0000017313FALSE00000173132023-08-072023-08-070000017313us-gaap:CommonStockMember2023-08-072023-08-070000017313us-gaap:MediumTermNotesMember2023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 7, 2023

CAPITAL SOUTHWEST CORPORATION

(Exact Name Of Registrant As Specified In Charter)

| | | | | | | | |

| | |

| Texas | 814-00061 | 75-1072796 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

8333 Douglas Avenue, Suite 1100

Dallas, Texas 75225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 238-5700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.25 par value per share | CSWC | The Nasdaq Global Select Market |

| 7.75% Notes due 2028 | CSWCZ | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2023, Capital Southwest Corporation (the “Company”) issued a press release, a copy of which has been furnished as Exhibit 99.1 hereto.

The information furnished in this Current Report on Form 8-K under Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the "Securities Act"), except as shall be expressly set forth by reference in a future filing.

Item 7.01 Regulation FD Disclosure.

The Company expects to hold a conference call with analysts and investors on August 8, 2023. A copy of the investor presentation slides to be used by the Company on such conference call is furnished as Exhibit 99.2 to this Form 8-K and incorporated herein by reference.

The information set forth under this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference into any filing under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 7, 2023

| | | | | | | | |

| | |

| By: | /s/ Bowen S. Diehl |

| | Name: Bowen S. Diehl |

| | Title: Chief Executive Officer and President |

Exhibit 99.1

| | | | | | | | |

| | 8333 Douglas Avenue, Suite 1100

Dallas, Texas 75225

T 214.238.5700

F 214.238.5701 |

Capital Southwest Announces Financial Results for First Fiscal Quarter Ended June 30, 2023 and Announces Increase in Total Dividends to $0.62 per share for the Quarter Ended September 30, 2023

CSWC Reports Pre-Tax Net Investment Income of $0.67 Per Share for Quarter Ended June 30, 2023

Dallas, Texas – August 7, 2023 – Capital Southwest Corporation (“Capital Southwest,” “CSWC” or the “Company”) (Nasdaq: CSWC), an internally managed business development company focused on providing flexible financing solutions to support the acquisition and growth of middle market businesses, today announced its financial results for the first fiscal quarter ended June 30, 2023.

First Quarter Fiscal Year 2024 Financial Highlights

•Total Investment Portfolio: $1.3 billion

◦Credit Portfolio of $1.1 billion:

▪97% 1st Lien Senior Secured Debt

▪$108.0 million in new committed credit investments

▪Weighted Average Yield on Debt Investments: 12.9%

▪Current non-accruals with a fair value of $22.4 million, representing 1.7% of the total investment portfolio

◦Equity Portfolio of $122.5 million, excluding investment in I-45 Senior Loan Fund ("I-45 SLF")

▪$3.9 million in new equity co-investments

◦CSWC Investment in I-45 SLF of $51.9 million at fair value

▪I-45 SLF portfolio of $131.7 million

•Portfolio consists of 33 issuers: 95% 1st Lien Debt

▪$78.0 million of debt outstanding at I-45 SLF

•I-45 SLF fund leverage of 1.20x debt to equity at fair value

▪I-45 SLF paid a $2.1 million quarterly dividend to CSWC; an annualized yield of 16.5%

•Pre-Tax Net Investment Income: $25.0 million, or $0.67 per weighted average share outstanding

•Dividends: Paid $0.54 per share Regular Dividend and $0.05 per share Supplemental Dividend

◦118% LTM Pre-Tax NII Regular Dividend Coverage

◦Total Dividends for the quarter ended June 30, 2023 of $0.59 per share

•Net Realized and Unrealized Depreciation: $0.7 million

◦$0.6 million of net appreciation related to I-45 SLF

◦$0.6 million of net depreciation related to the credit portfolio

◦$0.7 million of net depreciation related to the equity portfolio

•Balance Sheet:

◦Cash and Cash Equivalents: $21.3 million

◦Total Net Assets: $636.2 million

◦Net Asset Value (“NAV”) per Share: $16.38

In commenting on the Company’s results, Bowen Diehl, President and Chief Executive Officer, stated, “The June quarter was another strong quarter for Capital Southwest, with solid originations in six new and seven existing portfolio companies and a well-performing portfolio that produced $0.67 of pre-tax net investment income for the quarter, which more than earned both our $0.54 per share regular dividend and our $0.05 per share supplemental dividend paid for the quarter. On the capitalization front, we continued to programmatically raise equity through our equity at-the-market program, raising $45.6 million in gross proceeds at 110% of the prevailing NAV per share during the quarter. Over the past twelve months, we have raised over $160 million in equity capital, reducing our regulatory leverage from 1.10x down to 0.87x as of the June 30, 2023 quarter end. In addition, during the quarter, we successfully raised approximately $72 million in unsecured notes due 2028, which further diversified our balance sheet liability structure. In consideration of the performance of our portfolio, improvements in our operating leverage, and rising market interest rates, the Board of Directors has declared an increase in our regular quarterly dividend to $0.56 per share for the September 30, 2023 quarter. In addition, given the excess earnings being generated by our floating rate debt portfolio, our Board of Directors has also declared a supplemental dividend of $0.06 per share for the September 30, 2023 quarter, resulting in total dividends for the September 30, 2023 quarter of $0.62 per share. While future dividend declarations are at the discretion of our Board of Directors, it is our intent to continue to distribute quarterly supplemental dividends for the foreseeable future while base rates remain materially above long-term historical averages and we have a meaningful UTI balance. Finally, we are very pleased to have received an investment grade rating from Fitch Ratings during the quarter. We now have investment grade ratings from both Moody's and Fitch, which we believe is further market corroboration of our strong investment track record, first lien focused investment strategy, and prudent balance sheet management.”

First Quarter Fiscal Year Investment Activities

Originations

During the quarter ended June 30, 2023, the Company originated $111.9 million in new commitments, consisting of investments in six new portfolio companies totaling $98.6 million and add-on commitments in seven portfolio companies totaling $13.3 million. New portfolio company investment transactions that closed during the quarter ended June 30, 2023 are summarized as follows:

Edge Autonomy Holdings, LLC, $22.5 million 1st Lien Senior Secured Debt, $4.0 million Revolving Loan: Edge Autonomy designs and manufactures highly engineered autonomous and unmanned aircraft systems utilized in military, civilian and academic applications.

FS Vector, LLC, $18.0 million 1st Lien Senior Secured Debt, $2.0 million Revolving Loan, $1.0 million Common Equity: FS Vector is an independent strategic advisory firm offering solutions to fintech clients navigating challenging and complicated regulatory and market environments.

Bond Brand Loyalty ULC, $18.0 million 1st Lien Senior Secured Debt, $2.0 million Revolving Loan, $1.0 million Preferred and Common Equity: Bond Brand Loyalty is a diversified, tech-enabled customer loyalty and engagement services firm that provides large corporate customers with the combined capabilities of a strategic consultancy, software provider, and marketing agency to design, implement, and operate consumer and employee loyalty programs.

Heat Trak, LLC, $11.5 million 1st Lien Senior Secured Debt with Warrants: Heat Trak is the original developer and leading marketer of portable electric snow and ice melting mats and accessories.

