UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

(Commission File No. 001-41157)

BIONOMICS LIMITED

(Translation of registrant’s name into English)

200 Greenhill Road

Eastwood SA 5063

Tel: +618 8150 7400

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Yes ☐ No ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

Yes ☐ No ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On July 28, 2023, the Company lodged a release with the Australian Securities Exchange (ASX), as required by the laws and regulations of Australia, updating the Shareholders about the ASX de-listing process . The announcement and the Shareholder Communication Letter are both furnished herewith as Exhibits 99.1 and 99.2, respectively, to this report on Form 6-K. A copy of the ADS Comversion Facility Election Form is available on the Company's website.

1

EXHIBIT INDEX

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

Bionomics Limited |

|

(Registrant) |

|

|

|

|

By: |

/s/ Alan Fisher |

|

Name: |

Alan Fisher |

|

Title: |

Non-Executive Chairman |

Date: July 28, 2023

1

Exhibit 99.1

ASX ANNOUNCEMENT

28 July 2023

Shareholder communication on the De-listing process

Bionomics Limited (ASX: BNO, Nasdaq: BNOX), (“Bionomics” or the “Company”), a clinical-stage biopharmaceutical company developing novel, allosteric ion channel modulators designed to transform the lives of patients suffering from serious central nervous system (“CNS”) disorders with high unmet medical need, refers to its Announcement released to the ASX on 25 July 2023 titled “Bionomics announces voluntary delisting”.

In accordance with ASX Listing Rules 3.17, please find attached the copies of the following documents being sent to Shareholders today:

•a letter giving information about the de-listing process and the options available to Shareholders, and

•an ADS Conversion Facility Election Form.

Released on authority of the Company Secretary.

FOR FURTHER INFORMATION PLEASE CONTACT:

|

|

General: Ms. Suzanne Irwin Company Secretary CoSec@bionomics.com.au |

|

About Bionomics Limited

Bionomics (ASX:BNO, NASDAQ:BNOX) is a clinical-stage biopharmaceutical company developing novel, allosteric ion channel modulators designed to transform the lives of patients suffering from serious CNS disorders with high unmet medical need. Bionomics is advancing its lead drug candidate, BNC210, an oral, proprietary, selective negative allosteric modulator of the α7 nicotinic acetylcholine receptor, for the acute treatment of Social Anxiety Disorder (SAD) and chronic treatment of Post-Traumatic Stress Disorder (PTSD). Beyond BNC210, Bionomics has a strategic partnership with Merck & Co., Inc. (known as MSD outside the United States and Canada) with two drugs in early-stage clinical trials for the treatment of cognitive deficits in Alzheimer’s disease and other central nervous system conditions. Bionomics’s pipeline also includes preclinical assets that target Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for CNS conditions of high unmet need.

www.bionomics.com.au

Bionomics Limited | 200 Greenhill Road, Eastwood, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

Exhibit 99.2

ABN 53 075 582 740

28 July 2023

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Dear Shareholder

Bionomics Limited (ASX: BNO, Nasdaq: BNOX) – Voluntary delisting from the ASX

Bionomics Limited (Bionomics or the Company) (ASX: BNO, Nasdaq: BNOX) has requested and received formal approval from the Australian Securities Exchange (ASX) to be removed from the official list of the ASX (Official List) pursuant to ASX Listing Rule 17.11 (Delisting).

This letter seeks to provide you, as a holder of fully paid ordinary shares in the capital of the Company (Shares), with information about the Delisting process, the options available to you in connection with your Shares and certain implications which may arise for you as a result of the Delisting. Full details regarding the options available to you in respect of your Shares are set out in Section 5.

The information in this letter does not take into account your individual investment objectives, financial situation and needs. The information in this letter is of a general nature and is not financial product advice and should not be relied upon as the sole basis for any investment decision. As a holder of Shares (Shareholder), you should consult your financial, legal, tax or other professional advisor in relation to the information contained in this letter and how you should act with respect to your Shares.

1Why is Bionomics delisting from the ASX?

