As filed with the Securities and Exchange Commission on February 20,

2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

COLLIERS INTERNATIONAL GROUP INC.

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Province or other jurisdiction of

incorporation or organization) |

6500

(Primary Standard Industrial Classification

Code Number (if applicable)) |

NOT APPLICABLE

(I.R.S. Employer Identification No.

(if applicable)) |

1140 Bay Street, Suite 4000

Toronto, Ontario M5S 2B4

(416) 960-9500

(Address and telephone number of Registrant’s principal executive offices)

Corporation Service Company

251 Little Falls Drive, Wilmington, DE 19808

(302) 636-5401

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

|

|

Christian Mayer

Colliers International Group Inc.

1140 Bay Street, Suite 4000

Toronto, Ontario M5S 2B4

(416) 960-9500 |

Mile T. Kurta, Esq.

Christopher R. Bornhorst, Esq.

Torys LLP

1114 Avenue of the Americas, 23rd Floor

New York, New York 10036

(212) 880-6000 |

Rima Ramchandani, Esq.

Torys LLP

79 Wellington St. W

Toronto, Ontario M5K 1N2

(416) 865-7666 |

Approximate date of commencement of proposed sale of the securities to

the public:

From time to time after the effective date of this Registration Statement.

Ontario, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box):

| |

|

|

|

|

|

| |

A. ☒ |

|

upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| |

B. ☐ |

|

at some future date (check the appropriate box below) |

| |

|

|

1. ☐ |

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| |

|

|

2. ☐ |

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| |

|

|

3. ☐ |

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| |

|

|

4. ☐ |

|

after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous

basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. ☒

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

This short form base shelf prospectus has been filed under

legislation in each of the provinces and territories of Canada that permits certain information about these securities to be determined

after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires

the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing

to purchase any of these securities. This short form base shelf prospectus has been filed in reliance on an exemption from the preliminary

base shelf prospectus requirement for a well-known seasoned issuer.

No securities regulatory authority has expressed an opinion about these

securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes an offering of these securities

only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities

in those jurisdictions. Information has been incorporated by reference in this short form base shelf prospectus from documents filed

with securities commissions or similar authorities in Canada and with the U.S. Securities and Exchange Commission. Copies of the documents

incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Colliers International Group

Inc. at 1140 Bay Street, Suite 4000, Toronto, Ontario M5S 2B4, telephone (416) 960-9500, and are also available electronically at www.sedarplus.com

and www.sec.gov.

SHORT FORM BASE SHELF PROSPECTUS

| New Issue |

February 20, 2024 |

COLLIERS INTERNATIONAL

GROUP INC.

Subordinate Voting Shares

Preference Shares

Debt Securities

Warrants

Subscription Receipts

Units

Colliers International Group Inc. (the “Corporation”

or “Colliers”) may offer and issue from time to time during the 25-month period that this short form base shelf prospectus

(the “Prospectus”), including any amendments hereto, remains effective, (i) subordinate voting shares of the Corporation

(“Subordinate Voting Shares”); (ii) preference shares of the Corporation (“Preference Shares”);

(iii) debt securities (“Debt Securities”), which may include Debt Securities convertible into or exchangeable for Subordinate

Voting Shares and/or other securities of the Corporation; (iv) warrants to purchase Subordinate Voting Shares, Preference Shares, or Debt

Securities (“Warrants”); (v) subscription receipts of the Corporation exchangeable for Subordinate Voting Shares

and/or other securities of the Corporation (“Subscription Receipts”); or (vi) units (“Units”) comprised

of one or more of the other securities described in this Prospectus (all of the foregoing collectively, the “Securities”)

or any combination thereof. The Securities may be offered separately or together, in amounts, at prices and on terms to be determined

based on market conditions at the time of sale and set forth in one or more accompanying prospectus supplements (each a “Prospectus

Supplement”).

The specific terms of the Securities with respect to a particular offering

will be set out in the applicable Prospectus Supplement and may include, where applicable (i) in the case of Subordinate Voting Shares,

the number of Subordinate Voting Shares offered, the offering price (in the event the offering is a fixed price distribution), the manner

of determining the offering price(s) (in the event the offering is not a fixed price distribution), whether the Subordinate Voting Shares

are being offered for cash or other consideration, and any other terms specific to the Subordinate Voting Shares being offered; (ii) in

the case of Preference Shares, the number of Preference Shares being offered, the designation of a particular class or series, if applicable,

the offering price, whether the Preference Shares are being offered for cash or other consideration, the dividend rate, if any, any terms

for redemption or retraction, any conversion rights, and any other terms specific to the Preference Shares being offered; (iii) in the

case of Debt Securities, the specific designation, the aggregate principal amount, the currency or the currency unit for which the Debt

Securities may be purchased, the maturity, the interest provisions, the authorized denominations, the offering price, whether the Debt

Securities are being offered for cash or other consideration, the covenants, the events of default, any terms for redemption or retraction,

any exchange or conversion rights attached to the Debt Securities, whether the debt is senior or subordinated to the Corporation’s

other liabilities and obligations, whether the Debt Securities will be secured by any of the Corporation’s assets and any other

terms specific to the Debt Securities being offered; (iv) in the case of Warrants, the offering price, whether the Warrants are being

offered for cash or other consideration, the designation, the number and the terms of the Subordinate Voting Shares, Preference Shares

or Debt Securities purchasable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the

exercise price, the dates and periods of exercise, and any other terms specific to the Warrants being offered; (v) in the case of Subscription

Receipts, the number of Subscription Receipts being offered, the offering price, whether the Subscription Receipts are being offered for

cash or other consideration, the procedures for the exchange of the Subscription Receipts for Subordinate Voting Shares, Preference Shares,

Debt Securities or Warrants, as the case may be, and any other terms specific to the Subscription Receipts being offered; and (vi) in

the case of Units, the designation and terms of the Units and of the securities comprising the Units and any other terms specific to the

Units being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian

dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the Prospectus Supplement describing

the Securities.

All shelf information permitted under applicable law to be omitted from

this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus.

Each Prospectus Supplement will be incorporated by reference in this Prospectus for the purposes of securities legislation as of the date

of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

This Prospectus constitutes a public offering of the Securities only in

those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell the Securities in those jurisdictions.

The Corporation may offer and sell Securities to, or through, underwriters or dealers and may also offer and sell certain Securities directly

to other purchasers or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A Prospectus

Supplement relating to each issue of Securities offered thereby will set forth the names of any underwriters, dealers or agents involved

in the offering and sale of the Securities and will set forth the terms of the offering of the Securities, the method of distribution

of the Securities including, to the extent applicable, the proceeds to the Corporation and any fees, discounts or any other compensation

payable to underwriters, dealers or agents and any other material terms of the plan of distribution.

The Securities may be sold from time to time in one or more transactions

at a fixed price or prices or at non-fixed prices. If offered on a non-fixed price basis, the Securities may be offered at market prices

prevailing at the time of sale including sales in transactions that are deemed to be “at-the-market distributions” as such

term is defined in National Instrument 44-102 – Shelf Distributions of the Canadian Securities Administrators and, as defined,

an “ATM Distribution”, at prices determined by reference to the prevailing market prices or at negotiated prices. The

prices at which the Securities may be offered may vary as between purchasers and during the period of distribution.

