0001897982FALSEDEF 14A00018979822022-07-012023-06-30iso4217:USD00018979822021-10-012022-06-3000018979822020-10-012021-09-3000018979822019-10-012020-09-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:PeoMember2022-07-012023-06-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:PeoMember2021-10-012022-06-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:PeoMember2020-10-012021-09-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:PeoMember2019-10-012020-09-300001897982ecd:PeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2022-07-012023-06-300001897982ecd:PeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2021-10-012022-06-300001897982ecd:PeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2020-10-012021-09-300001897982ecd:PeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2019-10-012020-09-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:PeoMember2022-07-012023-06-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:PeoMember2021-10-012022-06-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:PeoMember2020-10-012021-09-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:PeoMember2019-10-012020-09-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:PeoMember2022-07-012023-06-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:PeoMember2021-10-012022-06-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:PeoMember2020-10-012021-09-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:PeoMember2019-10-012020-09-300001897982ecd:PeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2022-07-012023-06-300001897982ecd:PeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2021-10-012022-06-300001897982ecd:PeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2020-10-012021-09-300001897982ecd:PeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2019-10-012020-09-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-07-012023-06-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-10-012022-06-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-10-012021-09-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:PeoMember2019-10-012020-09-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:NonPeoNeoMember2022-07-012023-06-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:NonPeoNeoMember2021-10-012022-06-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:NonPeoNeoMember2020-10-012021-09-300001897982azpn:GrantDateFairValueOfEquityAwardsForTheCoveredFYMemberecd:NonPeoNeoMember2019-10-012020-09-300001897982ecd:NonPeoNeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2022-07-012023-06-300001897982ecd:NonPeoNeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2021-10-012022-06-300001897982ecd:NonPeoNeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2020-10-012021-09-300001897982ecd:NonPeoNeoMemberazpn:GrantedInPeriodUnvestedAtPeriodEndMember2019-10-012020-09-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:NonPeoNeoMember2022-07-012023-06-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:NonPeoNeoMember2021-10-012022-06-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:NonPeoNeoMember2020-10-012021-09-300001897982azpn:GrantedPriorPeriodUnvestedAtPeriodEndMemberecd:NonPeoNeoMember2019-10-012020-09-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:NonPeoNeoMember2022-07-012023-06-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:NonPeoNeoMember2021-10-012022-06-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:NonPeoNeoMember2020-10-012021-09-300001897982azpn:GrantedInPeriodVestedInPeriodMemberecd:NonPeoNeoMember2019-10-012020-09-300001897982ecd:NonPeoNeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2022-07-012023-06-300001897982ecd:NonPeoNeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2021-10-012022-06-300001897982ecd:NonPeoNeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2020-10-012021-09-300001897982ecd:NonPeoNeoMemberazpn:GrantedPriorPeriodVestedInPeriodMember2019-10-012020-09-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-07-012023-06-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-10-012022-06-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-10-012021-09-300001897982azpn:AwardsGrantedThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2019-10-012020-09-30000189798212022-07-012023-06-30000189798222022-07-012023-06-30000189798232022-07-012023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Aspen Technology, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | |

| Letter From Our President and Chief Executive Officer |

| October 24, 2023

Dear Fellow Stockholder:

Fiscal 2023 was an important year for AspenTech. We achieved many key milestones that laid the foundation for the next stage of our growth as a leading, global industrial software player.

During this foundational building year, we delivered solid financial results while also making significant progress in bringing together our Open Systems International, Inc. ("OSI"), Subsurface Science & Engineering ("SSE") and Heritage AspenTech businesses. We also completed our acquisition of inmation Software GmbH, now called AspenTech DataWorks, which combines our industrial AIoT offerings, to deliver an industry-leading data platform that supports each of our product suites.

Today, our product portfolio is unified across the organization. Our offerings have expanded to include industry leading software from OSI, now part of the Digital Grid Management ("DGM") suite, SSE, as well as AspenTech DataWorks, all of which strengthen our sustainability efforts and create new opportunities for us to provide value for customers. Now, more than ever, I believe AspenTech is well-positioned to be at the forefront of enabling advancements in sustainability, with the ability to provide truly end-to-end solutions across asset-intensive industries. Transforming a company is not easy; reaching this point has required the hard work and dedication of our most valuable resource – our employees – and I thank them for those efforts.

This year’s annual meeting of stockholders will be held virtually on December 14, 2023, at 9:00 a.m. Eastern time. During the annual meeting, stockholders will be asked to elect our directors, to ratify the appointment of KPMG for fiscal year 2024, and to approve, on an advisory basis, our fiscal 2023 executive compensation as disclosed in the enclosed Proxy Statement.

Each of these proposals is important, and we recommend you vote in favor of each of them. We urge you to complete, sign and return your proxy card (if one has been provided), or use telephone or internet voting prior to the annual meeting, so that your shares will be represented and voted at the annual meeting even if you cannot attend.

The future is very bright at AspenTech. As we leverage the strong foundation we built in fiscal 2023, I am eager to see what the future holds for our company, and am confident in our ability to help our customers address the dual challenge. On behalf of the entire Board of Directors and management team, I want to express my gratitude to you, our stockholders, for your continued commitment to our success over so many years.

Sincerely, Antonio J. Pietri President and Chief Executive Officer

|

Antonio J. Pietri President & Chief Executive Officer Aspen Technology, Inc.

About Aspen Technology, Inc. ___________________________________________ Nasdaq: AZPN Headquarters: Bedford, Massachusetts Employees: 3,973 as of October 20, 2023 |

ASPEN TECHNOLOGY, INC.

20 Crosby Drive

Bedford, Massachusetts 01730

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

We invite you to attend our 2023 annual meeting of stockholders (the “annual meeting”), which is being held as follows:

| | |

Date: December 14, 2023 Time: 9:00 a.m. Eastern time Virtual Location: The annual meeting will be held online in a virtual meeting format, via the internet, at www.virtualshareholdermeeting.com/AZPN2023 with no physical in-person meeting of the stockholders. Stockholders attending our virtual annual meeting will be able to vote and submit questions during the annual meeting. |

| | | | | | | | |

| Proposals That Require Your Vote | Board Recommendation |

| 1. | To elect the nominees of the Board, Patrick M. Antkowiak, Thomas F. Bogan, Karen M. Golz, Ram R. Krishnan, Antonio J. Pietri, Arlen R. Shenkman, Jill D. Smith and Robert M. Whelan, Jr., to the Board of Directors to hold office until the 2024 annual meeting of stockholders; | “FOR” each director nominee |

| 2. | To ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for fiscal year 2024; and | “FOR” |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers as identified in the Proxy Statement for the annual meeting (so-called “say on pay” vote). | “FOR” |

Each of the foregoing proposals is fully set forth in the Proxy Statement, which you are urged to read thoroughly. Stockholders also will be asked to consider any other business properly presented at the annual meeting.

Only stockholders of record at the close of business on October 18, 2023 are entitled to vote at the annual meeting. Subject to certain conditions in accordance with our bylaws, the annual meeting may be adjourned from time to time without notice. The Notice of Internet Availability of Proxy Materials was mailed on or about October 24, 2023.

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on December 14, 2023 virtually via the internet at : www.virtualshareholdermeeting.com/AZPN2023

The Proxy Statement, form of proxy card and the 2023 Annual Report are available in the “Investor Relations” section of our website located at www.aspentech.com, as well as at www.proxyvote.com |

Whether or not you expect to virtually attend the annual meeting, please complete, date, sign and return a proxy card (if one was provided), or vote over the telephone or the internet, as instructed in these materials, as promptly as possible in order to ensure your representation at the annual meeting. Even if you vote by proxy, you may still vote if you virtually attend the annual meeting. If your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from the record holder.

