TIDMPTY

RNS Number : 0960W

Parity Group PLC

21 April 2021

PARITY GROUP PLC

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2020

21 April 2021

Parity Group plc ("Parity" or the "Group" or the "Company"), the

data and technology focussed professional services business,

announces its full year results for the year ended 31 December

2020.

Business Highlights

-- Transformation begun in 2019 is complete and the business

returned to an Operating Profit in 2020 of GBP23k (2019: Operating

loss of GBP725k).

-- Removed GBP4.2m of operating costs, enabling GBP1.6m to be invested back into the business.

-- Significantly improved operational gearing with new operating model.

-- Reduction of staff numbers and headcount costs has enabled

investment in people who bring new skills.

-- Updated team's incentives to be geared towards profitable

growth, managing down reliance on revenues that delivered little or

no margin.

Post period end and outlook

-- Encouraging start to 2021, with new business wins including a

contract from the Scottish government representing a total

opportunity of up to GBP5m over the next three to six years, plus a

number of other public and private sector wins amounting to an

estimated GBP400,000 in External contribution during the financial

year.

-- Having significantly improved its working capital management

over the past two years the Group has secured a new debt facility

from Leumi ABL that will support its future growth ambitions.

-- Investment in technology has enabled greater efficiency,

stronger margins and supports the growth opportunity, with more

future plans in this area.

-- While the short-term economic impacts of the pandemic have

affected performance, in the longer term it has accelerated the

trends that underpin Parity's new strategy.

-- If the pandemic eases as expected, anticipate more growth in

H2 2021 as business confidence returns.

Financial Highlights

Year ended 31 December 2020 2019

Revenue 57.8 80.4

------ ------

External Contribution 5.6 8.1

------ ------

Operating profit before non-underlying

items 0.5 0.4

------ ------

Operating profit / (loss) 0.0 (0.7)

------ ------

Adjusted profit before tax 0.1 0.1

------ ------

Loss before tax (0.3) (1.1)

------ ------

Net cash excluding lease liabilities 0.2 1.4

------ ------

Commenting on the results, John Conoley, Non-Executive Chairman

of Parity Group plc, said:

" I am delighted to see the real progress made in 2020 and it is

especially pleasing to be able to report a second half profit in

2020. In 2019 the Board made a decision to change the strategic

direction of the business, to focus on the growing opportunity in

data and to position Parity as the partner of choice for clients

who want to realise the true potential of their data. Clearly

despite the challenges of the pandemic, the change in strategic

direction was the right decision and the growth in profitability

should continue. This is my last statement as Non-Executive

Chairman of Parity Group plc and I leave Parity in a strong

position."

Matthew Bayfield, Chief Executive, said:

"Despite the Covid-19 pandemic we have been able to deliver an

operating profit in 2020 and report a profit before tax in the

second half of 2020, which is testament to the viability of our new

strategy and to the dedication and skill of our people, who I would

like thank for their hard work during a very challenging time.

"Whilst the pandemic has made this year difficult for many

businesses, it has also underlined the need for strong data

management and data governance in businesses and government bodies.

This is exactly where Parity sits and where we see opportunity for

growth. We are now operating in a truly digital economy sooner than

we expected and Parity is extremely well placed to benefit from

this. We are more confident than ever in our ability to deliver

above average total shareholder returns in the coming years,

despite the lasting impacts of the pandemic."

Investor Presentation

Matthew Bayfield, CEO and Mike Johns, CFO will provide a live

presentation relating to the final results for 2020 via the

Investor Meet Company platform on 21st Apr 2021 at 1:00pm BST.

The presentation is open to all existing and potential

investors. Questions can be submitted pre-event via the Investor

Meet Company dashboard up until 9am the day before the meeting or

at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Parity Group plc via:

https://www.investormeetcompany.com/parity-group-plc/register-investor

.

Investors who already follow Parity Group plc on the Investor

Meet Company platform will automatically be invited.

-S-

Contacts

Parity Group PLC www.parity.net

Matthew Bayfield, CEO + 44 (0) 208 543 5353

Mike Johns, CFO

finnCap Ltd https://www.finncap.com/

Jonny Franklin-Adams / Simon Hicks / Fergus

Sullivan

Tim Redfern / Charlotte Sutcliffe +44 (0) 20 7220 0500

Houston Parity@Houston.co.uk

Kate Hoare

Alexander Clelland +44 (0) 204 529 0549

Chairman's report

2020 - Progress in difficult times

We are delighted to be able to report real progress in 2020

despite the obvious challenges faced in a year that saw fundamental

changes to the way we all work. In 2019 the Board made a decision

to change the strategic direction of the business, to focus on the

growing opportunity in data and to position Parity as the partner

of choice for clients who want to realise the true potential of

their data. When this decision was taken we had of course not

foreseen the pandemic. However, the timing was fortuitous; while in

the short term the economic impacts of the pandemic have affected

our performance, in the longer term it has accelerated the trends

that underpin Parity's new strategy. As a result, Parity has come

through 2020 far more strongly than would otherwise have been the

case and it is pleasing to be able to report a second half profit

in 2020. This has been driven by the success of our transformation

programme, and we remain confident of further growth in

profitability in the current financial year.

Strategy

Data is an ever more valuable and important commodity in both

the private and public sector. Parity's strategy is simple: to

service the market for people who can help manage that valuable

data. The pandemic created its challenges, but it has also created

opportunity.

With more remote working, data security has become of paramount

importance for almost all businesses, increasing the demand for

support and skills around data which Parity provides. With even

more transactions moving online, retailers need to be able to

fulfil, track and analyse very large amounts of raw data. In the

public sector, the pandemic has generated a huge demand for

effective and efficient tracking of data by both the NHS and other

government entities. Furthermore, the demand for faster, more

reliable broadband has further fuelled the demand for skilled

people who can manage data in both the private and public sector. I

am pleased to say Parity is a partner for businesses all these

markets and more, and opportunities in others are growing.

Parity is also building its reputation in the growing data

analytics space. The ever increasing reliance on data for decision

making is resulting in more demand for highly skilled, experience

people who are capable of collecting, curating and analysing

complex data. These type of data analytics skills remain scarce,

which is why Parity can play a vital role, connecting real data

experts with organisations who need them.

Results

I am very pleased to report that the transformation programme

embarked upon in 2019 has delivered its key objectives and at an

operating level, the Group returned to a modest Operating Profit in

2020 of GBP23k (2019: Operating loss of GBP725k). This was despite

revenue across the Group being 28% lower at GBP57.8 million,

largely as a result of lower recruitment revenues as our large

contract with the Scottish Government, which was not renewed in

early 2019, continued to wind down. Adjusted profit before tax of

GBP122k was very similar to the year before. This is a significant

achievement in a challenging environment, reflecting the progress

we have made as an organisation, without the need to furlough

employees. The Group also continues to benefit from strong working

capital management and debtor days remain at an excellent average

of 14 days.

