Regulatory News:

Antin (Paris:ANTIN):

(€m, unless otherwise indicated)

2023

2022

% change

AUM, in €bn

31.1

30.6

+1.7%

Fee-Paying AUM, in €bn

20.2

19.1

+5.8%

Revenue

282.9

214.2

+32.1%

Underlying EBITDA

175.5

118.5

+48.2%

Underlying EBITDA margin

62%

55%

+7pp

Underlying net income

127.9

79.7

+60.6%

Underlying EPS (after dilution, in €)

0.73

0.44

+65.7%

2023 HIGHLIGHTS

- AUM at more than €31bn, up +1.7%. Fee-Paying AUM at more than

€20bn, up +5.8%

- Robust fundraising in a challenging environment: Flagship Fund

V passed €9.0bn in commitments, fundraising continues into 2024;

NextGen Fund I closed at target size of €1.2bn

- Four investments announced across Flagship and NextGen

investment strategies

- All funds continued to perform on or ahead of plan

- Strong revenue growth of +32.1% with long-term contracted

management fees representing more than 98% of revenue

- Significant underlying EBITDA growth of +48.2%, underlying

EBITDA margin at 62% (vs. 55% in 2022)

- Underlying net income growth of +60.6%

- Proposed full-year dividend of €0.71 per share (+69% vs. last

year), representing a payout ratio of close to 100%

- 2024 outlook: successful completion of fundraising for Flagship

Fund V above €10bn target, underlying EBITDA expected at or above

2023 level

ALAIN RAUSCHER, chairman and CEO,

declared:

“Antin delivered strong financial results

in 2023, with significant growth across all financial metrics,

including considerably higher EBITDA and net income. This is

entirely driven by increased management fees that are long-term

contracted, while the potential for future performance fee revenues

remains substantial.

In a challenging market for fundraising,

we already secured 90% of Fund V's target, raising significant

commitments from existing investors and record commitments from new

investors. We also closed NextGen Fund I at its target. Meanwhile,

our portfolio companies continued to deliver growth and robust

margin improvements, resulting in resilient fund valuations.

Most important, we believe the medium-term

prospects for infrastructure and for Antin are better than ever,

with supportive megatrends such as the energy transition and the

digitalisation of infrastructure providing substantial growth

opportunities.”

