TIDMAYM

Anglesey Mining plc, a UK mining company

Projects:

100% ownership of the Parys Mountain underground copper-zinc-lead-silver-gold

deposit in North Wales, UK where an independent Preliminary Economic Assessment

announced in January 2021 showed:

· a financial model for an expanded case at 3,000 tpd with a pre-tax NPV10% of

US$120 million, (£96 million), 26% IRR and 12-year mine life

During the year, Anglesey released an updated resource estimate of 1.3 million

tonnes of Measured resources, 4.0 million tonnes of Indicated resources together

with 11.7 million tonnes of Inferred resources

A 49.7% interest in the Grängesberg Iron project in Sweden, up from 19.9% last

year. Anglesey has management rights and a right of first refusal to increase

the Group's interest to 100%. At Grängesberg, an independent Pre-Feasibility

Study announced on 19 July 2022 showed:

· Probable Ore Reserves of 82.4 million tonnes of supporting a 16-year mine

life with annual production of 2.5 million tonnes of concentrate grading 70%

iron ore

· Post-tax NPV8% of US$688 million with an IRR of 25.9% after tax

A 12% shareholding in Labrador Iron Mines Holdings Limited which holds Direct

Shipping Ore (DSO) deposits of iron in Canada where an independent Preliminary

Economic Assessment of its Houston project published in March 2021 showed:

· Potential for production of 2 million dmt of DSO per year, with an initial

12-year mine life, for total production of 23.4 million dmt of product at 62.2%

Fe over the life of the mine

· NPV8% CAD109 million at a conservative base case iron ore price with a 39%

IRR and a 12-year mine life

Chairman's Letter

[image]To Anglesey Shareholders

The past year has seen a continuation of global uncertainty generated by the

ongoing conflict in Ukraine and other potential flashpoints. Globally, inflation

has also remained stubbornly high leading to a `cost-of-living' crisis in many

countries across the world. Meanwhile, economic growth has been slow, even in

China, which placed a cloud over metal prices.

Despite the global macro uncertainty, very encouraging progress was made at both

our Parys Mountain copper-zinc-lead-silver-gold project and our iron ore project

in Sweden. While equity markets remained very challenging for junior companies,

we successfully raised £865,000 in May 2022, attracting new institutional

investor support, and a further £1.5 million in new financings in May and July

2023.

Review of Activities

The momentum from the previous year was maintained at Parys Mountain. Strong

assays were received from the White Rock/Engine Zone infill drilling programme,

which fed into the mineral resource update that was completed in April 2023.

Importantly, 92% of the White Rock and Engine Zone resources are now in the

Measured and Indicated categories, which represents a significant increase in

confidence - a very important aspect that will feed into the next round of mine

design and optimisation work.

From a permitting perspective, modern mines are required to place significant

emphasis on the management and disposal of tailings. The original planning

permissions for Parys Mountain were based on a conventional valley fill, wet

tailings disposal. Modern best practice required a rethink of this method with

Knight Piésold completing the conceptual design for a dry-stack tailings

management facility in the valley to the south of the mine infrastructure. This

conceptual design highlighted that this location has the potential to store

almost 7.0 million tonnes of dry-stacked tailings, more than sufficient to

support the expanded production scenario evaluated in the 2021 Preliminary

Economic Assessment.

Environmental baseline studies continued at Parys Mountain, and the required Pre

-Application Report was submitted to the North Wales Minerals and Waste Planning

Service, marking the formal commencement of the consent process. This was

followed up with the initial Pre-Application Consultation meeting between

Anglesey Mining and statutory consultee groups, including Natural Resources

Wales, Cadw and multiple Council departments.

In Sweden, a Pre-Feasibility Study Update for the Grängesberg Iron Ore Project

was completed in July 2022 following which discussions commenced with

environmental consulting groups to start planning the baseline environmental

studies as recommended in the Pre-Feasibility Update and a requirement for the

Bankable Feasibility Study. During the year, we increased our stake in

Grängesberg Iron Mines AB, the holding company, to 49.7% through the acquisition

of a 29.8% stake for a value of £525,000 from our local partner, Roslagen

Resources AB. Meanwhile, in Canada, Labrador Iron Mines continued to advance its

Houston direct shipping iron ore project toward production.

Further details on these operational activities may be found in the Strategic

Report.

Sudden passing of Howard Miller, Non-Executive Director

It was with great sadness that we reported the death of our esteemed colleague,

Howard Miller, in December 2022. Howard had been a Non-Executive Director of

Anglesey since 2001, serving as Lead Independent Director from 2013 until his

passing. Howard had a wealth of knowledge and experience across all legal,

financial and management areas, and provided wise counsel and sound advice to

the Anglesey Board and company management. He will be sadly and fondly missed.

Corporate activity

In May 2022, a Placing and Subscription was successfully completed, raising

gross proceeds of £864,416 with institutional and other investors, including the

Chairman and the Chief Executive, at a price of 3.4 pence per share. After the

financial year end, a further £1,500,000 was successfully raised in May and July

2023 at a price of 1.5p per share, which included a 1 for 2 attaching warrant

with an exercise price of 2.5p per share and an expiry of November 2024. The

Chairman and the Chief Executive also participated in this round of funding.

Metal prices

While base metal prices softened over the last year, particularly zinc,

commodities are showing some overall resilience. Demand for metals that are

critical to the global climate transition and clean energy technologies remains

strong, and when combined with the apparent lack of investment on the supply

side, will likely lead to future deficits and higher prices. As a board, we

retain our confident view that the outlook for minerals, particularly for the

copper and zinc minerals at Parys Mountain, and for iron ore where we hold

significant investments, is very encouraging.

In July 2022 the UK Government published the first-ever UK Critical Minerals

Strategy, setting out its approach to accelerating domestic capabilities,

collaborating with international partners and enhancing international markets.

The strategy, refreshed in March 2023, aims to improve the security of supply of

critical minerals to safeguard British industries now and in the future, deliver

our clean energy transition and protect national security and defence

capability. "Modern society relies on critical minerals- from phones to wind

turbines, from cars to fighter jets". "Almost everything we do to communicate,

to get around, to work and to play, is increasingly based, directly or

indirectly, on minerals extracted from the ground many thousands of miles away".

Environmental and social focus

The purpose and objective of Anglesey Mining is to create value for shareholders

in an environmentally, socially, and ethically responsible manner which is also

to the benefit of all stakeholders. We place a high priority on environmental,

social and governance (ESG) matters, and we are committed to being a responsible

mining company, which maintains mutually beneficial long-term relationships with

key stakeholders and the local community. Readers are invited to refer to the

report on Corporate Governance.

Outlook

The results from the work completed at Parys Mountain over the last year provide

extremely encouraging support to the 2021 Preliminary Economic Assessment, which

demonstrated that a significant copper-zinc-lead-silver-gold mine can be

developed at Parys Mountain with very positive financial returns.

In the current year, we are maintaining the previous momentum on all the

required elements of project development. Infill drilling of the large Northern

Copper Zone is scheduled to start in October, targeting conversion of a portion

of that zone from the inferred resource category to the higher confidence

indicated category.

