TIDMVRCI

RNS Number : 3688V

Verici Dx PLC

14 April 2021

Verici Dx plc

("Verici Dx" or the "Company")

Final Results for the period ended 31 December 2020

Verici Dx plc (AIM: VRCI), a developer of advanced clinical

diagnostics for organ transplant, announces its inaugural audited

results for the period ended 31 December 2020.

Strategic and Operational highlights

-- Verici Dx was successfully admitted to AIM in November

raising gross proceeds of c.$18.8m (GBP14.5m)

o The fundraising was significantly oversubscribed by

institutional and other investors, and the current share price has

notably outperformed the market since IPO

o The net proceeds are being used primarily to fund the clinical

utility and validation studies for lead products Clarava(TM) and

Tuteva(TM), as well as other bioinformatics and health economic

studies

-- Appointed Angela Rose as Senior Director of Clinical Trial

Operations in December 2020 to oversee the clinical trials to their

conclusion

Financial highlights

-- Adjusted EBITDA loss of $1.24m(1)

-- Cash balance at 31 December 2020 of $17.8m

Post-period end

-- Expanded scope of licence agreement with Mount Sinai, in

January 2021, to include an additional patent filing related to the

analysis of gene expression in a blood-based test (liquid biopsy)

to predict risk of fibrosis (chronic kidney graft damage) and

rejection of the graft

-- Accelerated CLIA(1) approval strategy to enable faster commercial launch of leading products

-- In February 2021, appointed David Schultenover as Vice

President of Quality and Regulatory to project manage the

accelerated CLIA approval strategy

Commenting on the outlook, Julian Baines, Non-executive

Chairman, said: "We have been very pleased with the progress of the

Company in such a short time and our primary focus remains on the

successful prosecution of our clinical trials, as the first key

step in commercialising our innovative transplant products.

"We are already making good progress, initially partnering with

three leading US centres ( Northwestern University Feinberg School

of Medicine, Henry Ford Health System and University of Maryland,

Baltimore ) in our collaborative, multi-centre observational

clinical validation study. We expect to bring more US sites on

board shortly and are currently also progressing discussions to

include a number of EU sites, to ensure that our products are fully

tested for validation by the end of 2021, in line with our

objectives set out at the time of our IPO.

"On behalf of the Board, I would like to thank our employees,

stakeholders and shareholders for their support and we look forward

to providing further updates on progress throughout the current

year."

Notes:

1. Earnings before income tax, depreciation and amortisation,

adjusted to exclude exceptional items and foreign exchange loss

2. The CLIA (Clinical Laboratory Improvement Amendments) regime

is used by the Center for Medicare and Medicaid Services (CMS) to

regulate laboratory testing in the US, and requires all clinical

laboratories to be certified before they can accept human samples

for diagnostic testing

Investor briefing

Sara Barrington, Chief Executive Officer, and David Anderson,

Chief Financial Officer, will provide a live presentation relating

to the Final Results via the Investor Meet Company platform on

Wednesday 14 April 2021 at 5.00 p.m. (BST).

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9.00 a.m. the day before

the meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet VERICI DX PLC via:

https://www.investormeetcompany.com/verici-dx-plc/register-investor

Investors who already follow Verici Dx plc on the Investor Meet

Company platform will automatically be invited.

Enquiries:

Verici Dx www.v ericidx .com

Sara Barrington, CEO Via Walbrook PR

Julian Baines, Chairman

N+1 Singer (Nominated Adviser & Broker) Tel: 020 7496 3000

Aubrey Powell / Justin McKeegan / Tom

Salvesen

Walbrook PR Limited Tel: 020 7933 8780 or vericidx@walbrookpr.com

Paul McManus / Sam Allen Mob: 07980 541 893 / 07748 651 727

About Verici Dx plc www.vericidx.com

Verici Dx is an immuno-diagnostics company developing and

commercialising tests to understand how a patient will and is

responding to organ transplant, with an initial focus on kidney

transplants. The body's own immune system poses a threat to a

successful transplant or graft. Patients' immune systems differ in

how they respond to the presence of the transplanted organ,

characterising this response is called immune phenotyping. Our

products and solutions are underpinned by extensive scientific

research into the recipient's immune phenotype and how that impacts

on acute rejection, chronic injury and ultimately failure of the

transplant. These immuno-profile signatures also inform clinicians

as to the optimal strategy for immunosuppressive and other

therapies for the most successful treatment to ensure graft

acceptance with the least amount of side effects.

The foundational research was driven by a deep understanding of

cell-mediated immunity and is enabled by access to expertly curated

collaborative studies in highly informative cohorts in kidney

transplant.

Chairman's statement

I am delighted to report on the first annual results for Verici

Dx plc since admission to AIM in November 2020 and this report

covers the period from the Company's incorporation on 22 April 2020

to 31 December 2020.

A full description of our strategy and business model is

provided in the Strategic Report below, however in summary Verici

Dx is an immuno-diagnostics development company, initially focussed

on the kidney transplantation market, incorporating the FractalDx

technology and associated assets previously owned by Renalytix AI

plc and licensed from the Icahn School of Medicine at Mount Sinai,

New York.

We have two leading products which aim to understand how a

patient will and is responding to kidney transplantation and these

have started clinical validation trials:

-- Clarava(TM) , which is a pre-transplant prognosis for the risk of early acute rejection; and

-- Tuteva(TM) , a post-transplant diagnostic focused upon acute

cellular rejection, including sub-clinical rejection not being

diagnosed through the current standard of care of rising serum

creatinine levels.

Our kidney transplant assays use advanced next-generation

sequencing that we believe can define a personalised risk profile

for each patient over the course of their transplant journey and

can detect injury in advance of currently available clinical tests,

with a view to minimising risk of transplant rejection.

The initial focus of Verici Dx on the kidney transplantation

market reflects the urgent clinical need in this area. According to

the World Health Organisation (WHO), there are reports to suggest

that between five and ten million people die annually from kidney

disease (compared to 1.8m who die from the most prominent cancer,

lung cancer) and about 300,000 people around the world are

currently on a waiting list waiting for a kidney transplant and is

expected to rise due to an increase in kidney disease. We believe

we have unique kidney transplant diagnostic technology that enables

accurate, data-driven support for clinical decisions, such as the

most appropriate immunosuppressive therapy for that patient. This

has not only near-term scope to reduce the unnecessary and serious

consequences from over- or under-dosing for immunosuppression, but

also to improve the longevity of transplanted kidneys and, by

reducing the risk and rate of transplant failure, much broader

potential to deliver huge health economic benefits by improving

transplant outcomes.

