UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a‑16 OR 15d‑16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2024

COMMISSION FILE NUMBER 001-39081

BioNTech SE

(Translation of registrant’s name into English)

An der Goldgrube 12

D-55131 Mainz

Germany

+49 6131-9084-0

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20‑F or Form 40‑F: Form 20‑F ☒ Form 40‑F ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(7): ☐

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

On November 4, 2024, BioNTech SE (the “Company”) issued a press release announcing its third quarter 2024 financial results and corporate update and details of a conference call to be held at 8:00 am EST on November 4, 2024 to discuss the results. The press release and the conference call presentation are attached as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein.

The information contained in Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, unless expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| BioNTech SE | | | |

| | | | |

| | | | |

| By: | /s/ Jens Holstein | | By: | /s/ Dr. Sierk Poetting |

| Name: Jens Holstein | | | Name: Dr. Sierk Poetting |

| Title: Chief Financial Officer | | | Title: Chief Operating Officer |

Date: November 4, 2024

EXHIBIT INDEX

| | | | | |

| |

| Exhibit | Description of Exhibit |

| |

| 99.1 | |

| |

| 99.2 | |

| |

BioNTech Announces Third Quarter 2024 Financial Results and Corporate Update

•Presented clinical data for multiple assets across modalities, including bispecific antibody candidate BNT327/PM8002 and mRNA cancer vaccine candidate BNT113 based on BioNTech’s FixVac platform

•Initiated two Phase 2 dose optimization trials with BNT327/PM8002 in small-cell lung cancer and in triple-negative breast cancer to inform planned pivotal Phase 3 trials

•Phase 2 clinical trial on track to evaluate mRNA-based individualized cancer vaccine candidate autogene cevumeran (BNT122/RO7198457) as an adjuvant treatment in patients with high-risk muscle-invasive urothelial cancer

•Successfully launched variant-adapted COVID-19 vaccines for the 2024/2025 vaccination season in multiple regions

•Reports third quarter 2024 revenues of €1.2 billion, net profit of €198.1 million and diluted earnings per share of €0.81 ($0.89)1

•Ended the third quarter of 2024 with €17.8 billion in cash and cash equivalents plus security investments

•Expects to be at low end of full year 2024 revenue guidance range (€2.5-3.1 billion)

•Re-confirms guidance of planned full year 2024 R&D expenses of €2.4-2.6 billion and reduced guidance range for SG&A expenses to €600-700 million and for capital expenditures for operating activities to €300-400 million

Conference call and webcast scheduled for November 4, 2024, at 8:00 a.m. EST

(2:00 p.m. CET)

MAINZ, Germany, November 4, 2024 (GLOBE NEWSWIRE) -- BioNTech SE (Nasdaq: BNTX, “BioNTech” or “the Company”) today reported financial results for the three and nine months ended September 30, 2024 and provided an update on its corporate progress.

“BioNTech’s achievements during the period were the successful launch of our variant-adapted COVID-19 vaccines and the progress across our oncology pipeline. In particular, we initiated later-stage trials and shared important updates for our PD-L1 x VEGF-A bispecific antibody candidate BNT327/PM8002 and for our mRNA cancer vaccine portfolio. These successes reinforce the potential of our multi-platform technology approach and inform our strategy to pursue novel proprietary combinations,” said Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech. “We remain focused on advancing our late-stage oncology product candidates towards potential registration. We believe our pipeline and capabilities uniquely position us to execute on our vision of becoming a global multiproduct immunotherapy company.”

Financial Review for Third Quarter and Nine Months of 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

in millions €, except per share data |

|

| Third Quarter 2024 |

|

| Third Quarter 2023 |

|

| Nine Months 2024 |

|

| Nine Months 2023 |

Revenues |

|

| 1,244.8 |

|

| 895.3 |

|

| 1,561.1 |

|

| 2,340.0 |

Net profit / (loss) |

|

| 198.1 |

|

| 160.6 |

|

| (924.8) |

|

| 472.4 |

Diluted earnings / (loss) per share |

|

| 0.81 |

|

| 0.66 |

|

| (3.83) |

|

| 1.94 |

Revenues reported were €1,244.8 million for the three months ended September 30, 2024, compared to €895.3 million for the comparative prior year period. For the nine months ended September 30, 2024, revenues were €1,561.1 million, compared to €2,340.0 million for the comparative prior year

period. The higher revenues in the third quarter of 2024 as compared to the comparative prior year period can be largely attributed to the earlier approvals received for its variant-adapted COVID-19 vaccines as compared to last year.

Cost of sales were €178.9 million for the three months ended September 30, 2024, compared to €161.8 million for the comparative prior year period. For the nine months ended September 30, 2024, cost of sales were €297.8 million, compared to €420.7 million for the comparative prior year period.

Research and development (“R&D”) expenses were €550.3 million for the three months ended September 30, 2024, compared to €497.9 million for the comparative prior year period. For the nine months ended September 30, 2024, R&D expenses were €1,642.4 million, compared to €1,205.3 million for the comparative prior year period. R&D expenses were mainly influenced by progressing clinical studies for the Company’s late-stage oncology pipeline candidates.

Sales, general and administrative (“SG&A”) expenses2, in total, amounted to €150.5 million for the three months ended September 30, 2024, compared to €153.5 million for the comparative prior year period. For the nine months ended September 30, 2024, SG&A expenses were €466.9 million, compared to €415.4 million for the comparative prior year period. SG&A expenses were mainly influenced by personnel expenses.

Other operating result amounted to negative €354.6 million during the three months ended September 30, 2024, compared to negative €9.0 million for the comparative prior year period. For the nine months ended September 30, 2024, other operating result amounted to negative €616.9 million compared to negative €134.4 million for the prior year period. Other operating result was primarily influenced by provisions for contractual disputes.

Income taxes were realized with an amount of €39.4 million in tax income for the three months ended September 30, 2024, compared to €66.8 million in accrued tax expenses for the comparative prior year period. For the nine months ended September 30, 2024, income taxes were realized with an amount of €54.1 million in tax income for the nine months ended September 30, 2024, compared to €50.5 million of accrued tax expenses for the comparative prior year period.

Net profit was €198.1 million for the three months ended September 30, 2024, compared to €160.6 million net profit for the comparative prior year period. For the nine months ended September 30, 2024, net loss was €924.8 million, compared to a net profit of €472.4 million for the comparative prior year period.

Cash and cash equivalents plus security investments as of September 30, 2024, reached €17,839.8 million, comprising €9,624.6 million in cash and cash equivalents, €7,078.0 million in current security investments and €1,137.2 million in non-current security investments.

Diluted earnings per share was €0.81 for the three months ended September 30, 2024, compared to €0.66 for the comparative prior year period. For the nine months ended September 30, 2024, loss per share was €3.83, compared to diluted earnings per share of €1.94 for the comparative prior year period.

Shares outstanding as of September 30, 2024, were 239,739,752, excluding 8,812,448 shares held in treasury.

“We successfully launched our variant-adapted COVID-19 vaccines upon receipt of earlier approvals as compared to last year. This drove our strong revenues in the third quarter,” said Jens Holstein, CFO of BioNTech. “Our cost discipline in combination with our financial position allow us to continue

to focus on those assets that we believe offer a fast path to market and the highest potential to generate value for patients and shareholders.”

2024 Financial Year Guidance3

The Company expects its revenues for the full 2024 financial year to be at the low end of the guidance range provided in its outlook:

| | | | | | | | |

Total revenues for the 2024 financial year |

| low end of €2.5 billion - €3.1 billion |

The range reflects certain assumptions and expectations, including, but not limited to: COVID-19 vaccine uptake and price levels, including seasonal variations; inventory write-downs and other charges by BioNTech’s collaboration partner Pfizer Inc. (“Pfizer”) that negatively influence BioNTech’s revenues; anticipated revenues from a pandemic preparedness contract with the German government; and revenues from the BioNTech Group service businesses, namely InstaDeep Ltd (“InstaDeep”), JPT Peptide Technologies GmbH, and BioNTech Innovative Manufacturing Services GmbH. Generally, the Company continues to remain largely dependent on revenues generated in its collaboration partner’s territories in 2024.

2024 Financial Year Expenses and Capex

The Company has reduced its previous guidance for expected SG&A expenses and capital expenditures for operating activities for the 2024 financial year:

| | | | | | | | | | | | | | | | | |

|

|

| Guidance March 2024 | Guidance November 2024 |

|

R&D expenses4 |

|

| €2,400 million - €2,600 million | €2,400 million - €2,600 million |

|

SG&A expenses |

|

| €700 million - €800 million | €600 million - €700 million |

|

Capital expenditures for operating activities |

|

| €400 million - €500 million | €300 million - €400 million |

|

The full interim unaudited condensed consolidated financial statements can be found in BioNTech’s Report on Form 6-K for the period ended September 30, 2024, filed today with the United States Securities and Exchange Commission (“SEC”) and available at https://www.sec.gov/.

Endnotes

1Calculated applying the average foreign exchange rate for the nine months ended September 30, 2024, as published by the German Central Bank (Deutsche Bundesbank).