Permitting activities continue ongoing with the feedback from the Pre

-Application Consultation fine-tuning the Environmental Impact and Social

Assessment work programmes. Metallurgical test work is underway on a trade-off

study of pre-concentration methods which will be taken into the next round of

studies and design. Additionally, the metallurgical test work will determine the

environmental parameters of the tailings product, which forms a critical aspect

of the preliminary tailings design.

All of these activities are required to move the Parys Mountain project into the

next stage of study, prior to a fully committed decision to proceed to

production. Completion of each of these stages is a key requirement for securing

the necessary finance to move the project towards production. While all this

work will require some time to complete, it should ensure continuous progress

over the course of the year.

At Grängesberg, we expect to commence the environmental baseline studies during

the year, as recommended in the 2022 Pre-Feasibility Study. Discussions with

potential partners are expected to continue as we determine the most appropriate

route to progress the Grängesberg development opportunity.

In closing I wish to recognise the dedication and enthusiasm of our small

management team, led by Jo Battershill, for the significant progress made over

the past year, and thank our board of directors for their leadership, as well as

consultants and advisors for their contribution. Finally, I should welcome our

new shareholders and thank them, and all our shareholders, for their continued

support.

John F. Kearney

Chairman of the Board

22 September 2023

[image]Strategic report

Despite the global geopolitical instability highlighted in the Chairman's

report, we are very pleased to report that the recommencement of work at Parys

Mountain has delivered very positive results over the course of the year. In

addition, significant progress was made at our iron ore project in Sweden during

the reporting period.

Parys Mountain continues to gain momentum

[image]The Parys Mountain Cu-Zn-Pb-Ag-Au Project on the Isle of Anglesey hosts a

significant polymetallic deposit with an updated resource estimate of 16.1Mt

grading 1.3% Zn, 1.0% Cu, 0.7% Pb, 15g/t Ag and 0.2g/t Au. The site has a head

frame, a 300m deep production shaft, is connected to grid power, located only 20

miles from the port of Holyhead and is well advanced towards permitting for an

operation. We have freehold ownership of the minerals and much of the surface

land on the western portion of the property where all the current resources are

located. Access to infrastructure is good, political risk is low and the project

enjoys the support of local people and government.

An independent Preliminary Economic Assessment (PEA) was completed in January

2021, using the three-year trailing metal prices as of September 2020 -

US$2.81/lb Cu, US$1.20/lb Zn, US$0.95/lb Pb, US$16.67/oz Ag and US$1459/oz Au.

Three separate development cases or scenarios were evaluated as part of the PEA,

utilising planned mine tonnages ranging from 5.5Mt at 1,500tpd, to 11.4Mt at

3,000tpd in an expanded case.

The expanded case produced the most attractive financial returns, indicating a

total cash operating surplus of more than £408 million over a 12-year mine life,

which translated to a pre-tax net present value discounted at 10% of over £96

million with an IRR of 26%.

While the Parys Mountain Project has a long history and a substantial amount of

data, much of this needs to be updated as an integral part of a Pre-Feasibility

Study. The work conducted over the last year, and much of that planned for the

current year, is to bring the data to a sufficient level of confidence to

complete the Pre-Feasibility Study.

Resource update lifts confidence

A series of 10 drill holes for 2,750m were completed early in 2023. These holes

were designed to infill drill both the White Rock and Engine Zones, collectively

referred to as the Morfa Du Zone, and upgrade the resource categories across the

deposits.

After receiving the assay results from the drilling and conducting a robust

review of the geology, the resource interpretation was updated internally

resulting in tighter geological constraints being applied. [A large wooden crate

with logs stacked on top

Description automatically generated with medium confidence]Micon International

Limited were then engaged to complete an independent mineral resource estimate.

The updated mineral resource estimate completed in March 2023 introduced the

first Measured resource to the Parys Mountain mineral inventory. Overall, the

combined Measured and Indicated categories now account for 92%, or 5.3 million

tonnes, of the Morfa Du Zone - including a Measured resource of 1.3 million

tonnes. Prior to the drilling programme, 78% of the Morfa Du Zone was in the

indicated category.

The importance of lifting the resource confidence should not be underestimated.

Advancing the project from the 2021 Preliminary Economic Assessment through a

Pre-Feasibility Study and subsequent Bankable Feasibility Study will require

additional mine design optimisations. The higher confidence category will

ultimately reduce the level of uncertainty through the mine design process.

The updated mineral resource estimate for the Morfa Du Zone comprises 5.72Mt at

0.36% Cu, 2.30% Zn, 1.24% Pb, 28/t Ag and 0.28g/t Au (2.0% CuEq or 5.6% ZnEq),

as set out in the table below. On a like-for-like basis, the previous resource

estimate of the Morfa Du Zone was 6.9Mt at 0.44% Cu, 2.70% Zn, 1.40% Pb, 30g/t

Ag and 0.24g/t Au (2.2% CuEq or 6.2% ZnEq).

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Morfa Du - Mineral Resource Estimate (March 2023) |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

| | |Grades |Contained Metal |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Classification|Tonnes|Cu |Zn |Pb |Ag |Au |Cu |Zn |Pb |Ag |Au |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

| |(Mt) |(%) |(%) |(%) |(g/t)|(g/t)|(kt)|(kt) |(kt)|(Moz)|(koz)|

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Measured |1.30 |0.33|2.32|1.28|33 |0.43 |4.3 |30.4 |16.7|1.38 |18.3 |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Indicated |3.98 |0.37|2.39|1.29|27 |0.23 |14.7|95.3 |51.4|3.44 |29.7 |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Inferred |0.45 |0.40|1.41|0.65|25 |0.25 |1.8 |6.4 |2.9 |0.36 |3.6 |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

|Total |5.72 |0.36|2.30|1.24|28 |0.28 |20.4|131.7|70.9|5.17 |51.3 |

+--------------+------+----+----+----+-----+-----+----+-----+----+-----+-----+

Table 1 - Morfa Du Mineral Resource Estimate (March 2023)

Notes to table:

· Mineral Resources are based on JORC Code definitions

· Operating costs for mining, processing and G&A were modelled at US$45.15/t

of mill feed

· An Average Value operating cut-off of US$45.15/t has been applied

· Payability varies depending on metal (from 70% up to 97.5%)

· Metal prices used in the NSR and CuEq calculations were based on US$3,350/t

for Zn, US$2,292/t for Pb, US$9,523/t for Cu, US$25.50oz for Ag and US$1850/oz

for Au

· Recoveries used in the NSR were based on historical metallurgical testwork

and the 2,000t bulk sample processed in 1991 (80% to 82% for Zn, 48% to 80% for

Cu, 68% to 78% for Pb, 72% for Ag and 25% for Au to concentrate and 40% for Au

to gravity)

· Dilution allowance of 5% included

· CuEq - Copper equivalent was calculated using the formula set out below:

CuEq = (Cu grade % x Cu Recovery) + (Zn grade % x Zn recovery % x (Zn price / Cu

price)) + (Pb grade % x Pb recovery % x (Pb price / Cu price)) + (Ag grade g/t /

31.103 x Ag recovery % x (Ag price / Cu price)) + (Au grade g/t / 31.103 x Au

recovery % x (Au price / Cu price))

· It is the opinion of Anglesey Mining and the Competent Persons that all

elements and products included in the metal equivalent formula have a reasonable

potential to be recovered and sold

· Density values were calculated using a linear regression of density versus

the combined Cu, Pb, and Zn grade

· Rows and columns may not add up exactly due to rounding

The tighter geological constraints removed previous zones of inferred material

that were supported by limited drilling leading to a reduced overall resource

estimate however, it is important to note that these areas still represent key

target zones for future drilling.