In connection with any offering of Securities, except as otherwise set

out in a Prospectus Supplement relating to a particular offering of Securities and other than an ATM Distribution, the underwriters may

over-allot or effect transactions intended to maintain or stabilize the market price of the Securities offered at a level above that which

might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. An investor who acquires

Securities forming part of the underwriters’ over-allocation position will acquire those Securities under this Prospectus, regardless

of whether the over-allocation position is ultimately filled through the exercise of the over-allotment option or through secondary market

purchases. No underwriter or dealer involved in an ATM Distribution under this Prospectus, no affiliate of such an underwriter or dealer,

and no person or company acting jointly or in concert with such underwriter or dealer will over-allot Securities in connection with such

distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Securities.

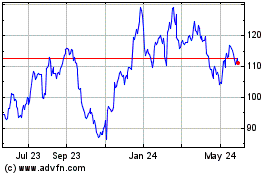

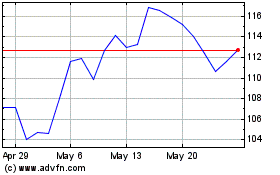

The outstanding Subordinate Voting Shares are listed on the Toronto Stock

Exchange (the “TSX”) under the symbol “CIGI”. The Subordinate Voting Shares are also listed on the Nasdaq

Stock Market (“Nasdaq”) under the symbol “CIGI”. On February 16, 2024, the last trading day prior to the

date of this Prospectus, the closing price of the Subordinate Voting Shares on the TSX was C$173.78 and the closing price of the Subordinate

Voting Shares on Nasdaq was US$129.04.

Unless otherwise specified in the applicable Prospectus Supplement,

there is no market through which the Preference Shares, Debt Securities, Warrants, Subscription Receipts or Units issuable pursuant to

this Prospectus and any applicable Prospectus Supplement may be sold and purchasers may not be able to resell the Preference Shares, Debt

Securities, Warrants, Subscription Receipts or Units purchased under this Prospectus or any Prospectus Supplement. This may affect the

trading prices of the Preference Shares, Debt Securities, Warrants, Subscription Receipts or Units in the secondary market, the transparency

and availability of trading prices, the liquidity of the Preference Shares, Debt Securities, Warrants, Subscription Receipts or Units,

and the extent of issuer regulation. See the “Risk Factors” section of the applicable Prospectus Supplement. Unless otherwise

specified in the applicable Prospectus Supplement, the Preference Shares, Debt Securities, Warrants, Subscription Receipts or Units will

not be listed on any securities exchange.

As of the date hereof, the Corporation has determined that it qualifies

as a “well-known seasoned issuer” under the WKSI Blanket Orders (as defined below). See “Well-Known Seasoned Issuer”.

Colliers’ registered office and head office is located at 1140 Bay

Street, Suite 4000, Toronto, Ontario M5S 2B4.

This offering is made by a Canadian issuer that is permitted, under the multijurisdictional disclosure

system adopted by the United States (“U.S.”) and Canada, to prepare this Prospectus in accordance with Canadian disclosure

requirements. Purchasers of the Securities should be aware that such requirements are different from those of the United States. Financial

statements incorporated herein by reference have been prepared in accordance with accounting principles generally accepted in the United

States of America (“U.S. GAAP”) and were subject to the rules and regulations of the SEC and the Public Company Accounting

Oversight Board (“PCAOB”). Financial statements which will be deemed incorporated by reference herein in the future, or which

may form part of a Prospectus Supplement in the future, will be prepared in accordance with U.S. GAAP.

Purchasers of the Securities should be aware that the acquisition of

the Securities may have tax consequences both in the U.S. and in Canada. Such consequences for purchasers who are resident in, or citizens

of, the U.S. or who are resident in Canada may not be described fully herein or in any applicable Prospectus Supplement. Purchasers of

the Securities should read the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering

of Securities and consult their own tax advisors.

The enforcement by investors of civil liabilities under U.S. federal

securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of the Province of Ontario,

that most of its officers and directors are residents of Canada, that some or all of the underwriters or experts named in the registration

statement are not residents of the United States, and that a substantial portion of the assets of the Corporation and said persons are

located outside the United States. See “Enforcement of Certain Civil Liabilities”.

All dollar amounts in this Prospectus are expressed in United States

dollars, except as otherwise indicated. References to “$”, “US$” or “dollars” are to United States

dollars and references to “C$” are to Canadian dollars.

NONE OF THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”),

ANY U.S. STATE SECURITIES REGULATORY AUTHORITY OR CANADIAN SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THE SECURITIES OR PASSED UPON

THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The Corporation has two classes of issued and outstanding shares: the Subordinate

Voting Shares, which are listed and posted for trading on the TSX and Nasdaq, and the multiple voting shares (the “Multiple Voting

Shares”). Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable

Canadian securities laws. The Subordinate Voting Shares and the Multiple Voting Shares are substantially identical with the exception

of the multiple voting rights and conversion rights attached to the Multiple Voting Shares. Each Subordinate Voting Share is entitled

to one (1) vote and each Multiple Voting Share is entitled to twenty (20) votes on all matters upon which the holders of shares are entitled

to vote, and holders of Subordinate Voting Shares and Multiple Voting Shares will vote together on all matters subject to a vote of holders

of both those classes of shares as if they were one class of shares, except to the extent that a separate vote of holders as a separate

class is required by law or provided by the Corporation’s articles. The Multiple Voting Shares are convertible into Subordinate

Voting Shares on a one-for-one basis at any time at the option of the holders thereof and automatically in certain other circumstances.

See “Description of Share Capital – Conversion”. The holders of Subordinate Voting Shares benefit from contractual provisions

that give them certain rights in the event of a take-over bid for the Multiple Voting Shares. See “Description of Share Capital

– Take-Over Bid Protection”.

Directors of the Corporation residing outside of Canada have appointed

Colliers International Group Inc., 1140 Bay Street, Suite 4000, Toronto, Ontario, Canada M5S 2B4, as agent for service of process. Purchasers

are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that resides

outside of Canada, even if the party has appointed an agent for service of process. See “Enforcement of Certain Civil Liabilities”.

No underwriter has been involved in the preparation of this Prospectus

nor has any underwriter performed any review of the contents of this Prospectus.

Investing in the Securities involves certain risks. The risks outlined

in this Prospectus and in the documents incorporated by reference herein, including the applicable Prospectus Supplement, should be carefully

reviewed and considered by prospective investors in connection with any investment in Securities. See “Risk Factors”.

Table of Contents

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference

herein contain “forward-looking statements” within the meaning of applicable U.S. securities laws, including the United States

Private Securities Litigation Reform Act of 1995, and “forward-looking information” within the meaning of applicable Canadian

securities laws (collectively, “forward-looking statements”), concerning the current expectations, estimates, forecasts

and projections of management regarding the Corporation’s future growth, results of operations, performance and business prospects

and opportunities. All statements other than statements of historical fact included in this Prospectus which address events, results,

outcomes or developments that the Corporation expects to occur are, or may be deemed to be, forward-looking statements. Forward-looking

statements are generally, but not always, identified by the use of forward-looking terminology such as “may,” “would,”

“could,” “will,” “anticipate,” “believe,” “plan,” “expect,” “intend,”

“estimate,” “aim,” “endeavour”, or variations of such words and phrases and similar expressions or

statements. Forward-looking statements in this Prospectus include, but may not be limited to, statements regarding potential offerings

of Securities hereunder and other more particular statements made in the applicable Prospectus Supplement.