In early November last year, Verici Dx was successfully admitted

to trading on AIM, raising gross proceeds of c.$18.8m (GBP14.5m).

The fundraising was significantly oversubscribed by institutional

and other investors, and the share price has appreciably

outperformed the market in the period since then. The net proceeds

are being used primarily to fund the clinical utility and

validation studies for Clarava(TM) and Tuteva(TM), as well as other

bioinformatics and health economic studies.

We are already making good progress initially partnering with

three leading US centres ( Northwestern University Feinberg School

of Medicine, Henry Ford Health System and University of Maryland,

Baltimore ) in our collaborative, multi-centre observational

clinical validation study. We expect to bring more US sites on

board shortly and are currently also progressing discussions to

include a number of EU sites, to ensure that our products are fully

tested for validation by the end of 2021, in line with our

objectives set out at the time of our IPO.

I am also very pleased that we have been able to announce

further key milestones in the development of our strategy during

the reporting period and post-period end:

-- In December 2020, we announced the appointment of Angela Rose

as Senior Director of Clinical Trial Operations. Angela has over 15

years' experience in clinical trial project management and she will

be instrumental in overseeing the clinical trials to their

conclusion.

-- In January 2021, we announced the expansion of the scope of

our licence agreement with Mount Sinai to include an additional

patent filing related to the analysis of gene expression in a

blood-based test (liquid biopsy) to predict risk of fibrosis

(chronic kidney graft damage) and rejection of the graft. Assuming

successful development, the addition of a product that can predict

the risk of long-term graft failure will establish an end-to-end

solution for clinicians seeking to understand how a patient will

and is responding to organ transplant.

-- In February 2021, we announced the acceleration of our CLIA

laboratory opening and approvals strategy, including the

appointment of David Schultenover as Vice President of Quality and

Regulatory, who joined from Thermo Fisher Scientific, where, as

Senior Director of Regulatory, Quality and Compliance, he was

responsible for 154 people covering regulatory affairs, Quality

Assurance and Quality Control.

We have been very pleased with the progress of the Company in

such a short time and our primary focus remains the successful

prosecution of our clinical trials, as the first key-step in

commercialising our innovative transplant products.

On behalf of the Board, I would like to thank our employees,

stakeholders and shareholders for their support, and we look

forward to providing further updates on progress throughout the

current year.

Julian Baines

Non-executive Chairman

Strategic Report

Our Strategy and Business Model

Verici Dx plc is an immuno-diagnostics development company,

initially focused on the kidney transplantation market. The

Company's kidney transplant assays will use advanced

next-generation sequencing that may define a personalised

risk-profile of each patient over the course of their transplant

journey, as well as may detect injury in advance of currently

available clinical tests.

The Company successfully admitted to trading on AIM, a market

operated by the London Stock Exchange, on 3 November 2020 raising

gross proceeds of US$18.8m In the period to 31 December 2020 the

Company focussed on putting in place the additional people and

resources to enable it to commence its clinical trials in 2021.

Kidney transplantation is the treatment of choice for subjects

with end stage renal disease ("ESRD"). An estimated 37 to 50 per

cent. of transplant recipients have evidence of rejection, which

events can be sub-divided into:

-- Clinical Acute Rejection ("cAR") occurring in approximately

10 to 15 per cent. of kidney transplant recipients in the first

year post transplant. This is usually indicated by a rise in serum

creatinine over baseline and determined by a for-cause biopsy. It

is usually alleviated with a change in immunosuppressive

therapy.

-- Subclinical Acute Rejection ("subAR") occurring in 27 to 40

per cent. of patients with stable serum creatine in the first 1

year post transplant. It can be referred to as silent rejection

because it often goes undetected. The only way to identify subAR is

through a surveillance biopsy. However only 17 per cent. of

transplant centres in the U.S. employ a surveillance biopsy

program.

It is now well established that the recipient's immune response

directed toward the transplanted kidney drives acute rejection,

leading to chronic injury and failure of the transplant, thus

necessitating lifelong immunosuppression drug therapy. One of the

major issues with current immunosuppressive protocols is that they

are not tailored to the individual patient's needs. In clinical

practice, immunosuppressive therapy is often decided based on broad

clinical criteria including anti-HLA antibodies, race, prior

transplantations and recipient age. However, these indicators

perform poorly in predicting individual risk for development of

acute rejection. As a result, most patients receive a standardised

immunosuppressive protocol resulting in a significant proportion

some individuals being exposed to either insufficient or excessive

immunosuppression, leading to acute rejection and/or complications

associated with over-immunosuppression. These complications include

infections, malignancy, diabetes, hypertension and heart disease.

The number of patients receiving higher doses of immunosuppression

around the time of a transplant continues to increase in an attempt

to minimise rejection and protect the transplanted kidney.

Current standard of care

There is no current pre-transplant mechanism to determine the

optimal approach to immunosuppressive therapy for a given patient

beyond the presence of recipient antibodies directed toward the

donor tissue, which can be found in only approx. 10 per cent. of

patients. Early identification of individuals at high risk of acute

rejection could allow targeted therapies aimed at improving

long-term outcomes. Evidence exists that the phenotype and function

of the immune system in patients before kidney transplantation

affects the risk for subsequent acute rejection after

transplantation, but no biomarker has been identified to quantify

or otherwise assess this risk. Following transplant, clinicians use

a standardised approach to managing immunosuppression, slowly

reducing drug levels to a maintenance level over the first 3 to 6

months. There are currently no biomarkers available to indicate if

a patient is under or over immunosuppressed. Manifestation of

clinical acute rejection via measurement of serum creatinine is the

current indicator used to determine that a patient is

under-immunosuppressed, which means measuring the damage to the

kidney by observing the effects of the damage after it has happened

increasing the risk of rejection. There is no generally accepted

mechanism to identify patients with subclinical acute rejection,

except to find evidence of rejection on a surveillance biopsy.

Furthermore, there is no clinically available mechanism to identify

a patient that is at risk of developing graft injury, either

through inflammation or fibrosis or both, and therefore at risk of

long-term graft failure.

Verici's proposed solution

To address this "one size fits all approach", the Company is

developing tests to understand how a patient is likely and may be

responding to organ transplant. The recipient's immune system poses

a threat to the grafted organ. Patients' immune systems vary in

their response to the presence of the transplanted organ;

characterising this immune response is called immuno-phenotyping.