By Order of the Board of Directors,

| | | | | | | | | | | |

| | | |

| | Mark Mouritsen Senior Vice President, Chief Legal Officer and Secretary Bedford, Massachusetts October 24, 2023 | |

| | | |

Our registered trademarks include AspenTech, aspenONE and Aspen Plus. For convenience, registered trademarks appear in this Proxy Statement without ® symbols, but that practice does not mean that we will not assert, to the fullest extent under applicable law, our rights to the trademarks. All other trademarks, trade names and service marks appearing in this Proxy Statement and not owned by us are the property of their respective owners.

2023 Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement.

This summary does not contain all of the information that you should consider, and

you should read the entire Proxy Statement carefully before voting.

| | | | | | | | | | | | | | | | | |

| Annual Meeting of Stockholders | |

| Meeting Date | Meeting Place | Meeting Time | Record Date | |

| | | | | |

| December 14, 2023 | The annual meeting will be held in a virtual format, at www.virtualshareholdermeeting.com/AZPN2023 | 9:00 a.m. Eastern time | October 18, 2023 | |

| | | | | |

| | | | | | | | | | | |

| Voting Matters |

| Proposals That Require Your Vote | Board Recommendation | Page |

| 1. | To elect the nominees of the Board of Directors, Patrick M. Antkowiak, Thomas F. Bogan, Karen M. Golz, Ram R. Krishnan, Antonio J. Pietri, Arlen R. Shenkman, Jill D. Smith and Robert M. Whelan, Jr., to the Board of Directors to hold office until the 2024 annual meeting of stockholders; | “FOR” each director nominee | 24 |

| 2. | To ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for fiscal year 2024; and | “FOR” | 36 |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers as identified in the Proxy Statement for the annual meeting (so-called “say on pay” vote). | “FOR” | 37 |

| | | | | | | | | | | | | | |

| How to Vote Prior to the Annual Meeting | |

| By mailing your proxy card | By telephone | By internet | |

| | | | |

|

Cast your ballot, sign your proxy card and send by free post

Mark, sign and date your proxy card (if one was provided) and return it in the postage-paid envelope. Your proxy card must arrive by December 13, 2023. |

Dial toll-free 24/7

1-800-690-6903

Use a touch-tone telephone to transmit your voting instructions at any time up to 11:59 p.m. Eastern time on December 13, 2023. Follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card (if one was provided). |

Visit 24/7

www.proxyvote.com

Use the internet to transmit your voting instructions at any time up to 11:59 p.m. Eastern time on December 13, 2023. Follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card (if one was provided). | |

| | | | |

Stockholders will be entitled to one vote at the annual meeting for each outstanding share of common stock, par value $0.0001 per share (“common stock”), they hold of record as of the record date. As of October 18, 2023, the record date, there were 63,749,655 shares of common stock outstanding.

| | | | | |

| Letter From Our Independent Chair |

| October 24, 2023 Dear Fellow Stockholder: It is my pleasure to invite you to attend this year’s virtual annual meeting of stockholders to be held on December 14, 2023, at 9:00 a.m. Eastern time.

As Antonio noted in his letter, as the first full year following the Emerson transaction, fiscal 2023 was a critical year to set the foundation for our transformation in fiscal 2024 and beyond. The board is pleased with the progress AspenTech made towards integrating our market-leading assets and solutions and realizing the significant potential value of our strategic partnership with Emerson.

The board’s focus this past year has been centered on supporting management to effectively scale and build this foundation, as well as engaging on the longer-term strategy for this next phase of growth. The board also has invested with the goal on ensuring the highest level of corporate governance practices, including having the right committees in place to provide effective oversight.

Stockholder engagement continues to be a priority for the board, to ensure that we hear from all our stakeholders. Accordingly, we spoke directly with stockholders this year to seek feedback on compensation, Environmental, Social and Governance ("ESG") topics, and other areas. As a result, we have incorporated what we heard in the redesign of our executive compensation, to align long-term incentives more closely to company performance.

The board also expanded its oversight and engagement with management on AspenTech’s ESG strategies, with a particular focus on sustainability, diversity, equity and inclusion ("DEI"), and cybersecurity. Helping our customers realize their sustainability goals is a key differentiator for AspenTech. Management’s progress on and commitment to each of these key business drivers – including the addition of dedicated resources and leadership in each – is commendable.

Please review the attached Proxy Statement and our Annual Report for additional information about our performance over the past year. As we continue our journey to drive transformational growth, this is an exciting time for AspenTech. In partnership with Emerson, we will continue to advance our unique position to drive energy efficiencies and profitability for our customers across the asset intensive industries.

On behalf of the entire board, I would like to express my appreciation for the hard work of the AspenTech team, and to our customers and shareholders for your confidence in us. We look forward to shaping the future together.

Sincerely, Jill D. Smith Independent Board Chair

|

Jill D. Smith Chair of our Board, Retired President and Chief Executive Officer, Allied Minds plc, and former Chair, Chief Executive Officer and President of DigitalGlobe Inc.

|

|

Business Highlights

| | | | | | | | |

| Our Mission | |

| We are helping companies at the forefront of the world’s dual challenge meet the increasing demand for resources from a rapidly growing population with the expectation of a higher living standard in a profitable and sustainable manner. |

| Our Business | |

| We are a global leader in industrial software focused on serving customers in asset-intensive industries. Our solutions address complex environments where it is critical to optimize across the full asset lifecycle, including asset design, operation, and maintenance, enabling customers to run their assets safer, greener, longer and faster. We combine engineering first principles, deep industry knowledge and advanced technologies to drive value creation. |

| Recent Developments | |

In 2022, our Board of Directors approved a change in our fiscal year end from September 30th to June 30th. Unless otherwise specified below, references to fiscal year 2023 therefore are to the twelve-month period ended June 30, 2023 (“fiscal 2023”). References to fiscal year 2022 are to the nine-month period ended June 30, 2022 (“fiscal 2022”). References to fiscal years 2021 and 2020 are to the twelve-month periods ended September 30, 2021 and September 30, 2020, respectively.

In fiscal 2023, we made progress on many of our key strategic priorities. A key focus for us this past year has been the transformation of the Open Systems International, Inc. (“OSI”) and Geological Simulation Software (“SSE”) businesses and their successful integration with the business of AspenTech Corporation (formerly known as Aspen Technology, Inc. or "Heritage AspenTech"). As a result, we have created a larger, diversified and faster growing industrial software leader following our business combination transactions (the “Emerson Transactions”) with Heritage AspenTech and Emerson Electric Co. ("Emerson') as described in the Transaction Agreement and Plan of Merger, dated as of October 10, 2021, as amended (the “Transaction Agreement”).