The Corporation cautions that forward-looking statements

are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Corporation at the time of making

such statements, are inherently subject to known and unknown risks, uncertainties and other factors which may cause the actual results

to be materially different from any future results, performance or achievements contemplated in the forward-looking statements. Readers,

therefore, should not place undue reliance on such statements and information.

Such factors and assumptions underlying the forward-looking

statements in this document include, but are not limited to: economic conditions, especially as they relate to rising interest rates,

commercial and consumer credit conditions and business spending, particularly in regions where the Corporation’s business may be

concentrated; rising inflation and its impact on compensation costs, hiring and retention of talent, and the Corporation’s ability

to recover costs from its clients; the continuing aftermath of the global COVID-19 pandemic and its related impact on economic conditions,

and in particular its impact on client demand for the Corporation’s services, the Corporation’s ability to deliver services

and ensure the health and productivity of its employees; commercial real estate and real asset values, vacancy rates and general conditions

of financial liquidity for transactions; the effect of significant movements in average capitalization rates across different property

types; a change in or loss of the Corporation’s relationship with U.S. government agencies; defaults by borrowers on loans originated

under the Fannie Mae DUS Program (as defined in the Annual MD&A); a reduction by clients in their reliance on outsourcing for their

commercial real estate needs; competition in the markets served by the Corporation; the impact of changes in the market value of assets

under management on the performance of the Corporation’s investment management business; a decline in the Corporation’s ability

to fundraise in its investment management operations, or an increase in redemptions from its perpetual funds and separately managed accounts;

a decline in our ability to attract, recruit and retain talent; a decline in the Corporation’s performance impacting our continued

compliance with the financial covenants under the Corporation’s debt agreements, or the Corporation’s ability to negotiate

a waiver of certain covenants with the Corporation’s lenders; the effect of increases in interest rates on the Corporation’s

cost of borrowing; unexpected increases in operating costs, such as insurance, workers’ compensation and health care; changes in

the frequency or severity of insurance incidents relative to historical experience; the effects of changes in foreign exchange rates in

relation to the US dollar on the Corporation’s Canadian dollar, Euro, Australian dollar and UK pound sterling denominated revenues

and expenses; a decline in the Corporation’s ability to identify and make acquisitions at reasonable prices and successfully integrate

acquired operations; disruptions, cyber-attacks or security failures in our information technology systems, and our ability to recover

from such incidents; the ability to comply with laws and regulations related to the Corporation’s global operations, including real

estate and mortgage banking licensure, labour and employment laws and regulations, as well as the anti-corruption laws and trade sanctions;

political conditions, including political instability, any outbreak or escalation of hostilities, elections, referenda, trade policy changes,

immigration policy changes and terrorism and the impact thereof on the Corporation’s business; changes in climate and environment-related

policies that may adversely impact the Corporation’s business; and changes in government laws and policies at the federal, state/provincial

or local level that may adversely impact the Corporation’s business.

Additional risk factors and details with respect to

such risk factors are described in the section entitled “Risk Factors” in this Prospectus and any risk factors included in

the documents incorporated by reference. Additional information about these assumptions and risks and uncertainties is contained in the

Corporation’s filings with securities regulators, including the Corporation’s current annual information form and its most

recent annual and interim management’s discussion and analysis, each which have been filed with the SEC and are incorporated by

reference herein. Although the Corporation has attempted to identify important factors and risks that could cause actual results to differ

materially, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance

that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements herein

are made as of the date of this Prospectus only and Colliers does not assume any obligation to update or revise them to reflect new information,

estimates or opinions, future events or results or otherwise, except as required by applicable law.

AVAILABLE

INFORMATION

The Corporation files reports and other information

with the securities commissions and similar regulatory authorities in each of the provinces and territories of Canada. These reports and

information are available to the public free of charge on SEDAR+ at www.sedarplus.com.

The Corporation will file with the SEC a registration

statement on Form F-10 relating to the Securities (the “Registration Statement”). This Prospectus, which constitutes

a part of the Registration Statement, does not contain all of the information contained in the Registration Statement, certain items of

which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC.

The Corporation is subject to the information requirements

of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”) and applicable Canadian

securities legislation and, in accordance therewith, files reports and other information with the SEC and with the securities regulatory

authorities in Canada. Under the multijurisdictional disclosure system adopted by the U.S. and Canada, documents and other information

that the Corporation files with the SEC may be prepared in accordance with the disclosure requirements of Canada, which are different

from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the U.S. Exchange Act prescribing

the furnishing and content of proxy statements, and its officers, directors and principal shareholders are exempt from the reporting and

short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. In addition, the Corporation is not required

to publish financial statements as promptly as U.S. companies subject to the provisions of the U.S. Exchange Act that are applicable to

U.S. domestic reporting companies.

In addition, as a foreign private issuer, Colliers

is permitted to follow TSX listing rules in lieu of those required by Nasdaq. In particular, Colliers intends to follow the listing rules

of the TSX in respect of private placements instead of the requirements of Nasdaq to obtain shareholder approval for certain dilutive

events (such as issuances of common shares that will result in a change of control, certain transactions other than a public offering

involving issuances of a 20% or greater interest in Colliers and certain acquisitions of the shares or assets of another company). The

TSX threshold for shareholder approval of private issuances of common shares is generally 25%, subject to additional shareholder approval

requirements in the case of certain issuances to insiders, and accordingly, Colliers will be permitted to rely on shareholder approval

rules that may be less favorable to shareholders than for U.S. domestic companies that are subject to Nasdaq shareholder approval rules.

Investors may read any document that the Corporation

has filed with, or furnished to, the SEC at the SEC’s website on the SEC’s Electronic Data Gathering, Analysis and Retrieval

system (“EDGAR”) at www.sec.gov.

Investors should rely only on information contained

or incorporated by reference in this Prospectus and any applicable Prospectus Supplement. The Corporation has not authorized anyone to

provide the investor with different information. The Corporation is not making an offer of the Securities in any jurisdiction where the

offer is not permitted. Investors should not assume that the information contained in this Prospectus is accurate as of any date other

than the date on the front of this Prospectus, unless otherwise noted herein or as required by law. It should be assumed that the information

appearing in this Prospectus and the documents incorporated herein by reference are accurate only as of their respective dates. The business,

financial condition, results of operations and prospects of the Corporation may have changed since those dates.

FINANCIAL

INFORMATION

The financial statements of the Corporation incorporated

herein by reference and in any Prospectus Supplement are reported in U.S. dollars and have been prepared in accordance with U.S. GAAP.

U.S. GAAP differs in some significant respects from International Financial Reporting Standards as issued by the International Accounting

Standards Board, and thus the financial statements may not be comparable to financial statements of other Canadian companies.

