Premier Energy&Water Portfolio Update

04 November 2015 - 12:37AM

UK Regulatory

TIDMPEW TIDMPEWZ

Premier Energy and Water Trust PLC announces that at close of business on 30

October 2015 its twenty largest investments were as follows:

% of total assets

OPG Power Ventures 7.7

China Power Intl. Develop 5.0

Renewable Energy Generation 4.4

National Grid 4.0

Nextera Energy 3.6

SSE PLC 3.6

First Trust MLP and Energy Income Fund 3.4

Beijing Enterprises Holdings 3.3

China Everbright Intl. 3.2

Engie 3.0

iShares Global Utilities ETF 2.9

Qatar Electricity & Water 2.7

Enersis 2.6

EDP - Energias do Brasil 2.5

Greenko Group Ord and 8% Bond* 2.4

Pennon Group 2.3

ACEA 2.1

TerraForm Global 9.75% Bond 15/08/2022 1.9

Tenaga Nasional Berhad 1.8

Consolidated Edison 1.7

* Holding in both convertible bond and equity

At close of business on 30 October 2015 the total net assets of Premier Energy

and Water Trust PLC amounted to GBP76.4 million. The sector breakdown and

geographical allocation were as follows:

Sector Breakdown:

Electricity 48.9%

Multi Utilities 18.5%

Water & Waste 8.2%

Gas 5.6%

Cash/Net Current Assets 7.9%

Renewable Energy 10.6%

Index Options 0.3%

Total 100.0%

Geographical Allocation:

Europe (excluding UK) 4.9%

China 16.9%

North America 16.6%

Global 7.9%

Asia (excluding China) 15.3%

United Kingdom 16.5%

Latin America 6.6%

Cash/Net Current Assets 7.9%

Eastern Europe 4.4%

Middle East 2.7%

Index Options 0.3%

END

(END) Dow Jones Newswires

November 03, 2015 08:37 ET (13:37 GMT)

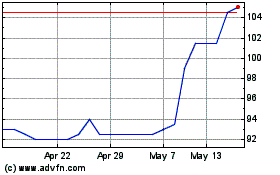

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From Apr 2024 to May 2024

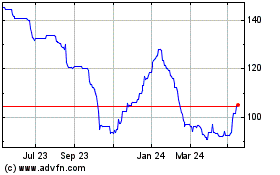

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From May 2023 to May 2024