After non-underlying items of GBP447k before tax, all incurred

in the first half, we recorded a loss before tax for the year of

GBP325k (2019: loss before tax of GBP1.1m).

Board and people

As Parity has undergone its transformation to focus on the

opportunity in data, there have been several senior leadership

changes including appointments of individuals with strong

technology experience and who share our vision for the new

Parity.

In June, Roger Antony stepped down, having served as Group

Finance Director for the last four years. I would like to record

the Board's thanks to Roger for the many years of service he gave

the company and his professionalism throughout.

Mike Johns joined the Board as CFO in June and brings

significant experience to the Board having worked in tech and data

led businesses for more than 20 years. At board level Mike has led

organisations through change and development and has considerable

corporate finance experience having led successful fundraising,

acquisition and sales processes.

We continue to strengthen the board and in May 2020 welcomed

Gerry Brandon. Gerry is an active board member on multiple

AIM-listed companies and is CEO of AIM-listed DeepVerge plc.

The Board would like to record its thanks to all of the

employees who have risen to the considerable challenges of working

through the pandemic. We took a decision not to furlough employees

so that we could remain close to our customers and support them

through difficult times. I believe this was the right decision both

for the welfare of our people and in the longer term for the

business. We have been very encouraged by the loyalty of our

customers and the level of repeat business that we enjoy is

testament to the excellent service our people provide.

Financing and dividend

On 20 April 2021 the Group signed an agreement with Leumi ABL

for a new 3-year GBP9m asset-based lending facility replacing the

previous facility from PNC. The new facility increases the amount

that can be borrowed against billed and unbilled receivables giving

the Group greater flexibility and it is expected that the new terms

will reduce annual borrowing costs.

The Board is not proposing a dividend at this time but will keep

this policy under review.

Current trading and outlook

So far in 2021 we have been successful with opportunities in the

public and private sectors. We started 2021 with both new contracts

and non-competitive renewals that range from supporting the NHS at

a critical time, and supporting national technology infrastructure,

to enabling retailers to maximise the online opportunity.

If the pandemic eases as expected, we would anticipate more

growth in H2 2021 as business confidence returns. AI & Machine

Learning continue to create more unstructured data challenges

requiring digital and data specialists. As a consequence, we have

an encouraging pipeline of both public and private sector

opportunities to convert as we continue to leverage our investments

in people, marketing and technology.

Finally, this is my last statement as Non-Executive Chairman of

Parity Group plc and I leave Parity in a strong position. The

company has made great progress over the past few years. Having

completed its transformation into a data and technology focused

business, it is for the first time free from past legacy issues and

in 2020 has delivered an impressive performance despite the

challenges of the pandemic. Now is the right time for me to hand

over the reins as Chairman and I wish my successor every success in

his new position.

Chief Executive's statement

Progress in an exceptional year

2020 was a watershed year in so many ways for so many people and

businesses. It would be wrong not to start a review of the year

without acknowledging the sacrifices and suffering endured by so

many people, and to thank everyone for their support during what

has been a very difficult time for everybody. I would obviously

like to single out the people who work for Parity who, despite the

obvious challenges, worked as hard as ever. They have enabled us to

make real progress in the most exceptional circumstances.

Whilst the Covid-19 pandemic has made this a very difficult year

for many businesses, it has also underlined the need for strong

data management and data analytics in businesses and government

bodies. This is exactly where Parity sits and where we see

opportunity for growth - we exist to be a trusted partner of data

driven transformation, through providing people, skills and

consulting. Whether it be the critical nature of cyber security

with large numbers of people working remotely, or the growth in

online shopping that has increased demand for better data analysis

of consumer trends, the need for strong data skills has never been

clearer. We are now operating in a truly digital economy sooner

than we expected and Parity is extremely well placed to benefit

from this, having spent the last two years successfully positioning

the business as a specialist in the fast-growing data skills market

with the experience and credentials to back that up.

Continuing investment in technology

Investing in technology has played an important role in our

transformation, enabling us to create greater efficiency, stronger

margins and the ability to scale our business as we pursue our

growth agenda. In the year we made progress creating and

implementing new technology systems and platforms, with more

exciting developments planned in due course. Specifically, during

2020 we put in place a whole new management information system

covering CRM, marketing, HR and finance. Furthermore, we now have a

technology platform onto which we can build additional

customer-focussed technology solutions.

Transformation complete

Despite the Covid-19 pandemic we have been able to deliver an

operating profit in 2020 and report a profit before tax in the

second half of 2020, our first unadjusted profitable half year for

two years. This change has been driven by the transformation

programme we begun in 2019 to develop Parity into a data focussed

business, positioned to meet the growing demand for data skills

from both the public and private sector. I am pleased to report

that the transformation delivered everything and more than we set

out to achieve. We now have a radically different business:

-- We have a leadership team with strong data and technology

experience, who all share the vision for the new Parity

-- We have invested in technology that will support our growth

strategy and have more plans in this area

-- We have significantly improved operational gearing with our new operating model

-- We reassessed costs and removed GBP4.2m of annual operating

costs, enabling us to reinvest GBP1.6m back into the business

-- By reducing staff numbers and therefore headcount costs, we

have been able to invest in new people who have brought new skills

and dynamism to the business

-- Our marketing and new business efforts have been completely

overhauled and are now bearing fruit

-- We have completely changed our focus, and our team's

incentives, towards profitable growth; managing down our reliance

on revenues that delivered little or no margin and changing our

focus to higher margin work

Whilst there has been significant change, we have also

successfully preserved the core strengths of Parity that underpin

our brand and market position:

-- We continue to help our clients release the value of their

data by focusing on the market for data skills, a fast growing and

exciting market segment

-- We have maintained our excellent reputation in the public

sector as evidenced by recent new business wins

-- We have grown our community of data specialists; at a time

when there has been considerable flux in the market for people with

data skills we remain the specialist provider

New business wins

The start to 2021 has been encouraging. In January we won a new

three-year contract from the Scottish government as its Digital

Technology Resources partner to support the delivery of the

Reaching 100% (R100) superfast broadband infrastructure programme.

The award represents a total opportunity of up to GBP5.0m over the

next three to six years for Parity. We also renewed a contract

without competitive tender with one of our larger clients in the

retail sector and we won new consultancy work form a very large

multinational business.

Since then, we have also been appointed as a partner to help

connect a prominent retailer with the skilled data and digital

resources it requires to support its various brands' ambitious

transformation and growth plans across UK and Europe. We also have

partnerships with IFS (a global leader in Cloud ERP solutions) and

Cedar Bay (a partner in the IFS ecosystem) to supply skilled data

and digital resources, as well as the extension of engagement with

human resources platform specialist, Resilience Engine. In

addition, we have secured a contract within the public sector to

supply data talent for NHS Digital projects (the national provider

for the NHS in England of information, data and IT systems).

