--03-31false000144419200014441922023-07-042023-07-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 04, 2023 |

ACASTI PHARMA INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Quebec |

001-35776 |

98-1359336 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3009, boul. de la Concorde East Suite 102 |

|

Laval, Quebec |

|

H7E 2B5 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 450 686-4555 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, no par value per share |

|

ACST |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information regarding the Reverse Stock Split (as defined herein) contained in Item 5.03 of this Current Report on Form 8-K is incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 29, 2023, the Board of Directors (the “Board”) of Acasti Pharma Inc. (the “Company”) approved an amendment to the Company's Articles of Incorporation to implement a reverse stock split of the Company’s Class A common shares, no par value per share (the “Common Shares”), at a ratio of 1-for-6 (the “Reverse Stock Split”). Thereafter, on July 4, 2023, the Company filed Articles of Amendment to its Articles of Incorporation (the “Articles of Amendment”) with the Registraire des entreprises du Québec, to implement the Reverse Stock Split. The Reverse Stock Split will be effective as of 12:01 a.m. (Eastern Time) on July 10, 2023, and the Common Shares will begin trading on the Nasdaq Capital Market on a post-split basis on July 10, 2023.

As a result of the Reverse Stock Split, every six (6) shares of the Company’s issued and outstanding Common Shares will be converted into one (1) Common Share, reducing the number of issued and outstanding Common Shares from approximately 44.6 million shares to approximately 7.4 million shares. The Company’s transfer agent, Computershare Trust Company, N. A. (“Computershare”), will provide instructions to shareholders of record regarding the process for exchanging certificated Common Shares.

The Company has unlimited shares authorized. Therefore, the Articles of Amendment did not reduce the number of authorized Common Shares. The effect of the Articles of Amendment and the Reverse Stock Split was to increase the number of Common Shares available for issuance relative to the number of Common Shares issued and outstanding. The Reverse Stock Split did not alter the par value of the Common Shares or modify any voting rights or other terms of the Common Shares.

No fractional shares will be issued in connection with the Reverse Stock Split. Shareholders who otherwise would be entitled to receive fractional shares because they hold a number of pre-Reverse Stock Split Common Shares not evenly divisible by six (6), will, in lieu of a fractional share, be issued one whole post-Reverse Stock Split Common Share.

Computershare will be issuing all of the post-Reverse Stock Split Common Shares through their paperless Direct Registration System (“DRS”), also known as “book-entry form,” unless otherwise requested by a shareholder. Computershare will hold the Common Shares in an account set up for such shareholder. Shareholders who wish to hold paper certificates may obtain such certificates upon request to Computershare.

All book-entry or other electronic positions representing issued and outstanding Common Shares will be automatically adjusted. Those shareholders holding Common Shares in “street name” will receive instructions from their brokers.

In addition, pursuant to their terms, a proportionate adjustment will be made to the per share exercise price and number of Common Shares issuable under all of the Company’s outstanding options to purchase Common Shares, and the number of Common Shares authorized and reserved for issuance pursuant to the Company’s Equity Incentive Plan and Stock Option Plan will be reduced proportionately.

After the Reverse Stock Split, the trading symbol for the Common Shares will continue to be “ACST.” The new CUSIP number for the Common Shares is 00430K865.

The above description of the Articles of Amendment and the Reverse Stock Split is a summary of the material terms thereof and is qualified in its entirety by reference to the Articles of Amendment, a copy of which is attached hereto as Exhibit 3.1, as filed with the Registraire des entreprises du Québec on July 4, 2023.

Item 8.01 Other Events.

On July 7, 2023, the Company issued a press release relating to the matters described in Item 5.03 above. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated herein by reference.

Item 9.01 Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Acasti Pharma Inc. |

|

|

|

|

Date: |

July 7, 2023 |

By: |

/s/ Prashant Kohli |

|

|

|

Chief Executive Officer |

EX 3.1

CERTIFICATE OF AMENDMENT

Business Corporations Act (CQLR, chapter S-31.1)

I attest that the legal person

ACASTI PHARMA INC.

has modified its articles pursuant to the Business Corporations Act (Québec) to integrate the changes outlined in the attached articles.

July 10, 2023 at 12:01 a.m.

Filed in the register on July 4, 2023 under the

Québec Registration Number 1160589793.

(Signed)

Registraire des entreprises

DOCPROPERTY "DocsID" * MERGEFORMAT LEGAL_1:80997207.1

|

|

Registraire des entreprises |

REZ-909 (2017-04) Page 1 of 1 |

Articles of Amendment

|

|

Business Corporations Act (Québec) |

Québec Enterprise Number: 1160589793 |

1 Information about the business

ACASTI PHARMA INC.

Version(s) of the name of the corporation in any other language other than French, if applicable

2.1 Amendment to Name

2.2 Other Amendments

See Schedule Attached.

2.3. Date and Time of certificate, if applicable

Date: July 10, 2023 Time: 12:01 a.m.

Last name and first name of the authorized officer or director:

Prashant Kohli

Electonic signature of:

Prashant Kohli

Reserved for the administration

Reference number of request: 020200103314688

Numeric designation:

LEGAL_1:80872475.2

SCHEDULE TO

ARTICLES OF AMENDMENT

OF

ACASTI PHARMA INC.

(the “Corporation”)

As of the date of the issuance of a Certificate of Amendment confirming the present Articles of Amendment, all of the issued and outstanding Class “A” Shares (the “Common Shares”) in the capital of the Corporation are consolidated (the “Consolidation”) on the bases of one (1) post-Consolidation Common Share for every six (6) pre-Consolidation Common Shares (provided that each fractional Common Share that results from the Consolidation shall be rounded up to the nearest whole number).

