Australian, NZ Dollars Advance Amid Rising Risk Appetite

19 July 2017 - 1:49PM

RTTF2

The Australian and NZ dollars strengthened against their major

opponents in the Asian session on Wednesday amid rising risk

appetite, with optimism on China's economy and fading prospects of

an imminent increase to U.S. interest rates underpinning risk

sentiment ahead of central bank meetings on Thursday.

Market participants are awaiting policy statements from both the

Bank of Japan and the European Central Bank due tomorrow, although

no big changes are expected.

Raft of upbeat economic data from China early this week

continued to lift investor mood. China second quarter GDP data,

industrial output and retail sales - all beat expectations,

signaling a pickup in economic growth momentum.

The latest survey from Westpac Bank revealed that a leading

index for the Australian economy continued to show pessimism in

June, and at a sharper rate. The index was down 0.14 percent after

easing an upwardly revised 0.01 percent in May.

The aussie rose on Tuesday, as the Reserve Bank of Australia's

minutes of the July 4 meeting showed an upbeat assessment of the

economy. But the kiwi showed mixed performance against its major

rivals. While the kiwi rose against the greenback, it fell against

the euro. Against the yen, it held steady.

The aussie strengthened to a 2-1/2-month high of 1.4526 against

the euro and more than a 2-year high of 0.7947 against the

greenback, off its early lows of 1.4592 and 0.7916, respectively.

If the aussie extends rise, it may find resistance around 1.42

against the euro and 0.81 against the greenback.

The aussie rose to 1.0035 against the loonie and 89.02 against

the yen, from Tuesday's closing values of 0.9995 and 88.70,

respectively. The aussie is seen finding resistance around 1.02

against the loonie and 90.00 against the yen.

The kiwi that closed Tuesday's trading at 1.5718 versus the euro

rose to 1.5623. The kiwi is likely to find resistance around the

1.42 mark.

The kiwi advanced to a 2-day high of 82.77 versus the yen and an

8-1/2-month high of 0.7387 against the greenback, from Tuesday's

closing values of 82.34 and 0.7349, respectively. On the upside,

84.00 and 0.75 are likely seen as the next resistance levels for

the kiwi against the yen and the greenback, respectively.

Reversing from an early session's low of 1.0800 against the

aussie, the kiwi edged up to 1.0746. Further uptrend may take the

kiwi to a resistance around the 1.06 region.

Looking ahead, Canada manufacturing sales for May and U.S.

building permits and housing starts for June are set for release in

the New York session.

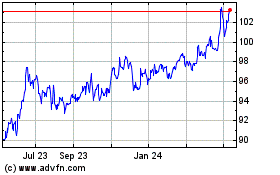

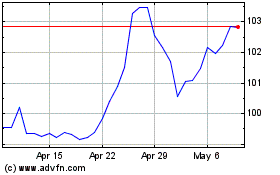

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2024 to May 2024

AUD vs Yen (FX:AUDJPY)

Forex Chart

From May 2023 to May 2024