Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

23 November 2022 - 8:22AM

Edgar (US Regulatory)

Filed pursuant to

Rule 424(b)(3)

SEC File No. 333-264306

PROSPECTUS SUPPLEMENT NO. 1

(to Prospectus dated September 13, 2022)

PRIMARY OFFERING OF

15,747,677 ORDINARY SHARES

SECONDARY OFFERING OF

9,200,947 ORDINARY SHARES,

ALPHA TAU MEDICAL LTD.

This prospectus supplement

updates, amends and supplements the prospectus contained in our Post-Effective Amendment No. 1 to our Registration Statement on Form F-1,

effective as of September 13, 2022 (as supplemented or amended from time to time, the “Prospectus”) (Registration No. 333-264306).

Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement

is being filed to update, amend and supplement the information included in the Prospectus with information on Alpha Tau’s third

quarter 2022 financial results, which is set forth below.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered

with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement

updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future

reference.

Our ordinary shares

and warrants are listed on the Nasdaq Stock Market LLC under the trading symbols “DRTS” and “DRTSW,” respectively.

On November 18, 2022, the closing prices for our ordinary shares and warrants on the Nasdaq Stock Market LLC were $3.98 per ordinary

share and $0.25 per warrant.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 10 of the Prospectus and other risk factors contained

in the documents incorporated by reference therein for a discussion of information that should be considered in connection with an investment

in our securities.

Neither the Securities

and Exchange Commission, the Israeli Securities Authority nor any state securities commission has approved or disapproved of these securities

or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal

offense.

The date of this prospectus

supplement is November 22, 2022.

CONSOLIDATED

BALANCE SHEETS

U.S. dollars in thousands

| | |

September 30, | | |

December 31, | |

| | |

2022 | | |

2021 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,930 | | |

$ | 23,236 | |

| Restricted cash | |

| 792 | | |

| 618 | |

| Short-term deposits | |

| 101,735 | | |

| 8,080 | |

| Prepaid expenses and other receivables | |

| 2,869 | | |

| 707 | |

| | |

| | | |

| | |

| Total current assets | |

| 111,326 | | |

| 32,641 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Long term prepaid expenses | |

| 393 | | |

| 2,028 | |

| Property and equipment, net | |

| 7,647 | | |

| 7,546 | |

| | |

| | | |

| | |

| Total long-term assets | |

| 8,040 | | |

| 9,574 | |

| | |

| | | |

| | |

| Total assets | |

$ | 119,366 | | |

$ | 42,215 | |

CONSOLIDATED

BALANCE SHEETS

U.S. dollars in thousands (except

share and per share data)

| | |

September 30, | | |

December 31, | |

| | |

2022 | | |

2021 | |

| | |

Unaudited | | |

Audited | |

| LIABILITIES, CONVERTIBLE PREFERRED SHARES AND SHAREHOLDERS' DEFICIENCY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Trade payables | |

$ | 1,310 | | |

$ | 1,203 | |

| Other payables and accrued expenses | |

| 2,043 | | |

| 3,202 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 3,353 | | |

| 4,405 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Warrants liability | |

| 8,757 | | |

| - | |

| Warrants to Convertible Preferred shares | |

| - | | |

| 18,623 | |

| | |

| | | |

| | |

| Total liabilities | |

| 12,110 | | |

| 23,028 | |

| | |

| | | |

| | |

Convertible preferred shares of no-par value per share –

Authorized: 0 and 25,348,176 shares as of September 30, 2022 and December 31, 2021, respectively; Issued and outstanding: 0 and 13,739,186 shares as of September 30, 2022 and December 31, 2021, respectively | |

| - | | |

| 53,964 | |

| | |

| | | |

| | |

| SHAREHOLDERS' DEFICIENCY: | |

| | | |

| | |

Ordinary shares of no-par value per share –

Authorized: 362,116,800 and 72,423,360 shares as of September 30, 2022 and December 31, 2021, respectively; Issued and outstanding : 69,011,550 and 40,528,913 shares as of September 30, 2022 and December 31, 2021, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 190,462 | | |

| 18,063 | |

| Accumulated deficit | |

| (83,206 | ) | |

| (52,840 | ) |

| | |

| | | |

| | |

| Total shareholders' equity (deficiency) | |

| 107,256 | | |

| (34,777 | ) |

| | |

| | | |

| | |

| Total liabilities, Convertible Preferred shares and shareholders' equity (deficiency) | |

$ | 119,366 | | |

$ | 42,215 | |

CONSOLIDATED

STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except

share and per share data)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2022 | | |

2021 | | |

2022 | | |

2021 | |

| | |

| | |

| | |

| | |

| |

| | |

Unaudited | |

| Research and development, net | |

$ | 4,827 | | |

$ | 3,032 | | |

$ | 15,510 | | |

$ | 8,218 | |

| | |

| | | |

| | | |

| | | |

| | |

| Marketing expenses | |

| 248 | | |

| 102 | | |

| 577 | | |

| 356 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 2,283 | | |

| 500 | | |

| 8,064 | | |

| 1,273 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating loss | |

| 7,358 | | |

| 3,634 | | |

| 24,151 | | |

| 9,847 | |

| | |

| | | |

| | | |

| | | |

| | |

| Financial (income) expenses, net | |

| (4,744 | ) | |

| 1,168 | | |

| 6,198 | | |

| 13,622 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before taxes on income | |

| 2,614 | | |

| 4,802 | | |

| 30,349 | | |

| 23,469 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense (benefit) | |

| 9 | | |

| (5 | ) | |

| 17 | | |

| 21 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| 2,623 | | |

| 4,797 | | |

| 30,366 | | |

| 23,490 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net comprehensive loss | |

$ | 2,623 | | |

$ | 4,797 | | |

$ | 30,366 | | |

$ | 23,490 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to Ordinary shareholders, basic and diluted | |

$ | 0.04 | | |

$ | 0.12 | | |

$ | 0.49 | | |

$ | 0.58 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used in computing net loss per share attributable to Ordinary shareholders, basic and diluted | |

| 68,798,251 | | |

| 40,515,336 | | |

| 61,654,800 | | |

| 40,513,766 | |

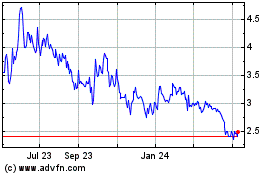

Alpha Tau Medical (NASDAQ:DRTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpha Tau Medical (NASDAQ:DRTS)

Historical Stock Chart

From Apr 2023 to Apr 2024