The Company's products and solutions are underpinned by extensive

scientific research into how the recipient's immune phenotype is

likely to respond to the transplanted organ and how that response

further influences acute rejection, chronic injury and, ultimately,

failure of the transplant. These immuno-profile signatures may also

assist clinicians as to their assessment of the optimal strategy

for immunosuppressive and other therapies to enable successful

graft acceptance at the lowest compatible level of

treatment-induced side effects.

The research underpinning our technology is driven by a deep

understanding of cell-mediated immunity and is facilitated by

access to expertly curated, collaborative studies in highly

informative cohorts in organ transplant. The Company has an

exclusive worldwide patent and a non-exclusive technical

information licence with Mount Sinai derived from the work of

Professor Barbara Murphy and collaborators in transplant

immunology, focusing on the use of high throughput genomic

technologies to understand better the immune system mechanisms that

lead to graft injury and loss. The Company's current and planned

clinical development programmes are not only directed by an

extensive Science Advisory Board of key opinion leaders in the

fields of clinical transplant and transplant immunology, but also

will be conducted at an expanding list of key transplant centres in

the US and beyond for the multi-centre validation trials being

funded.

We are developing two leading products for clinical validation

and commercialisation:

-- Clarava(TM) , a pre-transplant prognosis for the risk of early acute rejection ("EAR"); and

-- Tuteva(TM) , a post-transplant diagnostic focused upon acute

cellular rejection ("ACR") including sub-clinical rejection not

being diagnosed through the current standard of care of rising

serum creatine levels.

These products are planned to be offered as laboratory developed

tests ("LDT") in the US, taking advantage of the lighter regulatory

burden of authorisation under the CLIA regime, which is

administered by CMS, in partnership with state health departments,

rather than seeking clearance from the FDA. In Europe the company

will be seeking CE marking. CE marking issued by an EEA Notified

Body will remain valid in the UK market until 30 June 2023. To

address the UK market post-Brexit, the Company will be seeking the

UKCA (UK Conformity Assessed) mark as well. In addition to

obtaining CE and UKCA markings, the products (medical devices),

will be registered with MHRA (as required by MHRA since 1 January

2021).

The Company is planning on complementing this commercial path

with an efficient route through reimbursement coding, pricing and

coverage determinations in the US. For inclusion into NICE

guidelines in the UK, evidence-based data (such as health economic

cost-effectiveness and patient outcome/clinical-effectiveness data,

along with diagnostic test accuracy data), shall be applied for

review by NICE Diagnostic Assessment Programme.

Market opportunity

Globally there are approximately 95,000 transplants currently

performed each year, of which about 24,000 are performed in the US

and 25,000 in Europe. In the US, the comparatively low of

procedures compared to the numbers of individuals on the waiting

list was recognised as an issue for patients waiting for a

transplant for on average 3 to 5 years, and even longer in some

geographical locations. It also formed part of the policy in the

2019 US Executive Order, Advancing American Kidney Health, whereby

transplant organizations were required to improve efficiencies in

the transplant network and expand support for living donors, with

the further goal of doubling the number of available transplants by

2030. The Company's portfolio is likely to support the confidence

for living donors from the increased success of

transplantation.

Group and Company History

The Company was incorporated in England and Wales on 22 April

2020, as a wholly owned subsidiary of Renalytix AI plc

("Renalytix").

On 4 May 2020, the Company purchased the assets attached to the

Fractal DX portfolio of patents previously licensed to Renalytix by

Mount Sinai, for a consideration of $2,000,000. The consideration

was satisfied by the issuance of non-interest-bearing Convertible

Loan Notes ("CLNs") from the Company to Renalytix. The CLN

instrument provided for a total of up to $3,000,000 of borrowings

to be made available to the Company.

On 17 January 2020, ResolveDx Inc was incorporated in the state

of Delaware, USA as a wholly owned subsidiary of Renalytix. On 14

August 2020, ownership of ResolveDx Inc was transferred to the

Company and, on 21 August 2020 ResolveDx Inc changed its name to

Verici Dx Inc.

Pursuant to the terms of the CLNs, notice was given by Renalytix

on 28 October 2020 to convert all of its existing debt of

$2,500,000 by the Company into 9,831,681 ordinary shares of 0.1

pence each ("Ordinary Shares") at the IPO issue price.

In anticipation of a distribution in specie by Renalytix of its

entire shareholding in the Company on 7 July 2020, the entire

issued share capital of the Company was sub divided to create 1,000

Ordinary Shares of GBP0.001 each. Additionally, 59,415,135 Ordinary

Shares of GBP0.001 each were allotted. Those 59,416,135 shares were

then immediately reclassified as 59,416,134 A shares and 1 Golden

Share and all the A shares and Golden Share were converted into new

ordinary shares at the time of the Company's admission to AIM, a

market operated by the London Stock Exchange, on 3 November

2020.

Risks and uncertainties

Set out below are the risks which the Directors believe could

materially affect the Group's ability to achieve its financial and

operating objectives and control or mitigating activities adopted

to manage them. The risks are not listed in order of

significance.

(a) The Company does not yet have all collaborations in place

with institutions that it needs for its validation and for utility

studies and there is no guarantee that the Company will be able to

demonstrate clinical utility of the Clarava(TM) or Tuteva(TM)

products

Following the validation study for its products, the Company

intends to run a clinical utility study to support applications for

reimbursement, which is necessary for successful commercialisation

and to provide further evidence to support marketing claims.

The Company has identified some initial institutions which will

carry out the utility studies and has not yet entered into the

relevant agreements with these institutions. There is a risk that

the Company will not be able to secure these collaborations, which

would impact the Company's ability to proceed to the utility study

stage. Whilst the utility study is not a source of continuing

revenue, it is a short-term revenue stream from sales of the

Clarava(TM) and Tueteva(TM) tests following the validation

study.

Furthermore, there is a risk that the Company will not be able

to demonstrate the clinical utility of the Clarava(TM) and

Tuteva(TM) products in a real-world setting, which would impact the

Company's ability to secure reimbursement. If such reimbursement is

not achieved, it will make commercialisation of the Clarava(TM) and

Tuteva(TM) tests significantly more challenging and would impact

the Company's ability to generate revenue.

