TIDMREDX

RNS Number : 4502Q

Redx Pharma plc

18 October 2023

THIS ANNOUNCEMENT, INCLUDING THE APPICES, AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR

INTO THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SHARES IN REDX PHARMA

PLC IN ANY JURISDICTION.

THE SECURITIES DISCUSSED HEREIN MAY NOT BE OFFERED OR SOLD IN

THE UNITED STATES, UNLESS REGISTERED UNDER THE U.S. SECURITIES ACT

OF 1933, AS AMED (THE "SECURITIES ACT"), OR PURSUANT TO AN

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, REGISTRATION

UNDER THE SECURITIES ACT. NO PUBLIC OFFERING OF THE SECURITIES

DISCUSSED HEREIN IS BEING MADE IN THE UNITED STATES AND THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFERING OF

SECURITIES FOR SALE IN THE UNITED STATES AND THE COMPANY DOES NOT

CURRENTLY INT TO REGISTER ANY SECURITIES UNDER THE SECURITIES ACT.

ADDITIONALLY, THE SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY OTHER

SECURITIES COMMISSION OR REGULATORY AUTHORITY IN THE UNITED STATES,

NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON ORORSED THE

MERITS OF THE SUBSCRIPTION. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENCE IN THE UNITED STATES.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 AS IT FORMS PART OF DOMESTIC

LAW IN THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018. IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN

RESPECT OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE

INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH

PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE

INFORMATION.

Redx Pharma plc

("Redx" or "the Company")

Proposed Subscription to raise c.GBP14.1 million

Alderley Park, 18 October 2023 - Redx Pharma plc (AIM: REDX),

the clinical-stage biotechnology company focused on discovering and

developing novel, small molecule, targeted therapeutics for the

treatment of fibrotic disease and cancer, today announces that it

has conditionally raised c.GBP14.1 million (before expenses) by way

of a subscription for 54,074,458 new Ordinary Shares (the

"Subscription Shares") by existing shareholders (the

"Subscription"). The Subscription, which is subject to certain

conditions, will be effected at a price of 26 pence per

Subscription Share (the "Issue Price"), being the closing market

price on 17 October 2023 (the business day prior to the date of

this announcement). The net proceeds of the Subscription will allow

the Company to continue to progress its pipeline, as detailed

further below.

MTS Securities, LLC is acting as exclusive placement agent (the

"Exclusive Placement Agent") in connection with the

Subscription.

Dr Jane Griffiths, Chair of the Board of Directors

commented:

"At Redx we are focussed on developing novel, targeted therapies

for fibrotic disease and cancer in areas of high unmet medical

need. This fundraise enables us to continue the strong progress of

our industry-leading ROCK portfolio, specifically advancing our

ROCK2-selective inhibitor, zelasudil, in idiopathic pulmonary

fibrosis (IPF) and commencing clinical studies for our

gastrointestinal-targeted ROCK inhibitor, RXC008, which has the

potential to be a first-in-class treatment for fibrostenotic

Crohn's disease.

We would like to thank our existing shareholders for their

continued strong support of Redx and our ambition to create world

leading medicines to transform patients' lives ."

Highlights of the Transaction

-- Subscription of c.GBP14.1 million (before expenses) at the

Issue Price by existing shareholders.

-- One of the Redmile Funds, which taken together are the

Company's largest shareholder, is participating in the Subscription

and has agreed to subscribe for 31,548,692 Subscription Shares at

the Issue Price. Sofinnova Partners , an existing Shareholder, is

also participating in the Subscription and has agreed to subscribe

for 7,887,173 Subscription Shares at the Issue Price. In addition,

Polar Capital and Invus, both existing shareholders of the Company,

are also participating in the Subscription, either directly or

through entities in their respective groups.

-- Following completion of the Subscription, the Company

estimates that it will have available cash of approximately GBP28.1

million which is expected to provide the Company with working

capital in order to fund the anticipated progression of its ROCK

portfolio to important value inflection points in 2024, thereby

continuing the delivery of its stated strategy to drive shareholder

value.

-- Redx expects to use the net proceeds of the Subscription, its

existing cash resources and a risk-adjusted forecast of milestone

income from partnered programmes due before the end of 2024 as

follows:

o report topline Phase 2a data from zelasudil IPF clinical trial

which will include early efficacy, safetyand PK/PD data;

o complete additional investigative preclinical studies for

zelasudil to enable a complete response to the FDA partial clinical

hold, allowing for longer dosing durations in the US;

o progress RXC008 into clinical development in fibrostenotic

Crohn's disease by initiating a Phase 1 study in healthy

volunteers;

o report topline Phase 2 data from PORCUPINE and PORCUPINE2

clinical trials of RXC004 as a combination therapy with immune

checkpoint inhibitors in patients with genetically selected MSS

mCRC and unselected biliary tract cancer;

o continue to explore partnerships to advance certain programmes

from the Redx portfolio; and

o for general and administrative working capital into the third

quarter of 2024.

The issue of the Subscription Shares is conditional, inter alia,

on the passing by Shareholders of certain resolutions at a General

Meeting of the Company, which is being convened at the offices of

Cooley (UK) LLP, 22 Bishopsgate, London EC2N 4BQ on 6 November 2023

at 11:00 a.m. (London time). Application will be made to the London

Stock Exchange for the Subscription Shares to be admitted to

trading on AIM ("Admission").

Related Party Transaction

As the Redmile Funds hold 73.26 per cent. of the Existing

Ordinary Shares, Redmile is a related party of the Company pursuant

to the AIM Rules. In addition, as Sofinnova holds 13.16 per cent.

of the Existing Ordinary Shares, Sofinnova is also a related party

of the Company pursuant to the AIM Rules. Consequently, the

participation of Redmile via its fund, RedCo II, and Sofinnova in

the Subscription constitute related party transactions for the

purposes of AIM Rule 13. The independent directors for the purposes

of this transaction (being all Directors other than Natalie Berner,

who is a representative of Redmile and Dr Joseph Anderson, who is a

representative of Sofinnova) consider, having consulted with Spark,

the Company's nominated adviser, that the terms of (i) RedCo II's

subscription for Subscription Shares in the Subscription and (ii)

Sofinnova's subscription for Subscription Shares in the

Subscription are fair and reasonable in so far as Shareholders are

concerned.

