false

0001553788

0001553788

2024-06-05

2024-06-05

0001553788

SBEV:CommonStockParValue0.001PerShareMember

2024-06-05

2024-06-05

0001553788

SBEV:WarrantsToPurchaseSharesOfCommonStockMember

2024-06-05

2024-06-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June

5, 2024

| SPLASH

BEVERAGE GROUP, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 001-40471 |

|

34-1720075 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

1314 East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33316 |

|

| (Address of Principal Executive Offices) |

| |

| (954) 745-5815 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

SBEV |

|

NYSE American LLC |

| Warrants to purchase shares of common stock |

|

SBEV-WT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As previously reported on January 29, 2024 in a Current

Report on Form 8-K, on October 6, 2023, the Splash Beverage Group, Inc. (the “Company”) had received a notification (the “Deficiency

Letter”) from the staff at NYSE American LLC (“NYSE American”) that it was not in compliance with Section 1003(a)(i)

of the continued listing standards set forth in the NYSE American Company Guide (the “Company Guide”), requiring a listed

company to have stockholders’ equity of (i) at least $2.0 million if it has reported losses from continuing operations or net losses

in two of its three most recent fiscal years. The Company submitted a proposed compliance plan to the NYSE American (“Plan”),

advising it of the actions it has or will take to regain compliance by April 6, 2025.

On December 20, 2023, the Company received a notification

(the “Plan Letter”), with NYSE acceptance of the proposed plan and further deficiency notice. In the Plan Letter the NYSE

indicated that in addition to Section 1003(a)(i) of the Company Guide, the Company was also not in compliance with Section 1003(a)(ii)

of the Company Guide, requiring a listed company to have stockholders’ equity of at least $4.0 million if it has reported losses

from continuing operations or net losses in three of its four most recent fiscal years.

On June 5, 2024, the Company received notification

from the NYSE American indicating that it is not in compliance with the Exchange’s continued

listing standards under Section 1003(a)(iii) of the Company Guide, requiring a listed company

to have stockholders’ equity of $6 million or more if the listed company has reported losses from continuing operations and/or

net losses in its five most recent fiscal years. The Company is now subject to the procedures and requirements of Section 1009 of the

Company Guide.

If the Company is not in compliance with the continued

listing standards by April 6, 2025 or if the Company does not make progress consistent with the Plan during the plan period, the NYSE

American may commence delisting procedures.

Item 8.01 Other Events.

On June 18, 2024, the Company issued a press release

relating to the matters described in Item 3.01 of this Current Report on Form 8-K, a copy of which is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

Forward-Looking Statements

The Company cautions you that statements included

in this Current Report on Form 8-K that are not a description of historical facts are forward-looking statements. Words such as “believes,”

“anticipates,” “plans,” “expects,” “indicates,” “will,” “intends,”

“potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to

identify forward-looking statements. These statements are based on the Company’s current beliefs and expectations. These forward-looking

statements include statements regarding the Company’s expectations regarding a period to comply with the Plan and applicable Exchange

requirements, and actions of the Company and/or the Exchange to be taken with respect to matters discussed in the Deficiency Letter and

the Plan Letter. The inclusion of forward-looking statements should not be regarded as a representation by the Company that any of its

plans will be achieved. Actual results may differ from those set forth in this release due to the risks and uncertainties associated with

continued listing on the Exchange, risks and uncertainties inherent in the Company’s business, and other risks described in the

Company’s filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof, and the Company undertakes no obligation to revise or update this report to reflect

events or circumstances after the date hereof. This caution is made under the safe harbor provisions of Section 21E of the Private Securities

Litigation Reform Act of 1995.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

SPLASH BEVERAGE GROUP, INC. |

| |

|

|

| Dated: June 18, 2024 |

By: |

/s/ Robert Nistico |

| |

Name: |

Robert Nistico |

| |

Title: |

Chief Executive Officer |

EXHIBIT 99.1

Procedural Notice of Noncompliance of NYSE Listing

Standard

FORT LAUDERDALE,

FL - (NewMediaWire)