2 SG&A expenses include sales and marketing expenses as well as general and administrative expenses.

3Guidance excludes external risks that are not yet known and/or quantifiable. It does not include potential payments resulting from the outcomes of ongoing and/or future legal disputes or related activity, such as judgements or settlements, or other extraordinary items, all of which may have a material effect on the Company’s results of operations and/or cash flows. BioNTech continues to expect to report a loss for the 2024 financial year.

4 Guidance for R&D expenses reflects the expected impact of collaborations and potential M&A transactions, in each case to the extent disclosed, and which are subject to change based on future developments. Guidance does not otherwise reflect M&A, collaboration or licensing transactions that the Company may enter into in the future.

Operational Review of the Third Quarter 2024, Key Post Period-End Events and Outlook

Variant-adapted COVID-19 Vaccines

In the third quarter of 2024, BioNTech and Pfizer executed the commercial launch of their variant-adapted COVID-19 vaccines for the 2024/2025 vaccination season.

•On July 3, 2024, BioNTech and Pfizer’s Omicron JN.1-adapted COVID-19 vaccine was approved by the European Commission (“EC”). Shortly following approval, the updated vaccines were made available to European Union (“EU”) member states. The EC approved the co-administration of the companies’ COVID-19 vaccine with approved seasonal influenza vaccines in individuals 12 years of age and older and also authorized glass pre-filled syringes, a new presentation of the vaccine that allows for refrigerated storage conditions. On September 24, 2024, the EC approved BioNTech and Pfizer’s Omicron KP.2-adapted COVID-19 vaccine. The companies began shipments of their KP.2-adapted COVID-19 vaccine to EU member states that ordered this formulation.

•On August 22, 2024, the U.S. Food and Drug Administration (“FDA”) approved the companies’ KP.2-adapted COVID-19 vaccine. The vaccines were shipped immediately following approval and made available in pharmacies, hospitals, and clinics across the U.S.

•On July 24, 2024, the United Kingdom’s Medicines and Healthcare Products Regulatory Agency (“MHRA”) approved the companies’ JN.1-adapted vaccine and post period, on October 10, 2024, approved the companies’ KP.2-adapted COVID-19 vaccine.

•BioNTech and Pfizer will continue to monitor the evolving epidemiology of COVID-19 and remain prepared to develop modified vaccine formulas as the data support and as regulatory agencies recommend.

COVID-19 – Influenza Combination Vaccine Program

An mRNA-based combination vaccine candidate (BNT162b2 + BNT161) against COVID-19 and influenza is in development in collaboration with Pfizer.

•In August 2024, BioNTech and Pfizer provided topline results from the Phase 3 trial (NCT06178991) evaluating the companies’ mRNA combination vaccine candidate in healthy individuals 18-64 years of age. The vaccine candidate was compared to the co-administration of a licensed influenza vaccine with the companies’ licensed COVID-19 vaccine. The primary immunogenicity objectives were non-inferiority of the antibody responses to influenza (hemagglutination inhibition) and to SARS-CoV-2 (neutralizing titer) elicited by the combination vaccine candidate as compared to standard of care. The trial showed higher influenza A responses and comparable COVID-19 responses versus the comparator vaccines but did not meet one of its primary immunogenicity objectives of non-inferiority against the influenza B strain. No safety signals with the combination vaccine candidate have been identified in an ongoing safety data review. BioNTech and Pfizer are evaluating adjustments to the candidate and will discuss next steps with health authorities.

Select Oncology Pipeline Updates

Next-Generation Immune Checkpoint Immunomodulator Programs

BNT327/PM8002 is a bispecific antibody candidate combining Programmed Cell Death Ligand-1 (“PD-L1”) checkpoint inhibition with Vascular Endothelial Growth Factor A (“VEGF-A”) neutralization and is being developed in collaboration with Biotheus Inc. (“Biotheus”).

•In October 2024, the first patient was dosed in a multi-site, open-label Phase 2 clinical trial (NCT06449222) to evaluate the safety, efficacy, and pharmacokinetics of BNT327/PM8002 at two dose levels in combination with chemotherapy in the first- and second-line treatment of

patients with locally advanced/metastatic triple negative breast cancer (“TNBC”). These data will inform a Phase 3 clinical trial in first-line TNBC that is expected to start in 2025.

•In September 2024, the first patient was dosed in a multi-site, open-label Phase 2 clinical trial (NCT06449209) to evaluate BNT327/PM8002 in combination with chemotherapy in patients with untreated extensive-stage small-cell lung cancer (“ES-SCLC”), and in patients with SCLC that progressed after first- or second-line treatment. These data will inform a Phase 3 clinical trial in first-line SCLC that is expected to start in 2024.

•A Phase 2/3 clinical trial in first-line non-small cell lung cancer (“NSCLC”) is expected to start in 2024.

•In June 2024, evaluation of BNT327/PM8002 in combination with BNT325/DB-1305, a Trophoblast Cell-Surface Antigen 2 (“TROP2”)-targeted antibody-drug conjugate (“ADC”) candidate, was initiated as part of an ongoing Phase 1/2 clinical trial (NCT05438329). The clinical trial evaluates the safety and tolerability of BNT325/DB-1305 alone and in combination with BNT327/PM8002 in various solid tumor indications. Additional trials of novel BNT327/PM8002 combinations with proprietary ADCs are planned to start in 2024.

•In September 2024, data were presented from three clinical trials evaluating BNT327/PM8002 in patients with advanced TNBC, Epidermal Growth Factor Receptor (“EGFR”)-mutated NSCLC and renal cell carcinoma (“RCC”) at the 2024 Congress of the European Society for Medical Oncology (“ESMO”):

◦Data from an ongoing open-label, single-arm Phase 1/2 clinical trial (NCT05918133) evaluating BNT327/PM8002 in combination with chemotherapy as first-line treatment in patients with advanced or metastatic TNBC showed clinically meaningful anti-tumor activity regardless of PD-L1 status and a manageable safety profile with no new safety signals observed beyond those typically described for anti-PD-(L)1 therapies, anti-VEGF therapies, and chemotherapy.

◦Data from a Phase 2 clinical trial (NCT05756972) evaluating BNT327/PM8002 in combination with chemotherapy in patients with advanced EGFR-mutated NSCLC who progressed after EGFR-tyrosine kinase inhibitor treatment showed encouraging anti-tumor activity regardless of PD-L1 status and a generally manageable safety profile.

◦Data from an open-label multi-cohort Phase 1/2 clinical trial (NCT05918445) evaluating BNT327/PM8002 monotherapy showed encouraging anti-tumor activity and a manageable safety profile in patients with previously untreated advanced non clear cell RCC or treated advanced clear cell RCC.

•Data in first-line TNBC are planned to be presented at the San Antonio Breast Cancer Symposium, taking place from December 10 to December 13 in San Antonio, Texas, U.S. Additional data are expected to be presented in 2025.

BNT316/ONC-392 (gotistobart) is an anti-cytotoxic T-lymphocyte Associated Protein 4 (“CTLA-4”) monoclonal antibody candidate being developed in collaboration with OncoC4, Inc. (“OncoC4”).

•In October 2024, the FDA placed a partial clinical hold on the Phase 3 trial (PRESERVE-003; NCT05671510) due to varying results between patient populations. The trial assesses the efficacy and safety of BNT316/ONC-392 as monotherapy in patients with metastatic NSCLC that progressed under previous PD-(L)1-inhibitor treatment. Enrollment of new patients has been paused while patients already enrolled in the trial will continue to receive treatment. Trials evaluating BNT316/ONC-392 in other indications remain unaffected.

•In September 2024, preliminary data from the Phase 2 (PRESERVE-004; NCT05446298) clinical trial evaluating BNT316/ONC-392 in combination with pembrolizumab in patients with platinum-resistant ovarian cancer were presented at ESMO. The data suggest encouraging preliminary clinical activity and a manageable tolerability profile with no new safety signals detected for the combination.

mRNA Cancer Vaccine Programs

BNT111, BNT113 and autogene cevumeran (BNT122/RO7198457) are investigational vaccines for the treatment of cancer based on BioNTech’s systemically administered uridine mRNA-lipoplex technology.

BNT111 is based on BioNTech’s wholly owned, off-the-shelf FixVac platform, and encodes shared melanoma associated antigens.

•A randomized Phase 2 clinical trial (BNT111-01; NCT04526899) is being conducted in collaboration with Regeneron Pharmaceuticals Inc. (“Regeneron”) to evaluate BNT111 in combination with cemiplimab in patients with anti-PD-(L)1 refractory/relapsed, unresectable stage III or IV melanoma.

•In July 2024, BioNTech announced that the trial met its primary efficacy outcome measure, demonstrating a statistically significant improvement in overall response rate (“ORR”) in patients treated with BNT111 in combination with cemiplimab, as compared to an historical control in this indication and treatment setting. The ORR in the cemiplimab monotherapy arm was in line with the historical control of anti-PD-(L)1 or anti-CTLA-4 treatments in this patient group. The treatment was generally well tolerated and the safety profile of BNT111 in combination with cemiplimab in this trial was consistent with previous clinical trials assessing BNT111 in combination with anti-PD-(L)1-containing treatments. The Phase 2 trial will continue as planned to further assess the secondary endpoints which were not mature at the time of the primary analysis.

