- 3Q24 total revenues of $250.4 million, up 18%

year-over-year

- 3Q24 NUPLAZID® (pimavanserin) net product

sales of $159.2 million, up 10% year-over-year

- 3Q24 DAYBUE™ (trofinetide) net product sales

of $91.2 million, up 36% year-over-year

Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced its

financial results for the third quarter ended September 30,

2024.

“The success of Acadia’s two growing commercial franchises is

clearly reflected in our third quarter 2024 results, where we

delivered $250.4 million in total revenues, putting us on track to

reach an impressive milestone of more than $1 billion in annualized

sales in 2025,” said Catherine Owen Adams, Chief Executive Officer.

“In my new role as CEO, I’m inspired and excited by the

possibilities that lie ahead for Acadia, both with our current

portfolio and the exciting innovations in our pipeline. The

opportunity to deliver additional groundbreaking therapies to

patients who need them is truly compelling. Furthermore, I see

significant potential to enhance shareholder value as we continue

to execute our commercial priorities and advance our pipeline

assets.”

Company Updates

- In August, world-renowned actor/entrepreneur and Parkinson’s

disease advocate Ryan Reynolds announced with the Company the

launch of a multi-faceted disease education campaign, More to

Parkinson’s®, to raise awareness among caregivers, patients and

their care providers about a common, yet under-recognized aspect of

Parkinson’s disease – Parkinson’s-related hallucinations and

delusions.

- Advancing the science in Parkinson’s disease with data

presentations at the International Congress of Parkinson’s Disease

and Movement Disorders Society in October on the topics of sleep

improvements and the value of early treatment of Parkinson’s

disease psychosis with pimavanserin versus treating later in

disease progression.

- In October, Health Canada granted marketing authorization of

DAYBUE (trofinetide) for the treatment of Rett syndrome in adult

and pediatric patients two years of age and older under its

Priority Review process. The Notice of Compliance authorization of

DAYBUE makes it the first and only drug approved in Canada for the

treatment of Rett syndrome.

- In November, the Company announced it entered into a definitive

asset purchase agreement to sell its Rare Pediatric Disease

Priority Review Voucher (PRV) for $150 million, following the

closing of the sale. Pursuant to the license agreement, Acadia is

required to pay Neuren Pharmaceuticals Limited one-third of the net

proceeds received from the sale of the PRV.

Financial Results

Revenues

Net product sales of NUPLAZID were $159.2 million and $144.8

million for the three months ended September 30, 2024 and 2023,

respectively. The 10% year-over-year increase in net product sales

of NUPLAZID included 7% volume growth in 2024 compared to 2023. Net

product sales of NUPLAZID were $446.5 million and $405.3 million

for the nine months ended September 30, 2024 and 2023,

respectively.

Net product sales of DAYBUE were $91.2 million and $66.9 million

for the three months ended September 30, 2024 and 2023,

respectively. Net product sales of DAYBUE were $251.7 million and

$90.1 million for the nine months ended September 30, 2024 and

2023, respectively. The increase in net product sales of DAYBUE for

both periods was primarily due to the growth in unit sales.

Research and Development

Research and development expenses were $66.6 million, compared

to $157.0 million for the three months ended September 30, 2024 and

2023, respectively. The decrease was mainly due to decreased

business development payments, which in the period ending September

30, 2023 included the $100.0 million payment to Neuren under the

license agreement for trofinetide. For the nine months ended

September 30, 2024 and 2023, research and development expenses were

$202.5 million and $284.9 million, respectively. The decrease was

mainly due to the aforementioned payment, partially offset by

increased costs from clinical stage programs.

Selling, General and Administrative

Selling, general and administrative expenses were $133.3 million

and $97.9 million for the three months ended September 30, 2024 and

2023, respectively. For the nine months ended September 30, 2024

and 2023, selling, general and administrative expenses were $358.3

million and $295.1 million, respectively. The increase for this

period was primarily driven by the costs related to the consumer

activation program to support the NUPLAZID franchise, increased

marketing costs in the U.S. to support DAYBUE and investments to

support commercialization of DAYBUE outside the U.S.

Net Income (Loss)

For the three months ended September 30, 2024, Acadia reported

net income of $32.8 million, or $0.20 per common share, compared to

net loss of $65.2 million, or $0.40 per common share, for the same

period in 2023. Net income for the three months ended September 30,

2024 included $26.2 million of non-cash stock-based compensation

expense. Net loss for the three months ended September 30, 2023

included $18.5 million of non-cash stock-based compensation

expense. For the nine months ended September 30, 2024, Acadia

reported net income of $82.7 million, or $0.50 per common share,

compared to a net loss of $107.1 million, or $0.65 per common

share. Net income for the nine months ended September 30, 2024

included $56.6 million of non-cash stock-based compensation

expense. Net loss for the nine months ended September 30, 2023

included $48.4 million of non-cash stock-based compensation

expense.

