PG&E Bond Prices Jump, While Shares Fall -- Update

25 June 2019 - 7:18AM

Dow Jones News

By Matt Wirz

PG&E Corp. bond prices surged in heavy trading Monday even

as shares declined, a divergence that some analysts said reflects

uncertainty about how much new equity the bankrupt California

utility needs to raise in order to address claims tied to past and

future wildfires.

About $290 million of the bonds changed hands, making PG&E

the most actively traded high-yield corporate, according to

MarketAxess. Its bond due 2034 hit 109.25 cents on the dollar, up

from 107.5 Friday and 101.38 at the start of last week. The

company's stock fell 5.6% to $21.67.

The company's shares and bonds both rallied last week after the

company reached its first major settlement with wildfire victims

and California Gov. Gavin Newsom proposed a plan for a

multibillion-dollar fund to cover fire-related liabilities.

Ultimate recoveries on PG&E shares and bonds will depend on

how the company raises capital to offset wildfire liabilities. Some

of the funding could come from increasing charges to electricity

ratepayers and from issuance of new bonds backed by the utility's

future revenues. But the larger the size of the state wildfire fund

-- options floated by Mr. Newsom range from $10.5 billion to $21

billion -- the more shareholders or bondholders will have to

contribute themselves.

If the fund is on the higher end, "we assume $9 billion of

traditional equity would need to be raised to fund PG&E's

contribution," Morgan Stanley & Co. analyst Stephen Byrd wrote

in a report published Monday.

Bondholders could pay such a sum through a rights offering, but

that would dilute existing shareholders, hedge-fund analysts said.

If the shareholders foot the bill themselves, the cash they spend

would eat into potential profits on the company stock

postbankruptcy, they said.

In the Treasury market, the yield on the 10-year note fell to

2.021% from 2.066% after the Federal Reserve Bank of Dallas

released a lukewarm reading of manufacturing activity. The WSJ

Dollar index lost 0.2%.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

June 24, 2019 17:03 ET (21:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

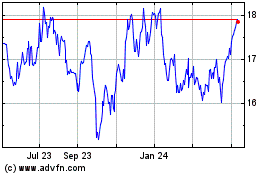

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2024 to May 2024

PG&E (NYSE:PCG)

Historical Stock Chart

From May 2023 to May 2024