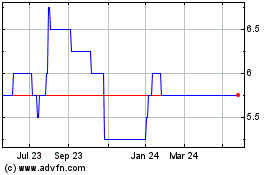

Aura Renewable Acquisiti... (LSE:ARA)

Historical Stock Chart

From Jul 2023 to Jul 2024