Filed Pursuant to Rule 424(b)(5)

Registration No. 333-276794

PROSPECTUS

ARCUTIS BIOTHERAPEUTICS, INC.

$100,000,000

Common Stock

We have entered into an amended and restated sales agreement, or the Sales Agreement, with TD Cowen, relating to shares of our common stock offered by this prospectus. In accordance with the terms of such Sales Agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $100,000,000 from time to time through TD Cowen acting as our agent.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ARQT.” On January 30, 2024 the last reported sale price of our common stock on the Nasdaq Global Select Market was $5.87 per share.

Sales of our common stock, if any, under this prospectus will be made in sales deemed to be an “at-the-market” equity offering as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. TD Cowen is not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between TD Cowen and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to TD Cowen for sales of common stock sold pursuant to the Sales Agreement will be up to 3.0% of the aggregate gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of TD Cowen will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to TD Cowen with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 5 of this prospectus and under similar headings in the documents incorporated by reference into this prospectus before investing in our securities. Neither the Securities and Exchange Commission not any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

TD Cowen

The date of this prospectus is February 8, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. By using a shelf registration statement, we may offer shares of our common stock having an aggregate offering price of up to $100,000,000 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of offering.

This prospectus describes the specific details of this offering and also adds to and updates information contained in the documents incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference in this prospectus, on the other hand, you should rely on the information in this prospectus. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated by reference in this prospectus supplement-the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

We have not, and TD Cowen has not, authorized anyone to provide any information other than that contained in or incorporated by reference in this prospectus, any applicable prospectus supplement, and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and TD Cowen take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and TD Cowen is not, making an offer to sell or soliciting an offer to buy our securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus, any applicable prospectus supplement, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find More Information” and “Information Incorporated by Reference.”

We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “Arcutis,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Arcutis Biotherapeutics, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of common stock of the Company.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

PROSPECTUS SUMMARY

This summary provides a general overview of selected information and does not contain all of the information you should consider before buying our common stock. Therefore, you should read the entire prospectus, any applicable prospectus supplement, and any free writing prospectus that we have authorized for use in connection with this offering carefully, including the information incorporated by reference herein and therein, before deciding to invest in our common stock. Investors should carefully consider the information set forth under “Risk Factors” beginning on page 5 of this prospectus and in the documents incorporated by reference into this prospectus. Company Overview

We are a commercial-stage biopharmaceutical company focused on developing and commercializing treatments for dermatological diseases with high unmet medical needs. Our current portfolio is comprised of highly differentiated topical and systemic treatments with significant potential to treat immune-mediated dermatological diseases and conditions. We believe we have built the industry's leading platform for dermatologic product development and commercialization. Our strategy is to focus on validated biological targets, and to use our drug development platform and deep dermatology expertise to develop differentiated products that have the potential to address the major shortcomings of existing therapies in our targeted indications. We believe this strategy uniquely positions us to rapidly advance our goal of bridging the treatment innovation gap in dermatology, while maximizing our probability of technical success and financial resources.

Corporate Information

We were formed under the laws of the State of Delaware in June 2016 under the name Arcutis, Inc. and changed our name to Arcutis Biotherapeutics, Inc. in October 2019. Our principal executive offices are located at 3027 Townsgate Road, Suite 300, Westlake Village, California 91361, and our telephone number is (805) 418-5006. Our website address is www.arcutis.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

THE OFFERING

| | | | | | | | |

| Common stock offered by us | | Shares of our common stock having an aggregate offering price of up to $100,000,000. |

| | |

| Shares of common stock to be outstanding immediately after this offering | | Up to 112,318,819 shares, assuming sales of 17,035,775 shares of common stock are made in this offering at an offering price of $5.87 per share, which was the last reported sale price of shares of our common stock on the Nasdaq Global Select Market on January 30, 2024. The actual number of shares that may be issued will vary depending on the sales price under this offering. |

| | |

| Plan of Distribution | | “At-the-market” offering that may be made from time to time through or to our sales agent, TD Cowen, as agent. See “Plan of Distribution” on page 17. |

| | |

| Use of Proceeds | | We intend to use the net proceeds from this offering, if any, for general corporate purposes, and to fund the continued development of our multiple product candidate programs and commercial launch planning. See “Use of Proceeds” on page 9. |

| | |

| Risk Factors | | Investing in our common stock involves significant risks. See “Risk Factors” beginning on page 5 of this prospectus and the other information included in, or incorporated by reference into, this prospectus for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock. |

| | |

| Nasdaq Global Select Market symbol | | "ARQT" |

The number of shares of common stock to be outstanding after this offering as shown above is based on 95,283,044 shares of our common stock outstanding as of September 30, 2023 (after giving effect to the issuance of 33,425,000 shares of our common stock in an underwritten public offering in October 2023), and excludes:

