Bovis Homes Group PLC Trading update (2240G)

19 November 2015 - 6:00PM

UK Regulatory

TIDMBVS

RNS Number : 2240G

Bovis Homes Group PLC

19 November 2015

19 November 2015

Bovis Homes Group PLC

Trading update

Bovis Homes Group PLC is today issuing a trading update ahead of

its financial year end on 31 December 2015.

Current trading

The Group's sales rate has strengthened in the autumn sales

period. Since the beginning of September, we have achieved a weekly

private sales rate 20% ahead of the prior year (excluding PRS) at

0.62 reservations per site. We have sufficient reservations to

deliver the planned volume growth of over 8% in 2015, which would

represent a record volume of homes for the Group, and construction

activity to complete homes targeted for this year is on track.

Sales prices have continued to be robust and we expect the average

sales price for 2015 to be circa 7% ahead of the prior year. As a

result of this good progress, the Group is set to deliver an

increase in capital turn to over one times and a further

improvement in return on capital employed for the full year.

Following planning delays on a number of new high profit margin

sites, the overall mix of homes for 2015 is more weighted to

existing sites than previously anticipated. In the short term,

subcontract labour availability remains the key constraint on

delivering increased production which has driven cost inflation

although this is showing signs of moderating. Accordingly, whilst

sales prices continue to move ahead, we now expect the

aforementioned mix effect combined with the impact of higher cost

increases to lead to an operating profit margin in 2015 only

marginally ahead of the prior year (2014: 17%).

The Group continues to deliver strong profit from targeted land

sales, mainly related to long term strategic sites, in line with

the overall land strategy and focus on capital efficiency.

We have made good progress with reservations for 2016, which

stand at around 1,650 homes, 18% higher than at the same point last

year. In recent weeks we have been active on 107 sales outlets and

have been trading from an average of 103 sales outlets in the year

to date.

Structure

We announced the launch of two new regions in the second half of

2015 to support the growth of the business over the next few years.

Our new West Midlands and East Midlands regions have been created

by splitting our existing Central region. The recently launched

Thames Valley region is gearing up to deliver its first new homes

having secured planning on its first three sites. This new

structure will provide improved operational focus in our regional

businesses and will support effective management of our growth

strategy.

Land

During 2015 to date, we have added 25 consented sites and circa

4,000 plots. The average return on capital employed of the land

acquired in 2015 based on investment appraisal at the time of

acquisition is circa 28%.

Our growth strategy continues to be focused on investment in

high quality land in the Group's targeted areas. A large pipeline

of terms agreed land opportunities is in place, which when combined

with expected strategic land successes provides confidence in the

Group's ability to deliver our planned future growth. The consented

land market continues to be disciplined with land values reacting

sensibly to changes in housing market conditions.

We continue to make good progress with our valuable strategic

land assets. Since the half year, planning consent has been

achieved for 750 units at Tavistock and 690 units at Wokingham. We

are also progressing 386 units at Edwalton, 257 units at Witney and

201 units at Gravesend where planning has been confirmed subject to

finalisation of S106 agreements. During October, a resolution to

grant planning consent was achieved for circa 1,700 units at North

Whiteley and last week, a resolution to grant planning was secured

for circa 1,000 units at Bexhill. All of these sites are controlled

through call options which will allow the Group to acquire the

sites at a discount to the agreed market value. Some of these sites

are able to be acquired on tranche drawdown or using deferred

payment terms which will enable the Group to manage the capital

related to these sites. Development partners are also being

identified for the larger sites as appropriate.

In summary, David Ritchie, Chief Executive, commented:

"Bovis Homes is taking another step forward with its growth

strategy in 2015. We continue to trade well supported by a strong

market backdrop and have in place the required pipeline of sales to

deliver our planned volume growth for the full year.

"The growth in volume and increase in sales prices are expected

to deliver strong revenue growth and a capital turn in excess of

one. Whilst our operating profit margin is now expected to be only

marginally ahead of the prior year, the Group remains on track to

deliver a further increase in return on capital employed in

2015.

"We continue to invest in high quality land, including the

successful conversion of our valuable strategic land assets, and

remain confident of delivering our strategy of growth in volumes

and returns."

Enquiries: David Ritchie, Chief Executive

Earl Sibley, Group Finance Director

Bovis Homes Group PLC

Tel: 07855 432 699

Reg Hoare/James White/Giles Robinson

MHP Communications

Tel: 020 3128 8788

Conference Call for analysts

David Ritchie, Chief Executive, and Earl Sibley, Group Finance

Director, of Bovis Homes will host a conference call at 09:30

today, Thursday 19 November 2015, to discuss the Trading

Update.

To access the call please dial +44(0)1452 580 111 and quote

conference ID: 82804076. Please dial in 5 minutes prior to the

start of the conference call to allow time for registration. A

recording of the conference call will be available until midnight

on 16 December 2015 on +44(0)1452 550 000, accessible with the

conference ID: 82804076.

****************************************************************************************

Certain statements may be forward looking statements. Forward

looking statements involve evaluating a number of risks,

uncertainties or assumptions that could cause actual results to

differ materially from those expressed or implied by those

statements. Forward looking statements regarding past trends,

results or activities should not be taken as a representation that

such trends, results or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTUWSWRVBAAAAA

(END) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

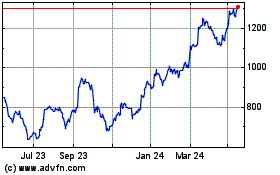

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

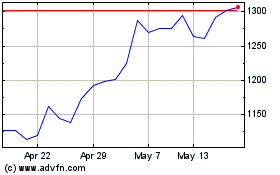

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024