Disney Beats Ests, Rev Up - Analyst Blog

06 February 2013 - 9:20PM

Zacks

The Walt Disney

Company (DIS) posted first-quarter fiscal 2013 earnings of

79 cents a share that surpassed the Zacks Consensus Estimate by a

couple of cents but inched down 1.3% from the comparable year-ago

quarter. Including one-time items, earnings came in at 77 cents a

share.

Revenue gains at the Parks and

Resorts business and strong performance of the Media Networks

division continue to boost the company’s profits.

Total revenue of this Zacks Rank #3

(Hold) company increased 5% year over year to $11,341 million and

exceeded the Zacks Consensus Estimate of $11,237 million. However,

total segment operating income decreased 3% year over year to

$2,380 million.

Segment

Details

Media Networks

revenues elevated 7% year over year to $5,101 million, reflecting

an increase of 7% in Cable Networks to $3,538 million coupled with

a 6% rise in Broadcasting revenues to $1,563 million. The segment’s

operating income marked an increase of 2% to $1,214 million boosted

by a 16% jump in Broadcasting operating income to $262 million,

which reflected higher advertising revenues at ABC Television

Network and at owned television stations coupled with increased

program sales. However, operating income at the Cable

Networks division declined 2% to $952 million, signifying increased

programming and production costs at ESPN.

Management stated that so far in

the second quarter of fiscal 2013, ESPN's ad sales are pacing up

7%. Going forward, management remains confident of a strong

performance by ESPN as it remains the favorite destination of

sports lovers and has the right mix of exclusive sporting licenses

with top sporting leagues. Moreover, new affiliate deals are

expected to boost revenues.

The company entered into a number

of content distribution deals with companies like Comcast

Corp (CMCSA), Netflix Inc.

(NFLX), Charter Communications Inc. (CHTR) and Cox

Communications.

We believe these deals will fortify

Disney’s multichannel subscription model by adding more platforms

to deliver its content any time and on any device. The company’s

focus on providing out-of-home access to its popular programs will

help it gain new subscribers. Moreover, such moves not only

strengthen Disney’s position but create long-term revenue

generating opportunities.

Parks and Resorts

revenues rose 7% to $3,391 million, while the segment’s operating

income rose 4% to $577 million, reflecting higher revenues from

domestic parks and resorts.

Disney remains focused on deploying

its capital toward expanding its Parks and Resorts business, and in

turn, enhancing its markets and creating long-term growth

opportunities. Management stated that so far in the second quarter

of fiscal 2013, domestic resort reservations are up 4% and booking

rates are up in the high-single-digits.

Studio

Entertainment revenues declined 5% to $1,545 million,

while operating income plunged 43% to $234 million compared with

$413 million in the year-ago quarter, reflecting decline in home

entertainment and theatrical distribution.

Consumer Products

revenues increased 7% to $1013 million, while segment operating

income rose 11% to $346 million, reflecting gains at Merchandise

Licensing along with retail business.

Interactive Media

revenues for the quarter increased 4% to $291 million, while

operating income marked a significant improvement and came in at $9

million compared with a loss of $28 million, reflecting revenue

gains at Japan mobile business.

Other Financial

Details

During the quarter, Disney

generated free cash flow of $599 million. The company ended the

quarter with cash and cash equivalents of $3,207 million, net

borrowings of $14,241 million up $3,317 million from the previous

quarter, and shareholders’ equity of $41,016 million, excluding

non-controlling interest of $2,354 million.

Strong results poise the company

well to enhance shareholders value through share repurchases.

During the reported quarter, it bought back 21 million shares for

approximately $1 billion. Fiscal year-to-date, the company bought

back 27.1 million shares worth $1.4 billion.

CHARTER COMM-A (CHTR): Free Stock Analysis Report

COMCAST CORP A (CMCSA): Free Stock Analysis Report

DISNEY WALT (DIS): Free Stock Analysis Report

NETFLIX INC (NFLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

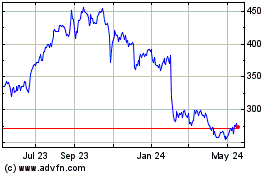

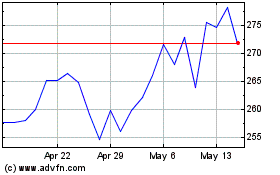

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024