RNS Number:9446R

First Artist Corporation PLC

25 February 2002

Embargoed Release: 0700 hours 25th February 2002

First Artist Corporation Plc ("First Artist" or "the Company")

Interim Results for the six months ended 31 December 2001

First Artist is a leading European management and representation company looking

after the commercial interests of footballers and other high profile

personalities in the football and television market.

Highlights

- Sales up 205 per cent. to £3.0 million;

- Operating profit before goodwill up 100 per cent. to £1.0 million;

- Acquisition of FIMO completed on 21 December 2001 with effective control from

1 July 2001 - integration progressing well;

- Listing on AIM on 21 December 2001;

- £5 million raised through placing on 21 December 2001;

- Acquisition of Ian Elliott football agency completed on 19 July 2001;50 (2000:

24) football deals completed during the period;

- Increase in the number of FIFA registered agents employed by the Group to 7

(2000: 2); and

- Investment in UK media division.

Jon Smith, Chief Executive of First Artist Corporation plc, comments:

'I am pleased to report that the integration of FIMO within the First Artist

group is progressing successfully. We have completed a number of cross-border

deals during the period, which were only made possible by the alliance, and we

are already benefiting from the improved information flow across Europe. We are

continuing to explore new alliances, which will allow us to access new football

markets and accelerate our expansion across the globe. This expansion will

proceed in priority markets based on potential profitability.

We are also looking at investment in areas outside of football. We have expanded

our presence in media personality representation organically by developing a

separate division and formalising our offering through a dedicated agency

service. I look forward to the balance of this year with confidence."

Headline numbers Six months ended 31 Six months ended 31 Year ended 30 June

December 2001 December 2000 2001

(Unaudited) (Unaudited) (Audited)

£m £m £m

Sales 3.0 1.0 1.7

Operating profit* 1.0 0.5 0.7

Profit before tax* 1.0 0.5 0.7

Earnings per share (pence)* 1.91 1.84 2.27

Fully diluted earnings per share* 1.81 1.84 2.24

* Stated before goodwill amortisation of £653,000 (2000: £nil).

For further details please contact:

Jon Smith - Chief Executive Tel: 020 8900 1818

First Artist Corporation plc

www.1startist.com

Kirsty Campbell Tel: 020 7648 8721

Seymour Pierce Limited

Adam Reynolds/Takki Sulaiman Tel: 020 7735 9415

Hansard Communications

www.hansardcommunications.com

mail@hansardcommunications.com

Chairman's Statement

For the six months ended 31 December 2001

I am pleased to present our maiden interim results as an AIM-listed company for

the six months ended 31 December 2001. First Artist joined the Alternative

Investment Market on 21 December 2001, completing its acquisition of FIMO Sport

Promotion AG ("FIMO") and successfully raising £5 million from institutional and

other investors.

Sales increased to £3.0 million for the six-month period ended 31 December 2001,

up from £1.0 million in the corresponding period last year. These sales include

£2.0 million from the acquisitions made in the period. An operating profit of

£1.0 million before goodwill amortisation was generated compared to £0.5 million

in the corresponding period last year. The operating profit includes £0.75

million generated by the acquisitions made in the period. Earnings per share

before goodwill amortisation was 1.91 pence compared to 1.84 pence in the

corresponding period last year. The Board intends to use its funds to expand its

operations and to provide working capital and no interim dividend payment will

be made this year.

Group and financial review

Sales

The consolidated results of the Group include the results of FIMO from 1 July

2001 and the results of the business acquired from Mr Ian Elliott from 19 July

2001.

The Group generated sales of £3.0 million in the period, up 205% on the

corresponding period last year. Sales of £1.0 million, up 7.1% on the

corresponding period last year were generated in the continuing business of

First Artist, the remainder coming from the acquisitions of FIMO and Ian

Elliott's business. There were 50 football deals (2000: 24) during the period,

31 originating in the UK and 19 in Europe.

£1.4million (June 30 2001: £0.3million) of conditional income is carried forward

to be recognised in future periods.

Gross profit

The gross profit is stated after third-party commissions payable of £0.6 million

(2000: £nil) which represents around 20% of the gross commissions earned. 26% of

this cost represents third-party commission payable within contracts derived in

the UK, and the balance represents commission payable within contracts derived

in Europe.