•8,228,270 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2023, with a weighted-average exercise price of $18.81 per share;

•2,924,356 shares of common stock issuable upon the vesting and settlement of restricted stock units, or RSUs, outstanding as of September 30, 2023;

•3,018,500 shares of common stock issuable upon the exercise of options outstanding that were granted after September 30, 2023;

•3,698 shares of unvested common stock subject to repurchase by us as of September 30, 2023;

•1,487,426 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2020 Equity Incentive Plan, or 2020 Plan, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under the 2020 Plan;

•1,524,787 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2020 Employee Stock Purchase Plan, or ESPP, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under the ESPP;

•915,425 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2022 Employment Inducement Incentive Plan;

•7,500,000 shares of common stock issuable upon the exercise of pre-funded warrants to purchase shares of our common stock issued in connection with an underwritten public offering in October 2023.

Except as otherwise indicated, all information in this prospectus assumes:

•no repurchase by us of any shares of unvested common stock subject to repurchase;

•no exercise of outstanding options or settlement of outstanding RSUs; and

•no exercise of the pre-funded warrants referred to above.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully review the risks and uncertainties described below and under the section titled “Risk Factors” in our most recent annual report on Form 10-K and in our subsequent reports on Form 10-Q and current reports on Form 8-K that are incorporated by reference into this prospectus, together with other information in this prospectus and the information and documents incorporated by reference in this prospectus, and any free writing prospectus that we have authorized for use in connection with this offering before you make a decision to invest in our common stock. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common stock, and the occurrence of any of these risks might cause you to lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

If you purchase shares of our common stock in this offering, you may experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to you.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. The exercise or settlement of outstanding pre-funded warrants, stock options and RSUs would result in further dilution of your investment. See the section titled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering. Because the sales of the shares offered hereby will be made directly into the market or in negotiated transactions, the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing stockholders, will experience significant dilution if we sell shares at prices significantly below the price at which they invested. In addition, to the extent we need to raise additional capital in the future and we issue additional shares of common stock or securities convertible or exchangeable for our common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering.

We will have broad discretion in the use of proceeds from this offering and may invest or spend the proceeds in ways with which you do not agree and in ways that may not increase the value of your investment.

We will have broad discretion over the use of proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. You may not agree with our decisions, and our use of the proceeds may not yield any return on your investment. Our failure to apply the proceeds from this offering effectively could compromise our ability to pursue our growth strategy and we might not be able to yield a significant return, if any, on our investment of these net proceeds. You will not have the opportunity to influence our decisions on how to use these net proceeds. Any of the foregoing could adversely affect the market price of our common stock.

Future sales or issuances of our common stock in the public markets, or the perception of such sales, could depress the trading price of our common stock.

The sale of a substantial number of shares of our common stock or other equity-related securities in the public markets, or the perception that such sales could occur, could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We may sell large quantities of our common stock at any time pursuant to this prospectus or in one or more separate offerings. We cannot predict the effect that future sales of common stock or other equity-related securities would have on the market price of our common stock.

The actual number of shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to TD Cowen at any time throughout the term of the Sales Agreement. The number of shares that are sold by or to TD Cowen under the Sales Agreement will fluctuate based on the market price of the shares of common stock during the sales period and limits we set with TD Cowen. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference herein, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

•the success, cost, and timing of our plans to develop and commercialize immuno-dermatology drugs, including our current products, ZORYVE® roflumilast cream (ARQ-151) and roflumilast foam (ARQ-154), ARQ-234, ARQ-252, and ARQ-255 for indications including plaque psoriasis, atopic dermatitis, scalp psoriasis, seborrheic dermatitis, hand eczema, vitiligo, and alopecia areata;

