Rotala PLC Pre-close trading statement (8141N)

23 January 2019 - 6:00PM

UK Regulatory

TIDMROL

RNS Number : 8141N

Rotala PLC

23 January 2019

RNS

23 January 2019

Rotala Plc

("Rotala" or the "Company" or the "Group")

Pre-close trading statement

Rotala is pleased to announce the following update on trading

for the year ended 30 November 2018 ("FY 18") and the prospects for

the current year ending 30 November 2019 ("FY 19").

FY 18 trading

The Company announces that trading during FY 18 was in line with

market expectations. Net debt, which stood at GBP32.8 million at

the half year, had fallen to GBP31.5 million by the end of the

year. During the financial year, the Group achieved further growth

through the acquisition, from CEN Group Limited, of its entire bus

business, trading as "Central Buses". This acquisition was made in

accordance with the Group's declared strategy of acquisitive growth

and has considerably strengthened the Group's network of bus

services in the northern part of Birmingham, particularly in the

Perry Barr area.

Fuel Hedging

Currently, the annual fuel requirement of the Group is

approximately 11.5 million litres. Taking advantage of a weakness

in crude oil prices, in late November 2018, the Board took out a

number of fuel hedge contracts, using diesel derivatives, in order

to cover approximately 50% of its fuel requirement for FY 2019. The

coverage of these hedging contracts has recently been extended. All

of the Group's fuel requirement for 2019 has now been covered by

hedging contracts, at an average price of 100p per litre, which is

the price that the Group has used in preparing its budget for

2019.

The Board will continue to monitor market conditions closely and

take out such further fuel hedges as it deems are appropriate to

meet its objective of reducing volatility in its costs and creating

business certainty.

Dividend

The Company expects to maintain its progressive dividend policy

and will be announcing details of a final dividend payment in due

course.

FY 19 outlook

The Company is pleased to report that trading for the current

year has begun in line with budget. In the view of the Board, the

uncertainty and disruption caused by the Bus Services Act 2017

continues to drive change in the bus industry. Accordingly, the

Board remains focused on identifying suitable acquisitions which

will enhance and expand the services of the Group. At the same time

the Group possesses ample financial facilities to undertake further

acquisitions.

The Group performed well in 2018 and, with a strong management

team and a comprehensive network of operating facilities, is well

placed to take advantage of these continuing developments in the

bus industry. Such uncertainty brings opportunity to groups like

Rotala and the Group is well placed to take advantage of any

acquisition opportunities that may arise.

Rotala Plc 0121 322 2222

John Gunn, Chairman

Simon Dunn, Chief Executive

Kim Taylor, Group Finance Director

Nominated Adviser & Joint Broker:

Cenkos Securities plc 020 7397 8900

Stephen Keys/Callum Davidson (Corporate Finance)

Michael Johnson/Julian Morse (Corporate Broking)

Joint Broker: Dowgate Capital Stockbrokers Ltd 0203 903 7715

David Poutney/James Serjeant (Corporate Broking)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPGUWAGUPBGMP

(END) Dow Jones Newswires

January 23, 2019 02:00 ET (07:00 GMT)

Rotala (LSE:ROL)

Historical Stock Chart

From Apr 2024 to May 2024

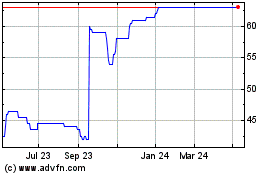

Rotala (LSE:ROL)

Historical Stock Chart

From May 2023 to May 2024