EXCHANGE

RATE INFORMATION

The following table sets out the high and low rates

of exchange for one U.S. dollar expressed in Canadian dollars during each of the following periods, the average rate of exchange for those

periods, and the rate of exchange in effect at the end of each of those periods, each based on the rate of exchange published by the Bank

of Canada for the conversion of Canadian dollars into United States dollar.

| |

Years ended December 31,

|

| |

2023 |

2022 |

2021 |

| High…………………………………………………… |

C$1.3875 |

C$1.3856 |

C$1.2942 |

| Low……………………………………………………. |

C$1.3128 |

C$1.2451 |

C$1.2040 |

| Average for the Period………………………………… |

C$1.3497 |

C$1.3011 |

C$1.2535 |

| End of Period………………………………………….. |

C$1.3226 |

C$1.3544 |

C$1.2678 |

On February 16, 2024 the average daily rate of exchange

was US$1.00 = C$1.3484 as published by the Bank of Canada.

THE CORPORATION

Colliers is a leading diversified professional services

and investment management company, incorporated under the Business Corporations Act (Ontario). The Corporation provides commercial

real estate professional services and investment management to corporate and institutional clients in 34 countries around the world (66

countries including affiliates and franchisees). Colliers’ primary service lines are Outsourcing & Advisory, Investment Management,

Leasing and Capital Markets.

The registered office and head office of the Corporation

is located at 1140 Bay Street, Suite 4000, Toronto, Ontario M5S 2B4. Additional information regarding the Corporation and its business

is set out in the AIF (as defined below), which is incorporated by reference herein.

DOCUMENTS

INCORPORATED BY REFERENCE

Information has been incorporated by reference in this

Prospectus from documents filed with securities commissions or similar authorities in each of the provinces and territories of Canada

and filed with, or furnished to, the SEC. Copies of the documents incorporated herein by reference may be obtained on request without

charge from the Corporate Secretary of the Corporation at 1140 Bay Street, Suite 4000, Toronto, Ontario M5S 2B4, telephone (416) 960-9500.

These documents are also available on SEDAR+, which can be accessed online at www.sedarplus.com and are filed with the SEC as exhibits

to the Registration Statement, available on EDGAR at www.sec.gov.

The following documents, filed by the Corporation with

the securities commissions or similar authorities in each of the provinces and territories of Canada and with the SEC, are specifically

incorporated by reference into and form an integral part of this Prospectus:

| (a) | the annual information form of the Corporation dated as of February 15, 2024 for the financial year ended

December 31, 2023 (the “AIF”); |

| (b) | the audited consolidated financial statements of the Corporation as at and for the years ended December

31, 2023 and 2022, the notes thereto, Management’s Report on Internal Control over Financial Reporting, and the report of Independent

Registered Public Accounting Firm dated February 15, 2024; |

| (c) | management’s discussion and analysis of financial condition and results of operations dated February

15, 2024 for the fiscal year ended December 31, 2023 (the “Annual MD&A”); and |

| (d) | the management information circular of

the Corporation dated February 16, 2023 for the annual meeting of shareholders held on April

5, 2023 (the “Information Circular”). |

Any document of the type referred to in section 11.1

of Form 44-101F1 of National Instrument 44-101 – Short Form Prospectus Distributions (“NI 44-101”) filed

by the Corporation with the securities commissions or similar regulatory authorities in Canada and the U.S. after the date of this Prospectus

and all Prospectus Supplements, disclosing additional or updated information filed pursuant to the requirements of applicable securities

legislation in Canada and the U.S. and during the 25-month period that this Prospectus is effective, shall be deemed to be incorporated

by reference in this Prospectus. In addition, any “template version” of “marketing materials” (as defined in National

Instrument 41-101 – General Prospectus Requirements) filed after the date of a Prospectus Supplement and prior to the termination

of the distribution of Securities to which such Prospectus Supplement relates, shall be deemed to be incorporated by reference in such

Prospectus Supplement.

Each annual report on Form 40-F (or another applicable

form) filed by the Corporation with the SEC will be incorporated by reference in the Registration Statement. In addition, any report on

Form 6-K (or another applicable form) filed or furnished by the Corporation with the SEC after the date of this Prospectus shall be deemed

to be incorporated by reference in the Registration Statement only if and to the extent expressly provided in such report. The Corporation’s

reports on Form 6-K and its annual report on Form 40-F (and other SEC filings made by the Corporation) are available at the SEC’s

website at www.sec.gov.

Upon a new annual information form being filed by the

Corporation with the applicable securities regulatory authorities during the 25-month period that this Prospectus is effective, notwithstanding

anything herein to the contrary, the following documents shall be deemed no longer to be incorporated by reference in this Prospectus

for purposes of future offers and sales of Securities hereunder: (i) the previous annual information form, (ii) any material change reports

filed by the Corporation prior to the end of the financial year of the Corporation in respect of which the new annual information form

is filed, and (iii) any business acquisition reports filed by the Corporation for acquisitions completed prior to the beginning of the

financial year of the Corporation in respect of which the new annual information form is filed. Upon annual consolidated financial statements

and the accompanying management’s discussion and analysis being filed by the Corporation with the applicable securities regulatory

authorities during the 25-month period that this Prospectus is effective, the previous annual consolidated financial statements and the

previous interim consolidated financial statements most recently filed, and in each case the accompanying management’s discussion

and analysis, shall be deemed no longer to be incorporated by reference in this Prospectus for purposes of future offers and sales of

Securities hereunder. Upon interim consolidated financial statements and the accompanying management’s discussion and analysis being

filed by the Corporation with the applicable securities regulatory authorities during the 25-month period that this Prospectus is effective,

all interim consolidated financial statements and the accompanying management’s discussion and analysis filed prior to the new interim

consolidated financial statements shall be deemed no longer to be incorporated by reference in this Prospectus for purposes of future

offers and sales of Securities under this Prospectus. Upon a new management information circular in connection with an annual meeting

being filed with the applicable securities regulatory authorities during the currency of this Prospectus, the management information circular

filed in connection with the previous annual meeting (unless such management information circular also related to a special meeting) will

be deemed no longer to be incorporated by reference in this Prospectus for purposes of future offers and sales of Securities hereunder.

A Prospectus Supplement containing the specific terms

of an offering of Securities and other information relating to the Securities will be delivered to prospective purchasers of such Securities

together with this Prospectus and will be deemed to be incorporated into this Prospectus as of the date of such Prospectus Supplement

but only for the purpose of the offering of the Securities covered by that Prospectus Supplement.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Prospectus to the

extent that a statement contained herein, or in any other subsequently filed document which also is or is deemed to be incorporated by

reference herein, modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this Prospectus,

except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior

statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or

superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted

a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that

is necessary to make a statement not misleading in light of the circumstances in which it was made.

CONSOLIDATED

CAPITALIZATION

There have been no material changes in the share and

loan capital of Colliers since December 31, 2023, which have not been disclosed in this Prospectus or in the documents incorporated by

reference herein.

Disclosure regarding the consolidated capitalization

of Colliers will be set forth in the applicable Prospectus Supplement(s) for any Securities offered pursuant to this Prospectus.

