LOS ANGELES, Oct. 8 /PRNewswire-FirstCall/ -- Cathay General

Bancorp (the "Company"), (NASDAQ:CATY), the holding company for

Cathay Bank (the "Bank"), today announced results for the third

quarter of 2009. FINANCIAL PERFORMANCE Third Quarter Third Quarter

2009 2008 ----------------------------------------------------

-------------- Net (loss)/income ($17.7) million $6.9 million Net

(loss)/income available to common stockholders ($21.8) million $6.9

million (Loss)/basic earnings per common share ($0.43) $0.14

(Loss)/ diluted earnings per common share ($0.43) $0.14 THIRD

QUARTER HIGHLIGHTS -- Nonaccrual loans down 6% - Total nonaccrual

loans decreased by 6%, or $21.5 million, to $361.6 million at

September 30, 2009 compared to $383.1 million at June 30, 2009. --

Total accruing delinquent loans down 50% - Total loans delinquent

30 days or more and still accruing interest decreased by 50% to

$79.3 million at September 30, 2009 compared to $158.2 million at

June 30, 2009. -- Increase in net interest margin - Net interest

margin for the third quarter of 2009 increased to 2.65% from 2.49%

for the second quarter of 2009. -- Allowance for credit losses

strengthened - Total allowance for credit losses increased to

$194.4 million, or 2.73%, of total loans at September 30, 2009

compared to 2.42% of total loans at June 30, 2009. -- Decrease in

provision for credit losses - The Company recorded a provision for

credit losses of $76.0 million during the third quarter of 2009, a

decrease of $17.0 million in the provision for credit losses, as

compared to a provision of $93.0 million during the second quarter

of 2009. -- Capital strengthened - During the month of September

2009, the Company raised $31.7 million in additional capital

through the sale of 3.5 million shares of common stock in its

at-the-market capital offering. "We are pleased that our

nonaccruals dropped by $21.5 million during the third quarter and

are committed to continue to aggressively dispose of other real

estate owned. We are also encouraged by the significant decline in

past due loans. We recorded a provision for credit losses during

the third quarter of $76 million which increased our allowance for

credit losses to 2.73% of total loans," commented Dunson Cheng,

Chairman of the Board, Chief Executive Officer, and President of

the Company. "During the first nine months of the year, we had

solid growth in total deposits, which increased by $874 million, or

13%, net of a $211 million reduction of brokered deposits, which

helped us to improve our net loan to deposit ratio to 89.8% at

September 30, 2009. We are especially pleased that our core

deposits increased $533.9 million to $3.2 billion at September 30,

2009, equating to a 26.9% growth rate, if annualized," said Peter

Wu, Executive Vice Chairman and Chief Operating Officer. "As part

of our ongoing evaluation of our capital levels and needs during

this challenging economic period, we previously announced an 'at

the market' stock issuance program on September 9, 2009 to further

strengthen our capital base. We are pleased that we raised $31.7

million of new capital through this program at the end of the third

quarter. Our focus continues to be managing through this

challenging credit cycle, resolving problem assets on a case by

case basis without resorting to bulk sales and maintaining strong

liquidity. We expect an increase in the pace of sales of nonaccrual

loans and foreclosed real estate during the remainder of the year

as we continue to resolve problem assets," concluded Dunson Cheng.