ACTIVITY UPDATE

FUNDRAISING

- Fundraising amounted to €1.8bn in 2023 (€2.4bn including

co-investment), of which €1.6bn related to Flagship Fund V and

€0.2bn to NextGen Fund I. Fundraising conditions remained complex,

primarily due to fund investor liquidity and capital allocation

constraints

- Flagship Fund V passed €9.0bn in commitments in 2023,

representing 90% of the Fund’s target size of €10bn and already

close to +40% above the €6.5bn raised for Flagship Fund IV. More

than €5.6bn (~60%) of commitments were raised from returning fund

investors and a record €3.4bn (~40%) of commitments were raised

from new ones. The final close is expected in 2024

- NextGen Fund I successfully held a final closing at

€1.2bn in 4Q 2023, reaching its target size and demonstrating

Antin’s ability to successfully raise capital for new investment

strategies

- Antin also achieved significant strategic fundraising

objectives, including strong re-investments from its existing

fund investors, a significant expansion of its fund investor

base, as well as continued geographic diversification. Across its

three investment strategies, Antin had more than 320 fund investors

at the end of 2023, up +60% since its Initial Public Offering in

September 2021

INVESTMENT ACTIVITY

- Investments totalled €2.0bn in 2023 (€2.1bn including

co-investment), with four investments announced across

Flagship and NextGen

- The cash tender offer for 100% of OPDEnergy was

announced in 2Q 2023 and marked the second portfolio investment of

Flagship Fund V. The offer received regulatory approval of

the Spanish authorities in 1Q 2024. The acquisition of Consilium

Safety, announced in 4Q 2023, marked the third portfolio

investment of Flagship Fund V, resulting in the fund being ~26%

committed as of 31 December 2023

- NextGen Fund I announced two investments in 2023,

including the acquisition of smart grid business PearlX and

a joint venture with Enviro, backed by Michelin, to create

the world’s first large-scale tyre recycling plant. Both

investments demonstrate Antin’s strong commitment to the energy

transition and circular economy. NextGen Fund I was ~48% committed

as of 31 December 2023

- While Mid Cap Fund I announced no new investments in

2023, additional capital was invested in growth and the development

of the existing portfolio companies, resulting in the fund being

~47% committed as of 31 December 2023. Antin announced its

investment in Excellence Imagerie in January 2024, after the end of

the reporting period

EXIT ACTIVITY

- Realisations slowed in 2023, consistent with the broader

private infrastructure exit activity. Antin signed and completed

the sale of Hesley Group in 4Q 2023

- Flagship Fund III and Fund III-B were 38% and 26% realised

respectively as of 31 December 2023. Flagship Fund II was 92%

realised, with one remaining portfolio company

FUND PERFORMANCE

- All funds continued to perform either on plan or above plan,

supported by continued growth and robust margin evolution across

the portfolio, demonstrating the strength of Antin’s risk-reward

investment framework and the resilience of the portfolio companies

held by the Antin Funds

- Flagship Funds II and III are ahead of plan with Gross

Multiples of 2.6x and 1.8x respectively. Flagship Fund IV and Fund

III‑B are early in their post-investment periods and performing on

plan with Gross Multiples of 1.3x and 1.6x. Mid Cap Fund I, NextGen

Fund I and Flagship Fund V are in the investment period. They

continue to deploy capital and build their respective portfolios,

with Gross Multiples of 1.2x, 1.0x and 1.1x respectively

INCOME STATEMENT ANALYSIS

REVENUE

- Revenue reached €282.9m in 2023, up +32.1%. This strong

increase was driven by higher management fees, which accounted for

more than 98% of total revenue. They are generated by funds raised

with a contractual duration of 10 years and provide significant

predictability to Antin’s revenue

- Management fees in 2023 totalled €278.4m, up +33.1% or

€69.2m. They benefited from the scale-up of the Flagship investment

strategy and the successful final closing of the inaugural NextGen

Fund

- Management fees from Flagship Funds grew by €62.5m.