Cash and Investments

At September 30, 2024, Acadia’s cash, cash equivalents and

investment securities totaled $565.3 million, compared to $438.9

million at December 31, 2023.

Full Year 2024 Financial Guidance

Acadia is updating its 2024 guidance:

- NUPLAZID net product sales guidance is narrowed to the high end

of the prior range and is now expected to be $600 to $610

million.

- DAYBUE net product sales guidance is narrowed to the low end of

the prior range and is now expected to be $340 to $350

million.

- Total revenue guidance is revised to a range of $940 to $960

million.

- R&D expense guidance is lowered and is now expected to be

between $280 to $290 million.

- SG&A expense guidance is increased and is now expected to

be between $480 to $495 million.

Conference Call and Webcast Information

Acadia will host a conference call to discuss the third quarter

2024 results today, Wednesday, November 6, 2024 at 1:30 p.m.

PT/4:30 p.m. ET. The conference call may be accessed by registering

for the call here. Once registered, participants will receive an

email with the dial-in number and unique PIN number to use for

accessing the call.

About NUPLAZID® (pimavanserin)

Pimavanserin is a selective serotonin inverse agonist and

antagonist preferentially targeting 5-HT2A receptors. These

receptors are thought to play an important role in neuropsychiatric

disorders. In vitro, pimavanserin demonstrated no appreciable

binding affinity for dopamine (including D2), histamine,

muscarinic, or adrenergic receptors. Pimavanserin was approved for

the treatment of hallucinations and delusions associated with

Parkinson’s disease psychosis by the U.S. Food and Drug

Administration in April 2016 under the trade name NUPLAZID.

About DAYBUE™ (trofinetide)

Trofinetide is a synthetic version of a naturally occurring

molecule known as the tripeptide glycine-proline-glutamate (GPE).

The mechanism by which trofinetide exerts therapeutic effects in

patients with Rett syndrome is unknown. Trofinetide was approved

for the treatment of Rett syndrome in adults and pediatric patients

2 years of age and older by the U.S. Food and Drug Administration

in March 2023 under the trade name DAYBUE.

About Acadia Pharmaceuticals

Acadia is advancing breakthroughs in neuroscience to elevate

life. Since our founding we have been working at the forefront of

healthcare to bring vital solutions to people who need them most.

We developed and commercialized the first and only FDA-approved

drug to treat hallucinations and delusions associated with

Parkinson’s disease psychosis and the first and only approved drug

in the United States and Canada for the treatment of Rett syndrome.

Our clinical-stage development efforts are focused on Prader-Willi

syndrome, Alzheimer’s disease psychosis and multiple other programs

targeting neuropsychiatric symptoms in central nervous system

disorders. For more information, visit us at Acadia.com and follow

us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements other than

statements of historical fact and can be identified by terms such

as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “projects,” “predicts,”

“potential,” “continue” and similar expressions (including the

negative thereof) intended to identify forward-looking statements.

Forward-looking statements contained in this press release,

include, but are not limited to, statements about: (i) our business

strategy, objectives and opportunities, including support for and

innovations in our pipeline assets and business development

opportunities, and potential for enhanced shareholder value; (ii)

plans for, including timing, development and progress of

commercialization or regulatory timelines for, NUPLAZID, DAYBUE

(both within and outside the U.S.) and our product candidates;

(iii) benefits to be derived from and efficacy of our products,

including the potential advantages of NUPLAZID and DAYBUE; (iv) the

timing and conduct of our clinical trials, including continued

enrollment of our clinical trials in Prader-Willi syndrome and

Alzheimer’s disease psychosis, and the timing and content of our

presentations regarding our clinical trials; (v) our estimates

regarding our future financial performance, profitability or

capital requirements, including our full year 2024 financial

guidance and potential achievement of our milestone of annualized

sales in 2025; and (vi) the closing of the sale of the PRV, receipt

of payment for the PRV in connection with the closing, HSR

clearance of the sale and the anticipated use of proceeds from the

sale of the PRV. Forward-looking statements are subject to known

and unknown risks, uncertainties, assumptions and other factors

that may cause our actual results, performance or achievements to

differ materially and adversely from those anticipated or implied

by our forward-looking statements. Such risks, uncertainties and

other factors include, but are not limited to: our dependency on

the continued successful commercialization of NUPLAZID and DAYBUE

and our ability to maintain or increase sales of NUPLAZID or

DAYBUE; our plans to commercialize DAYBUE outside the U.S.,

including in Canada; the costs of our commercialization plans and

development programs, and the financial impact or revenues from any

commercialization we undertake; our ability to satisfy or waive all

required closing conditions for the sale of the PRV and ultimately

close the PRV sale; our ability to obtain HSR clearance in a timely

manner or at all; our ability to successfully deploy the proceeds

of the PRV sale as anticipated; our ability to obtain necessary

regulatory approvals for our product candidates and, if and when

approved, market acceptance of our products; the risks associated

with clinical trials and their outcomes, including risks of

unsuccessful enrollment and negative or inconsistent results; our

dependence on third-party collaborators, clinical research

organizations, manufacturers, suppliers and distributors; the

impact of competitive products and therapies; our ability to

generate or obtain the necessary capital to fund our operations;