Since its US IPO and listing on Nasdaq in December 2021 to 18 July 2023, the average daily trading volume of the Company’s American Depositary Shares (ADS) traded on Nasdaq was 26,595 (equivalent to 4,787,100 Shares based on a ratio of 180 Shares to 1 ADS) compared to an average daily trading volume of 220,528 Shares per day on ASX. The lower level of liquidity on ASX means there are reduced trading opportunities for Shareholders who wish to exit their holdings. Accordingly, the Company wishes to move to having Nasdaq as its sole listing.

1

Exhibit 99.2

The continued listing of the Company on ASX requires the Company to incur considerable corporate and administrative costs, including listing fees. The Company is seeking to minimise its expenditure and would cease incurring such additional costs if it is removed from the Official List.

1.3US capital raisings / US focus

The Delisting from ASX and retention of a primary listing on Nasdaq is expected to fully leverage the Company’s large institutional investor base and other financing options in the USA that currently has the most active biotechnology ecosystem on a global basis. Being dual listed on ASX and Nasdaq is currently limiting fundraising options for the Company.

1.4Location of directors and management

With the exception of the Company’s Chair, Mr Alan Fisher, and a director, Dr Jane Ryan, all of the Company's non-executive board members and the Company’s Managing Director (President and CEO) reside outside of Australia, reflecting the Company's focus on international rather than domestic markets.

1.5Geographic analysis of shareholder base

The majority of the Company’s largest Shareholders are located in North America and Europe, with less than 10% of the Company’s issued share capital held by Shareholders resident in Australia. This reflects the shift in the Company's shareholding base away from Australian resident investors to overseas investors, who will likely benefit from a sole listing on Nasdaq.

2What are the consequences of Delisting?

The main consequence of the Delisting for Shareholders is that, from the time the Delisting takes effect on 28 August 2023 (Delisting Date), Bionomics Shares will no longer be quoted or traded on the ASX. Therefore, Shareholders who wish to sell their Shares on the ASX will need to do so before the Delisting Date.

Shareholders who retain their Shares after the Delisting Date will be issued share certificates, which will be proof of ownership of their Shares and should be held in safe-keeping by the Shareholder. Shareholders who wish to sell their Shares after the Delisting Date must either:

(a)elect to participate in the Voluntary Sale Facility (described in section 4(a)(iii) below);

(b)convert their Shares to ADSs and sell their ADSs on Nasdaq by engaging a US broker or an Australian broker who has an agreement with a US broker that is able to buy or sell ADSs on Nasdaq and instruct them to contact the Company’s depositary bank Citibank, N.A (Depositary) by email to arrange for the conversion of their certificated Shares into ADSs (see https://ir.bionomics.com.au/ir-resources/share-ownership for more details); or

(c)sell their Shares via off-market private transactions (subject to compliance with the Corporations Act 2001 (Cth)).

Following the Delisting, Bionomics will remain an Australian incorporated company and will maintain its listing of ADSs on Nasdaq under the trading symbol ‘BNOX’. Trading of ADSs on the Nasdaq will continue, uninterrupted, during and after the Delisting.

2

Exhibit 99.2

Copies of Bionomics’ press releases and other corporate information will continue to be available on the US Securities and Exchange Commission’s (SEC) website (www.sec.gov) as well as the Company’s website at www.bionomics.com.au.

Each ADS represents the right to receive, and to exercise the beneficial ownership interests in, 180 Shares that are on deposit with Citicorp Nominees Pty Limited (Custodian), the custodian appointed by the Depositary. The Depositary will be (directly or indirectly through the Custodian) the holder of the Shares underlying the ADSs.

Holders of ADSs do not have direct Shareholder rights. The Depositary holds, on the ADS holder’s behalf, the rights attaching to the Shares underlying your ADSs. Holders of ADSs are able to exercise the rights attaching to the Shares represented by the ADSs through the Depositary to the extent contemplated in the deposit agreement (Deposit Agreement), a copy of which is available from Bionomics’ website (https://ir.bionomics.com.au/financials-filings/sec-filings) and the SEC’s website (www.sec.gov). To exercise any rights attaching to Shares which are not contemplated under the Deposit Agreement, holders of ADSs will need to arrange for the cancellation of their ADSs so that they can become a direct Shareholder.

Shares represented by ADSs are treated as held under a bare trust for such holder. Consequently, the Shares will be regarded as owned by the ADS holder for Australian income tax and capital gains tax purposes. Dividends paid on the underlying Shares will also be treated as dividends paid to the ADS holder, as the person beneficially entitled to those dividends.