HH-Inspire Acquisition, Inc. (dba Inspire Aesthetics), $8.0 million 1st Lien Senior Secured Debt, $0.8 million Revolving Loan, $0.3 million Preferred Equity: Inspire Aesthetics is a multi-location plastic surgery and aesthetics platform offering a comprehensive range of procedures and treatments.

LKC Technologies, Inc., $6.5 million 1st Lien Senior Secured Debt, $2.0 million Revolving Loan, $1.0 million Preferred Equity: LKC Technologies sells RETeval, the only FDA cleared hand-held electroretinography device on the market today.

Prepayments and Exits

During the quarter ended June 30, 2023, the Company received proceeds from the sale of one equity investment totaling $3.4 million.

Chandler Signs: Proceeds of $3.4 million, generating an IRR of 13.0% since original closing in January 2016.

First Fiscal Quarter 2024 Operating Results

For the quarter ended June 30, 2023, Capital Southwest reported total investment income of $40.4 million, compared to $37.2 million in the prior quarter. The increase in investment income was primarily attributable to an increase in average debt investments outstanding and an increase in the weighted average yield on investments.

For the quarter ended June 30, 2023, total operating expenses (excluding interest expense) were $5.7 million, compared to $5.6 million in the prior quarter.

For the quarter ended June 30, 2023, interest expense was $9.7 million as compared to $8.8 million in the prior quarter. The increase was primarily attributable to an increase in average debt outstanding and an increase in the weighted average interest rate on total debt.

For the quarter ended June 30, 2023, total pre-tax net investment income was $25.0 million, compared to $22.8 million in the prior quarter.

During the quarter ended June 30, 2023, Capital Southwest recorded total net realized and unrealized losses on investments of $0.7 million, compared to $4.2 million of total net realized and unrealized losses in the prior quarter. For the quarter ended June 30, 2023, this included net realized and unrealized gains on I-45 SLF of $0.6 million, net unrealized losses on debt investments of $0.6 million and net realized and unrealized losses on equity investments of $0.7 million. The net increase in net assets resulting from operations was $23.8 million for the quarter, compared to $18.2 million in the prior quarter.

The Company’s NAV at June 30, 2023 was $16.38 per share, as compared to $16.37 at March 31, 2023. The increase in NAV per share from the prior quarter is primarily due to pre-tax net investment income in excess of dividends paid for the quarter, as well as the issuance of common stock at a premium to NAV per share through the Equity ATM Program (as described below), partially offset by net realized and unrealized losses on investments and the issuance of restricted stock awards.

Liquidity and Capital Resources

At June 30, 2023, Capital Southwest had approximately $21.3 million in unrestricted cash and money market balances, $195.0 million of total debt outstanding on the Credit Facility (as defined below), $139.1 million, net of unamortized debt issuance costs, of the 4.50% Notes due January 2026 outstanding, $147.4 million, net of unamortized debt issuance costs, of the 3.375% Notes due October 2026, $69.3 million, net of unamortized debt issuance costs, of the 7.75% Notes due August 2028 and $121.4 million, net of unamortized debt issuance costs, of SBA Debentures (as defined below) outstanding. As of June 30, 2023, Capital Southwest had $204.4 million in available borrowings under the Credit Facility. The regulatory debt to equity ratio at the end of the quarter was 0.87 to 1.

In June 2023, the Company issued approximately $71.9 million in aggregate principal amount, including the underwriters' full exercise of their option to purchase an additional $9.4 million in aggregate principal amount to cover over-allotments, of 7.75% notes due 2028 (the "August 2028 Notes"). The August 2028 Notes mature on August 1, 2028 and may be redeemed in whole or in part at any time, or from time to time, at the Company’s option on or after August 1, 2025. The August 2028 Notes bear interest at a rate of 7.75% per year, payable quarterly on February 1, May 1, August 1 and November 1 of each year, beginning on August 1, 2023. The August 2028 Notes are the direct unsecured obligations of the Company, rank pari passu with the Company's other outstanding and future unsecured unsubordinated indebtedness and are effectively or structurally subordinated to all of the Company's existing and future secured indebtedness, including borrowings under the Credit Facility and the SBA Debentures. The August 2028 Notes are listed on the Nasdaq Global Select Market under the trading symbol "CSWCZ."

The Company has an "at-the-market" offering (the "Equity ATM Program"), pursuant to which the Company may offer and sell, from time to time through sales agents, shares of its common stock having an aggregate offering price of up to $650,000,000. During the quarter ended June 30, 2023, the Company sold 2,527,458 shares of its common stock under the Equity ATM Program at a weighted-average price of $18.03 per share, raising $45.6 million of gross proceeds. Net proceeds were $44.9 million after commissions to the sales agents on shares sold. Cumulative to date, the Company has sold 19,140,580 shares of its common stock under the Equity ATM Program at a weighted-average price of $20.39, raising $390.3 million of gross proceeds. Net proceeds were $384.0 million after commissions to the sales agents on shares sold. As of June 30, 2023, the Company has $259.7 million available under the Equity ATM Program.

In August 2016, CSWC entered into a senior secured credit facility (the “Credit Facility”) to provide additional liquidity to support its investment and operational activities. Borrowings under the Credit Facility accrue interest on a per annum basis at a rate equal to the applicable SOFR rate plus 2.15%. As of June 30, 2023, the Credit Facility's revolver period ends on August 9, 2025 with a final maturity of August 9, 2026. At June 30, 2023, the Credit Facility had total commitments of $400 million from a group of eleven bank lenders and $195.0 million in borrowings outstanding.

On August 2, 2023, CSWC entered into the Third Amended and Restated Senior Secured Revolving Credit Agreement which (1) increased commitments under the Credit Facility from $400 million to $435 million; (2) added an uncommitted accordion feature that could increase the maximum commitments up to $750 million; (3) extended the end of the Credit Facility's revolving period from August 9, 2025 to August 2, 2027 and extended the final maturity from August 9, 2026 to August 2, 2028; and (4) amended several financial covenants.

On April 20, 2021, our wholly owned subsidiary, Capital Southwest SBIC I, LP (“SBIC I”), received a license from the Small Business Administration (the "SBA") to operate as a Small Business Investment Company ("SBIC") under Section 301(c) of the Small Business Investment Act of 1958, as amended. The SBIC license allows SBIC I to obtain leverage by issuing SBA-guaranteed debentures ("SBA Debentures"), subject to the issuance of a leverage commitment by the SBA. SBA debentures are loans issued to an SBIC that have interest payable semi-annually and a ten-year maturity. The interest rate is fixed shortly after issuance at a market-driven spread over U.S. Treasury Notes with ten-year maturities. Current statutes and regulations permit SBIC I to borrow up to $175 million in SBA Debentures with at least $87.5 million in regulatory capital, subject to SBA approval. As of June 30, 2023, SBIC I had a total leverage commitment from the SBA in the amount of $130.0 million, of which $5.0 million remains unused.

