BoJ Chief Says Future Rate Decisions Will Be Data Dependent

18 November 2024 - 2:01PM

RTTF2

Bank of Japan Governor Kazuo Ueda said the future interest rate

decisions will be data-dependent and avoided giving clear idea

about the timing of the next rate hike.

At each monetary policy meeting, the BoJ will make policy

decisions based on its assessment of economic activity and prices

with the data and information available at the time of each

meeting, Ueda told business leaders in Nagoya. "The actual timing

of the adjustments will continue to depend on developments in

economic activity and prices as well as financial conditions going

forward," he said. Ueda said the bank will pay due attention to

various risk factors, such as the course of overseas economies,

especially the US economy and developments in financial and capital

markets.

He avoided giving clear idea about the timing of the next

interest rate hike. Markets expect a quarter-point increase at the

next meeting in December.

At the October meeting, the board had maintained the key rate at

around 0.25 percent, which was the highest since late 2008.

The BoJ had ended its negative interest rate policy in March and

last lifted the benchmark rate in July to the current level.

Core inflation is forecast to be around 2 percent for the fiscal

2025 and 2026. The governor today said he expects inflationary

pressures stemming from wage increases to strengthen as an

improvement in economic activity and solid wage growth

continue.

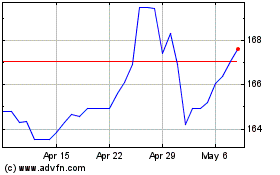

Euro vs Yen (FX:EURJPY)

Forex Chart

From Nov 2024 to Dec 2024

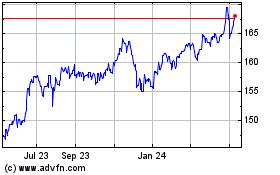

Euro vs Yen (FX:EURJPY)

Forex Chart

From Dec 2023 to Dec 2024