Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259484

PROSPECTUS SUPPLEMENT NO. 15

(To Prospectus Dated June 6, 2022)

(Prospectus Supplement No. 1 Dated June 30, 2022)

(Prospectus Supplement No. 2 Dated July 11, 2022)

(Prospectus Supplement No. 3 Dated August 2, 2022)

(Prospectus Supplement No. 4 Dated August 11, 2022)

(Prospectus Supplement No. 5 Dated August 22, 2022)

(Prospectus Supplement No. 6 Dated August 26, 2022)

(Prospectus Supplement No. 7 Dated September 30, 2022)

(Prospectus Supplement No. 8 Dated October 7, 2022)

(Prospectus Supplement No. 9 Dated November 7, 2022)

(Prospectus Supplement No. 10 Dated November 14, 2022)

(Prospectus Supplement No. 11 Dated December 1, 2022)

(Prospectus Supplement No. 12 Dated December 12, 2022)

(Prospectus Supplement No. 13 Dated December 21, 2022)

(Prospectus Supplement No. 14 Dated December 22, 2022)

Up to 13,426,181 Shares of Common Stock

This Prospectus Supplement

No. 15 (this “Prospectus Supplement”) updates and supplements the prospectus dated June 6, 2022, as supplemented by Prospectus

Supplement No. 1 dated June 30, 2022 and as further supplemented by Prospectus Supplement No. 2 dated July 11, 2022; Prospectus Supplement

No. 3 dated August 2, 2022; Prospectus Supplement No. 4 dated August 11, 2022; Prospectus Supplement No. 5 dated August 22, 2022, Prospectus

Supplement No. 6 dated August 26, 2022; Prospectus Supplement No. 7 dated September 30, 2022; Prospectus Supplement No. 8 filed on October

7, 2022; Prospectus Supplement No. 9 filed on November 7, 2022; Prospectus Supplement No. 10 dated November 14, 2022, Prospectus Supplement

No. 11 dated December 1, 2022; Prospectus Supplement No. 12 dated December 12, 2022; Prospectus Supplement No. 13 dated December 21, 2022,

and Prospectus Supplement No. 14 dated December 22, 2022 (the “Prospectus”), which forms a part of our Registration Statement

on Form S-1, as amended by that Post-Effective Amendment No. 1 on Form S-1 (“Post-Effective Amendment”), which Post-Effective

Amendment was declared effective by the Securities and Exchange Commission on June 6, 2022 (Registration No. 333-259484). This Prospectus

Supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Reports

on Form 8-K, filed with the Securities and Exchange Commission on January 19, 2023, January 20, 2023 and January 23, 2023 (the “Form

8-Ks”). Accordingly, we have attached the Form 8-K to this Prospectus Supplement.

The Prospectus and this Prospectus

Supplement relate to the offer and sale from time to time by 3i, LP, a Delaware limited partnership (“3i, LP”), or their permitted

transferees that may be identified in the Prospectus by prospectus supplement (the “Selling Stockholders”) of up to 13,426,181

shares of Common Stock consisting of:

| |

● |

up to 2,180,497 shares of Common Stock issued upon conversion of 20,000 shares of our Series A Preferred Stock originally issued in a private placement to 3i, LP, based upon an initial conversion price of $9.906 and stated par value of $1,080 (which stated par value includes a one-time dividend equal to an 8% increase in the original stated par value of $1,000), or any adjustments thereto. See the section titled “Business - The Private Placement (PIPE Financing);” |

| |

● |

up to 2,018,958 shares of Common Stock issuable upon exercise of the PIPE Warrant based upon an exercise price of $9.906; and |

| |

● |

up to 9,226,726 additional shares of Common Stock that may be issuable upon conversion of our Preferred Stock using the Floor Price of $1.9812 or any adjustments thereto. See the section titled, “Description of Our Capital Stock — The Series A Preferred Stock.” This amount also includes 505,740 shares allocated to the exercise of the PIPE Warrant to comply with our obligation to register 125% of the number of shares of our Common Stock issuable upon the exercise of the PIPE Warrant. See the section titled, “Description of Our Capital Stock — PIPE Warrant.” |