In November 2015, I-45 SLF entered into a senior secured credit facility led by Deutsche Bank. On March 30, 2023, the I-45 credit facility was amended to permanently reduce total commitments to $100 million from a group of four bank lenders. After giving effect to the amendment, borrowings under the I-45 credit facility bear interest at a rate equal to Term SOFR plus 2.41%. The I-45 credit facility is scheduled to mature in March 2026. As of June 30, 2023, I-45 SLF had $78.0 million in borrowings outstanding under the I-45 credit facility.

Share Repurchase Program

On July 28, 2021, the Company's board of directors (the "Board") approved a share repurchase program authorizing the Company to repurchase up to $20 million of its outstanding shares of common stock in the open market at certain thresholds below its NAV per share, in accordance with guidelines specified in Rules 10b5-1(c)(1)(i)(B) and 10b-18 under the Securities Exchange Act of 1934. On August 31, 2021, the Company entered into a share repurchase agreement, which became effective immediately, and the Company will cease purchasing its common stock under the share repurchase program upon the earlier of, among other things: (1) the date on which the aggregate purchase price for all shares equals $20 million including, without limitation, all applicable fees, costs and expenses; or (2) upon written notice by the Company to the broker that the share repurchase agreement is terminated. During the quarter ended June 30, 2023, the Company did not repurchase any shares of the Company’s common stock under the share repurchase program.

Regular Dividend of $0.56 Per Share and Supplemental Dividend of $0.06 Per Share for Quarter Ended September 30, 2023

On August 3, 2023, the Board declared a total dividend of $0.62 per share for the quarter ended September 30, 2023, comprised of a Regular Dividend of $0.56 per share and a Supplemental Dividend of $0.06 per share.

The Company's dividend will be payable as follows:

Regular Dividend

Amount Per Share: $0.56

Ex-Dividend Date: September 14, 2023

Record Date: September 15, 2023

Payment Date: September 29, 2023

Supplemental Dividend

Amount Per Share: $0.06

Ex-Dividend Date: September 14, 2023

Record Date: September 15, 2023

Payment Date: September 29, 2023

When declaring dividends, the Board reviews estimates of taxable income available for distribution, which may differ from net investment income under generally accepted accounting principles. The final determination of taxable income for each year, as well as the tax attributes for dividends in such year, will be made after the close of the tax year.

Capital Southwest maintains a dividend reinvestment plan ("DRIP") that provides for the reinvestment of dividends on behalf of its registered stockholders who hold their shares with Capital Southwest’s transfer agent and registrar, American Stock Transfer and Trust Company. Under the DRIP, if the Company declares a dividend, registered stockholders who have opted into the DRIP by the dividend record date will have their dividend automatically reinvested into additional shares of Capital Southwest common stock.

First Quarter 2024 Earnings Results Conference Call and Webcast

Capital Southwest has scheduled a conference call on Tuesday, August 8, 2023, at 11:00 a.m. Eastern Time to discuss the first quarter 2024 financial results. You may access the call by using the Investor Relations section of Capital Southwest's website at www.capitalsouthwest.com, or by using http://edge.media-server.com/mmc/p/u3nrxpe8.

An audio archive of the conference call will also be available on the Investor Relations section of Capital Southwest’s website.

For a more detailed discussion of the financial and other information included in this press release, please refer to the Capital Southwest's Form 10-Q for the period ended June 30, 2023 to be filed with the Securities and Exchange Commission and Capital Southwest’s First Fiscal Quarter 2024 Earnings Presentation to be posted on the Investor Relations section of Capital Southwest’s website at www.capitalsouthwest.com.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is a Dallas, Texas-based, internally managed business development company with approximately $1.3 billion in investments at fair value as of June 30, 2023. Capital Southwest is a middle market lending firm focused on supporting the acquisition and growth of middle market businesses with $5 million to $35 million investments across the capital structure, including first lien, second lien and non-control equity co-investments. As a public company with a permanent capital base, Capital Southwest has the flexibility to be creative in its financing solutions and to invest to support the growth of its portfolio companies over long periods of time.

Forward-Looking Statements

This press release contains historical information and forward-looking statements with respect to the business and investments of Capital Southwest, including, but not limited to, the statements about Capital Southwest's future performance and financial performance and financial condition, and the timing, form and amount of any distributions or supplemental dividends in the future. Forward-looking statements are statements that are not historical statements and can often be identified by words such as "will," "believe," "expect" and similar expressions and variations or negatives of these words. These statements are based on management's current expectations, assumptions and beliefs. They are not guarantees of future results and are subject to numerous risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. These risks include risks related to: changes in the markets in which Capital Southwest invests; changes in the financial, capital, and lending markets; changes in the interest rate environment and its impact on our business and our portfolio companies; regulatory changes; tax treatment; our ability to operate our wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small business investment company; an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us; the impact of supply chain constraints and labor shortages on our portfolio companies; and the elevated levels of inflation and its impact on our portfolio companies and the industries in which we invests.

Readers should not place undue reliance on any forward-looking statements and are encouraged to review Capital Southwest's Annual Report on Form 10-K for the year ended March 31, 2023 and any subsequent filings, including the "Risk Factors" sections therein, with the Securities and Exchange Commission for a more complete discussion of the risks and other factors that could affect any forward-looking statements. Except as required by the federal securities laws, Capital Southwest does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changing circumstances or any other reason after the date of this press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer

214-884-3829

| | | | | | | | | | | |

| CAPITAL SOUTHWEST CORPORATION AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES |

| (In thousands, except shares and per share data) |

| | | |

| June 30, | | March 31, |

| 2023 | | 2023 |

| (Unaudited) | | |

| Assets | | | |

| Investments at fair value: | | | |

| Non-control/Non-affiliate investments (Cost: $1,025,318 and $947,829, respectively) | $ | 1,046,398 | | | $ | 966,627 | |

| Affiliate investments (Cost: $180,907 and $191,523, respectively) | 187,058 | | | 188,505 | |

| Control investments (Cost: $80,800 and $80,800, respectively) | 51,862 | | | 51,256 | |

| Total investments (Cost: $1,287,025 and $1,220,152, respectively) | 1,285,318 | | | 1,206,388 | |

| Cash and cash equivalents | 21,278 | | | 21,585 | |

| Receivables: | | | |

| Dividends and interest | 19,743 | | | 18,430 | |

| Escrow | 467 | | | 363 | |

| Other | 819 | | | 647 | |

| Income tax receivable | 102 | | | 368 | |

| Debt issuance costs (net of accumulated amortization of $5,919 and $5,642, respectively) | 3,440 | | | 3,717 | |

| Other assets | 5,836 | | | 6,186 | |

| Total assets | $ | 1,337,003 | | | $ | 1,257,684 | |

| | | |

| Liabilities | | | |

| SBA Debentures (Par value: $125,000 and $120,000, respectively) | $ | 121,352 | | | $ | 116,330 | |

| January 2026 Notes (Par value: $140,000 and $140,000, respectively) | 139,135 | | | 139,051 | |

| October 2026 Notes (Par value: $150,000 and $150,000, respectively) | 147,448 | | | 147,263 | |

| August 2028 Notes (Par value: $71,875 and $0, respectively) | 69,327 | | | — | |