We continue to attract excellent talented people into the

business. At the beginning of the year, we recruited Kevin Gould, a

f ormer Commercial Lead for Accenture in UK and Ireland, who joins

the management team as Commercial Director. Kevin has already

helped us access new opportunities and convert tenders into new

business.

Conclusion

It is a little over two years since I became Chief Executive of

Parity and both the business and the environment in which it

operates have changed considerably. As a result, we are now in a

strong position for future growth. I have ambitious plans for this

business, there is a significant opportunity for us in the data

market and we want to grasp it quickly. We are more confident than

ever in our ability to deliver above average total shareholder

returns in the coming years, despite the lasting impacts of the

pandemic.

Parity is now more efficient, more focussed and clearer about

its objectives and purpose, as well as growing its margins and

profitability again. The market for data services is strong and our

reputation in that market as an excellent provider of experienced

people with much sought after data skills is very good, and

constantly improving. The people we employ at Parity continue to be

a major differentiator. I will end, as I started, by thanking them

for their hard work and our shareholders for their continued

support.

Operational and Financial Review

-- The Group's restructuring and cost reduction over the past

two years have enabled it to remain financially robust in a year

heavily impacted by the pandemic.

-- The Group returned to an operating profit despite the pandemic.

-- Having significantly improved its working capital management

over the past two years the Group has secured a new debt facility

from Leumi ABL that will support its future growth ambitions.

-- Investment in new technology during the year has included the

successful implementation of a new integrated financial system from

Access Group.

-- Net cash[ ] of GBP0.2m as at 31 December 2020 (2019: GBP1.4m).

Performance highlights for 2020 2019 Variance(2)

2020

Adjusted(1) Reported Adjusted(1) Reported

------------ --------- ------------ --------- ------------

Revenue (GBP million) 57.8 57.8 80.4 80.4 -28%

------------ --------- ------------ --------- ------------

External contribution (GBP

million) 5.6 5.6 8.1 8.1 -31%

------------ --------- ------------ --------- ------------

Operating profit (GBP million) 0.5 0.0 0.4 (0.7) 5%

------------ --------- ------------ --------- ------------

Operating profit %(3) 8.4% 0.4% 5.5% -8.9% 53%

------------ --------- ------------ --------- ------------

Finance costs (GBP million) (0.3) (0.3) (0.3) (0.3) 5%

------------ --------- ------------ --------- ------------

Profit/(loss) before Tax (GBP

million) 0.1 (0.3) 0.1 (1.1) 6%

------------ --------- ------------ --------- ------------

Basic earnings per share (pence) (0.02) (0.46) 0.09 (1.05) -126%

------------ --------- ------------ --------- ------------

Net cash (GBP million)(4) 0.2 0.2 1.4 1.4 -83%

------------ --------- ------------ --------- ------------

Notes

1 - Excludes from the Income Statement the impact of

non-underlying items of GBP0.4m in 2020 (2019: GBP1.2m)

2 - Variance compares 2020 adjusted against 2019 adjusted to

provide a consistent view of performance

3 - Operating profit % is calculated as operating profit as a %

of External contribution

4 - Net cash represents cash and cash equivalents less loans and

borrowings and excluding leases

Despite a difficult year in which the majority of businesses and

sectors have been affected by the pandemic, the Group has made

significant progress and ends the year in a strong financial

position. The transformation and restructuring of the business

commenced in 2019 has been successful, resulting in both improved

operational efficiency and reduced costs, and ultimately placing

Parity in a position of strength to be the partner of choice for

companies with complex data needs. This has enabled the Group to

absorb the impact of the pandemic and the known impact of the wind

down of the Scottish Government framework ("SG Framework")

terminated in 2019, without the need to furlough employees or to

make unplanned changes to the business.

As a result, the Group has been able to return to an Operating

Profit in 2020, a significant achievement in such a turbulent year.

Adjusted Profit before tax has been maintained at similar levels to

2019 and the Group delivered an unadjusted Profit before tax in the

second half of 2020, reflecting the progress we have made an

organisation with our transformation programme.

In addition to delivering a profitable operating model, the

Group continues to manage its working capital, efficiently reducing

its utilisation of debt facilities during the year.

Continuing investment in technology during the year, including

the implementation of new integrated financial systems, will enable

the Group to drive further operational efficiencies over coming

years.

Revenue

With the Group's operating structure now more closely aligned to

meeting client needs, the Board has focused reporting by client

type, split between Public and Private Sectors and this shift is

reflected in the segmental reporting of revenue.

The continued wind down in 2020 of the SG framework was

compounded by the impact of the pandemic on new business,

particularly in the private sector. As a result, total revenue for

2020 was lower at GBP57.8m (2019: GBP80.4m).

Segmental performance

Public sector

Despite the turmoil caused by the pandemic, the Group has

demonstrated its strength in the public sector with an increase in

revenue across a number of key clients. The Group has remained

close to its Public Sector clients, assisting several with the

transition to remote working and supporting changes they have made

to projects in light of the shift in priorities forced upon them by

Covid.

With many key digital transformation projects largely unaffected

by Covid during 2020 and some clients, including ONS, creating new

projects in response to the pandemic, non-SG framework revenues for

the year increased by GBP7m, partially offsetting the impact of the

wind down of the SG framework.

Overall public sector revenue for the year was GBP43.3m (2019:

GBP58.1m). External contribution as a % of revenue was 9.0% (2019:

9.8%), the slight decline by 0.8% principally a consequence of the

conclusion of the UK government FastStream managed service project

that contributed GBP0.5m in 2019.

Private sector

With the private sector impacted most by the pandemic, new

business activity dramatically slowed and projects were delayed as

private sector clients assessed the impact of the pandemic during

the first half of 2020. Overall revenues from the private sector

declined by GBP7.8m to GBP14.5m in 2020 (2019: GBP22.3m) due to a

combination of new business activity dramatically slowing as

clients dealt with the impact of the pandemic and an active move

away from a low margin partnerships arrangement with Avanade. With

the focus on higher margin activities, external contribution as a %

of revenue has increased to 11.7% (2019: 10.8%).

Encouragingly, the Group has seen increased activity from

private sector clients and prospects during the latter months of

2020 and the beginning of 2021 and expect the increase in new

business opportunities will provide a platform for growth in

2021.