•the anticipated impact of the coronavirus disease 2019 (COVID-19) outbreak on our ongoing and planned clinical trials and other business operations, including any potential delays, halts, or modifications to our clinical trials and other potential changes to our clinical development plans or business operations;

•our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates;

•our ability to satisfy the conditions, covenants and obligations under our amended loan and security agreement with SLR Investment Corp.;

•the timing of and our ability to obtain and maintain regulatory approvals;

•future agreements, if any, with third parties in connection with the commercialization of our product candidates;

•the success, cost, and timing of our product candidate development activities and planned clinical trials;

•the rate and degree of market acceptance and clinical utility of our product candidates;

•the potential market size and the size of the patient populations for our product candidates, if approved for commercial uses;

•the potential U.S. market sales for our product candidates, if approved for commercial use;

•our commercialization, marketing, and manufacturing capabilities and strategy;

•the success of competing therapies that are or may become available;

•our ability to attract and retain key management and technical personnel;

•our expectations regarding our ability to obtain, maintain, and enforce intellectual property protection for our product candidates;

•our anticipated use of the net proceeds from this offering; and

•our estimates regarding expenses, future revenue, capital requirements, and needs for additional financing.

You should read this prospectus and the documents incorporated by reference herein completely and with the understanding that our actual results may differ materially from what we expect as expressed or implied by our forward-looking statements. In light of the significant risks and uncertainties to which our forward-looking statements are subject, you should not place undue reliance on or regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at

all. We discuss many of these risks in greater detail in the documents incorporated by reference herein, including under the heading “Risk Factors.” These forward-looking statements represent our estimates and assumptions only as of the dates of this prospectus and the documents incorporated by reference herein and therein, and any free writing prospectus, as applicable, regardless of the time of delivery of this prospectus or any sale of our common stock and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate gross sales proceeds of up to $100.0 million from time to time. The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales Agreement with TD Cowen as a source of financing. We intend to use the net proceeds, if any, from this offering for general corporate purposes, and to fund the continued development, approval and commercialization of our multiple programs. The amounts and timing of our actual expenditures will depend on numerous factors, including our development and commercialization efforts with respect to our product candidates, as well as the amount of cash used in our operations. We therefore cannot estimate with certainty the amount of net proceeds to be used for the purposes described above. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the use of the net proceeds from this offering, we intend to invest the net proceeds in short term, investment-grade interest-bearing securities such as money market accounts, certificates of deposit, commercial paper, corporate bonds and guaranteed obligations of the U.S. government.

DIVIDEND POLICY

We have never declared or paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings use in the operation of our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant.

DILUTION

Our net tangible book value as of September 30, 2023 was $40.1 million, or $0.65 per share. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of September 30, 2023. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

Our pro forma net tangible book value as of September 30, 2023 was $135.9 million, or $1.43 per share. Pro forma net tangible book value per share represents the amount of our net tangible book value, divided by 95,283,044 shares of our common stock outstanding as of September 30, 2020 after giving effect to the issuance and sale of 33,425,000 shares of common stock in an underwritten public offering in October 2023 and our receipt of approximately $95.8 million in net proceeds therefrom.

After giving effect to the sale of 17,035,775 shares of our common stock in this offering at an assumed offering price of $5.87 per share, the last reported sale price of our common stock on Nasdaq on January 30, 2024, and after deducting offering commissions and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of September 30, 2023 would have been $232.7 million, or $2.07 per share. This represents an immediate increase of $0.64 per share to pro forma net tangible book value for existing stockholders and immediate dilution of $3.80 per share to investors purchasing our common stock in this offering. The following table illustrates this dilution on a per share basis:

| | | | | | | | | | | | | | | | | |

| Assumed public offering price per share | | | | | $ | 5.87 | |

Net tangible book value per share of as September 30, 2023 | | $ | 0.65 | | | | |

Increase in net tangible book value attributable to the pro forma transaction described above | | 0.78 | | | | |

Pro forma net tangible book value per share at September 30, 2023 | | 1.43 | | | | |

Increase in pro forma net tangible book value per share attributable to new investors | | 0.64 | | | | |