INCOME STATEMENT REVIEW Net loss attributable to common

stockholders for the three months ended September 30, 2009 was

$21.8 million, a $28.7 million income decrease, compared to net

income attributable to common stockholders of $6.9 million for the

same period a year ago. Loss per share for the three months ended

September 30, 2009, was $0.43 compared to earnings of $0.14 per

diluted share for the same period a year ago due primarily to

increases in the provision for credit losses, lower net interest

income and higher provision for OREO write-downs. Return on average

stockholders' equity was negative 5.58% and return on average

assets was negative 0.60% for the three months ended September 30,

2009, compared to a return on average stockholders' equity of 2.71%

and a return on average assets of 0.25% for the same period of

2008. Net interest income before provision for credit losses Net

interest income before provision for credit losses decreased to

$72.5 million during the third quarter of 2009, a decline of $1.1

million, or 1.5%, compared to $73.6 million during the same quarter

a year ago. The decrease was due primarily to the increases in

interest expense paid for securities sold under agreements to

repurchase. The net interest margin, on a fully taxable-equivalent

basis, was 2.65% for the third quarter of 2009. The net interest

margin increased 16 basis points from 2.49% in the second quarter

of 2009, and decreased 23 basis points from 2.88%, on a fully

taxable-equivalent basis, in the third quarter of 2008. The

decrease in net interest margin from the prior year primarily

resulted from increases in non-accrual loans and the increase in

the borrowing rate on our long term repurchase agreements and other

borrowed funds. The majority of our variable rate loans contain

interest rate floors, which help limit the impact of the recent

decreases in the prime interest rate. For the third quarter of

2009, the yield on average interest-earning assets was 4.82%, on a

fully taxable-equivalent basis, the cost of funds on average

interest-bearing liabilities equaled 2.48%, and the cost of

interest bearing deposits was 1.80%. In comparison, for the third

quarter of 2008, the yield on average interest-earning assets was

5.70%, on a fully taxable-equivalent basis, cost of funds on

average interest-bearing liabilities equaled 3.21%, and the cost of

interest bearing deposits was 2.84%. The interest spread, defined

as the difference between the yield on average interest-earning

assets and the cost of funds on average interest-bearing

liabilities, decreased 15 basis points to 2.34% for the third

quarter ended September 30, 2009, from 2.49% for the same quarter a

year ago, primarily due to the reasons discussed above. The cost of

deposits, including demand deposits, decreased 33 basis points to

1.62% in the third quarter of 2009 compared to 1.95% in the second

quarter of 2009 due primarily to growth in core deposits and

decreased 89 basis points from 2.51% in the third quarter of 2008

due partly to decrease in market rates and partly to growth in core

deposits. Provision for credit losses The provision for credit

losses was $76.0 million for the third quarter of 2009 compared to

$93.0 million for the second quarter of 2009 and compared to $15.8

million in the third quarter of 2008. The provision for credit

losses was based on the review of the adequacy of the allowance for

loan losses at September 30, 2009. The provision for credit losses

represents the charge against current earnings that is determined

by management, through a credit review process, as the amount

needed to establish an allowance that management believes to be

sufficient to absorb credit losses inherent in the Company's loan

portfolio, including unfunded commitments. The following table

summarizes the charge-offs and recoveries for the periods as

indicated: For the three months For the nine months ended September

30, ended September 30,

---------------------------------------------------

------------------- (In thousands) 2009 2008 2009 2008

---------------------------------------- -------- -------- --------

Charge-offs: Commercial loans $27,748 $6,796 $49,913 $8,917

Construction loans- residential 13,126 3,230 58,535 8,239

Construction loans- other 3,072 - 11,840 - Real estate loans 10,732

172 25,188 554 Real estate- land loans 3,865 - 7,599 339

Installment and other loans - - 4 - ------- ------ -------- -------

Total charge-offs 58,543 10,198 153,079 18,049 ------- ------

-------- ------- Recoveries: Commercial loans 219 1,067 523 1,634

Construction loans- residential 598 - 772 83 Construction loans-

other - - 1 - Real estate loans 46 - 46 - Real estate- land loans

685 - 686 - Installment and other loans 2 4 19 16 ------- ------

-------- ------- Total recoveries 1,550 1,071 2,047 1,733 -------

------ -------- ------- Net Charge-offs $56,993 $9,127 $151,032

$16,316 ======= ====== ======== ======= Total charge-offs of $58.5

million for the third quarter of 2009 included $13.1 million of

charge-offs on twelve residential construction loans, $3.1 million

of charge-offs on commercial property construction loans, $9.2

million of charge-offs on commercial real estate loans, $27.7

million on 25 commercial loans, $1.5 million charge-offs on

residential mortgage loans, and $3.9 million of charge-offs on land

loans. Net loan charge-offs increased from $56.0 million in the

second quarter of 2009 to $57.0 million in the third quarter of

2009 and compared to $9.1 million in the third quarter of last

year. Net loan charge-offs remained high in the third quarter as a

result of the continuing weak economy. Non-interest income

Non-interest income, which includes revenues from depository

service fees, letters of credit commissions, securities gains

(losses), gains (losses) on loan sales, wire transfer fees, and

other sources of fee income, was $10.3 million for the third

quarter of 2009, an increase of $18.7 million compared to the

non-interest loss of $8.4 million for the third quarter of 2008.

The increase in non-interest income was primarily due to net

securities losses in 2008 of $15.3 million. In the third quarter of

2009, net gains on sales of agency mortgage-backed securities were

$2.9 million compared to a $27.8 million other-than-temporary

impairment charge on agency preferred stock which was partially

offset by net gains of $12.5 million from sales of agency

mortgage-backed securities in the same quarter a year ago. In the

third quarter of 2009, the Company sold an aircraft owned through a

leveraged lease and recorded a $3.3 million gain. Offsetting the

above gains were losses of $1.3 million from interest rate swap

agreements, a decrease of $1.0 million from foreign exchange and

currency transaction commissions, and $328,000 from higher

write-downs of venture capital investments. Non-interest expense

Non-interest expense increased $3.8 million, or 10.8%, to $38.8

million in the third quarter of 2009 compared to $35.0 million in

the same quarter a year ago. The efficiency ratio was 46.87% in the

third quarter of 2009 compared to 53.69% for the same period a year

ago due to the securities losses recorded in the prior year. OREO

expense increased $2.9 million to $4.1 million in the third quarter

of 2009 from $1.2 million in the same quarter a year ago primarily

due to higher OREO provision and expense resulting from increased

OREO activities. FDIC and State assessments increased $3.2 million

to $4.5 million in the third quarter of 2009 from $1.3 million in

the same quarter a year ago due to a higher assessment rate.

