UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

(Commission File No. 001-41157)

BIONOMICS LIMITED

(Translation of registrant’s name into English)

200 Greenhill Road

Eastwood SA 5063

Tel: +618 8150 7400

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Yes ☐ No ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

Yes ☐ No ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On July 25, 2023, the Company lodged a release with the Australian Securities Exchange (ASX), as required by the laws and regulations of Australia, announcing the Company's intention to de-list from the ASX. The announcement is furnished herewith as Exhibit 99.1 to this report on Form 6-K.

1

EXHIBIT INDEX

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

Bionomics Limited |

|

(Registrant) |

|

|

|

|

By: |

/s/ Alan Fisher |

|

Name: |

Alan Fisher |

|

Title: |

Non-Executive Chairman |

Date: July 25, 2023

1

Exhibit 99.1

ASX ANNOUNCEMENT

25 July 2023

Bionomics announces voluntary delisting

Bionomics Limited (ASX:BNO, NASDAQ:BNOX) (Bionomics or the Company) announces its intention to de-list from the Australian Securities Exchange.

Delisting

Bionomics advises that it has submitted a formal request to the ASX to be removed from the official list of the ASX (Official List) in accordance with ASX Listing Rule 17.11 (Delist or the Delisting). This formal request follows the receipt of in-principle approval from the ASX in relation to the proposed Delisting, subject to the satisfaction of the conditions set out below.

The Board has ultimately determined that the costs and administrative burden of remaining listed on ASX outweigh any benefits of a continued listing. Following the Delisting, the Company will maintain its listing on the Nasdaq and the fully paid ordinary shares in the Company (Shares) will no longer be quoted on the ASX. Further details regarding the reasons for and consequences of the Delisting are set out below.

Reasons for seeking removal from the Official List

The Board considers that it is in the best interests of the Company and its shareholders for the Company to Delist for the following reasons.

(a)Shift to Nasdaq: Since its US IPO and listing on Nasdaq in December 2021, the average daily trading volume of the Company’s ADSs traded on Nasdaq was 26,595 (equivalent to 4,787,100 Shares based on a ratio of 180 Shares to 1 ADS) compared to an average daily trading volume of 220,528 Shares per day on ASX. The lower level of liquidity on ASX means there are reduced trading opportunities for shareholders who wish to exit their holdings. Accordingly, the Company wishes to move to having Nasdaq as its sole listing.

(b)Additional costs: The continued listing of the Company on ASX requires the Company to incur considerable corporate and administrative costs, including listing fees. The Company is seeking to minimise its expenditure and would cease incurring such additional costs if it is removed from the official list of ASX. The Company considers the financial, administrative and compliance obligations and costs associated with managing an ASX listing and a Nasdaq listing, including the higher level of regulatory compliance costs associated with a dual listing, noting that there are a number of material differences between the Nasdaq listing rules and the ASX listing rules, unjustifiable and not in the best interests of the Company’s securityholders.

(c)US capital raisings / US focus: The Delisting from ASX and retention of a primary listing on Nasdaq is expected to fully leverage the Company’s large institutional investor base and other financing options in the USA that currently has the most active biotechnology ecosystem on a global basis. Being dual listed on ASX and Nasdaq is currently limiting fundraising options for the Company.

Bionomics Limited | 200 Greenhill Road, Eastwood, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

(d)Location of directors and management: With the exception of the Company’s Chair, Mr Alan Fisher, and director, Dr Jane Ryan, all of the Company's non-executive board members and the Company’s Managing Director (President and CEO) are now based outside Australia, reflecting the Company's focus on international rather than domestic markets.

Arrangements for sale of Shares

The Company will notify shareholders whose securities are held on the Company’s Australian principal share register of the time and date at which the Company will be removed from the Official List shortly and inform those shareholders that if they wish to sell their securities on ASX they will need to do so before that date and if they don’t they will only be able to sell their securities on-market on Nasdaq. The Company will also inform those shareholders generally what they will need to do if they wish to sell their securities on Nasdaq.

No change will occur to the quotation and trading of the Company’s securities on Nasdaq as a result of the removal from the Official List.

Consequences for the Company and its shareholders

The consequences for the Company and its shareholders if the Company is removed from the Official List of the ASX are set out below.

