TIDMGBP

RNS Number : 5314R

Global Petroleum Ltd

27 October 2023

27 October 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

Global Petroleum Limited

("Global" or "the Company")

Annual Financial Report - Year Ended 30 June 2023

Global (AIM: GBP) announces its financial results for the year

ended 30 June 2023.

Summary

Operational

-- The focus during the reporting period, and subsequently, has

been on ongoing exploration work and the farm-out process in

respect of Global's Namibian licence PEL0094 ("Licence");

-- In August 2023 the Company announced that the Namibian

authorities had given approval for the Company and its partners to

proceed to the First Renewal Period of the Licence, with a duration

of two years from September 2023 to September 2025. Importantly,

the usual requirement at the end of the Initial Exploration Period

to relinquish 50 per cent of the Licence area was waived;

-- The Company believes that the Walvis Basin, where PEL0094 is

situated, has the potential to be extremely successful, and has the

advantage of much shallower water depths generally than the

discoveries in the Orange Basin;

-- Global has continued its efforts to farm-out an interest in

the Licence. As the Company anticipated, following the discoveries

potential farminees have first looked for possible opportunities in

the Orange Basin;

-- In Italy, in September 2023, the Company announced that it

had been informed that appeals against the environmental decrees

granted in its favour by the Italian authorities had recently been

dismissed. The Company submitted further documentation in

connection with the Applications some months ago to the Italian

Ministry of Ecological Transition and has been awaiting further

dialogue with the Ministry regarding the process going forward.

Financial

-- Loss after tax US$1,283,634 (2022: loss US$1,647,094)

reflecting ongoing exploration expenditure in Namibia;

-- Cash balance at year end US$356,389 (30 June 2022:

US$1,139,775), and US$376,000 at 23 October 2023, reflecting the

equity raise in August 2023;

-- Costs and overheads minimised with all Directors now waiving salaries/fees;

-- Equity raise of GBP250,000 gross proceeds in August 2023,

following confirmation of entering the First Renewal Period by the

Namibian authorities, regarded as disappointing by the Company.

Strategy and Outlook

Global believes the drilling in the Orange Basin by Shell and

TotalEnergies to date strongly suggests that Namibia has become a

world class petroleum province and that the Walvis Basin and the

Company's Licence will benefit accordingly.

The Company continues to explore all strategic alternatives in

order to preserve and maximise shareholder value. In order to

facilitate this, the urgent priority for the Company is to

strengthen its finances in the very near future.

At the Company's request, the Namibian authorities have extended

the deadline for Global to provide the work programme guarantee

required under the Licence renewal until the end of November 2023.

Absent further extensions/deferrals, the Company requires

significant additional funding in order to meet its Licence and

other payments due in the near future, for which the Company does

not currently have sufficient cash resources.

The Company confirms that a full copy of its latest Annual

Report and Accounts will be available shortly on the Company's

website: www.globalpetroleum.com.au

For further information, please visit www.globalpetroleum.com.au

or contact:

+44 (0) 20 3 875

Global Petroleum Limited 9255

Peter Hill, Managing Director & CEO

Andrew Draffin, Company Secretary

Panmure Gordon (UK) Limited (Nominated Adviser +44 (0) 20 7886

& Joint Broker) 2500

John Prior / Freddie Twist

Corporate Broking: Hugh Rich

CMC Markets (Joint Broker) +44 (0) 20 7170

Tom Curran/Thomas Smith 8200

Tavistock (Financial PR & IR) +44 (0) 20 7920

Simon Hudson / Nick Elwes 3150

The following is an extract from the Annual Financial Report,

the full report can be accessed at the link below:

Link:

http://www.rns-pdf.londonstockexchange.com/rns/5314R_1-2023-10-27.pdf

LETTER TO SHAREHOLDERS

Dear Shareholders,

We are pleased to present to you the Global Petroleum Limited

("Global" or the "Company") Annual Financial Report for the year

ended 30 June 2023.

The Company's focus during the reporting period, and

subsequently, has been on ongoing exploration work and its farm-out

process in respect of its Namibian licence PEL0094 ("Licence"), the

extension/renewal of the Licence period, and the strengthening of

its finances in order to maintain its options for the Licence. The

Company has also continued to engage with the Italian authorities

regarding the Company's exploration permit applications.