Occupancy expense increased $606,000 primarily due to increases in

depreciation expense of $782,000 primarily related to our new

administrative offices at 9650 Flair Drive, El Monte which opened

in January 2009, which were partially offset by lower rental

expense of $206,000. Professional service expense increased

$284,000, or 8.3%, primarily due to increases in credit appraisal

expenses, legal expenses, and collection expenses. Offsetting the

above described increases were decreases of $2.0 million in

salaries and employee benefits and decreases of $1.4 million

expense from operations of affordable housing investments. Salaries

and employee benefits decreased primarily due to a $665,000

decrease in option compensation expense, a $556,000 decrease in

bonus accruals, and a $331,000 decrease in salaries. Expense from

operations of affordable housing investments decreased as the

result of an expense reversal of $494,000 to the prior year's

estimated losses in the third quarter of 2009 compared to

additional expense adjustment of $577,000 in the same quarter a

year ago. Income taxes The tax benefit for the third quarter of

2009 resulted from the pretax loss for the quarter and the

utilization of low income housing tax credits. BALANCE SHEET REVIEW

Total assets increased by $167.1 million, or 1.4%, to $11.7 billion

at September 30, 2009, from $11.6 billion at December 31, 2008

primarily due to a $211.0 million increase in securities

available-for-sale and a $420.2 million increase in cash, due from

banks and short-term investments offset by a $421.7 million

decrease in net loans. The changes in the loan composition from

December 31, 2008, are presented below: Type of Loans: September

30, December 31, % 2009 2008 Change

------------------------------------------------ -------------

------ (Dollars in thousands) Commercial $1,401,069 $1,620,438 (14)

Residential mortgage 666,510 622,741 7 Commercial mortgage

4,124,384 4,132,850 (0) Equity lines 192,743 168,756 14 Real estate

construction 715,071 913,168 (21) Installment 11,819 11,340 4 Other

5,092 3,075 66 ---------- ---------- Gross loans and leases

$7,116,688 $7,472,368 (5) Allowance for loan losses (189,370)

(122,093) 55 Unamortized deferred loan fees (8,880) (10,094) (12)

---------- ---------- Total loans and leases, net $6,918,438

$7,340,181 (6) ========== ========== Total deposits were $7.7

billion at September 30, 2009, an increase of $874.5 million, or

12.8%, from $6.8 billion at December 31, 2008, primarily due to

increases of $305.7 million, or 46.4%, in money market accounts and

increases of $527.2 million, or 16.3%, in time deposits of $100,000

or more offset by decreases of $160.4 million, or 9.8%, in time

deposits under $100,000. Brokered deposits which are reported in

time deposits under $100,000 declined $226.0 million to $746.9

million at September 30, 2009 from $972.9 million at December 31,

2008. The changes in the deposit composition from December 31,

2008, are presented below: Deposits September 30, December 31, %

2009 2008 Change ----------------------------------------------

------------ ------ (Dollars in thousands) Non-interest-bearing

demand $831,800 $730,433 14 NOW 324,774 257,234 26 Money market

965,159 659,454 46 Savings 349,298 316,263 10 Time deposits under

$100,000 1,484,056 1,644,407 (10) Time deposits of $100,000 or more

3,756,142 3,228,945 16 ---------- ---------- Total deposits

$7,711,229 $6,836,736 13 ========== ========== ASSET QUALITY REVIEW

At September 30, 2009, total non-accrual loans were $361.6 million,

a decrease of $21.5 million, or 5.6%, from $383.1 million at June

30, 2009 and an increase of $180.4 million, or 99.6%, from $181.2

million at December 31, 2008. A summary of non-accrual loans by

collateral type as of September 30, 2009 is shown below: Collateral

Type No. No. No. of Other of of California Borrowers States

Borrowers Total Borrowers -----------------------------------

----------------- ----------------- (Dollars in thousands except

no. of borrowers) Commercial real estate $110,361 32 $55,968 29

$166,329 61 Commercial 18,599 29 6,624 10 25,223 39 Construction-

residential 86,901 16 9,428 6 96,329 22 Construction- non-

residential 34,227 5 974 2 35,201 7 Residential mortgage 8,617 30

2,654 12 11,271 42 Land 22,265 16 4,993 6 27,258 22

------------------ ----------------- ------------------ Total

$280,970 128 $80,641 65 $361,611 193 ==================

================= ================== Included in nonaccrual

commercial real estate loans is a loan with an outstanding balance

of $47.6 million to a borrower who filed for bankruptcy in March

2009. While the loan is non-accrual at September 30, 2009,

management believes that the value of the underlying real estate

collateral is sufficient for a full collection of principal and

interest. Nonaccrual loans also include those troubled debt

restructurings that do not qualify for accrual status. At September

30, 2009, total residential construction loans were $297.1 million

of which $7.9 million were in the Central Valley in California and

$17.7 million were in San Bernardino and Riverside counties in

California. Residential construction loans of $7.9 million in the

Central Valley and $8.3 million in San Bernardino and Riverside

counties were on non-accrual status as of September 30, 2009. At

September 30, 2009, total land loans were $200.7 million of which

$28.6 million were in San Bernardino, Riverside, and Imperial

counties and $2.8 million were in the Central Valley. Land loans of

$2.8 million in the Central Valley and a land loan of $4.7 million

in Riverside were on non-accrual status as of September 30, 2009.