The shares of Common Stock

covered by the Prospectus and this Prospectus Supplement were registered pursuant to the terms of a registration rights agreement between

us and 3i, LP. We will not receive any proceeds from the sale of shares of Common Stock offered for resale by the Selling Stockholders,

although we may receive up to $20 million in gross proceeds if the Selling Stockholders exercise the PIPE Warrant in full.

We are an “emerging

growth company” and a “smaller reporting company” as defined under U.S. federal securities laws and, as such, have elected

to comply with reduced public company reporting requirements. The Prospectus, together with this Prospectus Supplement, complies with

the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company. We are incorporated in Delaware.

This Prospectus Supplement

should be read in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus

Supplement, you should rely on the information in this Prospectus Supplement.

Our Common Stock is listed

on the NASDAQ Global Market under the symbol “ALLR.” On January 23, 2023, the last reported sale price of our Common Stock

was $0.29 per share. As of January 23, 2023, we had 24,541,214 shares of Common Stock outstanding, which includes shares issuable pursuant

to notices of conversion dated January 23, 2023.

Since December 2021 pursuant

to a series of exercise of conversion of shares of Series A Preferred Stock by 3i, LP, we have issued 16,465,390 shares of Common Stock

to 3i, LP, which includes shares issuable pursuant to notices of conversion dated January 23, 2023. Accordingly, as of January 23, 2023,

we had 11,694 shares of Series A Preferred Stock issued and outstanding.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk

Factors” beginning on page 13 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon

the accuracy or adequacy of this Prospectus Supplement and the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated January 23, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 12, 2023

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor,

Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement

On January 12, 2023, upon

the approval of the Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”)

of Allarity Therapeutics, Inc. (the “Company”), the Company entered into a new separate employment agreement with James G.

Cullem, our chief executive officer (the “Cullem Employment Agreement”), and Joan Brown, our chief financial officer (the

“Brown Employment Agreement” and together with Cullem Employment Agreement, the “New Employment Agreements”) in

connection with the additional executive officer positions that they were appointed to in June 2022.

The effectiveness of the New

Employment Agreements are contingent upon the Company securing a new capital raise of at least seven million dollars by or before February

15, 2023, unless the capital raise requires audited financial statements for the year ending December 31, 2022, then on or before April

30,2023 (a “New Financing”). In the event the New Financing does not occur, Mr. Cullum’s prior employment contract as

Chief Business Officer of the Company and Ms. Brown’s employment contract as director of financial reporting of the Company will

continue to remain in full force and effect. In the event the New Financing occurs, subject to the survival of any terms as reflected

in the Employment agreement, the prior employment agreements will be superseded by the New Employment Agreements.

Under their respective New

Employment Agreements, Mr. Cullem and Ms. Brown will, among other things, be (i) entitled to participate in all of the Company’s

employee benefit plans and programs as generally maintained and made available to its executive officers by the Company; (ii) eligible

for grants of equity compensation as determined at the sole discretion of the Compensation Committee; (iii) entitled to certain severance

and change of control benefits contingent upon such employee’s agreement to a general release of claims in favor of the Company

following termination of employment; and (iv) entitled to reimbursement of expenses in the course and scope of authorized Company business.

In addition, each respective employment agreement includes customary confidentiality and assignment of intellectual property obligations.