Set out below in Appendix I to this Announcement (which forms

part of this Announcement) is an adapted extract from the Circular

proposed to be sent to Shareholders. The Circular, containing the

Notice of General Meeting, will be posted to shareholders later

today and will also be available from the Company's website at:

www.redxpharma.com .

The capitalised terms not otherwise defined in the text of this

Announcement are defined in Appendix II and the glossary is

contained at Appendix III. The expected timetable of principal

events is set out in Appendix IV.

This Announcement should be read in its entirety.

The person responsible for the release of this Announcement on

behalf of the Company is Nischal Hindia, Interim General Counsel

& Company Secretary.

For further information, please contact:

Redx Pharma Plc T: +44 1625 469

918

UK Headquarters

Caitlin Pearson, Head of Communications

ir@redxpharma.com

Lisa Anson, Chief Executive Officer

US Office

Peter Collum, Chief Financial Officer

SPARK Advisory Partners (Nominated Adviser) T: +44 203 368

Matt Davis / Adam Dawes 3550

MTS Securities, LLC (Exclusive Placement Agent) T: +1 212 887

Mark Epstein 2100

WG Partners LLP (Joint Broker) T: +44 203 705

Claes Spång / Satheesh Nadarajah / David Wilson 9330

Panmure Gordon (UK) Limited (Joint Broker) T: +44 207 886

Rupert Dearden / Freddy Crossley / Emma Earl 2500

FTI Consulting T: +44 20 3727

Simon Conway / Ciara Martin 1000

About Redx Pharma Plc

Redx Pharma (AIM: REDX) is a clinical-stage biotechnology

company focused on the discovery and development of novel, small

molecule, targeted therapeutics for the treatment of fibrotic

disease, cancer and the emerging area of cancer-associated

fibrosis, aiming initially to progress them to clinical proof of

concept before evaluating options for further development and

potential value creation. The Company's lead fibrosis product

candidate, the selective ROCK2 inhibitor, zelasudil (RXC007), is in

development for interstitial lung disease and is undergoing a Phase

2a trial for idiopathic pulmonary fibrosis (IPF) with topline data

expected in H1 2024. The Company's second fibrosis candidate,

RXC008, a GI-targeted ROCK inhibitor for the treatment of

fibrostenotic Crohn's disease, is progressing towards a CTA

application during the fourth quarter of 2023. Redx's lead oncology

product candidate, the Porcupine inhibitor RXC004, being developed

as a targeted treatment for Wnt-ligand dependent cancers, is

expected to report anti-PD-1 combination Phase 2 data during the

first half of 2024, following which Redx will seek a partner for

ongoing development.

The Company has a strong track record of discovering new drug

candidates through its core strengths in medicinal chemistry and

translational science, enabling the Company to discover and develop

differentiated therapeutics against biologically or clinically

validated targets. The Company's accomplishments are evidenced not

only by its wholly-owned clinical-stage product candidates and

discovery pipeline, but also by its strategic transactions,

including the sale of pirtobrutinib (RXC005, LOXO-305), a

non-covalent (reversible) BTK inhibitor now approved by the US FDA

for adult patients with mantle cell lymphoma previously treated

with a covalent BTK inhibitor, and AZD5055/RXC006, a Porcupine

inhibitor targeting fibrotic diseases including IPF, which

AstraZeneca is progressing in a Phase 1 clinical study. In

addition, Redx has forged collaborations with Jazz Pharmaceuticals,

which includes JZP815, a pan-RAF inhibitor developed by Redx which

Jazz is now progressing through Phase 1 clinical studies, and an

early stage oncology research collaboration.

This Announcement should be read in its entirety.

Important Notice

This Announcement and the information contained in it is

restricted and is not for release, publication or distribution,

directly or indirectly, in whole or in part, in, into or from the

United States, Canada, Australia, Japan or the Republic of South

Africa or any other jurisdiction in which the same would constitute

a violation of the relevant laws or regulations of that

jurisdiction (each, a "Restricted Jurisdiction"). The offering of

securities mentioned herein have not been, and will not be,

registered under the U.S. Securities Act. The Subscription Shares

may not be offered or sold in the United States, except pursuant to

an exemption from the registration requirements of the U.S.

Securities Act or pursuant to an effective registration statement

filed with the U.S. Securities and Exchange Commission. There will

be no public offer of securities of the Company in the United

States.

This Announcement has been issued by, and is the sole

responsibility, of the Company. No representation or warranty

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by MTS

Securities, LLC ("MTS") or by any of their respective affiliates,

directors, officers, employees, advisers or agents as to or in

relation to, the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefore is expressly disclaimed. MTS has not authorised

the contents of, or any part of, this Announcement.

MTS is acting exclusively for the Company and no-one else in

connection with the Subscription and will not regard any other

person as a client in relation to such matters and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to such matters. The responsibilities of SPARK Advisory

Partners Limited ("SPARK") as nominated adviser to the Company are

owed to the London Stock Exchange and the Company and not to any

other person including, without limitation, in respect of any

decision to acquire Subscription Shares in reliance on any part of

this Announcement.

No public offering of Subscription Shares is being made in the

United Kingdom, any Restricted Jurisdiction or elsewhere. The

distribution of this Announcement and the offering of the

Subscription Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Company or MTS that would

permit an offering of such Subscription Shares or possession or

distribution of this Announcement or any other offering or

publicity material relating to such Subscription Shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this Announcement comes are required by the

Company and MTS to inform themselves about, and to observe, such

restrictions.

The information in this Announcement may not be forwarded or

distributed to any other person and may not be reproduced in any

manner whatsoever. Any forwarding, distribution, reproduction, or

disclosure of this information in whole or in part is unauthorised.

Failure to comply with this directive may result in a violation of

the U.S. Securities Act or the applicable laws of other

jurisdictions.