Operating profit before goodwill amortisation

The operating profit before goodwill amortisation is stated after deducting

operating expenses. The operating profit earned by the Group during the period

was £1.0 million compared to £0.5 million in the corresponding period last year.

Operating profit of £0.25 million (2000: £0.5 million) was generated in the

continuing business of First Artist, the remainder coming from the acquisitions

of FIMO and Ian Elliott. The increase in overheads (including PLC costs) has

been borne by the continuing business of First Artist.

The operating expenses of £1.4 million include £0.65 million (2000: £0.46)

incurred by the continuing business of First Artist. This increase primarily

represents the cost of an increased head-count from 6 at the end of the

corresponding period last year to 14 at 31 December 2001, combined with the

associated costs of being a plc. In addition the continuing business has

invested around £0.1 million in relation to its new media division.

Goodwill amortisation

The Group has adopted Financial Reporting Standard 10 and consequently any

purchased goodwill arising on consolidation in respect of acquisitions made has

been capitalised. This goodwill is amortised by equal annual instalments over

its useful economic life. The goodwill of FIMO has been amortised from the date

of taking control of that business being 1 July 2001. The goodwill of Ian

Elliott has been amortised from the date of acquisition being 19 July 2001. The

goodwill amortisation charge for the period is £653,000 (2000: £nil).

Taxation

The charge for taxation is based on the estimated effective rate for the year as

a whole. The underlying tax charge before goodwill amortisation is 17.1% (2000:

33.3%). This rate is less than the UK standard rate due to the high proportion

of profits generated in Switzerland.

Earnings per share

The adjusted basic earnings per share before goodwill amortisation was 1.91

pence (2000: 1.84 pence) based on a weighted average number of shares in issue

of 44,247,826 (2000: 18,650,000), and based on a profit after tax of £845,000

(2000: £344,000). The fully diluted earnings per share was 1.81 pence (2000:

1.84 pence) based on 46,747,826 shares (2000: 18,650,000). The earnings per

share calculations have included the shares issued in consideration for FIMO on

21 December 2001 as though they were in issue for the entire period from the

date of taking control of that company on 1 July 2001.

The earnings per share was 0.43 pence (2000: 1.84 pence) and the fully diluted

earnings per share was 0.41 pence (2000: 1.84 pence).

Balance sheet

The net assets of the Group increased from £3.0 million to £15.9 million as at

31 December 2001 representing £0.3 million of profit and foreign exchange

translation adjustments for the financial period and £12.6 million of new share

capital net of costs. The net assets comprise of £12.2 million of unamortised

goodwill, £0.7 million of tangible assets, £4.1 million of net current assets

less £1.1 million of long-term creditors. The net current assets of £4.1 million

is made up of £4.2 million of cash and £2.0 million of working capital less £2.1

million of deferred consideration. The working capital of £2.0 million includes

an amount of £1.2 million representing debtors due in more than one year.

Liquidity and capital resources

At 31 December 2001, the Group's cash balance stood at £4.2 million, up from

£2.4 million at 30 June 2001. Around £0.9 million of this cash balance will be

paid to the vendors of FIMO over the next twelve months.

£4.4 million was raised net of costs through the placement of 10 million shares

at 50 pence on 21 December 2001. £4.2 million was utilised on the purchase of

Ian Elliott and FIMO for £0.3 million and £3.9 million respectively. £0.5

million was spent on capital expenditure and £0.2 million was paid in

corporation tax. The remaining sources of funds included cash acquired in FIMO

of £1.6 million representing £1.1 million of loans repaid by the vendors and

£0.5 million of cash and £0.7 million of operating cash from £1.0 million of

operating profit before goodwill amortisation.

Acquisitions

On 19 July 2001 the Group acquired the client listing and services of Ian

Elliott, a football agent, for a total consideration of £405,000 excluding

costs. This consideration is payable in three instalments over the two years

following acquisition.

Goodwill arising from this acquisition was £472,000.

On 21 December 2001 the Group acquired the whole of the issued share capital of

FIMO, although the effective date of control was agreed between the parties as

being 1 July 2001. The consideration was made up of £3.0 million of cash and the

allotment and issue of 16,650,000 ordinary shares of 0.25 pence each to the

value of £8.33 million. In addition the Group has agreed to pay an amount equal

to the aggregate of the net assets of FIMO at 30 June 2001 less its fixed assets

and the expected payments due under certain transfer contracts. This represents

around £3.8 million of which £0.8 million was paid on completion.