OSI is focused on optimizing transmission and distribution systems for utility companies in the power industry, which places us in the middle of the global electrification imperative, including managing the complexity created from a broader set of renewables and other power sources. The utilities and power market is an opportunity for us to cross-sell our solutions into our industrial customer base. The SSE business allows us to provide an end-to-end solution for the oil and gas supply chain with an extension to the chemicals supply chain. There is also a long-term growth opportunity as companies continue to leverage subsurface technologies for carbon sequestration, geothermal and hydro energy, and mining of rare earth metals for applications, such as electric vehicle batteries. We believe we are well positioned to help customers solve for the complexity of the dual challenge of meeting the increasing demand for resources from a rapidly growing population in a profitable and sustainable manner. References to “AspenTech”, “we”, “us” or the “Company” refer to the combined business of Heritage AspenTech, the OSI business and the SSE business following the closing (the "Closing") of the Emerson Transactions on May 16, 2022. References to the “Board” and any committees thereof refer to our Board of Directors and its committees following the Closing. References to the “Heritage AspenTech Board” and any committees thereof refer to the board of directors of Heritage AspenTech and its committees prior to the Closing. |

| | | | | | | | | | | | | | |

| | | | |

| Fiscal 2023 Highlights | |

| Business Results | Product Suite ACV Growth | Integration Progress | |

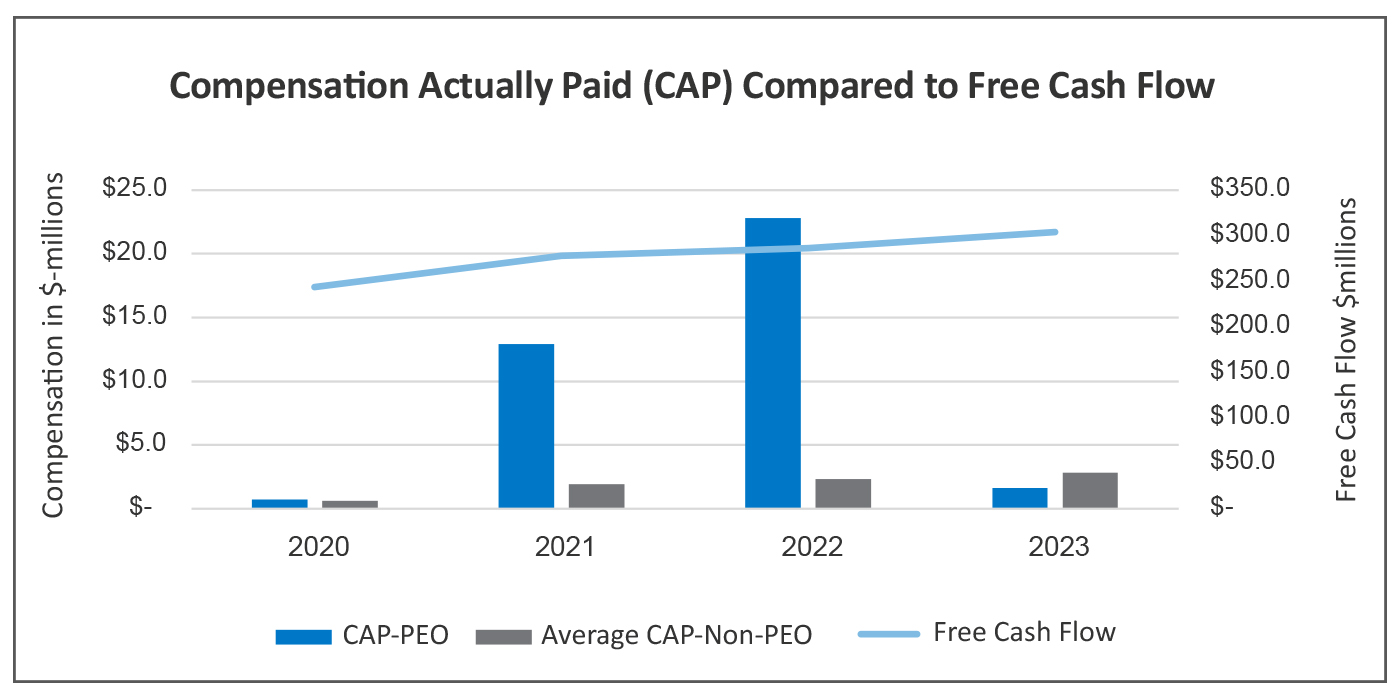

| •Annual Contract Value was $884.9 million at the end of fiscal 2023, increasing by 11.8% year over year •Revenue was $1.04 billion in fiscal 2023 •Net loss was $107.8 million in fiscal 2023 •Operating cash flow was $299.2 million in fiscal 2023 •Free cash flow was $292.3 million in fiscal 2023(1)

| •Engineering contributed 3.9 points of growth

•Manufacturing and Supply Chain contributed 2.6 points of growth

•Asset Performance Management contributed 0.7 points of growth

•Subsurface Science & Engineering contributed 3.0 points of growth

•Digital Grid Management contributed 1.7 points of growth | •Tokenized SSE suite and aligned SSE contract structure with overall business •Achieved separability between professional services and software licenses in OSI •Building out OSI's 3rd-party implementation ecosystem •Ahead of our expectations in converting OSI to a term contract model •Combined our AIoT hub with inmation Software GmbH to form AspenTech Dataworks Industrial Data Management

| |

(1) Free cash flow is a non-GAAP financial measure. For a description and reconciliation of free cash flow to the most directly comparable financial measure prepared in accordance with GAAP, please see “Non-GAAP Business Metrics” beginning on page 40 in Part II, Item 7 to our annual report on Form 10-K for the fiscal year ended June 30, 2023 filed with the Securities and Exchange Commission ("SEC") on August 21, 2023.

Director Nominee Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Committee Memberships | |

| Name | Age | Independent | Director Since* | Audit | Human Capital | Nominating and Corporate Governance | M&A | Other Public Company Boards |

| Patrick M. Antkowiak | 63 | þ | 2022 | • | | | | 0 |

| Thomas F. Bogan | 72 | þ | 2022 | | • (Chair) | | • | 2 |

| Karen M. Golz | 69 | þ | 2022 (2021) | • (Chair) | | | | 2 |

| Ram R. Krishnan | 52 | | 2022 | | • | • | • (Chair) | 0 |

| Antonio J. Pietri | 58 | | 2022 (2013) | | | | | 0 |

| Arlen R. Shenkman | 53 | þ | 2022 | • | | | • | 1 |

| Jill D. Smith | 65 | þ | 2022 (2021) | | | • (Chair) | | 2 |

Robert M.

Whelan, Jr. | 71 | þ | 2022 (2011) | | • | | • | 0 |

* For the Heritage AspenTech directors who became members of our Board upon the Closing of the Emerson Transactions on

May 16, 2022, the start of their service as Heritage AspenTech directors is shown in parentheses.

| | | | | | | | | | | | | | |

| Independence | | Tenure* | |

| | | | |

| | | *Prior tenure includes tenure as Heritage AspenTech directors. | |

| | | | | | | | |

| Average Director Nominee Age | Attendance by Directors

at Board Meetings in

Fiscal 2023 | Total Board and Committee Meetings

in Fiscal 2023 |

| 63 | 95% | 36 |

Stockholder Engagement

Stockholder Engagement

The Human Capital Committee considers the opinions of stockholders in making compensation decisions. The sections below describe our work in fiscal 2023 to engage with our stockholders following the voting results from our 2022 annual meeting of stockholders. We plan to maintain an ongoing dialogue with stockholders going forward to better understand their perspectives around executive compensation, governance, and other related matters, as well as best practices for Environmental, Social and Governance ("ESG") and Diversity, Equity and Inclusion ("DEI") issues.