There are matters set out within this Announcement that are

forward-looking statements. Such statements are only predictions,

and actual events or results may differ materially. Neither the

Company or MTS undertake any obligation to update publicly, or

revise, forward-looking statements, whether as a result of new

information, future events or otherwise, except to the extent

legally required. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

Announcement. No statement in this Announcement is or is intended

to be a pro t forecast or pro t estimate or to imply that the

earnings of the Company for the current or future nancial periods

will necessarily match or exceed the historical or published

earnings of the Company. The price of the Company's Ordinary Shares

and the income from them may go down as well as up and investors

may not get back the full amount invested on disposal of the

Company's Ordinary Shares.

This Announcement is not an offering document, prospectus,

prospectus equivalent document or AIM admission document. It is

expected that no offering document, prospectus, prospectus

equivalent document or AIM admission document will be required in

connection with the Subscription and no such document has been or

will be prepared or submitted to be approved by the Financial

Conduct Authority or submitted to the London Stock Exchange in

relation to the Subscription.

Neither the content of the Company's website nor any links on

the Company's website is incorporated in, or forms part of, this

Announcement.

APPIX I: EXTRACTS FROM THE CIRCULAR

Background to and reasons for the Subscription

Redx is a clinical-stage biotechnology company founded in 2010

and whose Ordinary Shares have traded on AIM since 2015. The

Company is focused on discovering and developing novel, small

molecule, targeted therapeutics for the treatment of fibrotic

disease and cancer, including the emerging area of

cancer-associated fibrosis, that address significant unmet medical

needs. Redx's core strengths in medicinal chemistry and

translational science have enabled the Company to discover and

develop differentiated, novel compounds against biologically or

clinically validated targets. In particular, this expertise has led

to the development of a differentiated portfolio of Rho Associated

Coiled-Coil Containing Protein Kinase (ROCK) inhibitors, as

potentially either best-in-class or first-in-class drug candidates

and Redx has made substantial progress with its wholly-owned

clinical and preclinical stage pipeline. Moving forward, Redx will

prioritise developing its ROCK portfolio through various clinical

stage studies, and will pursue partnerships for the remaining

pipeline candidates, including RXC004 and programmes in the

discovery portfolio.

ROCK Portfolio

Redx's lead fibrosis product, zelasudil (RXC007), is a highly

selective Rho Associated Coiled-Coil Containing Protein Kinase 2

(ROCK2) inhibitor being developed as a potential best-in-class

treatment in fibrosis. ROCK2 is a biologically and clinically

validated target that has been shown to sit at a nodal point in a

cell signalling pathway thought to be central to fibrosis. As a

selective ROCK2 inhibitor, zelasudil has the potential to treat

several fibrotic diseases across various therapeutic areas,

including Idiopathic Pulmonary Fibrosis (IPF) and other progressive

fibrotic interstitial lung diseases (ILD), in highly fibrotic

tumours such as pancreatic cancer, and in widespread multi-organ

fibrosis, such as chronic Graft versus Host Disease (cGvHD).

Zelasudil has demonstrated robust preclinical anti-fibrotic effects

across multiple industry-standard in vivo preclinical models. In

the Phase 1 healthy volunteer study the compound was well tolerated

and demonstrated dose dependent exposure in man at doses predicted

to deliver efficacy. IPF is being targeted as the first indication

for clinical development, and a Phase 2a clinical study in IPF

initiated in the fourth quarter of 2022, with topline clinical data

expected to be reported in the first half of 2024. IPF is a severe

and life-threatening chronic lung condition, with limited treatment

options, which is estimated by GlobalData to affect 170,000

patients globally. IPF has an addressable market opportunity

estimated to be worth $3.6 billion by 2029.

Redx's second ROCK asset and next clinical development candidate

is RXC008, a Gastrointestinal (GI) targeted ROCK inhibitor being

developed as a potential first-in-class treatment for fibrostenotic

Crohn's disease. Crohn's disease affects 1.7 million people

globally and over 70,000 new cases are diagnosed each year. More

than 50 per cent. of patients with Crohn's disease develop

significant fibrosis and stricture formation within ten years after

diagnosis. The current management of fibrotic strictures of the

gastrointestinal tract is primarily surgical as no drugs are

specifically approved for fibrosis, which can progress despite

intervention with anti-inflammatory therapies. RXC008 is a small

molecule designed to have its action within the GI tract, the site

of the fibrotic strictures in Crohn's disease. Any absorbed RXC008

is quickly degraded by enzymes present in the bloodstream thereby

avoiding systemic exposure. Preclinical data in multiple models of

inflammatory bowel disease show robust preclinical efficacy,

including complete reversal of fibrosis in one of the models. Redx

intends to submit a CTA application during the fourth quarter of

2023 which would allow for the commencement of a Phase 1 clinical

trial in the first half of 2024. The proposed Phase 1 study will be

split into three parts which will initially involve single

ascending dose and multiple ascending dose cohorts of healthy

volunteers before moving into the third part with a limited number

of patients with fibrostenotic Crohn's disease. The Phase 1 study

is designed to monitor safety and to confirm minimal systemic

exposure, as well as demonstrating target engagement in the

gastrointestinal tract. Beyond this, Redx has provisional plans for

a Phase 2 proof-of-concept study which has been designed with

expert input from a Clinical Advisory Board, including members from

the Science, Translational & Clinical Andrology Research

Consortium, and will be subject to input from regulatory

authorities.

Programmes for Partnership

Redx's clinical stage oncology product, RXC004, is a highly

potent, orally active Porcupine inhibitor being developed as a

targeted therapy for Wnt-ligand dependent cancer. Porcupine is a

key enzyme in the Wnt signalling pathway, well established as a key

driver of both tumour growth and immune evasion. Redx has completed

recruitment in two multi-arm Phase 2 clinical studies in patients

with Wnt-ligand dependent solid tumours as both a monotherapy, and

in combination with anti-PD-1 immune check point inhibitors and

expects to report topline data during the first half 2024 following

which Redx will seek a partner for ongoing development. In the

Phase 2 programme, Redx is evaluating RXC004 in genetically

selected MSS mCRC as a monotherapy and in combination with

nivolumab, an immune checkpoint inhibitor, as a monotherapy in

genetically selected pancreatic cancer, and as a monotherapy and in

combination with an anti-PD-1, pembrolizumab, in unselected biliary

tract cancer. All three of these cancer types have high unmet need

with limited treatment options and poor 5-year survival rates of

less than 3 per cent. for biliary and pancreatic cancer and 14 per

cent. for MSS mCRC.