Troubled debt restructurings on accrual status totaled $59.4

million at September 30, 2009 and were comprised of 12 loans. These

loans are classified as troubled debt restructurings as a result of

granting a concession to borrowers. The concessions may be granted

in various forms, including reduction in the stated interest rate,

reduction in the loan balance or accrued interest, and extension of

the maturity date. Although these loan modifications are considered

Statement 15 troubled debt restructurings, the loans have performed

under the restructured terms and have demonstrated sustained

performance under the modified terms. The sustained performance

considered by management includes the periods prior to the

modification if the prior performance met or exceeded the modified

terms as well as cash paid to set up interest reserves. At

September 30, 2009, net carrying value of other real estate owned

increased $25.7 million, or 42.0%, to $86.7 million from $61.0

million at December 31, 2008. At September 30, 2009, $50.6 million

of OREO was located in California, $25.1 million of OREO was

located in Texas, $5.0 million of OREO was located in state of

Washington, $4.5 million of OREO was located in Nevada, and $1.5

million was located in all other states. The ratio of

non-performing assets to total assets was 4.0% at September 30,

2009, compared to 2.2% at December 31, 2008, and compared to 4.2%

at June 30, 2009. Total non-performing assets increased $213.0

million, or 84.6%, to $464.8 million at September 30, 2009,

compared with $251.8 million at December 31, 2008, primarily due to

a $180.4 million increase in non-accrual loans and a $25.7 million

increase in OREO. Total non-performing assets decreased $8.9

million, or 1.9%, to $464.8 million at September 30, 2009, compared

with $473.7 million at June 30, 2009, primarily due to a $21.5

million decrease in non-accrual loans offset by a $12.9 million

increase in OREO. The allowance for loan losses was $189.4 million

and the allowance for off-balance sheet unfunded credit commitments

was $5.0 million at September 30, 2009, and represented the amount

that the Company believes to be sufficient to absorb credit losses

inherent in the Company's loan portfolio. The allowance for credit

losses, the sum of allowance for loan losses and for off-balance

sheet unfunded credit commitments, was $194.4 million at September

30, 2009, compared to $129.4 million at December 31, 2008, an

increase of $65.0 million, or 50.2%. The allowance for credit

losses represented 2.73% of period-end gross loans and 51.4% of

non-performing loans at September 30, 2009. The comparable ratios

were 1.73% of period-end gross loans and 68.9% of non-performing

loans at December 31, 2008. Results of the changes from December

31, 2008 and June 30, 2009, to September 30, 2009, to the Company's

non-performing assets and troubled debt restructurings are

highlighted below: (Dollars in September 30, June 30, % December

31, % thousands) 2009 2009 Change 2008 Change -------------

-------- ------ ------------ ------ Non-performing assets Accruing

loans past due 90 days or more $16,507 $16,952 (3) $6,733 145

Non-accrual loans: Construction- residential 96,329 154,348 (38)

100,169 (4) Construction- non-residential 35,201 23,797 48 22,012

60 Land 27,258 27,060 1 12,608 116 Commercial real estate,

excluding land 166,329 133,161 25 19,733 743 Commercial 25,223

34,844 (28) 20,904 21 Residential mortgage 11,271 9,869 14 5,776 95

-------- -------- -------- Total non-accrual loans: $361,611

$383,079 (6) $181,202 100 -------- -------- -------- Total non-

performing loans 378,118 400,031 (5) 187,935 101 Other real estate

owned and other assets 86,662 73,715 18 63,892 36 -------- --------

-------- Total non-performing assets $464,780 $473,746 (2) $251,827

85 -------- -------- -------- Performing troubled debt

restructurings $59,400 $23,705 151 $924 6,329 ======== ========

======== Allowance for loan losses $189,370 $169,551 12 $122,093 55

Allowance for off-balance sheet credit commitments 5,023 5,835 (14)

7,332 (31) -------- -------- -------- Allowance for credit losses

$194,393 $175,386 11 $129,425 50 ======== ======== ======== Total

gross loans outstanding, at period-end $7,116,688 $7,254,264

(2)$7,472,368 (5) Allowance for loan losses to non-performing

loans, at period-end 50.08% 42.38% 64.97% Allowance for loan losses

to gross loans, at period-end 2.66% 2.34% 1.63% Allowance for

credit losses to non-performing loans, at period-end 51.41% 43.84%

68.87% Allowance for credit losses to gross loans, at period-end

2.73% 2.42% 1.73% Loans past due 30 to 89 days still accruing

decreased $78.5 million, or 55.6%, from $141.3 million at June 30,

2009, to $62.8 million at September 30, 2009. The following table

presents types and changes of loans past due 30 days or more and

still accruing as the dates indicated: (Dollars in September 30,

June 30, % December 31, % thousands) 2009 2009 Change 2008 Change

------------- -------- ------ ------------ ------ Accruing loans

past due 30 to 89 days Construction- residential 8,912 12,295 (28)

28,814 (69) Construction- non-residential 5,654 1,944 191 16,716

(66) Land 6,652 20,170 (67) 12,029 (45) Commercial real estate,

excluding land 26,122 93,808 (72) 48,412 (46) Commercial 12,576

8,569 47 28,568 (56) Residential mortgage 2,884 4,446 (35) 8,271

(65) Other - 65 (100) 5 (100) ------- -------- -------- Total loans

past due 30 to 89 days $62,800 $141,297 (56) $142,815 (56) -------

-------- -------- Accruing loans past due 90 days or more 16,507

16,952 (3) $6,733 145 ------- -------- -------- Total accruing

loans past due 30 or more $79,307 $158,249 (50) $149,548 (47)

======= ======== ======== CAPITAL ADEQUACY REVIEW At September 30,

2009, the Tier 1 risk-based capital ratio of 12.63%, total

risk-based capital ratio of 14.49%, and Tier 1 leverage capital

ratio of 9.29%, continue to place the Company in the "well

capitalized" category for regulatory purposes, which is defined as

institutions with a Tier 1 risk-based capital ratio equal to or

greater than 6%, a total risk-based capital ratio equal to or

greater than 10%, and a Tier 1 leverage capital ratio equal to or

greater than 5%. At December 31, 2008, the Company's Tier 1

risk-based capital ratio was 12.12%, the total risk-based capital

ratio was 13.94%, and Tier 1 leverage capital ratio was 9.79%.

