Current Report Filing (8-k)

22 December 2022 - 8:06AM

Edgar (US Regulatory)

0000874292false00008742922022-12-202022-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) December 20, 2022

ADDVANTAGE TECHNOLOGIES GROUP, INC.

(Exact name of Registrant as specified in its Charter)

Oklahoma

(State or other Jurisdiction of Incorporation)

| | | | | |

| 1-10799 | 73-1351610 |

| (Commission file Number) | (IRS Employer Identification No.) |

| |

1430 Bradley Lane, Suite 196, Carrollton, Texas | 75007 |

| (Address of Principal Executive Offices) | (Zip Code) |

(918) 251-9121

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 | AEY | NASDAQ |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Accounts Receivable Agreements with Vast Bank, N.A.

On December 20, 2022, the Company signed Modification Addendums (the “Modification”) to its accounts receivable purchase facilities for its Nave, Triton and Fulton subsidiaries with Vast Bank, N.A. (“Vast”).

The Nave and Triton facilities, after Modification, provide credit capacities of $13.0 million for Nave and $3.0 million for Triton. Effective March 17, 2023, Vast will charge a fee of 1.75% of sold receivables. Additionally, the maturity date of both facilities will be extended to December 17, 2023.

The Fulton facilities, after Modification, provide a credit capacity excluding a major customer of $1.5 million, with a fee of 2.0% of sold receivables, and credit capacity secured by receivables of a major customer of $1.5 million, with a fee of 1.6% of sold receivables, effective December 17, 2022. The maturity date of the facilities was extended to December 17, 2023.

For all four facilities, the lender advances 90% of sold receivables and establishes a reserve of 10% of the sold receivables at initial sale, which increases to 100% over time after 120 days, until the Company collects the sold receivables. All four facilities mature on December 17, 2023.

Item 2.03 Creation of a Direct Financial Obligation or An Obligation Under an Off-Balance Sheet Arrangement.

The information included or incorporated by reference in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this item 2.03.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ADDvantage Technologies Group, Inc. | |

| | |

| Date: December 21, 2022 | |

| | |

| /s/ Michael A. Rutledge | |

| Michael A. Rutledge | |

| Chief Financial Officer | |

| | |

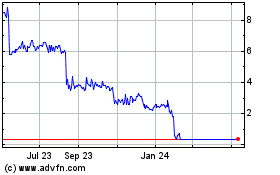

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

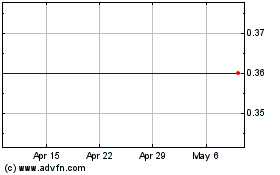

From Mar 2024 to Apr 2024

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024