4What is the Delisting process and timetable?

(i)Suspension of Shares from ASX trading and Delisting

Shareholders will continue to be able to trade their Shares on the ASX until the close of trading on 24 August 2023 (Suspension Date), when trading in Shares will be suspended. Following suspension of Shares from quotation, Shareholders will no longer be able to trade their Shares on the ASX. It is expected that two business days following the suspension of trading of Shares, Bionomics will be removed from the Official List.

Shareholders who retain their Shares after the Delisting Date will be issued share certificates, which will be proof of ownership of their Shares and should be held in safe-keeping by the Shareholder.

(ii)ADS Conversion Facility

The Company has established a facility pursuant to which Shareholders may elect to convert, prior to the Delisting, all of their Shares to ADS (ADS Conversion Facility), unless they are a custodian or nominee holding Shares on behalf of multiple holders. If the number of Shares held by a Shareholder is such that the aggregate entitlement of the Shareholder includes a fractional entitlement to an ADS, then the entitlement of that Shareholder will be rounded down to the nearest whole number of ADSs and the Shareholder will retain the remaining Shares held which are not converted to ADSs.

The Company will cover Shareholder’s costs of participating in the ADS Conversion Facility, to facilitate participation in the ADS Conversion Facility.

3

Exhibit 99.2

See section 5 below for details on how to participate, prior to the Delisting, in the ADS Conversion Facility.

(iii)Voluntary Sale Facility

Following the Delisting, the Company will establish a voluntary sale facility through which Shareholders will be able to elect to exit their Shareholding by having their Shares converted to ADSs, with the ADS to be sold on Nasdaq (without incurring any brokerage or any related costs, levies or fees) with the proceeds of the sale to be remitted to the Shareholder (Voluntary Sale Facility).

The Voluntary Sale Facility is expected to operate from 7 September 2023 to 8 December 2023.

(b)Indicative dates for the Delisting process

The table below sets out an indicative timeline for the Delisting process.

|

|

Date |

Event |

25 July 2023 |

Bionomics announces the Delisting on the ASX. |

28 July 2023 |

This letter, accompanied by the ADS Conversion Facility election form, is sent or emailed to Shareholders containing details of the Delisting and information on the options available to Shareholders. |

24 August 2023 |

Closing Date for participation in the ADS Conversion Facility |

24 August 2023

(at close of trading) |

Suspension Date – effective date of the suspension in trading of Shares on the ASX. Shareholders will not be able to trade Bionomics Shares on the ASX after this date. |

28 August 2023

(at close of trading) |

Delisting Date – effective date of removal of Bionomics from the Official List. |

7 September 2023 |

Opening date of the Voluntary Sale Facility. |

8 December 2023 |

Closing date of the Voluntary Sale Facility. |

All dates and times in this letter refer to Australian Central Time / Australian Central Daylight Savings Time (as applicable). These dates and times are indicative only and subject to change. Bionomics will announce any amendment to those dates and times.

As a holder of Shares, you have the following options in respect of the Delisting, which you should carefully consider before deciding what to do with your Shares. If you do nothing, then Option 3 will apply by default.

OPTION 1: Sell your Shares on the ASX on or before the Suspension Date

You can sell your Shares on the ASX at any time prior to the close of trading on the Suspension Date, which is currently expected to be 24 August 2023. You should contact your stockbroker or financial advisor to arrange the sale.

After the Suspension Date, you will not be able to sell your Shares on the ASX.

If you elect to sell your Shares on the ASX prior to the Suspension Date, you will be responsible for all costs associated with the sale, including any broker commission.

OPTION 2: Participate in the ADS Conversion Facility

4

Exhibit 99.2

You can elect to participate in the ADS Conversion Facility and convert all of your Shares into ADSs on a 180:1 basis, unless you are a custodian or nominee holding Shares on behalf of multiple holders, to be held directly in uncertificated form in the Direct Registration System (DRS) on the American Depositary Receipt (ADR) register of the Depositary.