Redx's Discoidin Domain Receptor (DDR) inhibitor programme

reached the key milestone of development candidate nomination, as

RXC009, in October 2023. DDRs have recently gained traction as new

druggable targets with the potential to treat multiple fibrotic

conditions, including kidney fibrosis and Redx plans to present

data on the programme at the upcoming American Society of

Nephrology (ASN) Kidney Week meeting.

The Company's major focus for oncology research is a Kirsten rat

sarcoma viral oncogene (KRAS) inhibitor programme, targeting both

G12D selective and multi-KRAS profiles. RAS is the most frequently

mutated oncogene across different cancer types, with KRAS mutations

accounting for approximately 85 per cent. of these mutated

oncogenes. Therefore, KRAS inhibitors targeting multiple commonly

occurring mutations may offer a treatment option for large segments

of colorectal, pancreatic and lung cancer patients for whom

treatment options are currently limited. This programme is in lead

optimisation.

The Company has a very experienced management team led by Lisa

Anson, a well-respected and experienced industry executive and

former President of AstraZeneca in the UK and the ABPI and under

her leadership, the management team have established a focused

strategy aimed at driving shareholder value. Redx's ambition is to

create world leading medicines to transform patients' lives by

becoming a leading biotech company focused on the development of

novel and differentiated targeted medicines. As Redx will now

prioritise clinical development of its ROCK inhibitor portfolio,

the Company will seek to leverage its strength in medicinal

chemistry and proven discovery engine through establishing

partnerships.

Since 2019, Redx has completed three notable partnership deals,

two with Jazz Pharmaceuticals and one with AstraZeneca, with total

remaining potential milestone payments to Redx of approximately

$755 million plus mid-single digit revenue royalties. From these

programmes, Redx has near-term potential milestones of $15 million

and has also identified a number of additional programmes,

including RXC004, for partnership.

Notable Achievements

ROCK Portfolio

Zelasudil

-- On 11 October 2022, Redx announced that the first patient had

been dosed in a Phase 2a IPF clinical trial, which has regulatory

approval in the UK and seven other European countries. This 12-week

multi-cohort, randomised, double-blind, placebo-controlled dose

ranging study will provide early efficacy readouts, safety and

tolerability in IPF patients with or without standard IPF therapy.

Currently, the first cohort of patients has completed dosing at 20

mg BID, with no safety or tolerability findings that precluded dose

escalation, and with 10 of the 16 patients dosed electing to

continue into the open label extension to allow for an additional

12-weeks of dosing. The second cohort of patients being treated

with 50 mg BID is currently recruiting and it is expected that

recruitment into the third cohort of the trial will be completed by

the end of 2023, allowing topline data to be announced during the

first half of 2024.

-- On 21 August 2023, Redx announced that the US FDA had granted

zelasudil Orphan Drug Designation for the treatment of IPF. The

designation provides Redx with various development and commercial

incentives, including market exclusivity, in order to address this

unmet need for patients.

-- Redx has an open IND in the US for zelasudil, however, dosing

for longer than 28 days is currently under an FDA partial clinical

hold based on skeletal muscle findings in dog toxicology studies.

Redx has clear guidance from the FDA on the study requirements to

resolve the partial clinical hold. In addition to sharing the

results from a long term non-clinical dog toxicity study at

clinically relevant doses, the Company has decided to undertake a

13-week investigative dog study to specifically address the FDA's

guidance to show that the toxicity in dog skeletal muscle is

monitorable and reversible. The Company has recently met with the

FDA regarding this study design. Redx believe that the dog is a

highly sensitive species for this observation as no muscle toxicity

was observed in mice following treatment with zelasudil at very

high exposures for up to 26-weeks, and no muscle related adverse

events nor creatine kinase (CK) rises, a biomarker of muscle

damage, have been observed in humans to date. It is expected that a

complete response will be submitted to the FDA during the second

quarter of 2024 which could allow the partial hold to be lifted,

enabling longer-term dosing in subsequent clinical studies in the

US.

-- Redx has presented preclinical data at a number of

significant scientific conferences which supports the development

of zelasudil in other indications including fibrotic oncology. On

11 May 2023, Redx presented preclinical data at the Resistant

Tumour Microenvironment, Keystone Symposia, which showed that

zelasudil, in combination with gemcitabine/Abraxane(R) in

metastatic and high-extra cellular matrix (ECM) patient-derived

PDAC models, increased survival compared to single agent standard

of care alone. This, taken together with other preclinical data

generated, has shown the potential of zelasudil in combination with

standard of care as a potential treatment for cancer-associated

fibrosis which Redx intends to investigate further in highly

fibrotic tumours such as pancreatic cancer, in a future Phase 1

study.

-- Additionally, on 2 October 2022, Redx presented data at the

International Colloquium on Lung and Airway Fibrosis (ICLAF)

conference from murine bleomycin-induced lung fibrosis and murine

sclerodermatous chronic graft versus host disease (GvHD) models

which have similar underlying disease mechanisms to those observed

in auto-immune driven fibrotic diseases such as systemic sclerosis

and interstitial lung disease (ILD). With this preclinical data

showing positive results, Redx also intends to initiate a Phase 2a

study in cGvHD, where there is a clear route to approval and a

significant market opportunity, in the future.

RXC008

-- On 30 March 2022, RXC008, was nominated as a clinical

development candidate as a potential first-in-class treatment for

fibrostenotic Crohn's disease.

-- On 23 November 2022, Redx presented data at the Inflammatory

Bowel Disease Nordic (IBD Nordic) conference showing the effect of

RXC008 in supressing fibrosis and tissue injury in pre-clinical

models of Crohn's disease. The data showed that RXC008 can suppress

fibrosis and attenuate tissue injury in animal models of

GI-fibrosis and has the potential to be developed as a novel

therapy to inhibit fibrotic stricture formation in Crohn's

disease.

