reAlpha Tech Corp. (“reAlpha” or the “Company”) (Nasdaq: AIRE),

a real estate technology company developing and commercializing

artificial intelligence (“AI”) technologies, today announced that

it has acquired 85% of the outstanding equity in AiChat Pte. Ltd.

(“AiChat”).

AiChat is an award winning Singapore-based company that develops

AI-powered conversational customer experience solutions that

provide enterprise customers with intelligent chatbots and

automation tools that improve customer interactions and operational

efficiency. The Company will acquire the remaining 15% on June 30,

2025.

The total purchase price is $1.14 million, which is payable in

shares of the Company’s common stock in three tranches beginning no

later than January 1, 2025. The Company has also agreed to infuse

$300,000 into AiChat at such time determined by the parties. This

strategic acquisition marks a significant milestone in reAlpha’s

growth trajectory and underscores its commitment to expanding its

technological capabilities and market presence in the Asia-Pacific

(APAC) region.

reAlpha expects that integrating AiChat's conversational AI and

customer experience platform, which supports over 250 languages,

into its business will enhance reAlpha’s technological capabilities

by providing customers with more robust and intelligent customer

interaction tools due to the sentiment analysis and machine

learning capabilities from AiChat’s platform.

Additionally, reAlpha believes that AiChat’s platform

capabilities and already established sales channels will increase

usage and visibility of its technologies and platforms, including

Claire, reAlpha’s commission-free homebuying platform, which in

turn is expected to lead to more customers using reAlpha’s

platforms when seeking real estate solutions, including homebuyers

purchasing a home via Claire. As a result of this acquisition,

reAlpha believes its brand and market position in the AI industry

will be further bolstered by leveraging AiChat’s brand and

expertise in such industry.

The global conversational AI market, the industry AiChat

operates in, is projected to expand from $13.2 billion in 2024 to

$49.9 billion by 2030, growing at a compound annual growth rate

(CAGR) of 24.9% over the forecast period.

Giri Devanur, CEO of reAlpha, commented, “We are thrilled to

welcome AiChat to the reAlpha group. We believe this accretive

acquisition is a large step in our journey to bring the global real

estate industry into the digital era. AiChat’s innovative platform

and talented team will accelerate our efforts to make Claire set

the new standard for efficiency, accessibility and reliability when

it comes to buying a new home.”

Kester Poh, AiChat's CEO and founder, along with the key

management team, are expected to continue to lead AiChat as part of

the reAlpha group. reAlpha believes that this will ensure

continuity and leverage their domain expertise to drive forward the

combined company’s vision. Mr. Poh added, “Joining forces with

reAlpha opens up exciting new opportunities for AiChat. We look

forward to integrating our technology with reAlpha’s resources and

expertise, which will help us to enhance our product offerings and

expand our market leadership.”

For additional details concerning the terms of this acquisition,

please reference the Company’s Current Report on Form 8-K which

will be filed with the U.S. Securities and Exchange Commission (the

“SEC”).

About reAlpha Tech Corp.

reAlpha is a real estate technology company with a mission to

shape the property technology, or “proptech,” market landscape

through the commercialization of artificial intelligence

technologies and strategic synergistic acquisitions that complement

our business model. For more information about reAlpha, visit

www.realpha.com.

About Claire

Claire, announced on April 24, 2024, is reAlpha’s generative

AI-powered, zero-commission homebuying platform. The tagline: No

fees. Just keys.TM

Claire's introduction aligns with major shifts in the real

estate sector after the National Association of Realtors (NAR)

agreed to settle certain lawsuits after they were found to have

violated antitrust laws, resulting in inflated fees paid to

buy-side agents. This development is expected to result in the end

of the standard 6 percent sales commission, which equates to

approximately $100 billion in realtor fees paid annually. Claire

offers a cost-free alternative for homebuyers by utilizing an

AI-driven workflow that assists them through the home buying

process.

Homebuyers can use Claire’s conversational interface to guide

them through every step of their journeys, from property search to

closing the deal. By offering support 24/7, Claire is poised to

make the homebuying process more efficient, enjoyable and

cost-efficient. Claire matches buyers with their dream homes using

over 400 data attributes and provides insights into market trends

and property values. Additionally, Claire can assist with

questions, booking property tours, submitting offers, and

negotiations.

Currently, Claire is under limited availability for homebuyers

located in Palm Beach, Miami-Dade and Broward counties in South

Florida, but we are actively seeking new MLS and brokerage licenses

that will allow us to expand into a larger number of U.S.

states.

For more information on Claire, please visit www.reAlpha.com

About AiChat Pte. Ltd.

AiChat Pte. Ltd. is a Singapore-based company that develops

AI-powered conversational customer experience solutions. Its

platform leverages artificial intelligence to provide businesses

with intelligent chatbots and automation tools that improve

customer interactions and operational efficiency. For more

information about AiChat, visit www.aichat.com.

Forward-Looking Statements

The information in this press release includes “forward-looking

statements”. Forward-looking statements include, among other

things, statements about the AiChat acquisition; the anticipated

benefits of the AiChat acquisition, reAlpha’s ability to anticipate

the future needs of the short-term rental market; future trends in

the real estate, technology and artificial intelligence industries,

generally; and reAlpha’s future growth strategy and growth rate. In

some cases, you can identify forward-looking statements by

terminology such as “may”, “should”, “could”, “might”, “plan”,

“possible”, “project”, “strive”, “budget”, “forecast”, “expect”,

“intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”,

“potential” or “continue”, or the negatives of these terms or

variations of them or similar terminology. Factors that may cause

actual results to differ materially from current expectations

include, but are not limited to: reAlpha’s limited operating

history and that reAlpha has not yet fully developed its AI-based

technologies; reAlpha’s ability to commercialize its developing

AI-based technologies; whether reAlpha’s technology and products

will be accepted and adopted by its customers and intended users;

reAlpha’s ability to integrate the business of AiChat into its

existing business and the anticipated demand for AiChat’s services;

the inability to maintain and strengthen reAlpha’s brand and

reputation; the inability to accurately forecast demand for

short-term rentals and AI-based real estate focused products; the

inability to execute business objectives and growth strategies

successfully or sustain reAlpha’s growth; the inability of

reAlpha’s customers to pay for reAlpha’s services; changes in

applicable laws or regulations, and the impact of the regulatory

environment and complexities with compliance related to such

environment; and other risks and uncertainties indicated in

reAlpha’s SEC filings. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

statements. Although reAlpha believes that the expectations

reflected in the forward-looking statements are reasonable, there

can be no assurance that such expectations will prove to be

correct. reAlpha’s future results, level of activity, performance

or achievements may differ materially from those contemplated,

expressed or implied by the forward-looking statements, and there

is no representation that the actual results achieved will be the

same, in whole or in part, as those set out in the forward-looking

statements. For more information about the factors that could cause

such differences, please refer to reAlpha’s filings with the SEC.

Readers are cautioned not to put undue reliance on forward-looking

statements, and reAlpha does not undertake any obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240715820562/en/

For media inquiries:

ICR on behalf of reAlpha media@realpha.com

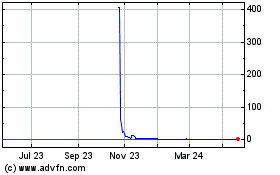

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

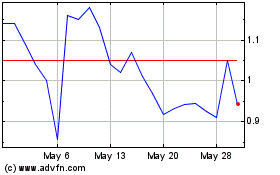

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Nov 2023 to Nov 2024