2022 Proxy Voting Results and Fiscal 2023 Stockholder Outreach

At our 2022 annual meeting of stockholders, our "say on pay" proposal received support from 79% of our stockholders. Following this vote, in fiscal 2023, our Board worked with management to directly engage our largest stockholders and survey them for feedback regarding the "say on pay" vote and other matters. We subsequently reached out to 24 stockholders, representing approximately 78% of our common stock not held by Emerson, to engage with them and hear their views on executive compensation and other related areas. Following this outreach, we held direct conversations with seven stockholders, representing approximately 38% of our common stock not held by Emerson, from June to September 2023. The chair of our Human Capital Committee participated in all of these conversations and the Chair of our Board participated in all but one of these conversations. Both the chair of our Human Capital Committee and the Chair of our Board are independent directors.

Fiscal 2023 Stockholder Feedback

During our meetings with stockholders, we discussed a variety of topics, including the approach and philosophy of our Board and Human Capital Committee to executive compensation. The stockholders we spoke with were largely supportive of our choice of growth and profitability performance metrics as key indicators of our business performance. The feedback we received from our stockholders on our executive compensation program helped inform the change we have made to the program discussed below.

A common theme in these discussions was that our stockholders wanted to better understand the following two elements of our compensation program for our named executive officers:

•Our stockholders expressed a desire for us to incorporate performance-based stock units ("PSUs") into the design of our executive long-term incentive plan (“LTI”). In light of this feedback and additional research and analysis, including an engagement with our independent compensation consultant, William Towers Watson ("WTW"), the Human Capital Committee modified our executive compensation program by introducing PSUs in our fiscal 2024 LTI design as a replacement for stock options. Please see "Compensation Discussion and Analysis - Fiscal 2024 Compensation Actions" for additional details on this change.

•Our stockholders also inquired about the one-time equity award that Antonio Pietri, our President and Chief Executive Officer, received in June 2022 following the Closing of the Emerson Transactions. We explained that there were two drivers of the Board’s decision to grant this one-time equity award to Mr. Pietri. First, given the size of the Emerson Transactions and their transformative impact on our business, the Board wanted to ensure Mr. Pietri was properly incentivized to manage our business through the transition period following the Closing and to drive AspenTech toward its integration and synergy targets. Second, due to the timing of the Closing in May 2022, the Board decided to grant a special, one-time equity award following the Emerson Transactions in place of his fiscal 2023 annual equity award, which typically would have been granted during our normal September grant cycle. Mr. Pietri received his regular fiscal 2024 annual award during the normal grant cycle.

In addition, we discussed topics relating to ESG and DEI. Stockholders would like to see, in certain cases, more disclosure for different aspects of ESG and DEI and encouraged us to continue the journey to incorporate these areas into our corporate initiatives.

We highly value the feedback and perspectives of our stockholders. We remain committed to continuing an active dialogue with our stockholders in the future through our ongoing outreach efforts.

Environmental, Social and Governance Highlights and Oversight

The Board believes ESG initiatives benefit our many different stakeholders and drive long-term value creation. We focus our efforts where we can have the most positive impact on our stakeholders and are committed to effectively governing and managing ESG risks and opportunities that arise from our business strategy. Specifically, we maintain a minimal environmental footprint and our solutions aim to help customers in asset-intensive industries make significant strides in improving the environmental sustainability of their operations while maintaining profitability. We also recognize that the source of our innovation and expertise is our employees and that novel and impactful ideas result from people with varying backgrounds, experiences and perspectives working together, so building a diverse and inclusive workforce is a pillar of our culture. We understand the importance of cybersecurity and are continuously advancing and investing in this program through both advanced tools and continuous employee training. Finally, we are committed to strong governance principles, such as maintaining board diversity and upholding high standards of conduct for our directors, officers and employees. This past year we hired a Chief Product and Sustainability Officer, a Sustainability Director and a Chief Security Officer to help lead our corporate ESG efforts.

| | | | | | | | |

| | |

| Environmental Highlights | | Social Highlights |

•Worked with an independent third-party consulting firm to measure our global greenhouse gas (GHG) emissions and released our 2019, 2020 and 2021 scope 1 & 2 GHG inventory. | | •Hired a dedicated DEI leader to accelerate our global DEI efforts. |

•Launched a new sustainability business group tasked to identify and implement sustainability pathways that will be most impactful in helping our customers accelerate progress towards their net-zero targets. We have developed over 100 sustainability models aligned with these pathways based on existing capabilities in our products. | | •Developed DEI pillars and added a core value focused on DEI into our core values framework to help drive an inclusive culture that advocates for equal employment opportunities, regardless of race, gender, culture, physical ability, or sexual orientation. |

•Joined the Energy Transitions Commission, a global coalition of leaders from across the energy landscape committed to achieving net-zero emissions. | | •Held several events with employee resource groups during fiscal 2023, engaging our employees through education, innovation and collaboration. |

•Continued participation as a member in the Alliance to End Plastic Waste. | |

•Partnered with Pride Connection to promote our brand within the LGBTQ+ and Latinx communities. |

| | |

| Corporate Governance Highlights |

Our governance structure reflects our commitment to advancing the long-term interests of our stockholders, maintaining accountability, diversity, ethical conduct and alignment of interests between leadership and investors. Highlights of our governance

profile include:

| | | | | | | | |

| Elections: | Voting standard | Majority of Votes Cast |

| Resignation policy | Yes |

| Chair: | Separate Chair of the Board and CEO | Yes |

| Independent Chair of the Board | Yes |

| Meetings: | Number of Board meetings held in fiscal 2023 | 10 |

| Regular executive sessions of independent directors | Yes |

| Number of committee meetings held in fiscal 2023 | 26 |

Directors attending more than 75% of the meetings of the Board or committees on which they served that were held during the period in which they served in fiscal 2023 | All |

| Director Status: | Stock ownership guidelines for executives and non-employee directors | Yes |

| Code of Business Conduct and Ethics for directors, officers and employees | Yes |

Limits on the number of boards of directors of other public companies a

director can join | Yes |

| Oversight: | ESG report | Annual |

| Risk oversight by full Board and committees | Yes |

| Senior executive succession planning | Yes |

| Say on pay vote | Annual |

| Committee authority to retain independent advisors | Yes |

| | | | | |

We are proud of these and our other environmental and social initiatives at our company. More information can be found in our 2022/2023 Aspen Technology ESG Report, which is included on our website. The information on our website, including the 2022/2023 Aspen Technology ESG Report, is not incorporated by reference into, and should not be considered a part of, this Proxy Statement.

| |

Our Board has oversight responsibility for our overarching ESG matters, including establishing processes concerning material ESG issues and evaluating climate-related risks and opportunities. Specific ESG direction is evaluated through the committees of the Board. A summary of ESG oversight activities by our committees is included below. For a more comprehensive discussion of governance oversight, please see "Information Regarding the Board and Corporate Governance".

| | | | | | | | |

| Audit Committee | Human Capital Committee | Nominating and Corporate Governance Committee |

•Oversees our policies for risk assessment and management, including ESG-related risks. | •Periodically reviews our overall executive officer compensation principles and structure. | •Develops and recommends to the Board a set of corporate governance principles. |

•Reviews and oversees the implementation of our policies and procedures related to cybersecurity risk assessment and management. | •Reviews and assesses risks arising from our employee compensation policies and practices. | •Develops and maintains a director succession plan for the Board. |

| •Periodically reviews the levels of equity ownership of executive officers and non-employee directors. | •Oversees and reviews our policies and procedures related to ESG and oversees shareholder engagement and shareholder inquiries related to ESG matters. |

•Oversees our human capital management, including DEI initiatives. | •Reviews our annual ESG report. |

•Periodically reports to the Board on succession planning for the CEO and such other executive officers as the Board may request or the committee determines is appropriate. | •Considers factors relevant for director nominees, including our diversity objectives. |

Executive Compensation Highlights

The Human Capital Committee believes that our executive compensation program is responsibly aligned with the best interests of our stockholders and is appropriately designed and reasonable in light of the executive compensation programs of our peer group companies.