(a)shareholders will no longer be able to trade their Shares on the ASX;

(b)the Company’s Shares will only be capable of being traded on Nasdaq in the form of ADSs, which will require shareholders to transfer their Shares to ADSs to trade on Nasdaq and engage a suitably qualified Australian broker or a US based broker who is able to trade on Nasdaq, or by off-market, private transactions, which will require shareholders to identify and agree terms with potential purchasers of Shares;

(c)following Delisting, the Company will not be subject to the ASX Listing Rules. In particular, the following ASX Listing Rule requirements will no longer apply:

●continuous disclosure and other periodic reporting requirements (although the Company’s reporting requirements (including continuous disclosure – see below) will still be governed by the Corporations Act, the applicable rules of Nasdaq and its reporting obligations under US securities laws, as described in section (e) below);

●disclosure of certain information under the ASX Listing Rules (including changes of capital or information related to directors and the auditor of the Company);

●restrictions on the issue of new capital (such as the inability of the Company to issue in excess of 15% of its capital in any 12-month period without shareholder approval) and certain restrictions on transactions with related parties (although these will still be governed by the Corporations Act and the applicable rules of Nasdaq);

●requirements relating to significant changes to the Company’s activities; and

●the requirement to report against the ASX Corporate Governance Principles and Recommendations;

(d)if, following removal from the Official List, the Company has 100 or more shareholders, it will be an “unlisted disclosing entity” under the Corporations Act;

(e)as an unlisted disclosing entity, the Company will still be required to give continuous disclosure of material matters in accordance with the Corporations Act by filing notices with ASIC under section 675 of the Corporations Act and the Company will still be required to lodge annual audited and half-yearly financial statements in accordance with the requirements of the Corporations Act. However, if the Company ceases to be an unlisted disclosing entity there will be no ongoing requirement for the Company to give continuous disclosure of material

Bionomics Limited | 200 Greenhill Road, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

matters under section 675, or lodge half-yearly financial statements reviewed by an auditor, but as a public company it will continue to be required to lodge annual audited financial statements. In addition, the Company notes that it will also be required to fulfill its public reporting obligations under US securities laws as a US public company and, while its securities are listed on Nasdaq, its disclosure obligations under applicable Nasdaq listing rules;

(f)the related party transaction provisions of the Corporations Act will continue to apply to the Company as a public company; and

(g)directors will continue to be subject to directors’ duties under the Corporations Act, including to act in good faith and in the best interests of the Company.

Some shareholders may consider that the reduction of obligations associated with an ASX listing is a disadvantage, including, in particular, minority shareholders. While there will be differences in the regulatory regimes pre and post-Delisting, minority shareholders will continue to benefit from the protections in the Corporations Act, such as in relation to the alteration of shareholder rights, financial reporting obligations and holding annual meetings of shareholders. Shareholders will also have protections as a result of US securities laws and applicable Nasdaq listing rules.

Conditions

ASX’s in-principle decision to approve the Delisting is subject to the Company’s compliance with the following conditions imposed by ASX under Listing Rule 17.11 and Guidance Note 33:

(a)The Company sends written or electronic communications to all shareholders whose Shares are held on the Company’s Australian principal share register, in form and substance satisfactory to ASX (Notice), setting out:

(i)the nominated time and date at which the entity will be removed from the ASX and that:

(A)if they wish to sell their Shares on ASX, they will need to do so before then; and

(B)if they don’t, thereafter they will only be able to sell the underlying securities on‐market on Nasdaq in the form of ADSs; and

(ii)generally what they need to do if they wish to sell their securities on Nasdaq.

(b)The removal shall not take place any earlier than one month after the date the information in the Notice has been sent to shareholders.

(c)The Company releases the full terms of this decision to the market upon making a formal application to ASX to remove the Company from the official list of ASX.

Arrangements to enable shareholders to sell their Shares or convert them to ADSs

In relation to the Delisting, the Company intends to establish the following facilities for shareholders on the Australian principal share register:

(a)a voluntary sale facility through which Baker Young Limited (AFSL 246735, ABN 92 006 690 320) and their nominated US Intermediary will, for a period of 3 months after the Company has been Delisted, facilitate sales on behalf of shareholders on Nasdaq, and convert the net proceeds of the sale into Australian dollars at the prevailing rate at the time, and the Company will arrange to remit the net proceeds of the sale to the shareholders; and

(b)a voluntary facility pursuant to which shareholders may elect to convert their Shares to ADSs,

(together, the Delisting Facilities), with any associated costs of the Delisting Facilities to be covered by the Company.