EARNINGs

COVERAGE RATIOS

Earnings coverage ratios will be provided in the applicable

Prospectus Supplement with respect to any issuance of Preference Shares or Debt Securities having a term to maturity in excess of one

year pursuant to this Prospectus, as required by applicable Canadian securities laws.

USE OF PROCEEDS

The net proceeds to the Corporation from any offering

of Securities and the proposed use of those proceeds will be set forth in the applicable Prospectus Supplement relating to that offering

of Securities. All expenses relating to an offering of Securities and any compensation paid to underwriters, dealers or agents, as the

case may be, will be paid out of the proceeds of the offering or from the Corporation’s general funds, unless otherwise stated in

the applicable Prospectus Supplement.

PLAN OF

DISTRIBUTION

The plan of distribution with respect to an offering

of Securities under this Prospectus will be described in the Prospectus Supplement for the applicable distribution of Securities.

DESCRIPTION

OF SHARE CAPITAL

The authorized share capital of Colliers consists

of (i) an unlimited number of Preference Shares, issuable in series, none of which are issued and outstanding as of February 16, 2024,

(ii) an unlimited number of Subordinate Voting Shares, of which 46,246,182 were issued and outstanding as of February 16, 2024, (iii) and

an unlimited number of Multiple Voting Shares, of which 1,325,694 were issued and outstanding as of February 16, 2024. All of the issued

and outstanding Multiple Voting Shares are, directly or indirectly, held by Jay S. Hennick and Henset Capital Inc. (the “Multiple

Voting Shareholder”).

The Multiple Voting Shares carry a greater number of

votes per share relative to the Subordinate Voting Shares, and therefore the Subordinate Voting Shares are “restricted securities”

within the meaning of such term under applicable Canadian securities laws. Colliers is entitled to file this Prospectus on the basis that

Colliers satisfies the requirements of Section 12.3(1)(b) of National Instrument 41-101 – General Prospectus Requirements.

The Subordinate Voting Shares are listed and posted

for trading on the TSX and Nasdaq under the symbol “CIGI”. The Multiple Voting Shares are not listed and do not trade on any

public market or quotation system.

Except as described in this Prospectus, the Subordinate

Voting Shares and the Multiple Voting Shares have the same rights, are equal in all respects and are treated by the Corporation as if

they were one class of shares.

Subordinate Voting Shares and Multiple

Voting Shares

Rank

The Subordinate Voting Shares and Multiple Voting Shares

rank pari passu with respect to the payment of dividends, return of capital and distribution of assets in the event of the liquidation,

dissolution or winding up of the Corporation. In the event of the liquidation, dissolution or winding-up of the Corporation or any other

distribution of the Corporation’s assets among its shareholders for the purpose of winding-up its affairs, whether voluntarily or

involuntarily, the holders of Subordinate Voting Shares and the holders of Multiple Voting Shares are entitled to participate equally

in the remaining property and assets of the Corporation available for distribution to the holders of shares, without preference or distinction

among or between the Subordinate Voting Shares and the Multiple Voting Shares, subject to the rights of the holders of any Preference

Shares.

Dividends

Subject to the prior rights of the holders of Preference

Shares, if any, the holders of Subordinate Voting Shares and Multiple Voting Shares are entitled to receive dividends as and when declared

by the Corporation’s board of directors on a share-for-share basis or, in the discretion of the Corporation’s board of directors,

in a greater amount per Subordinate Voting Share than per Multiple Voting Share. The Corporation is permitted to pay dividends unless

there are reasonable grounds for believing that: (i) the Corporation is insolvent; or (ii) the payment of the dividend would render the

Corporation insolvent. Under the terms of the Corporation’s existing debt agreements, the Corporation is not permitted to pay dividends,

whether in cash or in specie, in the circumstances of an event of default thereunder occurring and continuing or an event of default

occurring as a consequence thereof.

Voting Rights

Holders of Subordinate Voting Shares are entitled

to one vote per Subordinate Voting Share and holders of Multiple Voting Shares are entitled to 20 votes per Multiple Voting Share on

all matters upon which shareholders are entitled to vote. As of February 16, 2024 the Subordinate Voting Shares represent approximately

97.21% of the Corporation’s total issued and outstanding shares and approximately 63.56% of the voting power attached to all of

the Corporation’s issued and outstanding shares.

Conversion

The Subordinate Voting Shares are not convertible into

any other class of shares, except as described below under “—Take-over Bid Protection”. Each outstanding Multiple Voting

Share may at any time, at the option of the holder and without further consideration, be converted into one Subordinate Voting Share.

In addition, the Multiple Voting Shares will convert

automatically into Subordinate Voting Shares at such time that is the earliest to occur of the following: (i) the date that the number

of Multiple Voting Shares and Subordinate Voting Shares held by Mr. Hennick and the Multiple Voting Shareholder, together with their associates

and affiliates, is less than 4,000,000; (ii) 24 months after the termination of the New MSA (as defined in the AIF) in the circumstances

as described below under “—Take-over Bid Protection”; and (iii) September 1, 2028.

Meetings of Shareholders

Holders of Subordinate Voting Shares and Multiple Voting

Shares are entitled to receive notice of any meeting of our shareholders and may attend and vote at such meetings, except those meetings

where only the holders of shares of another class or of a particular series are entitled to vote. A quorum for the transaction of business

at a meeting of shareholders is present if at least two shareholders entitled to vote at the meeting are present in person or represented

by proxy.

Subdivision, Consolidation and

Issuance of Rights

No subdivision, consolidation, reclassification or

other change of the Multiple Voting Shares or the Subordinate Voting Shares may be made without the Multiple Voting Shares or Subordinate

Voting Shares, as the case may be, being concurrently subdivided, consolidated, reclassified or made subject to the other change under

the same conditions.

Certain Amendments

The rights, privileges, conditions and restrictions

attaching to the Subordinate Voting Shares and the Multiple Voting Shares may be respectively modified if the amendment is authorized

by at least two-thirds of the votes cast at a meeting of the holders of Subordinate Voting Shares and the holders of Multiple Voting Shares

duly held for that purpose. However, if the holders of Subordinate Voting Shares, as a class, or the holders of Multiple Voting Shares,

as a class, are to be affected in a manner different from the other classes of shares, such amendment must, in addition, be authorized

by at least two-thirds of the votes cast at a meeting of the holders of the class of shares which is affected differently.

Take-over Bid Protection

If a take-over bid (as defined in the Securities

Act (Ontario)) is made to the holders of the Multiple Voting Shares, each Subordinate Voting Share shall become convertible into a

Multiple Voting Share at the option of the holder thereof at any time during the period commencing on the eighth day after the date on

which the offer is made and ending on the last date upon which holders of Multiple Voting Shares will be entitled to accept the offer.