On 11 August 2023 the Company announced that the Namibian

authorities had given approval for the Company and its partners to

proceed to the First Renewal Period of the Licence, with a duration

of two years from September 2023 to September 2025.

Importantly, the usual requirement at the end of the Initial

Exploration Period to relinquish 50 per cent of the Licence area

was waived.

In the broader Namibian context, Global is in agreement with the

widely held industry view that the drilling in the Orange Basin by

Shell and TotalEnergies to date strongly suggests that Namibia has

become a world class petroleum province, in terms of scale of

likely resources.

The relevance of the Orange Basin discoveries for Global and its

partners lies in the fact that the oil in the Orange Basin is

interpreted both by the operators of the discoveries and the

Company to be sourced from the Barremian-Aptian Kudu Shale. Work by

the Company has demonstrated that this source rock is likely

generating oil in and around the Company's PEL0094 Licence. In

addition, there are further similarities between some of the

reservoirs and trapping styles in the Orange Basin and those mapped

by the Company in its Licence. Accordingly, the Company believes

that the Walvis Basin, where PEL0094 is situated, also has the

potential to be extremely successful, and has the advantage of much

shallower water depths generally than the discoveries in the

south.

Global has continued its efforts to farm-out an interest in the

Licence. As the Company anticipated, following the discoveries

potential farminees have first looked for possible opportunities in

the Orange Basin.

Regarding Italy, in September 2023 the Company announced that it

had been informed that appeals against the environmental decrees

granted in its favour by the Italian authorities had recently been

dismissed by the Council of State (having previously been dismissed

by the Tribunal in Rome). The actions were brought by the

Municipality of Margherita di Savoia in Puglia against the relevant

Italian Ministries and entities - with Global joined as an

"interested party" - and related to all four of the Company's

exploration permit applications in the Southern Adriatic

("Applications").

The Company submitted further documentation in connection with

the Applications some months ago to the Italian Ministry of

Ecological Transition and has been awaiting further dialogue with

the Ministry regarding the process going forward.

Once this process is complete, the Company will assess its

options in relation to the Applications and make a further

announcement accordingly.

Financial Position and Corporate

As noted above, rather than an extension of the Initial

Exploration Period of the Licence for a further 12 months as

originally contemplated, the Company was invited by the Namibian

authorities to apply for an extension into the First Renewal

Period.

Due to factors outside the Company's control, this process took

longer than anticipated, and than had previously been the case.

Having received confirmation of the Licence extension in August

rather than June 2023 as originally expected, the Company was then

in a position to proceed with an equity raise, and on 31 August

2023 Global announced that it had raised GBP250,000 in aggregate

before costs through the placing of 250,000,000 Ordinary Shares

(the "Placing") at a placing price of 0.1 pence per share. The

Company regarded the amount raised as disappointing in relation to

the sum targeted.

The Company has taken steps to cut costs where practicable to

preserve its cash resources. However this alone will not ensure the

Company's ability to continue as a going concern for the next 12

months. As announced on 13 September 2023, three of the Company's

Directors have been deferring Directors' salary/fees since July

2023, as part of an overall effort to reduce costs generally, and

in particular to minimise outgoings until such time as the

financial position of the Company has been strengthened. As of the

date of this report, all of the Directors are now deferring

salary/fees.

The Company requires significant additional funding in order to

meet its Licence and other payments due in the near future, for

which the Company does not currently have sufficient cash

resources. Accordingly, the Company will very likely need to raise

funds via a share placing in the near future.

Further information regarding the Company's Licence position

specifically, and on its going concern status generally, is

provided in note 1 to the financial statements.

Financial Results

During the year ended 30 June 2023, the Group recorded a loss

after tax of US$1,283,634 (2022: US$1,167,094). Cash balances at 30

June 2023 amounted to US$356,389 (30 June 2022: US$1,139,775). On

23 October 2023 Global had cash balances of US$376,000 following

the equity raise completed after the end of the reporting period.

The Group has no debt outside of suppliers who are settled on

normal commercial terms.