•BioNTech plans to present data from this trial at an upcoming medical conference in 2025.

BNT113 is based on BioNTech’s FixVac platform encoding Human Papilloma Virus 16 (“HPV16”) antigens.

•A global, randomized Phase 2 clinical trial (AHEAD-MERIT; NCT04534205) is being conducted to evaluate BNT113 in combination with pembrolizumab versus pembrolizumab monotherapy as a first-line treatment in patients with unresectable, recurrent or metastatic, PD-L1+, HPV16+ head and neck squamous cell carcinoma.

•In September 2024, an exploratory analysis of antitumor activity (15 patients) and immunogenicity (3 patients) from the safety run-in of AHEAD-MERIT was presented at ESMO. The data support the tolerability of BNT113 and clinical activity in combination with pembrolizumab was observed. In addition, BNT113 was found to induce de novo T-cell responses against HPV16 antigens.

•Also at ESMO, results were presented from an investigator-sponsored Phase 1/2 dose escalation clinical trial (HARE-40; NCT03418480) evaluating BNT113 alone in the post-adjuvant and metastatic settings in patients with HPV16+ head and neck and other cancers. BNT113 was shown to induce immune responses in patients in the adjuvant and end-stage clinical settings and to be overall well tolerated with a manageable safety profile.

Autogene cevumeran (BNT122/RO7198457) is an mRNA cancer vaccine candidate for individualized neoantigen-specific immunotherapy (“iNeST”) being developed in collaboration with Genentech, Inc. (“Genentech”), a member of the Roche Group (“Roche”).

•A randomized, double-blind, multi-site Phase 2 clinical trial (IMCODE-004; NCT06534983) evaluating autogene cevumeran as an adjuvant treatment with nivolumab in patients with high-risk muscle-invasive urothelial cancer (“MIUC”) is enrolling patients. The trial aims to evaluate the efficacy of autogene cevumeran in combination with nivolumab compared to nivolumab alone in approximately 360 patients. The primary endpoint for the study is investigator-assessed disease-free survival (“DFS”). Secondary objectives include overall survival (“OS”) and safety.

•Autogene cevumeran is also being evaluated in ongoing Phase 2 trials in adjuvant resected pancreatic ductal adenocarcinoma (“PDAC”) (NCT05968326), adjuvant colorectal cancer (“CRC”) (NCT04486378) and first-line advanced melanoma (NCT03815058).

•BioNTech plans to disclose interim data from the Phase 2 clinical trial (NCT04486378) in stage II (high-risk) and III circulating tumor DNA+ (“ctDNA”) adjuvant CRC, which is projected for late 2025 or 2026.

ADC Programs

BNT323/DB-1303 (trastuzumab pamirtecan) is an ADC candidate targeting Human Epidermal Growth Factor 2 (“HER2”) that is being developed in collaboration with Duality Biologics (Suzhou) Co. Ltd. (“DualityBio”).

•BNT323/DB-1303 is being evaluated in a Phase 1/2 clinical trial (NCT05150691) in patients with advanced/unresectable, recurrent or metastatic HER2-expressing solid tumors. A potentially registrational cohort of patients with HER2-expressing (IHC3+, 2+, 1+ or ISH-positive) advanced/recurrent endometrial carcinoma has completed enrollment. Data from this cohort are expected in 2025.

•A confirmatory Phase 3 trial (NCT06340568) in patients with advanced endometrial cancer is in planning.

•A pivotal Phase 3 trial (DYNASTY-Breast02; NCT06018337) is being conducted in patients with Hormone Receptor-positive (“HR+”) and HER2-low metastatic breast cancer that progressed on hormone therapy and/or Cyclin-Dependent Kinase 4/6 (“CDK4/6”) inhibition. In September 2024, a Trial-in-Progress poster was presented at ESMO.

•Topline data from the ongoing Phase 3 trial in HR+ and HER2-low metastatic breast cancer that have progressed on hormone therapy and/or CDK4/6 inhibition are expected in 2026.

BNT324/DB-1311 is an ADC candidate targeting B7H3 that is being developed in collaboration with DualityBio.

•A first-in-human, open-label Phase 1/2 clinical trial (NCT05914116) in patients with advanced solid tumors is ongoing.

•In July 2024, the FDA granted Orphan Drug designation to BNT324/DB-1311 for the treatment of advanced or metastatic esophageal squamous cell carcinoma.

•The first preliminary data update from this trial is expected to be presented at the ESMO Asia Congress (December 6-8, 2024 in Singapore).

BNT326/YL202 is an ADC candidate targeting Human Epidermal Growth Factor 3 (“HER3”) that is being developed in collaboration with MediLink Therapeutics (Suzhou) Co., Ltd. (“MediLink”).

•A multi-site, international, open-label, first-in-human Phase 1 clinical trial (NCT05653752) sponsored by MediLink evaluating BNT326/YL202 as a later-line treatment in patients with locally advanced or metastatic EGFR-mutated NSCLC or HR+/HER2-negative breast cancer is ongoing. On August 15, 2024, the FDA lifted the partial clinical hold that was placed on this trial, initially announced on June 17, 2024. Trial recruitment has been reinitiated with a focus on dose levels no higher than 3 mg/kg, where the safety profile was manageable and encouraging clinical activity was observed.

Cell Therapy Programs

BNT211 consists of a chimeric antigen receptor (“CAR”)-T cell product candidate targeting Claudin-6 (“CLDN6”)-positive solid tumors in combination with a CAR-T cell-amplifying RNA vaccine (“CARVac”) encoding CLDN6.

•A first-in-human, open-label, multi-site Phase 1 dose escalation and dose expansion basket trial (NCT04503278) is being conducted to evaluate BNT211 in patients with CLDN6-positive relapsed or refractory solid tumors, including ovarian cancers and testicular germ cell tumors.

•In September 2024, data from the ongoing trial presented at ESMO showed signs of antitumor activity across indications. CARVac was shown to improve CAR-T persistence in some patients. The data also suggested that the safety profile of CLDN6 CAR T cells with and without CARVac is consistent with the previously published effects of CAR T therapies and that repeated CARVac administration does not significantly increase toxicity.

•A pivotal Phase 2 trial in patients with testicular germ cell tumors is expected to start in 2025 based on encouraging activity observed in this patient group.

Corporate Update for the Third Quarter 2024 and Key Post Period-End Events

•On October 1, 2024, BioNTech, alongside its artificial intelligence (“AI”) subsidiary InstaDeep, presented an overview of its AI approach during an edition of the Company’s Innovation Series called AI Day. As part of the event, BioNTech showcased the Company’s approach to AI capability scaling and deployment across its pipeline. These updates covered the introduction of a new near exascale supercomputer, the launch of a novel Bayesian Flow Network (“BFN”) generative model, and multiple updates on the deployment of AI across BioNTech’s preclinical and clinical operations.

Upcoming Investor and Analyst Events

•Innovation Series R&D Day: November 14, 2024

•Fourth Quarter and Full Year 2024 Financial Results and Corporate Update: March 10, 2025

Conference Call and Webcast Information

BioNTech invites investors and the general public to join a conference call and webcast with investment analysts today, November 4, 2024, at 8:00 a.m. EST (2:00 p.m. CET) to report its financial results and provide a corporate update for the third quarter of 2024.

To access the live conference call via telephone, please register via this link. Once registered, dial-in numbers and a PIN number will be provided.

The slide presentation and audio of the webcast will be available via this link.

Participants may also access the slides and the webcast of the conference call via the “Events & Presentations” page of the Investors' section of the Company’s website at www.BioNTech.com. A replay of the webcast will be available shortly after the conclusion of the call and archived on the Company’s website for 30 days following the call.

About BioNTech

Biopharmaceutical New Technologies (BioNTech) is a global next generation immunotherapy company pioneering novel therapies for cancer and other serious diseases. BioNTech exploits a wide array of computational discovery and therapeutic drug platforms for the rapid development of novel biopharmaceuticals. Its broad portfolio of oncology product candidates includes individualized and off-the-shelf mRNA-based therapies, innovative chimeric antigen receptor (CAR) T cells, several protein-based therapeutics, including bispecific immune checkpoint modulators, targeted cancer antibodies and antibody-drug conjugate (ADC) therapeutics, as well as small molecules. Based on its deep expertise in mRNA vaccine development and in-house manufacturing capabilities, BioNTech and its collaborators are developing multiple mRNA vaccine candidates for a range of infectious diseases alongside its diverse oncology pipeline. BioNTech has established a broad set of relationships with multiple global and specialized pharmaceutical collaborators, including Biotheus, DualityBio, Fosun Pharma, Genentech, a member of the Roche Group, Genevant, Genmab, MediLink, OncoC4, Pfizer and Regeneron.