Cullem Employment Agreement

The Cullem Employment Agreement

provides for an annual base salary of $425,000.00 (as of January 1, 2023), which, upon agreement by Mr. Cullem and the Board, Mr. Cullem

may elect to receive up to thirty thousand dollars ($30,000.00) of such base salary in restricted stock grants in the Company. Any such

restricted stock grants will be made quarterly, at the start of each calendar quarter, at the stock fair market value (“FMV”)

on the 1st day of each calendar quarter. In addition, commencing with the calendar year 2023, Mr. Cullem will be eligible to receive an

annual bonus representing up to 50% of Mr. Cullem’s base salary based on the achievement of individual and corporate performance

targets, metrics and/or management-by-objectives to be determined and approved by the Company. The Board has the discretion to pay such

annual bonus in restricted stock grants in lieu of cash, depending on the financial circumstances of the Company, at the FMV on the date

of grant no later than March 1st of the grant year.

In addition, subject to and

concurrently with the closing of a New Financing, the Company agreed to grant Mr. Cullem the following stock options, which will have

an exercise price equal to the FMV of the Company’s shares on the grant date and a term of ten (10) years, and be subject to the

vesting schedule provided below:

| ● | Stock options in the amount of three and one-half percent (3.5%) of the Company’s issued and outstanding

shares of common stock immediately after such closing; provided, however, that such amount will not exceed fifty percent (50%) of the

options available to be granted under the Company’s 2021 Equity Incentive Plan (the “Grant Limitation”). In addition,

such grant will be subject to any shareholder approval required by law, regulation or applicable listing rule (the “Requisite Approval”),

and will vest ratably over a forty-eight (48) month period commencing July 1, 2022. |

| ● | Stock options for an additional two percent (2.0%) of the Company’s issued and outstanding shares

of common stock immediately after the closing of such New Financing; provided however, that such grant will not exceed the Grant Limitation

and such grant will be subject to any Requisite Approval. Such option grant will provide for one hundred percent (100%) vesting upon the

completion of a Phase 2 clinical trial involving the Company’s drug candidates, Stenoparib or Dovitinib, in combination with another

drug or therapeutic candidate in ovarian cancer, renal cell carcinoma, or other indication or therapy determined by the Company’s

Board. |

In the event the stock options

exceed the Grant Limitation, the Company agreed to seek shareholder approval at its next annual meeting to increase the number of options

available under the Company’s 2021 Equity Incentive Plan in order to have sufficient options to cover the grants. In consideration

of the grant of new options described above, upon grant of such options, all prior vested and unvested options previously granted to Mr.

Cullem (under any prior employment agreement with the Company) will be deemed waived and forfeited by Mr. Cullem and null and void. In

the event new stock options are not granted to Mr. Cullem under the Cullem Employment Agreement, all options (vested and unvested) previously

granted under prior employment agreements with Company will remain in full force and effect.

The Cullem Employment Agreement

can be terminated, in writing with thirty (30) days’ prior written notice, by the Company for or without Cause (as such term is

defined in the Cullem Employment Agreement) and Mr. Cullem can resign with or without Good Reason (as such term is defined in the Cullem

Employment Agreement). If Mr. Cullem is terminated without Cause or resigns with Good Reason, or is terminated by the Company as a result

of a Change-of-Control (as such term in defined in the Cullem Employment Agreement), the Company agreed to provide Mr. Cullem with severance

pay in an amount equal to twelve (12) months’ pay at Mr. Cullem’s final base salary rate, payable in the form of salary continuation.

Such severance payments are conditioned upon Mr. Cullem’s execution and non-revocation of a general release of claims.

Brown Employment Agreement

The Brown Employment Agreement

provides for an annual base salary of $250,000.00 (as of January 1, 2023). In addition, commencing with calendar year 2023, Mr. Brown

will be eligible to receive an annual bonus representing up to 40% of Mr. Brown’s base salary based on the achievement of individual

and corporate performance targets, metrics and/or management-by-objectives to be determined and approved by the Company. The Board has

the discretion to pay such annual bonus in restricted stock grants in lieu of cash, depending on the financial circumstances of the Company,

at the stock FMV on the date of grant no later than March 1st of the grant year.