(b) There are risks associated with offering the Clarava(TM) and

Tuteva(TM) tests as an LDT that are outside the Company's

control

The Clarava(TM) and Tuteva(TM) tests do not as yet have status

as an LDT and the Company does not yet have a CLIA-certified

laboratory. The Company may be able to generate revenue from

offering the Clarava(TM) and Tuteva(TM) tests as an LDT. However,

there are inherent risks associated with offering the Clarava(TM)

and Tuteva(TM) tests as an LDT that are outside the Company's

control, including test uptake, which would have an impact on the

amount of revenue the Company could generate

(c) The Company is dependent on other third parties who provide

certain resources and services to the Company as the Company has

limited resources in the short-term

The Company relies in part on external resources to conduct the

research, development, supply of supplies and clinical testing of

its Clarava(TM) and Tuteva(TM) products, including in relation to

the Company's laboratory systems which rely on software developed

by external manufacturers. The future development of the

Clarava(TM) and Tuteva(TM) products and other products will partly

depend upon the performance of these third parties. The Company

cannot guarantee that the relevant third parties will be able to

carry out their obligations under the relevant arrangements.

(d) The Company is reliant upon the expertise and continued

service of a small number of key individuals of its management,

board of directors and scientific advisors

The Company relies on the expertise and experience of a small

number of key individuals. The retention of their services cannot

be guaranteed. Accordingly, the departure of these key individuals

could have a negative impact on the Company's operations, financial

conditions, its ability to execute the Company's business strategy

and future prospects.

Going forwards, the Company will rely, in part, on the

recruitment of appropriately qualified personnel, including

personnel with a high level of scientific and technical expertise

in the industry. The Company may be unable to find a sufficient

number of appropriately highly trained individuals to satisfy its

growth rate which could affects its ability to develop products as

planned.

In addition, if the Company fails to succeed in pre-clinical or

clinical studies, it may make it more challenging to recruit and

retain appropriately qualified personnel. The Company's inability

to recruit key personnel or the loss of the services of key

personnel or consultants may impede the progress of the Company's

research and development objectives as well as the

commercialisation of its lead and other products.

(e) The Company may need to raise additional funding to take

advantage of future opportunities

The Company may need to raise additional funding to take

advantage of future opportunities. No assurance can be given that

any such additional funding will be available or, if available,

that it will be on terms that are favourable to the Company or

shareholders. If the Company is unable to obtain additional funding

as required, it may be required to reduce the scope of its

operations or anticipated expansion.

(f) The Company's strategy involves generating additional

commercially valuable IP that can be protected

The Company intends to build further its intellectual property

portfolio. No assurance can be given that any future patent

applications will result in granted patents, that the scope of any

patent protection will exclude competitors or provide competitive

advantages to the Company, that any of the Company's patents will

be held valid if challenged or that third parties will not claim

rights in or ownership of the patents and other proprietary rights

held by the Company.

(g) Positive results from pilot trials and early clinical

studies of the Company's Clarava(TM) and Tuteva(TM) products are

not necessarily predictive of the results of later clinical

studies. If the Company cannot replicate the positive results from

earlier tests or studies in its later-stage clinical studies, it

may be unable to successfully develop, obtain regulatory approval

for, and commercialise its products

Positive results from early-stage clinical studies may not

necessarily be predictive of the results from later-stage clinical

studies. Many companies in the pharmaceutical, biotechnology and

medical device industries have suffered significant setbacks in

later-stage clinical trials after achieving positive results in

early-stage development, and the Company cannot be certain that it

will not face similar setbacks. These setbacks have been caused,

among other things, by pre-clinical findings made while clinical

trials were underway. Moreover, pre-clinical and clinical data is

often susceptible to varying interpretations and analyses, and many

companies that believed their product candidates performed

satisfactorily in pre-clinical studies and clinical trials

nonetheless failed to obtain regulatory approval.

(h) The Company is subject to research and product development

risk

The Company may not be able to develop new products or to

identify specific market needs that can be addressed by tests or

solutions developed by the Company. Product development will be a

key ongoing activity in the Company. However, there can be no

guarantee that further products will be developed, successfully

launched, or accepted by the market. All new product development

has an inherent level of risk and can be a lengthy process and

suffer unforeseen delays, cost overruns and setbacks, such as

difficultly recruiting patients into clinical trials. The nature of

the diagnostics industry may mean new products may become obsolete

as a result of competition or regulatory changes which could have a

material adverse effect on the Company's business, results of

operations and financial condition.

In addition, research and development may subject to various

requirements, such as research subject protection for individuals

participating in clinical evaluations of new products,

institutional review board oversight, regulatory authorisations,

and design control requirements. Failure to comply with

requirements could result in penalties, delay, or prevent

commercialisation of products.

(i) The Company is subject to risks associated with medical and

technological change and obsolescence

Demand for the Company's products could be adversely impacted by

the development of alternative technology and alternative medicines

with similar applications. There can be no assurance that the

technology and products currently being developed by the Company

will not be rendered obsolete. As a result, there is the

possibility that new technology or products may be superior to, or

render obsolete, the technology and products that the Company is

currently developing. Any failure of the Company to ensure that its

products remain up to date with the latest advances may have a

material adverse impact on the Company's competitiveness and

financial performance. The Company's success will depend, in part,

on its ability to develop and adapt to these technological changes

and industry trends.

(j) The Company's failure to maintain compliance of its clinical

laboratory operations with applicable laws could result in

substantial civil or criminal penalties

The operation of a clinical laboratory by the Company will be in

a highly regulated environment which, among other things, will

require maintaining compliance with CLIA certification and state

clinical laboratory licensing requirements. Failure to maintain

compliance with these requirements may result in a range of

enforcement actions, including certificate or licence suspension,

limitation, or revocation, directed plan of action, onsite

monitoring, civil monetary penalties and criminal sanctions. Such

failure may also result in significant adverse publicity. Any of

these consequences could limit or entirely prevent continued

operation of the Company and therefore impact its financial

performance.

(k) The Company is subject to various health regulatory laws

pertaining to fraud and abuse and related matters, and any failure

to comply with such laws could result in substantial civil or

criminal penalties

The Company's employees, independent contractors, consultants,

and collaborators may engage in misconduct or other improper

activities, including non-compliance with regulatory standards and

requirements, which could cause significant liability for the

Company and harm the Company's operations and reputation.

The Company is exposed to the risk that the Company's employees,

independent contractors, consultants, and collaborators may engage

in fraud or other misconduct to comply with manufacturing standards

the Company has established, to comply with federal and state

healthcare fraud and abuse laws and regulations and similar laws

and regulations established and enforced by comparable non-US

regulatory authorities, to report financial information or data

accurately or to disclose unauthorised activities to the Company.

