BigDish PLC Further re Issue of Equity (3759L)

06 September 2019 - 4:00PM

UK Regulatory

TIDMDISH

RNS Number : 3759L

BigDish PLC

06 September 2019

BigDish Plc

("BigDish" or the "Company")

Further re Issue of Equity

BigDish Plc (LON: DISH), announces that, further to the

announcement released by the Company on 22 August 2019, the

requisite regulatory approvals in relation to the issue of the

13,812,920 ordinary shares to certain Pouncer shareholders

("Deferred Consideration Shares") as part of the acquisition

agreement were not obtained and as a consequence, the Company has

withdrawn the application to admit the Deferred Consideration

Shares to trading on the London Stock Exchange.

The Company will now submit a new application for 10,391,472 new

ordinary shares of the previously unsuccessful application of the

13,812,920 ordinary shares, which have received the requisite

regulatory approvals to be admitted to trading on the London Stock

Exchange. Admission of the balance of the remaining 3,421,448

ordinary shares, which are still subject to regulatory approvals,

will be sought at a later date.

Application has been made for 10,391,472 new ordinary shares of

no par value to be admitted to trading which is expected to occur

on or around 11 September 2019 ("Admission").

Total Voting Rights

Following Admission, the Company's enlarged issued share capital

will be 348,950,355. The total number of voting rights in the

Company is therefore 348,950,355. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR")

Enquiries:

Zak Mir, Digital Communications

Officer +44 (0) 7867 527658

Jonathan Morley-Kirk, Non-Executive +44 (0) 7797 859986

Chairman jmk@bigdish.com

Notes to Editors

BigDish Plc is a London Stock Exchange listed food technology

company that operates a yield management platform for the

restaurant industry, including a mobile App.

The Company helps restaurants in the UK fill their spare

capacity and optimise their revenues through smart and dynamic

discounts. Consumers can access these via the BigDish App and

website platforms. Restaurants pay BigDish a fee per diner

seated.

BigDish is fully committed to delivering shareholder value to

its stakeholders through this model and is actively seeking to

expand across the UK. An expansion strategy has been outlined which

divides the UK into territorial target areas.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FURDMGGLGKDGLZM

(END) Dow Jones Newswires

September 06, 2019 02:00 ET (06:00 GMT)

Amala Foods (LSE:DISH)

Historical Stock Chart

From Apr 2024 to May 2024

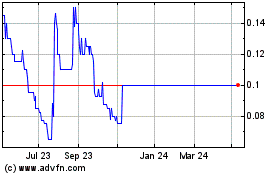

Amala Foods (LSE:DISH)

Historical Stock Chart

From May 2023 to May 2024