For more information, please visit www.BioNTech.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech’s expected revenues related to sales of BioNTech’s COVID-19 vaccine, referred to as COMIRNATY where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech’s collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech’s partners; the rate and degree of market acceptance of BioNTech’s COVID-19 vaccine and, if approved, BioNTech’s investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech’s research and development programs, including BioNTech’s current and future preclinical studies and clinical trials, including statements regarding the expected timing of initiation, enrollment, and completion of studies or trials and related preparatory work and the availability of results, and the timing and outcome of applications for regulatory approvals and marketing authorizations; BioNTech’s expectations regarding potential future commercialization in oncology, including goals regarding timing and indications; the targeted timing and number of additional potentially registrational trials, and the registrational potential of any trial BioNTech may initiate; discussions with regulatory agencies; BioNTech’s expectations with respect to intellectual property; the impact of BioNTech’s collaboration and licensing agreements; the development, nature and feasibility of sustainable vaccine production and supply solutions; the deployment of AI across BioNTech’s preclinical and clinical operations; BioNTech’s estimates of revenues, research and development expenses, selling, general and administrative expenses and capital expenditures for operating activities; and BioNTech’s expectations of net profit / (loss). In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

The forward-looking statements in this press release are based on BioNTech’s current expectations and beliefs of future events, and are neither promises nor guarantees. You should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control and which could cause actual results to differ materially and adversely from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, projected data release timelines, regulatory submission dates, regulatory approval dates and/or launch dates, as well as risks associated with preclinical and clinical data, including the data discussed in this release, and including the possibility of unfavorable new preclinical, clinical or safety data and further analyses of existing preclinical, clinical or safety data; the nature of the clinical data, which is subject to ongoing peer review, regulatory review and market interpretation; BioNTech’s pricing and coverage negotiations regarding its COVID-19 vaccine with governmental authorities, private health insurers and other third-party payors; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech’s other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side-effect profile and durability of immune response; the timing of and BioNTech’s ability to obtain and maintain regulatory approval for its product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech’s and its counterparties’ ability to manage and source necessary energy resources; BioNTech’s ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech’s third-party collaborators to continue research and

development activities relating to BioNTech's development candidates and investigational medicines; the impact of COVID-19 on BioNTech’s development programs, supply chain, collaborators and financial performance; unforeseen safety issues and potential claims that are alleged to arise from the use of products and product candidates developed or manufactured by BioNTech; BioNTech’s and its collaborators’ ability to commercialize and market BioNTech’s COVID-19 vaccine and, if approved, its product candidates; BioNTech’s ability to manage its development and related expenses; regulatory developments in the United States and other countries; BioNTech’s ability to effectively scale its production capabilities and manufacture its products and product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech’s Report on Form 6-K for the period ended September 30, 2024 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date hereof. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise.

CONTACTS

Investor Relations

Michael Horowicz

Investors@biontech.de

Media Relations

Jasmina Alatovic

Media@biontech.de

Interim Consolidated Statements of Profit or Loss

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Three months ended September 30, | | | Nine months ended September 30, |

| | | | | | | | | | | | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 |

(in millions €, except per share data) |

| | (unaudited) | | | (unaudited) | | | (unaudited) | | | (unaudited) |

Revenues |

| | 1,244.8 | | | 895.3 | | | 1,561.1 | | | 2,340.0 |

Cost of sales |

| | (178.9) | | | (161.8) | | | (297.8) | | | (420.7) |

Research and development expenses |

| | (550.3) | | | (497.9) | | | (1,642.4) | | | (1,205.3) |

Sales and marketing expenses |

| | (18.1) | | | (14.4) | | | (46.6) | | | (44.7) |

General and administrative expenses (1) |

| | (132.4) | | | (139.1) | | | (420.3) | | | (370.7) |

Other operating expenses (1) |

| | (410.9) | | | (36.8) | | | (719.9) | | | (239.6) |

Other operating income |

| | 56.3 | | | 27.8 | | | 103.0 | | | 105.2 |

Operating profit / (loss) |

| | 10.5 | | | 73.1 | | | (1,462.9) | | | 164.2 |

Finance income |

| | 156.2 | | | 156.3 | | | 498.8 | | | 363.2 |

Finance expenses |

| | (8.0) | | | (2.0) | | | (14.8) | | | (4.5) |

Profit / (Loss) before tax |

| | 158.7 | | | 227.4 | | | (978.9) | | | 522.9 |

Income taxes |

| | 39.4 | | | (66.8) | | | 54.1 | | | (50.5) |

Net profit / (loss) |

| | 198.1 | | | 160.6 | | | (924.8) | | | 472.4 |

Earnings / (Loss) per share |

| |

| | |

| | |

| | |

|

Basic earnings / (loss) per share |

| | 0.82 | | | 0.67 | | | (3.83) | | | 1.96 |

Diluted earnings / (loss) per share |

| | 0.81 | | | 0.66 | | | (3.83) | | | 1.94 |

(1) Adjustments to prior-year figures due to change in functional allocation of general and administrative expenses and other operating expenses.

Interim Consolidated Statements of Financial Position

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | September 30, | | | December 31, |

(in millions €) | | | 2024 | | | 2023 |

Assets | | | (unaudited) | | | |

Non-current assets | |

|

| | |

|

Goodwill | |

| 374.0 | | | 362.5 |

Other intangible assets | |

| 873.9 | | | 804.1 |

Property, plant and equipment | |

| 917.4 | | | 757.2 |

Right-of-use assets | |

| 242.0 | | | 214.4 |

Other financial assets | |

| 1,332.2 | | | 1,176.1 |

Other non-financial assets | |

| 84.8 | | | 83.4 |

Deferred tax assets | |

| 90.7 | | | 81.3 |

Total non-current assets | |

| 3,915.0 | | | 3,479.0 |

Current assets | |

|

| | |

|

Inventories | |

| 303.1 | | | 357.7 |

Trade and other receivables | |

| 988.0 | | | 2,155.7 |

Other financial assets | |

| 7,084.7 | | | 4,885.3 |

Other non-financial assets | |

| 275.8 | | | 285.8 |

Income tax assets | |

| 210.0 | | | 179.1 |

Cash and cash equivalents | |

| 9,624.6 | | | 11,663.7 |

Total current assets | |

| 18,486.2 | | | 19,527.3 |

Total assets | |

| 22,401.2 | | | 23,006.3 |

| | | | | | |

Equity and liabilities | |

|

| | |

|

Equity | |

|

| | |

|

Share capital | |

| 248.6 | | | 248.6 |

Capital reserve | |

| 1,373.0 | | | 1,229.4 |

Treasury shares | |

| (8.8) | | | (10.8) |

Retained earnings | |

| 18,838.5 | | | 19,763.3 |

Other reserves | |

| (1,336.8) | | | (984.6) |

Total equity | |

| 19,114.5 | | | 20,245.9 |

Non-current liabilities | |

|

| | |

|

Lease liabilities, loans and borrowings | |

| 206.3 | | | 191.0 |

Other financial liabilities | |

| 44.3 | | | 38.8 |

Provisions | |

| 8.5 | | | 8.8 |

Contract liabilities | |

| 376.9 | | | 398.5 |

Other non-financial liabilities | |

| 90.4 | | | 13.1 |

Deferred tax liabilities | |

| 37.8 | | | 39.7 |

Total non-current liabilities | |

| 764.2 | | | 689.9 |

Current liabilities | |

|

| | |

|

Lease liabilities, loans and borrowings | |

| 37.4 | | | 28.1 |

Trade payables and other payables | |

| 762.6 | | | 354.0 |

Other financial liabilities | |

| 241.6 | | | 415.2 |

Income tax liabilities | |

| 363.6 | | | 525.5 |

Provisions | |

| 731.5 | | | 269.3 |

Contract liabilities | |

| 236.0 | | | 353.3 |

Other non-financial liabilities | |

| 149.8 | | | 125.1 |

Total current liabilities | |

| 2,522.5 | | | 2,070.5 |

Total liabilities | |

| 3,286.7 | | | 2,760.4 |

Total equity and liabilities | |

| 22,401.2 | | | 23,006.3 |

Interim Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Three months ended September 30, | | | Nine months ended September 30, |

| | | | | | | | | | | | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 |

(in millions €) |

| | (unaudited) | | | (unaudited) | | | (unaudited) | | | (unaudited) |

Operating activities |

| |

| | |

| | |

| | |

|

Net profit / (loss) |

| | 198.1 | | | 160.6 | | | (924.8) | | | 472.4 |

Income taxes |

| | (39.4) | | | 66.8 | | | (54.1) | | | 50.5 |

Profit / (Loss) before tax |

| | 158.7 | | | 227.4 | | | (978.9) | | | 522.9 |

Adjustments to reconcile profit before tax to net cash flows: |

| |

| | |

| | |

| | |

|

Depreciation and amortization of property, plant, equipment, intangible assets and right-of-use assets |

