0001776197FALSE00017761972023-09-292023-09-290001776197us-gaap:CommonClassAMember2023-09-292023-09-290001776197us-gaap:CommonClassBMember2023-09-292023-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

September 29, 2023

________________________________

Akumin Inc.

(Exact name of Registrant as specified in its charter)

________________________________

| | | | | | | | |

| Delaware | 001-39479 | 88-4139425 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer Identification No.) |

| | | | | |

8300 W. Sunrise Boulevard Plantation, Florida | 33322 |

| (Address of principal executive offices) | (Zip Code) |

(844) 730-0050

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, $0.01 par value per share | | AKU | | The Nasdaq Stock Market LLC |

| Common Stock, $0.01 par value per share | | AKU | | Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Waiver of the September 29, 2023 Cash Interest Payment under the 11.00% Unsecured PIK Toggle Series A Note

On September 29, 2023, Akumin Operating Corp., a Delaware corporation (the “Issuer”), a wholly owned indirect subsidiary of Akumin Inc. (the “Company”), and Stonepeak Magnet Holdings LP (“Stonepeak”), entered into a Temporary Waiver Agreement (the “Waiver”) in connection with the 11.00% Unsecured PIK Toggle Series A Note, dated as of September 1, 2021 (as amended, restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Series A Note”), between the Issuer and Stonepeak, the form of which was attached as Exhibit B to the Series A Notes and Common Share Purchase Agreement between the Company, the Issuer and Stonepeak, dated June 25, 2021, which was filed as Exhibit 10.4 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

Summary of the Material Terms and Conditions of the Waiver

Under the terms of the Waiver, (i) the Issuer acknowledged that (A) it was obligated to pay Stonepeak $9,311,817.46 in PIK Interest as of the September 29, 2023 PIK Interest Payment Date (each as defined in the Series A Note), (B) that it was obligated to pay Stonepeak $3,939,615.08 in Cash Interest as of the September 29, 2023 Cash Interest Payment Date (each as defined in the Series A Note) and (C) that absent the Waiver, the Issuer’s failure to make the Cash Interest payment to Stonepeak would have constituted a Trigger Event (as defined in Section 7 of the Series A Note) and would have entitled Stonepeak to certain rights and remedies against the Issuer and the Company under Section 8 of the Series A Note; (ii) Stonepeak extended the due date of the September 29, 2023 Cash Interest payment to October 16, 2023 and agreed that no Trigger Event occurred upon the Issuer’s failure to make the Cash Interest payment due on September 29, 2023 and that it would not be entitled as a result thereof to any rights and remedies under Section 8 of the Series A Note; and (iii) the Issuer agreed that except as expressly provided in the Waiver, (A) none of rights and remedies granted to Stonepeak under Section 8 of the Series A Note are invalidated, impaired or otherwise modified and (B) the Waiver does not waive or release the Issuer from any past, existing or future Default, Event of Default or Trigger Event (each as defined in the Series A Note).

In the event that the Issuer does not pay Stonepeak $3,939,615.08 in Cash Interest by October 16, 2023, the extension of the Cash Interest Payment Date from September 29, 2023 to October 16, 2023 and the waiver of Stonepeak’s rights and remedies under Section 8 of the Series A Note shall be deemed ineffective and Stonepeak shall immediately be entitled to all its rights and remedies under Section 8 of the Series A Note as if the Waiver had never existed.

The foregoing summary of the Waiver does not purport to be complete and is qualified in its entirety by reference to the full and complete terms of the Waiver, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 10.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Akumin Inc. |

| | |

| Date: October 5, 2023 | By: | /s/ Riadh Zine |

| | Riadh Zine

Chairman, Chief Executive Officer and Director |

TEMPORARY WAIVER AGREEMENT

This TEMPORARY WAIVER AGREEMENT, dated as of September 29, 2023 (this “Agreement”), is between Akumin Operating Corp., a Delaware corporation (the “Issuer”) and Stonepeak Magnet Holdings LP (the “Holder”). Capitalized terms used herein that are not otherwise defined shall have the meanings ascribed thereto Series A Note (as defined below).