If the number of Shares held by a Shareholder is such that the aggregate entitlement of the Shareholder includes a fractional entitlement to an ADS, then the entitlement of that Shareholder will be rounded down to the nearest whole number of ADSs and the Shareholder will retain the remaining Shares held which are not converted to ADSs (Remaining Shares). Shareholders with Remaining Shares will be eligible to participate in the Voluntary Sales Facility with respect to the Remaining Shares.

Shareholders will not be charged any fees by the Company if they convert their Shares into ADSs by participating in the ADS Conversion Facility by the Suspension Date.

Shareholders who would like to participate in the ADS Conversion Facility should complete an ADS Conversion Facility election form (Conversion Form) and return it to the Company’s Australian Share Registry, Computershare Investor Services Pty Limited (Computershare), by the Suspension Date, being 24 August 2023. A personalised Conversion Form accompanies this letter.

If you return your Conversion Form after the Suspension Date, you will not be able to participate in the ADS Conversion Facility.

If you elect to convert your Shares into ADSs, you may then choose to hold those ADSs or sell them on the Nasdaq at a later time through a US broker or an Australian broker who has an agreement with a US broker that is able to buy or sell ADSs on Nasdaq (subject to compliance with Nasdaq trading requirements).

If you elect to participate in the ADS Conversion Facility and then subsequently sell your ADSs on Nasdaq, any costs incurred in connection with the sale will be borne by you.

OPTION 3: Take no action by the Suspension Date

If you take no action by the Suspension Date (i.e. you do not proceed with Option 1 or Option 2 above), you will retain your Shares but they will no longer be quoted, or able to be traded on the ASX and your Shareholding will become a certificated holding.

If you take no action, a share certificate will be issued for your Shares and be sent to you by post within 8 business days of the Delisting Date. This must be kept in a safe place as it is proof of ownership of Shares in the Company.

OPTION 4: Participate in the Voluntary Sale Facility

If you take no action by the Suspension Date and as a consequence remain a Shareholder as at the Delisting Date (or if you hold Remaining Shares following participation in the ADS Conversion Facility), you will be sent, together with the share certificate for your Shares, an election form (Sale Election Form) which will enable you to elect to participate in the Voluntary Sale Facility, together with further information regarding the operation of the Voluntary Sale Facility.

If you wish to participate in the Voluntary Sale Facility, you must complete and return the Sale Election Form and your share certificate in accordance with the instructions on the form to Computershare by the closing date, expected to be 8 December 2023. Please note that if you elect to participate in the Voluntary Sale Facility, unless you are a custodian or nominee holding Shares on behalf of multiple holders, you can only elect to sell all of your Shares (i.e. you cannot elect to sell just a portion of your holding).

5

Exhibit 99.2

Under the Voluntary Sale Facility, Bionomics will facilitate the conversion of your Shares to ADSs and the transfer to Bionomics’ appointed sale agent, Baker Young Limited (AFSL 246735, ABN 92 006 690 320) (Sale Agent), and their nominated US Intermediary for the purpose of enabling the sale of the ADSs. Computershare will aggregate the sale elections into batches and the Sale Agent will, at its discretion, effect the sale of the ADSs in each batch on the Company’s behalf on Nasdaq.

Sale proceeds will be remitted to you in Australian dollars to the bank account recorded on the share register or by cheque, or by Global Wire, based on the average price of the ADSs sold in the applicable batch and the relevant exchange rate at the time of conversion (rounded down to the nearest cent). You will not receive interest on any proceeds.

The Company will pay all brokerage and any related costs, levies or fees associated with the sale of ADSs on Nasdaq on behalf of participating Shareholders and remittance of sale proceeds (including any foreign currency conversion fee) in connection with the Voluntary Sale Facility.

The Voluntary Sale Facility is expected to be open for participation from 7 September 2023 until 8 December 2023. Participation in the Voluntary Sale Facility is entirely voluntary and Shareholders are not obliged to sell their securities through the facility.

There are risks associated with:

(a)participating in the ADS Conversion Facility and holding ADSs; and

(b)participating in the Voluntary Sale Facility and selling your Shares.

