TIDMROC

RNS Number : 5049G

Rockpool Acquisitions PLC

15 November 2022

Press release 15th November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as retained in UK law

pursuant to the European Union (Withdrawal) Act 2018 and as amended

by the Market Abuse (Amendment)(EU Exit) Regulations 2019 (SI

2019/310) . Upon the publication of this announcement via the

Regulatory Information Service, this inside information is now

considered to be in the public domain.

Rockpool Acquisitions Plc

("Rockpool" or "the Company")

Potential Reverse Takeover and Suspension of Listing

Rockpool Acquisitions Plc, the Special Purpose Acquisition

Company ("SPAC") formed to undertake the acquisition of a company

or business headquartered or materially based in Northern Ireland

or alternative transactions with suitable targets, including those

that may not have a direct connection with Northern Ireland , has

entered into heads of terms ("Heads") relating to the proposed

acquisition (the "Acquisition") of the entire issued and to be

issued share capital of Amcomri Group Limited ("Amcomri"), the

holding company of a fast-growing, acquisitive group of quality UK

Engineering and Manufacturing businesses.

The group consists of nine SMEs acquired over the past five

years in those industrial sectors, and has a wealth of experience

in optimising business performance.

The Group primarily provides a range of specialist engineering

and equipment services to the power, rail, petrochemical, process

and production electronics industries in the UK and Ireland. Within

these sectors it offers a range of services and equipment to allow

asset owners to extend the operating life of key high value

critical assets or associated infrastructure.

More recently it has established a second focus area in

specialist printing in which it owns a further two operating

companies, its most recent acquisition in this sector being Bex

Design & Print Limited, a 35-year-old specialist screen and

digital print business supplying into the electronics and other

industries.

The Heads provide that the transaction will be subject to a

number of matters including the negotiation of a formal sale and

purchase agreement. The consideration for the Acquisition if it is

concluded ("the Price" ) will be GBP22,340,625 (based on the

forecast pro-forma aggregate EBITDA for FY2022 of GBP5.401m, an

agreed EV to EBITDA multiple of 6.84 and net debt of GBP14.6m) to

be satisfied by the issue at completion fully paid to the Sellers

of 284,284,523 new ordinary shares of Rockpool (Ordinary Shares),

or (in order to maintain sufficient Ordinary Shares in public

hands) by the issue at completion of a combination of Ordinary

Shares and, either, nil-coupon convertible loan notes, or

non-voting convertible shares, which on conversion into Ordinary

Shares would together equal 284,284,523 Ordinary Shares. If all the

consideration were to be paid in Ordinary Shares issued at

completion then immediately following such issue the issued share

capital of Rockpool would be held as follows:

Name of Shareholder Shares %

Amcomri Holdings Limited 229,374,978 77.23%

Stephill Investments Limited 35,180,207 11.84%

Other Target Shareholders 19,729,336 6.73%

Rockpool Shareholders 12,725,003 4.28%

The terms of the Acquisition value the existing issued share

capital of Rockpool at GBP1m, or approximately GBP0.0786 per

Ordinary Share.

In accordance with the intention set out in the Company's

prospectus published at the time it came to the market in July

2017, the founders of the Company, Neil Adair, Mike Irvine and

Richard Beresford, will be granted 5 year options to acquire 10% of

the post-admission fully diluted (including by the exercise of

those options) Ordinary Share capital at a price of GBP0.15 per

Ordinary Share, representing a 90% premium to the price at which

the Amcomri acquisition values the Ordinary Shares.

As mentioned above, as well as being subject to contract, the

Acquisition is subject to certain conditions, including obtaining

of a whitewash under Rule 9 of the Takeover Code, t here being no

adverse change or deterioration in the business, assets, financial

or trading position or prospects of Amcomri or its subsidiaries

between the date of the Heads and completion which is in the

reasonable opinion of the Rockpool Board, material and on due

diligence. Under the Heads, Rockpool has agreed to indemnity

Amcomri for up to GBP50,000 in relation to the costs of pursuing

and negotiating the transaction should the transaction not complete

in certain circumstances. Amcomri has also agreed to indemnify

Rockpool in relation to its costs should the transaction not

proceed to completion for certain reasons.

The Acquisition, if completed, will constitute a Reverse Take

Over ("RTO") under the Listing Rules. Therefore, the Company has

requested a suspension of its listing pending either the issue of

an announcement giving further details of the RTO, the publication

of a Prospectus, or an announcement that the RTO is no longer in

contemplation. The suspension will take effect immediately.

Mike Irvine, co-founder and Non-Executive Director of Rockpool,

said: "I am delighted that we are able to announce the potential

acquisition of Amcomri which is intended to see Rockpool transform

from a SPAC into a profitable trading enterprise. Amcomri's track

record of successfully acquiring businesses and its wealth of

experience in optimising business performance when combined with

the opportunities for further acquisitions that a listing should

provide, make the Acquisition a transaction that should create

value for both the Rockpool and Amcomri shareholders."

Ends -

For further information please contact:

Rockpool Acquisitions Plc

Mike Irvine, Non-Executive Director mike@cordovancapital.com

www.rockpoolacquisitions.plc.uk

Shard Capital (Broker)

Damon Heath / Erik Woolgar Tel: +44 (0)20 7186 9952

Abchurch (Financial PR)

Julian Bosdet Tel: +44 (0)20 4594 4070

julian.bosdet@abchurch-group.com

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SUSBUBDBUUBDGDU

(END) Dow Jones Newswires

November 15, 2022 10:56 ET (15:56 GMT)

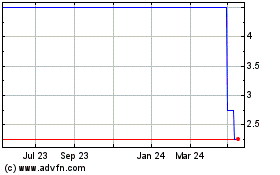

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Jan 2025 to Feb 2025

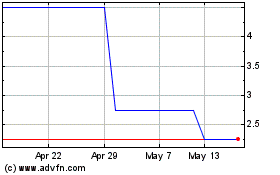

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Feb 2024 to Feb 2025