During the third quarter of 2009, the Company raised additional

capital of $31.7 million from the sale of approximately 3.5 million

shares of common stock. YEAR-TO-DATE REVIEW Net loss available to

common stockholders for the first nine months of 2009 was $44.4

million, an $97.8 million, or 183%, decrease compared to net income

available to common stockholders of $53.4 million for the same

period a year ago. Loss per share was $0.89 compared to earnings of

$1.08 per diluted share for the same period a year ago due

primarily to increases in the provision for loan losses, lower net

interest income and higher provision for OREO write-downs. The net

interest margin for the nine months ended September 30, 2009,

decreased 38 basis points to 2.61% compared to 2.99% for the same

period a year ago. Return on average stockholders' equity was

negative 3.35% and return on average assets was negative 0.37% for

the nine months ended September 30, 2009, compared to a return on

average stockholders' equity of 7.09% and a return on average

assets of 0.67% for the same period of 2008. The efficiency ratio

for the nine months ended September 30, 2009 was 46.66% compared to

44.00% for the same period a year ago. ABOUT CATHAY GENERAL BANCORP

Cathay General Bancorp is the holding company for Cathay Bank, a

California state-chartered bank. Founded in 1962, Cathay Bank

offers a wide range of financial services. Cathay Bank currently

operates 31 branches in California, eight branches in New York

State, one in Massachusetts, two in Texas, three in Washington

State, three in the Chicago, Illinois area, one in New Jersey, one

in Hong Kong, and a representative office in Shanghai and in

Taipei. Cathay Bank's website is found at

http://www.cathaybank.com/. Cathay General Bancorp's website is

found at http://www.cathaygeneralbancorp.com/. Information set

forth on such websites is not incorporated into this press release.

FORWARD-LOOKING STATEMENTS AND OTHER NOTICES The information

contained in this press release is not intended as a solicitation

to buy Cathay General Bancorp stock or any other securities and is

provided for information only. Statements made in this press

release, other than statements of historical fact, are

forward-looking statements within the meaning of the applicable

provisions of the Private Securities Litigation Reform Act of 1995

regarding management's beliefs, projections, and assumptions

concerning future results and events. These forward-looking

statements may include, but are not limited to, such words as

"aims," "anticipates," "believes," "could," "estimates," "expects,"

"hopes," "intends," "may," "plans," "projects," "seeks," "shall,"

"should," "will," "predicts," "potential," "continue," and

variations of these words and similar expressions. Forward-looking

statements are based on estimates, beliefs, projections, and

assumptions and are not guarantees of future performance. These

forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from our historical experience and our present expectations or

projections. Such risks and uncertainties and other factors

include, but are not limited to, adverse developments or conditions

related to or arising from: significant volatility and

deterioration in the credit and financial markets; adverse changes

in general economic conditions; the effects of the Emergency

Economic Stabilization Act, the American Recovery and Reinvestment

Act, and the Troubled Asset Relief Program (TARP) and any changes

or amendments thereto; deterioration in asset or credit quality;

the availability of capital; the impact of any goodwill impairment

that may be determined; acquisitions of other banks, if any;

fluctuations in interest rates; the soundness of other financial

institutions; expansion into new market areas; earthquakes,

wildfires, or other natural disasters; competitive pressures;

changes in laws, regulations, and accounting rules, or their

interpretations; legislative, judicial, or regulatory actions and

developments against us; and general economic or business

conditions in California and other regions where Cathay Bank has

operations, including, but not limited to, adverse changes in

economic conditions resulting from the continuation or worsening of

the current economic downturn. These and other factors are further

described in Cathay General Bancorp's Current Report on Form 8-K

filed on September 9, 2009, as amended on September 23, 2009 (Item

8.01 in particular), other reports filed with the Securities and

Exchange Commission ("SEC"), and other filings Cathay General

Bancorp makes with the SEC from time to time. Actual results in any

future period may also vary from the past results discussed in this

press release. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on any forward-looking

statements, which speak to the date of this press release. Cathay

General Bancorp has no intention and undertakes no obligation to

update any forward-looking statement or to publicly announce any

revision of any forward-looking statement to reflect future

developments or events, except as required by law. Cathay General

Bancorp's filings with the SEC are available at the website

maintained by the SEC at http://www.sec.gov/, or by request

directed to Cathay General Bancorp, 9650 Flair Drive, El Monte,

California 91731, Attention: Investor Relations (626) 279-3286.

