TIDMNANO

RNS Number : 6614A

Nanoco Group PLC

23 January 2024

23 January 2024

NANOCO GROUP PLC

(" Nanoco ", the "Group" or the "Company" )

NOTIFICATION OF TRANSACTIONS BY PERSONS DISCHARGING MANAGERIAL

RESPONSIBILITY

Nanoco (LSE: NANO), a world leader in the development and

manufacture of cadmium-free quantum dots and other specific

nanomaterials emanating from our technology platform, announces

that on 23 January 2024 nil-cost options over ordinary shares of 10

pence each in the Company ("Ordinary Shares") were granted under

both the Nanoco Group 2015 Long Term Incentive Plan (the "LTIP")

and the Nanoco 2015 Deferred Bonus Plan (the "DBP") to the

executive directors and other staff as noted below.

Name of Director / PDMR Options granted Options granted Total resultant

under LTIP under DBP options held

Brian Tenner (CEO - Director,

PDMR) 2,255,220 577,736 6,904,550

---------------- ---------------- ----------------

Nigel Pickett (CTO - Director,

PDMR) 1,604,897 424,667 5,170,926

---------------- ---------------- ----------------

Liam Gray (CFO - Director,

PDMR) 1,148,112 294,894 3,138,288

---------------- ---------------- ----------------

Other non-disclosable

staff 2,556,312 194,904 n/a

---------------- ---------------- ----------------

Total number of options

granted 7,564,541 1,492,201 n/a

---------------- ---------------- ----------------

Ordinarily the number of options awarded under the LTIP and DBP

would have been calculated by reference to the average closing

mid-market share price for the three days after the announcement of

the Group's results for the year ending 31 July 2023. This was

16.58 pence.

However, the Group has delayed the annual issue of options until

after the delivery and announcement of a series of important

production and development agreements. With the announcement of the

two-year development agreement with STMicroelectronics ("ST") on 12

January 2024, the Company is now able to issue these options.

During this period, the share price has appreciated, and the Board

felt it appropriate to reflect this increase in the calculation of

the awards and hence has used the average closing mid-price in the

three days after the ST announcement. This was 19.97 pence.

The use of the higher price to calculate the number of awards

has resulted in a reduction in the number of awards to each person

by approximately 17%.

DBP

The DBP options are subject to a two-year holding period and

ordinarily will vest following the announcement of Nanoco's results

for its financial year ending 31 July 2025. There are no further

performance conditions for the DBP options.

LTIP

The vesting of the LTIP options is subject to the achievement of

two performance conditions. Fifty percent (50%) will vest depending

on absolute total shareholder return ("Absolute TSR") over the

three-year performance period ending 31 July 2026. Absolute TSR is

calculated as the sum of any change in the market capitalization of

the Group plus any dividends paid during the performance period.

Fifty percent (50%) will vest depending on growth in the Group's

revenue over the same three-year performance period.

The Board has adopted Absolute TSR as one of two performance

conditions for the last two years due to the potentially distorting

effects of any return of capital on a simple share price target.

The table below sets out the targets for Absolute TSR.

Range Absolute TSR Proportion of

(equivalent CAGR (%) and share award that will

price) vest

Below threshold Less than GBP30.9 million Nil

--------------------------------- -----------------

GBP30.9 million (15% CAGR,

Threshold 27.8 pence) 25%

--------------------------------- -----------------

GBP43.2 million (20% CAGR,

Target 31.6 pence) 60%

--------------------------------- -----------------

GBP56.5 million (25% CAGR,

Maximum 35.8 pence) 100%

--------------------------------- -----------------

The table also discloses the equivalent compound annual growth

rate ('CAGR') and resulting Share Price (excluding dividends) as

compared to the average of the closing mid-market price of the

Company's shares for the three months before the release of Group's

annual results for the year ending 31 July 2023 (as announced on 17

October 2023 and in accordance with the rules of the scheme, being

18.28p).

Given the Group is still entering a new stage in its

development, the Directors consider that the revenue targets are

commercially sensitive and hence are not being disclosed at this

time. However, in order to maintain transparency, the targets will

be disclosed at the same time as the actual outcome is assessed

following the end of the performance period.

Ordinarily, the LTIP options will vest (subject to the

achievement of the performance conditions) following the

announcement of Nanoco's results for its financial year ending 31

July 2026. The options are then subject to an additional two-year

holding period.

This notification is made pursuant to the requirements under the

UK Market Abuse Regulation.

For further information, please contact:

Nanoco Group PLC : +44 (0)1928 761 404

Brian Tenner, CEO

Liam Gray, CFO & Company Secretary

Cavendish Capital Markets Limited (Financial Adviser & Joint

Corporate Broker): +44 (0) 20 7220 0500

Ed Frisby / George Lawson (Corporate Finance)

Tim Redfern / Charlie Combe (Corporate Broking)

Jasper Berry (Sales)

Turner Pope Investments (Joint Corporate Broker):

+44 (0) 20 3657 0050

Andrew Thacker

James Pope

Powerscourt +44 (0)7970 246 725

Elly Williamson

Ollie Simmonds

Nanoco@powerscourt-group.com

FORWARD LOOKING STATEMENTS

This announcement (including information incorporated by

reference in this announcement) and other information published by

Nanoco may contain statements about Nanoco that are or may be

deemed to be forward looking statements. Such statements are

prospective in nature. All statements other than historical

statements of facts may be forward looking statements. Without

limitation, statements containing the words "targets", "plans",

"believes", "expects", "aims", "intends", "will", "may",

"anticipates", "estimates", "projects" or "considers" or other

similar words may be forward looking statements.