Pro forma as adjusted net tangible book value per share after giving effect to this offering | | | | | 2.07 | |

| Dilution per share to new investors | | | | | $ | 3.80 | |

The shares sold in this offering, if any, will be sold from time to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $5.87 per share shown in the table above, assuming all of our common stock in the aggregate amount of $100.0 million is sold at that price, would cause our pro forma as adjusted net tangible book value per share after the offering to be $2.12 per share and would increase the dilution to new investors to $4.75 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $5.87 per share shown in the table above, assuming all of our common stock in the aggregate amount of $100.0 million is sold at that price, would cause our pro forma as adjusted net tangible book value per share after the offering to be $2.01 per share and would decrease the dilution to new investors to $2.86 per share, after deducting commissions and estimated aggregate offering expenses payable by us.

To the extent that any outstanding pre-funded warrants, options or RSUs are exercised or settled, new options are issued, or we issue additional shares of common stock or other equity or convertible debt securities in the future, there will be further dilution to investors participating in this offering.

The above discussion and table are based on 95,283,044 shares of our common stock outstanding as of September 30, 2023 (after giving effect to the issuance of 33,425,000 shares of our common stock in an underwritten public offering in October 2023), and excludes:

•8,228,270 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2023, with a weighted-average exercise price of $18.81 per share;

•2,924,356 shares of common stock issuable upon the vesting and settlement of restricted stock units, or RSUs, outstanding as of September 30, 2023;

•3,018,500 shares of common stock issuable upon the exercise of options outstanding that were granted after September 30, 2023;

•3,698 shares of unvested common stock subject to repurchase by us as of September 30, 2023;

•1,487,426 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2020 Equity Incentive Plan, or 2020 Plan, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under the 2020 Plan;

•1,524,787 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2020 Employee Stock Purchase Plan, or ESPP, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under the ESPP;

•915,425 shares of common stock that were reserved for future issuance as of September 30, 2023 under our 2022 Employment Inducement Incentive Plan; and

•7,500,000 shares of common stock issuable upon the exercise of pre-funded warrants to purchase shares of our common stock issued in connection with an underwritten public offering in October 2023.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our restated certificate of incorporation and restated bylaws, which have been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference.”

Our authorized capital stock consists of 300,000,000 shares of common stock, $0.0001 par value per share, and 10,000,000 shares of undesignated preferred stock, $0.0001 par value per share.

Common Stock

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ARQT.”

Dividend Rights

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of our common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our board of directors may determine.

Voting Rights

Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders. We have not provided for cumulative voting for the election of directors in our restated certificate of incorporation, which means that holders of a majority of the shares of our common stock will be able to elect all of our directors. Our restated certificate of incorporation establishes a classified board of directors, to be divided into three classes with staggered three-year terms. Only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No Preemptive or Similar Rights

Our common stock is not entitled to preemptive rights, and is not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

Upon our liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of our common stock and any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Fully Paid and Nonassessable

All outstanding shares of common stock are, and the shares of common stock to be issued in this offering will be, fully paid and nonassessable.

Transfer Agent

The transfer agent and registrar for our common stock is Equiniti Trust Company. The transfer agent’s address is 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120-4101.

Preferred Stock

Under the terms of our restated certificate of incorporation, our board of directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of their qualifications, limitations or restrictions, in each case without further vote or

action by our stockholders. Our board of directors is also authorized to increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of our company and might adversely affect the market price of our common stock and the voting and other rights of the holders of our common stock. We have no current plan to issue any shares of preferred stock.

Pre-Funded Warrants

In October 2023, in an underwritten public offering of our common stock, we issued and sold, in lieu of common stock for certain investors, pre-funded warrants to purchase 7,500,000 shares of our common stock at a public offering price of $2.4999 per underlying share of common stock. The exercise price of the warrants is $0.0001 per underlying share of common stock. The pre-funded warrants are exercisable at any time.

Anti-Takeover Provisions

The provisions of Delaware General Corporation Law, or DGCL, our restated certificate of incorporation and our restated bylaws could have the effect of delaying, deferring or discouraging another person from acquiring control of our company. These provisions, which are summarized below, may have the effect of discouraging takeover bids. They are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us because negotiation of these proposals could result in an improvement of their terms.