However, this conversion right shall not come into effect if:

| (a) | an identical offer is made concurrently to purchase Subordinate Voting Shares (if any are then issued

and outstanding), which offer has no condition attached to it other than the right to not take up and pay for shares tendered if no shares

are purchased pursuant to the take-over bid for Multiple Voting Shares; |

| (b) | holders of more than 50% of the issued and outstanding Multiple Voting Shares deliver a certificate or

certificates to Colliers’ transfer agent certifying that such holders will not deposit such Multiple Voting Shares under the take-over

bid therefor; or |

| (c) | the take-over bid for Multiple Voting Shares is not completed by the offeror. |

Mr. Hennick and the Multiple Voting Shareholder are

subject to an agreement (the “Trust Agreement”) with TSX Trust Company (“TSX Trust”) and Colliers

in order to provide the holders of Subordinate Voting Shares with certain additional rights in the event that a take-over bid having certain

characteristics is made for the Multiple Voting Shares. Under applicable securities law, an offer to purchase Multiple Voting Shares would

not necessarily require that an offer be made to purchase Subordinate Voting Shares.

The Trust Agreement prevents the sale, directly or

indirectly, of Multiple Voting Shares owned by the Multiple Voting Shareholder pursuant to a take-over bid at a price per share in excess

of 115% of the then current market price of the Subordinate Voting Shares as determined under applicable legislation. This prohibition

does not apply if: (a) such sale is made pursuant to an offer to purchase Multiple Voting Shares made to all holders of Multiple Voting

Shares and an offer identical in all material respects is made concurrently to purchase Subordinate Voting Shares, which identical offer

has no condition attached other than the right not to take-up and pay for shares tendered if no shares are purchased pursuant to the offer

for Multiple Voting Shares; or (b) there is a concurrent unconditional offer to purchase all of the Subordinate Voting Shares at a price

per share at least as high as the highest price per share paid pursuant to the take-over bid for the Multiple Voting Shares. Further restrictions

on transactions involving the Multiple Voting Shares at a price that is greater than the current market price of the Subordinate Voting

Shares are also set out in the New Trust Agreement (as defined and discussed below).

The Trust Agreement contains provisions for the authorization

of action by TSX Trust to enforce the rights thereunder on behalf of the holders of the Subordinate Voting Shares. No holder of Subordinate

Voting Shares has the right, other than through TSX Trust, to institute any action or proceeding or to exercise any other remedy to enforce

any rights arising under the Trust Agreement unless TSX Trust fails to act on a request authorized by holders of not less than 10% of

the outstanding Subordinate Voting Shares after provision of reasonable funds and indemnity to TSX Trust.

Holders of Subordinate Voting Shares may have additional

rights under applicable securities legislation in the event of a take-over bid.

The Trust Agreement cannot be amended, varied or modified

and no provision thereof will be waived, except with the approval of at least two-thirds of the votes cast by the holders of Subordinate

Voting Shares present in person or represented by proxy at a meeting duly called for the purpose of considering such amendment, variation,

modification or waiver, which two-thirds majority must include a simple majority of the votes cast by the holders of Subordinate Voting

Shares, excluding any person who owns Multiple Voting Shares, is an affiliate of a person who owns Multiple Voting Shares or is a person

who has an agreement to purchase Multiple Voting Shares prior to giving effect to the amendment, variation, modification or waiver.

Additionally, on April 16, 2021, Mr. Hennick and the

Multiple Voting Shareholder entered into an additional trust agreement (the “New Trust Agreement”) relating to the

Multiple Voting Shares. The New Trust Agreement provides that the Multiple Voting Shares will convert into Subordinate Voting Shares on

a one-for-one basis and for no additional consideration or premium upon the earliest to occur of: (a) the date that the sum of the number

of Multiple Voting Shares and Subordinate Voting Shares held by Mr. Hennick and the Multiple Voting Shareholder, together with their associates

and affiliates, is less than 4,000,000 (subject to adjustment and including ownership of securities convertible into Subordinate Voting

Shares); (b) 24 months after the termination of the New MSA (as defined in the AIF) as a result of Mr. Hennick’s death, disability,

voluntary resignation or the occurrence of certain other specific events set out in the New MSA; and (c) September 1, 2028. Additionally,

the New Trust Agreement provides that Mr. Hennick and the Multiple Voting Shareholder will not sell any Multiple Voting Shares at a price

greater than the market price of the Subordinate Voting Shares on the date of the agreement to sell such shares unless through the facilities

of Nasdaq or the TSX, pursuant to a take-over bid, or similar transaction, where there is a concurrent offer made to, or acquisition from,

the holders of all of the Subordinate Voting Shares on terms that are at least as favorable to the holders of Subordinate Voting Shares

as those made to Mr. Hennick or the Multiple Voting Shareholder, pursuant to an issuer bid or pursuant to the granting of a permitted

security interest. The provisions related to any amendment, variation, modification or waiver under the New Trust Agreement are consistent

with those set out in the Trust Agreement.

Preference Shares

The Preference Shares are issuable, from time to time,

in one or more series, as determined by the Corporation’s board of directors. The Corporation’s board of directors will determine,

before the issue of any series of Preference Shares, the designation, preferences, rights, restrictions, conditions, limitations, priorities

as to payment of dividends and/or distribution on liquidation, dissolution or winding-up, or prohibitions attaching to such series. The

Preference Shares, if issued, will rank prior to the Subordinate Voting Shares and the Multiple Voting Shares with respect to the payment

of dividends and in the distribution of assets in the event of liquidation, dissolution or winding-up of Colliers or any other distribution

of assets of Colliers among its shareholders for the purpose of winding-up its affairs, and may also be given such other preferences over

the Subordinate Voting Shares and the Multiple Voting Shares as may be determined with respect to the respective series authorized and

issued. Except as required by law, the Preference Shares will not carry voting rights.

DESCRIPTION

OF DEBT SECURITIES

This description sets forth certain general terms and

provisions that would apply to any Debt Securities that Colliers may issue pursuant to this Prospectus. Colliers will provide particular

terms and provisions of a series of Debt Securities, and the extent to which the general terms and provisions described below may apply

to that series, in a Prospectus Supplement.

The Debt Securities will be issued under one or more

indentures (each, an “Indenture”), in each case between Colliers and one or more appropriately qualified financial

institutions authorized to carry on business as a trustee in Canada and/or the United States, as may be required by applicable securities

laws. The description below is not exhaustive and is subject to, and qualified in its entirety by reference to, the detailed provisions

of the applicable Indenture. Accordingly, reference should also be made to the applicable Indenture, a form of which has been filed as

an exhibit to the Registration Statement. A copy of the final, fully executed Indenture, together with any supplemental indenture and/or

the form of note for any Debt Securities offered hereunder, will be filed by the Corporation with applicable provincial and territorial

securities commissions or similar regulatory authorities in Canada after it has been entered into, and will be available electronically

on SEDAR+ under the profile of Colliers, which can be accessed at www.sedarplus.com, and will also be filed by post-effective amendment

to the Registration Statement or by incorporation by reference to documents filed or furnished with the SEC.

Debt Securities may be offered separately or in combination

with one or more other Securities. The Corporation may also, from time to time, issue Debt Securities and incur additional indebtedness

other than pursuant to Debt Securities issued under this Prospectus.

The following sets forth certain general terms and

provisions of the Debt Securities. The particular terms and provisions of Debt Securities offered and sold by a Prospectus Supplement,

and the extent to which the general terms and provisions described below may apply to such Debt Securities, will be described in such

Prospectus Supplement.

