Lok'nStore Group PLC Pre-close trading update (6374I)

12 August 2019 - 4:00PM

UK Regulatory

TIDMLOK

RNS Number : 6374I

Lok'nStore Group PLC

12 August 2019

12 August 2019

Lok'nStore Group plc

("Lok'nStore", the "Company" or the "Group")

Pre-close trading update

"Robust sales growth, eight more landmark stores in development

and increased financial firepower"

Lok'nStore, the fast growing AIM listed self-storage company, is

pleased to provide the following update on trading in the financial

year to 31 July 2019.

Trading in FY2019 was strong with revenue in the self storage

business up 8.7%. At 31 July 2019 self-storage unit occupancy was

up 6.0% and price per let sq. ft. was up 0.6% compared to the same

date twelve months ago.

Delivering on our growth strategy, we have opened four new

landmark stores in Dover, Cardiff, Exeter and Ipswich, as well as

acquiring an existing store in Hedge End, Southampton. We are on

site in Leicester and Gloucester which will open during FY2020 and

have exchanged contracts on two further landmark sites in Stevenage

and Warrington.

In January 2019 we disposed of the document storage business for

GBP7.64 million and completed the sale and manage-back of the

Crayford store for GBP7.52 million in February 2019. The proceeds

will be reinvested back into new faster growth landmark stores.

During the year we secured a new GBP75 million five year

revolving credit facility which will provide funding for site

acquisition and development to support the Group's ambitious growth

plans. The facility also provides for a GBP25 million accordion

uplift to GBP100 million and runs to 2024 with an option for two

one year extensions. With net debt of GBP29 million at 31 July 2019

the Company has headroom of around GBP71 million for new landmark

stores.

Preliminary results will be announced on Monday 4 November

2019.

Andrew Jacobs, CEO of Lok'nStore said:

"We have delivered another strong trading performance this year

with 8.7% growth in revenue. Trading at our new stores has been

encouraging. With our secured pipeline of eight new landmark sites

which will add 27% to trading space we are delivering on our

objective of growing rapidly by acquiring new sites.

In executing our strategy we are producing predictable growth in

dividends for investors from an increasing number of stores

underpinned by a growing cash flow and asset base."

-Ends-

Enquiries:

Lok'nStore

Andrew Jacobs, CEO

Ray Davies, Finance Director 01252 521010

finnCap Ltd

Julian Blunt/Giles Rolls, Corporate Finance

Alice Lane, Corporate Broking 020 7220 0500

Camarco

Billy Clegg/Tom Huddart/Jake Thomas 020 3757 4980

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPBMPTMBBBBJL

(END) Dow Jones Newswires

August 12, 2019 02:00 ET (06:00 GMT)

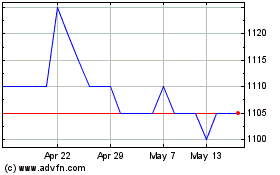

Lok'n Store (LSE:LOK)

Historical Stock Chart

From Apr 2024 to May 2024

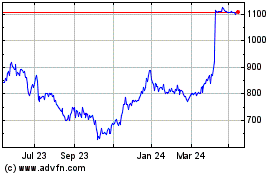

Lok'n Store (LSE:LOK)

Historical Stock Chart

From May 2023 to May 2024