Such misconduct could also involve the improper use of information

obtained in the course of clinical trials, which could result in

regulatory sanctions and serious harm to the Company's reputation.

It is not always possible to identify and deter misconduct, and the

precautions the Company will take to detect and prevent this

activity may not be effective in controlling unknown or unmanaged

risks or losses or in protecting the Company from governmental

investigations or other actions or lawsuits stemming from a failure

to comply with such laws, standards or regulations. If any such

actions are instituted against the Company, or the Company's key

employees, independent contractors, consultants, or collaborators,

and the Company is not successful in defending itself or asserting

the Company's rights, those actions could have a significant impact

on the Company's business and results of operations, including the

imposition of significant criminal, civil and administrative

sanctions including monetary penalties, damages, fines,

disgorgement, individual imprisonment, additional reporting

requirements and oversight if the Company becomes subject to a

corporate integrity agreement or similar agreement to resolve

allegations of non-compliance with these laws, reputational harm,

and the Company may be required to curtail or restructure the

Company's operations.

(l) The Company's failure to prevent a data breach would result

in serious reputational damage to the Company and may result in

civil or criminal lawsuits and associated penalties

The Company takes its responsibility to maintain patient

confidentiality and protect patient data extremely seriously. By

its nature, the de-identified data that is being processed is

highly sensitive and includes genetic and demographic information,

the processing of which is subject to the most onerous obligations

of applicable data protection legislation. If, due to a technical

oversight, human error or malicious action by an employee or third

party, the privacy, security or integrity of the data were

compromised, the Company may be obliged to report such breach once

it became aware of under applicable laws and regulations such as

Health Insurance Portability and Accountability Act 1996 ("HIPAA"),

EU General Data Protection Regulations (EU) 2016/679 ("GDPR"), Data

Protection Act 2018 ("DPA") or other US state or EU member

state-specific laws, as well as the data privacy laws of other

countries such as Japan, Singapore, Hong Kong and China.

Depending on the nature and extent of the breach, the Company

may become subject to a regulatory investigation, which would

divert time and financial resources from the day-to-day operation

of the business and may result in civil or criminal lawsuits and

financial fines and penalties as well as adverse publicity. If

third parties and/or customers of the Company become aware of such

breaches, they may opt to cancel existing contracts or not enter

new contracts with the Company, reducing revenue. The Company may

also be required to personally inform the patients whose data was

released or accessed as a result of a data breach, which may

increase the severity of the reputational damage and may lead to

patients revoking their consent for the data to be used by the

Company. In addition, patients may have the right to bring claims

for compensation for such breaches which might be brought by way of

class or representative actions and claim significant sums as

damages. To mitigate the risk of a data breach or related issue,

the Company will employ technical security measures to protect data

and work closely with its data providers to ensure that each party

understands its obligations to protect personal data.

Financial Performance

The financial performance of the Group in the period from

incorporation on 22 April 2020 to 31 December 2020 reflects the

initial acquisition of the FractalDX licence and related assets,

the costs incurred up to and including the IPO on 3 November and

the operating costs of the business since IPO.

Income Statement

As the Company is in development phase, it is not yet generating

revenues from its operating activities. The main components of the

Administrative expenses of US$1,595,161 were professional costs of

US$ 553,454, employee related costs of US$ 258,852 (excluding the

share-based payment charge), laboratory and development costs of

US$ 355,107 and foreign exchange losses of US$ 159,538. Due to a

dollar denominated cash balance in the parent company the

appreciation in the value of sterling against the dollar resulted

in this foreign exchange loss. Total depreciation and amortisation

was US$ 192,235.

Of the total costs of IPO of US$ 1,235,501, US$ 275,508 has been

charged to the Income Statement and shown separately on the face on

the Income Statement given its size and non-recurring nature. Also

disclosed separately is the share-based payments charge of US$

2,794,625. As many of the options granted vested immediately the

full benefit is reflected in these financial statements, as opposed

to being spread over the period of vesting, which for the other

option holders is a weighted average of 2.78 years.

The finance expense in the period is almost exclusively arising

from the imputed interest cost of the Convertible Loan Note issued

to Renalytix for both the purchase of the initial license and other

related tangible assets, and to fund the initial working capital

requirements of the Company prior to IPO. The Convertible Loan

Notes were non-interest bearing but a charge is required under

International Financial Reporting Standard Number 9 "Financial

Instruments".

Statement of Financial Position and Cash Flow Statement

The principal asset of the Group is the licence acquired from

Renalytix and relating to the FractalDx patents, together with

related tangible assets. The aggregate purchase price paid for the

acquired assets was US$ 2,000,000. In the period since acquisition

of the assets on 4 May 2020, legal fees incurred in the further

prosecution and development of the patents has been incurred and

certain additional equipment purchased.

The net proceeds from the IPO were US$17,559,999, after

accounting for those IPO costs charged to the Income Statement,

from which the total spend on operations and investing activities

was US$1,012,427. Due to the appreciation in the value of sterling

against the US dollar in the time from IPO to year end, and the

substantial funds held in sterling at year end, a foreign exchange

gain of US$928,007 increased the year end cash balance to

US$17,751,087.

Section 172 Statement

The Directors, in line with their duties under s172 of the

Companies Act 2006, act in a way they consider, in good faith,

would be most likely to promote the success of the Company for the

benefit of its members as a whole, and in doing so have regard to a

range of matters when making decisions for the long term. Key

decisions and matters that are of strategic importance to the

Company are appropriately informed by s172 factors.

Section 172(1)(a) to (f) requires each Director to act in the

way he or she considers would be most likely to promote the success

of the company for the benefit of its members as a whole, with

regard to the following matters:

(a) the likely consequences of any decision in the long term

(b) the interests of the Company's employees

(c) the need to foster the Company's business relationships with suppliers, customers and others

(d) the impact of the Company's operations on the community and

the environment

(e) the desirability of the Company maintaining a reputation for

high standards of business conduct; and

(f) the need to act fairly between members of the Company.

The Company's activities and progress regarding these matters

since our IPO on 3 November 2020 have been described above in the

other sections of the Strategic Report, and in the Directors'

Report and Corporate Governance Statements below.