In fiscal 2023, we used a mix of compensation elements in our program, including:

•base salary;

•annual variable cash incentive bonuses;

•long-term equity incentives in the form of stock options and time-based restricted stock units (“RSUs”);

•severance and change in control benefits; and

•medical, dental and life insurance and other similar benefits.

| | | | | |

| What We Do | What We Don't Do |

aMaintain a clawback policy | rNo hedging or pledging of company securities |

aMaintain stock ownership guidelines for our executive officers and non-employee directors | rNo multi-year guarantees for salary increases or non-performance-based guaranteed bonuses or equity compensation |

aUtilize an independent compensation consultant | rNo excessive perquisites |

aReview compensation award design, principles and processes annually | rNo supplemental executive retirement plans |

| rNo tax gross-up payments for any change in control payments |

| rNo single-trigger benefits in connection with a change in control |

Our executive compensation is heavily weighted toward at-risk, performance-based compensation designed to align the interests of our executives with those of our stockholders. In fiscal 2023, an average of approximately 89% of the compensation of our named executive officers (other than Mr. Pietri, our Chief Executive Officer) was at-risk compensation in the form of variable cash incentive bonuses and equity awards and 47% of Mr. Pietri’s compensation was at-risk compensation in the form of variable cash incentive bonuses. The reason for Mr. Pietri's lower composition of at-risk compensation in fiscal 2023 was due to the fact he only received cash compensation for fiscal 2023 and did not receive an annual equity grant in fiscal 2023 as a result of his one-time equity award granted in June 2022 following the Closing of the Emerson Transactions. However, we anticipate his composition of at-risk compensation in fiscal 2024 to return closer to historical levels as Mr. Pietri received his regular annual grant during the fiscal 2024 grant cycle.

Questions and Answers About These Proxy Materials and Voting

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the internet. We have sent a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders of record as of the close of business on October 18, 2023. Instructions on how to access proxy materials over the internet or to request a printed copy of the proxy materials may be found in the Notice. In addition, you may request to receive future proxy materials in printed form by mail. Your election to receive future proxy materials by mail will remain in effect until you terminate such election and ask to receive future proxy materials electronically. We intend to mail the Notice on or about October 24, 2023 to all stockholders of record entitled to vote at the annual meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, ten or more days after we mail the Notice.

How can I access the proxy materials over the internet?

You may view and also download our proxy materials for the annual meeting - which consist of the Notice, the Proxy Statement, the form of proxy card and our annual report - in the “Investor Relations” section of our website located at www.aspentech.com as well as at www.proxyvote.com.

Why is the 2023 annual meeting a virtual, online meeting?

To minimize travel and expenses and provide an opportunity for more of our stockholders to attend, the annual meeting will be a virtual meeting of stockholders where stockholders will participate by accessing a website using the internet. There will not be a physical meeting location. Our virtual meeting will be governed by our rules of conduct and procedures that will be posted in the "Investor Relations" section of our website located at www.aspentech.com in advance of the annual meeting.

We have designed the virtual annual meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting. In order to encourage stockholder participation and transparency, subject to our rules of conduct and procedures, we will:

•provide stockholders attending the annual meeting with the ability to submit appropriate questions relating to an agenda item on which stockholders are entitled to vote during the annual meeting through the annual meeting website when such item is being considered;

•provide management with the ability to answer as many questions submitted during the annual meeting in accordance with the meeting rules of conduct as possible in the time allotted for the annual meeting without discrimination;

•address technical and logistical issues related to accessing the virtual meeting platform;

•provide procedures for accessing technical support to assist in the event of any difficulties accessing the annual meeting; and

•conduct an informal online question and answer session, to the extent time permits.

How do I virtually attend the annual meeting?

The annual meeting will be a virtual meeting and no physical meeting of stockholders will be held. You are entitled to participate in the annual meeting only if you were a stockholder of record as of the close of business on October 18, 2023 or if you hold a valid proxy for the annual meeting. Please confirm with our service provider, Broadridge, whether advance registration is required for beneficial owners. The online meeting will begin promptly at 9:00 a.m. Eastern time on December 14, 2023. We encourage you to access the annual meeting prior to the start time leaving ample time for the check in. You will be able to attend the annual meeting online and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/AZPN2023. You also will be able to vote your shares online by attending the annual meeting by audio webcast. To participate in the annual meeting, you will need to review the information included on your Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

How do I submit a question to the Board or management at the annual meeting?

If you wish to submit a question to be asked at the annual meeting, you may log into, and ask a question on, the virtual meeting platform at www.virtualshareholdermeeting.com/AZPN2023 using your login number. Once past the login screen, click “Ask a Question,” type in your question and click “Submit.”

We do not place restrictions on the type or form of questions asked during the formal portion of the annual meeting so long as they relate to the specific agenda items on which stockholders are entitled to vote and are asked during the period of time when the applicable matter is being considered; however, we reserve the right to edit or reject questions that are irrelevant to our business, repetitious of statements made by other persons, include derogatory references to individuals or that are otherwise in bad taste, are related to personal grievances or a matter of individual concern that is not a matter of interest to stockholders generally.

What if I have technical difficulties or trouble accessing the virtual annual meeting?

We encourage you to access the meeting prior to the start time. If you encounter any difficulties accessing the virtual annual meeting during the check-in or meeting time, please call the number provided on the virtual meeting platform at www.virtualshareholdermeeting.com/AZPN2023.

Who can vote at the virtual annual meeting?

Only stockholders of record as of the close of business on October 18, 2023, the record date, will be entitled to vote at the annual meeting. On the record date, there were 63,749,655 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote.

Stockholder of Record: Shares Registered in Your Name

If at the record date your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Co., LLC, then you are a stockholder of record. As a stockholder of record, you may vote at the annual meeting or vote by proxy. Whether or not you plan to virtually attend the annual meeting, we urge you to fill out and return a proxy card (if one was provided) or vote by proxy over the telephone or on the internet as instructed below, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or other Nominee

If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You also are invited to virtually attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares at the annual meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

•election of directors nominated by the Board;

•ratification of the appointment by the Audit Committee of the Board of KPMG as our independent registered public accounting firm for fiscal year 2024; and

•approval, on an advisory basis, of the compensation of our named executive officers as identified in this Proxy Statement.

What if another matter is properly brought before the annual meeting?

The Board does not know of any other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the annual meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For each of the proposals, you may vote either “FOR”, “AGAINST” or “ABSTAIN.”

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the annual meeting, vote by proxy using a proxy card (if one was provided), vote by proxy over the telephone, or vote by proxy through the internet. Whether or not you plan to virtually attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote at the annual meeting, even if you have already voted by proxy.

•At the virtual annual meeting. To vote at the virtual annual meeting, follow the instructions at www.virtualshareholdermeeting.com/AZPN2023. You will need to enter your login number found on the Notice or proxy card.

•Via the internet. To vote through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number provided on the Notice. Your vote must be received by 11:59 p.m. Eastern time on December 13, 2023 to be counted.

•By mail. To vote using a proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. Your proxy card must arrive by December 13, 2023.