Flagship Fund V generated an additional €91.4m in fees in 2023,

benefitting from a twelve-month contribution to revenue in 2023

compared to a five-month contribution in 2022, and from additional

funds raised during the year. Management fees for Flagship Fund IV

decreased by €22.5m in 2023 as the Fund entered the post-investment

period on 2 August 2022. From that date, Flagship Fund IV began

charging management fees at a lower fee rate on the cost of

investments not yet realised. Due to the realisation of

investments, management fees from Flagship Fund III and Fund III-B

declined by €3.6m and €1.2m respectively

- Management fees generated by Antin’s latest investment

strategy, NextGen, increased by €6.7m in 2023. Fundraising

of NextGen Fund I continued in 2023 until the Fund held its final

closing at target in the fourth quarter

- The effective management fee rate(1) stood at 1.32% in

2023 compared with 1.35% in 2022. The slight decrease in the fee

rate is driven primarily by Flagship Fund IV moving from the

investment period to the post-investment period on 2 August 2022,

and therefore charging a management fee rate of approximately 1.2%

compared to approximately 1.5% before

- In addition, carried interest and investment income

recorded a loss of €(1.2)m in 2023, compared with a gain of €2.1m

in 2022. Carried interest revenue amounted to €(0.1)m and

investment income amounted to €(1.0)m in 2023. The recognition of

negative investment income is primarily due to the ordinary J‑curve

effects related to Flagship Fund V and NextGen Fund I, which are

early in the fund’s life cycle. In particular, Flagship Fund V is

incurring fund level expenses for the evaluation of investment

opportunities and management fees while only one portfolio company

was subject to revaluation

EBITDA

- Underlying EBITDA reached €175.5m in 2023, up +48.2%,

significantly above the revenue growth of +32.1%. It benefited from

operating leverage, resulting in a larger increase in revenues than

in operating expenses, following the hiring of employees and

investments in the build-out of the operating platform in prior

years. Underlying EBITDA margin stood at 62%, up 7

percentage points compared to 2022. The growth in underlying EBITDA

and the margin expansion demonstrate the scalability of Antin’s

business model and are the result of operating leverage embedded in

our business model

- Total operating expenses amounted to €107.4m in 2023, an

increase of +12.2%, driven by higher personnel expenses

- Personnel expenses stood at €74.2m in 2023, up +15.1%

driven by higher headcount to support growth, inflation-linked wage

increases and promotions

- The number of employees, excluding the fund

administration team based in Luxembourg, grew by +10.9%, from 174

as of 31 December 2022 to 193 as of 31 December 2023. The number of

employees increased primarily in the investment team and in

operations. The investment team continued to be strengthened to

accompany the growth in Fee-Paying AUM. Hiring in New York outpaced

other office locations in support of Antin’s expansion in North

America. The build-out of the operations team was linked to the

Group’s growth and enhances the platform’s scalability. It included

among other areas key hires in technology and sustainability

- The remaining increase in personnel expenses was driven by

wage increases related to inflation and promotions

- Other operating expenses and taxes totalled €33.2m in

2023, up by +6.2%

- The largest share of the increase came from administration

fees, which are related to Antin’s in-house fund administration

platform based in Luxembourg and recharged to the funds, generating

an equal amount of revenue and thus no impact on EBITDA

- Reported EBITDA stood at €114.4m in 2023 compared with

€20.9m in 2022. The difference between underlying and reported

EBITDA relates entirely to the non-recurring Free Share Plan

implemented at the time of the IPO and hedge transactions

associated with the plan

NET INCOME

- Underlying net income amounted to €127.9m in 2023, up

+60.6%

- Depreciation & amortisation stood at €16.1m in 2023,

up +20.3%, driven by the amortisation of placement fees related to

fundraising and the depreciation linked to the recognition of

right-of-use assets related to lease agreements for the expansion

of the Group’s offices in Paris and London

- Net financial result increased significantly to an

income of €10.6m in 2023 compared to a €(1.6)m expense in 2022.

This is primarily due to the allocation of Antin’s significant cash

balances to short-term deposit accounts and money market

instruments earning interest following increases in interest

rates

- Income tax totalled €42.1m in 2023. The effective tax

rate increased to 25% from 23%, due mostly to changes in the United

Kingdom effective as of 1 April 2023, increasing the corporate tax

rate from 19.0% to 25.0%

- Underlying Earnings Per Share (EPS) after dilution

amounted to €0.73 per share in 2023, up +65.7% compared with €0.44

per share in 2022. This increase is driven primarily by the

increase in underlying net income. It also benefited from lower

dilution effects related to the Free Share Plan

- Reported net income amounted to €74.8m in 2023 compared

to €(16.8)m in 2022

BALANCE SHEET AND COMMITMENTS

- The balance sheet remained strong as of 31 December

2023, with €423.9m in cash and cash equivalents and no borrowings

or financial liabilities

- Antin’s commitments in relation to its investments in the Antin

Funds and in Carried Interest totalled €184.2m as of 31 December

2023, of which €128.9m is uncalled capital that constitutes

an off-balance sheet commitment. It included €108.7m related to

investments in Antin Funds and €20.2m related to investments in the

Carried Interest

DISTRIBUTION TO SHAREHOLDERS

- At the Shareholder Meeting on 13 June 2024, a full-year

distribution of €0.71 per share will be proposed to

shareholders for the fiscal year 2023, representing an increase of

+69% compared with the previous year. The total estimated payout

would amount to €127.2m, representing a payout ratio of close to

100% of underlying net income. The proposed distribution will be

entirely paid out of distributable income

- The first instalment of €0.32 per share, equivalent to €57.3

million, was distributed on 16 November 2023 and the remaining

balance of €0.39 per share, equivalent to €69.9m, will be paid on

19 June 2024, with the ex-dividend date set for 17 June 2024

GOVERNANCE

- Antin’s Board of Directors, which met on 6 March 2024, approved

the audited financial statements for the 2023 fiscal year. The

Statutory Auditors are in the process of issuing a report with an

unqualified opinion, which will be issued in the 2023 Universal

Registration Document

- The Board of Directors decided to propose the re‑appointments

as Directors of Alain Rauscher, Mark Crosbie, Mélanie Biessy and

Ramon de Oliveira to the Annual Shareholders’ Meeting on 13 June

2024. The current two-year term of office for Russell Chambers will

end at the time of the Annual Shareholders’ Meeting. The Board

warmly thanked him for his contributions to the work of the Board

of Directors and for his active involvement in the Audit and

Nomination and Compensation Committees

POST-CLOSING EVENT

- Acquisition of Excellence Imagerie. Antin announced on

22 January 2024 the investment in Excellence Imagerie, a leading

medical imaging group in France, marking the sixth investment for

Mid Cap Fund I

OUTLOOK

- Growth. Growth in Fee-Paying AUM above that of the

infrastructure market over a fund cycle. Successful completion of

fundraising for Flagship Fund V in 2024 above the Fund’s target

size of €10bn

- EBITDA. Underlying EBITDA in 2024 expected to be at or

above prior year level

- Distribution to shareholders. Majority of cash earnings

to be distributed with the absolute quantum of annual dividends

expected to grow over time. Distributions paid in two instalments

per year, one in autumn and the second after the Annual

Shareholders' Meeting

WEBCAST PRESENTATION

- Antin’s management will hold a webcast presentation to present

the full-year 2023 earnings today at 11:00am CET (10:00am London

time)