Reconciliation of revenue to adjusted operating profit

GBP million 2020 2019

Revenue 57.8 80.4

------- -------

Contractor Costs (52.3) (72.3)

------- -------

External contribution 5.6 8.1

------- -------

Selling & administration expenses(1) (4.4) (6.7)

------- -------

Share-based payment charges (0.1) (0.2)

------- -------

Depreciation & amortisation (0.6) (0.8)

------- -------

Operating profit(1) 0.5 0.4

------- -------

1 - Excludes from the Income Statement the impact of

non-underlying items of GBP0.4m in 2020 (2019: GBP1.2m)

Selling & administrative costs

During the year, the Group completed the operational

transformation that it commenced in 2019, meeting its objective of

improving operational efficiency and reducing its cost base (both

fixed and variable costs). As a direct result of the transformation

programme, the Group has removed GBP4.2m of costs from the

business, enabling it to reinvest GBP1.6m in key new client focused

roles and a new integrated IT infrastructure. The net reduction in

costs of GBP2.6m from the transformation programme combined with

earlier committed cost reductions in 2018 and early 2019 bring the

total reduction in selling and administrative costs between 2018

and 2020 to GBP3.7m (a decrease of 46%).

Depreciation and amortisation

In accordance with IFRS 16, the 2020 results are presented with

lease assets and liabilities recognised in the Group's Statement of

Financial Position, where the Group is the lessee.

Non-underlying items

The Board measures the performance of the Group after excluding

costs (and income) that would not be incurred during the normal

operation of the business and classify these exceptional costs

under the category of non-underlying items. With the completion of

the restructuring during 2020 and no significant non-underlying

items being incurred in the second half of 2020 the total for the

year was GBP0.4m (2019: GBP1.2m) a significant reduction on the

prior year. A detailed analysis of the non-underlying items is

provided in note 5.

Taxation

The tax charge on the loss before tax was GBP0.15m (2019:

GBP0.03m), mainly representing a deferred tax adjustment in respect

of prior periods to claim capital allowances offset by a change in

the rate of corporation tax. The Group did not provide for

corporation tax payable in 2020 due to the utilisation of Group

relief and the availability of carried forward deductible timing

differences and tax losses.

Earnings per share and dividend

The basic loss per share from continuing operations was 0.46

pence (2019: loss of 1.05 pence per share). The Group's results for

both 2020 and 2019 were impacted by significant restructuring

costs.

The Board does not propose a dividend for 2020 (2019: nil) but

will keep the position under review.

Statement of financial position

Trade and other receivables

Despite the disruption caused by the pandemic and distraction

inevitably caused by the implementation of a new financial system,

the Group has maintained its excellent performance on trade

debtors. Group debtor days (calculated on billings on a countback

basis) at the end of the year were 14 days (2019: 12 days).

Overall Trade and other receivables decreased during the year to

GBP6.1m (2019: GBP6.7m). This was a direct result of the reduction

in contractor numbers during the year (contractors at the end of

December 2020 were 514 compared with 648 at the end of December

2019).

Trade and other payables

Trade and other payables decreased during the year by GBP1.4m to

GBP4.6m (2019: GBP6.0m). GBP0.7m of the decrease is directly

attributable to payments in 2020 for amounts owed to contractors at

the end of 2019 that were delayed due to the timing of public

holidays. A further GBP0.3m of the decrease is the payment in 2020

of non-underlying costs accrued in 2019. The other key movements in

the year were the reduction in contractor numbers accounting for a

decrease of circa GBP0.8m which was partially offset by an increase

in VAT accruals with the deferral under the government scheme of

GBP0.3m of VAT payments until 2021.

At the year end, creditor days were 23 days (2019: 24 days).

Loans and borrowings

Loans and borrowings represent the Group's debt under its

asset-based lending ("ABL") facility. This is a working capital

facility and linked to the same cycle as trade receivables. The

asset-based lending facility has been in place with PNC Business

Credit ("PNC") since 2010 in substantially the same form and was

last renewed in May 2019.

As a result of the significant improvements made in working

capital management over the last two years the Group has reduced

its utilisation of existing debt facilities. In 2020 the average

borrowings were GBP1.6m and the Group only borrowed more than GBP3

million for 29 days during the year.

With the latest two-year extension on the PNC facility due to

end in May 2021 the Board took the decision to explore new

financing options that could provide the Group with a more cost

effective and flexible debt facility that better meets its future

growth ambitions.

On 20 April 2021 the Group signed an agreement with Leumi ABL

for a new 3-year GBP9m ABL facility. The new facility increases the

amount that can be borrowed against billed and unbilled receivables

and crucially the Group will only pay fees on amounts it borrows

(under the expiring PNC facility the Group were charged a 1% fee

for any unutilised facility).

The new facility has a fixed rate for borrowing of 2% above base

for receivables and 2.9% above base for unbilled receivables

(expiring PNC facility has a rate of 2% above base for all

receivables and an additional 1% charge for unutilised funds). It

is expected that the new terms will reduce annual borrowing costs

and the increase in amounts that can be borrowed against billed and

unbilled receivables will give the group greater flexibility when

utilising the facility.

Cash flow and net debt

During the period the Group generated GBP0.4m of cash from

operating activities (excluding non-underlying items) and also

benefited from a deferral of GBP0.3m of VAT payments until 2021

under a government scheme. These cash inflows were offset by

GBP0.4m of cash outflows for finance costs for the Group and

GBP0.4m of payments for 2020 non-underlying items. In addition to

the normal course cash movements in 2020 the Group also made

payments totalling GBP1m that related to one-off events in 2019,

GBP0.7m being the payment to contractors of 2019 fees delayed due

to public holidays (as previously noted) and GBP0.3m of

non-underlying items accrued in 2019.

Defined benefit pension surplus

As a result of a strong investment performance during the year

increasing scheme assets, the Defined Benefit Pension has moved

from a net deficit of GBP0.9m at the beginning of the year to a net

surplus of GBP0.2m at the end of the year. The Group will commence

a triennial actuarial review of the pension in April 2021 and the

outcome of this review (expected in 2022) will guide any future

contributions the Group agrees to pay. During 2020 the Group paid

GBP0.3m contributions to the scheme.