This report was approved by the Board of Directors on 13 April

2021 and signed on its behalf by:

Julian Baines

Non-executive Chairman

Consolidated statement of profit or loss

and other comprehensive income for the period

ended 31 December 2020

Period

22 April

to

Note 31 December

2020

US$

Administrative expenses 3 (1,595,161)

Exceptional expense - share based payments (2,794,625)

Exceptional expense - costs of listing (275,508)

_________

Loss from operations (4,665,294)

Finance expense (69,713)

_________

Loss before tax (4,735,007)

Tax expense -

_________

Loss from continuing operations (4,735,007)

Other comprehensive income:

Exchange gains arising on translation of

foreign operations 1,028,907

_________

Loss and total comprehensive income attributable

to the owners of the Company (3,706,100)

_________

Earnings per share attributable to the

ordinary equity holders of the parent

Loss per share

Basic and diluted (US$ cents) (5.46)

_________

Consolidated statement of financial position

at 31 December 2020

2020

Note US$

Assets

Current assets

Trade and other receivables 7 323,224

Cash and cash equivalents 17,751,087

_________

18,074,311

_________

Non-current assets

Property, plant and equipment 5 464,042

Intangible assets 6 1,767,424

_________

2,231,466

_________

Total assets 20,305,777

_________

Liabilities

Current liabilities

Trade and other payables 8 681,890

_________

NET ASSETS 19,623,887

_________

Issued capital and reserves attributable

to

owners of the parent

Share capital 9 181,614

Share premium reserve 20,353,748

Share-based payments reserve 2,794,625

Convertible debt option -

Foreign exchange reserve 1,028,907

Retained earnings (4,735,007)

_________

TOTAL EQUITY 19,623,887

_________

Consolidated statement of cash flows for

the period ended 31 December 2020

Period

22 April

to

Note 31 December

2020

US$

Cash flows from operating activities

Loss for the period (4,665,294)

Adjustments for:

Depreciation of property, plant and equipment 123,242

Amortisation of intangible fixed assets 68,993

Finance expense (69,713)

Share-based payment expense 2,794,625

_________

(1,748,147)

Increase in trade and other receivables (323,224)

Increase in trade and other payables 681,890

Settled by Convertible Loan Note 11 535,164

Income taxes paid -

_________

Net cash outflow from operating activities (854,317)

_________

Cash flows from investing activities

Purchases of property, plant and equipment (25,851)

Purchase of intangibles (132,259)

_________

Net cash used in investing activities (158,110)

Cash flows from financing activities

Issue of ordinary shares 18,795,500

Expenses of share issue (959,993)

_________

Net cash from financing activities 17,835,507

Net increase in cash and cash equivalents 16,823,080

Cash and cash equivalents at beginning of -

year

Exchange gains on cash and cash equivalents 928,007

_________

Cash and cash equivalents at end of year 17,751,087

_________

Total

attributable

Share-based Foreign to equity

Share Share payment Convertible exchange Retained holders of Total

capital premium reserve debt option reserve earnings parent equity

US$ US$ US$ US$ US$ US$ US$ US$

22 April 2020 1 - - - - - 1 1

Comprehensive

income for

the period

Loss - - - - - (4,735,007) (4,735,007) (4,735,007)

Other

comprehensive

Income - - - - 1,028,907 - 1,028,907 1,028,907

_________ _________ _________ _________ _________ _________ _________ _________

Total

comprehensive

Income

for the

period - - - - 1,028,907 (4,735,007) (3,706,100) (3,706,100)

_________ _________ _________ _________ _________ _________ _________ _________

Contributions

by and

distributions

to owners

Issue of share

capital 181,613 20,283,029 - - - - 20,464,642 20,464,642

Issue of

Convertible

Loan

Note - - - 165,138 - - 165,138 165,138

Conversion of

Convertible

Loan Note

into shares - - - (94,419) - - (94,419) (94,419)

Transfer of

balance

following

conversion of

Convertible

Loan Note - 70,719 - (70,719) - - - -

Share-based

payment - - 2,794,625 - - - 2,794,625 2,794,625

_________ _________ _________ _________ _________ _________ _________ _________

Total

contributions

by

and

distributions

to owners 181,613 20,353,748 2,794,625 - - - 23,329,986 23,329,986

_________ _________ _________ _________ _________ _________ _________ _________

31 December

2020 181,614 20,353,748 2,794,625 - 1,028,907 (4,735,007) 19,623,887 19,623,887

_________ _________ _________ _________ _________ _________ _________ _________

Notes to the financial statements for the period ended 31

December 2020

1 General information

The principal activity of Verici Dx plc (the "Company") is the

development of prognostic and diagnostic tests for kidney

transplant patients.

The Company is a public limited company incorporated in England

and Wales and domiciled in the UK. The address of the registered

office is Avon House, 19 Stanwell Road, Penarth, Cardiff CF64 2EZ

and the company number is 12567827.

The Company was incorporated as Verici Dx Limited on 22 April

2020 as a private company and on 9 September 2020 the Company was

re-registered as a public company and changed its name to Verici Dx

plc.

The audited preliminary announcement has been prepared in

accordance with the Group's accounting policies as disclosed in the

financial statements for the period ended 31 December 2020 and

international accounting standards in conformity with the

requirements of the Companies Act 2006 ('IFRS'), and the applicable

legal requirements of the Companies Act 2006. This preliminary

announcement was approved by the Board of Directors on 13 April

2021. The preliminary announcement does not constitute statutory

financial statements within the meaning of section 434 of the

Companies Act 2006.

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, amongst

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this announcement and the Company undertakes no obligation to

update its view of such risks and uncertainties or to update the

forward-looking statements contained herein. Nothing in this

announcement should be construed as a profit forecast.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of IFRS, this announcement does not itself

contain sufficient information to comply with IFRSs. The Company is

in process of publishing its full financial statements in the

report and accounts for the period ended 31 December 2020

imminently. The report and accounts will also be made available

electronically on the Company's website at www.vericidx.com . The

Annual General Meeting will be held on Wednesday 19 May 2021 at

12pm. In light of the COVID-19 related Government measures which

are presently in place to restrict social gatherings, and

overriding health and safety concerns, the Company has decided to

hold this year's AGM partly by means of electronic facilities in

accordance with Article 43 of the Company's articles of

association, with only the minimum quorum of two shareholders

physically present. In the interests of safety, anyone seeking to

attend in person (other than those forming the quorum) will be

refused entry. The Company will provide a facility for remaining

shareholders to join the General Meeting either online or

telephonically and there will be an opportunity for shareholders to

listen and ask questions. In order to facilitate the process, the

board of directors would request that Shareholders register for the

meeting and submit questions in advance, before 12 p.m. on 17 May

2021. To register for dial-in details and to submit any questions

please contact Walbrook PR via email at verici@walbrookpr.com or

call +44 (0)20 7933 8780.