Strategy and Outlook

Global is in full agreement with the widely held industry view

that the drilling in the Orange Basin by Shell and TotalEnergies to

date strongly suggests that Namibia has become a world class

petroleum province, in terms of scale of likely resources and that

the Walvis Basin will benefit accordingly, a development from which

Global would be well positioned to benefit.

The Company continues to explore all strategic alternatives in

order to preserve and maximise shareholder value. In order to

facilitate this, the urgent priority for the Company is to

strengthen its finances in the very near future.

At the Company's request the Namibian authorities have extended

the deadline for Global to provide the work programme guarantee

required under the Licence renewal until the end of November 2023.

Absent further extensions/deferrals, the Company requires

significant additional funding in order to meet its Licence and

other payments due in the near future, for which the Company does

not currently have sufficient cash resources.

John van der Welle Peter Hill

Chairman Chief Executive Officer

OPERATING AND FINANCIAL REVIEW

Namibian Project

The Namibian Project consists of an operated 78 per cent

participating interest in Petroleum Exploration Licence ("PEL")

0094 (acquired in 2018) which covers Block 2011A (see Figure 1).

The Company also previously held an operated 85 per cent

participating interest in PEL0029 covering Blocks 1910B and 2010A.

PEL0029 expired on 3 December 2020, enabling the Company to focus

its technical efforts on PEL0094.

Over the course of 2020 the Company purchased historic 2D

seismic data, and commissioned an AVO study. Interpretation of this

data plus the studies enabled the source rock to be mapped with

even further confidence into Global's acreage. This work also

helped improve interpretation of the Marula prospect (increasing

the geological chance of success of Marula), as well as our

understanding of the relatively under-explored eastern part of the

block, vindicating the Company's view that the overall acreage is

highly prospective.

Consequently, in January 2021 the Company announced an updated

estimate of Prospective Resources for PEL0094. The additional

Prospective Resources in the east of PEL0094 consisted of 7 new

leads with a total unrisked gross Prospective Resources (Best

Estimate) of 2,048 million barrels of oil ("barrels"). As

previously reported, the pre-existing prospects - Marula and

Welwitschia Deep - contain a total of 881 million barrels, making a

new total on the Licence of 2,929 million barrels unrisked gross

Prospective Resources (Best Estimate).

Regarding the Prospective Resources attributable to Global, the

total unrisked net Prospective Resources (Best Estimate) total

2,284 million barrels, compared with the previous number of 687

million barrels net to Global - which related to Marula and

Welwitschia Deep alone.

In April 2022 the Company announced that the Namibian

authorities had granted a one-year extension to the Initial

Exploration Period, from September 2022 to September 2023, and

during the reporting period Global has continued with its technical

work.

After successfully mapping, with the latest technology, the

Barremian-Aptian Kudu Shale source rock from previous drilling in

the Walvis Basin into its Licence area, in late 2021 the Company

worked with the well-regarded geochemical consultancy IGI to build

a number of petroleum systems models for the Walvis Basin. This

study was further updated in mid-2022 and predicts that in all

cases the source rock is mature in the northern Walvis Basin and

that sufficient volumes of hydrocarbons have migrated into the

prospects in PEL0094. In June 2022 the Company licensed a satellite

radar oil seep study over the Walvis, in which a number of oil

seeps have been identified within PEL0094. This further supports

the Company's interpretation of a working petroleum system in the

area.

The Company purchased additional 2D seismic data in 2022 and

carried out further technical interpretation both on the principal

prospects, Marula and Welwitschia Deep and, in particular, on the

leads in the eastern part of the Licence, with the objective of

proving up further resources and better defining those already

reported.

On 14 August 2023 the Company announced that the Namibian

authorities had given approval for the Company and its partners to

proceed to the First Renewal Period ("FRP") of the Licence, with a

duration of two years from September 2023 to September 2025.

Importantly, the usual requirement at the end of the Initial

Exploration Period ("IEP") to relinquish 50 per cent of the Licence

area was waived. The work commitment for the FRP is to acquire,

process and interpret 2,000 kms of 3D seismic data (the "3D

Seismic") - carried over from the IEP and to drill a well

contingent upon the results of the 3D Seismic. The original well

commitment for the FRP - as specified in the Petroleum Agreement

for PEL0094 - was firm, rather than contingent.