| | 44.4 | | | 41.3 | | | 132.6 | | | 104.6 |

Share-based payment expenses |

| | 40.9 | | | 15.5 | | | 77.4 | | | 37.2 |

Net foreign exchange differences |

| | (35.5) | | | (20.4) | | | (77.4) | | | (364.3) |

(Gain) / Loss on disposal of property, plant and equipment |

| | — | | | 3.3 | | | (0.2) | | | 3.6 |

Finance income excluding foreign exchange differences |

| | (156.2) | | | (148.5) | | | (498.8) | | | (357.4) |

Finance expense excluding foreign exchange differences |

| | 5.3 | | | 2.0 | | | 14.8 | | | 4.5 |

Government grants |

| | (14.6) | | | — | | | (26.8) | | | (3.0) |

Unrealized (gain) / loss on derivative instruments at fair value through profit or loss(1) |

| | (6.0) | | | (3.5) | | | 0.7 | | | 196.7 |

Working capital adjustments: |

| |

| | |

| | |

| | |

|

Decrease / (Increase) in trade and other receivables, contract assets and other assets(1) |

| | (830.2) | | | 631.2 | | | 1,267.6 | | | 5,662.0 |

Decrease in inventories |

| | 37.0 | | | 33.2 | | | 54.6 | | | 23.9 |

(Decrease) / Increase in trade payables, other financial liabilities, other liabilities, contract liabilities, refund liabilities and provisions |

| | 117.9 | | | (25.0) | | | 590.7 | | | (293.9) |

Interest received and realized gains from cash and cash equivalents |

| | 73.1 | | | 70.3 | | | 353.3 | | | 166.4 |

Interest paid and realized losses from cash and cash equivalents |

| | (1.6) | | | (1.2) | | | (6.9) | | | (3.7) |

Income tax received / (paid), net(1) |

| | 1.6 | | | (10.2) | | | (190.8) | | | (417.8) |

Share-based payments |

| | (134.4) | | | (4.2) | | | (143.6) | | | (761.2) |

Government grants received |

| | 60.7 | | | — | | | 102.7 | | | — |

Net cash flows from / (used in) operating activities |

| | (638.9) | | | 811.2 | | | 671.0 | | | 4,520.5 |

Investing activities |

| |

| | |

| | |

| | |

|

Purchase of property, plant and equipment |

| | (72.8) | | | (53.2) | | | (219.9) | | | (165.6) |

Proceeds from sale of property, plant and equipment |

| | 0.3 | | | (0.8) | | | 0.5 | | | (0.8) |

Purchase of intangible assets and right-of-use assets |

| | (10.2) | | | (97.2) | | | (141.3) | | | (348.9) |

Acquisition of subsidiaries and businesses, net of cash acquired |

| | — | | | (336.9) | | | — | | | (336.9) |

Investment in other financial assets(1) |

| | (2,958.2) | | | (1,047.1) | | | (10,301.5) | | | (3,710.2) |

Proceeds from maturity of other financial assets(1) |

| | 2,898.8 | | | 303.0 | | | 7,974.3 | | | 303.0 |

Net cash flows used in investing activities |

| | (142.1) | | | (1,232.2) | | | (2,687.9) | | | (4,259.4) |

Financing activities |

| |

| | |

| | |

| | |

|

Proceeds from loans and borrowings |

| | — | | | 0.1 | | | — | | | 0.1 |

Repayment of loans and borrowings |

| | — | | | (0.1) | | | (2.3) | | | (0.1) |

Payments related to lease liabilities |

| | (7.9) | | | (9.3) | | | (36.3) | | | (28.0) |

Share repurchase program |

| | — | | | (301.7) | | | — | | | (737.7) |

Net cash flows used in financing activities |

| | (7.9) | | | (311.0) | | | (38.6) | | | (765.7) |

Net decrease in cash and cash equivalents |

| | (788.9) | | | (732.0) | | | (2,055.5) | | | (504.6) |

Change in cash and cash equivalents resulting from exchange rate differences |

| | (2.3) | | | 61.2 | | | 1.2 | | | 125.3 |

Change in cash and cash equivalents resulting from other valuation effects |

| | 39.1 | | | — | | | 15.2 | | | — |

Cash and cash equivalents at the beginning of the period |

| | 10,376.7 | | | 14,166.6 | | | 11,663.7 | | | 13,875.1 |

Cash and cash equivalents as of September 30 |

| | 9,624.6 | | | 13,495.8 | | | 9,624.6 | | | 13,495.8 |

(1) Adjustments to prior-year figures relate to reclassifications within the cash flows from operating and investing activities, respectively.

3rd Quarter 2024 Financial Results & Corporate Update November 4, 2024 Exhibit 99.2

This Slide Presentation Includes Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech’s expected revenues and net profit/(loss) related to sales of BioNTech’s COVID-19 vaccine, referred to as COMIRNATY where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech’s collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech’s partners; the rate and degree of market acceptance of BioNTech’s COVID-19 vaccine and, if approved, BioNTech’s investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech’s research and development programs, including BioNTech’s current and future preclinical studies and clinical trials, including statements regarding the expected timing of initiation, enrollment, and completion of studies or trials and related preparatory work and the availability of results, and the timing and outcome of applications for regulatory approvals and marketing authorizations; BioNTech’s expectations regarding potential future commercialization in oncology, including goals regarding timing and indications; the targeted timing and number of additional potentially registrational trials, and the registrational potential of any trial BioNTech may initiate; discussions with regulatory agencies; BioNTech’s expectations with respect to intellectual property; the impact of BioNTech’s collaboration and licensing agreements; the development, nature and feasibility of sustainable vaccine production and supply solutions; the deployment of AI across BioNTech’s preclinical and clinical operations; BioNTech’s estimates of revenues, research and development expenses, selling, general and administrative expenses, and capital expenditures for operating activities; and BioNTech’s expectations of net profit / (loss). In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. The forward-looking statements in this presentation are based on BioNTech’s current expectations and beliefs of future events, and are neither promises nor guarantees. You should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control and which could cause actual results to differ materially and adversely from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, projected data release timelines, regulatory submission dates, regulatory approval dates and/or launch dates, as well as risks associated with preclinical and clinical data, including the data discussed in this release, and including the possibility of unfavorable new preclinical, clinical or safety data and further analyses of existing preclinical, clinical or safety data; the nature of the clinical data, which is subject to ongoing peer review, regulatory review and market interpretation; BioNTech’s pricing and coverage negotiations regarding its COVID-19 vaccine with governmental authorities, private health insurers and other third-party payors; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech’s other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side- effect profile and durability of immune response; the timing of and BioNTech’s ability to obtain and maintain regulatory approval for its product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech’s and its counterparties’ ability to manage and source necessary energy resources; BioNTech’s ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech’s third-party collaborators to continue research and development activities relating to BioNTech's development candidates and investigational medicines; the impact of COVID-19 on BioNTech’s development programs, supply chain, collaborators and financial performance; unforeseen safety issues and potential claims that are alleged to arise from the use of products and product candidates developed or manufactured by BioNTech; BioNTech’s and its collaborators’ ability to commercialize and market BioNTech’s COVID-19 vaccine and, if approved, its product candidates; BioNTech’s ability to manage its development and related expenses; regulatory developments in the United States and other countries; BioNTech’s ability to effectively scale its production capabilities and manufacture its products and product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech’s Report on Form 6-K for the period ended September 30, 2024 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date hereof. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation in the event of new information, future developments or otherwise. 2

Financial Results Jens Holstein, Chief Financial Officer3 Strategic Outlook Ryan Richardson, Chief Strategy Officer4 COVID-19 & Oncology Pipeline Update Özlem Türeci, Co-founder & Chief Medical Officer2 3rd Quarter 2024 Highlights Ugur Sahin, Co-founder & Chief Executive Officer1

1 3rd Quarter 2024 Highlights Ugur Sahin, Founder & Chief Executive Officer

Q3 2024 Highlights Partnered with: 1. Pfizer; 2. Biotheus; 3. Genentech, a member of the Roche Group; 4. Duality Bio; 5. In collaboration with Regeneron. A glossary of defined terms can be found at the end of the presentation. Execution in COVID-19 Franchise1 Successfully launched variant-adapted COVID-19 vaccines1 for the 2024/2025 vaccination season in multiple regions Progress in Oncology Pipeline BNT327/PM80022 Presented clinical data for BNT327/PM80022 showcasing pan- tumor activity Dosed first patients in two global dose-optimization Phase 2 studies evaluating BNT327/PM80022 in SCLC and TNBC Dosed first patients in trial evaluating BioNTech’s novel IO + ADC combination, BNT3272 + BNT3254 mRNA Cancer Vaccine Candidates Announced positive topline Phase 2 results for mRNA cancer vaccine FixVac candidate BNT1115 in cutaneous melanoma Presented clinical data for FixVac candidate BNT113 Planned Phase 2 trial evaluating autogene cevumeran (BNT122/RO7198457)3 in adjuvant MIUC Corporate Update Provided overview on BioNTech’s strategy to scale and deploy AI capabilities across its pipeline at inaugural AI Day 5

Developing the Next Generation of Cancer Medicines: Leveraging Our Multi-Modal Technology Portfolio for Combination Approaches 6 Partnered with: 1. Biotheus; 2. Genentech, member of Roche Group. BNT327/PM80021 FixVacs Autogene cevumeran (BNT122/RO7198457)2 Space for synergies Space for potentially curative approaches Immunomodulators Space for synergies Space for synergies mRNA vaccines Targeted therapies

2 COVID-19 & Oncology Pipeline Update Özlem Türeci, Chief Medical Officer

The Continuous Evolution of SARS-CoV-2 Has Led to Differing Regulatory Recommendations Globally EC UK U.S. Canada Japan JN.1-adapted KP.2-adapted 8 mRNA vaccine technology enables us to rapidly meet regulators’ specific recommendations in different regions and allows for timely availability of vaccines adapted to the most current SARS-CoV-2 variants JN.1 is a SARS-CoV-2 variant. KP.2 is a sub-lineage of the JN.1 variant.