-- On 21 February 2023, a Scientific Advisory Board was held

between Redx and key opinion leaders in fibrostenosis in Crohn's

disease to review the Phase 1 study proposal, including the

population for patient part of the study, and to discuss overall

clinical development proposals and potential study designs beyond

Phase 1.

-- On 07 August 2023, Redx completed a scientific advisory

meeting with the MHRA, to review the data which will support a CTA

submission. This included data on drug substance and drug product

specifications, the preclinical toxicology package and the proposed

Phase 1 study design (including predictions for starting dose in

humans, dose escalation and stopping criteria proposals) all of

which were endorsed by the MHRA.

-- The package to support a CTA submission is complete and a

Phase 1 study protocol prepared. Redx is planning to submit a CTA

package in the fourth quarter of 2023 to enable a Phase 1 Healthy

Volunteer Study to commence in the first half of 2024.

Subsequently, Redx intends to submit an IND to allow for US

participation in future patient studies.

Programmes for Partnering

RXC004

-- On 17 May 2023, Redx announced its intention to partner the

RXC004 programme following the data readout from the Phase 2

combination with anti-PD-1 modules in genetically selected MSS mCRC

and pancreatic cancer. Recruitment into these modules is now

closed, with some modules having smaller numbers than original

targets for feasibility reasons. A topline data readout is expected

during the first half of 2024.

-- On 8 March 2023, Redx announced topline data from the Phase 2

monotherapy module in advanced biliary tract cancer from 16

previously treated patients enrolled in the PORCUPINE2 study, the

primary endpoint of which was progression free survival at six

months. The initial data showed some patients received durable

clinical benefit from RXC004, consistent with clinical activity

seen in the earlier Phase 1 trial, which Redx believes is notable

given few drugs have received regulatory approval as single agents

in this treatment setting. The emerging single agent profile of the

RXC004 data reported to date is supportive of the primary efficacy

hypothesis in combination with anti-PD-1, and Redx therefore

believe that the most suitable development path for this programme

is to partner with a Company that can further progress its

development in combination with anti-PD-1 and other potential

combination treatment options.

Discovery

-- On 27 October 2022, Redx presented data from its novel

Discoidin Domain Receptor 1 (DDR1) inhibitor programme in chronic

kidney disease models at the American Society of Nephrology (ASN)

Kidney Week. The data presented showed that inhibition of DDR with

REDX12271 reduced inflammation and fibrosis in Unilateral Ureteral

Obstruction Models. Redx has since continued to advance this

programme towards development candidate status, which was reached

in October 2023 with the nomination of RXC009. RXC009 is being

developed for kidney fibrosis, including as a potential treatment

for Alport syndrome. Further data are being presented at the 2023

ASN meeting later this year, following which the Company intends to

partner the programme for further development. Redx has filed

multiple patents claiming distinct chemical series as inhibitors of

DDR.

-- Redx has filed multiple patents applications claiming

distinct chemical series with KRAS activity. To date, Redx has

generated encouraging early data and is continuing to further

expand the preclinical data package.

Partnered Programmes

-- Redx has a successful track-record in establishing meaningful

partnerships with large pharmaceutical companies. Currently, Redx

has three partnerships ongoing with Jazz Pharmaceuticals and

AstraZeneca, with near-term potential milestones of $15 million and

total potential remaining milestones of $755 million, as well as

royalties from these ongoing partnerships:

o On 9 November 2022, Jazz Pharmaceuticals announced that the

first patient had been dosed in the Phase 1 trial of JZP815, the

pan-RAF inhibitor programme developed by Redx and acquired by Jazz

Pharmaceuticals in 2019. To date, $11. 5 million of milestones

payments have been received from this programme.

o RXC006 / AZD5055, a Porcupine inhibitor in development for

fibrotic diseases was licensed to AstraZeneca in 2020 with $17

million in milestones being received to date. AstraZeneca continue

to progress this programme through Phase 1 studies.

o Redx has a further research collaboration with Jazz

Pharmaceuticals for discovery and preclinical development for

targeted cancer therapies on the Ras/RAF/MAP kinase pathway. One

target under this collaboration was discontinued in June 2022 due

to pipeline prioritisation by Jazz, while the second programme

continues to advance towards an IND application. Redx has received

$20 million in milestone payments to date from this

partnership.

Redx's track record in discovering and developing novel,

small-molecule targeted therapeutics was further validated on 23

January 2023, when the Redx discovered pirtobrutinib,

(Jaypirca(TM)) a highly selective kinase inhibitor became the first

and only FDA approved non-covalent (reversible) BTK inhibitor

available. Pirtobrutinib was sold to Loxo Oncology, now part of Eli

Lilly, in 2017 and Redx has no remaining economic interest.

The Company has sufficient resources to fund its priority

programmes into 2024 and through near-term milestones. However,

Redx requires additional capital to fund its currently active and

planned clinical development activity. In particular, this includes

the ongoing work required to enable a complete response to the FDA

in relation to the partial clinical hold in respect of zelasudil

and moving RXC008 into a Phase 1 clinical programme. The Board

believes that the Subscription is in the best interests of

Shareholders in order to provide further cash resources to fund the

Company's strategic plan and to provide flexibility when

considering options upon data readouts in order to determine the

optimal route for value creation for Shareholders. Furthermore,

strong support from existing investors through the Subscription

provides additional confirmation and evidence of the strength of

the Company's assets and focused strategy.