– June 18, 2024 - Splash Beverage Group, Inc. (NYSE

American: SBEV) (“Splash” or the “Company”), a portfolio company of leading beverage brands, issued a

statement stating that on June 5, 2024, the Company received a procedural notification from the NYSE American indicating that

it is not compliant with the Exchange’s continued listing standards under Sections

1003(a)(iii) of the Company Guide, requiring a listed company to have

stockholders’ equity of $6 million or more if the listed company has reported losses from continuing operations and/or net

losses in its five most recent fiscal years. The Company is subject to the procedures and requirements of Section 1009 of the

Company Guide.

If the Company is not in compliance with the continued

listing standards by April 6, 2025 or if the Company does not make progress consistent with the plan of compliance submitted with the

Exchange, the NYSE American may commence delisting procedures

The management team at the Company

acknowledges concerns regarding the non-compliance. The Company wants to assure our stakeholders, including shareholders, employees, customers,

and partners, that we have actively been taking measures to address these concerns and strengthen our financial position. The Company

remains confident in the underlying strength of our business model, the dedication of our workforce, and our ability to adapt to changing

capital market conditions.

About Splash Beverage Group,

Inc.

Splash Beverage Group, an innovator

in the beverage industry, owns a growing portfolio of alcoholic and non-alcoholic beverage brands including Copa di Vino wine by the glass,

SALT flavored tequilas, Pulpoloco sangria, and hydration and energy drinks. Splash’s strategy is to rapidly develop early-stage

brands already in its portfolio as well as acquire and then accelerate brands that have high visibility or are innovators in their categories.

Led by a management team that has built and managed some of the top brands in the beverage industry and led sales from product launch

into the billions, Splash is rapidly expanding its brand portfolio and global distribution.

For more information visit:

www.SplashBeverageGroup.com

www.copadivino.com

www.drinksalttequila.com

www.pulpo-loco.com

Forward-Looking Statement

This press release includes “forward-looking

statements” within the meaning of U.S. federal securities laws. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,”

“could,” “should,” “believes,” “predicts,” “potential,” “continue”

and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from the expected results and, consequently, you should

not rely on these forward-looking statements as predictions of future events. These forward-looking statements and factors that may cause

such differences include, without limitation, the risks disclosed in the Company’s Annual Report on Form 10-K filed with the SEC

on March 29, 2024, and in the Company’s other filings with the SEC. Readers are cautioned not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Except as required by law, the Company disclaims any obligation to update or publicly

announce any revisions to any of the forward-looking statements contained in this press release.

Contact Information:

Splash Beverage Group

Info@SplashBeverageGroup.com

v3.24.1.1.u2

Cover

|

Jun. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 05, 2024

|

| Entity File Number |

001-40471

|

| Entity Registrant Name |

SPLASH

BEVERAGE GROUP, INC.

|

| Entity Central Index Key |

0001553788

|

| Entity Tax Identification Number |

34-1720075

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1314 East Las Olas Blvd

|

| Entity Address, Address Line Two |

Suite 221

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33316

|

| City Area Code |

(954)

|

| Local Phone Number |

745-5815

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SBEV

|

| Security Exchange Name |

NYSEAMER

|

| Warrants to purchase shares of common stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of common stock

|

| Trading Symbol |

SBEV-WT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

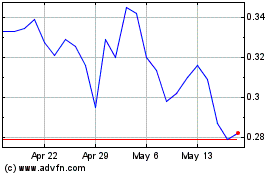

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Jan 2025 to Feb 2025

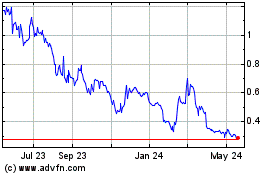

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Feb 2024 to Feb 2025