Bionomics Limited | 200 Greenhill Road, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

Bionomics will release additional documents that provide more information about the Delisting Facilities, including information and any relevant forms for shareholders to participate in the Delisting Facilities.

Remedies available to shareholders

If a shareholder of the Company considers the removal from the Official List to be contrary to the interests of the shareholders of the Company as a whole or oppressive to, unfairly prejudicial to, or unfairly discriminatory against a shareholder or shareholders, it may apply to the court for an order under Part 2F.1 of the Corporations Act. Under section 233 of the Corporations Act, the court can make any order that it considers appropriate in relation to the Company, including an order that the Company be wound up or an order regulating the conduct of the Company’s affairs in the future.

If a shareholder of the Company considers that the removal form the Official List involves “unacceptable circumstances”, it may apply to the Takeovers Panel for a declaration of unacceptable circumstances and other orders under Part 6.10 Division 2 Subdivision B of the Corporations Act (refer also to Guidance Note 1: Unacceptable Circumstances issued by the Takeovers Panel). Under section 657D of the Corporations Act, if the Takeovers Panel has declared circumstances to be unacceptable, it may make any order that it thinks appropriate to protect the rights or interests of any person or group of persons, where the Takeovers Panel is satisfied that those rights or interests are being affected, or will be or are likely to be affected, by the circumstances.

Timetable

The proposed timetable for the satisfaction of conditions and the expected date of removal of the Company from the Official List are as follows:

|

|

Event |

Indicative date* |

Notification of intention to delist |

25 July 2023 |

Despatch of letters and ADS Conversion Facility election forms to shareholders (in relation to the Delisting Facilities) |

28 July 2023 |

Closing Date: Participation in ADS Conversion Facility |

24 August 2023 |

Last day for trading of the Company's Shares on ASX |

24 August 2023 |

Completion of removal of the Company from the Official List of the ASX |

28 August 2023 |

Opening Date: voluntary sale facility |

7 September 2023 |

Closing Date: Participation in voluntary sale facility closes |

8 December 2023 |

*Dates and times are indicative only and subject to change by the Company or ASX.

Shares may continue to be traded on ASX up until the last trading day, after which trading will be suspended until the Delisting on the next trading day.

ENDS

Bionomics Limited | 200 Greenhill Road, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

Exhibit 99.1

FOR FURTHER INFORMATION PLEASE CONTACT:

Baker Young

GPO Box 1672

Adelaide, South Australia 5001

Australia

+61 8 8236 8899 (Monday – Friday 9:00am – 5:00pm (ACST))

Bionomics@bakeryoung.com.au

About Bionomics Limited

Bionomics Limited (ASX:BNO, Nasdaq:BNOX) is a clinical-stage biopharmaceutical company developing novel, allosteric ion channel modulators designed to transform the lives of patients suffering from serious central nervous system (CNS) disorders with high unmet medical need. Bionomics is advancing its lead drug candidate, BNC210, an oral, proprietary, selective negative allosteric modulator of the α7 nicotinic acetylcholine receptor, for the acute treatment of Social Anxiety Disorder (“SAD”) and chronic treatment of Post-Traumatic Stress Disorder (“PTSD”). Beyond BNC210, Bionomics has a strategic partnership with Merck & Co., Inc (known as MSD outside the United States and Canada) with two drugs in early-stage clinical trials for the treatment of cognitive deficits in Alzheimer’s disease and other central nervous system conditions. Bionomics’s pipeline also includes preclinical assets that target Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for CNS conditions of high unmet need.

www.bionomics.com.au

Bionomics Limited | 200 Greenhill Road, Eastwood, South Australia, +61 8 8150 7400, ABN: 53 075 582 740

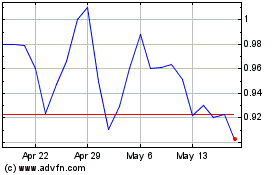

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bionomics (NASDAQ:BNOX)

Historical Stock Chart

From Mar 2024 to Mar 2025