Size of the Subscription and Use of Proceeds

Through the Subscription, the Company has conditionally raised

gross proceeds of GBP14,059,359 (the sterling equivalent of

$17,140,000 as at 17 October 2023) in order to fund the anticipated

progression of its ROCK portfolio to important value inflection

points in 2024, thereby continuing the delivery of its stated

strategy to drive shareholder value. Redx expects to use the net

proceeds of the Subscription, its existing cash resources and a

risk-adjusted forecast of milestone income from partnered

programmes due before the end of 2024 as follows:

-- Report topline Phase 2a data from zelasudil IPF clinical

trial which will include early efficacy, safety and PK/PD data;

-- Complete additional investigative preclinical studies for

zelasudil to enable a complete response to the FDA partial clinical

hold, allowing for longer dosing durations in the US;

-- Progress RXC008 into clinical development in fibrostenotic

Crohn's disease by initiating a Phase 1 study in healthy

volunteers;

-- Report topline Phase 2 data from PORCUPINE and PORCUPINE2

clinical trials of RXC004 as a combination therapy with immune

checkpoint inhibitors in patients with genetically selected MSS

mCRC and unselected biliary tract cancer;

-- Continue to explore partnerships to advance certain

programmes from the Redx portfolio; and

-- For general and administrative working capital into the third quarter of 2024.

As the Company executes its business plan, the Board and

management will continue to ensure that resources are allocated to

allow progression of the project portfolio in the most efficient

way and to assess options on an ongoing basis to ensure that Redx

extracts maximum value from its intellectual property. Following

completion of the Subscription, the Company estimates that it will

have available cash of approximately GBP28.1 million.

Current Financial Summary

On 17 May 2023, Redx announced its unaudited interim results for

the six months ended 31 March 2023. Financial highlights for the

period included net cash of GBP34.6 million (31 March 2022: GBP31.6

million); a loss for the period of GBP16.1 million (six months

ended 31 March 2022: GBP9.8 million loss) and total research and

development expenditure of GBP16.1 million (six months ended 31

March 2022: GBP12.9 million).

Details of the Subscription

Structure and Principal Terms of the Subscription

Pursuant to the Subscription Agreement, the Subscribers, being

existing Shareholders, have conditionally agreed to subscribe for,

and the Company has conditionally agreed to allot and issue, in

aggregate, 54,074,458 Subscription Shares representing gross

proceeds of GBP14,059,359 million (the sterling equivalent of

$17,140,000 as at 17 October 2023).

The Subscription for the Subscription Shares is conditional,

inter alia, on the following:

(i) Resolutions 1 and 3 being passed at the General Meeting;

(ii) in respect of each Subscriber, the representations and

warranties of such Subscriber in the Subscription Agreement being

true and correct as of the date when made and as of the Closing

Date as though made at that time, and all obligations, covenants

and agreements of such Subscriber required to be performed at or

prior to the Closing Date having been performed;

(iii) the representations and warranties of the Company in the

Subscription Agreement being true and correct in all material

respects (except for those which are by their terms qualified by

materiality which shall be true, correct and complete in all

respects) as of the Closing Date as though made at that time, and

all obligations, covenants and agreements of the Company and any

Group Company required to be performed at or prior to the Closing

Date having been performed; and

(iv) Admission having occurred.

The Company has agreed to pay to MTS certain commissions based

on the aggregate value of the Subscription Shares placed to certain

investors at the Issue Price and to pay the expenses incurred in

relation to the Subscription.

Application for Admission

Application will be made to the London Stock Exchange for the

Subscription Shares to be admitted to trading on AIM. Admission is

expected to take place, and dealings on AIM are expected to

commence, at 8:00 a.m. on 7 November 2023.

Effect of the Subscription

The Subscription Shares will, when issued and fully paid, rank

pari passu in all respects with the Existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after Admission. Upon

completion of the Subscription, the Subscription Shares will

represent approximately 13.9 per cent. of the Enlarged Share

Capital.

A summary of the Subscription Agreement is set out in paragraph

3 of Part II (Additional Information) of the Circular.

Related Party Transaction

As the Redmile Funds hold 73.26 per cent. of the Existing

Ordinary Shares, Redmile is a related party of the Company pursuant

to the AIM Rules. In addition, as Sofinnova holds 13.16 per cent.

of the Existing Ordinary Shares, Sofinnova is also a related party

of the Company pursuant to the AIM Rules. Consequently, the

participation of Redmile via its fund, RedCo II and Sofinnova in

the Subscription constitute related party transactions for the

purposes of AIM Rule 13. The independent directors for the purposes

of this transaction (being all Directors other than Natalie Berner,

who is a representative of Redmile and Dr Joseph Anderson, who is a

representative of Sofinnova) consider, having consulted with Spark,

the Company's nominated adviser, that the terms of (i) RedCo II's

subscription for Subscription Shares in the Subscription and (ii)

Sofinnova's subscription for Subscription Shares in the

Subscription are fair and reasonable in so far as Shareholders are

concerned.

General Meeting

The Directors do not currently have sufficient authority to

allot in full the Subscription Shares. Accordingly, the Board is

seeking the approval of the Shareholders to allot the Subscription

Shares at the General Meeting, together with approval to disapply

pre-emption rights.

A notice convening the General Meeting, which is to be held at

11:00 a.m. on 6 November 2023 at the offices of Cooley (UK) LLP, 22

Bishopsgate, London EC2N 4BQ, is set out in the Circular. At the

General Meeting, the following Resolutions will be proposed:

Resolution 1 - An ordinary resolution to authorise the Directors

to allot Ordinary Shares up to an aggregate nominal amount of

GBP540,744.58 being equal to 54,074,458 Subscription Shares.

Resolution 2 - An ordinary resolution to authorise the Directors

to:

(i) allot shares in the Company and to grant rights to subscribe

for or to convert any security into shares in the Company up to an

aggregate nominal amount which represents one third of the Enlarged

Share Capital; and

(ii) allot equity securities in connection with a rights issue

in favour of (i) holders of ordinary shares in proportion to their

respective holdings of ordinary shares; and (ii) to holders of

other equity securities as required by the rights attached to those

securities or as the Directors otherwise consider necessary up to a

maximum nominal amount which represents one third of the Enlarged

Share Capital.

This Resolution is conditional upon Admission and will replace

the equivalent authorities granted at the Company's annual general

meeting held on 14 March 2023.

Resolution 3 - A special resolution to authorise the Directors

to allot the Subscription Shares, pursuant to the authority

conferred on them by Resolution 1, and to dis-apply statutory

pre-emption rights in respect of the allotment of such shares, as

if section 561 of the Act did not apply to such allotment. This

Resolution is conditional upon the passing of Resolution 1.

