Victoria sees full-year profit ahead of expectations for a fifth consecutive year

05 April 2018 - 10:45PM

ADVFN NewsWire

The carpets group also said it has invested a

significant amount of management focus during the past year

identifying additional suitable acquisition opportunities, pointing

out that shareholders should anticipate further acquisition-led

growth focused on Europe

Victoria said

ongoing operational improvements in logistics, procurement, and

production efficiencies are expected to continue to deliver further

organic earnings growth

() expects its revenue and

underlying pre-tax profit to be ahead of consensus market

expectations for the financial year ended 31 March 2018 and said

shareholders should anticipate further acquisition-led growth

focused on Europe.

The AIM-listed firm said its full-year performance has continued

to deliver like-for-like growth, gains in market share and

operational synergies, including the rationalisation of its UK

manufacturing facilities which has positively impacted gross profit

margin and reduced overheads since being implemented.

The carpets manufacturer said the trading performance of the two

ceramics business it acquired in late 2017 has also been

encouraging and consistent with expectations.

Victoria said in line with its strategy to diversify both

geographically and by product category, nearly 60% of the firm’s

earnings are now generated from outside the UK and are spread

across several product categories, reducing group’s overall

operational risk.

It noted that ongoing operational improvements in logistics,

procurement, and production efficiencies are expected to continue

to deliver further organic earnings growth over the coming 12

months.

Additionally, Victoria said it has invested a significant amount

of management focus during the past year identifying additional

suitable acquisition opportunities, pointing out that shareholders

should anticipate further acquisition-led growth focused on

Europe.

Geoff Wilding, Victoria's executive chairman, said: “"The Board

is encouraged by 2018 trading to date. Together with progress on

ongoing internal initiatives to deliver synergies and revenue

growth, and the very attractive acquisition prospects already

identified, the Board is confident it will deliver another year of

significant, earnings-accretive growth in the 2018/19 financial

year."

The group expects to announce its preliminary results for the

year ended 31 March 2018 in July.

In mid-morning trading, Victoria’s shares were up 3.1% to

765p.

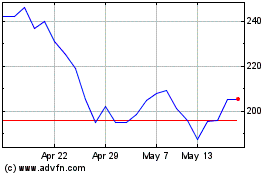

Victoria (LSE:VCP)

Historical Stock Chart

From Apr 2024 to May 2024

Victoria (LSE:VCP)

Historical Stock Chart

From May 2023 to May 2024