Goodwill arising from this acquisition was £12.3 million.

Outlook and current operations

The board considers these results satisfactory and in line with the plans set

for this half year. The acquisition of FIMO has delivered the initial benefits

envisaged, and the management teams are integrating well. We see this as the

beginning of our expansion of football activities overseas. Current trading

remains in line with our plans and expectations.

Chairman

Brian Baldock

22nd February 2002

Consolidated Profit and Loss Account

For the six months ended 31 December 2001

Notes Six months ended 31 Six months ended 31 Year

December 2001 December 2000 ended 30

(Unaudited) £000's (Unaudited) £000's June

2001

(Audited)

£000's

Sales Continuing 1,037 968 1,702

Acquisitions 1,915 - -

2,952 968 1,702

Cost of sales (616) - (22)

Gross profit 2,336 968 1,680

Operating expenses (1,360) (455) (1,002)

Operating profit before

goodwill amortisation

Continuing 223 513 678

Acquisitions 753 - -

976 513 678

Goodwill amortisation (653) - -

Operating profit after

goodwill amortisation 323 513 678

Investment income 53 17 63

376 530 741

Interest payable (10) (14) (26)

Profit on ordinary

activities before

taxation 366 516 715

Taxation 2 (174) (172) (237)

Profit on ordinary

activities after taxation 192 344 478

Dividends 3 - - (37)

Retained profit for the

period 192 344 441

Adjusted earnings per

share 4 1.91 pence 1.84 pence 2.27 pence

Adjusted fully diluted

earnings per share 4 1.81 pence 1.84 pence 2.24 pence

Basic earnings per share 4 0.43 pence 1.84 pence 2.27 pence

Diluted earnings per

share 4 0.41 pence 1.84 pence 2.24 pence

Consolidated Balance Sheet

As at 31 December 2001

Notes As at As at As at

31 December 2001 31 December 2000 30 June

(Unaudited) £000's (Unaudited) £000's 2001

(Audited)

£000's

FIXED ASSETS

Intangible assets 7 12,157

Tangible assets 732 161 297

12,889 161 297

CURRENT ASSETS

Debtors 4,572 837 1,167

Cash at bank and in hand 4,237 795 2,391

8,809 1,632 3,558

CREDITORS: Amounts falling due (4,739) (947) (877)

within one year

NET CURRENT ASSETS 4,070 685 2,681

TOTAL ASSETS LESS CURRENT 16,959 846 2,978

LIABILITIES

CREDITORS: Amounts falling due (1,066) - -

in greater than one year

Provision for liabilities and (11) - (11)

charges

NET ASSETS 15,882 846 2,967

CAPITAL AND RESERVES

Called up share capital 6 134 10 67

Share premium account 6 14,485 1,966

-

Profit and loss account 6 1,263 836 934

15,882 846 2,967

Consolidated Cash Flow Statement

For the six months ended 31 December 2001

Notes Six months ended 31 Six months ended 31 Year ended

December 2001 December 2000 30 June 2001

(Unaudited) (Unaudited) (Audited)

£000's £000's £000's

Cash flow from operating

activities 5 680 209 89

Returns on investments and

servicing of finance 43 3 38

Taxation (183) - (154)

Capital expenditure (464) (3) (155)

Equity dividends paid - (33) (33)

Acquisitions (4,155) - -

Cash (outflow)/inflow before (4,079) 176 (215)

financing

FINANCING:-

Issue of shares (net of costs) 4,351 - 1,987

Loans repaid on acquisition 1,088 - -

Cash acquired 483 - -

Increase in cash in the period 1,843 176 1,772

Net funds at the beginning of 2,391 619 619

Net funds at the end of the 4,234 795 2,391

Statement of Total Recognised Gains and Losses

For the six months ended 31 December 2001

Six months ended Six months ended 31 Year ended

31 December 2001 December 2000 30 June 2001

(Unaudited) (Unaudited) (Audited)

£000's £000's £000's

Profit for the financial period 192 344 478

Exchange adjustments 138 - -

Total recognised gains and 330 344 478

losses

Notes to the Interim Accounts:

For the six months ended 31 December 2001

1. Basis of preparation

The financial information contained in this interim report does not constitute

statutory accounts within the meaning of Section 240 of the Companies Act 1985.