COVID-19 and Influenza Disease Burden Show Different Seasonality Patterns Data last updated: October 4, 2024 1. https://www.cdc.gov/respiratory-viruses/guidance/background.html?CDC_AAref_Val=https://www.cdc.gov/respiratory-viruses/background/index.html accessed 07 October 2024 0 2 4 6 8 10 0 2 4 6 8 10 12 Oct Nov Dec Jan Feb Mar Apr May June July Aug Sep H o s p it a liz a ti o n r a te p e r 1 0 0 ,0 0 0 p o p u la ti o n COVID-19 Influenza 2 0 2 3 - 2 0 2 4 2 0 2 2 - 2 0 2 3 Susceptibility to infection remains a concern after the winter vaccination season. Potential need for additional vaccination later in the season could contribute to improved vaccine coverage over time. Data on weekly new hospital admissions of patients from surveillance sites in the U.S. Respiratory Virus Hospitalization Surveillance Network.1 9

BNT327/PM80026 (PD-L1 x VEGF-A) 1L/2L met. TNBC, +chemotherapy Oncology Pipeline with Three New Phase 2 Trials: BNT327/PM80025 and Autogene Cevumeran (BNT122/RO7198457) Partnered with: 1. Genentech, member of Roche Group; 2. Genmab; 3. OncoC4; 4. DualityBio; 5. MediLink Therapeutics; 6. Biotheus; 7. In collaboration with Regeneron. Phase 1 Phase 1/2 Phase 2 Phase 3 BNT211 (CLDN6) Multiple solid tumors BNT312/GEN10422 (CD40x4-1BB) Multiple solid tumors BNT316/ONC-392 (gotistobart)3 (CTLA-4) Multiple solid tumors BNT142 (CD3xCLDN6) Multiple CLDN6-pos. adv. solid tumors BNT325/DB-13054 (TROP-2) Multiple solid tumors BNT316/ONC-392 (gotistobart)3 (CTLA-4) anti-PD-1/PD-L1 experienced NSCLC BNT323/DB-13034 (trastuzumab pamirtecan) (HER2) Multiple solid tumors BNT324/DB-13114 (B7H3) Multiple solid tumors BNT323/DB-13034 (trastuzumab pamirtecan) (HER2) HR+/HER2-low met. breast cancer BNT116 Adv. NSCLC BNT152 + BNT153 (IL-7, IL-2) Multiple solid tumors BNT221 Refractory metastatic melanoma BNT321 (sLea) Metastatic PDAC BNT322/GEN10562 Multiple solid tumors Autogene cevumeran (BNT122/RO7198457)1 Multiple solid tumors BNT314/GEN10592 (EpCAMx4-1BB) Multiple solid tumors mRNA Next generation IO Cell therapy Legend Combination studies ADCs BNT326/YL2025 (HER3) Multiple solid tumors BNT1117 aPD(L)1-R/R melanoma, + cemiplimab BNT113 1L rel./met. HPV16+ PDL-1+ head and neck cancer, + pembrolizumab Autogene cevumeran (BNT122/RO7198457)1 1L adv. melanoma, + pembrolizumab Autogene cevumeran (BNT122/RO7198457)1 Adj. ctDNA+ stage II or III CRC BNT1167 1L adv. PD-L1 50% NSCLC, + cemiplimab Autogene cevumeran (BNT122/RO7198457)1 Adj. PDAC, + atezolizumab + mFOLFIRINOX BNT316/ONC-392 (gotistobart)3 (CTLA-4) mCRPC, + radiotherapy BNT321 (sLeA) adjuvant PDAC, +mFOLFIRINOX BNT316/ONC-392 (gotistobart)3 (CTLA-4) PROC, + pembrolizumab BNT327/PM80026 (PD-L1 x VEGF-A) 1L/2L+ (ES-)SCLC, +chemotherapy BNT315/GEN10552 (OX40) Multiple solid tumors BNT327 / BNT325 combination4,6 Multiple solid tumors BNT311/GEN1046 (acasunlimab)2 (PD-L1x4-1BB) R/R met. NSCLC, +/- pembrolizumab BNT311/GEN1046 (acasunlimab)2 (PD-L1x4-1BB) Multiple solid tumors Autogene cevumeran (BNT122/ RO7198457)1 Adj. MIUC, + Nivolumab NEW NEW NEW 10

BNT327/PM80021 – A Next-Gen Investigational IO Agent that Combines Two Clinically Validated MoAs 11 1. Partnered with Biotheus. The mechanism of action graphic was generated by Biorender.com. “Two-in-one” mechanism of actionDual blockade of PD-L1 and VEGF-A has demonstrated clinical synergy • Encouraging safety/activity profile with over 700 patients treated to date • Monotherapy activity and synergy in combination therapy observed in early clinical studies • Favorable safety profile vs. PD-L1 + VEGF inhibition or PD-1 alone Anti-VEGF-A (IgG) Anti-PD-L1 (VHH)

BNT327/PM80021 Mono and Combo Have Been Investigated in More Than 700 Patients Across 10+ Indications 12 1. Partnered with Biotheus. 2L+ Cervical Cancer PROC 2L+ PSOC 2L+ NSCLC EGFRm 2L SCLC Lung Gynae- cology 1L SCLC 2L+ Endometrial Cancer 1L NSCLC WT PD-L1+ (+ Nab-Paclitaxel) (+ FOLFOX4) (+ FOLFIRI) (+ Pemetrexed / Platinum) (+ Pemetrexed/Carboplatin) (+ Paclitaxel) (+ Etoposide/Platinum) Mono Combo 2L+ ccRCC 1L MPM 1L HCC Advanced BTC Breast 1L TNBC 2L NEN Others Combo Ongoing studies with BNT327/PM8002 Gastro- intestinal Geni- tourinary nccRCC Mono

Extensive Clinical Data Collection Demonstrates Pan-Tumor Potential of BNT327/PM80021 13 1. Partnered with Biotheus; 2. Wu J et al ESMO 2024 384MO; 3. Cheng Y et al ESMO 2023 1992P; 4. Wu C et al ASCO 2024 P8533; 5. Wu YL et al ESMO 2024 1255MO; 6. Wu L et al ASCO 2024 P5524 7. Sheng X. et al ESMO 2024 1692P. * Confirmed ORR reported for the following cohorts: TNBC, 1L and 2L/3L EGFRm NSCLC and RCC. Unconfirmed ORR reported for the following cohorts: SCLC, 2L NSCLC, CC and PROC. TNBC2 SCLC3 NSCLC4,5 CC6 PROC6 ccRCC7 nccRCC7 1L 2L Overall 1L4 2L4 2L/3L EGFRm 5 2L+ 1L+ 2L 1L BNT327 mono or combination nab- paclitaxel paclitaxel mono mono carboplatin + pemetrexed mono mono mono mono N 42 36 17 8 64 45 34 28 22 ORR*, % 73.8 61.1 47.1 12.5 57.8 42.2 20.6 25.0 36.4 DCR, % 95.2 86.1 100 62.5 95.3 93.3 67.7 82.1 90.9 mPFS, mos. 13.5 5.5 13.6 6.7 NR 8.3 5.5 10.9 15.1 mDOR, mos. 11.7 10.0 NR 3.7 NR NR 9.6 19.6 NR Congress ESMO 2024 ESMO 2023 ASCO 2024 ASCO 2024 ESMO 2024 ASCO 2024 ASCO 2024 ESMO 2024 ESMO 2024 BNT327/PM80021 has shown encouraging clinical activity across broad range of indications