Resolution 4 - A special resolution to authorise the Directors

generally to allot and issue equity securities for cash pursuant to

the authority conferred on them by Resolution 2, up to an aggregate

nominal amount which represents 10 per cent. of the Enlarged Share

Capital. This Resolution is conditional upon Admission and the

passing of Resolution 2 and will replace the equivalent authorities

granted at the Company's annual general meeting held on 14 March

2023.

The authorities and the powers described in Resolutions 1 and 3

above will (unless previously revoked or varied by the Company in

general meeting) expire on the date 3 months from the passing of

such Resolutions or at the conclusion of the next annual general

meeting of the Company following the passing of the Resolutions,

whichever occurs first. The authorities and the powers described in

Resolutions 2 and 4 above will (unless previously revoked or varied

by the Company in general meeting) expire on the date 15 months

from the passing of such Resolutions or at the conclusion of the

next annual general meeting of the Company following the passing of

the Resolutions, whichever occurs first. The authority and the

power described in Resolutions 1 and 3 above are in addition to any

like authority or power previously conferred on the Directors. The

authority and the power described in Resolutions 2 and 4 above are

in substitution for the authority and power previously conferred on

the Directors pursuant to the like resolutions (being resolutions 6

and 7) passed at the Company's annual general meeting held on 14

March 2023.

Resolutions 1 and 2 are ordinary resolutions and require a

simple majority of those voting in person or by proxy to vote in

favour of the Resolutions. Resolutions 3 and 4 are special

resolutions and will require approval by not less than 75 per cent.

of the votes cast by Shareholders voting in person or by proxy.

Irrevocable Undertakings and Letters of Intent

The Directors, who in aggregate hold 394,154 Ordinary Shares,

representing approximately 0.12 per cent. of the Existing Ordinary

Shares, have irrevocably undertaken to vote in favour of the

Resolutions at the General Meeting.

In addition, the Company has received letters of intent from

RedCo II, RM3, Sofinnova, Polar Capital Funds Plc - Healthcare

Opportunities Fund and Invus Public Equities, L.P., who in

aggregate hold 314,731,169 Ordinary Shares representing

approximately 93.97 per cent. of the Existing Ordinary Shares,

confirming that each of such shareholders intends to cast, or

procure that all the votes attaching to the Ordinary Shares held by

such Shareholders are cast, in favour of the Resolutions at the

General Meeting.

APPIX II: DEFINITIONS

The following definitions apply throughout this Announcement,

unless the context otherwise requires:

Act the Companies Act 2006 (as amended);

Admission the admission of the Subscription Shares

to trading on AIM becoming effective

in accordance with the AIM Rules;

AIM the market of that name operated by

the London Stock Exchange;

AIM Rules the AIM Rules for Companies governing

the admission to and operation of AIM

published by the London Stock Exchange

as amended from time to time;

AIM Rules for Nominated the AIM Rules for Nominated Advisers

Advisers published by the London Stock Exchange

as amended from time to time;

AstraZeneca AstraZeneca AB;

Board or Directors the directors of the Company, as at

the date of this Announcement, whose

names are set out on page 12 of the

Circular;

business day any day (excluding Saturdays and Sundays)

on which banks are open in London for

normal banking business and the London

Stock Exchange is open for trading;

certificated or in in relation to a share or other security,

certificated form a share or other security that is not

in uncertificated form, that is not

in CREST;

Circular or document the circular, dated 18 October 2023;

Closing Date the date of completion of the Subscription;

Closing Price the closing middle market quotation

of an Ordinary Share as derived from

FactSet;

Company or Redx Redx Pharma plc, a company incorporated

in England and Wales with company number

7368089 whose registered office is at

Block 33, Mereside, Alderley Park, Macclesfield

SK10 4TG;

CREST the relevant system (as defined in the

CREST Regulations) for the paperless

settlement of trades and the holding

of uncertificated securities, operated

by Euroclear, in accordance with the

same regulations;

CREST Manual the rules governing the operation of

CREST, as published by Euroclear;

CREST member a person who has been admitted by Euroclear

as a system-member (as defined in the

CREST Regulations);

CREST Participant ID the identification code or membership

number used in CREST to identify a particular

CREST member or other CREST participant;

CREST participant a person who is, in relation to CREST,

a system participant (as defined in

the CREST Regulations);

CREST Regulations the Uncertificated Securities Regulations

2001 (SI 2001 No. 3875), as amended;

CREST sponsor a CREST participant admitted to CREST

as a CREST sponsor;

CREST sponsored member a CREST member admitted to CREST as

a sponsored member (which includes all

CREST Personal Members);

EEA European Economic Area;

Enlarged Share Capital the issued Ordinary Share capital of

the Company immediately following Admission;

EU the European Union;

Euroclear Euroclear UK & International Limited,

the operator of CREST;

Exclusive Placement MTS;

Agent

Existing Ordinary Shares 334,911,458 Ordinary Shares, being entire

share capital of the Company in issue

as at the date of this Announcement;

FactSet FactSet Research Systems Inc., a financial

data and software company based in the

United States;

FCA the Financial Conduct Authority of the

UK

;

Form of Proxy the form of proxy which accompanies

the Circular for use in connection with

the General Meeting;

FSMA the Financial Services and Markets Act

2000 (as amended);

General Meeting the general meeting of the Company to

be held at 11:00 a.m. on 6 November

2023 at the offices of Cooley (UK) LLP,

22 Bishopsgate, London EC2N 4BQ;

Group together the Company and its subsidiary

undertakings and "Group Company" shall

mean the Company and any such subsidiary

undertaking;

Invus Invus Public Equities, L.P.