Forward-looking statements inherently contain risks and

uncertainties as they relate to events or circumstances in the

future. Important factors such as business or economic cycles, the

terms and conditions of Nanoco's financing arrangements, tax rates,

or increased competition may cause Nanoco's actual financial

results, performance or achievements to differ materially from any

forward-looking statements. Due to such uncertainties and risks,

readers are cautioned not to place undue reliance on such

forward-looking statements, which speak only as of the date hereof.

Nanoco disclaims any obligation to update any forward looking or

other statements contained herein, except as required by applicable

law.

About Nanoco Group plc

Nanoco (LSE: NANO) is a nano-material production company,

specialising in the production of its patented cadmium free quantum

dots (CFQD(R)) and other patented nano-materials for use in the

electronics industries.

Founded in 2001 and headquartered in Runcorn, UK, Nanoco

continues to build out a world-class, patent-protected IP portfolio

alongside the scaling of the production for commercial orders.

Nano-materials are materials with dimensions typically in the

range 1 - 100 nm. Nano-materials have a range of useful properties,

including optical and electronic. Quantum dots are a subclass of

nano-material that have size-dependent optical and electronic

properties. Within the sphere of quantum dots, the Group exploits

different characteristics of the quantum dots to target different

performance criteria that are attractive to specific markets or

end-user applications such as the Sensor, Electronics and Display

markets. Nanoco's CFQD(R) quantum dots are free of cadmium and

other toxic heavy metals, and can be tuned to emit light at

different wavelengths across the visible and infrared spectrum,

rendering them useful for a wide range of display applications.

Nanoco's HEATWAVE(TM) quantum dots can be tuned to absorb light at

different wavelengths across the near-infrared spectrum, rendering

them useful for applications including cameras and image

sensors.

Nanoco is listed on the Main Market of the London Stock Exchange

and trades under the ticker symbol NANO. For further information,

please visit: www.nanocotechnologies.com.

Notification of Dealing Forms

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name BRIAN TENNER

2. Reason for the notification

a) Position /status CHIEF EXECUTIVE OFFICER

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 LONG TERM INCENTIVE PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 2,255,220

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name BRIAN TENNER

2. Reason for the notification

a) Position /status CHIEF EXECUTIVE OFFICER

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 DEFERRED BONUS PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 577,736

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

Notification of Dealing Forms

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name DR NIGEL PICKETT

2. Reason for the notification

a) Position /status CHIEF TECHNICAL OFFICER

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 LONG TERM INCENTIVE PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 1,604,897

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name DR NIGEL PICKETT

2. Reason for the notification

a) Position /status CHIEF TECHNICAL OFFICER

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 DEFERRED BONUS PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 424,667

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

Notification of Dealing Forms

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name LIAM GRAY

2. Reason for the notification

a) Position /status CHIEF FINANCIAL OFFICER, NANOCO GROUP PLC

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 LONG TERM INCENTIVE PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 1,148,112

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

1. Details of the Person Discharging Managerial Responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name LIAM GRAY

2. Reason for the notification

a) Position /status CHIEF FINANCIAL OFFICER, NANOCO GROUP PLC

b) Initial notification INITIAL NOTIFICATION

/ amendment

3. Details of the Issuer

a) Name NANOCO GROUP PLC

b) LEI code 213800HOSJEZO1KOCV33

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

a) Type of instrument ORDINARY SHARES OF 1O PENCE EACH

Identification

code

ISIN: GB00B01JLR99

b) Nature of the transaction GRANT OF AN OPTION OVER ORDINARY SHARES UNDER

THE NANOCO 2015 DEFERRED BONUS PLAN

c) Price(s) and volume(s) Price(s) Volume(s)

Nil cost 294,894

d) Aggregated information: N/A

- Aggregated volume

- Price

e) Date of the transaction 23 JANUARY 2024

f) Place of the transaction OUTSIDE A TRADING VENUE

= END =

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHQKNBKABKDKDB

(END) Dow Jones Newswires

January 23, 2024 11:02 ET (16:02 GMT)

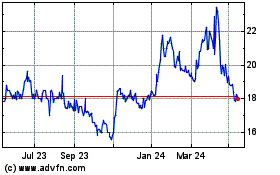

Nanoco (LSE:NANO)

Historical Stock Chart

From Mar 2024 to Apr 2024

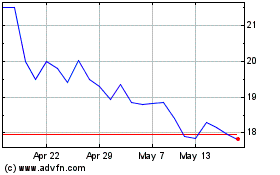

Nanoco (LSE:NANO)

Historical Stock Chart

From Apr 2023 to Apr 2024