WHEREAS, reference is made to the 11.00% Unsecured PIK Toggle Series A Note, dated as of September 1, 2021 (as amended, restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Series A Note”), between the Issuer and the Holder;

WHEREAS, the parties hereto agree that the Issuer was obligated to make a cash interest payment to Holder in the amount of $3,939,615.08 (the “Cash Interest Payment”) on the Cash Interest Payment Date (September 29, 2023) (“Applicable Interest Payment Date”) in accordance with Section 3 of the Series A Note (in addition to the PIK Interest in the amount of $9,311,817.46 (the “PIK Interest Payment”), which shall be paid on the applicable PIK Interest Date (September 29, 2023) as required by the Series A Note) (collectively, the “Interest Payment”), the failure to make which will be a Trigger Event under Section 7(d) of the Series A Note (the “Applicable Trigger Event”) and the parties desire to temporarily waive (the “Waiver”) (i) the payment of the Cash Interest Payment on the Applicable Interest Payment Date and (ii) the Applicable Trigger Event, each on and subject to the terms and conditions of this Agreement;

WHEREAS, upon the occurrence, and during the continuance, of the Applicable Trigger Event, the Holder would be entitled to exercise all rights and remedies under the Series A Note (absent this Agreement) as set forth in Section 8 of the Series A Note and corresponding provisions thereunder (including the charging of default interest, exercising rights of set off and conversion, and refusal to permit additional extensions of credit, as applicable) or applicable law (collectively, all such rights and remedies the “Rights and Remedies”); and

WHEREAS, the Issuer has requested that the Holder agree to the Waiver and temporarily waive the Applicable Trigger Event, subject to the terms and conditions of this Agreement.

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Waiver Under the Series A Note. In consideration of, and subject to, the Issuer’s timely compliance with the terms of this Agreement, and in reliance upon the representations, warranties, agreements and covenants of the Issuer set forth herein, subject to the satisfaction of each of the conditions to the effectiveness of this Agreement and solely to the extent the conditions subsequent to this Agreement is satisfied or waived in a timely manner, the Holder hereby agrees to:

(a)the Waiver;

(b)the Cash Interest Payment (as at September 29, 2023) shall be deemed to be due and payable, in cash, on October 16, 2023; and

(c)the Applicable Trigger Event shall not be deemed to occur and the Holder shall not have the ability to exercise the Rights and Remedies.

2.Acknowledgements. The Issuer hereby acknowledges and agrees, upon execution and delivery of this Agreement, subject to the terms and conditions set forth herein, that:

(a)the Applicable Trigger Event would constitute a Trigger Event under the Series A Note;

(b)subject to the terms of this Agreement, the Issuer hereby ratifies and affirms (as of the date hereof) the Series A Note and the obligations owing thereunder and acknowledges (as of the date hereof) that the Series A Note is and shall remain and in full force and effect;

(c)on the PIK Interest Date (September 29, 2023), the amount of the PIK Interest Payment is owed and due and payable;

(d)on October 16, 2023, the amount of Cash Interest Payment (as at September 29, 2023) is owed and due and payable;

(e)subject to the terms of this Agreement, the Holder has not waived, released or compromised, does not hereby waive, release or compromise, and may never waive, release or compromise any events, occurrences, acts, or omissions that may constitute or give rise to any Defaults, Events of Default or Trigger Event (other than the Waiver in accordance herewith) that existed or may have existed, or may presently exist, or may arise in the future, nor does the Holder waive any Rights and Remedies; and

(f)the Holder’s agreement to temporarily waive the Cash Interest Payment and the Applicable Trigger Event, as provided herein, shall not, except as expressly provided herein, invalidate, impair, negate or otherwise affect the Holder’s ability to exercise their Rights and Remedies under the Series A Note or otherwise.

3.Conditions to Effectiveness; Conditions Subsequent.

(a)This Agreement shall become effective immediately upon satisfaction of each of the following conditions: (i) receipt by each of the parties hereto of duly executed counterparts to this Agreement by each of the other parties hereto, and (iii) the accuracy of the representations and warranties of the Issuer and the Originator set forth in Section 4 below.

(b)The Waiver and the waiver of the Applicable Trigger Event shall retroactively be deemed ineffective to the extent the Issuer does not make the Cash Interest Payment, in cash, on the terms set forth in Section 3 of the Series A Note on or before October 16, 2023, and the Holder shall immediately be entitled to all Rights and Remedies as if this Agreement and the Waiver had never existed.