- Please visit Antin’s shareholder website

https://shareholders.antin-ip.com/ to listen to the webcast or

click here. A replay will also be available after the event.

CONSOLIDATED FINANCIAL STATEMENTS

INCOME STATEMENT ON AN UNDERLYING BASIS

(€m)

2023

2022

Management fees

278.4

209.2

Carried interest and investment income

(1.2)

2.1

Administrative fees and other revenue

net

5.7

2.8

TOTAL REVENUE

282.9

214.2

Personnel expenses

(74.2)

(64.5)

Other operating expenses & tax

(33.2)

(31.2)

TOTAL OPERATING EXPENSES

(107.4)

(95.7)

UNDERLYING EBITDA

175.5

118.5

% margin

62%

55%

Depreciation and amortisation

(16.1)

(13.4)

UNDERLYING EBIT

159.4

105.1

Net financial income and expenses

10.6

(1.6)

UNDERLYING PROFIT BEFORE INCOME

TAX

170.0

103.5

Income tax

(42.1)

(23.8)

% income tax

25%

23%

UNDERLYING NET INCOME

127.9

79.7

% margin

45%

37%

Underlying earnings per share

(€)

- before dilution

0.73

0.46

- after dilution

0.73

0.44

Weighted average number of

shares

- before dilution

175,571,129

174,531,363

- after dilution

176,316,749

181,978,992

INCOME STATEMENT: RECONCILIATION FROM UNDERLYING TO

IFRS

(€m, 2023)

Underlying basis

Non-recurring

items

IFRS basis

Management fees

278.4

-

278.4

Carried interest and investment income

(1.2)

-

(1.2)

Administrative fees and other revenue

net

5.7

-

5.7

TOTAL REVENUE

282.9

-

282.9

Personnel expenses

(74.2)

(60.8)

(135.0)

Other operating expenses & tax

(33.2)

(0.2)

(33.4)

TOTAL OPERATING EXPENSES

(107.4)

(61.1)

(168.4)

EBITDA

175.5

(61.1)

114.4

Depreciation and amortisation

(16.1)

-

(16.1)

EBIT

159.4

(61.1)

98.3

Net financial income and expenses

10.6

(3.6)

7.0

PROFIT BEFORE INCOME TAX

170.0

(64.7)

105.3

Income tax

(42.1)

11.5

(30.5)

NET INCOME

127.9

(53.1)

74.8

In 2023, Antin recognised €60.8m in personnel expenses related

to the Free Share Plan, of which €57.2m related to compensation

expenses and €3.7m to social charges. Antin also recognised

financial expenses of €3.6m related to the financing of the hedge

transaction associated with the Free Share Plan and a €11.5m

reduction of its income tax liability.

BALANCE SHEET

(€m)

31-Dec-2023

31-Dec-2022

Property, equipment and intangible

assets

20.6

19.0

Right-of-use assets

49.8

50.6

Financial assets

53.4

41.6

Deferred tax assets and other non-current

assets

17.1

17.2

TOTAL NON-CURRENT ASSETS

140.9

128.4

Cash and cash equivalents

423.9

422.0

Accrued income

14.4

8.7

Other current assets

38.4

37.7

TOTAL CURRENT ASSETS

476.7

468.4

TOTAL ASSETS

617.7

596.8

TOTAL EQUITY

497.5

473.5

Borrowings and financial liabilities

-

-

Lease liabilities

50.1

51.9

Other non-current liabilities

4.1

8.3

TOTAL NON-CURRENT LIABILITIES

54.1

60.2

Borrowings and financial liabilities

-

-

Lease liabilities

7.4

6.0

Income tax liabilities

14.6

1.8

Other current liabilities

44.0

55.3

TOTAL CURRENT LIABILITIES

66.0

63.1

TOTAL EQUITY AND LIABILITIES

617.7

596.8

CASH FLOW STATEMENT

(€m)

