United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 19, 2023

ACE GLOBAL BUSINESS ACQUISITION LIMITED

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands |

|

001-40309 |

|

n/a |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

Rm. 806, 8/F, Tower 2, Lippo Centre, No. 89

Queensway,

Admiralty, Hong Kong

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: +(852) 2151 5198 / 2151 5598

Former name or former address, if changed since

last report: N/A

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Ordinary Share, par value $0.001 per share, and one Redeemable Warrant entitling the holder to receive one Ordinary Share |

|

ACBAU |

|

Nasdaq Capital Market |

| Ordinary Shares |

|

ACBA |

|

Nasdaq Capital Market |

| Warrants |

|

ACBAW |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements.

As previously disclosed by Ace Global Business

Acquisition Limited, a British Virgin Islands business company (the “Parent”) in its filings with the U.S. Securities and

Exchange Commission (the “SEC”) via Current Report on Form 8-K respectively on December 23, 2022 and March 2, 2023, the Parent

has entered into an Agreement and Plan of Merger (the “Merger Agreement”) with (i) ACBA Merger Sub I Limited, a British Virgin

Islands business company and wholly owned subsidiary of the Parent (“Purchaser”); (ii) ACBA Merger Sub II Limited, a British

Virgin Islands business company and wholly owned subsidiary of Purchaser (“Merger Sub”); and (iii) LE Worldwide Limited, a

British Virgin Islands business company (“Company” and together with the Parent, Purchaser and Merger Sub, the “Parties”).

Also as previously disclosed, on July 6, 2023, the Parties entered into the Amendment No. 1 to the Merger Agreement (the “First

Amendment”).

On September 19, 2023, the Parties entered into

the Amendment No. 2 to the Merger Agreement (the “Second Amendment”). The Second Amendment amended the Merger Agreement to,

among other things, reduce the Merger Consideration, as defined in the Merger Agreement, from $150 million to $110 million. As a result

of the Second Amendment, as consideration for the transactions contemplated by the Merger Agreement, the Purchaser will issue to the Company

a number of ordinary shares valued at $104.5 million, which is $110 million less 5% of the aggregate amount of merger consideration that

is subject to holdback arrangements.

The foregoing description of the Second Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment, which has been

filed herewith as Exhibit 2.1.

Item 9.01. Financial Statements and Exhibits

(d) Exhibit.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: September 22, 2023 |

|

| |

|

| Ace Global Business Acquisition Limited |

|

| |

|

| By: |

/s/ Eugene Wong |

|

| Name: |

Eugene Wong |

|

| Title: |

Chief Executive Officer |

|

2

Exhibit 2.1

AMENDMENT NO. 2 TO AGREEMENT AND PLAN OF MERGER

This Amendment No. 2 dated

as of September 19, 2023 (the “Amendment No. 2”) is to amend the Agreement and Plan of Merger which was made and entered

into as of December 23, 2022, was modified by a joinder agreement dated as of March 2, 2023, and was amended by an Amendment No.1 to Agreement

and Plan of Merger dated as of July 6, 2023 (collectively, the “Merger Agreement”), by and among Ace Global Business

Acquisition Limited, a British Virgin Islands business company (“Parent”), LE Worldwide Limited, a British

Virgin Islands business company (the “Company”), ACBA Merger Sub I Limited, a British Virgin Islands business

company and wholly owned subsidiary of the Parent (“Purchaser”), and ACBA Merger Sub II Limited, a British Virgin

Islands business company and wholly owned subsidiary of Purchaser (“Merger Sub”). Capitalized terms used but not otherwise

defined herein shall have the meanings ascribed to such terms in the Merger Agreement.

Recitals

WHEREAS, pursuant to Section

15.2(a) of the Merger Agreement, the Merger Agreement may be amended by a writing signed by each of the Purchaser Parties and the Company;

and

WHEREAS, the Purchaser Parties

and the Company desire to further amend the Merger Agreement to reflect the changes agreed between the parties and to clarify certain

terms and conditions set forth therein.

NOW, THEREFORE, in consideration

of the mutual covenants and promises set forth in this Amendment No. 2, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Amendment of Certain Provisions.

(a) Merger Consideration. The parties

desire to amend the Merger Agreement so as to provide that Merger Consideration shall be revised from $150,000,000 to $110,000,000. Accordingly,

the Merger Agreement is hereby amended to read as follows:

(i) Definitions:

The following definitions are hereby amended in their entirety to read as follows:

“‘Closing Payment

Shares’ means ten million four hundred fifty thousand (10,450,000) Purchaser Ordinary Shares, which is equal to the Merger

Consideration Shares minus the Holdback Shares.”

“‘Holdback Shares’

means five hundred fifty thousand (550,000) Purchaser Ordinary Shares, representing five percent (5%) of the aggregate amount of the Merger

Consideration Shares.”

“‘Merger Consideration’

means One Hundred Ten Million Dollars ($110,000,000).”

“‘Merger Consideration

Shares’ means eleven million (11,000,000) Purchaser Ordinary Shares, which number is equal to the Merger Consideration divided

by $10.00, and to be allocated among the Shareholders as provided on Schedule A hereto.”