•By telephone. To vote over the telephone from a location in the United States, Canada or Puerto Rico, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m. Eastern time on December 13, 2023 to be counted.

Beneficial Owner: Shares Registered in the Name of the Broker, Bank or other Nominee

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a notice containing voting instructions from that organization rather than from us. To vote prior to the annual meeting, simply follow the voting instructions in the notice to ensure your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote at the virtual annual meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee included with these proxy materials or contact your broker, bank or other nominee to request a proxy form.

What is a proxy?

The term “proxy,” when used with respect to a stockholder, refers to either a person or persons legally authorized to act on the stockholder’s behalf or a format that allows the stockholder to vote without being present at the annual meeting.

Because it is important that as many stockholders as possible be represented at the annual meeting, the Board is asking that you review this Proxy Statement carefully and then vote by following the instructions set forth on the Notice. In voting prior to the annual meeting, you will deliver your proxy to the proxy holders, which means you will authorize the proxy holders to vote your shares at the virtual annual meeting in the way you instruct. The proxy holders consist of Antonio J. Pietri, Chantelle Breithaupt and Mark Mouritsen. All shares represented by valid proxies will be voted in accordance with a stockholder’s specific instructions.

How many votes do I have?

On each matter, you have one vote for each share of common stock you own as of the record date.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you complete and submit your proxy voting instructions, the individuals named as proxies will follow your instructions. If you are a stockholder of record and you submit proxy voting instructions but do not direct how to vote on each item, the individuals named as proxies will vote as the Board recommends on each proposal. The individuals named as proxy holders will vote on any other matters properly presented at the annual meeting in accordance with their best judgment.

Who is paying for this proxy solicitation?

We are soliciting your proxy and will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We have engaged Alliance Advisors, LLC on an advisory basis and they may help us solicit proxies from brokers, bank nominees and other institutional owners. We expect to pay Alliance Advisors, LLC a fee of approximately $10,000 for their services, plus expenses.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to our Secretary at our principal executive offices at: Aspen Technology, Inc., 20 Crosby Drive, Bedford, Massachusetts 01730.

•You may virtually attend the annual meeting and vote. Simply attending the annual meeting will not, by itself, revoke your proxy.

•Your most current proxy card or telephone or internet proxy is the one that is counted. If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee.

How are votes counted?

Votes will be counted by the inspector of election appointed for the annual meeting, who will separately count:

•with respect to each director nominee in Proposal One, “FOR”, “AGAINST”, “ABSTAIN” and broker non-votes;

•with respect to Proposal Two, “FOR”, “AGAINST”, and "ABSTAIN" votes; and

•with respect to Proposal Three, “FOR”, “AGAINST”, “ABSTAIN” and broker non-votes.

The presence, in person or by proxy, of the holders of a majority of the voting power of all of the then-outstanding shares of our capital stock generally entitled to vote at the annual meeting shall constitute a quorum for the transaction of business. Abstentions are counted as present when determining a quorum but will not count as votes cast and will have no effect on any of the proposals presented to the stockholders herein. Broker non-votes are counted as present when determining a quorum but will not count as votes cast and as such will have no effect on the outcome of those proposals. Brokers are entitled to vote for the ratification of the appointment of auditors and therefore we expect broker non-votes will not exist as to Proposal Two.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of KPMG as our independent registered public accounting firm for fiscal 2024 (Proposal Two) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal Two.

We expect the other proposals on the ballot will be considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, so unless the beneficial owner gives the broker or nominee specific instructions regarding the owner’s vote on each proposal, there may be broker non-votes on Proposals One and Three.

How many votes are needed to approve the proposals?

•For Proposal One, which relates to the election of directors, each of the nominees who receives a majority of the votes cast with respect to that nominee’s election at the annual meeting if a quorum is present. Each of the nominees who receives more “FOR” votes than “AGAINST” votes will be elected. Each of the nominees who receives more “AGAINST” votes than “FOR” votes will submit his or her offer of resignation for consideration by the Nominating and Corporate Governance Committee, which shall consider all relevant facts and circumstances and recommend to the Board the action to be taken with respect to such offer of resignation. Votes to “ABSTAIN” and broker non-votes will have no effect on the outcome of the vote. Please refer to “Information Regarding the Board and Corporate Governance - Director Nomination Process” for more information on this policy.

•Proposal Two, which relates to the ratification of KPMG as our independent registered accounting firm for fiscal 2024, must receive “FOR” votes constituting a majority of the votes cast at the annual meeting at which a quorum is present. Votes to “ABSTAIN” will not count as votes cast and will have no effect on the outcome of this vote. Because Proposal Two is considered a “routine” matter, brokers are entitled to vote on Proposal Two and therefore we expect broker non-votes will not exist. This vote is not binding on us, but will be given due consideration by our Board and the Audit Committee.

•Proposal Three, which relates to the approval, on an advisory basis, of the compensation of our named executive officers, must receive “FOR” votes constituting a majority of the votes cast at the meeting at which a quorum is present. Abstentions will not count as votes cast and will have no effect on the vote. Because this proposal is considered “non-routine,” brokers will not have discretionary authority to vote shares on this proposal without direction from the beneficial owner, and broker non-votes will have no effect on the vote. This vote is not binding on us, but will be given due consideration by our Board and the Human Capital Committee.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of a majority of the voting power of all of the then-outstanding shares of our capital stock generally entitled to vote at the annual meeting constitutes a quorum for the transaction of business. On the record date, there were 63,749,655 shares outstanding and entitled to vote. Thus, the holders of 31,874,828 shares must be present at the annual meeting virtually or represented by proxy at the annual meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the virtual annual meeting. Abstentions and broker non-votes count as present when determining a quorum.

The Board or the chair of the meeting may adjourn the meeting to another time or place (whether or not a quorum is present), and notice need not be given of the adjourned meeting if the time, place, if any, and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting, are announced at the meeting at which such adjournment is made. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting. If the adjournment is for more than 30 days, or after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the meeting.

When are stockholder proposals due for next year’s annual meeting?

If a stockholder wishes to have a proposal considered for inclusion in our Proxy Statement and proxy card in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), for presentation at the 2024 annual meeting of stockholders (“2024 Annual Meeting”), the proposal must be received in writing by June 26, 2024 by our Secretary at our principal executive offices at 20 Crosby Drive, Bedford, Massachusetts 01730.

Additionally, if a stockholder wishes to propose a director nominee or item of business before the 2024 Annual Meeting, the stockholder must give timely written notice to our Secretary at the address noted above. To be timely, a stockholder’s notice must be delivered to our Secretary not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders; provided, however, that in the event that the date of the annual meeting is advanced more than 30 days prior to such anniversary date or delayed more than 90 days after such anniversary date then to be timely we must receive such notice no earlier than 120 days prior to such annual meeting and no later than the later of 90 days prior to the date of the meeting or the 10th day following the day on which we first publicly announce the date of the meeting. For the 2024 Annual Meeting, notice must have been delivered no earlier than August 16, 2024 and no

later than September 15, 2024. In addition to the timing requirements set forth above, our bylaws set forth the procedures a stockholder must follow in order to nominate a director for election or to present any other proposal at an annual meeting of our stockholders, other than proposals intended to be included in our sponsored proxy materials.

To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than October 15, 2024.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Form 8-K within four business days of the annual meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K by that date, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days of the final results, amend the Current Report on Form 8-K to publish the final results.