2023

2022

NET CASH INFLOW / (OUTFLOW) RELATED TO

OPERATING ACTIVITIES

125.8

103.9

Of which (increase) / decrease in working

capital requirement

(43.3)

(6.0)

NET CASH INFLOW / (OUTFLOW) RELATED TO

INVESTING ACTIVITIES

(17.8)

(23.9)

Of which investment in financial

assets

(18.7)

(8.7)

Of which purchase of property and

equipment

(5.2)

(15.4)

Of which proceeds related to financial

assets

7.4

-

Of which net change in other financial

assets

(1.3)

0.2

NET CASH INFLOW / (OUTFLOW) RELATED TO

FINANCING ACTIVITIES

(105.6)

(50.7)

Of which dividends paid

(106.1)

(43.6)

Of which payment of lease liabilities

(6.0)

(3.4)

Of which disposal / (repurchase) of

treasury shares

(4.3)

(1.2)

Of which net financial interest received

and paid

10.7

(2.4)

NET INCREASE / (DECREASE) IN CASH AND

CASH EQUIVALENTS

2.3

29.3

Cash and cash equivalents, beginning of

period

422.0

392.6

Translation differences on cash and cash

equivalents

(0.4)

0.1

CASH AND CASH EQUIVALENTS, END OF

PERIOD

423.9

422.0

APPENDIX

DEVELOPMENT OF AUM AND FEE-PAYING AUM OVER THE LAST TWELVE

MONTHS

(€bn)

AUM

Fee-Paying AUM

Beginning of period, 31 December

2022

30.6

19.1

Gross inflows

2.4

2.1

Step-downs

-

-

Realisations (2)

(1.6)

(1.0)

Revaluations

(0.3)

-

End of period, 31 December 2023

31.1

20.2

Change in %

+1.7%

+5.8%

ACTIVITY REPORT

(€bn)

Dec-2023 last twelve

months

Dec-2022 last twelve

months

AUM

31.1

30.6

Fee-Paying AUM

20.2

19.1

Fundraising

1.8

8.2

Fundraising incl. co-investments

2.4

8.2

Investments

2.0

2.7

Investments incl. co-investments

2.1

3.5

Gross exits

-

2.2

Gross exits incl. co-investments

-

2.4

KEY STATS BY FUND

Fund

Vintage

AUM €bn

FPAUM €bn

Committed Capital €bn

% Committed

% Realised

Gross Multiple

Expectation

Flagship

Fund II

2013

0.6

0.3

1.8

87%

92%

2.6x

Above plan

Fund III (2)

2016

5.6

2.0

3.6

89%

38%

1.8x

Above plan

Fund IV

2019

10.9

4.6

6.5

87%

-

1.3x

On plan

Fund III-B

2020

1.5

0.8

1.2

88%

26%

1.6x

On plan

Fund V (3)

2022

8.9

9.0

9.0

26%

-

1.1x

On plan

Mid Cap

Fund I

2021

2.2

2.2

2.2

47%

-

1.2x

On plan

NextGen

Fund I

2021

1.4

1.2

1.2

48%

-

1.0x

On plan

(€bn)

COST OF INVESTMENTS

VALUE OF INVESTMENTS

Fund

Vintage

FPAUM

Committed Capital

Total

Realised

Remaining

Total

Realised

Remaining

Flagship

Fund II

2013

0.3

1.8

1.6

1.3

0.3

4.1

3.8

0.3

Fund III (3)

2016

2.0

3.6

2.9

0.7

2.3

5.9

2.0

3.9

Fund IV

2019

4.6

6.5

4.6

-

4.6

6.2

-

6.2

Fund III-B

2020

0.8

1.2

1.1

0.3

0.8

1.8

0.5

1.3

Fund V (4)

2022

9.0

9.0

0.8

-

0.8

1.0

-

1.0

Mid Cap

Fund I

2021

2.2

2.2

0.9

-

0.9

1.1

-

1.1

NextGen

Fund I

2021

1.2

1.2

0.2

-

0.2

0.2

-

0.2

DEFINITIONS

Antin: Umbrella term for Antin Infrastructure Partners

S.A.