The resource estimates for the Northern Copper Zone, Garth Daniel and Deep

Engine Zone were not updated and will be the target for the next round of

resource work.

Technical work streams well advanced - Geotechnical, Metallurgy and Tailings

Management

The 2023 drilling was also designed to provide samples for both geotechnical

domain modelling within the Morfa Du Zone and provide a suitable sample to

complete confirmatory metallurgical test work. From a geotechnical perspective,

the drill holes were surveyed with an acoustic televiewer, a downhole tool that

measures and models all the discontinuities within the surrounding rock. This

data was then confirmed through the geotechnical logging of orientated drill

core. All of this data was then utilised in the geotechnical assessment.

[A close-up of a black and white stone

Description automatically generated]During the reporting period, Knight Piésold,

one of the world's leading geotechnical consultants, completed the geotechnical

assessment of the Morfa Du Zone, which highlighted that the assumptions used in

the 2021 Preliminary Economic Assessment were appropriate for the selected

stoping method and confirmed the potential mining spans. This data will feed

into the next round of underground designs and optimisation process.

Subsequent to the geological and geotechnical logging of the drill core, we

dispatched a 340 kg sample to our retained mineral processing consultancy firm,

Grinding Solutions Limited ("GSL"), comprising a blend of White Rock and Engine

Zone with a combined head-grade of 0.42% Cu, 3.60% Zn, 3.08% Pb, 49g/t Ag and

0.7g/t Au (3.4% CuEq). The blend as delivered to GSL is 3.3 (White Rock) to 1.0

(Engine Zone), similar to the contribution that is expected to be delivered from

the mine in the early years, prior to production from the Northern Copper Zone

commencing.

The metallurgical testwork is designed to update results from testwork conducted

in 2007, which demonstrated that Dense Media Separation (DMS) would upgrade the

feed into the comminution circuit with a mass rejection of around 40% and

between 3 and 5% associated metal losses. The current round of testwork will

also complete a trade-off study between DMS and X-Ray based ore-sorting

technology which is now utilised across many mines around the globe.

If the Parys Mountain ore is suitable for pre-concentrating, the benefits will

be significant. Should the testwork confirm the previous 40% mass rejection and

associated metal losses, the designed milling rate could be significantly

smaller than the mining rate with the rejects going back underground to be used

as road base for the decline or stope-fill. Additionally, the 40% mass rejection

would significantly reduce the amount of mine tailings. Both benefits would also

lower the capital requirements of mine development. Ultimately, the decision on

whether to include a pre-concentration process or not will be decided through

economic trade-off analyses during the Pre-Feasibility Study.

Knight Piésold also completed the conceptual design of a dry stack tailings

management facility. The historical planning permissions for Parys Mountain

assumed a conventional tailings slurry storage. However, the preferred method

would now be a dry stack tailings management facility, which is aligned with the

recommendations from the Global Industry Standard on Tailings Management.

To integrate the filtered stack facility with the valley to the south of the

mine, the stack has been designed in 10 m lifts and modelled against existing

slopes at the north. Under the expanded case development proposal, the filtered

stack facility would require a capacity of 6.5 million tonnes over the proposed

12-year mine life, while also protecting a Special Site of Scientific Interest,

related to a lichenological interest, located nearby.

The conceptual configuration, size and cross-section of the tailings area are

presented below.

[A picture containing screenshot, plot, line, map

Description automatically generated]Figure 1 - Conceptual design for filtered,

dry stack tailings management facility

Environmental assessment and permitting

The permitting process has changed significantly since 1988. While we have

existing planning permissions that relate to the proposed development of the

mine, processing plant and tailings storage facility, these need to be updated

to meet today's more stringent requirements.

[A stone tower in a landscape

Description automatically generated]

Environmental and permitting activities have continued at Parys Mountain over

the course of the period.

Up to the end of March 2023 the following surveys had been completed:

· Habitat mapping and Habitat suitability

· Pond water testing

· Over-wintering and nesting birds

· Reptiles and great crested newts

· Invertebrates (aquatic and terrestrial)

· Soils and agricultural land quality

Work has also commenced on the following surveys:

· Groundwater testing, which will feed directly into both the infrastructure

foundation designs and the dry-stack tailings engineering studies

· Air quality, including noise and vibration surveys

· Landscape and

· Heritage

As a former operating mine, the project is classified as a Dormant Site, which

requires a Pre-Application Inquiry submission to the North Wales Mineral

Planning Authority. This Pre-Application Inquiry was submitted in 2022. A Pre

-Application Inquiry meeting with the Mineral Planning Authority and a number of

statutory consultees was held on site and in Amlwch in April 2023. The attendees

included Natural Resources Wales, Cadw, Anglesey County Council Departments

(Environmental Health, Highways & Transportation, Ecology & Environment and

Heritage), Archaeological Planning Services, local councillors and members of

both Westminster and Welsh governments.

The planning process allows for the statutory consultees to respond to the

proposal with any comments or queries regarding the project details. A number of

responses have now been received and will be used to define the limits of the

Environmental Impact and Social Assessment for Parys Mountain.

Bringing the Northern Copper Zone into play

The design, planning and logistics for the first round of infill drilling into

the Northern Copper Zone since 1974 has now been completed.

The NCZ was discovered in 1962 after testing an Induced Polarisation geophysical

target. The zone is interpreted as the downdip extension of the historical open

pit mined at Parys Mountain and appears as a wedge-shaped block with the thin

edge (15m wide) starting around 200m below surface that extends down to the

thicker end (over 100m width) at a depth of around 525m below surface. It

remains open both along strike to the east and at depth. The locations of the

historical drilling intersections are shown below:

[A picture containing diagram, text, map

Description automatically generated]Figure 2 - Existing intersections within the

Northern Copper Zone and Garth Daniel (long section)

The Northern Copper Zone has a 2012 resource estimate of 9.4Mt at 1.27% Cu, plus

minor Au, Ag, Zn and Pb credits (1.6% CuEq) - although very few holes were

assayed for all the metals. The internal resource estimate from the early 1970's

was >30Mt at 0.81% Cu - excluding any by-products - which should not be

considered compliant with any modern JORC or CIMM methodologies or NI43-101

reporting requirements.

While very few of the holes drilled before 1980 were assayed for gold, it was

recognised that the Northern Copper Zone contains gold with minor silver, zinc

and lead. Preliminary metallurgical testwork completed in 1969 at Lakefield

Research in Ontario demonstrated recoveries of up to 93.3% producing a copper

concentrate grading 23.2% Cu - but no testing was conducted on the recovery of

any other metals.