Risks of participating in the ADS Conversion Facility

If you elect to participate in the ADS Conversion Facility you will be issued ADSs and be subject to the rights and obligations of an ADS holder. Therefore, the Company strongly encourages you to read the section of the Company’s Form F-3 Registration Statement titled “Description of American Depositary Shares”, which includes a summary description of the material terms of the ADSs and of the material rights of owners of ADSs. A copy of the Company’s Form F-3 Registration Statement is available on the US Securities and Exchange Commission’s (SEC) website (www.sec.gov) as well as the Company’s website at www.bionomics.com.au.

Risks of participating in the Voluntary Sale Facility

If you elect to participate in the Voluntary Sale Facility, your total sale proceeds will depend on the level of buyer demand, buyer pricing constraints, trading volatility in Bionomics’ ADSs on Nasdaq, as well as the applicable exchange rate at the time of conversion.

Both the price of ADSs and the A$:US$ exchange rate may fluctuate from time to time and accordingly may impact, positively or negatively, the amount of sale proceeds you receive if you sell your Shares through the Voluntary Sale Facility.

The impact of these factors for those that elect to participate in the Voluntary Sale Facility, or those that did nothing and whose Shares remain as certificated holdings on the Australian share register, may be more or less adverse than if they had elected another option.

6

Exhibit 99.2

7Restrictions on Certain Shareholders

Notwithstanding anything in this letter to the contrary, Shareholders who either:

(a)are, or have been during the three months prior to completion of the Conversion Form or Sale Election Form, as applicable, an officer or director of the Company, a beneficial owner of Shares representing 10% or more of the voting power of the capital stock of the Company or an “affiliate” of the Company within the meaning of Rule 144 under the US Securities Act of 1933, as amended (Securities Act) (each, an Affiliate); or

(b)or were issued or acquired Shares from the Company or an Affiliate in transactions other than a public registered offering within a year prior to the completion of the Conversion Form or Sale Election Form, as applicable,

(each of (a) and (b), a Restricted Shareholder) will be subject to the following restrictions:

(1) ADSs resulting from participation in the ADS Conversion Facility by Restricted Shareholders will be subject to certain resale restrictions pursuant to the Securities Act; and

(2) Restricted Shareholders are not eligible to participate in the Voluntary Sales Facility, including with respect to any Remaining Shares.

This discussion does not address any tax or duty consequences other than:

(1) Australian income tax consequences to Shareholders that are Australian tax residents from participation in the ADS Conversion Facility or the sale of their Shares through the Voluntary Sale Facility; and

(2) United States backup withholding for Shareholders from the sale of their Shares through the Voluntary Sale Facility.

This discussion does not address any Australian tax consequences for persons that are not Australian residents for tax purposes nor does it address any US state or local tax consequences or any US federal income tax consequences other than relating to backup withholding. Shareholders should consult their tax advisors regarding any income or other tax consequences which may result from participation in the ADS Conversion Facility or the sale of their Shares through the Voluntary Sale Facility.

Australian income tax consequences

The following is a general description of the Australian income tax consequences for Shareholders who are individuals, complying superannuation funds or private companies and are Australian tax residents, which result from participation in the ADS Conversion Facility or the sale of their Shares through the Voluntary Sale Facility. It is not intended to be a comprehensive statement of the Australian income tax consequences of participating in the ADS Conversion Facility or the Voluntary Sale Facility.

The general description below only applies to Shareholders who hold their Shares on capital account for Australian income tax purposes and are an Australian resident for tax purposes. In particular, it does not apply to:

•Shareholders who buy and sell shares in the ordinary course of business (i.e. Shareholders who hold their Shares on revenue account);

•Shareholders who hold their Shares as trading stock for Australian income tax purposes;

7

Exhibit 99.2

•Shareholders that are subject to the taxation of financial arrangements rules in Division 230 of the Income Tax Assessment Act 1997 (Cth) in relation to gains and losses on their Shares.

The information is based upon Australian taxation law and practice in effect at the date of this letter.

The Company strongly encourages Shareholders to obtain their own tax advice based on the Shareholder’s particular circumstances before deciding which option to select. The general description of the Australian income tax consequences for Shareholders does not purport to provide Shareholders with any tax advice.

Participation in the ADS Conversion Facility

It is not anticipated the Shareholders will make a capital gain or capital loss as a result of participating in the ADS Conversion Facility. This is on the basis the Shareholders will continue to be the beneficial owners of the Shares as the ADS Conversion Facility is a bare trust arrangement.