Antin Funds: Investment vehicles managed by Antin

Infrastructure Partners SAS or Antin Infrastructure Partners UK

Assets Under Management (AUM): Operational performance

measure representing the assets managed by Antin from which it is

entitled to receive management fees, undrawn commitments, the

assets from co-investment vehicles which do not generate management

fees or carried interest, and the net value appreciation on current

investments

Carried Interest: A form of investment income that Antin

and other carried interest investors are contractually entitled to

receive directly or indirectly from the Antin Funds, which is

inherently variable and fully dependent on the performance of the

relevant Antin Fund(s) and its/their underlying investments

% Committed: Measures the share of a fund’s total

commitments that has been deployed. Calculated as the sum of (i)

closed and/or signed investments (ii) any earn-outs and/or purchase

price adjustments, (iii) funds approved by the Investment Committee

for add-on transactions, (iv) less any expected syndication, as a %

of a fund’s committed capital at a given time

Committed Capital: The total amounts that fund investors

agree to make available to a fund during a specified time

period

Fee-Paying Assets Under Management (FPAUM): The portion

of AUM from which Antin is entitled to receive management fees

across all of the Antin Funds at a given time

Gross Exits: Value amount of realisation of investments

through a sale or write-off of an investment made by an Antin Fund.

Refers to signed realisations in a given period

Gross Inflow: New commitments through fundraising

activities or increased investment in funds charging fees after the

investment period

Gross Multiple: Calculated by dividing (i) the sum of (a)

the total cash distributed to the Antin Fund from the portfolio

company and (b) the total residual value (excluding provision for

carried interest) of the Fund’s investments by (ii) the capital

invested by the Fund (including fees and expenses but excluding

carried interest). Total residual value of an investment is defined

as the fair market value together with any proceeds from the

investment that have not yet been realised. Gross Multiple is used

to evaluate the return on an Antin Fund in relation to the initial

amount invested.

Investments: Signed investments by an Antin Fund

Realisations: Cost amount of realisation of investments

through a sale or write-off of an investment made by an Antin Fund.

Refers to signed realisations in a given period

% Realised: Measures the share of a fund’s total value

creation that has been realised. Calculated as realised value over

the sum of realised value and remaining value at a given time

Realised Value / (Realised Cost): Value (cost) of an

investment, or parts of an investment, that at the time has been

realised

Remaining Value / (Remaining Costs): Value (cost) of an

investment, or parts of an investment, currently owned by Antin

Funds (including investments for which an exit has been announced

but not yet completed)

Step-Downs: Normally resulting from the end of the

investment period in an existing fund, or when a subsequent fund

begins to invest

Underlying EBITDA: Earnings before interest, taxes,

depreciation, and amortisation, excluding any non-recurring

effects

Underlying Profit: Net profit excluding post-tax

non-recurring effects

ABOUT ANTIN INFRASTRUCTURE PARTNERS

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €30bn in Assets under

Management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, digital, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore, Seoul and

Luxembourg, Antin employs over 220 professionals dedicated to

growing, improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN – ISIN:

FR0014005AL0)

https://shareholders.antin-ip.com/

Financial Calendar

1Q 2024 Activity Update

30 April 2024

2024 Annual Shareholders’

Meeting

13 June 2024

Half-Year 2024 Results

11 September 2024

3Q 2024 Activity Update

30 October 2024

(1)

Excluding catch-up fees and management

fees for Fund III-B

(2)

Gross exits for AUM and exits at cost for

Fee-Paying AUM

(3)

% realised and Value of investments

include the partial sale of portfolio companies from Flagship Fund

III to Fund III-B

(4)

Fundraising ongoing. % invested calculated

based on the Fund’s target commitments of €10bn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306210403/en/

SHAREHOLDER RELATIONS Ludmilla Binet Head of

Shareholder Relations

Email: shareholders@antin-ip.com

MEDIA Nicolle Graugnard Communication Director

Email: media@antin-ip.com

BRUNSWICK Email: antinip@brunswickgroup.com

Tristan Roquet Montegon +33 (0) 6 37 00 52 57

Gabriel Jabès +33 (0) 6 40 87 08 14

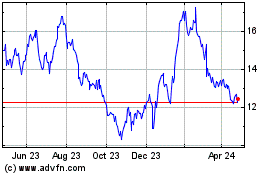

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

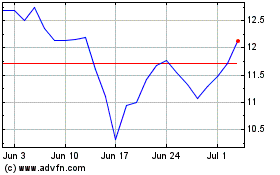

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024