Zambeef Products PLC Trading Statement (5465V)

04 December 2023 - 7:09PM

UK Regulatory

TIDMZAM

RNS Number : 5465V

Zambeef Products PLC

04 December 2023

ZAMBEEF PRODUCTS PLC

Incorporated in the Republic of Zambia

Company registration number: 31824

Share Code: ZAMBEEF

ISIN: ZM0000000201

TRADING STATEMENT

In accordance with the Lusaka Securities Exchange ("LuSE")

Listings Requirements, the Board of Directors of Zambeef Products

Plc (the "Company") hereby advises the shareholders of the Company

that the Total Basic Earnings per Share for the financial year

ended 30 September 2023 is expected to be 306% and 272% higher (in

Kwacha and US Dollar terms respectively) than that of the previous

financial year ended 30 September 2022.

The Company reiterates the guidance provided in the Company's

previous Trading Update of 7 November 2023, which included the

following information, and therefore there is no change to the most

recent market expectations as updated on 7 November 2023.

Extract from Trading Update of 7 November 2023:

"The Group's forward guidance on financial trading performance

for the year ended 30 September 2023 is expected to be above market

expectations, despite a challenging operating environment with

revenue, gross profit and adjusted EBITDA* (all in USD) expected to

be between 5-15% higher than market expectations.

Reported profit before tax (USD) is estimated to be c.30% higher

than current market expectations. A higher taxation charge is

expected to result in reported profit after tax below current

market expectations but above the previous financial year.

The Group continued to see increasing demand for its products,

supported by a price moderation approach, resulting in volume

growth across most product categories. Lower than expected selling

prices and higher input costs (which couldn't fully be passed on to

the consumer), including fuel and electricity, put pressure on

gross margins which moderated in the second half. During H2, the

Group had strong performance enhanced by better overall cost

control.

The exchange rate depreciated steadily in H1 however, was more

turbulent in H2, beginning the financial year at K15.9/USD and

ending the period at K21.31/USD."

The Company expects its results for the year ended 30 September

2023 to be released on 6 December 2023. Accordingly, shareholders

are advised to exercise caution when dealing in the Company's

Securities until the publication of results. The shareholders are

further advised that the information contained in this Trading

Statement has not been reviewed nor reported on by the external

auditors.

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation, impairments, loss on equity accounted

investments, loss on disposal and net unrealised foreign exchange

losses.

For further information, please visit www.zambeefplc.com or

contact:

Zambeef Products plc Tel: +260 (0) 211 369003

Faith Mukutu , Chief Executive Office

M'boo Mumba, Chief Financial Officer

Cavendish Capital Markets Limited (Nominated Adviser and Broker) Tel: +44 (0) 20 7220 0500

Ed Frisby/Abigail Kelly (Corporate Finance)

Tim Redfern (ECM)

Autus Securities Limited (Sponsoring Broker) Tel: +260 (0) 761 002 002

Mataka Nkhoma (Broker)

By order of the Board

Mwansa Mutimushi

Company Secretary

Notes to Editors

Zambeef Products plc is the largest integrated cold chain food

products and agribusiness company in Zambia and one of the largest

in the region, involved in the primary production, processing,

distribution and retailing of beef, chicken, pork, milk, dairy

products, fish, flour and stockfeed, throughout Zambia and the

surrounding region, as well as Nigeria and Ghana.

It has 269 retail outlets throughout Zambia and West Africa.

The Company is one of the largest suppliers of beef in Zambia.

Five beef abattoirs and five feedlots are located throughout

Zambia, with a capacity to slaughter 230,000 cattle a year. It is

also one of the largest chicken producers in Zambia, with a

capacity of 9.4m broilers and 25 million-day-old chicks a year. It

is one of the largest pig abattoirs and pork processing plants in

Zambia, with a capacity to slaughter 102,000 pigs a year, while

it's dairy has a capacity of 120,000 litres per day.

The Group is also one of the largest cereal row cropping

operations in Zambia, with approximately 7,265 hectares of row

crops under irrigation, which are planted twice a year, and a

further 7,924 hectares of rainfed/dry-land crops available for

planting each year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGZMGZRDNGFZG

(END) Dow Jones Newswires

December 04, 2023 03:09 ET (08:09 GMT)

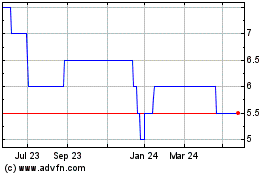

Zambeef Products (AQSE:ZAM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

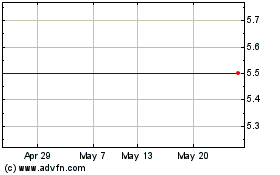

Zambeef Products (AQSE:ZAM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024