Consolidated Income Statement for the year ended 31 December

2020

2019

(Restated(2)

2020 )

Notes GBP'000 GBP'000

------------------------------------------ ------- ---------- --------------

Revenue 3 57,827 80,409

Contractor costs 4 (52,266) (72,302)

------------------------------------------ ------- ---------- --------------

External contribution 5,561 8,107

------------------------------------------ ------- ---------- --------------

Operating costs before non-underlying

items 4 (5,091) (7,660)

------------------------------------------ ------- ---------- --------------

Operating profit before non-underlying

items 470 447

------------------------------------------ ------- ---------- --------------

Non-underlying items 5 (447) (1,172)

------------------------------------------ ------- ---------- --------------

Operating profit/(loss) 23 (725)

------------------------------------------ ------- ---------- --------------

Finance costs 7 (348) (332)

------------------------------------------ ------- ---------- --------------

Loss before tax (325) (1,057)

------------------------------------------ ------- ---------- --------------

Analysed as:

Adjusted profit before tax(1) 122 115

Non-underlying items 5 (447) (1,172)

------------------------------------------ ------- ---------- --------------

Tax charge 8 (145) (25)

------------------------------------------ ------- ---------- --------------

Loss for the year attributable to owners

of the parent (470) (1,082)

------------------------------------------ ------- ---------- --------------

Loss per share

Basic 9 (0.46p) (1.05p)

Diluted 9 (0.46p) (1.05p)

------------------------------------------ ------- ---------- --------------

(1) Adjusted profit before tax is a non-IFRS alternative

performance measure, defined as profit before tax and

non-underlying items.

(2) The income statement has been presented by function rather

than nature. Refer to Note 1 Accounting Policies under

'Presentation of income statement'

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2020

2020 2019

Notes GBP'000 GBP'000

------------------------------------------------- -------- --------- ---------

Loss for the year (470) (1,082)

Other comprehensive income

Items that will never be reclassified to profit

or loss

Remeasurement of defined benefit pension scheme 1,041 931

Deferred taxation on remeasurement of defined

pension scheme 11 (198) (158)

Other comprehensive income for the year after

tax 843 773

------------------------------------------------- -------- --------- ---------

Total comprehensive income/(expense) for the

year attributable to owners of the parent 373 (309)

------------------------------------------------- -------- --------- ---------

Consolidated Statement of Changes in Equity for the year ended

31 December 2020

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

At 1 January 2020 2,053 33,244 14,319 34,560 (77,753) 6,423

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Share options - value

of employee services - - - - 90 90

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 90 90

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Loss for the year - - - - (470) (470)

Remeasurement of defined

benefit pension scheme - - - - 1,041 1,041

Deferred taxation on

remeasurement of defined

pension scheme taken

directly to equity - - - - (198) (198)

At 31 December 2020 2,053 33,244 14,319 34,560 (77,290) 6,886

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

At 31 December 2018 2,053 33,244 14,319 34,560 (77,612) 6,564

Adoption of IFRS 16 - - - - 6 6

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Revised at 1 January

2019 2,053 33,244 14,319 34,560 (77,606) 6,570

Share options - value

of employee services - - - - 162 162

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 162 162

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

Loss for the year - - - - (1,082) (1,082)

Remeasurement of defined

benefit pension scheme - - - - 931 931

Deferred taxation on

remeasurement of defined

pension scheme taken

directly to equity - - - - (158) (158)

--------------------------- --------- ---------- ------------ ---------- ---------- ---------

At 31 December 2019 2,053 33,244 14,319 34,560 (77,753) 6,423

Consolidated Statement of Financial Position as at 31 December

2020

2020 2019

Notes GBP'000 GBP'000

------------------------------- -------- --------- ---------

Assets

Non-current assets

Goodwill 10 4,594 4,594

Other intangible assets 6 32

Property, plant and equipment 23 43

Right-of-use assets 247 395

Trade and other receivables 87 -

Investments in subsidiaries - -

Deferred tax assets 11 627 970

Retirement benefit asset 208 -

Total non-current assets 5,792 6,034

------------------------------- -------- --------- ---------

Current assets

Trade and other receivables 6,062 6,739

Cash and cash equivalents 3,172 4,116

Total current assets 9,234 10,855

------------------------------- -------- --------- ---------

Total assets 15,026 16,889

------------------------------- -------- --------- ---------

Liabilities

Current liabilities

Loans and borrowings (2,941) (2,719)

Lease liabilities (321) (325)

Trade and other payables (4,610) (6,012)

Provisions (139) (324)

Total current liabilities (8,011) (9,380)

------------------------------- -------- --------- ---------

Non-current liabilities

Lease liabilities (87) (173)

Trade and other payables - -

Provisions (42) (21)

Retirement benefit liability - (892)

Total non-current liabilities (129) (1,086)

------------------------------- -------- ---------

Total liabilities (8,140) (10,466)

------------------------------- -------- --------- ---------

Net assets 6,886 6,423

------------------------------- -------- --------- ---------

Shareholders' equity

Called up share capital 2,053 2,053

Share premium reserve 33,244 33,244

Capital redemption reserve 14,319 14,319

Other reserves 34,560 34,560

Retained earnings (77,290) (77,753)

------------------------------- -------- ---------

Total shareholders' equity 6,886 6,423

------------------------------- -------- --------- ---------

Consolidated Statement of Cash Flows for the year ended 31

December 2020

2020 2019

Notes GBP'000 GBP'000

------------------------------------------------------ ------ --------- ----------

Operating activities

(Loss)/profit for the year (470) (1,082)

Adjustments for:

Net finance expense 7 348 332

Share-based payment expense 90 162

Income tax charge/(credit) 8 145 25

Amortisation of intangible assets 26 52

Depreciation of property, plant and equipment 20 56

Depreciation and impairment of right-of-use

assets 540 840

Loss on write down of assets - 16

Lease liability credit (21) -

678 401

Working capital movements

Decrease in trade and other receivables 764 5,233

(Decrease)/increase in trade and other payables (1,402) (2,249)

(Decrease)/increase in provisions (165) 282

Payments to retirement benefit plan (325) (249)

------------------------------------------------------ ------ --------- ----------

Net cash flows (used in)/from operating activities (450) 3,418

------------------------------------------------------ ------ --------- ----------

Investing activities

Purchase of property, plant and equipment - (44)

Net cash flows used in investing activities - (44)

------------------------------------------------------ ------ --------- ----------

Financing activities

Drawdown/(repayment) of finance facility 222 (4,192)

Principal repayment of lease liabilities (649) (764)

Net movements on intercompany funding - -

Interest paid 7 (67) (131)

------------------------------------------------------ ------ --------- ----------

Net cash flows (used in)/from financing activities (494) (5,087)

------------------------------------------------------ ------ --------- ----------

Net (decrease)/increase in cash and cash equivalents (944) (1,713)

------------------------------------------------------ ------ --------- ----------

Cash and cash equivalents at the beginning of

the year 4,116 5,829

------------------------------------------------------ ------ --------- ----------

Cash and cash equivalents at the end of the

year 3,172 4,116

------------------------------------------------------ ------ --------- ----------

Notes to the Audited Preliminary Results

1 Accounting policies

Basis of preparation

Parity Group plc (the "Company") is a company incorporated and

domiciled in the UK.