BNT327/PM80021 Shows Clinically Meaningful Efficacy in Metastatic Triple Negative Breast Cancer (mTNBC) 14 ITT PD-L1 CPS<1 PD-L1 1≤CPS<10 PD-L1 CPS≥10 Not detected Population, N 42 13 16 9 4 cORR, % (95% CI) 73.8 (58.0, 86.1) 76.9 (46.2, 95.0) 56.3 (29.9, 80.3) 100.0 (66.4, 100.0) 75.0 (19.4, 99.4) DCR, % (95% CI) 95.2 (83.8, 99.4) 100.0 (75.3, 100.0) 93.8 (69.8, 99.8) 100.0 (66.4, 100.0) 75.0 (19.4, 99.4) mPFS, mos. (95% CI) 13.5 (9.4, --) NR (5.7, --) 14.0 (7.2, --) 10.8 (5.5, 13.5) 14.0 (1.8, --) BNT327/PM80021 in combination with chemotherapy demonstrated meaningful efficacy, rapid tumor shrinkage and encouraging duration of response irrespective of PD-L1 status 1. Partnered with Biotheus. B e s t C h a n g e f ro m B a s e li n e ( % ) SoD change of target lesion(s) CPS<1 1CPS<10 CPS10 Not detected -100 -80 -60 -40 -20 0 20 40 Phase 1/2 (NCT05918133): clinical activity in combination with nab-paclitaxel by PD-L1 status in 1L TNBC Yanchun Meng et al., ESMO 2024, Presentation #348MO For the ITT population, mTTR was 1.9 months. and mDoR 11.7 months; mOS was not reached

Global Clinical Development Strategy for BNT327/PM80021 Partnered with: 1. Biotheus; 2. DualityBio Explore potential of BNT327/PM80021 in three waves of focused development • Phase 2 dose opt in SCLC NEW • Phase 2 dose opt in TNBC NEW Ongoing Outlook • Phase 2/3 NSCLC planned for 2024 • Phase 3 SCLC planned for 2024 • Phase 3 TNBC planned for 2025 Phase 1/2 evaluating BNT327/PM80021 in combination with BNT325/DB13052 TROP-2 ADC in multiple solid tumors 3 Explore novel combinations with ADCs in high unmet need indications Combine with SoC chemotherapy in potential Fast-to-Market indications Expand chemo and novel combinations across indications 21 Ongoing Outlook Additional combinations with ADCs planned to start in 2024 and in 2025 15

Positive FixVac Topline Data and Start of iNeST Phase 2 MIUC Trial Highlight Execution in Cancer Vaccine Portfolio 16 1. Partnered with Genentech, a member of the Roche Group; 2. In collaboration with Regeneron. Select iNeST and FixVac trials based on BioNTech’s mRNA-LPX technology platform Individualized vaccine: iNeST1 FixVac Adjuvant 1L R/R R/R 1L Multiple settings MIUC Phase 2 CRC Phase 2 PDAC Phase 2 Melanoma Phase 2 Solid Tumors Phase 1 Melanoma Phase 2 HPV16+ HNSCC Phase 2 NSCLC Phase 1 & 2 Autogene cevumeran (BNT122/RO7198457) BNT1112 BNT113 BNT1162 + Nivolumab Monotherapy + Atezolizumab + Pembrolizumab + Atezolizumab + Cemiplimab + Pembrolizumab Monotherapy, + Cemiplimab or CTx Recruitment ongoing Recruitment ongoing Data presented from epi sub-study at ASCO 2024 and from biomarker sub- study at ESMO-GI 2024 Recruitment ongoing Data presented from investigator-initiated Ph 1 trial at ASCO 2022 & AACR 2024 and published (Rojas et al., Nature 2023) Enrollment completed Data of prototype version Ph 1 published (Sahin et al., Nature 2017). Analysis of Ph 2 PFS as primary endpoint will be based on events and defined when reporting results Enrollment completed Data presented at AACR 2020. Manuscript expected to be published soon in peer-reviewed journal Enrollment completed Positive topline data announced July 2024 Data presented from Ph 1 at multiple conferences incl. SITC 2021 and published. (Sahin et al., Nature 2020) Enrollment completed Data of Ph 1 study presented at multiple conferences incl. ESMO-IO 2022 Data from safety run-in of Ph 1/2 trial and Ph1 IIT presented at ESMO 2024 Recruitment ongoing in Ph 2 in 1L NSCLC2 Ph 1 trial ongoing Data presented at SITC 2023 and AACR 2024 Data from Ph1 trial expected at SITC. NEW DATA DATA

Evaluating Autogene Cevumeran in the Adjuvant Treatment Setting for Cancers of High Unmet Need 17 Rationale for adjuvant setting Low tumor mass with residual cancer cells Healthier immune system allows for functional T-cell responses Tumor resistance mechanisms not fully established Pancreatic Ductal Adenocarcinoma 69−75% relapse rate within 5 years after adjuvant therapy1,2 • Projected to become the 2nd leading cause of cancer-related death in the US by 20303 • 5-year survival rates after resection are ~10%4 • Largely CPI resistant due to low mutation burden with few mutation- derived neoantigens and an immunosuppressive tumor microenvironment5 Phase 1 trial completed in adj. PDAC Randomized Phase 2 trial ongoing 20-35% relapse rate within 4 years after adjuvant therapy6 • 5-year survival rates of locoregional disease are ~70%7 • ctDNA is a marker for minimal residual disease and thus can identify patients at high risk of disease recurrence8,9,10 • In ctDNA-positive, Stage 2 (high risk) and Stage 3 CRC post adjuvant chemotherapy, duration of disease- free survival is 10 months11 Randomized Phase 2 trial ongoing Colorectal Cancer Unmet medical need 1. Jones et al. JAMA Surgery 2019; 2. Conroy et al. JAMA Oncology 2022; 3. Rahib et al. JAMA Network Open 2021; 4. Bengtsson et al., Sci Rep 2020; 5. Kabacaoglu et al. Frontiers Immunol 2018; 6. André et al., JCO 2015; 7. NIH SEER cancer stat facts (Accessed July 31, 2024); 8. Fan et al. PLoS One 2017; 9. Loupakis et al. JCO Precis Oncol 2021; 10. Kotani, D. et al Nat Med 2023. 11. Reinacher-Schick et al. ASCO 2024.

Unmet medical need Clinical trial design Phase 2 Trial Evaluating Autogene Cevumeran1 in the Adjuvant Setting in MIUC 18 1. Partnered with Genentech, a member of the Roche Group; 2. Bajorin et al 2021 NEJM; 3. American Cancer Society Cancer Facts and Figures 2024 18 Key endpoints: Inclusion criteria • Age 18 years • Histologically confirmed MIUC or upper urinary tract • Surgical resection of MIUC of the bladder or upper tract without any adj. chemotherapy or radiotherapy • Absence of residual disease or metastasis, confirmed by CT or MRI scans • TNM classification of resected specimen is (y)pT3-4 or (y)pN+ and M0 (UICC/AJCC, 7th edition) • ECOG status 0 or 1 Part A: Safety run-in Part B: Randomized phase Nivolumab, 480 mg, iv, + Saline solution, iv Autogene cevumeran1, iv + Nivolumab, iv Enrollment (expected) Q4W for 1 year Autogene cevumeran1, iv + Nivolumab, iv Phase 2 randomized, double-blind, multi-site study to evaluate efficacy and safety of adjuvant autogene cevumeran1 in combination with nivolumab vs nivolumab in MIUC (NCT06534983) n = 362 R 1:1 • Neoadjuvant chemotherapy, followed by cystectomy and, for eligible patients, this is followed by adjuvant treatment with an ICI. Standard of care • Adjuvant ICI significantly increases DFS in patients. Despite this, a significant number of patients will relapse in the first two years.2 • The 5-year survival among MIUC patients with distant metastasis has been reported to be about 8%.3 Medical need Primary DFS in PD-L1 ≥ 1 (INV) Secondary OS, Safety

Financial Update Jens Holstein, Chief Financial Officer3

General and administrative expenses (139.1) (420.3) Other operating result (9.0) (616.9) Operating profit / (loss) 73.1 (1,462.9) Sales and marketing expenses (14.4) (46.6) Cost of sales (161.8) (297.8) Nine months ended September 30, (370.7) (134.4) 164.2 (44.7) (420.7) Research and development expenses (497.9) (1,642.4) (1,205.3) Finance result 154.3 484.0 358.7 Income taxes (66.8) 54.1 (50.5) Net profit / (loss) 160.6 (924.8) 472.4 Earnings / (Loss) per share <blank> Revenues 895.3 1,561.1 2,340.0 2023 2024 2023 Three months ended September 30, Basic earnings / (loss) per share 0.67 (3.83) 1.96 Diluted earnings / (loss) per share 0.66 (3.83) 1.94 (in millions €, except per share data) 2024 1,244.8 (178.9) (550.3) (18.1) (132.4) (354.6) 10.5 148.2 39.4 198.1 0.82 0.81 <blank><blank> <blank> Q3 and YTD 2024 Financial Results 1. Numbers have been rounded; numbers presented may not add up precisely to the totals and may have been adjusted in the table. Presentation of the consolidated statements of profit or loss has been condensed. 2. Adjustments to prior-year figures due to change in functional allocation of general and administrative expenses and other operating expenses. 3. Consists of cash and cash equivalents of €9,624.6 million, current security investments of €7,078 million and non-current security investments of €1,137.2 million, as of September 30, 2024. More information can be found in BioNTech’s Report on Form 6-K for the period ended September 30, 2024, filed today with the United States Securities and Exchange Commission and available at https://www.sec.gov/. Balance Sheet as of September 30, 2024 €17.8bn Cash and cash equivalents plus security investments3 2 2 1 20