The oil and gas exploration sector in Namibia has been

transformed since early 2022 by significant oil discoveries (with

associated gas) in the Orange Basin, to the south of Global's

position. Shell and its partners Qatar Energy and NAMCOR made the

first discovery at Graff, followed by a discovery at nearby La Rona

and more recently further discoveries at Jonker and Lesedi. Shell

has a rig on contract until at least June 2024 to drill both

appraisal and exploration wells and perform tests on the

discoveries. Shell also performed a flow test at Graff.

Meanwhile in the licence immediately to the west, TotalEnergies

and its partners Qatar Energy, Impact Oil and Gas and NAMCOR made

the Venus discovery. Announced shortly after Graff, Venus has now

also been appraised by the Venus-1X well, which flowed oil with

positive results. TotalEnergies moved on to drill an unsuccessful

exploration well, Nara-1X, and followed this by moving to drill a

further exploration well - Mangetti-1X.

The scale of the exploration and appraisal effort strongly

suggests that a significant new petroleum producing province will

be established in Namibia within a decade. This has encouraged

others nearby to accelerate exploration. Chevron farmed into the

licence north of Venus and Woodside into a licence north of there.

On both licences large 3D seismic data surveys have been acquired,

prior to any decisions on drilling. To the north of Shell's

licence, GALP has announced that it will drill at least one

exploration well this coming drilling season.

The relevance of the Orange Basin discoveries for Global and its

partners lies in the fact that the oil in the Orange Basin is

interpreted both by the operators of the discoveries, and the

Company, to be sourced from the Barremian-Aptian Kudu Shale. Work

by the Company has demonstrated that this source rock is likely

generating oil in and around the Company's PEL0094 Licence. In

addition, there are further similarities between some of the

reservoirs and trapping styles in the Orange Basin and those mapped

by the Company in its Licence.

Accordingly, the Company believes that the Walvis Basin, where

PEL0094 is situated, also has the potential to be extremely

successful, and has the advantage of much shallower water depths

generally than the discoveries in the south.

FIGURE 1 - Map of Namibia showing PEL0094

Italian Applications

In August 2013, the Company submitted applications, proposed

work programmes and budgets to the Italian Ministry of Economic

Development for four exploration areas offshore Italy in the

Southern Adriatic: d 80 F.R- GP, d 81 F.R- GP, d 82 F.R-GP and d 83

F.R-GP (the "Applications"). The Applications are contiguous with

the Italian median lines abutting Croatia, Montenegro and Albania

respectively (see Figure 2 below).

As previously reported, various local authorities and interest

groups appealed to either the Rome Tribunal or the President of the

Republic against the Environmental Decrees in relation to the

applications of the four areas. Publication of Environmental

Decrees is the final administrative stage before grant of the

permits. All first instance appeals made to the Rome Tribunal and

to the President of the Republic were subsequently adjudicated in

Global's favour.

However, Puglia, as the Italian region principally interested,

made additional appeals to the Council of State (the highest level

of appeal in Italy) against the judgements of the Rome Tribunal.

The subsequent appeals were heard by the Council of State in

January 2020, and in February 2020 the Council of State issued a

judgement. Essentially, the Council of State suspended the

proceedings before it and referred the matter to the European

Court, requesting the Court to rule whether the four Applications

contravene a relevant EU Directive relating to the maximum

permissible size of individual permits, in particular having regard

to the fact that the four permit applications are contiguous.

The judgement of the European Court was announced by the Company

in January 2022. The Court found, in effect, that the Company's

Applications do not contravene EU law.

Separately from the appeals process above, in February 2019 the

Italian Parliament passed a Bill suspending all hydrocarbon

exploration activities - including permit applications - for a

period of 18 months. Under the proposed legislation, a

Government-appointed Commission was to review all onshore and

offshore areas for the stated purpose of evaluating their

suitability for hydrocarbon exploration and development in the

future. In doing so, the suitability of such activities in the

context of social, industrial, urban, water source and

environmental factors were to be evaluated. In offshore areas,

suitability would additionally be assessed having regard to the

impact of such activity on the littoral environment, marine

ecosystems and shipping routes. Following the 18-month evaluation

period, the intention was that a Hydrocarbon Plan would be

activated, setting out a strategy for future exploration and

development. Following the expiry of its initial 18-month term, the

moratorium was extended twice.