2 Summary of significant accounting policies

The principal accounting policies applied in the preparation of

this financial information has been applied consistently throughout

the year and will be set out in full in the notes to the group's

2020 Annual Report. Certain of those policies are reproduced

below.

Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards and interpretations

issued by the International Financial Reporting Standards

Interpretations Committee ("IFRIC") as adopted by the European

Union ("IFRS").

The functional currency and the presentational currency of the

Company is United States dollars ("USD" or "US$") as this is the

currency of the primary economic environment that the Company

operates in.

a) Standards, interpretations and amendments effective from 1 January 2020

New standards impacting the Group that will be adopted in the

annual financial statements for the period ended 31 December 2020,

and which have given rise to changes in the Group's accounting

policies are:

-- IFRS 16 Leases (IFRS 16); and

-- IFRIC 23 Uncertainty over Income Tax Treatments (IFRIC 23)

Other new and amended standards and Interpretations issued by

the IASB that will apply for the first time in the next annual

financial statements are not expected to impact the Group as they

are either not relevant to the Group's activities or require

accounting which is consistent with the Group's current accounting

policies.

b) Standards, interpretations and amendments not yet effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the group has decided

not to adopt early. The most significant of these is are as

follows, which are all effective for the period beginning 1 January

2020:

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Definition of Material)

-- IFRS 3 Business Combinations (Amendment - Definition of Business)

The Company is currently assessing the impact of these new

accounting standards and amendments.

Other

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

group.

Going concern

The Group is in the development phase of its business and has

not generated any revenues. At 31 December 2020 the Group has

available cash resources of $17,751,087 following its listing on

AIM, a market operated by the London Stock Exchange on 3 November

2020.

The Board has considered the impact of the ongoing COVID-19

pandemic. There has been minimal impact on the Company to date.

Given the impact of COVID-19 in the economy generally, the Board

has performed a number of stress tests to assess the ability of the

Company to continue as a going concern.

The Directors have prepared cash flow forecasts for the Group

for a review period of 12 months from the date of approval of this

historical financial information. These forecasts reflect an

assessment of current and future market conditions and their impact

on the Company's future cash flow performance.

The forecasts have been sensitised for additional costs which

may be incurred in the review period. In the sensitised scenario,

the forecasts indicate the Company would still have sufficient cash

to continue as a going concern.

Having considered the points above, the Directors remain

confident in the long-term future prospects for the Group, and

their ability to continue as a going concern for the foreseeable

future. They therefore adopt the going concern basis in preparing

the historical financial information of the Group.

Share-based payments

Where equity settled share options are awarded to employees, the

fair value of the options at the date of grant is charged to the

consolidated statement of comprehensive income over the vesting

period. Non-market vesting conditions are taken into account by

adjusting the number of equity instruments expected to vest at each

reporting date so that, ultimately, the cumulative amount

recognised over the vesting period is based on the number of

options that eventually vest. Non-vesting conditions and market

vesting conditions are factored into the fair value of the options

granted. As long as all other vesting conditions are satisfied, a

charge is made irrespective of whether the market vesting

conditions are satisfied. The cumulative expense is not adjusted

for failure to achieve a market vesting condition or where a

non-vesting condition is not satisfied.

Where equity instruments are granted to persons other than

employees, the consolidated statement of comprehensive income is

charged with the fair value of goods and services received.

Foreign currency translation

a) Function and presentational currency

Items included in the financial statements of the Group are

measured using USD, the currency of the primary economic

environment in which the entity operates ('the functional

currency'), which is also the Company's presentation currency.

b) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from the

settlement of such transactions and from the translation at

year-end exchange rates, of monetary assets and liabilities

denominated in foreign currencies to USD, are recognised in the

income statement.

Intangible assets

Intangible assets are measured at cost less accumulated

amortisation and any accumulated impairment losses.

Patents are recognised at fair value at the acquisition date.

Patents have a finite useful life and are subsequently carried at

cost less accumulated amortisation and impairment losses.

The Company amortises intangible assets with a limited useful

life on a straight-line basis. The following rates are applied:

Licence - the shorter of the remaining life of the licence and 15 years

Tangible assets

Tangible fixed assets are stated at cost net of accumulated

depreciation and accumulated impairment losses. Costs comprise

purchase costs together with any incidental costs of

acquisition.

Depreciation is provided to write down the cost less the

estimated residual value of all tangible fixed assets by equal

instalments over their estimated useful economic lives on a

straight-line basis. The following rates are applied:

Plant and machinery - 3 years

The assets' residual values, useful lives and depreciation

methods are reviewed, and adjusted prospectively if appropriate, if

there is an indication of a significant change since the last

reporting date. Low value equipment including computers is expensed

as incurred.

Impairment of tangible and intangible assets

At each reporting end date, the Company reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an individual asset, the Company

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

The recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit and loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment subsequently reverses, the carrying amount

of the asset (or cash-generating unit) is increased to the revised

estimate of its recoverable amount, but so that the increased

carrying amount does not exceed the carrying amount that would have

been determined had no impairment loss been recognised for the

asset (or cash-generating unit) in prior years. A reversal of an

impairment loss is recognised immediately in profit and loss.

3 Expenses by nature

Period

22 April

to

31 December

2020

US$

Employee benefit expenses 2,852,641

Depreciation of property, plant and equipment 123,242

Amortisation of intangible assets 68,993

Laboratory and development costs 355,107

Professional costs 553,454

Share-based payment expense for non-employees 200,836

Foreign exchange losses 159,538

Other costs 75,975

4 Employee benefit expenses

Period

22 April

to

31 December

2020

US$

Employee benefit expenses (including directors)

comprise:

Wages and salaries 244,848

Benefits 9,223

Share-based payment expense 2,593,789

Social security contributions and similar taxes 4,781

_________

2,852,641

_________

Key management personnel compensation

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities of the Group, including the Directors of the

Company.