4.Representations and Warranties of the Issuer. In consideration of the foregoing agreements, the Issuer hereby represents and warrants to the Holder as of the date hereof, as follows:

(a)Upon the effectiveness of this Agreement, the Issuer hereby reaffirms all covenants, representations and warranties made by it in the Series A Note and the Purchase Agreement, and agrees that all such covenants, representations and warranties shall be deemed to have been remade as of the effective date of this Agreement.

(b)The Issuer hereby represents and warrants that (i) this Agreement constitutes the legal, valid and binding obligation of such party, enforceable against it in accordance with its terms, (ii) upon the effectiveness of this Agreement, no Default, Event of Default or Trigger Event shall exist under the Series A Note.

5.Counterparts. This Agreement may be executed and delivered in any number of counterparts with the same effect as if the signatures on each counterpart were upon the same instrument. Any counterpart delivered by facsimile or by other electronic method of transmission shall be deemed an original signature thereto.

6.Successors and Assigns. This Agreement shall be binding upon each of the parties hereto and their respective successors and assigns, and shall inure to the benefit of each such person and their permitted successors and assigns.

7.Ratification; Conflict. The Series A Note, as modified by Section 1 of this Agreement is hereby ratified and confirmed and shall continue in full force and effect in accordance with its terms.

8.Amendment. No amendment, modification, termination or waiver of any provision of this Agreement shall be effective without the written agreement of each of the parties hereto. Any waiver or consent hereunder shall be effective only in the specific instance and for the specific purpose for which such waiver or consent is given.

9.Entire Agreement. This Agreement constitutes the entire agreement of the parties with respect to the subject matter hereof and supersedes any and all other prior written or oral contracts or negotiations between the parties hereto with respect to the subject matter hereof.

10.GOVERNING LAW; SUBMISSION TO JURISDICTION; JURY TRIAL WAIVER. SECTION 18 (GOVERNING LAW) AND SECTION 19 (SUBMISSION TO JURISDICTION’ JURY TRIAL WAIVER) OF THE SERIES A NOTE IS HEREBY INCORPORATED BY REFERENCE, MUTATIS MUTANDIS.

11.Counterparts; Electronic Signatures. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but such counterparts shall, together, constitute one and the same instrument. This Agreement shall be valid, binding, and enforceable against a party only when executed and delivered by an authorized individual on behalf of the party by means of (i) any electronic signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, and/or any other relevant electronic signatures law, including relevant provisions of the Uniform Commercial Code (collectively, “Signature Law”); (ii) an original manual signature; or (iii) a faxed, scanned, or photocopied manual signature. Each electronic signature or faxed, scanned, or photocopied manual signature shall for all purposes have the same validity, legal effect, and admissibility in evidence as an original manual signature. Each party hereto shall be entitled to conclusively rely upon, and shall have no liability with respect to, any faxed, scanned, or photocopied manual signature, or other electronic signature, of any party and shall have no duty to investigate, confirm or otherwise verify the validity or authenticity thereof. For avoidance of doubt, original manual signatures shall be used for execution or indorsement of writings and authentication of Series A Notes when required under the UCC or other Signature Law due to the character or intended character of the writings.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officers as of the day and year first above written.

AKUMIN OPERATING CORP.,

as Issuer

By: /s/ Riadh Zine

Name: Riadh Zine

Title: President & CEO

STONEPEAK MAGNET HOLDINGS LP,

as the Holder

By: Stonepeak Associates IV LLC,

its general partner

By: /s/ James Wyper

Name: James Wyper

Title: Senior Managing Director

[Signature page to Temporary Waiver Agreement]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

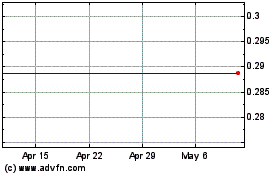

Akumin (NASDAQ:AKU)

Historical Stock Chart

From Apr 2024 to May 2024

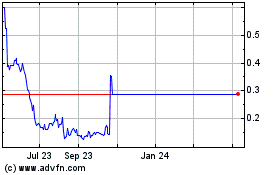

Akumin (NASDAQ:AKU)

Historical Stock Chart

From May 2023 to May 2024