By Margot Patrick in London and Julie Steinberg in Hong Kong

Huawei Technologies Co., targeted as a national security threat

by the U.S. and other governments, faces a new risk: reduced access

to the global financial system.

Two banks that helped power the Chinese company's rise as a

global technology supplier, HSBC Holdings PLC and Standard

Chartered PLC, won't provide it with any new banking services or

funding after deciding that Huawei is too high risk, people

familiar with those decisions said.

While HSBC made its decision last year, Standard Chartered moved

more recently as concerns about Huawei escalated this year from a

Justice Department investigation into whether the company violated

U.S. sanctions on Iran, some of the people said.

A third key bank, Citigroup Inc., continues to provide Huawei

with day-to-day banking services outside the U.S., people familiar

with that relationship said. New banking business would be subject

to review, and Citigroup is monitoring continuing developments in

the U.S., the people said.

This month, Huawei's finance chief Meng Wanzhou was arrested in

Canada and awaits possible extradition to the U.S. to face charges

over alleged sanctions violations and bank fraud. Her arrest has

heightened trade tensions between the U.S. and China and has

resulted in a diplomatic spat between China and Canada. Ms. Meng

denies any wrongdoing. Ms. Meng is out on bail with strict limits

on her movements.

Huawei, active in about 170 countries, relies on international

banks to manage cash, finance trade and fund its operations and

investments. For more than a decade, HSBC, Standard Chartered and

Citigroup Inc., another key financier, plugged Huawei into the

global financial system as it entered new markets, providing it

with everything from foreign currencies to bond funding from

Western investors. Chinese banks finance Huawei in some markets but

don't have the reach to service it globally.

Standard Chartered recently decided it had to sever business

with Huawei, people familiar with the matter said. Its relationship

with the company dates back to the 2000s, and includes providing

regional and global cash pools that free up excess cash in local

Huawei units and let it pay suppliers in multiple currencies.

HSBC stopped working with Huawei last year, people familiar with

the matter said, after the bank and a court-appointed monitor

flagged suspicious transactions by the company to U.S. prosecutors

in 2016. According to Canada court filings, HSBC was one of at

least four global banks that Ms. Meng or other Huawei executives

allegedly misled about Huawei's ties to Skycom Tech, a Hong Kong

company operating in Iran. The bank is still a mortgage lender on

two homes Ms. Meng and her husband own in Vancouver, according to

Canada property records.

A Huawei spokesman declined to comment on the company's bank

ties.

Citigroup's relationship with Huawei has included global

transaction banking and trade financing outside of the U.S., in

countries such as Mexico, Pakistan and Bangladesh, according to

public disclosures and people familiar with the relationship. It

also shared the lead role arranging several Huawei loan and bond

deals in recent years, Dealogic data shows.

Around January 2014, the bank instituted a new approach toward

Huawei and other clients it deemed riskier that included

periodically reviewing their transactions, said a person familiar

with the matter.

Goldman Sachs Group Inc. considered extending financing to the

Chinese company in 2013, people familiar with the matter said, but

decided not to, in part because Goldman executives received

negative feedback from the U.S. Treasury.

Other banks that have provided funding or services to Huawei,

including JPMorgan Chase & Co., Australia & New Zealand

Banking Group Ltd. and ING Groep NV, declined to comment on whether

they would enter into new business. An ANZ spokesman said it takes

its due diligence responsibilities very seriously and has detailed

policies and processes in place for use when engaging clients. A

spokesman for ING, whose subsidiary Bank Mendes Gans runs a cash

pool for Huawei in Europe, said the bank takes its sanctions policy

extremely seriously and continually assesses clients for risks.

Huawei, founded in 1987 by a former Chinese army officer, has

been seen as a prize client for Western banks looking to enter

China and help its companies go international. Its perceived ties

to the government, which Huawei denies, initially made Western

banks comfortable to enter business and extend financing at more

favorable terms than other privately owned Chinese companies,

according to executives whose banks sought business with Huawei as

far back as the mid-2000s.

"It's the kind of client Standard Chartered or HSBC would bend

over backwards for," said a former Standard Chartered executive.

"They are everywhere, and need help everywhere."

However, since at least 2007, some U.S. government officials

feared Huawei's telecommunications gear and security software could

pose risks to national security.

A Huawei deputy chairman on Tuesday said there is no evidence to

support claims the company is a cybersecurity threat.

In 2013, Reuters reported Huawei might be operating in Iran

through a closely tied company called Skycom Tech, prompting HSBC

to ask Huawei to explain its relationship to Skycom and business

with Iran, according to Canada court filings related to Ms. Meng's

extradition case. HSBC's questions led to an August 2013 meeting

between Ms. Meng and at least one HSBC executive.

At the meeting, Ms. Meng sought to assuage concerns about

Huawei's potential ties to Skycom and Iran, according to a copy of

her presentation in court filings, stating that Huawei was a former

shareholder in Skycom and that she had once been a board member but

stepped down. In the presentation, Ms. Meng praised HSBC for its

long-running relationship with the company, and "deep understanding

of Huawei's history of growth around the world."

U.S. authorities now allege Ms. Meng misrepresented the ties to

Skycom so that Huawei could keep moving money out of countries

subject to U.S. or European sanctions and into the international

banking system. They say HSBC and other banks cleared hundreds of

millions of dollars of transactions for Huawei that may have

violated sanctions, exposing the firms to "serious harm."

--Telis Demos contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com and Julie

Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

December 20, 2018 11:10 ET (16:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

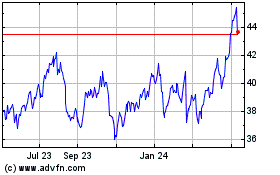

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

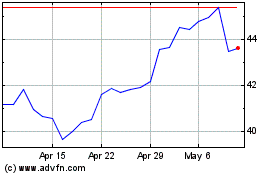

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024