Proposal One: Election of Directors

Our Board currently consists of eight members: Patrick M. Antkowiak, Thomas F. Bogan, Karen M. Golz, Ram R. Krishnan, Antonio J. Pietri, Arlen R. Shenkman, Jill D. Smith and Robert M. Whelan, Jr. Robert E. Beauchamp resigned from the Board effective September 2, 2023. As a result of Mr. Beauchamp’s departure, we have one vacancy on the Board. Proxies may not be voted for a greater number of persons than the nominees named. The Board has nominated each of the eight current Board members for election and has recommended that each be elected to the Board, each to hold office until the 2024 Annual Meeting and until his or her successor has been duly elected and qualified or until his or her earlier death, resignation or removal.

The Board knows of no reason why any of the nominees would be unable or unwilling to serve, but if any nominee should for any reason be unable or unwilling to serve, the proxies will be voted for the election of such other person for the office of director as the Board may recommend in the place of such nominee. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Skills and Experience Matrix | C-Suite Leadership | Global Leadership | Technology | Information Technology/Cybersecurity | Commercial/Profit & Loss | Operational | Process Engineering/Manufacturing | Compensation | Compliance/Risk Management | Public Company Corporate Governance | M&A/Business Development | Capital Markets | Sustainability | Talent Management |

PATRICK M. ANTKOWIAK President, CEM Technology Advisors, LLC and former Chief Strategy and Technology Officer and CVP, Northrop Grumman Corporation | • | • | • | • | | • | • | | • | | | | | |

THOMAS F. BOGAN Retired Vice Chairman, Workday, Inc. and former Executive Vice President of Workday’s Planning Business Unit | • | • | • | • | • | • | | • | • | • | • | • | | • |

KAREN M. GOLZ Retired Partner and former Global Vice Chair, Japan, Ernst & Young LLP | | • | | | | | | | • | • | | • | | |

RAM R. KRISHNAN Executive Vice President & Chief Operating Officer, Emerson Electric Co. | • | • | • | • | • | • | • | • | • | • | • | • | • | • |

ANTONIO J. PIETRI President & Chief Executive Officer, Aspen Technology, Inc. | • | • | • | • | • | • | • | • | • | • | • | • | • | • |

ARLEN R. SHENKMAN President and Chief Financial Officer, Boomi, Inc. | • | • | • | • | • | • | | | • | • | • | • | | • |

JILL D. SMITH Retired President and Chief Executive Officer, Allied Minds plc, and former Chair, Chief Executive Officer and President of DigitalGlobe Inc. | • | • | • | • | • | • | | • | • | • | • | • | | • |

ROBERT M. WHELAN, JR. Founder of Whelan & Co. | • | • | | | • | | | • | • | • | • | • | | • |

| | | | | | | | |

| Board Diversity Matrix (As of October 24, 2023) |

| Total Number of Directors | 8 |

| Female | Male |

| Part I: Gender Identity | 2 | 6 |

| Part II: Demographic Background | | |

| South Asian | | 1 |

| Hispanic or Latinx | | 1 |

| White | 2 | 4 |

Stockholders Agreement

As part of the Emerson Transactions, we, Emerson and its affiliate entered into a Stockholders Agreement, dated as of May 16, 2022 (the “Stockholders Agreement”). In connection with the Closing of the Emerson Transactions, Emerson initially designated Jill D. Smith, Ram R. Krishnan, Arlen R. Shenkman, Thomas F. Bogan and Patrick M. Antkowiak as nominees to the Board and Heritage AspenTech initially designated Robert E. Beauchamp, Karen M. Golz and Robert M. Whelan, Jr. as nominees to the Board. The Stockholders Agreement also provides that, until the Third Trigger Date, the then-current Chief Executive Officer of the Company, currently Antonio J. Pietri, must be included for nomination at any meeting at which directors are elected.

The Stockholders Agreement provides for additional nomination rights following the Closing of the Emerson Transactions. Pursuant to the Stockholders Agreement, among other things, (i) prior to the date that is forty-five days following such time as Emerson owns less than 20% of our outstanding common stock, subject to certain conditions (the “Third Trigger Date”), Emerson has the right to designate a number of director nominees equal to Emerson’s percentage ownership of our common stock outstanding multiplied by the total authorized number of directors currently of the Board, rounded up to the nearest whole person, which number will not be less than a majority of the Board (until the date that is forty-five days following such time as Emerson owns less than 40% of our outstanding common stock, subject to certain conditions (the “Second Trigger Date”)) and (ii) following the Third Trigger Date, Emerson has the right to designate one director nominee (each person designated by Emerson, an “Emerson Designee”). We are required, pursuant to the Stockholders Agreement, to cause each Emerson Designee to be included in the slate of nominees recommended by the Board for election and to use our best efforts to cause the election of each such Emerson Designee.

Pursuant to the Stockholders Agreement, in the event that any Emerson Designee who is a member of the Board (an “Emerson Director”), ceases to serve as a director for any reason, the vacancy resulting therefrom shall be filled by the Board with a substitute Emerson Designee. Under the terms of the Stockholders Agreement, based on Emerson's current ownership interest, Emerson has the right to nominate five Emerson Designees to our Board. Jill D. Smith, Ram R. Krishnan, Arlen R. Shenkman, Thomas F. Bogan and Patrick M. Antkowiak are the Emerson Designees.

Director Nominees

In order to ensure that the Board has a diversity of skills and experience with respect to accounting and finance, management and leadership, vision and strategy, business operations, business judgment, industry knowledge and corporate governance, the Nominating and Corporate Governance Committee takes into consideration factors it deems appropriate which may include, judgment, skill, diversity, character, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the

extent to which the candidate would be a desirable addition to the Board and any committees of the Board. The Nominating and Corporate Governance Committee may consider candidates proposed by management but is not required to do so. The Nominating and Corporate Governance Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and criteria for new Board members as well as the composition of the Board as

a whole.

The following is a brief biography of each nominee for director as of October 24, 2023 and includes information regarding the specific and particular experience, qualifications, attributes and skills of each nominee for director that led the Nominating and Corporate Governance Committee to believe that such nominee should continue to serve on the Board. For the Heritage AspenTech directors who became members of the Board upon the Closing of the Emerson Transactions on May 16, 2022, the start of their service as Heritage AspenTech directors is shown in parentheses.

| | | | | |

| Professional Experience

Mr. Antkowiak is currently president of CEM Technology Advisors, LLC, a strategy and technology consulting business. He spent over 38 years in increasingly senior roles at Northrop Grumman Corporation, including as the company’s Chief Technology Officer and Corporate Vice President from 2014 to 2018, and retired in 2019 as the company’s Chief Strategy and Technology Officer and Corporate Vice President, having led the company’s technology development strategy and execution, focusing the company on competitive differentiation in emerging technology areas across the space, airborne, maritime, ground and cyber domains. Mr. Antkowiak is currently a member of the Department of the Air Force Scientific Advisory Board. He also serves on the board of directors for the Advanced Robotics for Manufacturing (ARM) Institute and is a member of The Johns Hopkins University's Whiting School of Engineering Dean's advisory board. Mr. Antkowiak received his BSEE in electrical and computer engineering (ECE) from The Johns Hopkins University and his MSEE from the University of Maryland.