In February 2022, the Plan for Sustainable Energy Transition of

Appropriate Areas ("Plan") was published and came into legal

effect. A key structural component of the Plan is the provision

that in future only exploration for gas (as opposed to oil) will be

permitted in Italy, both onshore and offshore. With specific regard

to the Applications, the Plan also provides that certain sections

of the application areas as previously constituted are deemed to be

excluded, a process referred to by the relevant authorities as

"re-perimeterisation".

Notwithstanding the Company's reservations as to the

practicality of gas-only exploration - a reservation which Global

believes is widely shared within the Energy Industry and beyond -

the Company provided the Italian authorities technical evidence of

the gas prospectivity within the reduced application areas, also

thereby accepting the re-perimeterisation of those areas.

The Italian Ministry of Ecological Transition ("Ministry")

subsequently informed Global that the Company's exploration

objectives in the amended Applications are in compliance with the

provisions of the Plan. The Company accordingly submitted further

documentation several months ago, since when the Company has been

awaiting further dialogue with the Italian Ministry.

In the meantime, in September 2023, the Company announced that

it had been informed that appeals against the environmental decrees

granted in its favour by the Italian authorities had recently been

dismissed by the Council of State (having previously been dismissed

by the Tribunal in Rome). The actions were brought by the

Municipality of Margherita di Savoia in Puglia against the relevant

Italian Ministries and entities - with Global joined as an

"interested party" - and related to all four of the Company's

exploration permit applications in the Southern Adriatic:

Once this process is complete, the Company will assess its

options in relation to the Applications and make a further

announcement accordingly.

FIGURE 2 - Map of Permit Applications - Italy offshore.

STRATEGY

Global Petroleum's strategy is to maximize its gearing to

exploration success in order to enhance shareholder value. This

will be achieved through the acquisition of early licence positions

in frontier exploration areas in Africa and the Mediterranean

either directly through licence rounds, joint venture arrangements

or acquisition.

Whilst the geographic focus is Africa and the Mediterranean, the

Company will also consider other frontier areas that it considers

to be highly prospective.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 30 JUNE 2023

2023 2022

Note US$ US$

Continuing operations

Employee benefits expense (397,456) (450,400)

Administrative expense (727,225) (830,592)

Exploration and business development

expenses 11 (27,667) (21,767)

Depreciation and amortisation expense (3,439) (3,439)

Share based payments 19 (47,027) -

Other expenses (113,653) (162,970)

Foreign exchange gain (loss) 24,557 (178,445)

--------------- ------------

Results from operating activities (1,291,910) (1,647,613)

Finance income 8,276 519

--------------- ------------

Net finance income 8,276 519

--------------- ------------

(Loss) from continuing operations before

tax (1,283,634) (1,647,094)

--------------- ------------

Tax expense 3 -- -

--------------- ------------

(Loss) from continuing operations

after tax (1,283,634) (1,647,094)

--------------- ------------

(Loss) for the year (1,283,634) (1,647,094)

--------------- ------------

Earnings per share

From continuing and discontinued operations

Basic earnings per share (cents) 6 (0.12) (0.21)

Diluted earnings per share (cents) 6 (0.12) (0.21)

The accompanying notes form part of these financial

statements.

CONSOLIDATED STATEMENT OF F INANCIAL POSITION AS AT 30 JUNE

2023

2023 2022

Assets Current assets Note US$ US$

Cash and cash equivalents 7 356,389 1,139,775

Trade and other receivables 8 35,301 37,020

Other assets 12 190,083 185,159

-------------- ------------

Total current assets 581,773 1,361,954

-------------- ------------

Non-current assets

Property, plant and equipment 10 9,719 13,158

Exploration and evaluation assets 11 1,724,039 1,291,599

-------------- ------------

Total non-current assets 1,733,758 1,304,757

-------------- ------------

Total assets 2,315,531 2,666,711

============== ============

Liabilities

Current liabilities

Trade and other payables 13 89,894 112,048

Provisions 14 259,751 220,730

-------------- ------------

Total current liabilities 349,645 332,778

-------------- ------------

Total liabilities 349,645 332,778

============== ============

Net assets 1,965,886 2,333,933

============== ============

Equity

Issued capital 15 44,343,531 43,474,971

Reserves 23 854,227 1,249,042

Accumulated losses (43,231,872) (42,390,080)