The proposed drilling programme of 6 holes, for 3,750m, could potentially

provide multiple pierce points across the Northern Copper Zone, the Garth Daniel

Zone and the Central Zone, based on current interpretations. Examples of

historical intersections from these zones are detailed in the tables below.

Historical Historical

High-grade Lower-grade

Intersections Intersections

Hole ID Depth Width Grade Hole ID Depth Width Grade

(m) (m) CuEq ZnEq (m) (m) CuEq ZnEq

(%) (%) (%) (%)

AMC15 562.7 5.2 13.5 37.4 H34 349.9 146.3 1.2 3.3

A29 351.9 3.8 8.6 24.0 H30 297.6 80.9 1.5 4.3

AMC17 397.7 11.4 5.9 16.5 AMC19 313.4 13.6 2.4 6.6

A53 561.8 4.8 5.4 15.2 H31 398.7 50.9 1.2 3.3

H3 284.7 1.8 11.7 32.3 H17A 419.4 87.0 0.9 2.5

Table 2 - Historical drilling intersections - high-grade intersections from

Garth Daniel and Central Zone, lower grade intersections from Northern Copper

Zone.

Lifting the resource confidence category for the Northern Copper Zone, which is

currently all in the Inferred category, is a key target over the next year. The

Northern Copper Zone is projected to contribute almost 40% of the mill feed over

the 12-year mine life as proposed by the expanded case in the 2021 Preliminary

Economic Assessment.

Base metal prices soften, but fundamentals remain supportive

It is now well understood that the energy transition currently underway will

significantly increase demand for metals used in the manufacturing of electric

vehicles (EVs) and renewable power generation facilities. Ultimately, this will

require a vast supply response over the next two decades and a step change in

investments from miners. However, mining projects have long lead times and

require large investments. Based on data from the International Energy Agency

(IEA), lead times from resource discovery to production now averages 17-years,

which includes 12.5-years from discovery to feasibility and 4.5 years for

planning and construction, which is likely to have a significant impact on the

timing of any supply response. In addition, some established, well-funded mining

companies have recently demonstrated a preference to `buy-versus-build', which

potentially implies there are limited development options around.

Both EVs and renewable generation are more metal-intensive than fossil fuel

-based alternatives, which will continue to support metals demand as the world

transitions towards a carbon-free economy. According to the International Bar

Association, wind and solar installations require between 8 and 12 times more

copper than coal and gas generation capacity and EVs require 3 to 4 times more

of the base metal than internal combustion engine vehicles.

The IEA suggests this transition will lead to a six-fold increase in demand for

minerals by 2050 compared to current levels. While the growth rates for each

metal will vary and will depend on technologies chosen for batteries and power

generation and environmental policies, the underlying direction of travel for

the industry has been set. We continue to remain very confident that the outlook

for most minerals, particularly for the copper and zinc minerals at Parys

Mountain, is very encouraging.

Base metal prices were generally weaker throughout the course of the reporting

period. While copper and lead were around 13% lower year-on-year, zinc fell

almost 35%. The highs for most of the base metals complex were seen in April

2022. Over the same time frame, precious metals were flat. The entire commodity

suite saw lows for the year in September 2022, bought on by underlying financial

and economic indicators pointing to an extended period of weakness across all

major geographies and a pending recession. Consumer confidence in China and the

United States declined rapidly and purchasing managers indices for construction

and manufacturing all pointed to a drop in future orders.

The base case economic model in the PEA utilized three-year trailing metal

prices of $2.81/lb copper, $1.20/lb zinc, $0.95/lb lead, $16.67/oz silver, and

$1,459/oz gold, with an exchange rate of £1.00/$1.25. We continue to believe

that the base case three-year trailing metal prices used in the PEA are a very

conservative starting point. The three-year trailing metal prices to the end of

2022 were US$3.67/lb copper (31% above the price used in the 2021 PEA),

US$1.32/lb Zn (+10%), US$0.93/lb lead (-2%), US$22.57/oz silver (+35%) and

US$1790/oz gold (23%) with an exchange rate of £1.00/US$1.30 (+4%).

Prices at 14 September 2023, the last practicable date before the publication of

this report, were $3.78/lb copper, $1.16/lb zinc, $1.02/lb lead, $22.63/oz

silver and $1908/oz gold, with the exchange rate at £1.00/$1.24. Using these

commodity prices, the expanded case pre-tax NPV10% increases from US$120 million

to US$228 million, with pre-tax IRR of 36%, which clearly demonstrate the

sensitivity and leverage of a mine at Parys Mountain to higher metal prices.

At these September 2023 metal prices, copper production from a Parys Mountain

mine would represent 50% of the net smelter revenue under the expanded case

while zinc and lead would represent 27% and 18% respectively. The PEA indicates

production of 75,000 tonnes of copper, 166,000 tonnes of zinc, 80,000 tonnes of

lead, over 5 million ounces of silver and 30,000 ounces of gold over the

project's 12-year mine life, this equates to an average copper equivalent

production rate of 14,000 tonnes per year over the proposed life of the

operation.

Grängesberg iron ore - a strategic iron ore asset in Europe

On 9 February 2023 the group acquired a further 29.8% of the share capital of

Grängesberg Iron AB (GIAB) - the company that owns the Grängesberg Iron Ore

Project, thereby increasing its holding in GIAB to 49.7%. This was effected

through the purchase of a 29.8% stake in GIAB from Roslagen Resources AB

("Roslagen") and the assignment to Anglesey of 40% of the outstanding

subordinated debt (nominal value £335,000) owed to Roslagen by GIAB for a total

consideration of £525,000, satisfied by a cash payment of £87,000 and the issue

to Roslagen of 14,544,827 ordinary shares of Anglesey at a price of 3.0 pence

per share to be held in escrow for twelve months from the date of issue. See

Note 14 to financial statements.

In addition to the 49.7% holding, Anglesey also has management rights of GIAB

and a reciprocal right of first refusal over the remaining 50.3%.

The Grängesberg project, located about 200 kilometres north-west of Stockholm,

is a substantial iron ore asset located in a very favourable jurisdiction. Prior

to its closure in 1989, due to then prevailing market conditions, the mine had

produced around 180 million tonnes of iron ore.

[A large building with a large tower in the middle of a forest

Description automatically generated]

In late 2021, we commissioned an updated Pre-Feasibility Study on the

development of the Grängesberg project, which was completed in July 2022. The

study demonstrated a very robust project with production of 2.3 - 2.5 million

tonnes per annum of iron ore concentrate grading 70% Fe over an initial 16-year

life, generating strong economic returns, including a NPV8% of US$688 million

post-tax. The study assumed an iron ore price of US$120/t (62% Fe benchmark, CFR

China) with sensitivities indicating a long-term price of US$80/t required to

achieve a positive return at a discount rate of 8%.

The study confirmed the previous probable ore reserve estimate of 82.4 million

tonnes, which would support the proposed 16-year mine life at a throughput of

5.3 million tonnes per annum for production of between 2.3 and 2.5 million

tonnes per annum of 70% Fe concentrate.