In addition, concurrently

with the closing of a New Financing, the Company agreed to grant Ms. Brown stock options in the amount of three quarters of one percent

(0.75%) of the Company’s issued and outstanding shares of common stock immediately after the closing, which grant will be subject

to any Requisite Approval and granted pursuant to the 2021 Equity Incentive Plan. The exercise price will be the FMV of Company’s

shares on the date of grant. The stock options will vest ratably over a forty-eight (48) month period commencing July 1, 2022, and have

a term of ten (10) years.

The Brown Employment Agreement

can be terminated, in writing with thirty (30) days’ prior written notice, by the Company for or without Cause (as such term is

defined in the Brown Employment Agreement) and Ms. Brown can resign with or without Good Reason (as such term is defined in the Brown

Employment Agreement). If Ms. Brown is terminated without Cause or resigns with Good Reason or is terminated by the Company as a result

of Change-of-Control (as defined in the Brown Employment Agreement), the Company agreed to provide Ms. Brown with severance pay in an

amount equal to five (5) months’ pay at Ms. Brown’s final base salary rate, payable in the form of salary continuation. Such

severance payments are conditioned upon Ms. Brown’s execution and non-revocation of a general release of claims.

The information contained

in this Item 1.01 regarding the Cullem Employment Agreement and Brown Employment Agreement are qualified in its entirety by a copy of

such agreement attached to this Current Report on Form 8-K as Exhibit 10.1 and 10.2 respectively and incorporated herein by reference.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

The information contained

in Item 1.01 of this Current Report on Form 8-K regarding the compensation and material terms of the Cullem Employment Agreement and the

Brown Employment Agreement are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem

Chief Executive Officer |

| |

|

|

| Dated: January 19, 2023 |

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 19, 2023

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor,

Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b)

On January 19, 2023, Mr. Duncan Moore and Ms. Gail Maderis resigned as directors of Allarity Therapeutics, Inc. (“the Company”),

including their positions on each Board of Directors (the “Board”) committee on which they serve. In addition, on January

19, 2023, Mr. Soren G. Jensen gave notice that he will resign as a director, to be effective as of February 4, 2023. The resignations

by Messrs. Moore and Jensen, and Ms. Maderis are for personal reasons and not due to any disagreement with the Company’s management

team or the Company’s Board on any matter relating to the operations, policies or practices of the Company or any issues regarding

the Company’s accounting policies or practices.

As a result of the resignations

by Mr. Moore and Ms. Maderis, on January 19, 2023, the Board of the Company decreased the fixed number of authorized directors on the

Board from seven (7) to five (5).

Item 5.07. Submission of Matters to A Vote of

Security Holders.

The information disclosed

in Item 8.01 below is incorporated herein by reference.

Item 8.01. Other Events

On January 19, 2023,

the 2023 Annual Meeting of Stockholders of Allarity Therapeutics, Inc. (“Annual Meeting”) was adjourned with no business being

conducted in order to allow additional time for stockholders to vote on the proposals set forth in the Company’s definitive proxy

statement filed with the Securities and Exchange Commission (the “SEC”) on December 6, 2022 (the “Proxy Statement”).

The

adjourned Annual Meeting will reconvene on February 3, 2023 at 1:00 p.m. (Eastern Time) virtually at https://meetnow.global/MRJXJMN. The

record date for the determination of stockholders of the Company entitled to vote at the adjourned Annual Meeting remains the close of

business on December 6, 2022.

Stockholders

who have already voted do not need to recast their votes unless they wish to change their vote. Proxies previously submitted in respect

of the Annual Meeting will be voted at the adjourned Annual Meeting unless properly revoked, and stockholders who have previously submitted

a proxy or otherwise voted need not take any action. During the period of adjournment, the Company will continue to solicit votes from

its stockholders with respect to the proposals set forth in the Proxy Statement. No changes have been made in the proposals to be voted

on by stockholders at the Annual Meeting. Company encourages all stockholders as of the record date on December 6, 2022 who have not yet

voted to do so promptly.