CATHAY GENERAL BANCORP CONSOLIDATED FINANCIAL HIGHLIGHTS

(Unaudited) (Dollars in Three months ended Nine months ended

thousands, September 30, September 30, except per

---------------------------- ---------------------------- share

data) 2009 2008 % Change 2009 2008 % Change -----------------------

------- -------- ------- -------- -------- FINANCIAL PERFORMANCE

Net interest income before provision for credit losses $72,515

$73,601 (1) $208,937 $220,905 (5) Provision for credit losses

76,000 15,800 381 216,000 43,800 393 -------- ------- --------

-------- Net interest income after provision for credit losses

(3,485) 57,801 (106) (7,063) 177,105 (104) Non-interest income

10,287 (8,369) (223) 70,382 7,330 860 Non-interest expense 38,807

35,020 11 130,336 100,429 30 -------- ------- -------- --------

(Loss)/income before income tax (benefit) /expense (32,005) 14,412

(322) (67,017) 84,006 (180) Income tax (benefit) /expense (14,482)

7,370 (296) (35,362) 30,133 (217) -------- ------- --------

-------- Net (loss) /income (17,523) 7,042 (349) (31,655) 53,873

(159) Net (loss) /income attributable to noncontrolling interest

(156) (151) 3 (457) (452) 1 -------- ------- -------- -------- Net

(loss) /income attributable to Cathay General Bancorp (17,679)

6,891 (357) (32,112) 53,421 (160) -------- ------- --------

-------- Dividends on preferred stock (4,086) - 100 (12,249) - 100

-------- ------- -------- -------- Net (loss) /income available to

common stockholders $(21,765) $6,891 (416) $(44,361) $53,421 (183)

======== ======= ======== ======== Net (loss) /income available to

common stockholders per common share: Basic $(0.43) $0.14 (407)

$(0.89) $ 1.08 (182) Diluted $(0.43) $0.14 (407) $(0.89) $ 1.08

(182) Cash dividends paid per common share $0.010 $0.105 (90)

$0.195 $ 0.315 (38)

==========================================================================

SELECTED RATIOS Return on average assets -0.60% 0.25% (340) -0.37%

0.67% (155) Return on average total stockholders' equity -5.58%

2.71% (306) -3.35% 7.09% (147) Efficiency ratio 46.87% 53.69% (13)

46.66% 44.00% 6 Dividend payout ratio n/m 75.30% n/m n/m 29.12% n/m

* n/m - not meaningful

==========================================================================

YIELD ANALYSIS (Fully taxable equivalent) Total interest -earning

assets 4.82% 5.70% (15) 4.98% 6.00% (17) Total interest -bearing

liabilities 2.48% 3.21% (23) 2.73% 3.44% (21) Net interest spread

2.34% 2.49% (6) 2.25% 2.56% (12) Net interest margin 2.65% 2.88%

(8) 2.61% 2.99% (13)

==========================================================================

September September December Well Minimum CAPITAL 30, 30, 31,

Capitalized Regulatory RATIOS 2009 2008 2008 Requirements

Requirements Tier 1 risk-based capital ratio 12.63% 9.39% 12.12%

6.0% 4.0% Total risk-based capital ratio 14.49% 11.09% 13.94% 10.0%

8.0% Tier 1 leverage capital ratio 9.29% 7.65% 9.79% 5.0% 4.0%

==========================================================================

CATHAY GENERAL BANCORP CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) (In thousands, except September 30, December 31, %

share and per share data) 2009 2008 change

--------------------------------- ------------- ------------

--------- Assets Cash and due from banks $198,237 $84,818 134

Short-term investments and interest bearing deposits 331,767 25,000

1,227 Securities purchased under agreements to resell - 201,000

(100) Securities held-to-maturity 99,865 - 100 Securities

available-for-sale (amortized cost of $3,266,440 in 2009 and

$3,043,566 in 2008) 3,294,808 3,083,817 7 Trading securities 12 12

- Loans 7,116,688 7,472,368 (5) Less: Allowance for loan losses

(189,370) (122,093) 55 Unamortized deferred loan fees, net (8,880)

(10,094) (12) ----------- ----------- Loans, net 6,918,438

7,340,181 (6) Federal Home Loan Bank stock 71,791 71,791 - Other

real estate owned, net 86,662 61,015 42 Affordable housing

investments, net 98,046 103,562 (5) Premises and equipment, net

109,370 104,107 5 Customers' liability on acceptances 28,974 39,117

(26) Accrued interest receivable 33,459 43,603 (23) Goodwill

316,340 319,557 (1) Other intangible assets, net 24,448 29,246 (16)

Other assets 137,546 75,813 81 ----------- ----------- Total assets

$11,749,763 $11,582,639 1 =========== =========== Liabilities and

Stockholders' Equity Deposits Non-interest-bearing demand deposits

$831,800 $730,433 14 Interest-bearing deposits: NOW deposits

324,774 257,234 26 Money market deposits 965,159 659,454 46 Savings

deposits 349,298 316,263 10 Time deposits under $100,000 1,484,056

1,644,407 (10) Time deposits of $100,000 or more 3,756,142

3,228,945 16 ----------- ---------- Total deposits 7,711,229

6,836,736 13 ----------- ---------- Federal funds purchased -

52,000 (100) Securities sold under agreements to repurchase

1,550,000 1,610,000 (4) Advances from the Federal Home Loan Bank

929,362 1,449,362 (36) Other borrowings from financial institutions

1,313 - 100 Other borrowings for affordable housing investments

19,355 19,500 (1) Long-term debt 171,136 171,136 - Acceptances

outstanding 28,974 39,117 (26) Other liabilities 58,929 103,401

(43) ----------- ---------- Total liabilities 10,470,298 10,281,252

2 ----------- ---------- Commitments and contingencies - - -

----------- ---------- Stockholders' Equity Preferred stock,

10,000,000 shares authorized, 258,000 issued and outstanding in

2009 and 2008 243,103 240,554 1 Common stock, $0.01 par value,

100,000,000 shares authorized, 57,279,715 issued and 53,072,150

outstanding at September 30, 2009 and 53,715,815 issued and

49,508,250 outstanding at December 31, 2008 573 537 7 Additional

paid-in-capital 545,010 508,613 7 Accumulated other comprehensive

income, net 16,441 23,327 (30) Retained earnings 591,574 645,592

(8) Treasury stock, at cost (4,207,565 shares in 2009 and in 2008)