Micon concluded that the Grängesberg Project demonstrates an economically viable

project using the stated price assumptions, cost estimates and technical

parameters generated by the PFS, with the sensitivity analysis indicating

positive returns can be achieved even with using a 30% lower underlying iron ore

price.

+------------------------------------------+----------+----------------+

|Key Metric |Unit |2022 Updated PFS|

+------------------------------------------+----------+----------------+

|Ore to Mill |Mt |82.3 |

+------------------------------------------+----------+----------------+

|Life of Mine |Years |16.0 |

+------------------------------------------+----------+----------------+

|Contained Fe |Mt |30.6 |

+------------------------------------------+----------+----------------+

|Recovery |% |85 |

+------------------------------------------+----------+----------------+

|Recovered Fe |Mt |26.0 |

+------------------------------------------+----------+----------------+

|Outgoing Concentrate |Mt |37.2 |

+------------------------------------------+----------+----------------+

|Concentrate Grade |% Fe |70 |

+------------------------------------------+----------+----------------+

|Average Annual Concentrate Output |Mt |2.3 |

+------------------------------------------+----------+----------------+

|Cash Cost * |US$/t Conc|53.60 |

+------------------------------------------+----------+----------------+

|All-in Sustaining Cost ** |US$/t Conc|57.80 |

+------------------------------------------+----------+----------------+

|Pre-production Capital |US$m |399 |

+------------------------------------------+----------+----------------+

|Post-tax NPV8% |US$m |688 |

+------------------------------------------+----------+----------------+

|Post-tax Internal Rate of Return |% |26 |

+------------------------------------------+----------+----------------+

|Project Payback |Years |3.6 |

+------------------------------------------+----------+----------------+

|Average Annual Post-tax Operating Cashflow|US$m |130 |

+------------------------------------------+----------+----------------+

Table 3 - Key financial metrics from the updated 2022 PFS

* Cash costs are inclusive of mining costs, processing costs, site G&A,

transportation charges to port and royalties

** All-in Sustaining Cost includes cash costs plus sustaining capital and

closure cost

*** Post-tax Operating Cashflow based on iron ore price forecast of US$120/t

China CFR 62% Fe benchmark

In early 2023, a Memorandum of Understanding (MOU) was signed with Mine Storage

International to investigate the potential for Grängesberg to be converted into

a Pumped Hydro-Storage project at the end of the mine's producing life.

Pumped-Hydro Storage is a green-energy storage solution that utilises water and

gravity to store electrical energy. An underground mine can provide a closed

-loop solution using proven, pumped hydro-power technology. Essentially, the

system involves water being gravity fed through pipes down a shaft into the

turbines, which produce electricity for supply to the grid and also pump the

water back to surface. The mine storage system has a high round-trip efficiency

of 75-85% and proven durability.

The MoU with Mine Storage could lead to numerous future benefits including:

· A potential long-term revenue stream from the Grängesberg Mine to enhance

the cashflow

· Enabling the Circular Economy with existing technology turning a depleted

mine into a power storage asset ensuring generational benefits

· A well credentialled Swedish partner and potential exposure to Scandinavian

investors

The next stage of work for the Grängesberg project is the commencement of

environmental baseline surveys to feed into an Environmental Impact and Social

Assessment, which is a requirement to getting both the environmental permits and

development consent. Grängesberg has the potential to be restarted as one of

Europe's largest individual producers of iron ore concentrates. When combined

with the high-grade nature of the concentrate and proximity to European steel

mills, the asset clearly demonstrates highly strategic positioning.

Iron Ore - Grade is King

Demonstrating some similarities with the previous year, the price of iron ore

exhibited significant volatility over the course of the year. During the first

half of 2022, iron ore prices displayed upward momentum buoyed by the potential

for Chinese construction activity to increase after the initial Covid

restrictions were lifted, China accounts for about two-thirds of seaborne iron

ore demand. However, the second part of the year told a different story for iron

ore, which saw prices cut by almost 50% by October. The weakness was driven by

renewed worries over COVID-19 restrictions in China, plus concerns over the

country's property sector and cooling global economic growth.

Iron ore prices averaged US$121 per tonne (62% Fe CFR delivered to China) in

2022, down from an average of US$162 per tonne in 2021.

A report from the Institute for Energy Economics and Financial Analysis (IEEFA)

highlights that decarbonising the steel industry will require a significant lift

in both high-grade iron ore production and improved beneficiation techniques. To

reach a targeted net zero emissions by 2050, global steelmakers must switch

production methods from blast furnaces that consume coal to green hydrogen-based

direct reduced iron (DRI) processes. However, DRI technology is based on

Electric Arc Furnaces (EAFs) and requires a higher grade of iron ore than blast

furnaces - typically at least 67%.

DRI-based production of steel emits less carbon dioxide than the traditional

blast furnaces and enables the production of high-quality products in the EAF.

High-quality products require the highest quality of steel scrap; but if scrap

is limited, the use of DRI is necessary to guarantee specific qualities. The

board continues to believe that demand for high-grade Fe concentrate will

continue to rise, which could potentially support the development of the

Grängesberg Iron Ore Project.

The opportunity is now to advance the Grängesberg project through to a Financial

Investment Decision. This could be completed along with securing a strategic

investor, offtake partner, separate listing, or a combination of these options.

Labrador Iron Mines

Labrador Iron Mines Holdings Limited (LIM), in which we hold a 12% interest,

continues to progress plans to develop its Houston Project in the Labrador

trough. LIM published a PEA on its Houston Project in February 2021 which

supports its plan to resume iron ore production and demonstrated an initial 12

-year mine life with production of 2 million dmt of per year, for total

production of 23.4 million dmt of product at 62.2% Fe over the life of the

Houston mine.

The PEA estimates the Houston Project will generate an undiscounted net cash

flow of CAD$234 million and an after-tax net present value at an 8% discount

rate of CAD$109 million, and an after-tax internal rate of return of 39%, under

the base case $90/dmt benchmark pricing model. The PEA notes that using a spot

price of $160/dmt would increase the after-tax NPV8% to CAD$459 million and the

after-tax IRR to 209%.

Anglesey holds 19.29 million LIM shares which on 31 March 2023 were valued in

total at $1.7 million, or approximately £1.4 million (2022 - £1.9 million) on

the OTC Market in the United States. This value had not changed significantly at

22 September 2023.

Financial results and position

There are no revenues from the operation of the properties.

The loss before other comprehensive income for the year ended 31 March 2023

after tax was £961,288 compared to a loss of £693,242 in the 2022 fiscal year.

The administrative and other costs excluding investment income and finance

charges were £696,545 compared to £528,045 in the previous year. This increase

is due to additional expenses in relation to Grängesberg including the

administrative expenses in connection with the acquisition of an increased

shareholding this year and feasibility study costs.

The value of the group's holding in LIM is reported in other comprehensive

income and effectively is based on its share price. This year there is a loss of

£0.5 million as the share price declined. The outcome is a total comprehensive

loss for the year of £1,462,670, compared to a loss of £2,826,957 in the

previous year.