| Credit facility | 195,000 | | | 235,000 | |

| Other liabilities | 15,216 | | | 16,761 | |

| Accrued restoration plan liability | 593 | | | 598 | |

| Income tax payable | 876 | | | 156 | |

| Deferred tax liability | 11,855 | | | 12,117 | |

| Total liabilities | 700,802 | | | 667,276 | |

| | | |

| Commitments and contingencies (Note 10) | | | |

| | | |

| Net Assets | | | |

| Common stock, $0.25 par value: authorized, 40,000,000 shares; issued, 38,839,918 shares at June 30, 2023 and 38,415,937 shares at March 31, 2023 | 9,710 | | | 9,604 | |

| Additional paid-in capital | 667,440 | | | 646,586 | |

| Total distributable (loss) earnings | (40,949) | | | (41,845) | |

| Treasury stock - at cost, 0 shares at June 30, 2023 and 2,339,512 shares at March 31, 2023 | — | | | (23,937) | |

| Total net assets | 636,201 | | | 590,408 | |

| Total liabilities and net assets | $ | 1,337,003 | | | $ | 1,257,684 | |

| Net asset value per share (38,839,918 shares outstanding at June 30, 2023 and 36,076,425 shares outstanding at March 31, 2023) | $ | 16.38 | | | $ | 16.37 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SOUTHWEST CORPORATION AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| (In thousands, except shares and per share data) |

| | | | | | | | | |

| Three Months Ended | | |

| June 30, | | |

| 2023 | | 2022 | | | | | | |

| Investment income: | | | | | | | | | |

| Interest income: | | | | | | | | | |

| Non-control/Non-affiliate investments | $ | 30,640 | | | $ | 15,748 | | | | | | | |

| Affiliate investments | 4,179 | | | 2,512 | | | | | | | |

| | | | | | | | | |

| Payment-in-kind interest income: | | | | | | | | | |

| Non-control/Non-affiliate investments | 914 | | | 416 | | | | | | | |

| Affiliate investments | 742 | | | 271 | | | | | | | |

| | | | | | | | | |

| Dividend income: | | | | | | | | | |

| Non-control/Non-affiliate investments | 499 | | | 550 | | | | | | | |

| Affiliate investments | 60 | | | 101 | | | | | | | |

| Control investments | 2,144 | | | 1,535 | | | | | | | |

| Fee income: | | | | | | | | | |

| Non-control/Non-affiliate investments | 945 | | | 1,290 | | | | | | | |

| Affiliate investments | 157 | | | 118 | | | | | | | |

| Control investments | 24 | | | — | | | | | | | |

| Other income | 57 | | | 2 | | | | | | | |

| Total investment income | 40,361 | | | 22,543 | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Compensation | 2,510 | | | 1,542 | | | | | | | |

| Share-based compensation | 963 | | | 821 | | | | | | | |

| Interest | 9,681 | | | 5,484 | | | | | | | |

| Professional fees | 955 | | | 849 | | | | | | | |

| General and administrative | 1,249 | | | 1,217 | | | | | | | |

| Total operating expenses | 15,358 | | | 9,913 | | | | | | | |

| Income before taxes | 25,003 | | | 12,630 | | | | | | | |

| Federal income, excise and other taxes | 599 | | | 73 | | | | | | | |

| Deferred taxes | (152) | | | 119 | | | | | | | |

| Total income tax provision | 447 | | | 192 | | | | | | | |

| Net investment income | $ | 24,556 | | | $ | 12,438 | | | | | | | |

| Realized (loss) gain | | | | | | | | | |

| Non-control/Non-affiliate investments | $ | (5,806) | | | $ | 2,549 | | | | | | | |

| Affiliate investments | (6,655) | | | 15 | | | | | | | |

| | | | | | | | | |

| Income tax provision | (321) | | | (244) | | | | | | | |

| Total net realized (loss) gain on investments, net of tax | (12,782) | | | 2,320 | | | | | | | |

| Net unrealized appreciation (depreciation) on investments | | | | | | | | | |

| Non-control/Non-affiliate investments | 2,283 | | | (4,551) | | | | | | | |

| Affiliate investments | 9,169 | | | (714) | | | | | | | |

| Control investments | 606 | | | (5,902) | | | | | | | |

| Income tax provision | (20) | | | (1,081) | | | | | | | |

| Total net unrealized appreciation (depreciation) on investments, net of tax | 12,038 | | | (12,248) | | | | | | | |

| Net realized and unrealized (losses) gains on investments | (744) | | | (9,928) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net increase in net assets from operations | $ | 23,812 | | | $ | 2,510 | | | | | | | |

| | | | | | | | | |

| Pre-tax net investment income per share - basic and diluted | $ | 0.67 | | | $ | 0.50 | | | | | | | |

| Net investment income per share – basic and diluted | $ | 0.65 | | | $ | 0.49 | | | | | | | |

| Net increase in net assets from operations – basic and diluted | $ | 0.63 | | | $ | 0.10 | | | | | | | |

| Weighted average shares outstanding – basic and diluted | 37,597,884 | | | 25,513,534 | | | | | | | |

Q1 2024 Earnings Presentation 8333 Douglas Avenue, Suite 1100 | Dallas, Texas 75225 | 214.238.5700 | capitalsouthwest.com August 8, 2023 Capital Southwest Corporation

Page 2 Important Notices • These materials and any presentation of which they form a part are neither an offer to sell, nor a solicitation of an offer to purchase, any securities of Capital Southwest. • These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of Capital Southwest. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in Capital Southwest’s public filings with the Securities and Exchange Commission (the "SEC"). • There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Capital Southwest’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by Capital Southwest will be profitable or will equal the performance of these investments. • The information contained herein has been derived from financial statements and other documents provided by the portfolio companies unless otherwise stated. • Past performance is not indicative of future results. In addition, there can be no assurance that unrealized investments will be realized at the expected multiples shown as actual realized returns will depend on, among other factors, future operating results of each of Capital Southwest’s current portfolio companies, the value of the assets and economic conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions on which Capital Southwest’s expected returns are based. In many instances, Capital Southwest will not determine the timing or manner of sale of its portfolio companies. • Capital Southwest has filed a registration statement (which contains the prospectus) with the SEC for any offering to which this communication may relate and may file one or more prospectus supplements to the prospectus in the future. Before you invest in any of Capital Southwest's securities, you should read the registration statement and the applicable prospectus and prospectus supplement(s), including the information incorporated by reference therein, in order to fully understand all of the implications and risks of an offering of Capital Southwest's securities. You should also read other documents Capital Southwest has filed with the SEC for more complete information about Capital Southwest and any offering of its securities. You may get these documents for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, Capital Southwest will arrange to send you any applicable prospectus and prospectus supplement(s) if you request such materials by calling us at (214) 238-5700. These materials are also made available, free of charge, on our website at www.capitalsouthwest.com. Information contained on our website is not incorporated by reference into this communication.