General

Debt Securities may be issued from time to time in

one or more series. Debt Securities may be denominated and payable in any currency. Colliers may specify a maximum aggregate principal

amount for the Debt Securities of any series and, unless otherwise provided in the applicable Prospectus Supplement, a series of Debt

Securities may be reopened for issuance of additional debt securities of that series.

A Prospectus Supplement relating to a particular series

of Debt Securities will describe the terms of the Debt Securities being offered including, where applicable, the following:

| · | the designation, aggregate principal amount and authorized denominations of such Debt Securities; |

| · | the currency or currency units for which the Debt Securities may be purchased and the currency or currency

unit in which the principal and any interest is payable (in either case, if other than Canadian dollars); |

| · | the percentage of the principal amount at which such Debt Securities will be issued; |

| · | the date or dates on which such Debt Securities will mature; |

| · | the rate or rates per annum at which such Debt Securities will bear interest (if any), or the method of

determination of such rates (if any); |

| · | the dates on which such interest will be payable and the record dates for such payments; |

| · | the trustee(s) under the Indenture pursuant to which the Debt Securities are to be issued; |

| · | any redemption term or terms under which such Debt Securities may be redeemed; |

| · | whether such Debt Securities are to be issued in registered form, “book-entry only” form or

in the form of temporary or permanent global securities and the basis of exchange, transfer and ownership thereof; |

| · | any exchange or conversion terms into or for Subordinate Voting Shares and/or other securities of the

Corporation; |

| · | whether such Debt Securities will be subordinated to other liabilities of the Corporation; and |

| · | any other specific terms. |

The terms and provisions of any Debt Securities offered

under a Prospectus Supplement may differ from the terms described above and may not be subject to or contain any or all of the terms described

above. Debt Securities may be offered separately or together with other Securities. See “Description of Units”.

DESCRIPTION

OF WARRANTS

The Corporation may issue Warrants to purchase Subordinate

Voting Shares, Preference Shares or Debt Securities. This section describes the general terms that will apply to any Warrants issued pursuant

to this Prospectus. Warrants may be offered separately or together with other Securities and may be attached to or separate from any other

Securities.

Unless the applicable Prospectus Supplement otherwise

indicates, each series of Warrants will be issued under a separate warrant indenture to be entered into between the Corporation and one

or more banks or trust companies acting as Warrant agent. The Warrant agent will act solely as the agent of the Corporation and will not

assume a relationship of agency with any holders of Warrant certificates or beneficial owners of Warrants.

The applicable Prospectus Supplement will include details

of the warrant indentures, if any, governing the Warrants being offered. The specific terms of the Warrants, and the extent to which the

general terms described in this section apply to those Warrants, will be set out in the applicable Prospectus Supplement. The Prospectus

Supplement relating to any Warrants the Corporation offers will describe the Warrants and the specific terms relating to the offering.

The description will include, where applicable:

| · | the designation and aggregate number of Warrants; |

| · | the price at which the Warrants will be offered; |

| · | the currency or currencies in which the Warrants will be offered; |

| · | the date on which the right to exercise the Warrants will commence and the date on which the right will

expire; |

| · | the designation, number and terms of the Subordinate Voting Shares, Preference Shares or Debt Securities,

as applicable, that may be purchased upon exercise of the Warrants, and the procedures that will result in the adjustment of those numbers; |

| · | the exercise price of the Warrants; |

| · | the designation and terms of the Securities, if any, with which the Warrants will be offered, and the

number of Warrants that will be offered with each Security; |

| · | if the Warrants are issued as a unit with another Security, the date, if any, on and after which the Warrants

and the other Security will be separately transferable; |

| · | any minimum or maximum amount of Warrants that may be exercised at any one time; |

| · | any terms, procedures and limitations relating to the transferability, exchange or exercise of the Warrants; |

| · | whether the Warrants will be subject to redemption or call and, if so, the terms of such redemption or

call provisions; |

| · | material U.S. and Canadian federal income tax consequences of owning the Warrants; and |

| · | any other material terms or conditions of the Warrants. |

The terms and provisions of any Warrants offered under

a Prospectus Supplement may differ from the terms described above and may not be subject to or contain any or all of the terms described

above.

Warrant certificates will be exchangeable for new

Warrant certificates of different denominations at the office indicated in the Prospectus Supplement. Prior to the exercise of their

Warrants, holders of Warrants will not have any of the rights of holders of the securities subject to the Warrants. The Corporation may

amend the warrant indenture(s) and the Warrants, without the consent of the holders of the Warrants, to cure any ambiguity, to cure,

correct or supplement any defective or inconsistent provision, or in any other manner that will not prejudice the rights of the holders

of outstanding Warrants, as a group.

DESCRIPTION

OF SUBSCRIPTION RECEIPTS

The Corporation may issue Subscription Receipts separately

or together with Subordinate Voting Shares, Preference Shares, Debt Securities or Warrants, as the case may be. The Subscription Receipts

will be issued under a subscription receipt agreement. This section describes the general terms that will apply to any Subscription Receipts

that may be offered by the Corporation pursuant to this Prospectus.

The applicable Prospectus Supplement will include details

of the subscription receipt agreement covering the Subscription Receipts being offered. A copy of the subscription receipt agreement relating

to an offering of Subscription Receipts will be filed by the Corporation with securities regulatory authorities in Canada and the U.S.

after it has been entered into by the Corporation. The specific terms of the Subscription Receipts, and the extent to which the general

terms described in this section apply to those Subscription Receipts, will be set forth in the applicable Prospectus Supplement. This

description will include, where applicable:

| · | the number of Subscription Receipts; |

| · | the price at which the Subscription Receipts will be offered; |

| · | conditions to the exchange of Subscription Receipts into Subordinate Voting Shares, Preference Shares,

Debt Securities or Warrants, as the case may be, and the consequences of such conditions not being satisfied; |

| · | the procedures for the exchange of the Subscription Receipts into Subordinate Voting Shares, Preference

Shares, Debt Securities or Warrants; |

| · | the number of Subordinate Voting Shares, Preference Shares or Warrants that may be exchanged upon exercise

of each Subscription Receipt; |

| · | the aggregate principal amount, currency or currencies, denominations and terms of the series of Debt

Securities that may be exchanged upon exercise of each Subscription Receipt; |

| · | the designation and terms of any other Securities with which the Subscription Receipts will be offered,

if any, and the number of Subscription Receipts that will be offered with each Security; |

| · | the dates or periods during which the Subscription Receipts may be exchanged into Subordinate Voting Shares,

Preference Shares, Debt Securities or Warrants; |

| · | terms applicable to the gross or net proceeds from the sale of the Subscription Receipts plus any interest

earned thereon; |

| · | material U.S. and Canadian federal income tax consequences of owning the Subscription Receipts; |

| · | any other rights, privileges, restrictions and conditions attaching to the Subscription Receipts; and |

| · | any other material terms and conditions of the Subscription Receipts. |

The terms and provisions of any Subscription Receipts

offered under a Prospectus Supplement may differ from the terms described above and may not be subject to or contain any or all of the

terms described above.

Subscription Receipt certificates will be exchangeable

for new Subscription Receipt certificates of different denominations at the office indicated in the Prospectus Supplement. Prior to the

exchange of their Subscription Receipts, holders of Subscription Receipts will not have any of the rights of holders of the securities

subject to the Subscription Receipts.