During the year there were no additions to fixed assets (2022 - nil) and

£460,118 (2022 - £394,410) was capitalised in respect of the Parys Mountain

property as mineral property exploration and evaluation, as the programme of

geological and environmental work as well as drilling continued as described in

this Strategic report.

At 31 March 2023 the mineral property exploration and evaluation assets had a

carrying value of £16.2 (2022 - £15.7) million. These carrying values are

supported by the results of the 2021 Preliminary Economic Assessment of the

Parys Mountain project.

At the reporting date, as detailed in note 10, the directors considered the

carrying value of the Parys Mountain exploration and evaluation assets to

determine whether specific facts and circumstances suggest there is any

indication of impairment. They carefully considered the positive results of the

resource update completed in March 2023, the independent PEA and the plans for

moving the project forward. Consequently, the directors concluded that there

were no facts and circumstances which materially changed during the year which

might trigger an impairment review and that there are no indicators of

impairment.

On 17 May 2022 a placing to institutional investors for cash of 22,829,705

shares at 3.4 pence per share raising £864,416 gross was completed. These funds

will be used for ongoing work on the Parys Mountain project, as well as for

general corporate purposes.

Also in May 2022 a new Investor Agreement was concluded with Juno Limited to

replace the controlling shareholder and consolidated working capital agreements.

In the new Investor Agreement Juno agreed to participate in any future equity

financing, at the same price per share and on the same terms as the arm's-length

participants, to maintain its percentage, with the subscription price to be

satisfied by the conversion and consequent reduction of debt, and the company

agreed to pay Juno in cash ten percent of the net proceeds of any such equity

financing in further reduction of the debt. The interest rate on the outstanding

debt was reduced from 10% to 5% p.a. from 1 April 2022. In addition, Juno was

granted certain nomination and reporting rights, including the right to nominate

two directors to the board, so long as Juno holds at least 20% of the company's

outstanding shares and one director so long as Juno holds at least 10% of the

company's outstanding shares. This renegotiation was approved by an independent

board committee responsible for reviewing and approving any transactions and

potential transactions with Juno. The family interests of Danesh Varma have a

significant shareholding in Juno.

The net effect of the new agreement with the May 2022 financing was that the

debt due to Juno was reduced by £305,499, of which £78,345 was paid in cash and

the balance by conversion of debt.

The cash balance at 31 March 2023 was £247,134, compared to £922,177 at 31 March

2022.

At 31 March 2023 there were 295,220,548 ordinary shares in issue (2022 -

248,070,732), the increase being due to the financing events referred to above.

At 12 September 2023 there were 420,093,017 ordinary shares in issue.

Subsequent to the year-end two placings of equity were completed raising £1.5

million gross. See note 29.

Performance

The Group holds interests in exploration and evaluation properties and, until a

mine is placed into production, there are no standardised performance indicators

which can usefully be employed to gauge performance. The publication of the

independent PEA on the Parys Mountain project in January 2021, which built upon

the optimisation studies successfully completed over the previous two years, and

included a new expanded mineral resource estimate, with a financial model for an

expanded case at 3,000 tpd which indicated a pre-tax NPV10% of US$120 million

and a 26% IRR, demonstrated a significant improvement on previous studies and

steady progress.

The updated mineral resource estimate for the Morfa Du Zone completed in 2023

has increased the confidence in the geological model, which underpins the PEA.

Additionally, several other technical reports have been completed over the last

year that support the findings from the PEA. These include the geotechnical

assessment of the underground area, the proposed dry stack tailings design and

numerous environmental baseline surveys.

The completion of the independent updated PFS on the Grängesberg project

demonstrates a very robust project with production of 2.3 - 2.5Mtpa of iron ore

concentrate grading 70% Fe over an initial 16-year life, generating strong

economic returns, including a NPV8% of US$688 million post-tax using the stated

price assumptions, cost estimates and technical parameters.

The external factors affecting the ability of the Group to move its projects

forward are primarily the demand for metals and minerals, levels of metal

prices, and the market sentiment for investment in mining and mineral

exploration companies. These are discussed above, and risks and uncertainties

are dealt with below.

Other activities

The Directors continue to review new properties suitable for advanced

exploration or development that would be complementary to or provide synergies

with the existing projects and would be within the financing capability likely

to be available. A number of base metals projects have been identified as

potentially attractive and further early-stage opportunities continue to be

evaluated.

Environmental and Social Focus

The purpose and objective of Anglesey Mining is to create value for shareholders

in an environmentally, socially, and ethically responsible manner which is also

to the benefit of all stakeholders. Our current principal activity is to achieve

this by developing, building and operating a producing mine at Parys Mountain

and to progress the Grängesberg Iron Ore project in Sweden through to a decision

to mine.

There has been an increasing investor focus on ESG matters. These are areas on

which we have always placed high importance, although we have not attempted

quantitative measurements, particularly as having the social licence to operate,

and operating in an environmentally responsible manner, are critical for the

successful operation of any mining project. In Anglesey Mining we place a high

priority on sustainability, and on environmental, social and governance (ESG)

matters, and we are committed to being a responsible mining company, maintaining

mutually beneficial long-term relationships with key stakeholders and the local

community. Readers are invited to refer to the report on Corporate Governance.

The Directors, both individually and collectively, believe, in good faith, that

throughout the year and at every meeting of the Board and management when making

every key decision, they have acted to promote the success of the Group for the

benefit of its members as a whole, as required by Section 172 of the Companies

Act 2006, having regard to the stakeholders and matters set out in section

172(1) of the Companies Act 2006. The Directors' Section 172 Statement follows.

Section 172 of the Companies Act is contained in the part of the Act which

defines the duties of a director and concerns the "duty to promote the success

of the Company". Section 172 adopts an `enlightened shareholder value' approach

to the statutory duties of a company director, so that a director, in fulfilling

his duty to promote the success of the company must act in the way he considers,

in good faith, would be most likely to promote the success of the Company for

the benefit of its members as a whole, and in doing so have regard to other

specified factors insofar as they promote the Company's interests.

The Board of Anglesey Mining recognises its legal duty to act in good faith and

to promote the success of the Company for the benefit of its shareholders and

with regard to the interests of stakeholders as a whole and having regard to

other matters set out in Section 172. These include the likely consequences in

the long term of any decisions made; the interest of any employees; the need to

foster relationships with all stakeholders; the impact future operations may

have on the environment and local communities; the desire to maintain a

reputation for high standards of business conduct and the need to act fairly

between members of the Company.

The Board recognises the importance of open and transparent communication with

shareholders and with all stakeholders, including landowners, communities, and

regional and national authorities. We seek to maximise the operation's benefits

to local communities, while minimising negative impacts to effectively manage

issues of concern to society. Shareholders have the opportunity to discuss

issues and provide feedback at any time.

The application of the Section 172 requirements can be demonstrated in relation

to the Group's operations and activities during the past year as follows.