;

ISIN International Securities Identification

Number;

Issue Price 26 pence per Subscription Share;

Jazz Pharmaceuticals Jazz Pharmaceuticals Ireland Limited;

London Stock Exchange London Stock Exchange plc;

Long Stop Date 10 November 2023, being the long stop

date under the Subscription Agreement;

MTS MTS Securities, LLC;

Notice of General Meeting the notice convening the General Meeting

as set out in Part III of the Circular;

Official List the official list of the FCA pursuant

to Part VI of FSMA, as amended from

time to time;

Ordinary Shares ordinary shares of one penny each in

the capital of the Company;

Polar Capital Polar Capital LLP;

Prospectus Regulation the prospectus regulation rules of the

Rules FCA made under section 73A of FSMA;

Redmile Redmile Group, LLC;

Redmile Funds RM3, RedCo II and other funds advised

or managed by Redmile;

RedCo II RedCo II Master Fund, L.P., a fund advised

and managed by Redmile;

Regulation D Regulation D under the Securities Act

;

Regulation S Regulation S under the Securities Act

;

Regulatory Information a service approved by the London Stock

Service Exchange for the distribution to the

public of announcements and included

within the list on the website of the

London Stock Exchange;

Resolutions the resolutions set out in the Notice

of General Meeting to be proposed at

the General Meeting and set out on pages

26 to 30 of the Circular;

Restricted Jurisdiction the United States, Canada, Australia,

Japan or the Republic of South Africa

and any other jurisdiction where the

extension or availability of the Subscription

or distribution of the Circular or this

Announcement would breach any applicable

law;

RM3 RM Special Holdings 3, LLC an entity

owned directly or indirectly by funds

advised or managed by Redmile;

Securities Act the United States Securities Act of

1933, as amended;

Shareholders holders of the Ordinary Shares;

Sofinnova Sofinnova Crossover 1 SLP;

Spark Spark Advisory Partners Limited, the

Company's nominated adviser;

Subscribers the persons who have agreed to subscribe

for Subscription Shares;

Subscription the conditional Subscription for Subscription

Shares by the Subscribers at the Issue

Price pursuant to the terms of the Subscription

Agreement;

Subscription Agreement the Subscription Agreement relating

to the Subscription dated 18 October

2023 and entered into between the Company

and the Subscribers, a summary of which

is included in paragraph 3 of Part II

(Additional Information) of the Circular;

Subscription Shares the 54,074,458 new Ordinary Shares to

be issued pursuant to the Subscription;

UK or United Kingdom the United Kingdom of Great Britain

and Northern Ireland;

UK MAR the retained version of the EU Market

Abuse Regulation (596/2014) as it forms

part of domestic law in the United Kingdom

by virtue of the European Union (Withdrawal)

Act 2018;

uncertificated or in a share or other security recorded on

uncertificated form the relevant register of the share or

security concerned as being held in

uncertificated from in CREST and title

to which, by virtue of the CREST Regulations,

may be transferred by means of CREST;

and

US or United States the United States of America, its territories

and possessions, any state of the United

States and the District of Columbia.

A reference to GBP is to pounds sterling, being the lawful

currency of the UK.

A reference to $ or US$ is to United States dollars, being

the lawful currency of the US.

APPIX III: GLOSSARY

ABPI the Association of the British Pharmaceutical

Industry;

anti-PD-1 antibody immuno-oncology drug therapy that blocks

PD-1 receptors so T-cells are no longer

inhibited, allowing the patient's own

immune system to attack the tumour;

ASN American Society of Nephrology;

cGvHD chronic Graft versus Host Disease;

CK creatine kinase;

CTA Clinical Trial Application;

DDR Discoidin Domain Receptor;

DDR1 Discoidin Domain Receptor 1;

ECM extra cellular matrix;

ESMO European Society for Medical Oncology;

fibrostenosis fibrosis in the gut of patients with

Crohn's Disease;

GI-targeted focusing on the gastrointestinal tract;

ICLAF International Colloquium on Lung and

Airway Fibrosis;

ILD interstital lung disease;

IND investigational new drug application;

IPF idiopathic pulmonary fibrosis;

KRAS Kirsten rat sarcoma viral oncogene;

monotherapy therapy with a single drug;

MSS mCRC microsatellite stable metastatic colorectal

cancer;

nivolumab generic name for OPDIVO(R), Bristol

Myers Squibb's anti-PD-1 antibody;

Pan-RAF an orally available inhibitor of all

members of the serine/threonine protein

kinase Raf family, including A-Raf,

B-Raf and C-Raf protein kinases, with

potential antineoplastic activity;

PK/PD pharmacokinetic / pharmacodynamic;

Porcupine a target in the Wnt signalling pathway;

RAF Rapidly accelerated fibrosarcoma;

ROCK, ROCK2 Rho-Associated Coiled-Coil Kinase, Rho-Associated

Coiled-Coil Containing Protein Kinase

2;

Wnt ligand a ligand, or molecule that signals by

binding to a site on a target protein,

that drives the Wnt signalling pathway;

and

Wnt signalling pathway group of signal transduction pathways,

made of proteins that pass signals from

outside of a cell through cell surface

receptors to the inside of the cell.

APPENDIX IV: EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Announcement of the Subscription 7:00 a.m. on 18 October

2023

Publication and posting of the 18 October 2023

Circular (including the Notice

of General Meeting) and Forms

of Proxy

Latest time and date for receipt 11:00 a.m. on 2 November

of Forms of Proxy and electronic 2023

appointments of proxies via CREST

General Meeting 11:00 a.m. on 6 November

2023

Announcement of the results of 6 November 2023

the General Meeting

Admission and commencement of 8:00 a.m. on 7 November

dealings in the Subscription Shares 2023

on AIM

Subscription Shares in uncertificated As soon as possible

form expected to be credited to after 8:00 a.m. on 7

accounts in CREST November 2023

Despatch of definitive share certificates Within 10 business days

for the Subscription Shares in of Admission

certificated form

If any of the details contained in the timetable above should

change, the revised times and dates will be notified to

Shareholders by means of a Regulatory Information Service

announcement.

In this Announcement, all references to times and dates are to

times and dates in London, United Kingdom unless otherwise stated.

The timetable above assumes that Resolutions 1 and 3 are passed at

the General Meeting without amendment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUBVAROKURAUA

(END) Dow Jones Newswires

October 18, 2023 02:00 ET (06:00 GMT)

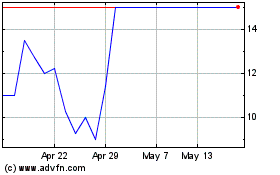

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Dec 2023 to Dec 2024