2024 Financial Year Guidance1 Revenues Expected to be at Low End of Range and Reduced SG&A Expenses and Capex Guidance1 21 FY 2024 revenues Total revenues €2,500 – 3,100 m €2,500 – €3,100 m..... Expected to be at low end Planned FY 2024 expenses and capex R&D expenses2 €2,400 – 2,600 m €2,400 – €2,600 m No change SG&A expenses €700 – 800 m €600 – €700 m €100 m reduction3 Capital expenditures for operating activities €400 – 500 m €300 – €400 m €100 m reduction3 Guidance March 2024 Revenue guidance considerations: Top-line sensitivity mainly dependent on the following factors • Vaccination rates and price levels in markets where significant COVID-19 vaccine sales are expected • Inventory write-downs and other charges, which are estimated to be ~10% of Company revenues • Anticipated revenues related to service businesses, including InstaDeep, JPT Peptide Technologies, IMFS and from the German pandemic preparedness agreement 1. Guidance excludes external risks that are not yet known and/or quantifiable. It does not include potential payments resulting from the outcomes of ongoing and/or future legal disputes or related activity, such as judgements or settlements, or other extraordinary items, all of which may have a material effect on the Company’s results of operations and/or cash flows. The Company continues to expect to report a loss for the 2024 financial year. 2. Guidance reflects the expected impact of collaborations and potential M&A transactions, in each case to the extent disclosed, and which are subject to change based on future developments. Guidance does not otherwise reflect M&A, collaboration or licensing transactions that the Company may enter into in the future. 3. For simplicity, midpoint in guidance ranges is applied when comparing the guidance provided in March 2024 with the guidance provided in November 2024. IMFS = BioNTech’s Innovative Manufacturing Services GmbH More information can be found in BioNTech’s Report on Form 6-K for the period ended September 30, 2024, filed today with the United States Securities and Exchange Commission and available at https://www.sec.gov/. Guidance November 2024 Commentary

4 Strategic Outlook Ryan Richardson, Chief Strategy Officer

Launch Progress in Q3 Reiterates Strength of COVID-19 Franchise1 EC UK U.S. Canada Japan JN.1-adapted KP.2-adapted 23 1. Partnered with Pfizer; 2. CDC Weekly Vaccination Dashboard. JN.1 is a SARS-CoV-2 variant. KP.2 is a sub-lineage of the JN.1 variant. Dose switching from JN.1- to KP.2-adapted vaccines underway or expected in countries with both approved Vaccination rates are higher in the U.S. versus the comparable period in 20232 Shift to commercial markets in UK, Japan, Switzerland, Australia, South Korea, Singapore and Brazil

COVID-19 Vaccine Market Presents a Long-term Business Opportunity Global Market Leadership Lean Fixed Cost Base Business Low OpEx leveraging partners’ global commercial infrastructure and sharing R&D expenses Anticipate maintenance of high market share in U.S., EU and Japan Potential for Cashflow Generation 24 Expected continuous demand for COVID-19 vaccines globally with evolving epidemiology of virus

2H 2024 2025+ COMIRNATY1 Updated variant-adapted vaccine roll-out COVID-19 / Flu Combination vaccine1 Phase 3 topline data BNT327/PM80022 NSCLC, TNBC, RCC Phase 2 data COMIRNATY1 Updated variant-adapted vaccine roll-out BNT323/DB-13033 2L+ HER2 EC Regulatory submission BNT327/PM80022 1L ES-SCLC and 2L SCLC Phase 2 data BNT211 CLDN6+ tumors Phase 1 data B BNT327/PM80022 TNBC Phase 2 data BNT327/PM80022 1L and 2L TNBC Phase 2 data BNT323/DB-13033 2L+ HER2 EC Phase 2 data Autogene cevumeran (BNT122/RO7198457)4 ctDNA adj. CRC Phase 2 topline data BNT1115 2L+ melanoma Phase 2 data Clinical Data Updates & Planned Regulatory Submissions in 2025 on Track Based on Strong Execution in 2H 2024 Partnered with: 1. Pfizer; 2. Biotheus; 3. DualityBio; 4. Genentech, member of Roche Group. 5. In collaboration with Regeneron. Catalyst-rich period for mid- to late-stage pipeline consisting of more than 10 Phase 2 and Phase 3 trials covering several tumor types with high unmet medical need 2 4 Data update Regulatory event 25

Save the date Innovation Series November 14, 2024 26

Thank you

Appendix

Program Indication Trial Phase Anticipated Timing Oncology BNT1111 R/R Melanoma Phase 2 2025 BNT116 Advanced NSCLC Phase 1/2 2024 Autogene cevumeran (BNT122/RO7198457)2 Adjuvant ctDNA+ stage II (high risk)/III CRC Phase 2 2025+ BNT312/GEN10423 Multiple solid tumors Phase 1/2 2025 BNT316/ONC-392 (gotistobart)4 R/R Melanoma Phase 1/2 2025 BNT323/DB-13035 Multiple solid tumors Phase 1/2 2025 BNT323/DB-13035 HR+ HER2-low met. BC Phase 3 2026 BNT324/DB-13115 Multiple solid tumors Phase 1/2 2024 BNT325/DB-13055 Multiple solid tumors Phase 1/2 2025 BNT327/PM80026 TNBC Phase 2 2024 BNT327/PM80026 ES-SCLC, SCLC and met. TNBC Phase 2 2025+ Program Updates Expected in 2024 and Beyond In collaboration with: 1. Regeneron. Partnered with 2. Genentech, member of Roche Group 3. Genmab; 4. OncoC4; 5. DualityBio; 6. Biotheus. 29

Abbreviations n L nth line EpCAM Epithelial cell adhesion molecule NSCLC Non-small cell lung cancer AACR American Association for Cancer Research ESMO European Society for Medical Oncology NR Not reported ADC Antibody-drug conjugate GI Gastrointestinal (c)ORR (Confirmed) objective response rate adj. Adjuvant HCC Hepatocellular carcinoma OS (median) Overall survival adv. Advanced HER2 (or 3) Human epidermal growth factor receptor 2 (or 3) PDAC Pancreatic ductal adenocarcinoma AI Artificial intelligence HNSCC Head and neck squamous cell carcinoma PD-(L)1 Programmed cell death protein (ligand) 1 ASCO American Society of Clinical Oncology HPV Human papilloma virus PFS Progression-free survival BC Breast cancer HR Hormone receptor PROC Platinum-resistant ovarian cancer BTC Biliary tract cancer HSV Herpes simplex virus PSOC Platinum-sensitive ovarian cancer CC Cervical cancer ICI Immune checkpoint inhibitor QxW Every x week CD Cluster of differentiation IL-x Interleukin x R Randomized CI Confidence interval IgG Immunoglobulin G (ncc/cc)RCC (non-clear cell/clear cell) Renal cell carcinoma CLDN6 Claudin 6 IIT Investigator initiated trial R&D Research and development CPI Checkpoint inhibitor iNeST Individualized Neoantigen-Specific Therapy R/R Relapsed/refractory CPS Combined positive score INV Investigator (ES)SCLC (Extensive stage) small cell lung cancer CRC Colorectal cancer IO Immuno-oncology SG&A Selling, general and administrative (m)CRPC (Metastatic) castration resistant prostate cancer ITT Intention to treat SITC Society of Immunotherapy of Cancer CT Computer tomography iv Intravenously SoC Standard of care ctDNA Circulating tumor DNA LPX Lipoplex SoD Sum of diameters CTLA-4 Cytotoxic T-lymphocyte-associated protein 4 m Median TNBC Triple-negative breast cancer CTx Chemotherapy met Metastatic TNM Classification systemof malignant tumors DCR Disease control rate MIUC Muscle-invasive urothelial carcinoma TROP-2 Trophoblast cell-surface antigen 2 DFS Disease-free survival M0 Metastasis 0 TTR Time to response DOR (median) Duration of response MoA Mechanism of Action UK United Kingdom EC Endometrial cancer mo(s). Month(s) U.S. United States EC European Community MPM Malignant pleural mesothelioma VEGF(R) Vascular edothelial growth factor (receptor) ECOG (PS) Eastern Cooperative Oncology Group MRI Magnetic resonance imaging VHH Heavy chain variable (performance status) mRNA Messenger ribonucleic acid WT Wild type EGFRm Epidermal growth factor receptor (mutated) NEN Neuroendocrine neoplasm 30

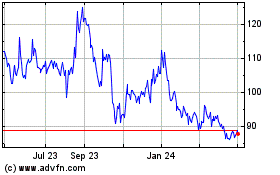

BioNTech (NASDAQ:BNTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

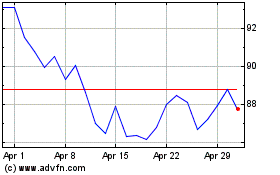

BioNTech (NASDAQ:BNTX)

Historical Stock Chart

From Dec 2023 to Dec 2024