Period

22 April

to

31 December

2020

US$

Salary 121,421

Share based payment expense 2,577,826

_________

2,699,247

_________

5 Tangible assets

Plant & machinery Total

US$ US$

Cost or valuation

At 22 April 2020

Additions 25,851 25,851

Acquired business assets 531,484 531,484

Foreign exchange movements 36,565 36,565

_________ _________

At 31 December 2020 593,900 593,900

_________ _________

Accumulated depreciation and impairment

At 22 April 2020

Depreciation (123,242) (123,242)

Foreign exchange movements (6,616) (6,616)

_________ _________

At 31 December 2020 (129,858) (129,858)

_________ _________

Net book value

At 31 December 2020 464,042 464,042

_________ _________

6 Intangible assets

License Total

US$ US$

Cost

At 22 April 2020

Additions 234,095 234,095

Acquired business assets 1,468,516 1,468,516

Foreign exchange movements 136,584 136,584

_________ _________

At 31 December 2020 1,839,195 1,839,195

_________ _________

Accumulated amortisation and impairment

At 22 April 2020

Amortisation charge (68,993) (68,993)

Foreign exchange movements (2,778) (2,778)

_________ _________

At 31 December 2020 (71,771) (71,771)

_________ _________

Net book value

At 31 December 2020 1,767,424 1,767,424

_________ _________

7 Trade and other receivables

2020

US$

Prepayments 202,546

Other debtors 120,678

_________

323,224

_________

8 Trade and other payables

2020

US$

Trade payables 394,331

Accruals 210,953

Loan 73,548

_________

Total financial liabilities

classified as financial liabilities measured

at amortised cost 678,832

Other payables - tax and social security payments 3,058

_________

Total trade and other payables 681,890

_________

The carrying value of trade and other payables

classified as financial liabilities measured

at amortised cost approximates fair value.

The loan was interest bearing at 4% and is

repayable by monthly instalment with the last

instalment payable in March 2021.

9 Share capital

Issued and fully paid

2020 2020

Number US$

Ordinary shares of GBP1 each

On incorporation 1 1

__________ __________

Ordinary shares of GBP0.001 each

Sub-division of existing shares into 1,000

ordinary shares 1,000 1

Issue of new shares 59,415,135 74,864

Issue of shares on conversion of Convertible

Loan Notes 9,831,681 12,771

Placing and offer of shares on admission to

AIM 72,500,000 93,978

__________ __________

At 31 December 141,747,816 181,614

__________ __________

On 7 July 2020 the entire issued share capital of the Company

was sub divided to create 1,000 ordinary shares of GBP0.001 each

and 59,415,135 ordinary shares of GBP0.001 each were allotted

pursuant to a dividend in specie by the then parent company,

Renalytix AI Plc. Those 59,416,135 shares were then immediately

reclassified as 59,416,134 A shares and one Golden Share and all A

shares and the Golden Share converted into ordinary shares at the

time of the Company's admission to AIM on 3 November 2020.

On 28 October 2020 pursuant to the conversion of the Convertible

Loan Notes in issue at that time of $2,500,000, a further 9,831,681

new ordinary shares were issued.

On 3 November 2020 pursuant to the Company's shares being

admitted to AIM, a market operated by the London Stock Exchange,

72,500,000 new ordinary shares were issued at an issue price of

GBP0.20 per share raising gross proceeds of US$18,795,500

(GBP14,500,000).

10 Share-based payment

On 28 October 2020, the Board adopted the Share Option Plan to

incentivise certain of the Group's employees and Directors. The

Share Option Plan provides for the grant of both EMI Options and

non-tax favoured options. Options granted under the Share Option

Plan are subject to exercise conditions as summarised below.

The Share Option Plan has a non-employee sub-plan for the grant

of Options to the Company's advisors, consultants, non-executive

directors, and entities providing, through an individual, such

advisory, consultancy, or office holder services and a US sub-plan

for the grant of Options to eligible participants in the Share

Option Plan and the Non-Employee Sub-Plan who are US residents and

US taxpayers.

With the exception of options over 10,631,086 shares, which

vested immediately on grant, the options vest equally over twelve

quarters from the grant date. If options remain unexercised after

the date one day before the tenth anniversary of grant, such

options expire. The Options are subject to exercise conditions such

that they shall, subject to certain exceptions, vest in equal

quarterly instalments over the three years immediately following

the date of grant, which vesting shall accelerate in full in the

event of a change of control of the Company.

2020 2020

Weighted

average

exercise

price (p) Number

Outstanding at 22 April - -

Granted during the period 0.32 14,574,782

Vested during the period 0.20 (10,631,086)

_________ _________

Outstanding at 31 December 0.32 3,943,696

_________ _________

Exercisable at 31 December 0.32 3,943,696

_________ _________

The exercise price of options outstanding at 31 December 2020

ranged between 20p and 45.5p and their weighted average contractual

life was 2.78 years.

The weighted average fair value of each option granted during

the year was 19p.

The fair value of each share option granted has been estimated

using a Black-Scholes model and ranges from 10p to 23p. The inputs

into the model are a share prices of 20p, 40p and 45.5p, exercise

prices of 20p, 40p and 45.5p, expected volatility of 79%, no

expected dividend yield, contractual life of between 2.9 and 1.9

years and a risk-free interest rate of 1.1%. As of 31 December

2020, none of the granted stock options have been exercised.

The Group recognised total expenses of $2,794,625 within

administrative expenses relating to equity-settled share-based

payment transactions during the period.

11 Acquisition of business assets

On 4 May 2020 the Company entered into an Asset Purchase

Agreement with Renalytix AI Plc. The fair value of the assets

acquired, and the consideration paid were as follows:

US$

Assets acquired

License 1,468,516

Plant & Machinery 531,484

_________

2,000,000

_________

Contractual repayment amount of Convertible Loan Note

Instrument at inception 2,000,000

_________

Consideration - repayment liability 2,000,000

_________

Subsequent to the acquisition of the business, further

Convertible Loan Notes were issued by Renalytix AI Plc to provide

working capital to the Company prior to its admission to the London

Stock Exchange on 3 November 2020. The Convertible Loan Note was

non-interest bearing.

On 28 October 2020 the total Convertible Loan Note of $2,500,000

was redeemed and converted into 9,831,681 ordinary shares. [state

applicable FX rate? Or equivalent $ value of GBP0.20 issue

price?]

Non-cash transaction

This transaction, together with the subsequent funding of

working capital of the Company by further issuance of Convertible

Loan Notes on the same terms until Admission to AIM on 3 November

2020, represented the major non-cash transaction in the year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DGGDSIGBDGBX

(END) Dow Jones Newswires

April 14, 2021 02:00 ET (06:00 GMT)

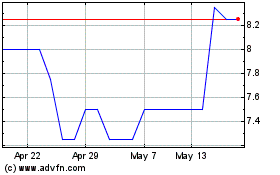

Verici Dx (LSE:VRCI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Verici Dx (LSE:VRCI)

Historical Stock Chart

From Dec 2023 to Dec 2024