The financial information set out in this document does not

constitute the Group's statutory accounts for the year ended 31

December 2020 or 2019 but is derived from those accounts. Statutory

accounts for 2019 have been delivered to the registrar of

companies. The auditors have reported on those accounts; their

reports were (i) unqualified, (ii) contained an Emphasis of Matter

highlighting a material uncertainty related on going concern (iii)

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006. Statutory accounts for 2020 will be delivered

to the registrar of companies in due course. The auditors have

reported on those accounts; their reports were (i) unqualified,

(ii) did not contain an Emphasis of Matter highlighting a

materiality uncertainly related to going concern and (iii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

The financial statements for the year ended 31 December 2020

(including the comparatives for the year ended 31 December 2019)

were approved and authorised for issue by the Board of Directors on

20 April 2021. This results announcement for the year ended 31

December 2020 was also approved by the Board on 20 April 2021.

The financial information set out in these audited preliminary

results has been prepared and approved by the Directors in

accordance with International Financial Reporting Standards (IFRS)

in conformity with the requirements of the Companies Act 2006. The

policies have been consistently applied to all the years presented

unless otherwise stated.

The Group meets its day to day working capital requirements

through an asset-based finance facility. The facility contains

certain financial covenants which have been met throughout the

period. On 20 April 2021, the Group signed an agreement with Leumi

ABL for a new 3-year GBP9m asset-based lending facility. The new

facility increases the amount that can be borrowed against billed

and unbilled receivables and it is expected that the new terms will

reduce annual borrowing costs. The increase in amounts that can be

borrowed will give the Group greater flexibility.

The financial statements have been prepared on a going concern

basis. The Directors have reviewed the Group's cash flow forecasts

for the period to 31 December 2022, taking account of reasonably

possible changes in trading performance, including potential

downsides from the ongoing impact of Covid-19. Downside

sensitivities have included reduced levels of new business and in

these scenarios, the Directors do not anticipate issues with the

Group's financing requirements. The Group also modelled available

headroom under the new facility and consider that the new facility

comfortably meets the Group's financing requirements.

Presentation of income statement

During the period, the Directors undertook a review of the financial statements

of the Group and this resulted in a change to the presentation of the income

statement. The revised presentation, which involves moving from a classification

of expenses by nature to a classification of expenses by function, was deemed

to be more appropriate and provides information that is more reliable and

relevant to users of the financial statements. In particular, presenting

external contribution gives a better understanding of the income generated

by services provided by the Group. External contribution is defined as revenue

less all external contractor and sub-contracted costs. In accordance with

IAS 1 'Presentation of Financial Statements', the Group has re-presented

the income statements for comparative periods. Other than re-presentation

of the income statement, no changes have been made to the comparative financial

statements.

Alternative performance measures

The Group uses certain alternative performance measures to report its results

as stated before non-underlying items. These are non-IFRS alternative performance

measures which the Directors consider can assist with an understanding of

the underlying performance of the Group and comparison of performance across

periods. They are not a substitute for and are not superior to any IFRS

measure.

Non-underlying items

The presentation of the alternative performance measure of adjusted profit

before tax and adjusted operating profit excludes non-underlying items.

The Directors consider that an underlying profit measure can assist with

an understanding of the underlying performance of the Group and comparison

of performance across periods. Items are classified as non-underlying by

nature of their magnitude, incidence or unpredictable nature and their separate

identification results in a calculation of an underlying profit measure

that is consistent with that reviewed by the Board in their monitoring of

the performance of the Group. Events which may give rise to the classification

of items as non-underlying include gains or losses on the disposal of a

business, restructuring of a business, transaction costs, litigation and

similar settlements, asset impairments and onerous contracts.

Adjusted profit before tax is defined as profit before tax and non-underlying

items.

Adjusted operating profit is defined as operating profit before non-underlying

items.

In previous periods, the Group's results separately presented non-recurring

items as a separate section of the income statement. The directors consider

that all items previously classified as non-recurring are non-underlying

and have reclassified these costs as such for all comparative periods in

accordance with IAS 8 'Accounting Policies, Changes in Accounting Estimates

and Errors'.

2 Segmental information

Factors that management used to identify the Group's reporting

segments

In accordance with IFRS 8 'Operating Segments' the Group's

management structure, and the reporting of financial information to

the Chief Operating Decision Maker (the Group Board), have been

used as the basis to define reporting segments.

Description of the types of services from which each reportable

segment derives its revenues

During the period, the Group changed the structure of its

organisation to be based around a combined operating model targeted

on finding the right solution or combination of solutions to each

clients' needs by way of a single account management function. As

such the previous reporting segments based on the service lines of

Recruitment and Consultancy are no longer the basis on which the

Group is managed and resources are allocated. The basis by which

the Group is now organised and its operating model is structured is

by customer sectors, being the public sector and the private

sector. The reporting of financial information presented to the

Chief Operating Decision Maker, being the Group board of directors,

is consistent with these reporting segments. As these reporting

segments are supported by a combined back office, there is no

allocation of overheads.

In accordance with IFRS 8 'Operating Segments', segmental

information from comparative periods has been restated.

The accounting policies of the operating segments are the same

as those described in the summary of significant accounting

policies.

Public sector Private Total

2020 sector 2020

2020

GBP'000 GBP'000 GBP'000

Revenue 43,283 14,544 57,827

Contractor costs (39,405) (12,861) (52,266)

----------------------- -------------- --------- ---------

External contribution 3,878 1,683 5,561

----------------------- -------------- --------- ---------

Public sector Private Total

sector

2019 2019 2019

(Restated) (Restated) (Restated)

GBP'000 GBP'000 GBP'000

Revenue 58,117 22,292 80,409

Contractor costs (52,426) (19,876) (72,302)

----------------------- -------------- ------------ ------------

External contribution 5,691 2,416 8,107

----------------------- -------------- ------------ ------------

All segment assets and liabilities are based in the UK.

3 Revenue

All of the Group's revenue derives from contracts with

customers. Trade receivables, amounts recoverable on contracts and

accrued income arise from contracts with customers.

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

2020 2019

GBP'000 GBP'000

------------------------------------------ --------- ---------

Services transferred over time 57,790 80,023

Services transferred at a point in time 37 386

------------------------------------------ --------- ---------

Revenue 57,827 80,409

------------------------------------------ --------- ---------

The Group's revenue disaggregated by primary geographical market

is as follows:

2020 2019

GBP'000 GBP'000

----------------- --------- ---------

United Kingdom 55,235 78,004

European Union 2,577 2,405

Other 15 -

----------------- --------- ---------

Revenue 57,827 80,409

----------------- --------- ---------

The largest single customer in the public sector contributed 25%

or GBP11.0m to public sector revenue (2019: 25% or GBP14.6m). The

largest single customer in the private sector contributed 46% or

GBP6.7m to private sector revenue (2019: 28% or GBP6.3m).