Page 3 • This presentation contains forward-looking statements relating to, among other things, the business, market conditions, financial condition and results of operations of Capital Southwest, the anticipated investment strategies and investments of Capital Southwest, and future market demand. Any statements that are not statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, preceded by, followed by, or include words such as "believe," "expect," "intend," "plan," "should" or similar words, phrases or expressions or the negative thereof. These statements are made on the basis of the current beliefs, expectations and assumptions of the management of Capital Southwest and speak only as of the date of this presentation. There are a number of risks and uncertainties that could cause Capital Southwest’s actual results to differ materially from the forward-looking statements included in this presentation. • These risks include risks related to: changes in the markets in which Capital Southwest invests; changes in the financial, capital, and lending markets; the impact of rising interest rates on Capital Southwest's business and its portfolio companies; the impact of supply chain constraints and labor difficulties on our portfolio companies; elevated levels of inflation and its impact on Capital Southwest's portfolio companies and the industries in which it invests; regulatory changes; tax treatment and general economic and business conditions; our ability to operate our wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small business investment company ("SBIC"); and an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us. • For a further discussion of some of the risks and uncertainties applicable to Capital Southwest and its business, see Capital Southwest’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 and its subsequent filings with the SEC. Other unknown or unpredictable factors could also have a material adverse effect on Capital Southwest’s actual future results, performance, or financial condition. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements. Capital Southwest does not assume any obligation to revise or to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, or otherwise, except as may be required by law. Forward-Looking Statements

Page 4 Bowen S. Diehl President and Chief Executive Officer Michael S. Sarner Chief Financial Officer Chris Rehberger VP Finance / Treasurer Conference Call Participants

Page 5 • CSWC was formed in 1961, and elected to be regulated as a BDC in 1988 • Publicly-traded on Nasdaq: Common Stock (“CSWC”) and 7.75% Notes due 2028 ("CSWCZ") • Internally Managed BDC with RIC tax treatment for U.S. federal income tax purposes • 28 employees based in Dallas, Texas • Total Balance Sheet Assets of $1.3 B as of June 30, 2023 • Operate Capital Southwest SBIC I, LP, a wholly-owned subsidiary • Manage I-45 Senior Loan Fund (“I-45 SLF”) in partnership with Main Street Capital (NYSE: “MAIN”) • Maintain investment grade issuer ratings of Baa3 from Moody's and BBB- from Fitch CSWC Company Overview CSWC is a middle-market lending firm focused on supporting the acquisition and growth of middle-market companies across the capital structure

Page 6 • Q1 2024 Pre-Tax Net Investment Income (“NII”) of $25.0 MM or $0.67 per share compared to $0.65 per share in the prior quarter, an increase of 3% • Increased Regular Dividend to $0.56 per share for the quarter ending September 30, 2023, an increase of 3.7% compared to the $0.54 per share Regular Dividend paid for the quarter ended June 30, 2023 ◦ Increased Supplemental Dividend to $0.06 per share for the quarter ending September 30, 2023, compared to the $0.05 per share Supplemental Dividend paid for the quarter ended June 30, 2023 • Investment Portfolio at Fair Value increased to $1.29 B from $1.21 B in prior quarter ◦ $111.9 MM in total new committed investments to six new portfolio companies and seven existing portfolio companies ◦ $3.4 MM in total proceeds from one equity exit generating an IRR of 13.0% and a realized gain of $1.9 MM • Issued $71.9 MM in aggregate principal of 7.75% Notes due 2028 (Nasdaq: "CSWCZ") • Raised $45.6 MM in gross proceeds through Equity ATM Program during the quarter ◦ Sold shares at weighted-average price of $18.03 per share, or 110% of the prevailing NAV per share • Regulatory Debt to Equity decreased to 0.87x in the quarter • Received BBB- investment grade rating from Fitch Ratings in June 2023 • $204 MM available on Credit Facility and $21.3 MM in cash and cash equivalents as of quarter end • Subsequent to quarter end, increased Credit Facility to $435 MM and extended maturity to August 2028 Q1 2024 Highlights Financial Highlights

Page 7 • In the last twelve months ended 6/30/2023, CSWC generated $2.46 per share in Pre-Tax NII and paid out $2.09 per share in Regular Dividends ◦ LTM Pre-Tax NII Regular Dividend Coverage of 118% • Cumulative Pre-Tax NII Regular Dividend Coverage of 109% since December 2015 • Total of $3.77 per share Special and Supplemental Dividends declared since December 2015 • Estimated Undistributed Taxable Income ("UTI") of $0.34 per share as of June 30, 2023 Track Record of Consistent Dividends Continues Dividend Yield – Quarterly Annualized Total Dividend / CSWC Share Price at Qtr. End D iv id en d Pe r Sh ar e $0.48 $0.50 $0.44 $0.46 $0.48 $0.49 $0.50 $0.51 $0.51 $0.51 $0.51 $0.52 $0.53 $0.54 $0.97 $0.57 $0.58 $0.59 $0.62 $1.25 $0.63 $0.34 $0.36 $0.38 $0.39 $0.40 $0.40 $0.41 $0.41 $0.41 $0.41 $0.42 $0.43 $0.44 $0.47 $0.48 $0.48 $0.50 $0.52 $0.53 $0.54 $0.56 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.50 $0.05 $0.05 $0.05 $0.06 $0.75 $0.15 Regular Dividend Per Share Supplemental Dividend Per Share Special Dividend Per Share 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 9/30/2023 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 9.3% 9.6% 9.1% 9.4% 9.2% 24.0% 17.9% 15.1% 14.5% 11.5% 9.4% 9.1% 8.6% 15.3% 8.1% 13.7% 13.3% 13.0% 11.8% 12.0%

Page 8 History of Value Creation $17.68 $17.38 $18.63 $20.90 $22.71 $21.97 $24.90 $28.27 $30.06 $30.66 $17.68 $17.34 $17.80 $19.08 $18.62 $15.13 $16.01 $16.86 $16.37 $16.38 $0.26 $0.26 $1.16 $2.31 $2.71 $3.41 $3.66 $3.71 $0.04 $0.57 $1.56 $2.93 $4.53 $6.18 $8.00 $10.03 $10.57 Net Asset Value Per Share Cumulative Special/Supplemental Dividends Paid Per Share Cumulative Regular Dividends Paid Per Share 9/30/2015 3/31/2016 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 3/31/2023 6/30/2023 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 Total Value (Net Asset Value + Cumulative Dividends Paid) Increase from Credit Strategy of $12.98 per share through 6/30/2023

Page 9 CORE: Lower Middle Market (“LMM”): CSWC led or Club Deals ◦ Companies with EBITDA between $3 MM and $20 MM ◦ Typical leverage of 2.0x – 4.0x Debt to EBITDA through CSWC debt position ◦ Commitment size up to $35 MM with hold sizes generally $5 MM to $35 MM ◦ Both sponsored and non-sponsored deals ◦ Securities include first lien, unitranche, and second lien ◦ Frequently make equity co-investments alongside CSWC debt OPPORTUNISTIC: Upper Middle Market (“UMM”): Club, First and Second Lien ▪ Companies typically have in excess of $20 MM in EBITDA ▪ Typical leverage of 3.5x – 5.5x Debt to EBITDA through CSWC debt position ▪ Hold sizes generally $5 MM to $20 MM ▪ Floating rate first and second lien debt securities Credit Investment Strategy