A Shareholder’s cost base or reduced cost base in the ADSs they receive as a consequence of participating in the ADS Conversion Facility should be equal to the cost base or reduced cost base of the Shareholder’s Shares at the time of the conversion of the Shares into ADSs.

Sale of Shares through the Voluntary Sale Facility

Each Share in the Company constitutes a separate asset for capital gains tax purposes. Shareholders will need to consider the consequences of the disposal of their Shares which were acquired in different parcels at different times. A Shareholder should make a capital gain where the capital proceeds a Shareholder receives in consideration for the disposal are greater than the Shareholder’s cost base in the Shares disposed of. A Shareholder should make a capital loss where the capital proceeds a Shareholder receives in consideration for the disposal are less than the Shareholder’s reduced cost base in the Shares disposed of.

A Shareholder’s net capital gain for an income year is included in their assessable income. Broadly, the net capital gain for an income year is the total of the capital gains made during the income year less capital losses incurred in the income year and available net capital losses made in previous income years. That amount may be reduced by further concessions, including the discount capital gains tax provisions.

If a Shareholder is an individual, or the Shareholder holds Shares as trustee of a trust or a complying superannuation fund and the Shareholder has held the Shares for at least 12 months before disposal (and has not chosen for indexation to apply, should the choice be available), the discount capital gain provisions should apply as follows:

(a)if the Shareholder is an individual, one half of the capital gain, after offsetting any capital losses, will be included in the Shareholder’s assessable income.

(b)if the Shareholder is a complying superannuation fund, two-thirds of the capital gain, after offsetting applicable capital losses will be included in the fund’s assessable income.

(c)The CGT discount rules are complex for trusts. However, generally the CGT discount may flow through to presently entitled beneficiaries where the beneficiaries would be entitled to apply the CGT discount.

The discount capital gain provisions do not apply to companies.

8

Exhibit 99.2

Certain United States Federal Income Tax Matters

United States Federal Income Tax Backup Withholding in Connection with the Sale of Shares in the Voluntary Sale Facility

Under the US federal income tax backup withholding rules, a portion (24% under current law) of the gross proceeds payable to a Shareholder in the Voluntary Sale Facility may be required to be withheld and remitted to the Internal Revenue Service (the IRS) unless the Shareholder provides its taxpayer identification number (employer identification number or social security number) (TIN) to Computershare, and certifies under penalties of perjury that such number is correct, or such Shareholder otherwise establishes an exemption. If Computershare is not provided with the correct TIN or another adequate basis for exemption, the Shareholder may also be subject to certain penalties imposed by the IRS. If withholding results in an overpayment of taxes, a refund may be obtained, provided the required information is timely furnished to the IRS.

The Sale Election Form will provide instructions to each Shareholder that is participating in the Voluntary Sale Facility which, if followed, will enable the prevention of backup withholding (in the event the Shareholder is otherwise exempt from backup withholding) in connection with the sale of such Shareholder’s Shares in the Voluntary Sale Facility.

HOLDERS ARE URGED TO CONSULT THEIR TAX ADVISORS REGARDING THE APPLICATION OF US FEDERAL INCOME TAX WITHHOLDING AND BACKUP WITHHOLDING, INCLUDING ELIGIBILITY FOR A WITHHOLDING TAX REDUCTION OR EXEMPTION, AND THE REFUND PROCEDURE.

IRS Form 8937

The Company expects to post a completed and signed IRS Form 8937 (Report of Organizational Actions Affecting Basis of Securities) to its website at https://ir.bionomics.com.au/ within 45 days after the date of the ADS Conversion Facility.

FOR FURTHER INFORMATION PLEASE CONTACT:

|

|

Baker Young GPO Box 1672 Adelaide, South Australia 5001 Australia Direct: +61 8 8236 8899 (Monday – Friday) 9:00am – 5:00pm (ACST) Bionomics@bakeryoung.com.au |

|

Yours sincerely,

Dr Spyridon “Spyros” Papapetropoulos

President and Chief Executive Officer

9

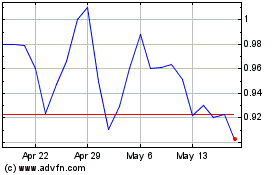

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Apr 2023 to Apr 2024