Current Report Filing (8-k)

25 January 2023 - 8:31AM

Edgar (US Regulatory)

0001800637

false

0001800637

2023-01-19

2023-01-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): January 19, 2023

AGRIFY

CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39946 |

|

30-0943453 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

76

Treble Cove Rd.

Building 3

Billerica, MA 01862 |

|

01862 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (617) 896-5243

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value

$0.001 per share |

|

AGFY |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 3.01. |

Notice of

Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On

January 19, 2023, Agrify Corporation (the “Company”) received a deficiency letter (the “Notice”) from the Listing

Qualifications Department (the “Staff”) of The Nasdaq Stock Market, LLC (“Nasdaq”) notifying the Company that,

for the last 30 consecutive business days, the bid price for the Company’s common stock had closed below $1.00 per share, which

is the minimum closing price required to maintain continued listing on the Nasdaq Stock Market under Nasdaq Listing Rule 5550(a)(2) (the

“Minimum Bid Requirement”).

The

Notice has no immediate effect on the listing of the Company’s common stock on Nasdaq. In accordance with Nasdaq Listing Rule 5810(c)(3)(A),

the Company has 180 calendar days to regain compliance with the Minimum Bid Requirement. To regain compliance with the Minimum Bid Requirement,

the closing bid price of the Company’s common stock must be at least $1.00 per share for a minimum of 10 consecutive trading days

during this 180-day compliance period, unless the Staff exercises its discretion to extend the minimum trading day period pursuant

to Nasdaq Listing Rule 5810(c)(3)(G). The compliance period for the Company will expire on July 18, 2023.

In

the event that the Company does not regain compliance within the 180-day compliance period, the Company may be eligible for

an additional 180 calendar day compliance period. To qualify, the Company would need to meet the continued listing requirement for market

value of publicly held shares and all other initial listing standards for Nasdaq, with the exception of the Minimum Bid Requirement,

and provide written notice to the Staff of its intention to cure the deficiency during the second compliance period. However, if it appears

to the Staff that the Company will not be able to cure the deficiency, or if the Company does not meet the other listing standards, the

Staff could provide notice that the Company’s common stock will become subject to delisting. In the event the Company receives

notice that its common stock is being delisted, the Nasdaq Listing Rules permit the Company to appeal any such delisting determination

by the Staff to a Hearings Panel.

There

can be no assurance that the Company will be able to regain compliance with the Minimum Bid Requirement or that the Company will otherwise

remain in compliance with the other listing standards for the Nasdaq Stock Market.

| Item 5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On

January 23, 2023, the Company’s Board of Directors appointed Timothy Hayden as the Company’s Interim Chief Financial Officer,

and Mr. Hayden will assume the role of the Company’s principal financial and accounting officer, in each case effective as of March

1, 2023.

Mr.

Hayden, age 44, served as the Company’s Senior Vice President of Corporate Development since July 2022, and his role later expanded

to become Chief Revenue Officer. During his career, Mr. Hayden, who is a Certified Public Accountant and Chartered Accountant in Ontario,

Canada, has amassed 20 years of broad experience across corporate finance, business development, operations, and M&A. Prior to joining

Agrify, Mr. Hayden served in several roles at Vivo Cannabis Inc., a Canadian licensed cannabis producer, serving as Vice President of

Corporate Development from August 2019 to August 2020, Chief Business Development Officer from August 2020 to November 2020 and Chief

Operating Officer from November 2020 to May 2022. From January 2017 to August 2019, Mr. Hayden served as M&A Senior Manager at Deloitte

Canada, and from November 2015 through January 2017, he served as Corporate Finance Manager – Deal Advisory for the healthcare

and public sector at KPMG UK LLP. Mr. Hayden’s previous experience includes positions at BDO UK LLP, National Health Service Improvement,

HDI Group and Deloitte South Africa. Mr. Hayden received a B.A. in Accounting from Rhodes University.

On

July 25, 2022, the Company entered into an Employment Agreement (the “Employment Agreement”) with Mr. Hayden. Pursuant to

the terms of the Employment Agreement, Mr. Hayden receives an annual base salary of $225,000 and be eligible to participate in all employee

benefit programs sponsored by the Company. Mr. Hayden will also be eligible to receive a discretionary performance-based bonus of up

to $75,000 with respect to each fiscal year of the Company, based on the mutually agreed upon goals that will be set by the compensation

committee of the Board, and was previously issued 7,500 restricted stock units that will vest in three equal installments on the one-year,

two-year and three-year anniversaries of grant. If Mr. Hayden’s employment with the Company is terminated for any reason, he will

be entitled to (i) his annual base salary through the termination date, (ii) any accrued unused paid time off, (iii) any vested benefit

due and owing under any employee benefit plan and (iv) any unreimbursed business expenses. If Mr. Hayden’s employment is terminated

by the Company without Cause or by Mr. Hayden for Good Reason (as such terms are defined in the Employment Agreement), he will also be

entitled to receive his base salary for a period of six months and continued participation in the Company’s group health insurance

benefits for a period of six months.

There

is no family relationship between Mr. Hayden and any director or executive officer of the Company. There are no transactions between

Mr. Hayden and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Securities

Exchange Act of 1934, as amended.

The

foregoing summary of the material terms of the Employment Agreement does not purport to be complete and is subject to, and qualified

in its entirety by, the full and complete terms of the Employment Agreement, a copy of which is filed with this Current Report on Form

8-K as Exhibit 10.1 and is incorporated herein by reference.

On

January 23, 2023, the Company issued a press release announcing recently implemented cost efficiency measures, enhanced sales initiatives

and leadership appointments. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d)

Exhibits.

The

Company hereby files the following exhibits:

| # | Management

contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGRIFY CORPORATION |

| |

|

| Date: January 24, 2023 |

By: |

/s/

Raymond N. Chang |

| |

|

Raymond N. Chang |

| |

|

Chief Executive Officer |

3

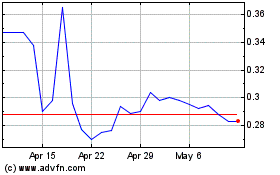

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Apr 2024 to May 2024

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From May 2023 to May 2024