(ii) Consideration: The first sentence

of Section 4.1(a) of the Merger Agreement is hereby amended in its entirety to read as follows:

“(a) Conversion of

Shares. At the Effective Time, by virtue of this Agreement and the Acquisition Merger and without any action on the part of the Merger

Sub, the Company or the Shareholders of the Company, the Purchaser shall issue the full amount of the Merger Consideration Shares, on

the basis that each Company Ordinary Share issued and outstanding immediately prior to the Effective Time (other than any Excluded Shares

and Appraisal Shares, if any) shall be canceled and automatically converted into the right to receive, without interest, its pro rata

portion of the Merger Consideration Shares, which are comprised of (i) 10,450,000 Purchaser Ordinary Shares as the Closing Payment Shares

and (ii) 550,000 Purchaser Ordinary Shares as the Holdback Shares.”

(b) Registration Statement. The

parties desire to amend the Merger Agreement so as to provide that the registration statement to be prepared by Purchaser shall be filed

as promptly as practicable on Form F-4 rather than Form S-4. Accordingly, the first sentence of Section 10.5(a) of the Merger Agreement

is hereby amended in its entirety to read as follows:

“(a) As promptly as practicable

after the date hereof, Purchaser shall prepare with the assistance, cooperation and commercially reasonable efforts of the Company Group,

and file with the SEC a registration statement on Form F-4 (as amended or supplemented from time to time, and including the Proxy Statement

contained therein, the “Registration Statement”) in connection with the registration under the Securities Act of Purchaser

Common Shares to be issued in the Reincorporation Merger and Acquisition Merger (including, for the avoidance of doubt, the Holdback Shares),

which Registration Statement will also contain a proxy statement of Parent (as amended, the “Proxy Statement”) for

the purpose of soliciting proxies from Parent shareholders for the matters to be acted upon at the Parent Special Meeting and a consent

solicitation statement for purposes of obtaining the Requisite Company Vote and providing the public shareholders of Parent an opportunity

in accordance with Parent’s organizational documents and the IPO Prospectus to have their Parent Ordinary Share redeemed in conjunction

with the shareholder vote on the Parent Shareholder Approval Matters as defined below.”

2. Miscellaneous.

(a) Except as expressly

provided in this Amendment No. 2, the Merger Agreement shall remain in full force and effect, and all references to “this

Agreement” in the Merger Agreement shall mean the Merger Agreement as further amended by this Amendment No. 2. In the event of

a conflict between the terms of this Amendment No. 2 and the Merger Agreement, the terms of this Amendment No. 2 shall prevail over

and supersede the conflicting terms in the Merger Agreement.

(b) Except

as provided in this Amendment No. 2, the Merger Agreement remains in full force and effect.

(c) This

Amendment No. 2 may be executed in any number of counterparts, each of which will be deemed an original, but all of which together will

constitute but one and the same instrument. This Amendment No. 2 will become effective when duly executed and delivered by each of the

parties hereto. Counterpart signature pages to this Amendment No. 2 may be delivered by electronic delivery (i.e., by email of a PDF signature

page) and each such counterpart signature page will constitute an original for all purposes.

[The remainder of this page intentionally left

blank; signature pages to follow]

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment No. 2 to be duly executed as of the day and year first above written.

| |

Parent: |

| |

|

|

|

| |

ACE GLOBAL BUSINESS ACQUISITION LIMITED, a British Virgin Islands business company |

| |

|

|

|

| |

By: |

/s/ Eugene Wong |

| |

|

Name: |

Eugene Wong |

| |

|

Title: |

CEO and Chairman of the Board |

| |

|

|

|

| |

Purchaser: |

| |

|

|

|

| |

ACBA MERGER SUB I LIMITED, a British Virgin Islands business company |

| |

|

|

|

| |

By: |

/s/ Eugene Wong |

| |

|

Name: |

Eugene Wong |

| |

|

Title: |

Sole Director |

| |

|

|

|

| |

Merger Sub: |

| |

|

|

|

| |

ACBA MERGER SUB II LIMITED, a British Virgin Islands business company |

| |

|

|

|

| |

By: |

/s/ Eugene Wong |

| |

|

Name: |

Eugene Wong |

| |

|

Title: |

Sole Director |

| |

|

|

|

| |

Company: |

| |

|

|

|

| |

LE WORLDWIDE LIMITED, a British Virgin Islands business company |

| |

|

| |

By: |

/s/ Lo Yeung Man Teddy |

| |

|

Name: |

Lo Yeung Man Teddy |

| |

|

Title: |

CEO |

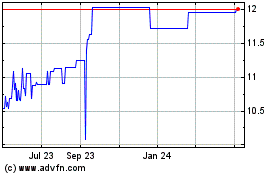

Ace Global Business Acqu... (NASDAQ:ACBAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

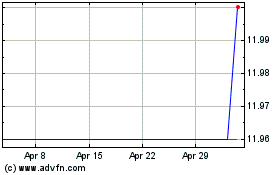

Ace Global Business Acqu... (NASDAQ:ACBAU)

Historical Stock Chart

From Apr 2023 to Apr 2024