Page 10 Credit Portfolio Heavily Weighted Towards First Lien Investments 97% of credit portfolio in first lien senior secured loans with an average investment hold size of 1.2% as of 6/30/23 Credit Portfolio Heavily Weighted to First Lien $ (M ill io ns ) A verage H old S ize % $93 $167 $239 $368 $474 $573 $794 $1,038 $1,111 5.6% 3.6% 3.8% 2.9% 2.3% 1.9% 1.5% 1.3% 1.2% Sub-Debt Second Lien First Lien Average Hold Size % 3/31/2016 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 3/31/2023 6/30/2023 $0.0 $250.0 $500.0 $750.0 $1,000.0 $1,250.0 —% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 64% 28% 8% 82% 10% 8% 4% 10% 86% 90% 8% 2% 6% 92% 2% 93% 7% 96% 4% 43% 41% 16% 97% 3%

Page 11 $111.9 MM in total new committed investments to six new portfolio companies and seven existing portfolio companies Q1 2024 Originations Portfolio Originations Q1 2024 Name Industry Type Total Debt Funded at Close ($000s) Total Equity Funded at Close ($000s) Unfunded Commitments at Close ($000s) Debt Yield to Maturity Edge Autonomy Holdings, LLC Aerospace & defense First Lien $22,500 $— $4,000 12.4% FS Vector, LLC Business services First Lien / Equity $18,000 $1,000 $2,000 13.1% Bond Brand Loyalty ULC Media & marketing First Lien / Equity $18,000 $1,000 $2,000 13.2% Heat Trak, LLC Consumer products & retail First Lien / Warrants $11,500 $— $— 14.9% HH-Inspire Acquisition, Inc. Healthcare services First Lien / Equity $8,036 $306 $765 13.8% LKC Technologies, Inc. Healthcare products First Lien / Equity $6,500 $1,000 $2,000 13.4% ITA Holdings Group, LLC (DBA Apollo MedFlight) Transportation & logistics First Lien $— $— $6,494 14.2% Roof OpCo, LLC Consumer services First Lien / Equity $4,889 $250 $— 12.7% Automatan, LLC (DBA Inspire Automation) Business services First Lien $1,000 $— $— 12.7% Lash OpCo Consumer products & retail First Lien $— $— $343 12.2% Other Equity Co-Investments Various Equity $— $312 $— N/A Total / Wtd. Avg $90,425 $3,868 $17,602 13.2% • $94.3 MM funded at close

Page 12 Portfolio Exits Q1 2024 Name Industry Type Net Proceeds ($000s) Realized Gain / (Loss) ($000s) IRR Chandler Signs Business Services Equity $3,402 $1,902 13.0% Total / Wtd. Avg $3,402 $1,902 13.0% Track Record of CSWC Exits Continues • During the quarter, CSWC exited one equity investment, generating proceeds of $3.4 MM and an IRR of 13.0% • Cumulative IRR of 14.1% on 68 portfolio company exits generating $802 MM in proceeds since launch of credit strategy in January 2015 $3.4 MM in total proceeds from one portfolio company exit

Page 13 CSWC Investment Portfolio Composition Note: All metrics above exclude the I-45 SLF (1) At June 30, 2023 and March 31, 2023, we had equity ownership in approximately 64% and 62%, respectively, of our investments (2) The weighted-average annual effective yields were computed using the effective interest rates during the quarter for all debt investments at cost as of June 30, 2023, including accretion of original issue discount but excluding fees payable upon repayment of the debt instruments (3) The weighted average annual effective yields on total investments were calculated by dividing total investment income, exclusive of non-recurring fees, by average total investments at fair value (4) Includes CSWC debt investments only. Weighted average EBITDA metric is calculated using investment cost basis weighting. For both quarters ended June 30, 2023 and March 31, 2023, nine portfolio companies are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful (5) Includes CSWC debt investments only. Calculated as the amount of each portfolio company’s debt (including CSWC’s position and debt senior or pari passu to CSWC’s position, but excluding debt subordinated to CSWC’s position) in the capital structure divided by each portfolio company’s adjusted EBITDA. Weighted average leverage is calculated using investment cost basis weighting. For both quarters ended June 30, 2023 and March 31, 2023, nine portfolio companies are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful Maintaining appropriate portfolio leverage while receiving attractive risk-adjusted returns Investment Portfolio - Statistics (in $000's) 3/31/2023 6/30/2023 Total CSWC Portfolio Total CSWC Portfolio Number of Portfolio Companies 85 89 Total Cost $1,139,352 $1,206,225 Total Fair Value $1,155,132 $1,233,456 Average Hold Size Debt Investments (at Fair Value) $13,303 $13,548 Average Hold Size Equity Investments (at Fair Value) $2,218 $2,150 % First Lien Investments (at Fair Value) 86.6% 87.2% % Second Lien Investments (at Fair Value) 3.1% 2.8% % Subordinated Debt Investments (at Fair Value) 0.1% 0.1% % Equity (at Fair Value) (1) 10.2% 9.9% Wtd. Avg. Yield on Debt Investments (2) 12.8% 12.9% Wtd. Avg. Yield on Total Investments (3) 12.1% 12.6% Wtd. Avg. EBITDA of Issuer ($MM's) (4) $21.0 $20.2 Wtd. Avg. Leverage through CSWC Security (5) 4.0x 3.8x

Page 14 CSWC Portfolio Mix as of June 30, 2023 at Fair Value Current Investment Portfolio (By Type) Current Investment Portfolio (By Industry) Current Investment Portfolio of $1.3 B continues to be diverse across industries First Lien 83.7% I-45 SLF 4.0% Second Lien 2.7% Equity 9.5% Business Services 13% Media & Marketing 13% Healthcare Services 11% Consumer Products and Retail 8% Consumer Services 8% Healthcare Products 6% Food, Agriculture & Beverage 5% Technology Products & Components 4% Software & IT Services 4% I-45 SLF LLC 4% Transportation & Logistics 4% Financial Services 3% Industrial Products 3% Environmental Services 2% (Note 1) I-45 SLF consists of 95% first lien senior secured debt (Note 2) Equity represents equity co-investments across 57 portfolio companies

Page 15 Approximately 96% of all debt investments are currently rated a "1" or "2" as credit portfolio continues to demonstrate strong performance Investment Rating 3/31/2023 Investment Rating Upgrades Investment Rating Downgrades 6/30/2023 # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) 1 10 $153.1 14.8% 1 $9.0 0.8% — $— —% 11 $155.8 14.0% 2 81 $839.5 80.9% — $— —% — $— —% 91 $912.3 82.1% 3 5 $44.7 4.3% — $— —% — $— —% 5 $42.9 3.9% 4 4 $0.3 —% — $— —% — $— —% — $— —% Wtd. Avg. Investment Rating (at Cost) 1.93 1.91 Quarter-over-Quarter Investment Rating Migration Note: We utilize an internally developed investment rating system to rate the performance and monitor the expected level of returns for each debt investment in our portfolio. The investment rating system takes into account both quantitative and qualitative factors of the portfolio company and the investments held therein. Investment Ratings range from a rating of 1, which represents the least amount of risk in our portfolio, to 4, which indicates that the investment is performing materially below underwriting expectations