Description

of Units

The Corporation may issue Units, separately or together,

with Subordinate Voting Shares, Preference Shares, Debt Securities, Warrants or Subscription Receipts or any combination thereof, as the

case may be. Each Unit would be issued so that the holder of the Unit is also the holder of each Security comprising the Unit. Thus, the

holder of a Unit will have the rights and obligations of a holder of each applicable Security. The specific terms and provisions that

will apply to any Units that may be offered by the Corporation pursuant to this Prospectus will be set forth in the applicable Prospectus

Supplement. This description will include, where applicable:

| · | the designation, aggregate number and terms of Units offered; |

| · | the price at which the Units will be offered (or the method of determining the price); |

| · | the currency or currencies in which the Units will be offered; |

| · | the number of Subordinate Voting Shares (which may be less than or more than one Subordinate Voting Share),

the number of Preference Shares (which may be less than or more than one Preference Share), the number of Warrants (which may be less

than or more than one Warrant), the number of Subscription Receipts (which may be less than one Subscription Receipt) and/or the principal

amount of Debt Securities comprising the Units, including whether and under what circumstances those Securities may be held or transferred

separately; |

| · | any provisions for the issuance, payment, settlement, transfer, exchange or amendment of the Units or

of the Securities comprising the Units; |

| · | the terms of the Securities comprising the Units; |

| · | the designation and terms of any Securities with which the Units will be offered, if any, and the number

of Units that will be offered with each such Security; |

| · | the date(s), if any, on or after which the Units and the related Securities will be transferable separately; |

| · | terms applicable to the gross or net proceeds from the sale of the Units plus any interest earned thereon; |

| · | material U.S. and Canadian federal income tax consequences of owning the Units; |

| · | any other rights, privileges, restrictions and conditions attaching to the Units; and |

| · | any other material terms and conditions of the Units. |

The terms and provisions of any Units offered under

a Prospectus Supplement may differ from the terms described above and may not be subject to or contain any or all of the terms described

above.

TRADING

PRICE AND VOLUME

Trading prices and volume information relating to the

applicable Securities will be provided as required in a Prospectus Supplement.

PRIOR SALES

Prior sales of the Corporation’s Securities will

be provided, as required, in a Prospectus Supplement with respect to the issuance of Securities pursuant to such Prospectus Supplement.

RISK FACTORS

Prospective purchasers of Securities should carefully

consider the risk factors incorporated by reference in this Prospectus (including subsequently filed documents incorporated by reference)

and those described in a Prospectus Supplement relating to a specific offering of Securities before investing in Securities. Discussions

of certain risks affecting the Corporation in connection with its business are provided in the Corporation’s disclosure documents

filed with the various securities regulatory authorities, which are incorporated by reference in this Prospectus. Readers are cautioned

that such risk factors are not exhaustive. The Corporation’s financial condition and results of operations could be materially adversely

affected by any of these risks and past performance is no guarantee of future performance. See “Cautionary Note Regarding Forward-Looking

Statements” and “Documents Incorporated by Reference” herein and “Risk factors” in the Corporation’s

current AIF.

LEGAL MATTERS

Certain legal matters relating to the offering of Securities

hereunder will be passed upon on behalf of the Corporation by Torys LLP with respect to Canadian and U.S. legal matters, including the

laws of the State of New York. At the date hereof, the partners and associates of Torys LLP, as a group, beneficially own, directly or

indirectly, less than one per cent of any outstanding securities of the Corporation or any associate or affiliate of the Corporation.

WELL-KNOWN

SEASONED ISSUER

The securities regulatory authorities in each of the

provinces and territories of Canada have adopted substantively harmonized blanket orders, including Ontario Instrument 44-501 –

Exemption from Certain Prospectus Requirements for Well-known Seasoned Issuers (Interim Class Order) (together with the equivalent

local blanket orders in each of the other provinces and territories of Canada, all as amended or extended, collectively, the “WKSI

Blanket Orders”). This Prospectus has been filed by the Corporation in reliance upon the WKSI Blanket Orders, which permit “well-known

seasoned issuers”, or “WKSIs”, to file a final short form base shelf prospectus as the first public step in an offering,

and exempt qualifying issuers from certain disclosure requirements relating to such final short form base shelf prospectus. As of the

date hereof, the Corporation has determined that it qualifies as a “well-known seasoned issuer” under the WKSI Blanket Orders.

The Corporation intends to rely on such exemptions to the full extent permitted by the WKSI Blanket Orders notwithstanding the inclusion

in this Prospectus of any disclosure that is permitted to be excluded pursuant to the WKSI Blanket Orders.

AUDITORS,

TRANSFER AGENT AND REGISTRAR

The auditor of the Corporation is PricewaterhouseCoopers LLP, Chartered Professional Accountants,

PwC Tower, 18 York Street, Suite 2500, Toronto, Ontario M5J 0B2. PricewaterhouseCoopers LLP has confirmed that they are independent with

respect to the Company within the meaning of the Chartered Professional Accountants of Ontario CPA Code of Professional Conduct and the

rules and regulations of the SEC and the PCAOB.

The transfer agent and registrar for the Subordinate

Voting Shares is TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario M5H 4H1.

ENFORCEMENT

OF CERTAIN CIVIL LIABILITIES

Notice to Canadian Investors

Certain of the Corporation’s directors, namely

Christopher Galvin, Benjamin F. Stein and L. Frederick Sutherland, reside outside of Canada. Each of these directors has appointed Colliers

International Group Inc., 1140 Bay Street, Suite 4000, Toronto, Ontario, Canada M5S 2B4, as agent for service of process. Purchasers are

advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada,

even if the party has appointed an agent for service of process.

Notice to U.S. Investors

The Corporation is incorporated under the laws of the

Province of Ontario and its principal place of business is in Canada. Most of the Corporation’s directors and officers, and some

of the experts named in this Prospectus, are residents of Canada, and all or a substantial portion of their assets, and a substantial

portion of the Corporation’s assets, are located outside the United States. As described below, the Corporation will appoint an

agent for service of process in the United States, but it may be difficult for holders of Securities who reside in the United States to

effect service within the United States. upon the Corporation or those directors, officers and experts who are not residents of the United

States. Investors should not assume that a Canadian court would enforce a judgment of a U.S. court obtained in an action against the Corporation

or such other persons predicated on the civil liability provisions of the U.S. federal securities laws or the securities or “blue

sky” laws of any state within the United States or would enforce, in original actions, liabilities against the Corporation or such

persons predicated on the U.S. federal securities laws or any such state securities or “blue sky” laws. The Corporation has

been advised that a monetary judgment of a U.S. court predicated solely upon the civil liability provisions of U.S. federal securities

laws would likely be enforceable in Canada if the U.S. court in which the judgment was obtained had a basis for jurisdiction in the matter

that was recognized by a Canadian court for such purposes. The Corporation cannot provide assurance that this will be the case. It is

less certain that an action could be brought in Canada in the first instance on the basis of liability predicated solely upon such laws.

The Corporation will file with the SEC, concurrently

with the Registration Statement, an appointment of agent for service of process on Form F-X. Under the Form F-X, the Corporation will