We believe Mr. Antkowiak’s expertise and experience in technology development and strategy are valuable to the Board.

|

Patrick M. Antkowiak President, CEM Technology Advisors, LLC and former Chief Strategy and Technology Officer and CVP, Northrop Grumman Corporation

Independent Director Since: 2022 Committees: Audit Age: 63 Other Current Public Company Boards: None

|

| | | | | |

| Professional Experience

Mr. Bogan served as Vice Chairman at Workday, Inc. from 2020 to 2022, and previously served as Executive Vice President of Workday’s Planning Business Unit. Mr. Bogan joined Workday from Adaptive Insights, where he was Chief Executive Officer and a director from 2015 until its acquisition by Workday in 2018. In 2022, Mr. Bogan joined the board of directors of Workday, Inc. Since 2021, he also has served as a director of Catapult Group International Ltd. From 2007 until January 2019, he was a director of Apptio, Inc., including its Chair from 2012 to 2019. Mr. Bogan previously served as a director of Citrix Systems, Inc. from 2003 to 2016, including its Chair from 2004 to 2015, and was a director of PTC Inc. from 2011 to 2015; and of Rally Software Development Corp. from 2009 to 2015. He has also served as a director and executive officer of various other public and privately held companies, including Greylock Partners, Rational Software Corp., Avatar Technologies and Pacific Data. Mr. Bogan received a bachelor’s degree in accounting from Stonehill College.

We believe Mr. Bogan’s knowledge and experience in the software industry as a CEO, Board member and investor are valuable to the Board.

|

Thomas F. Bogan Retired Vice Chairman, Workday, Inc. and former Executive Vice President of Workday's Planning Business Unit.

Independent Director Since: 2022 Committees: Human Capital (Chair); M&A Age: 72 Other Current Public Company Boards: Workday, Inc.; Catapult Group International Ltd.

|

| | | | | |

| Professional Experience

Ms. Golz is a retired partner of Ernst & Young (EY), where she held various senior leadership positions during her 40-year tenure, including, most recently, Global Vice Chair, Japan from 2016 to 2017. In addition to accounting, financial reporting and audit expertise, Ms. Golz brings considerable experience in international and regulatory matters. As Global Vice Chair of Professional Practice from 2010 to 2016, Ms. Golz oversaw accounting, auditing, regulatory, tools and methodologies and supported innovation within EY’s Global Assurance practice. Prior to that, Ms. Golz held the Americas and Global Vice-Chair of Professional Ethics/Independence. Ms. Golz is a board and audit committee member of Analog Devices, Inc., iRobot Corporation, and Osteon Holdings/Exactech, a privately held company. She is senior advisor to The Boston Consulting Group’s Audit and Risk Committee and is a National Association of Corporate Directors Board Leadership Fellow and sits on the Board of Trustees of the University of Illinois Foundation. She earned her Bachelor of Science degree in Accountancy, summa cum laude, from the University of Illinois, Urbana-Champaign and is a certified public accountant.

We believe that Ms. Golz's deep expertise in audit and financial reporting and corporate governance are valuable to the Board.

|

Karen M. Golz Retired Partner and former Global Vice Chair, Japan, Ernst & Young LLP

Independent Director Since: 2022 (2021) Committees: Audit (Chair) Age: 69 Other Current Public Company Boards: Analog Devices, Inc.; iRobot Corporation

|

| | | | | |

| Professional Experience

Mr. Krishnan has served as Executive Vice President and Chief Operating Officer of Emerson Electric Co. since 2021. Mr. Krishnan has extensive experience across Emerson’s Automation Solutions and Commercial & Residential Solutions businesses. He joined Emerson in 1994 as a project engineer and held a number of management roles of increasing responsibility. He was named President of Climate Technologies in Asia in 2011, serving in Hong Kong. He returned to the United States as Vice President of Profit Planning and Perfect Execution in 2015, a role he held until 2016, when he became Group President of Flow Solutions. He was named Chief Operating Officer of Final Control in 2017 and became the Group President of Final Control later that year following the successful $3.15 billion acquisition of Pentair’s valves and controls business. As Chief Operating Officer of Emerson, Mr. Krishnan oversees global supply chain operations, information technology, strategic planning and corporate development. Mr. Krishnan has a bachelor’s degree in metallurgical engineering from the Indian Institute of Technology, a master’s degree in materials engineering from Rensselaer Polytechnic Institute and a master’s degree in business administration from Xavier University.

We believe Mr. Krishnan’s operational, strategic, and mergers and acquisitions experience, as well as his knowledge of the industrial software market, are valuable to the Board.

|

Ram R. Krishnan Executive Vice President & Chief Operating Officer, Emerson Electric Co.

Director Since: 2022 Committees: Human Capital; Nominating and Corporate Governance; M&A (Chair) Age: 52 Other Current Public Company Boards: None

|

| | | | | |

| Professional Experience

Mr. Pietri was named President and Chief Executive Officer of Heritage AspenTech in 2013 and has served as a director of Heritage AspenTech since 2013. He became our President and Chief Executive Officer and joined our Board in 2022 upon the Closing of the Emerson Transactions. Before accepting his appointment as President and Chief Executive Officer, he had served as Heritage AspenTech’s Executive Vice President, Field Operations since 2007. Mr. Pietri served as Heritage AspenTech’s Senior Vice President and Managing Director for the Asia-Pacific region from 2002 to 2007 and held various other positions with Heritage AspenTech since 1996. From 1992 to 1996, he was at Setpoint Systems, Inc., which Heritage AspenTech acquired, and before that he worked at ABB Simcon and AECTRA Refining and Marketing, Inc. He holds an M.B.A. from the University of Houston and a B.S. in Chemical Engineering from the University of Tulsa.

We believe Mr. Pietri's working relationships with our customers and employees, deep understanding of our products and operations and the industrial software market, and his unique perspective on our growth strategy and day-to-day operations are valuable to the Board.

|

Antonio J. Pietri President & Chief Executive Officer, Aspen Technology, Inc.

Director Since: 2022 (2013) Committees: None Age: 58 Other Current Public Company Boards: None

|

| | | | | |

| Professional Experience

Mr. Shenkman is the President and Chief Financial Officer of Boomi, Inc. where he is responsible for driving business transformation and financial growth. Prior to that, Mr. Shenkman served as Executive Vice President and Chief Financial Officer of Citrix Systems Inc. from 2019 to 2022. Prior to joining Citrix, Mr. Shenkman served as Executive Vice President and Global Head of Business Development and Ecosystems of SAP from 2017 to 2019, where he was responsible for driving business development by building new ecosystems, fostering strategic partnerships, incubating new business models, and overseeing investments and mergers and acquisitions. Prior to that role, from 2015 to 2017, Mr. Shenkman served as Chief Financial Officer of SAP North America, SAP’s largest business unit, responsible for all finance functions in North America, including forecasting and planning, identifying efficiencies, and ensuring the region’s overall financial health. Mr. Shenkman previously served as SAP’s Global Head of Corporate Development from 2012 to 2015 and was a principal architect of SAP’s rapid transformation into a cloud company. Mr. Shenkman is the Chair of the Operating Committee and member of the audit committee and board of directors of Commvault Systems Inc. He has a J.D. from the University of Miami School of Law, an M.B.A. from the Fox School of Business at Temple University, and a bachelor’s degree in political science from George Washington University.

We believe Mr. Shenkman’s operational experience in the software industry, and his expertise in audit, financial reporting and mergers and acquisitions are valuable to the Board.

|

Arlen R. Shenkman President & Chief Financial Officer, Boomi, Inc.

Independent Director Since: 2022 Committees: Audit; M&A Age: 53 Other Current Public Company Boards: Commvault Systems Inc.

|

| | | | | |

| Professional Experience