Page 16 I-45 SLF Portfolio Overview Current I-45 Portfolio (By Industry) I-45 SLF loan portfolio of $132 MM is 95% first lien senior secured debt (1) For the quarter ended June 30, 2023, three portfolio companies are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful (2) Through I-45 SLF security Telecommunications Services: Consumer Current I-45 Portfolio (By Type) I-45 Portfolio Statistics (In Thousands) 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Total Investments at Fair Value $168,610 $160,998 $143,712 $131,723 Fund Leverage (Debt to Equity) at Fair Value 1.73x 1.75x 1.34x 1.20x Number of Issuers 39 39 36 33 Wtd. Avg. Issuer EBITDA (1) $81,162 $81,865 $74,955 $70,692 Avg. Investment Size as a % of Portfolio 2.6% 2.6% 2.8% 3.0% Wtd. Avg. Net Leverage on Investments (1)(2) 4.4x 4.5x 4.8x 4.9x Wtd. Avg. Spread to LIBOR / SOFR 6.3% 6.3% 6.3% 6.4% Wtd. Avg. Duration (Yrs) 3.3 2.9 2.6 2.4 95% 5% First Lien Non-First Lien Consumer Services Healthcare & Pharmaceuticals High Tech Industries Business Services 17% 16% 13% 10% 9% Telecommunications

Page 17 Income Statement (In Thousands, except per share amounts) Quarter Ended 9/30/22 Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Investment Income Interest Income $22,119 $27,639 $31,622 $34,819 PIK Interest Income 1,384 1,501 1,870 1,656 Dividend Income 2,527 2,382 2,207 2,703 Fees and Other Income 769 1,244 1,493 1,183 Total Investment Income $26,799 $32,766 $37,192 $40,361 Expenses Cash Compensation $2,254 $3,381 $2,693 $2,510 Share Based Compensation 1,060 992 832 963 General & Administrative 1,878 1,777 2,091 2,204 Total Expenses (excluding Interest) $5,192 $6,150 $5,616 $5,677 Interest Expense $6,629 $7,937 $8,823 $9,681 Pre-Tax Net Investment Income $14,978 $18,679 $22,753 $25,003 Gains / Losses and Taxes Net Realized and Unrealized Gains (Losses) $(4,986) $(16,476) $(4,228) $(744) Income Tax (Expense) / Benefit (534) 746 (349) (447) Net increase in Net Assets Resulting from Operations $9,458 $2,949 $18,176 $23,812 Weighted Average Diluted Shares Outstanding 27,988 31,381 35,244 37,598 Pre-Tax NII Per Diluted Weighted Average Share $0.54 $0.60 $0.65 $0.67 Net Increase in Net Assets Per Dil. Wtd. Average Share $0.34 $0.09 $0.52 $0.63

Page 18 Operating Leverage Trend Continue to realize operating efficiencies of internally managed structure Period Ending To ta l A ss et s ( $M M ) O perating Expenses as % of A vg A ssets$284 $326 $417 $552 $585 $736 $974 $1,258 $1,337 4.9% 4.2% 3.7% 3.0% 2.8% 2.4% 2.2% 1.9% 1.9% FY 16 FY 17 FY 18 FY 19 FY 20 FY 21 FY 22 FY 23 Q1 FY24 $0 $250 $500 $750 $1,000 $1,250 1% 2% 3% 4% 5% 6% Total Assets Operating Expenses(1) as % of Average Total Assets Note: Operating Leverage calculated as last twelve months operating expenses (excluding interest expense) divided by average annual assets (1) Operating expenses exclude interest expense

Page 19 $16.37 $0.67 $(0.54) $(0.05) $0.00 $(0.02) $0.09 $(0.14) $16.38 3/3 1/2 02 3 N AV/Shar e Pre- Tax Net I nv est ment In com e Regu lar Divi den d Sup ple ment al D ivi den d Net C han ge in Valu ati on of Debt Port fol io Net C han ge in Valu ati on of Equ ity Port fol io Accr eti on fro m Equ ity Iss uan ce Othe r C orp ora te 6/3 0/2 02 3 N AV/Shar e $14 $14.5 $15 $15.5 $16 $16.5 $17 $17.5 NAV per Share Bridge for Quarter Ended 6/30/2023 Earnings / Dividends $0.08 per Share Investment Portfolio Valuation Change $(0.02) per Share Other Corporate $(0.05) per Share Note: "Other Corporate" consists primarily of ($0.13) per share dilution from annual issuance of RSUs

Page 20 Significant Unused Debt Capacity with Long-Term Duration Earliest debt maturity occurs in January 2026 Facility Total Commitments Interest Rate Maturity Principal Drawn Undrawn Commitment January 2026 Notes (1) $140.0 MM 4.50% January 2026 $140.0 MM N/A I-45 Credit Facility (2) $100.0 MM Term SOFR + 2.41% March 2026 $78.0 MM $22.0 MM Credit Facility (3) $400.0 MM Term SOFR + 2.15% August 2026 $195.0 MM $204.4 MM (4) October 2026 Notes (5) $150.0 MM 3.375% October 2026 $150.0 MM N/A August 2028 Notes (6) $71.9 MM 7.75% August 2028 $71.9 MM N/A SBA Debentures $130.0 MM 4.13% (7) September 2031 (8) $125.0 MM $5.0 MM (9) P rin ci pa l P ay m en ts ($ M M ) Long-Term Debt Obligations (Calendar Year) $563.0 $71.9 $125.0 140.0 78.0 195.0 150.0 January 2026 Notes I-45 Credit Facility Credit Facility October 2026 Notes August 2028 Notes SBA Debentures CY 2023 CY 2024 CY 2025 CY 2026 CY 2027 CY 2028 CY 2029 - CY 2033 $0 $150 $300 $450 $600 (1) Redeemable in whole or in part at any time prior to October 31, 2025, at par plus a "make whole" premium, and thereafter at par (2) CSWC owns 80% of the equity and 50% of the voting rights of I-45 SLF with a joint venture partner (3) Subsequent to quarter end, the total commitments available increased to $435 million and the maturity was extended to August 2028 (4) Net of $0.6 MM in letters of credit outstanding (5) Redeemable in whole or in part at any time prior to July 1, 2026, at par plus a "make whole" premium, and thereafter at par (6) Redeemable in whole or in part at Capital Southwest's option on or after August 1, 2025 (7) Weighted average interest rate of all pooled and unpooled SBA Debentures for the three months ended June 30, 2023 (8) First pooled SBA Debentures mature on September 1, 2031 (9) Current statutes and regulations permit SBIC I to borrow up to $175 million in SBA Debentures with at least $87.5 million in regulatory capital, subject to SBA approval