Revenue includes GBP134,000 (2019: GBP30,000) that was included

as a contract liability at the beginning of the period. This

balance was held within payments in advance in trade and other

payables. The Group does not currently have any contract assets as

it does not enter in to contracts where, once performance has

occurred, the Group's right to consideration is dependent upon

anything other than the passage of time.

4 Operating expenses

2020 2019

GBP'000 GBP'000

------------------------------------------- ---- ---- --------- ---------

Contractor costs 52,266 72,302

------------------------------------------------------- --------- ---------

Employee benefit costs

- wages and salaries 2,975 5,008

- social security costs 342 576

- other pension costs 102 159

------------------------------------------------------- --------- ---------

3,419 5,743

----------------------------------------------------- --------- ---------

Depreciation, amortisation and impairment

Amortisation of intangible assets -

software 26 52

Depreciation of leased property, plant

and equipment - 7

Depreciation of owned property, plant

and equipment 20 49

Depreciation of right-of-use assets 540 698

Impairment of right-of-use assets - 142

------------------------------------------------------- --------- ---------

586 948

----------------------------------------------------- --------- ---------

All other operating expenses

Occupancy costs 44 170

IT costs 464 317

Net exchange (gain)/loss (2) 13

Equity settled share-based payment

charge 90 162

Other operating costs 937 1,479

------------------------------------------------------- --------- ---------

1,533 2,141

----------------------------------------------------- --------- ---------

Total operating expenses 57,804 81,134

------------------------------------------------------- --------- ---------

During the year the Group obtained the following services from

the Group's auditors:

Grant Thornton

UK LLP

2020 2019

GBP'000 GBP'000

------------------------------------------------------ --------- ---------

Audit of the Group, Company and subsidiary financial

statements 73 65

Tax compliance 16 16

Total other services 16 16

------------------------------------------------------ --------- ---------

Total fees 89 81

------------------------------------------------------ --------- ---------

All other services have been performed in the UK.

5 Non-underlying items

2019 2019

GBP'000 GBP'000

--------------------------------------------- --------- ---------

Restructuring

* Costs related to employees 370 940

* Costs related to premises (11) 230

* Other costs 88 68

Receipt from previously impaired receivable - (66)

447 1,172

--------------------------------------------- --------- ---------

Items are classified as non-underlying by nature of their

magnitude, incidence or unpredictable nature and their separate

identification results in a calculation of an underlying profit

measure that is consistent with that reviewed by the Board in their

monitoring of the performance of the Group. In previous periods,

the Group's results separately presented non-recurring items as a

separate section of the income statement. The directors consider

that all items classified as non-recurring in previous periods are

non-underlying and have reclassified these costs as such.

Non-underlying items during 2020 include costs related to the

ongoing restructuring of the Group, including employee termination

payments and fees for professional services.

6 Average staff numbers

The average number of staff employed by the Group during the

year was as follows:

2020 2019

Number Number

------- -------- --------

Group 44 76

-------- -------- --------

At 31 December 2020, the Group had 41 employees (2019: 57).

7 Finance costs

2020 2019

GBP'000 GBP'000

------------------------------------------------- --------- ---------

Interest expense on financial liabilities 67 131

Interest expense on lease liabilities 19 24

Interest income on lease assets (4) -

Net finance costs in respect of post-retirement

benefits 266 177

--------------------------------------------------- --------- ---------

348 332

------------------------------------------------- --------- ---------

The interest expense on financial liabilities represents

interest paid on the Group's asset-based financing facilities. A 1%

increase in the base rate would have increased annual borrowing

costs by approximately GBP17,000 (2019: GBP26,000).

8 Taxation

2020 2019

GBP'000 GBP'000

--------------------------------------------- ---- ---- --------- ---------

Current tax

Current tax on profit for the year - -

Total current tax expense - -

--------------------------------------------- ---- ---- --------- ---------

Deferred tax

Accelerated capital allowances (4) (12)

Origination and reversal of other temporary

differences 2 (20)

Adjustments in respect of prior periods 230 57

Change in corporation tax rate (83) -

--------------------------------------------------------- --------- ---------

Total deferred tax charge 145 25

--------------------------------------------------------- --------- ---------

Tax charge 145 25

--------------------------------------------------------- --------- ---------

The adjustment in respect of prior periods of GBP230,000 (2019:

GBP57,000) largely relates to decisions to claim or disclaim

capital allowances.

There is no current tax payable by the Group for 2020 (2019:

GBPnil).

The Group's profits for this accounting period are subject to

tax at a rate of 19% (2019: 19%). The decision to reduce the rate

to 17% due to be effective 1 April 2020 that was substantively

enacted on 15 September 2016 was reversed during the year. The

decision to keep the rate at 19% was substantively enacted on 17

March 2020. As such the tax rate of 19% (2019: 17%) has been

applied in calculating the UK deferred tax position of the

Group.

The reasons for the difference between the actual tax credit for

the year and the standard rate of corporation tax in the UK applied

to profit for the year are as follows:

2020 2019

GBP'000 GBP'000

Loss before tax (325) (1,057)

------------------------------------------------------------ ------ --------

Expected tax credit based on the standard rate

of UK

corporation tax of 19% (2019: 19%) (62) (201)

Expenses not allowable for tax purposes (2) 69

Adjustments in respect of prior periods 230 57

Tax losses not recognised 85 91

Change in corporation tax rate (83) -

Other (23) 9

------------------------------------------------------------ ------ --------

Tax charge 145 25

------------------------------------------------------------ ------ --------

Tax on each component of other comprehensive income is as

follows:

2020 2019

Before After Before After

tax Tax tax tax Tax tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- --------- ---------- --------- --------- ---------- ---------

Remeasurement of defined benefit

pension scheme 1,041 (198) 843 931 (158) 773

---------------------------------- --------- ---------- --------- --------- ---------- ---------

9 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the year by the weighted average number of fully paid

ordinary shares in issue during the year.

Diluted earnings per share is calculated on the same basis as

the basic earnings per share with a further adjustment to the

weighted average number of fully paid ordinary shares to reflect

the effect of all dilutive potential ordinary shares.

Weighted Weighted

average average

number number

of Loss of Loss

Loss shares per share Loss shares per share

2020 2020 2020 2019 2019 2019

GBP'000 '000 Pence GBP'000 '000 Pence

---------------------------- ---------- --------- ------------ ---------- --------- ------------

Basic (470) 102,624 (0.46) (1,082) 102,624 (1.05)

Effect of dilutive options - - - - - -

Diluted (470) 102,624 (0.46) (1,082) 102,624 (1.05)

As at 31 December 2020 the number of ordinary shares in issue

was 102,624,020 (2019: 102,624,020).

10 Goodwill

The carrying amount of goodwill is allocated to the Group's two

separate continuing cash generating units (CGUs), being Parity

Professionals Limited and Parity Consultancy Services Limited.