The

Company’s Proxy Statement, Definitive Additional Materials and any other materials filed by the Company with the SEC can be obtained

free of charge at the SEC’s website at www.sec.gov.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G.

Cullem |

| |

|

James G. Cullem

Chief Executive Officer |

| |

|

|

| Dated: January 20, 2023 |

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 23, 2023

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed on Form 8-K filed with

the Commission on December 12, 2022, on December 9, 2022, the Company and 3i, LP (“3i”), the holder of outstanding shares

of Series A Convertible Preferred Stock (“Series A Preferred Stock”) entered into a letter agreement (“Letter Agreement”)

which provided that pursuant to Section 8(g) of the Certificate of Designations for the Series A Preferred Stock, the parties agreed that

the Conversion Price (as defined in such Certificate of Designations”) was modified to mean the lower of: (i) the Closing Sale Price

(as defined in the Certificate of Designations) on the trading date immediately preceding the Conversion Date (as defined in the Certificate

of Designations and (ii) the average Closing Sale Price of the common stock for the five trading days immediately preceding the Conversion

Date, for the Trading Days (as defined in the Certificate of Designations) through and inclusive of January 19, 2023.

On January 23, 2023, the Company and 3i amended

the Letter Agreement to provide the term Conversion Price will be in effect until terminated by the Company and 3i.

The shares of Series A Preferred Stock was acquired

by 3i pursuant to the terms that certain Securities Purchase Agreement dated as of May 20, 2021 and the other related transaction documents

by and between the Company and 3i. In addition to the material relationship with 3i relating to the Series A Preferred Stock, as previously

disclosed, 3i is also a holder of a secured promissory note issued by the Company pursuant to a Secured Note Purchase Agreement and a

Security Agreement by and between the Company and 3i, each of which is dated as of November 22, 2022.

Item 3.03. Material Modification to

Rights of Security Holders.

As previously disclosed in Item 1.01, the Company’s

Board of Directors and 3i approved an amendment to the Letter Agreement dated December 9, 2022, to provide that the term Conversion Price

as defined in the Letter Agreement will continue to be utilized until terminated by the Company and 3i.

Item 7.01 Regulation FD Disclosure

The Company is announcing its proposed annual budget

for the calendar year. For the year ending December 31, 2023, the Company anticipates that its annual budget will consist of (1) milestone

payments pursuant to license agreements and, to a lesser extent, patents of approximately $4,924,000; (2) development costs, including

clinical trial costs, of approximately $10,496,000; and (3) general and operating expenses of approximately $6,262,000. The Company’s

proposed budget represents its projected total annual expenditures for the 2023 calendar year, and actual expenses and payments will differ

from month to month due to the timing of development costs and contractual milestone payments. The Company intends to finance its budget

through the raising of capital; no assurance can be given that the Company will be able to raise a sufficient amount of capital to finance

its budget for 2023.

This discussion contains forward-looking statements

based upon our current expectations that involve risks and uncertainties. Our actual results could differ materially from those anticipated

in these forward-looking statements as a result of various factors. Reference is made to the “Risk Factors” section contained

in our Form 10-K for the year ended December 31, 2022 and other periodic reports that we file with the Commission.

This information is furnished pursuant to Item

7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under

the Securities Act of 1933 or the Securities Exchange Act of 1934. By furnishing this information on this Current Report on Form 8-K,

we make no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation

FD.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: January 23, 2023 |

|

|

2

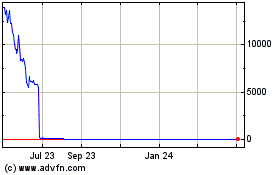

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

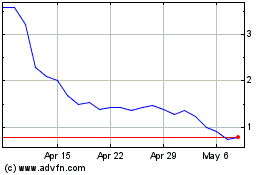

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024