our ability to grow, equip and train our specialized sales forces;

our ability to manage the growth and complexity of our

organization; our ability to maintain, protect and enhance our

intellectual property; and our ability to continue to stay in

compliance with applicable laws and regulations. Given the risks

and uncertainties, you should not place undue reliance on these

forward-looking statements. For a discussion of these and other

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to differ, please refer to our

quarterly report on Form 10-Q for the quarter ended June 30, 2024

as well as our subsequent filings with the Securities and Exchange

Commission (SEC) from time to time, including our quarterly report

on Form 10-Q for the quarter ended September 30, 2024 being filed

with the SEC today, which will be available at www.sec.gov. The

forward-looking statements contained herein are made as of the date

hereof, and we undertake no obligation to update them after this

date, except as required by law.

ACADIA PHARMACEUTICALS

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

amounts)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

Product sales, net

$

250,401

$

211,699

$

698,195

$

495,396

Total revenues

250,401

211,699

698,195

495,396

Operating expenses

Cost of product sales (1)(2)

18,857

14,622

60,038

23,747

Research and development (2)

66,606

156,963

202,518

284,878

Selling, general and administrative

(2)

133,294

97,890

358,348

295,094

Total operating expenses

218,757

269,475

620,904

603,719

Income (loss) from operations

31,644

(57,776

)

77,291

(108,323

)

Interest income, net

6,586

4,125

18,451

12,475

Other income (loss)

576

1,508

1,248

5,109

Income (loss) before income taxes

38,806

(52,143

)

96,990

(90,739

)

Income tax expense

6,041

13,033

14,281

16,344

Net income (loss)

$

32,765

$

(65,176

)

$

82,709

$

(107,083

)

Earnings (net loss) per share:

Basic

$

0.20

$

(0.40

)

$

0.50

$

(0.65

)

Diluted

$

0.20

$

(0.40

)

$

0.50

$

(0.65

)

Weighted average common shares

outstanding:

Basic

165,974

164,234

165,443

163,488

Diluted

166,178

164,234

166,136

163,488

(1) Includes license fees and

royalties

(2) Includes the following stock-based

compensation expense

Cost of product sales, license fees and

royalties

$

383

$

276

$

898

$

644

Research and development

$

3,863

$

5,063

$

11,705

$

12,701

Selling, general and administrative

$

21,918

$

13,200

$

43,996

$

35,053

ACADIA PHARMACEUTICALS

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

September 30, 2024

December 31, 2023

(unaudited)

Assets

Cash, cash equivalents and investment

securities

$

565,330

$

438,865

Accounts receivable, net

98,209

98,267

Interest and other receivables

12,154

4,083

Inventory

61,041

35,819

Prepaid expenses

51,550

39,091

Total current assets

788,284

616,125

Property and equipment, net

3,988

4,612

Operating lease right-of-use assets

44,253

51,855

Intangible assets, net

105,515

65,490

Restricted cash

8,770

5,770

Long-term inventory

25,699

4,628

Other assets

359

476

Total assets

$

976,868

$

748,956

Liabilities and stockholders’

equity

Accounts payable

$

19,081

$

17,543

Accrued liabilities

324,864

236,711

Total current liabilities

343,945

254,254

Operating lease liabilities

40,421

47,800

Other long-term liabilities

15,322

15,147

Total liabilities

399,688

317,201

Total stockholders’ equity

577,180

431,755

Total liabilities and stockholders’

equity

$

976,868

$

748,956

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106212607/en/

Investor Contact: Acadia Pharmaceuticals Inc. Al Kildani (858)

261-2872 ir@acadia-pharm.com

Media Contact: Acadia Pharmaceuticals Inc. Deb Kazenelson (818)

395-3043 media@acadia-pharm.com

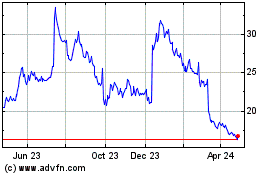

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

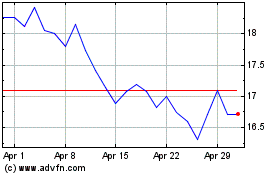

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Nov 2023 to Nov 2024