Carrying amounts are as follows:

Parity Consultancy

Parity Professionals Services

Limited Limited Total

GBP'000 GBP'000 GBP'000

------------------------------- ----------------------- ------------------- ----------

Carrying value

Balance at 1 January 2019 and

31 December 2019 2,642 1,952 4,594

------------------------------- ----------------------- ------------------- ----------

Balance at 1 January 2020 and

31 December 2020 2,642 1,952 4,594

------------------------------- ----------------------- ------------------- ----------

Goodwill was tested for impairment in accordance with IAS 36 at

the year end and no impairment charge was recognised. Impairment

calculations include the effect of changes following the

application of IFRS 16.

The recoverable amounts of the CGUs are based on value in use

calculations using the pre-tax cash flows based on budgets approved

by management for 2021. Years from 2022 to 2026 are based on the

budget for 2020 projected forward at expected growth rates, with no

growth assumed beyond these years. This approach is considered

prudent based on current expectations of the 2021 long-term growth

rate.

Major assumptions are as follows:

Parity Professionals Parity Consultancy

Limited Services Limited

% %

2020

Discount rate 11.3 11.3

Forecast revenue growth 12.2-13.3 10.0-15.9

Operating margin 2021 3.0 4.0

Operating margin 2022 onward 3.7-3.8 4.1-12.1

2019

Discount rate 13.0 12.5

Forecast revenue growth 2.0 10.0

Operating margin 2020 2.4 8.5

Operating margin 2021 onward 2.5-2.8 8.9-9.9

Discount rates are based on the Group's weighted average cost of

capital.

Forecast revenue growth rates are based on past experience and

future expectations of economic conditions. Growth for the CGUs is

assumed to be higher than the long-term growth rate for the UK

economy due to the following factors:

-- There is focused investment in growing new clients and

service lines, including areas that suffered as a result of the

Covid-19 pandemic;

-- The business has recruited new senior hires in sales

functions to focus on new business opportunities;

-- There is the expectation of further investment in and exploitation of technology; and

-- Recent new client wins and contract extensions help to underwrite the growth forecasts.

A 10% change in any of the underlying assumptions used in the

discounted cash flow forecasts would not lead to the carrying value

of goodwill being materially in excess of their recoverable

amounts.

11 Deferred taxation

2020 2019

GBP'000 GBP'000

------------------------------------------------- -------- --------

At 1 January 970 1,153

Recognised in other comprehensive income

Remeasurement of defined benefit pension scheme (198) (158)

Recognised in the income statement

Adjustments in relation to prior periods (230) (57)

Change in corporation tax rate 83 -

Capital allowances in excess of depreciation 4 12

Other short-term timing differences (2) 20

At 31 December 627 970

------------------------------------------------- -------- --------

The deferred tax asset of GBP627,000 (2019: GBP970,000)

comprises:

2019 2019

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Depreciation in excess of capital allowances 632 775

Other short-term timing differences 34 43

Retirement benefit (asset)/liability (39) 152

---------------------------------------------- --------- ---------

627 970

---------------------------------------------- --------- ---------

A deferred tax asset for deductible temporary differences is not

recognised unless it is more likely than not that there will be

taxable profits in the foreseeable future against which the

deferred tax asset can be utilised. At the balance sheet date, the

Directors assessed the probability of future taxable profits being

available against which Parity Consultancy Services Limited could

recognise a deferred tax asset for previously unrecognised

deductible temporary differences. The review concluded that it is

probable that future taxable profits will be available. As such,

the Directors have recognised a deferred tax asset for all

deductible temporary differences available to Parity Consultancy

Services Limited.

A deferred tax asset for unused tax losses carried forward is

normally recognised on the same basis as for deductible temporary

differences. However, the existence of the unused tax losses is

itself strong evidence that future taxable profit may not be

available. Therefore, when an entity has a history of recent

losses, the entity recognises a deferred tax asset arising from

unused tax losses only to the extent that there is convincing

evidence that sufficient taxable profit will be available against

which the unused tax losses can be utilised. At the balance sheet

date, the Directors considered recognising a deferred tax asset for

previously unrecognised unused tax losses carried forward by Parity

Consultancy Services Limited. The review concluded that given the

company's history of relatively recent tax losses and the

additional requirement of providing convincing evidence that

sufficient taxable profit will be available, a prudent approach

would be taken and deferred tax would remain unrecognised for tax

losses carried forward by the company.

The Directors believe that the deferred tax asset recognised is

recoverable based on the future earning potential of the Group and

the individual subsidiaries. The forecasts for Parity Professionals

Limited comfortably support the unwinding of the deferred tax asset

held by this company of GBP335,000 (2019: GBP378,000) and the

forecasts for Parity Consultancy Services Limited comfortably

support the unwinding of the deferred tax asset held by this

company of GBP292,000 (2019: GBP592,000).

The deferred tax asset at 31 December 2020 has been calculated

on the rate of 19% substantively enacted at the balance sheet date

(2019: 17%).

The movements in deferred tax assets during the period are shown

below:

(Charge)/credit Charge to

to other comprehensive

Asset income income

2020 statement 2020

GBP'000 2020 GBP'000

GBP'000

-------------------------------------- ---------- ------------------ ----------------------

Depreciation in excess of capital

allowances 632 (143) -

Other short-term timing differences 34 (9) -

Retirement benefit (asset)/liability (39) 7 (198)

-------------------------------------- ---------- ------------------ ----------------------

At 31 December 2020 627 (145) (198)

-------------------------------------- ---------- ------------------ ----------------------

Charge to

(Charge)/credit other comprehensive

Asset to income income

2019 statement 2019

GBP'000 2019 GBP'000

GBP'000

-------------------------------------- ---------- ------------------ ----------------------

Depreciation in excess of capital

allowances 775 (45) -

Other short-term timing differences 43 40 -

Retirement benefit liability 152 (20) (158)

At 31 December 2019 970 (25) (158)

-------------------------------------- ---------- ------------------ ----------------------

The Group has unrecognised carried forward tax losses of

GBP29,392,000 (2019: GBP30,599,000). The Group has unrecognised

capital losses carried forward of GBP282,441,000 (2019:

GBP282,441,000). These losses may be carried forward

indefinitely.

[ ] Net cash represents cash and cash equivalents less loans and

borrowings and excluding leases

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAELEADNFEAA

(END) Dow Jones Newswires

April 21, 2021 02:00 ET (06:00 GMT)

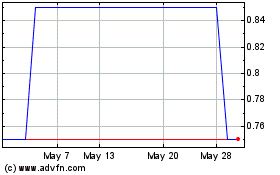

Partway (AQSE:PTY.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Partway (AQSE:PTY.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024