(125,736) (125,736) - ----------- ---------- Total Cathay General

Bancorp stockholders' equity 1,270,965 1,292,887 (2) -----------

---------- Noncontrolling interest 8,500 8,500 - -----------

---------- Total equity 1,279,465 1,301,387 (2) -----------

---------- Total liabilities and equity $11,749,763 $11,582,639 1

=========== =========== Book value per common stock share $19.09

$20.90 (9) Number of common stock shares outstanding 53,072,150

49,508,250 7 CATHAY GENERAL BANCORP CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (Unaudited) Three months ended Nine months

ended September 30, September 30, -----------------------

--------------------- 2009 2008 2009 2008 -----------------------

--------------------- (In thousands, except share and per share

data) INTEREST AND DIVIDEND INCOME Loan receivable, including loan

fees $99,588 $114,005 $302,232 $341,880 Investment securities-

taxable 31,589 27,575 94,104 84,507 Investment securities-

nontaxable 167 284 620 974 Federal Home Loan Bank stock 149 1,004

149 2,685 Agency preferred stock - 313 - 1,621 Federal funds sold

and securities purchased under agreements to resell 35 2,899 1,338

12,294 Deposits with banks 119 42 250 523 -----------------------

--------------------- Total interest and dividend income 131,647

146,122 398,693 444,484 -----------------------

--------------------- INTEREST EXPENSE Time deposits of $100,000 or

more 20,224 26,226 65,337 86,398 Other deposits 10,622 17,100

40,196 49,519 Securities sold under agreements to repurchase 16,555

15,174 48,527 44,716 Advances from Federal Home Loan Bank 10,664

11,785 31,781 35,229 Long-term debt 1,067 2,030 3,891 6,889

Short-term borrowings - 206 24 828 -----------------------

--------------------- Total interest expense 59,132 72,521 189,756

223,579 ----------------------- --------------------- Net interest

income before provision for credit losses 72,515 73,601 208,937

220,905 Provision for credit losses 76,000 15,800 216,000 43,800

----------------------- --------------------- Net interest income

after provision for loan losses (3,485) 57,801 (7,063) 177,105

----------------------- --------------------- NON-INTEREST INCOME

Securities gains (losses), net 2,883 (15,313) 52,319 (12,980)

Letters of credit commissions 1,150 1,465 3,159 4,281 Depository

service fees 1,272 1,189 3,940 3,636 Other operating income 4,982

4,290 10,964 12,393 ----------------------- ---------------------

Total non-interest income 10,287 (8,369) 70,382 7,330

----------------------- --------------------- NON-INTEREST EXPENSE

Salaries and employee benefits 14,410 16,376 46,369 50,643

Occupancy expense 3,999 3,393 12,126 9,918 Computer and equipment

expense 2,052 1,848 5,938 6,024 Professional services expense 3,694

3,410 10,021 8,890 FDIC and State assessments 4,464 1,336 15,372

3,172 Marketing expense 669 584 2,153 2,449 Other real estate owned

expense (income) 4,135 1,182 20,150 1,806 Operations of affordable

housing investments 1,407 2,840 5,255 5,361 Amortization of core

deposit intangibles 1,689 1,722 5,089 5,196 Other operating expense

2,288 2,329 7,863 6,970 -----------------------

--------------------- Total non-interest expense 38,807 35,020

130,336 100,429 ----------------------- ---------------------

(Loss)/income before income tax (benefit) /expense (32,005) 14,412

(67,017) 84,006 Income tax (benefit) /expense (14,482) 7,370

(35,362) 30,133 ----------------------- --------------------- Net

(loss)/income (17,523) 7,042 (31,655) 53,873 Less: net income

attributable to noncontrolling interest (156) (151) (457) (452)

----------------------- --------------------- Net (loss)/income

attributable to Cathay General Bancorp (17,679) 6,891 (32,112)

53,421 ----------------------- --------------------- Dividends on

preferred stock (4,086) - (12,249) - -----------------------

--------------------- Net (loss)/income available to common

stockholders $(21,765) $6,891 $(44,361) $53,421

======================= ===================== Net (loss)/income

available to common stockholders per common share: Basic $(0.43)

$0.14 $(0.89) $1.08 Diluted $(0.43) $0.14 $(0.89) $1.08 Cash

dividends paid per common share $0.010 $0.105 $0.195 $0.315 Basic

average common shares outstanding 50,183,296 49,441,621 49,758,833

49,392,655 Diluted average common shares outstanding 50,183,296

49,530,272 49,758,833 49,497,171 CATHAY GENERAL BANCORP AVERAGE

BALANCES - SELECTED CONSOLIDATED FINANCIAL INFORMATION (Unaudited)

For the three months ended,

--------------------------------------------------------------------------

(In thousands) September 30, September 30, June 30, 2009 2008 2009

-------------------------------- -------------------

------------------- Interest- Average Average Average earning

Average Yield/Rate Average Yield/Rate Average Yield/Rate assets

Balance (1) (2) Balance (1) (2) Balance (1) (2) -------------------

-------------------- ------------------- Loans and leases(1)