Page 21 Balance Sheet (In Thousands, except per share amounts) Quarter Ended 9/30/22 Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Assets Portfolio Investments $1,056,931 $1,150,046 $1,206,388 $1,285,318 Cash & Cash Equivalents 30,238 21,686 21,585 21,278 Other Assets 26,002 30,425 29,711 30,407 Total Assets $1,113,171 $1,202,157 $1,257,684 $1,337,003 Liabilities SBA Debentures $77,553 $100,582 $116,330 $121,352 January 2026 Notes 138,883 138,967 139,051 139,135 October 2026 Notes 146,893 147,078 147,263 147,448 August 2028 Notes — — — 69,327 Credit Facility 240,000 225,000 235,000 195,000 Other Liabilities 34,118 29,043 29,632 28,540 Total Liabilities $637,447 $640,670 $667,276 $700,802 Shareholders Equity Net Asset Value $475,724 $561,487 $590,408 $636,201 Net Asset Value per Share $16.53 $16.25 $16.37 $16.38 Regulatory Debt to Equity 1.11x 0.91x 0.88x 0.87x

Page 22 Portfolio Statistics (1) CSWC utilizes an internal 1 - 4 investment rating system in which 1 represents material outperformance and 4 represents material underperformance. All new investments are initially set to 2. Weighted average investment rating calculated at cost (2) Excludes CSWC equity investment in I-45 SLF (3) At Fair Value Continuing to build a well performing credit portfolio (In Thousands) Quarter Ended 9/30/22 Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Portfolio Statistics Fair Value of Debt Investments $903,451 $990,298 $1,037,595 $1,110,915 Average Debt Investment Hold Size $12,906 $13,382 $13,303 $13,548 Fair Value of Debt Investments as a % of Par 96% 96% 96% 97% % of Investment Portfolio on Non-Accrual (at Fair Value) 0.9% 0.3% 0.3% 1.7% Weighted Average Investment Rating (1) 1.95 1.96 1.93 1.91 Weighted Average Yield on Debt Investments 10.59% 11.97% 12.78% 12.94% Fair Value of All Portfolio Investments $1,056,931 $1,150,046 $1,206,388 $1,285,318 Weighted Average Yield on all Portfolio Investments 10.29% 11.70% 12.11% 12.64% Investment Mix (Debt vs. Equity) (2)(3) 91% / 9% 90% / 10% 90% / 10% 90% / 10%

Page 23 Investment Income Detail Constructing a portfolio of investments with recurring cash yield (In Thousands) Quarter Ended 9/30/22 Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Investment Income Breakdown Cash Interest $21,173 $26,619 $30,712 $33,703 Cash Dividends 2,527 2,382 2,208 2,703 PIK Income 1,384 1,501 1,869 1,656 Amortization of Purchase Discounts and Fees 963 1,062 969 1,172 Management/Admin Fees 329 310 369 380 Prepayment Fees & Other Income 423 892 1,065 747 Total Investment Income $26,799 $32,766 $37,192 $40,361 Key Metrics Cash Income as a % of Investment Income (1) 95% 95% 95% 96% % of Total Investment Income that is Recurring 98% 97% 97% 98% (1) Includes Purchase Discounts and Fees previously received in cash

Page 24 Key Financial Metrics Strong Pre-Tax Net Investment Income and Dividend Yield driven by net portfolio growth and investment performance (1) Return on Equity is calculated as the quarterly annualized Pre-Tax NII, Realized Earnings, or Total Earnings, respectively, divided by equity at the end of the prior quarter Quarter Ended 9/30/22 Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Key Financial Metrics Pre-Tax Net Investment Income Per Wtd Avg Diluted Share $0.54 $0.60 $0.65 $0.67 Pre-Tax Net Investment Income Return on Equity (ROE)(1) 12.94% 14.40% 15.89% 16.25% Realized Earnings Per Wtd Avg Diluted Share $0.21 $0.27 $0.65 $0.31 Realized Earnings Return on Equity (ROE)(1) 5.02% 6.43% 15.91% 7.65% Earnings Per Wtd Avg Diluted Share $0.34 $0.09 $0.52 $0.63 Earnings Return on Equity (ROE)(1) 8.17% 2.27% 12.69% 15.48% Regular Dividends per Share $0.50 $0.52 $0.53 $0.54 Supplemental / Special Dividends per Share $— $0.05 $0.05 $0.05 Total Dividends per Share $0.50 $0.57 $0.58 $0.59

Page 25 Interest Rate Sensitivity Fixed vs. Floating Credit Portfolio Exposure (1) Note: Illustrative change in annual NII is based on a projection of CSWC’s existing debt investments as of 6/30/2023, adjusted only for changes in Base Interest Rate. Base Interest Rate used in this analysis is 3-Month SOFR of 5.24% at 6/30/2023. The results of this analysis include the I-45 Senior Loan Fund, which is comprised of 97% floating rate debt assets and 100% floating rate liabilities (1) Portfolio Exposure includes I-45 SLF assets pro rata as a % of CSWC’s equity investment in the fund Change in Base Interest Rates Illustrative Annual NII Change ($'s) Illustrative Annual NII Change ($ Per Share) (200 bps) (19,108,365) (0.49) (150 bps) (14,331,274) (0.37) (100 bps) (9,554,183) (0.25) (50 bps) (4,777,091) (0.12) 50 bps 4,777,091 0.12 3% 97% Fixed Floating

Page 26 Corporate Information Board of Directors Senior Management Fiscal Year End Inside Director Bowen S. Diehl March 31 Bowen S. Diehl President & Chief Executive Officer Independent Directors Independent Auditor David R. Brooks Michael S. Sarner RSM US LLP Chicago, ILChristine S. Battist Chief Financial Officer, Secretary & Treasurer Jack D. Furst William R. Thomas Joshua S. Weinstein Ramona Rogers-Windsor Senior Managing Director Corporate Counsel Eversheds Sutherland (US) LLP Corporate Offices & Website Investor Relations 8333 Douglas Avenue Michael S. Sarner Suite 1100 Capital Southwest Dallas, TX 75225 214-884-3829 http://www.capitalsouthwest.com msarner@capitalsouthwest.com Transfer Agent American Stock Transfer & Trust Company, LLC Securities Listing 800-937-5449 Nasdaq: "CSWC" (Common Stock) www.amstock.com Nasdaq: "CSWCZ" (7.75% Notes due 2028) Industry Analyst Coverage Firm Analyst Contact Information Ladenburg Thalmann & Co., Inc. Mickey M. Schleien, CFA Direct: 305-572-4131 JMP Securities, LLC Devin Ryan Direct: 415-835-8900 Hovde Group Erik Zwick Direct: 617-510-1239 Jefferies, LLC Kyle Joseph Direct: 510-418-0754 Raymond James & Associates Robert Dodd Direct: 901-579-4560 Oppenheimer & Co., Inc. Mitchel Penn Direct: 212-667-7136 UBS Securities, LLC Vilas Abraham Direct: 212-713-3241

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_MediumTermNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

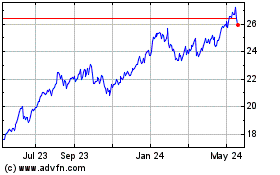

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Nov 2024 to Dec 2024

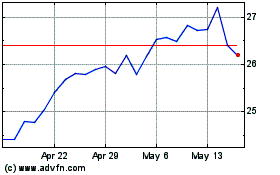

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2023 to Dec 2024