The interim financial information has been prepared on the basis of the

accounting policies set out in the Group's statutory accounts for the year ended

30 June 2001. In addition the Group has adopted Financial Reporting Standard

10, Goodwill and Intangible Assets. Purchased goodwill arising on consolidation

in respect of acquisitions made in the period is capitalised and amortised to

nil over its useful economic life.

The figures for the six months ended 31 December 2001 and the six months ended

31 December 2000 are unaudited. The figures for the year ended 30 June 2001

have been extracted from the statutory accounts filed with the Registrar of

Companies which contained an unqualified audit report and no adverse statement

under Section 237(2) or (3) of the Companies Act 1985.

2. Tax charge

The charge for taxation is based on the estimated effective rate for the year as

a whole.

The tax charge for the period consists of UK taxation of £102,000 (six months

ended 31 December 2000: £172,000, year ended 30 June 2001 £237,000) and overseas

taxation of £72,000 (six months ended 31 December 2000: £nil, year ended 30 June

2001: £nil).

3. Dividend

The directors have not declared an interim dividend.

4. Earnings per share

The calculations of earnings per share are based on the following profits and

numbers of shares:

The adjusted earnings per share is based on profit after tax before the goodwill

amortisation charge.

Six months ended Six months ended Year ended

31 December 2001 31 December 2000 30 June 2001

(Unaudited) (Unaudited) (Audited)

£000's £000's £000's

Number Number Number

Weighted average number of 0.25 pence ordinary

shares in issue during the period

For basic earnings per share 44,247,826 18,650,000 21,090,959

Exercise of share options 2,500,000 - 248,219

For diluted earnings per share 46,747,826 18,650,000 21,339,178

Profit for the financial period £000's £000's £000's

Profit for adjusted earnings per share 845 344 478

Adjustment for goodwill amortisation (653) - -

Profit for earnings per share 192 344 478

The comparative weighted average number of shares in issue has been adjusted to

reflect the subdivision of authorised share capital in December 2000 from £1

ordinary shares to shares of 0.25 pence each and the bonus issue of shares made

during the year ended 30 June 2001

5. Reconciliation of operating profit to net operating cash flow

Six months ended Six months ended Year ended

31-Dec-01 31-Dec-0000 30-Jun-01

(Unaudited) (Unaudited) (Audited)

£000's £000's £000's

Operating profit 323 513 678

Depreciation 37 8 23

Amortisation of goodwill 653

Profit on disposal (1)

(Increase) in debtors (411) (228) (559)

(Decrease) in creditors 79 (84) (53)

Net cash flow from operating activities 680 209 89

6. Reconciliation of movement in shareholders' funds

Six months ended Six months ended Year ended

31-Dec-01 31-Dec-00 30-Jun-01

(Unaudited) (Unaudited) (Audited)

£000's £000's £000's

Profit for the financial period 192 344 478

Foreign exchange adjustment 138 - -

Dividends - - (37)

330 344 441

New share capital subscribed net of costs 12,585 - 2,024

Increase in shareholders' funds 12,915 344 2,465

Opening shareholders' funds 2,967 502 502

Closing shareholders' funds 15,882 846 2,967

Shareholders' funds are entirely attributable to equity interests.

7. Acquisitions

Total Ian Elliott FIMO

£000's £000's £000's

Cash paid 3,995 185 3,810

Shares issued 8,325 - 8,325

Deferred consideration 3,221 220 3,001

Costs 230 67 163

15,771 472 15,299

Net assets (2,997) - (2,997)

Fair value adjustment 36 - 36

Goodwill arising 12,810 472 12,338

Goodwill amortisation (653) (39) (614)

Net book value 12,157 433 11,724

8. Interim Report

Copies of this interim report are being sent to all shareholders and will be

available to the public at the Company's registered office, First Artist House,

87 Wembley Hill Road, Wembley, Middlesex HA9 8BU for at least one month, free of

charge.

This information is provided by RNS

The company news service from the London Stock Exchange

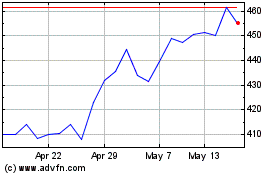

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

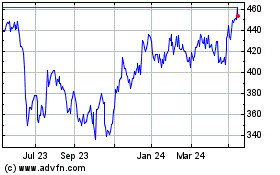

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024