Delaware Law

We are subject to the provisions of Section 203 of the DGCL. Under Section 203, we would generally be prohibited from engaging in any business combination with any interested stockholder for a period of three years following the time that this stockholder became an interested stockholder unless:

•prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

•upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares owned by persons who are directors and also officers, and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•at or subsequent to the date of the transaction, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

Under Section 203, a “business combination” includes:

•any merger or consolidation involving the corporation and the interested stockholder;

•any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

•any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder, subject to limited exceptions;

•any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

•the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an interested stockholder as an entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by such entity or person.

Restated Certificate of Incorporation and Restated Bylaw Provisions

Our restated certificate of incorporation and our restated bylaws include a number of provisions that could deter hostile takeovers or delay or prevent changes in control of our company, including the following:

•Board of Directors Vacancies. Our restated certificate of incorporation and restated bylaws authorize only our board of directors to fill vacant directorships, including newly created seats. In addition, the number of directors constituting our board of directors is permitted to be set only by a resolution adopted by a majority vote of our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors but promotes continuity of management.

•Classified Board. Our restated certificate of incorporation and restated bylaws provide that our board of directors is classified into three classes of directors, each with staggered three-year terms. A third party may be discouraged from making a tender offer or otherwise attempting to obtain control of us as it is more difficult and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

•Stockholder Action; Special Meetings of Stockholders. Our restated certificate of incorporation provides that our stockholders may not take action by written consent, but may only take action at annual or special meetings of our stockholders. As a result, a holder controlling a majority of our capital stock would not be able to amend our restated bylaws or remove directors without holding a meeting of our stockholders called in accordance with our restated bylaws. Further, our restated bylaws provide that special meetings of our stockholders may be called only by a majority of our board of directors, the chairman of our board of directors, our Chief Executive Officer or our President, thus prohibiting a stockholder from calling a special meeting. These provisions might delay the ability of our stockholders to force consideration of a proposal or for stockholders controlling a majority of our capital stock to take any action, including the removal of directors.

•Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders or to nominate candidates for election as directors at our annual meeting of stockholders. Our restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

•No Cumulative Voting. The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless a corporation’s certificate of incorporation provides otherwise. Our restated certificate of incorporation and restated bylaws do not provide for cumulative voting.

•Directors Removed Only for Cause. Our restated certificate of incorporation provides that stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least two-thirds of our outstanding common stock.

•Amendment of Charter Provisions. Any amendment of the above provisions in our restated certificate of incorporation require approval by holders of at least two-thirds of our outstanding common stock.

•Issuance of Undesignated Preferred Stock. Our board of directors has the authority, without further action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred stock would enable our board of directors to render more difficult or to discourage an attempt to obtain control of us by merger, tender offer, proxy contest or other means.

•Choice of Forum. Our restated certificate of incorporation provides that, to the fullest extent permitted by law, the Court of Chancery of the State of Delaware will be the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the DGCL, our restated certificate of incorporation or our restated bylaws; or any action asserting a claim against us that is governed by the internal affairs doctrine. The enforceability of similar choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable. This exclusive forum provision does not apply to suits brought to enforce a duty or liability created by the Exchange Act. It could apply, however, to a suit that falls within one or more of the categories enumerated in the exclusive forum provision and asserts claims under the Securities Act, inasmuch as Section 22 of the Securities Act of 1933, as amended, or the Securities Act, creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. There is uncertainty as to whether a court would enforce such provision with respect to claims under the Securities Act, and our stockholders will not be deemed to have waived our compliance with the federal securities laws and the rules and regulations thereunder.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with TD Cowen, under which we may issue and sell from time to time up to $100,000,000 of our common stock through or to TD Cowen as our sales agent. Sales of our common stock, if any, will be made at market prices by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act.

TD Cowen will offer our common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and TD Cowen. We will designate the maximum amount of common stock to be sold through TD Cowen on a daily basis or otherwise determine such maximum amount together with TD Cowen. Subject to the terms and conditions of the Sales Agreement, TD Cowen will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct TD Cowen not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. TD Cowen or we may suspend the offering of our common stock being made through TD Cowen under the Sales Agreement upon proper notice to the other party. TD Cowen and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time.