-------------- ------------

Total equity 1,965,886 2,333,933

============== ============

The accompanying notes form part of these financial

statements

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

JUNE 2023

Foreign

Currency

Issued Option Translation Accumulated

Capital Reserve Reserve Losses Total

US$ US$ US$ US$ US$

Consolidated Group

Balance at 1 July 2021 42,189,991 678,632 570,410 (40,742,986) 2,696,047

Comprehensive income

Loss for the year - - - (1,647,094) (1,647,094)

------------ --------- ------------ ---------------- -----------

Total comprehensive income for

the year - - - (1,647,094) (1,647,094)

------------ --------- ------------ ---------------- -----------

Transactions with owners, in

their capacity as owners, and

other transfers

Issue of shares 1,367,000 - - - 1,367,000

Transaction costs (82,020) - - - (82,020)

------------ --------- ------------ ---------------- -----------

Total transactions with owners

and other transfers 1,284,980 - - - 1,284,980

------------ --------- ------------ ---------------- -----------

Balance at 30 June 2022 43,474,971 678,632 570,410 (42,390,080) 2,333,933

============ ========= ============ ================ ===========

Balance at 1 July 2022 43,474,971 678,632 570,410 (42,390,080) 2,333,933

Comprehensive income

Loss for the year - - - (1,283,634) (1,283,634)

------------ --------- ------------ ---------------- -----------

Total comprehensive income for

the year - - - (1,283,634) (1,283,634)

------------ --------- ------------ ---------------- -----------

Transactions with owners, in

their capacity as owners, and

other transfers

Issue of shares 924,000 - - - 924,000

Transaction costs (55,440) - - - (55,440)

Issue of options - 47,027 - - 47,027

Expiry of options - (441,842) - 441,842 -

------------ --------- ------------ ---------------- -----------

Total transactions with owners

and other transfers 868,560 (394,815) - 441,842 915,587

------------ --------- ------------ ---------------- -----------

Balance at 30 June 2023 44,343,531 283,817 570,410 (43,231,872) 1,965,886

============ ========= ============ ================ ===========

The accompanying notes form part of these financial

statements

CONSOLIDATED STATEMENT OF CASHFLOWS FOR THE YEAR ENDED 30 JUNE

2023

2023 2022

Note US$ US$

Cash flows from operating activities

Interest received 8,276 519

Payments to suppliers and employees (1,202,684) (1,551,823)

GST/VAT refunds received 3,632 43,602

----------- -----------

Net cash (used in) operating activities 18a (1,190,776) (1,507,702)

----------- -----------

Cash flows from investment activities

Payments for exploration and business

development expenditure (460,107) (340,900)

Reclassification of bank guarantee - (130,050)

----------- -----------

Net cash (used in) investing activities (460,107) (470,950)

----------- -----------

Cash flows from financing activities

Proceeds from issue of shares 924,000 1,367,000

Payments for capital raising costs (55,440) (82,020)

----------- -----------

Net cash provided by financing activities 868,560 1,284,980

----------- -----------

Net decrease in cash held (782,323) (693,672)

Cash and cash equivalents at beginning

of financial year 1,139,775 1,834,434

Effect of exchange rates on cash holdings

in foreign currencies (1,063) (987)

----------- -----------

Cash and cash equivalents at end of

financial year 7 356,389 1,139,775

=========== ===========

The accompanying notes form part of these financial

statements

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MRBFTMTMTMTJ

(END) Dow Jones Newswires

October 27, 2023 02:26 ET (06:26 GMT)

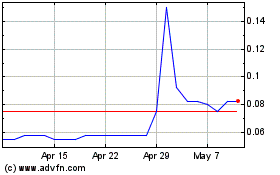

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Apr 2024 to May 2024

Global Petroleum (LSE:GBP)

Historical Stock Chart

From May 2023 to May 2024