LEGAL_1:80872475.2

EX 99.1

Acasti Pharma Announces 1-for-6 Reverse Stock Split

LAVAL, Québec, July 7, 2023 -- Acasti Pharma Inc. ("Acasti" or the "Company") (Nasdaq: ACST), a late-stage, biopharma company advancing GTX-104, its novel formulation of nimodipine that addresses the high unmet medical needs for a rare disease, aneurysmal subarachnoid hemorrhage (aSAH), today announced that the Company will effect a 1-for-6 reverse split of its issued and outstanding common shares. The reverse stock split will become effective July 10, 2023 at 12:01 a.m. ET. The Company's common shares will trade on a split-adjusted basis on The NASDAQ Capital Market, as of the opening of trading on Monday, July 10, 2023. The new CUSIP number for the Company's common shares will be 00430K865.

The reverse stock split is being affected as part of the Company's plan to regain compliance with the $1.00 minimum bid price continued listing requirement of The NASDAQ Capital Market.

When the reverse stock split becomes effective, every six common shares of Acasti will be automatically combined into one new common share of Acasti. No fractional shares will be issued, and no cash or other consideration will be paid. Instead, the Company will issue one whole share of the post-split common shares to any stockholder of record who otherwise would have received a fractional share as a result of the reverse stock split.

The reverse stock split will reduce the number of outstanding common shares from approximately 44.6 million shares to approximately 7.4 million shares.

Acasti’s transfer agent is Computershare Services Inc. Stockholders holding paper certificates representing pre-split holdings can contact our transfer agent by calling (800) 564-6253 (Canada and U.S.), (514) 982-7555 (Outside North America), or by email directed to corporateactions@computershare.com for the procedure to exchange existing stock certificates for new stock certificates or book-entry shares. Certificates representing pre-split holdings will be deemed to represent the stockholder's past split holdings until the stockholder presents the certificate to the transfer agent. Stockholders who are holding their shares in electronic form or through a brokerage facility do not have to take any action as the effects of the reverse stock split will automatically be reflected in their brokerage accounts.

About Acasti

Acasti is a late-stage biopharma company with drug candidates addressing rare and orphan diseases. Acasti's novel drug delivery technologies have the potential to improve the performance of currently marketed drugs by achieving faster onset of action, enhanced efficacy, reduced side effects, and more convenient drug delivery. Acasti's lead clinical assets have each been granted Orphan Drug Designation by the FDA, which provides seven years of marketing exclusivity post-launch in the United States, and additional intellectual property protection with over 40 granted and pending patents. Acasti's lead development asset, GTX-104, is an intravenous infusion targeting aneurysmal Subarachnoid Hemorrhage (aSAH), a rare and life-threatening medical emergency in which bleeding occurs over the surface of the brain in the subarachnoid space between the brain and skull.

For more information, please visit: https://www.acastipharma.com/en.

Forward-Looking Statements

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as amended, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and "forward-looking information" within the meaning of Canadian securities laws (collectively, "forward-looking statements"). Such forward looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of Acasti to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements which explicitly describe such risks and uncertainties, readers are urged to consider statements containing the terms "believes," "belief," "expects," "intends," "anticipates," "estimates", "potential," "should," "may," "will," "plans," "continue", "targeted" or other similar expressions to be uncertain and forward-looking. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The forward-looking statements in this press release, including statements concerning to compliance with the NASDAQ minimum bid price requirement, the effect and timing of the reverse stock split, including the estimated number of common shares outstanding after affecting the reverse stock split,

and the ability of the Company's drug candidates to achieve improved performance of currently marketed drugs, are based upon Acasti's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation: (i) the success and timing of regulatory submissions of the planned Phase 3 safety study for GTX-104; (ii) regulatory requirements or developments and the outcome and timing of the proposed IND application for GTX-104; (iii) changes to clinical trial designs and regulatory pathways; (iv) legislative, regulatory, political and economic developments; and (v) actual costs associated with Acasti's clinical trials as compared to management's current expectations. The foregoing list of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in documents that have been and are filed by Acasti from time to time with the Securities and Exchange Commission and Canadian securities regulators. All forward-looking statements contained in this press release speak only as of the date on which they were made. Acasti undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable securities laws.

For more information, please contact:

Acasti Contact:

Prashant Kohli

Chief Executive Officer

Tel: 450-686-4555

Email:info@acastipharma.com

www.acasti.com

Investor Relations:

Robert Blum

Lytham Partners, LLC

602-889-9700

ACST@lythampartners.com

v3.23.2

Document And Entity Information

|

Jul. 04, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--03-31

|

| Document Period End Date |

Jul. 04, 2023

|

| Entity Registrant Name |

ACASTI PHARMA INC.

|

| Entity Central Index Key |

0001444192

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-35776

|

| Entity Incorporation, State or Country Code |

A8

|

| Entity Tax Identification Number |

98-1359336

|

| Entity Address, Address Line One |

3009, boul. de la Concorde East

|

| Entity Address, Address Line Two |

Suite 102

|

| Entity Address, City or Town |

Laval

|

| Entity Address, State or Province |

QC

|

| Entity Address, Postal Zip Code |

H7E 2B5

|

| City Area Code |

450

|

| Local Phone Number |

686-4555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value per share

|

| Trading Symbol |

ACST

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

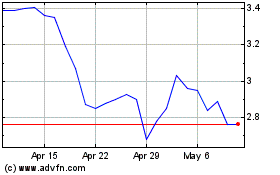

Acasti Pharma (NASDAQ:ACST)

Historical Stock Chart

From Apr 2024 to May 2024

Acasti Pharma (NASDAQ:ACST)

Historical Stock Chart

From May 2023 to May 2024