Having regard to the likely consequences of any decision in the long term

The Group's purpose and vision are set out in the Chairman's Letter and in this

Strategic Report. The Board oversees strategy and is committed to the long-term

goal of the development of the Parys Mountain Project. The activities towards

that goal are described and discussed in the Strategic Report. The Board remains

mindful that its strategic decisions have long-term implications for the Parys

Mountain project, and these implications are carefully assessed.

In evaluating alternatives or opportunities the likely consequences of any

decision in the long-term are always considered, together with the potential

impact on long-term shareholder value, including key competitive trends, supply

and demand of metals, potential impact on the environment and climate change

considerations, all of which were considered in the preparation of the PEA and

in the past year in the design of the proposed drystacked tailings management

facility.

Having regard to the need to foster business relationships with others

This is a mineral exploration and development business, without any regular

income and is entirely dependent upon new investment from the financial markets

for its continued operation. The benefits of maintaining strong relationships

with key partners, contractors and consultants are valued. This is discussed in

more detail elsewhere in the annual report. As a mine development company, the

we understand that a range of third parties - regulators, contractors, suppliers

and potential customers for the concentrates that would be produced from a mine

at Parys Mountain are relevant to the sustainability of the business.

Having regard to the interests of the employees

The Group currently has two full-time and one part-time employee and is managed

by its directors and a small number of associates and sub-contract staff. All

suggestions together with the views and interests of employees are considered in

all decision-making.

Having regard to the desirability of maintaining a reputation for high standards

of business conduct

The Board is committed to high standards of corporate governance, integrity, and

social responsibility and to managing our affairs in an honest and ethical

manner, as further discussed in the Corporate Governance Report. We strive to

apply ethical business practices and to conduct business in a responsible and

transparent manner with the goal of ensuring that Anglesey Mining plc maintains

a reputation for high standards of business conduct and good governance.

Having regard to the impact of operations on the community and the environment

A broad range of stakeholder considerations are taken into account when making

decisions and careful consideration is given to any potential impacts on the

local community and the environment. We strive to maintain good relations with

the local community, especially with local businesses in North Wales. For

example, in connection with its plans for the advancement of Parys Mountain,

discussions and consultations have been held with the North Wales Minerals and

Waste Planning Service and with local Councils. In connection with the Pre

-Application Inquiry submission to the North Wales Mineral Planning Authority a

meeting with the Mineral Planning Authority and a number of statutory consultees

was held on site and in Amlwch in April 2023. The attendees included Natural

Resources Wales, Cadw, Anglesey County Council Departments (Environmental

Health, Highways & Transportation, Ecology & Environment and Heritage),

Archaeological Planning Services, local councillors and members of both

Westminster and Welsh governments.

The Corporate Governance Report discusses how the Directors engage with and have

had regard to the community in which we operate. Further discussion of these

activities can be found in this Strategic Report.

As a mine development company, the Board understands that recognising and having

regard to the potential impact our operations may have on the community and the

environment, is essential to underpinning the social licence necessary to

operate. In making decisions about the development of a mine at Parys Mountain,

we seek to maximise the benefits to the local community, while minimising

negative impacts, and to effectively manage issues of concern to society. By

aligning future operations to environmental, social and governance performance

the Group will seek to deliver on its purpose to create value through

responsible and sustainable mining.

Having regard to the need to act fairly as between members of the Company

The Company has only one class of share in issue and all shareholders benefit

from the same rights, as set out in the Articles of Association and as required

by the Companies Act 2006. Since 1996 agreements have been in place with Juno

Limited, the largest shareholder, which provide that Anglesey will maintain an

independent board and that any transactions between Juno and Anglesey will be at

an arm's length basis. Effective 31 March 2022, as a further step to strengthen

its financial position and reduce debt, Anglesey entered into a new Investor

Agreement with Juno Limited, to amend and replace the Controlling Shareholder

Agreement and the Consolidated Working Capital Agreement. This renegotiation was

approved by an independent board committee responsible for reviewing and

approving any transactions and potential transactions with Juno.

The Board recognises its legal and regulatory duties and does not take any

decisions or actions, such as selectively disclosing confidential or inside

information, that would provide any shareholder with any unfair advantage or

position compared to the shareholders as a whole.

Risks and uncertainties

The Directors have carried out an assessment of the principal risks facing the

Group, including those that would threaten its business model, future

performance, solvency or liquidity. In conducting its business, the Group faces

a number of risks and uncertainties, the more significant of which are described

below. The board believes the principal risks are adequately disclosed in this

annual report and that there are no other risks of comparable magnitude which

need to be disclosed.

Mineral exploration and mine development is a high-risk, speculative business

and the ultimate success of Anglesey Mining will be dependent on the successful

development of a mine at Parys Mountain, which is subject to numerous

significant risks, most of which are outside the control of the Board.

In reviewing the risks facing the Group, the members of the Board consider they

are sufficiently close to operations and aware of activities to be able to

adequately monitor risk without the establishment of any formal process. There

may be risks against which it cannot insure or against which it may elect not to

insure because of high premium costs or other reasons. However, there are also

risks and uncertainties of a nature common to all mineral projects and these are

summarised below.

General mining risks

Actual results relating to, amongst other things, results of exploration,

mineral resources, mineral reserves, capital costs, mining production costs and

reclamation and post closure costs, could differ materially from those currently

anticipated by reason of factors such as changes in expected geological or

geotechnical structures, general economic conditions and conditions in the

financial markets, changes in demand and prices for minerals that are expected

to be produced, legislative, environmental and other judicial, regulatory,

political and competitive developments in areas in which the Group operates,

technological and operational difficulties encountered in connection with

activities, labour relations, costs and changing foreign exchange rates and

other matters.

The mining industry is competitive in all of its phases. There is competition

within the mining industry for the discovery and acquisition of properties

considered to have commercial potential. We face competition from other mining

companies in connection with the acquisition of properties, mineral claims,

leases and other mineral interests as well as for the recruitment and retention

of qualified employees and other personnel and in attracting investment and or

potential joint venture partners to our properties.

Exploration and development

Exploration for minerals and development of mining operations involve risks,

many of which are outside our control. Exploration by its nature is subject to

uncertainties and unforeseen or unwanted results are always possible.

Mineral exploration and development is a speculative business, characterized by

a number of significant risks including, among other things, unprofitable

efforts resulting not only from the failure to discover mineral deposits but

also from finding mineral deposits that, though present, are insufficient in

quantity and quality to return a profit from production.

Substantial expenditures are required to develop the mining and processing

facilities and infrastructure at any mine site. No assurance can be given that a

mineral deposit can be developed to justify commercial operations or that funds

required for development can be obtained on a timely basis and at an acceptable

cost. There can be no assurance that the Group's current development programmes

will result in profitable mining operations. Current operations are in

politically stable environments and hence unlikely to be subject to

expropriation but exploration by its nature is subject to uncertainties and

unforeseen or unwanted results are always possible.

Financing and liquidity risk

The Group has relied on equity financing to fund its working capital

requirements and will need to generate additional financial resources to fund

all future planned exploration and development programmes. Developing the Parys

Mountain project will be dependent on raising further funds from various

sources. There is no assurance that such additional financial resources and/or

positive cash flows or profitability will be forthcoming.

