Walmart Cuts Earnings Forecast -- WSJ

17 October 2018 - 6:02PM

Dow Jones News

Acquisition of Flipkart for $16 billion earlier this year

expected to weigh on results

By Sarah Nassauer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 17, 2018).

Walmart Inc. lowered its profit targets in the wake of its

largest-ever acquisition, but said sales growth will continue next

year.

The lowered profit goal for the current year reflects the

acquisition of Indian e-commerce company Flipkart, which Walmart

paid $16 billion to buy earlier this year. At the time, Walmart

said the deal was a long-term bet on a fast-growing market that

would depress earnings.

Walmart said it expects to earn between $4.65 and $4.80 a share

in the year ending Jan. 31, down from $4.90 to $5.05 earnings per

share.

Sales in existing stores will rise between 2.5% and 3% next

fiscal year, the company said Tuesday at an investor meeting,

continuing a string of solid sales gains for the world's largest

retailer amid investments in online growth and a strong economy. In

the second quarter, sales for Walmart accelerated at the fastest

rate in more than a decade.

Walmart executives laid out their plans for fending off

Amazon.com Inc., highlighting their advantage in food. Grocery

sales contribute 56% of Walmart's sales, making it the largest

grocer in the country.

"Having fresh food within 10 miles of 90% of the population is a

structural competitive advantage," Walmart Chief Executive Doug

McMillon told analysts gathered near the company's Bentonville,

Ark. headquarters. By the end of the year, 800 U.S. stores will

offer grocery delivery and over 2,000 will offer grocery pickup

service, where shoppers order online and pick up in store parking

lots.

The Flipkart deal is part of Walmart's effort to ramp up its web

business. The company said Tuesday it expects e-commerce sales --

still a small slice of its total business -- to rise 35% next year,

slightly slower than the 40% sales growth predicted for the current

year.

Walmart expects its ecommerce business to record a slightly

greater operating loss next year, Chief Financial Officer Brett

Biggs said.

Earlier this month, Amazon raised the minimum wage it pays all

U.S. employees to $15 an hour, putting pressure on some competitors

to increase wages to compete for workers.

Walmart has been gradually raising wages since 2015, most

recently setting a minimum wage of $11 earlier this year. "We will

keep investing in our people with wages and benefits and training

by market, as we have this year," Mr. McMillon said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

October 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

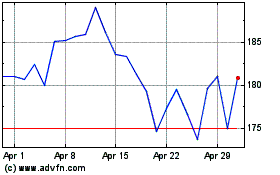

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to May 2024

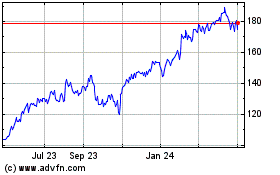

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From May 2023 to May 2024