$7,211,984 5.48% $7,425,818 6.11% $7,342,100 5.39% Taxable

investment securities 3,385,904 3.70% 2,484,473 4.42% 3,158,632

3.85% Tax-exempt investment securities(2) 18,590 5.48% 47,938 7.20%

19,315 6.60% FHLB stock 71,819 0.82% 64,228 6.22% 71,791 0.00%

Federal funds sold and securities purchased under agreements to

resell 104,946 0.13% 188,522 6.12% 3,989 0.10% Deposits with banks

57,297 0.82% 8,941 1.87% 37,363 0.78% -------------------

-------------------- ------------------- Total interest -earning

assets $10,850,540 4.82% $10,219,920 5.70% $10,633,190 4.88%

----------- ----------- ----------- Interest- bearing liabilities

Interest- bearing demand deposits $310,047 0.40% $268,802 0.57%

$278,944 0.41% Money market 967,839 1.54% 760,679 1.81% 834,063

1.56% Savings deposits 338,053 0.21% 337,538 0.31% 328,274 0.21%

Time deposits 5,175,066 2.04% 4,708,290 3.31% 5,064,471 2.50%

------------------- -------------------- ------------------- Total

interest -bearing deposits $6,791,005 1.80% $6,075,309 2.84%

$6,505,752 2.18% Federal funds purchased 163 0.45% 39,842 2.06%

16,747 0.26% Securities sold under agreements to repurchase

1,556,343 4.22% 1,550,000 3.89% 1,559,302 4.12% Other borrowed

funds 957,558 4.42% 1,157,430 4.05% 962,405 4.40% Long-term debt

171,136 2.47% 171,136 4.72% 171,136 3.09% -------------------

-------------------- ------------------- Total interest -bearing

liabilities 9,476,205 2.48% 8,993,717 3.21% 9,215,342 2.75%

Non-interest -bearing demand deposits 783,826 788,028 749,573

----------- ----------- ----------- Total deposits and other

borrowed funds $10,260,031 $9,781,745 $9,964,915 -----------

----------- ----------- Total average assets $11,626,641

$10,926,283 $11,385,247 Total average equity $1,264,864 $1,019,003

$1,300,018 ----------- ----------- ----------- For the nine months

ended,

-------------------------------------------------------------------------

(In thousands) September 30, September 30, 2009 2008

----------------------------------------------------

-------------------- Average Average Interest- Average Yield/Rate

Average Yield/Rate earning assets Balance (1) (2) Balance (1) (2)

----------------------- -------------------- Loans and leases (1)

$7,336,822 5.51% $7,118,773 6.42% Taxable investment securities

3,174,308 3.96% 2,404,666 4.69% Tax-exempt investment securities

(2) 20,234 6.30% 58,690 8.49% FHLB stock 71,800 0.28% 65,283 5.49%

Federal funds sold and securities purchased under agreements to

resell 63,300 2.83% 261,613 6.28% Deposits with banks 42,614 0.78%

13,007 5.37% ----------------------- -------------------- Total

interest-earning assets $10,709,078 4.98% $9,922,032 6.00%

----------- ---------- Interest-bearing liabilities

Interest-bearing demand deposits $283,027 0.40% $253,380 0.65%

Money market deposits 854,706 1.56% 733,578 1.92% Savings deposits

325,943 0.22% 335,193 0.39% Time deposits 5,070,283 2.48% 4,448,113

3.70% ----------------------- -------------------- Total interest-

bearing deposits $6,533,959 2.16% $5,770,264 3.15% Federal funds

purchased 11,220 0.27% 40,299 2.65% Securities sold under

agreements to repurchase 1,565,455 4.14% 1,553,622 3.84% Other

borrowed funds 1,012,015 4.20% 1,149,401 4.10% Long-term debt

171,136 3.04% 171,136 5.38% -----------------------

-------------------- Total interest-bearing liabilities 9,293,785

2.73% 8,684,722 3.44% Non-interest-bearing demand deposits 757,719

777,664 ----------- ---------- Total deposits and other borrowed

funds $10,051,504 $9,462,386 ----------- ---------- Total average

assets $11,461,781 $10,597,770 Total average equity $1,288,780

$1,014,810 ----------- ---------- (1) Yields and interest earned

include net loan fees. Non-accrual loans are included in the

average balance. (2) The average yield has been adjusted to a fully

taxable-equivalent basis for certain securities of states and

political subdivisions and other securities held using a statutory

Federal income tax rate of 35%. DATASOURCE: Cathay General Bancorp

CONTACT: Heng W. Chen of Cathay General Bancorp, +1-626-279-3652

Web Site: http://www.cathaybank.com/

http://www.cathaygeneralbancorp.com/

Copyright

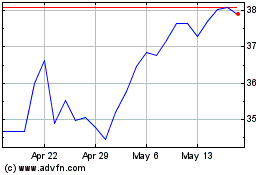

Cathay General Bancorp (NASDAQ:CATY)

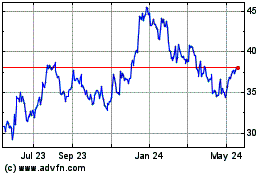

Historical Stock Chart

From Jun 2024 to Jul 2024

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jul 2023 to Jul 2024