There can be no assurance that we will be successful in obtaining any additional

required funding necessary to conduct operations on our properties. Failure to

obtain additional financing on a timely basis could cause planned activities and

programs to be delayed.

If additional financing is raised through the issuance of equity or convertible

debt securities, the interests of shareholders in the net assets of the Group

may be diluted.

Metal prices

The prices of metals fluctuate widely and are affected by many factors outside

our control. The relative prices of metals and future expectations for such

prices have a significant impact on the market sentiment for investment in

mining and mineral exploration companies. Metal prices are usually expressed and

traded in US dollars and any fluctuations may be either exacerbated or mitigated

by currency fluctuations which affect the revenue which might be received in

sterling.

Foreign exchange

LIM is a Canadian company; Angmag AB and GIAB are Swedish companies.

Accordingly, the value of the holdings in these companies is affected by

exchange rate risks. Operations at Parys Mountain are in the UK and exchange

rate risks are minor. Most of the cash balance at the year-end was held in

sterling.

Permitting, environment, climate change and social

Operations are subject to environmental legislation and regulations which are

evolving in pursuit of national climate change objectives and in a manner where

standards are becoming more stringent. Mineral extraction and processing can

have significant environmental impacts. Mining operations require approval of

environmental impact assessments and obtaining planning permissions. We hold

planning permissions for the development of the Parys Mountain property, but

further environmental studies and assessments and various approvals and consents

will be required to carry out proposed activities and these may be subject to

various operational conditions and reclamation requirements.

There can be no assurance that all permits, licences, permissions and approvals

that may be required for our activities will be obtainable on reasonable terms

or on a timely basis.

Employees and personnel

We are dependent on the services of a small number of key executives,

specifically the chairman, chief executive and finance director. The loss of

these persons or the inability to attract and retain additional highly skilled

and experienced employees for any areas which might be undertaken in the future

may adversely affect those businesses or operations. A discussion on the

composition and assessment of the Board of Directors is included in the Report

on Corporate Governance.

Group Prospects

Recognition of potential opportunities

The recommencement of activities at Parys Mountain is the first stage of

bringing the asset back into the focus of mainstream investors, both retail and

institutional. The economics of the project under the current commodity pricing

environment make the progression of Parys Mountain through to a financial

investment decision an obvious milestone.

Development of a new mine at Parys Mountain, producing copper, zinc and lead

with gold and silver credits, can deliver economic growth in the UK, regional

jobs for the community and business opportunities for local service providers.

Importantly, these critical and strategic metals, essential for the

decarbonisation of the economy, are primarily imported into the UK currently.

This creates a unique and timely opportunity, both for Anglesey Mining and for

the UK, to develop a new, modern, mine at Parys Mountain in an environmentally

sustainable manner.

A similar view can be held for the Grängesberg Iron Ore Project, where with the

Pre-Feasibility Study update now complete, we have a clear view on the

requirements to enable us to advance through to the Feasibility stage. When

combined with the Labrador Mines assets, Anglesey Mining has a very valuable and

strategic set of iron ore assets that should be progressed with the greatest

speed possible, but within the constraints of the resources available.

Outlook

The potential for a mine development at Parys Mountain remains very strong with

results from work programmes over the last year supporting the outcomes from the

2021 PEA. Therefore, we will continue to advance the project through additional

programmes to enable the commencement of a detailed Pre-Feasibility Study.

The work programmes approved by the Board for the current year include the

following:

· Commence infill drilling of the Northern Copper Zone to improve the resource

confidence categories

· Update the Northern Copper Zone mineral resource estimate

· Complete the metallurgical testwork for the Morfa Du Zone, including the

trade-off study between DMS and XRT pre-concentration methods

· Continue with the environmental and permitting activities

Other work streams to be factored in at Parys Mountain throughout the year

include:

· Re-optimise the underground development with initial focus on the Morfa Du

Zone;

· Include results of ongoing metallurgical testwork into the preliminary

engineering designs, with a particular focus on selecting the preferred pre

-concentration method;

· Preliminary engineering designs for the proposed dry-stack tailings

management facility;

· Preliminary engineering designs for the process plant; and,

· Updating the site infrastructure plans including decline portal location,

temporary mining waste storage location and supply of utilities.

All of these activities are required to enable the Parys Mountain copper-zinc

-lead-silver-gold project to move from the PEA to a full committed decision to

proceed to production. As has been said before, these steps do take some time to

reach fruition and are key requirements to securing the necessary finance to

move the project towards production.

At Grängesberg, the Pre-feasibility Study Update has provided a series of

recommendations to progress the project through to the commencement of a

Feasibility Study. The initial work programmes include the following:

· Commencement of the environmental baseline surveys;

· Updating the resource estimate to include domaining of the apatite zones

that could produce a valuable by-product stream; and,

· Updating the reserve estimate to incorporate the proposed alternative mining

method (sub-level open stoping with back fill instead of sublevel caving), which

would reduce the risk of any potential movement on the Export Fault zone.

At a general corporate level, the board will continue to review other

opportunities within the global metals and mining sector.

At the end of March 2023, the group had cash resources of £247,134 and at 12

September 2023 cash resources of £985,413. Subsequent to the year-end two

placings of equity were completed raising £1.5 million. See note 29.

This report was approved by the board of directors on 22 September 2023 and

signed on its behalf by:

Jo Battershill

Chief Executive

LEI: 213800X8BO8EK2B4HQ71

For further information, please contact:

Anglesey Mining plc

Jo Battershill, Chief Executive - Tel: +44 (0)7540 366000

John Kearney, Chairman - Tel: +1 416 362 6686

Davy

Nominated Adviser & Joint Corporate Broker

Brian Garrahy / Daragh O'Reilly - Tel: +353 1 679 6363

WH Ireland

Joint Corporate Broker

Katy Mitchell / Harry Ansell - Tel: +44 (0) 207 220 1666

About Anglesey Mining plc

Anglesey Mining is traded on the AIM market of the London Stock Exchange and

currently has 420,093,017 ordinary shares on issue.

Anglesey is developing its 100% owned Parys Mountain Cu-Zn-Pb-Ag-Au deposit in

North Wales, UK with a reported resource of 5.3 million tonnes at over 4.0%

combined base metals in the Measured and Indicated categories and 10.8 million

tonnes at over 2.5% combined base metals in the Inferred category.

Anglesey also holds an almost 50% interest in the Grängesberg Iron project in

Sweden, together with management rights and a right of first refusal to increase

its interest to 100%. Anglesey also holds 12% of Labrador Iron Mines Holdings

Limited, which through its 52% owned subsidiaries, is engaged in the exploration

and development of direct shipping iron ore deposits in Labrador and Quebec.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/anglesey-mining-plc/r/annual-financial-report,c3840948

The following files are available for download:

https://mb.cision.com/Main/22377/3840948/2315180.pdf ANRP23

END

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

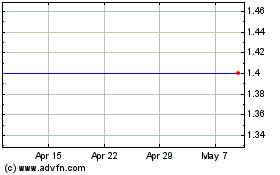

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024