The aggregate compensation payable to TD Cowen as sales agent will be up to 3.0% of the gross sales price of the shares sold through it pursuant to the Sales Agreement. We have also agreed to reimburse TD Cowen up to $50,000 of TD Cowen’s actual outside legal expenses incurred by TD Cowen in connection with this offering, and for certain other expenses, including TD Cowen's FINRA counsel fees in an amount up to $15,000. We estimate that the total expenses of the offering payable by us, excluding commissions payable to TD Cowen under the Sales Agreement, will be approximately $161,000.

The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common stock.

TD Cowen will provide written confirmation to us following the close of trading on the Nasdaq Global Select Market on each day in which common stock is sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of shares of common stock sold through it as sales agent on that day, the volume weighted average price of the shares sold, the percentage of the daily trading volume and the net proceeds to us.

We will report at least quarterly the number of shares of common stock sold through TD Cowen under the Sales Agreement, the net proceeds to us and the compensation paid by us to TD Cowen in connection with the sales of common stock.

Settlement for sales of common stock will occur, unless the parties agree otherwise, on the second business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sales of our common stock on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to TD Cowen will be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to TD Cowen against certain liabilities, including liabilities under the Securities Act. As sales agent, TD Cowen will not engage in any transactions that stabilize our common stock.

Our common stock is listed on the Nasdaq Global Select Market and trades under the symbol “ARQT.” The transfer agent of our common stock is Equiniti Trust Company.

TD Cowen and/or its affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services they have received and, may in the future receive, customary fees.

LEGAL MATTERS

The validity of the common stock offered by this prospectus will be passed upon by Latham & Watkins LLP, Menlo Park, California. Cowen and Company, LLC is being represented in connection with this offering by Cooley LLP, New York, New York.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022, and the effectiveness of our internal controls over financial reporting as of December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act, of which this prospectus form a part. For further information about us and the securities we are offering under this prospectus, you should refer to the registration statement and the exhibits and schedules filed with the registration statement. With respect to the statements contained in this prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed as an exhibit to the registration statement.

We file reports, proxy statements and other information with the SEC under the Exchange Act. The SEC maintains an Internet website that contains reports, proxy statements and other information about issuers, like us, that file electronically with the SEC. The address of that website is www.sec.gov. We maintain a website at www.arcutis.com. Information contained in or accessible through our website does not constitute a part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporates by reference the documents set forth below that have previously been filed with the SEC:

•Our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 28, 2023, and Amendment No. 1 to such Annual Report on Form 10-K/A, filed with the SEC on September 15, 2023. •The information specifically incorporated by reference into our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 18, 2023. •Our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 9, 2023, and Amendment No. 1 to such Quarterly Report on Form 10-Q/A, filed with the SEC on September 15, 2023; our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 8, 2023, and Amendment No. 1 to such Quarterly Report on Form 10-Q/A, filed with the SEC on September 15, 2023; and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 3, 2023.

•Our Current Reports on Form 8-K filed with the SEC on May 24, 2023 (solely with respect to Item 5.02), June 5, 2023, August 14, 2023, August 18, 2023 (solely with respect to Item 5.02) (as amended September 7, 2023), September 27, 2023 (solely with respect to Item 5.02), October 19, 2023 (solely with respect to Item 8.01 and Item 9.01), October 23, 2023, December 18, 2023 and January 11, 2024. •The description of our securities registered pursuant to Section 12 of the Exchange Act contained in Exhibit 4.3 to our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 28, 2023, including any amendment or report filed for the purpose of updating such description. All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Arcutis Biotherapeutics, Inc.

Attn: Head of Investor Relations

3027 Townsgate Road, Suite 300

Westlake Village, CA 91361

Telephone: (805) 418-5006

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

ARCUTIS BIOTHERAPEUTICS, INC.

$100,000,000

Common Stock

PROSPECTUS

TD Cowen

February 8, 2024

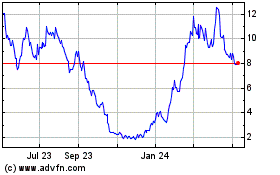

Arcutis Biotherapeutics (NASDAQ:ARQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

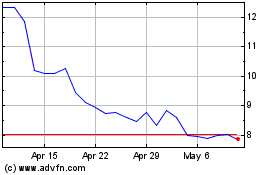

Arcutis Biotherapeutics (NASDAQ:ARQT)

Historical Stock Chart

From Apr 2023 to Apr 2024