Bluebird Merchant Ventures Limited High Grade Gold Grab Samples at Gubong (2759B)

09 January 2018 - 6:00PM

UK Regulatory

TIDMBMV

RNS Number : 2759B

Bluebird Merchant Ventures Limited

09 January 2018

9 January 2018

Bluebird Merchant Ventures Ltd

(the "Company" or "Bluebird")

High Grade Gold Grab Samples at Gubong

Bluebird Merchant Ventures (EPIC: BMV), the Asian focused

resource development group is pleased to announce the results of

preliminary 'grab samples' from the Gubong gold mine.

Highlights

-- Encouraging assay results indicating that a significant

amount of gold remains unmined at Gubong

-- 10 of 15 samples returned gold grades of over 1 g/t with 3

returning grades of 10 g/t and over

-- 12 of the 15 samples returned silver grades of 10 g/t and over

-- The grades indicate ore body structure

The samples were taken after engineers gained entry into the old

workings at Adit 4 and from spillage in Decline Shaft Number 2. All

the samples were taken from fines or broken ore lying on the

ground. The results, as tabulated below, represent the fact that

the old workings have significant amounts of gold which were left

in the form of broken ore that was never taken to the process

plant.

Of upmost significance are the spillage samples taken in the

shaft (KRA200011 - KRA200015). They imply that the ballast under

the tracks of each level used to transport ore for several years is

likely to carry gold - yet another source of early cheap

production. The Gubong mine could potentially have 30 to 40

kilometres of railed tunnels that was used to transport gold.

The Gubong mine is an orogenic deposit. Orogenic ore bodies

typically have a depth of 2 kilometres. The Gubong mine currently

has a depth of 500 metres. Historical drill results that were

previously announced on 3 October 2017 indicate that the structure

continues below the 500 metre level so the mine has significant

upside potential.

Sample Location Date Sample Gold (g/t) Silver

Number Type (g/t)

----------- ---------- ------------ -------- ----------- -------

KRA200006 Adit 4 18-10-2017 GRAB 1.00 17.00

----------- ---------- ------------ -------- ----------- -------

KRA200007 Adit 4 18-10-2017 GRAB 21.00 17.00

----------- ---------- ------------ -------- ----------- -------

KRA200008 Adit 4 18-10-2017 GRAB 7.00 10.00

----------- ---------- ------------ -------- ----------- -------

KRA200009 Adit 4 18-10-2017 GRAB 7.00 10.00

----------- ---------- ------------ -------- ----------- -------

KRA200010 Adit 4 18-10-2017 GRAB 1.3 40.00

----------- ---------- ------------ -------- ----------- -------

Decline

KRA200011 2 18-10-2017 GRAB 6.7 20.00

----------- ---------- ------------ -------- ----------- -------

Decline

KRA200012 2 18-10-2017 GRAB 13.3 17.00

----------- ---------- ------------ -------- ----------- -------

Decline

KRA200013 2 18-10-2017 GRAB 10.0 13.00

----------- ---------- ------------ -------- ----------- -------

Decline

KRA200014 2 18-10-2017 GRAB 3.1 8.00

----------- ---------- ------------ -------- ----------- -------

Decline

KRA200015 2 18-10-2017 GRAB 1.2 12.00

----------- ---------- ------------ -------- ----------- -------

Charles Barclay, COO, commented:

"The gold price was around USD 40/oz when the mine closed. These

results demonstrate that many areas of the mine were undoubtedly

left unmined due to what was, at the time, unpayable grades.

Furthermore, the potential for processing cheap payable tonnes in a

short space of time is good. Our initial goal is to delineate

sufficient ore to support the first three years of profitable

mining within the upper regions of the mine growing to an annual

production of 30,000 oz. Thereafter we will continually scale up

annual production as we access the lower regions of the mine."

Colin Patterson, CEO, commented:

"The sheer size of the Gubong gold mine becomes more evident as

we make progress. The fact that such good results have been seen

from the first few hundred metres of the mine is very encouraging.

The mine has over 120 kilometres of underground tunnels and was

South Korea's second largest gold mine. I am confident that the

Gubong project will deliver significant value to shareholders."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR")

Enquiries:

Bluebird Merchant Ventures

Ltd +44 (0)7797 859986

Jonathan Morley-Kirk,

Non-Executive Chairman

SP Angel Corporate Finance

LLP

Ewan Leggat

Smaller Company Capital

Ltd

Rupert Williams/Jeremy + 44 (0)203 470 0470

Woodgate +44 (0)203 651 2910

Blytheweigh +44 (0)200 7138 3204

Tim Blythe / Camilla

Horsfall

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDQVLFBVFFZBBD

(END) Dow Jones Newswires

January 09, 2018 02:00 ET (07:00 GMT)

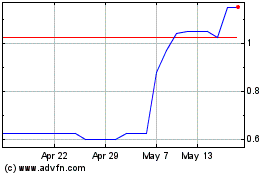

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From Apr 2024 to May 2024

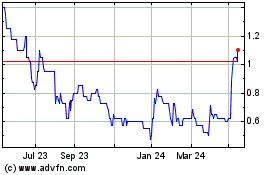

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From May 2023 to May 2024